Metallocene Polyethylene (mPE) Market by Application (Films, Sheets, Injection Molding, Extrusion Coating), Type (mLLDPE, mHDPE, Others (mLDPE, mMDPE)), Catalyst Type, End-Use Industry (packaging, automotive), and Region - Global Forecast to 2028

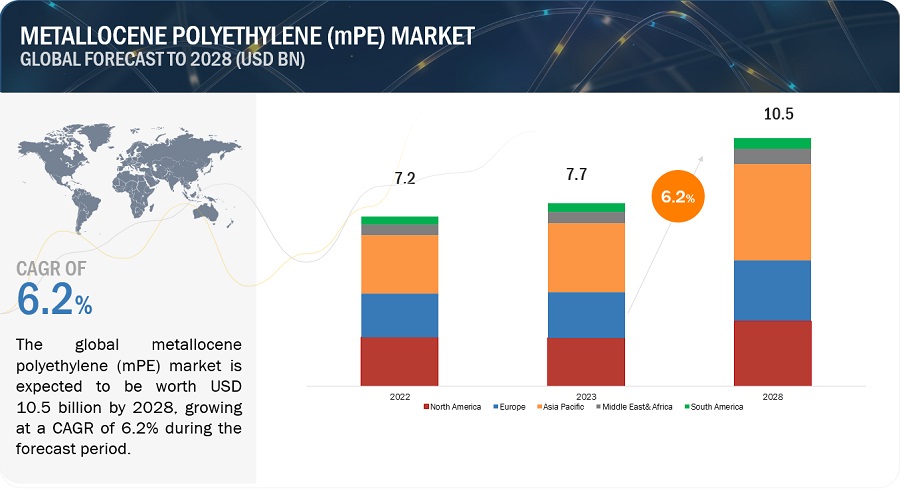

The global metallocene polyethylene (mPE) market is projected to grow from USD 7.7 billion in 2023 to USD 10.5 billion by 2028, at a CAGR of 6.2% during the forecast period. Continuous R&D efforts to improve mPE characteristics, lower production costs, and explore new applications can all help to market growth. Changing consumer expectations for more environmentally friendly and high-quality products may drive producers to choose materials such as mPE. This demand has the potential to ripple across supply chains and have an impact on market growth.

Attractive Opportunities in the Metallocene Polyethylene (mPE) Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing demand of metallocene polyethylene from the packaging industry

The packaging sector is undergoing a transformational shift as a result of shifting customer tastes, environmental concerns, and technological improvements. Metallocene polyethylene (mPE) has emerged as a game-changing material in this market, satisfying the expanding needs of the packaging business. One of the primary reasons for metallocene polyethylene's appeal is its superior mechanical characteristics. mPE has higher tensile strength, tear resistance, and puncture resistance than standard polyethylene.

Restraint: Technical barriers for manufacturers and end-users

Metallocene polyethylene (mPE) is produced by a specialized method that employs metallocene catalysts to make polymers with specified characteristics. While mPE has many advantages, there are several technical challenges that manufacturers may confront during production. Metallocene catalysts are susceptible to environmental factors and contaminants. It can be difficult to ensure the stability of these catalysts during the polymerization process since their reactivity might be altered by factors such as temperature, pressure, and the presence of impurities.

Opportunity: Customized material from polymer blends and composites

Metallocene polyethylene (mPE) can be blended or compounded with other polymers, additives, or reinforcing agents to produce specified qualities and performance characteristics. By combining mPE with other polymers, such as high-density polyethylene (HDPE), mechanical qualities such as tensile strength, impact resistance, and durability can be improved. Manufacturers can fine-tune the material's performance to suit various applications, from automobile components to industrial parts, by modifying the blend ratios and manufacturing conditions.

Challenges: Significant competition from bioplastics and recycled plastics

Metallocene polyethylene (mPE) competes with bioplastics and recycled plastics, as each offers distinct advantages and addresses different areas of sustainability and performance. Some bioplastics are compostable and biodegradable. Bioplastics have achieved success in specialized markets, such as single-use packaging, disposable goods, and cutlery, where the goal is to have as little impact on the environment as possible. Also, recycled plastics are frequently more affordable compared to metallocene Polyethylene.

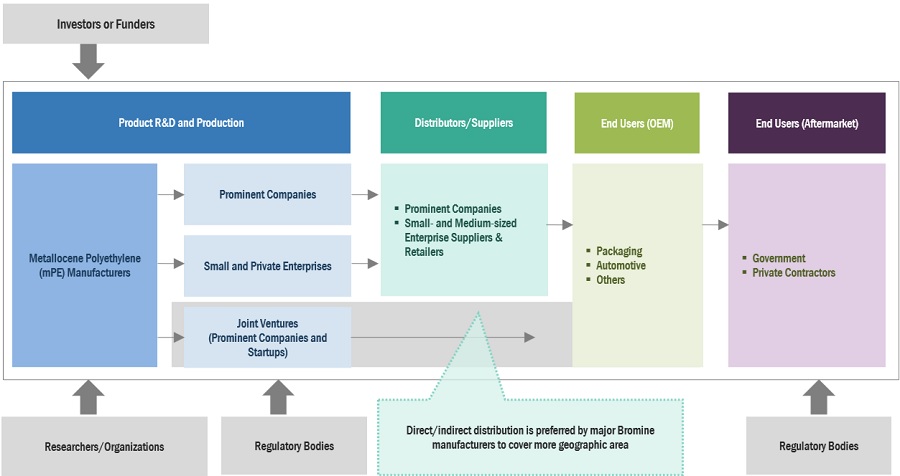

Metallocene Polyethylene (mPE) Market: Ecosystem

ExxonMobil Corporation (US), The Dow Chemical Company (US), LyondellBasell Industries Holdings B.V. (Netherlands), SABIC (Saudi Arabia), and Borealis AG (Austria) are some of the prominent companies in the metallocene polyethylene (mPE) market. These companies are well-established, financially stable, and have a global presence in the market.

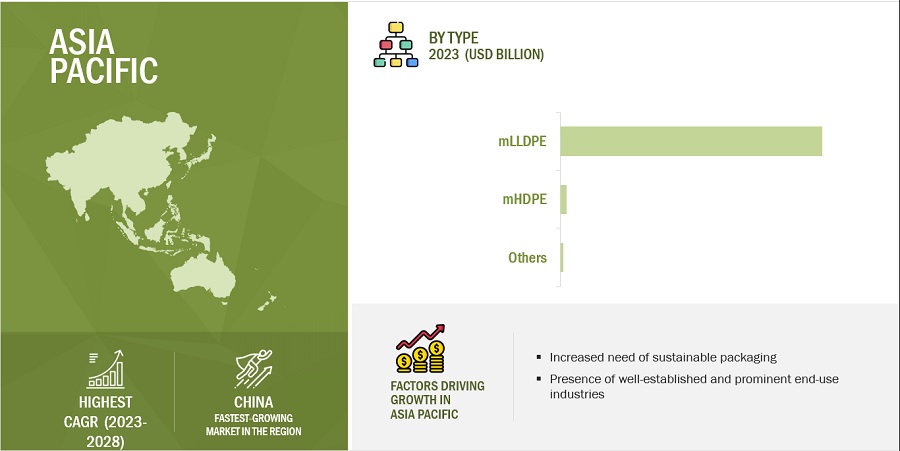

Based on type, the mLLDPE is projected to grow at a significant CAGR during the forecast period.

Continuous R&D efforts to improve the characteristics of mLLDPE and develop new grades suitable for specific applications might fuel market growth. Innovations in catalyst technology and polymerization techniques might have an impact on market growth. The barrier properties of mLLDPE are important for businesses that place a premium on product freshness and endurance. It is a popular choice for packing perishable items due to its ability to offer a protective shield against external influences such as moisture and gases.

Based on application, the films segment is expected to grow significantly during the forecast period.

Industries looking to lower transportation costs and environmental effect are driving the need for lightweight packaging materials. mPE films have a good blend of strength and weight, making them appropriate for packaging applications. Because of its ease and versatility, the flexible packaging business has seen substantial expansion. mPE films can be adjusted to meet a variety of flexible packaging requirements, ranging from food and beverages to industrial products. efficiency by reducing the amount of power used for cooling, which will save money in the long run.

Asia Pacific region is projected to grow at a significant CAGR during the forecast period.

Economic expansion and rising income levels in many Asia-Pacific countries boost consumption and demand for a variety of products, including those that employ metallocene polyethylene. Demand for packaged goods, disposable products, and consumer goods may rise as disposable income rises. Infrastructure development, such as construction, transportation, and utilities, can boost demand for materials used in these industries, such as mPE films used for construction wraps, barriers, and protective covers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

ExxonMobil Corporation (US), The Dow Chemical Company (US), LyondellBasell Industries Holdings B.V. (Netherlands), SABIC (Saudi Arabia), Borealis AG (Austria), SASOL(South Africa), Reliance Industries Limited (India), Braskem (Brazil), Mitsui & Co. (Japan), INEOS (UK), Westlake Chemical Corporation (US), Chevron Phillips Chemical Company LLC (US), Daelim Co., Ltd. (South Korea), LG Chem (South Korea) and UBE Corporation (Japan) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD million), Volume (Kilotons) |

|

Segments Covered |

Type, application, catalyst type, end-use industry and Region. |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include ExxonMobil Corporation (US), The Dow Chemical Company (US), LyondellBasell Industries Holdings B.V. (Netherlands), SABIC (Saudi Arabia), Borealis AG (Austria), SASOL(South Africa), Reliance Industries Limited (India), Braskem (Brazil), Mitsui & Co. (Japan), INEOS (UK), Westlake Chemical Corporation (US), Chevron Phillips Chemical Company LLC (US), Daelim Co., Ltd. (South Korea), LG Chem (South Korea) and UBE Corporation (Japan) |

This research report categorizes the microcapsule market based type, application, catalyst type, end-use industry, and region.

Based on type, the metallocene polyethylene (mPE) market has been segmented as follows:

- mLLDPE

- mHDPE

- Others (mLDPE, mMDPE, and mVLDPE)

Based on application, the metallocene polyethylene (mPE) market has been segmented as follows:

- Films

- Sheets

- Injection molding

- Extrusion coatings

- Others (heavy duty sacks and wires & cables.)

Based on the catalyst type, the metallocene polyethylene (mPE) market has been segmented as follows:

- Zirconocene

- Ferrocene

- Tetanocene

- Others (hafnocene and fluorenyl-based catalysts)

Based on end-use industry, the metallocene polyethylene (mPE) market has been segmented as follows:

- Packaging

- Food & Beverages

- Automotive

- Building & Construction

- Agriculture

- Healthcare

- Others (electrical & electronics and the textile industry)

Based on regions, the metallocene polyethylene (mPE) market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2022, SABIC and ExxonMobil formed a joint venture to expand the polyethylene production facility.

- In November 2022, SABIC partnered with Jinming Machinery Co., Ltd. & Bolsas de los Altos. to drive innovation in the flexible film packaging industry.

- In November 2022, LyondellBasell Industries Holding B.V. announced its plan to expand its propylene production capacity at its Channelview Complex near Houston, TX.

Frequently Asked Questions (FAQ):

What is metallocene polyethylene (mPE)?

Metallocene polyethylene (mPE) is a kind of polyethylene that is created during the polymerization process by employing metallocene catalysts. Polyethylene is a versatile polymer that is widely used in a variety of applications due to its low cost and ease of production.

What are the major types of metallocene polyethylene (mPE)?

mLLDPE and mHDPE are major types of metallocene polyethylene

Which key companies operate in the global metallocene polyethylene (mPE) market?

ExxonMobil Corporation (US), The Dow Chemical Company (US), LyondellBasell Industries Holdings B.V. (Netherlands), SABIC (Saudi Arabia), Borealis AG (Austria), SASOL(South Africa), Reliance Industries Limited (India), Braskem (Brazil), Mitsui & Co. (Japan), INEOS (UK), Westlake Chemical Corporation (US), Chevron Phillips Chemical Company LLC (US), Daelim Co., Ltd. (South Korea), LG Chem (South Korea) and UBE Corporation (Japan)

What are critical strategies adopted by the market players?

One of the most essential differentiating factors providing a competitive edge to companies in the market is the extensive adoption of strategies such as expansions, joint ventures, new product development, partnerships, mergers, and acquisitions, which gives them a head start in enhancing their presence in the evolving metallocene polyethylene (mPE) market.

What is the key driver of the metallocene polyethylene (mPE) market?

Increasing demand for metallocene polyethene from packaging industry is the critical driver for the metallocene polyethylene (mPE) market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from packaging industry- Sustainability and recycling initiativesRESTRAINTS- Limited adoption in some applications- Technical barriers for manufacturers and end usersOPPORTUNITIES- Customized material from polymer blends and composites- Cross-licensing of patent rights among companiesCHALLENGES- Significant competition from bioplastics and recycled plastics- Lack of awareness and availability of cheaper, low-quality mPE

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 VALUE CHAIN ANALYSIS

- 6.2 TECHNOLOGY ANALYSIS

-

6.3 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.5 CASE STUDY ANALYSISMETALLOCENE POLYETHYLENE FILMS FOR MEDICAL DEVICE FABRICATION AS ALTERNATIVE TO FLEXIBLE PVC- Objective- Solution statementAPPLICATIONS OF METALLOCENE POLYETHYLENE IN PACKAGING INDUSTRY- Objective- Solution statementAPPLICATIONS OF METALLOCENE POLYETHYLENE IN AUTOMOTIVE COMPONENTS- Objective- Solution statement

- 6.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.8 ECOSYSTEM/MARKET MAP OF METALLOCENE POLYETHYLENE

-

6.9 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSINSIGHTJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- Major patents

- 6.10 AVERAGE SELLING PRICE ANALYSIS

- 7.1 INTRODUCTION

-

7.2 METALLOCENE LINEAR LOW DENSITY POLYETHYLENE (MLLDPE)VERY HIGH IMPACT STRENGTH TO DRIVE MARKET

-

7.3 METALLOCENE HIGH DENSITY POLYETHYLENE (MHDPE)SUITABILITY FOR INJECTION MOLDING TO DRIVE MARKET

- 7.4 OTHER TYPES

-

8.1 INTRODUCTIONFILMS- Increase in use for packaging applications to drive marketSHEETS- Water resistance and tear resistance properties to drive marketINJECTION MOLDING- Wide usage in manufacturing various automotive components to drive marketEXTRUSION COATING- Use for medical equipment packaging to drive marketOTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 ZIRCONOCENEZIRCONOCENE OFFERS DISTINGUISHING CHARACTERISTICS

-

9.3 FERROCENEFERROCENE CAREFULLY CONTROLS POLYMERIZATION PROCESS

-

9.4 TETANOCENETETANOCENE FINDS APPLICATION IN DIFFERENT SECTORS

- 9.5 OTHER CATALYST TYPES

- 10.1 INTRODUCTION

-

10.2 PACKAGINGWIDE USAGE IN FLEXIBLE PACKAGING TO DRIVE MARKET

-

10.3 FOOD & BEVERAGESUSE OF SPECIFIC MPE VARIANTS IN INDUSTRY TO DRIVE MARKET

-

10.4 AUTOMOTIVESUITABILITY FOR USE IN VARIETY OF AUTOMOTIVE APPLICATIONS TO DRIVE MARKET

-

10.5 BUILDING & CONSTRUCTIONUSE FOR THERMAL AND SOUND INSULATION TO DRIVE MARKET

-

10.6 AGRICULTURESUITABILITY FOR USE IN GREENHOUSE FILMS TO DRIVE MARKET

-

10.7 HEALTHCAREUSE IN PRESERVATION OF STERILITY OF MEDICAL EQUIPMENT TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACTCHINA- Increase in production of various types of polyethylene to drive marketJAPAN- Significant use in plastic industry to drive marketINDIA- Packaging industry to drive marketSOUTH KOREA- Large-scale export of plastics to drive marketMALAYSIA- Increase in consumption of flexible plastics to drive marketINDONESIA- Innovation of mPE films to drive marketREST OF ASIA PACIFIC

-

11.3 NORTH AMERICARECESSION IMPACTUS- Growth of packaging, solar power generation, and automotive industries to drive marketCANADA- Rise in demand from diverse industries and sustainability efforts to drive marketMEXICO- Enhanced properties, industry leaders, and sustainability focus to drive market

-

11.4 EUROPERECESSION IMPACTGERMANY- Growing industrial and economic rebalance to drive demandITALY- Diverse industry applications to drive marketFRANCE- Versatile applications to drive growth in diverse industriesUK- Rise in demand from automotive and medical industries to drive marketRUSSIA- Rise in demand for packaging films in food & beverages industry to drive marketREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTTURKEY- Shift toward eco-friendly packaging to drive marketIRAN- Developments in infrastructure sector to drive marketSAUDI ARABIA- Development and innovations in various industries to drive demandUAE- Use in diverse industrial applications to drive marketSOUTH AFRICA- Industrial development and innovation to drive demandREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Increase in demand in diverse industries to drive marketARGENTINA- Increase in demand for flexible packaging and rigid plastics to drive marketCHILE- Packaging industry to drive demandREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

-

12.3 REVENUE ANALYSISREVENUE ANALYSIS OF TOP PLAYERS IN METALLOCENE POLYETHYLENE MARKET

-

12.4 MARKET SHARE ANALYSIS: METALLOCENE POLYETHYLENERANKING OF KEY MARKET PLAYERS, 2022

-

12.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT ANALYSIS

- 12.7 COMPETITIVE SCENARIO

-

13.1 THE DOW CHEMICAL COMPANYBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- DealsOTHERSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.2 EXXON MOBIL CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.3 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDOTHERSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.4 TOTAL ENERGIESBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.5 SABICBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- DealsOTHERSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.6 INEOSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.7 BOREALIS AGBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDPRODUCT LAUNCHESOTHERSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.8 PRIME POLYMER CO., LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

13.9 NOVA CHEMICALS CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals

-

13.10 BRASKEMBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.11 MITSUI & CO., LTDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.12 CHEVRON PHILLIPS CHEMICAL COMPANY LLCBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDOTHERS

-

13.13 DAELIM CO., LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.14 W. R. GRACE & CO.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.15 REPSOLBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.16 GAILBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.17 LG CHEMBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.18 UBE CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

13.19 SUMITOMO CHEMICAL CO., LTDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 METALLOCENE POLYETHYLENE MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

- TABLE 2 METALLOCENE POLYETHYLENE MARKET, BY CATALYST TYPE: INCLUSIONS & EXCLUSIONS

- TABLE 3 METALLOCENE POLYETHYLENE MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

- TABLE 4 METALLOCENE POLYETHYLENE MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 5 METALLOCENE POLYETHYLENE MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 6 METALLOCENE POLYETHYLENE MARKET: KEY CONFERENCES AND EVENTS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA, BY TOP THREE END-USE INDUSTRIES

- TABLE 9 METALLOCENE POLYETHYLENE MARKET: ECOSYSTEM

- TABLE 10 AVERAGE SELLING PRICE OF METALLOCENE POLYETHYLENE, BY REGION, 2019–2023 (USD/KT)

- TABLE 11 AVERAGE SELLING PRICE OF METALLOCENE POLYETHYLENE, BY TYPE, 2019–2023 (USD/KT)

- TABLE 12 METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 13 METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 14 METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 15 METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 16 MLLDPE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 17 MLLDPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 MLLDPE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 19 MLLDPE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 20 MHDPE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 MHDPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 MHDPE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 23 MHDPE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 OTHERS: MPE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 OTHERS: MPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OTHERS: MPE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 27 OTHERS: MPE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 31 METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 32 METALLOCENE POLYETHYLENE MARKET IN FILMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 METALLOCENE POLYETHYLENE MARKET IN FILMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 METALLOCENE POLYETHYLENE MARKET IN FILMS, BY REGION, 2019–2022 (KILOTON)

- TABLE 35 METALLOCENE POLYETHYLENE MARKET IN FILMS, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 METALLOCENE POLYETHYLENE MARKET IN SHEETS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 METALLOCENE POLYETHYLENE MARKET IN SHEETS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 METALLOCENE POLYETHYLENE MARKET IN SHEETS, BY REGION, 2019–2022 (KILOTON)

- TABLE 39 METALLOCENE POLYETHYLENE MARKET IN SHEETS, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 METALLOCENE POLYETHYLENE MARKET IN INJECTION MOLDING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 METALLOCENE POLYETHYLENE MARKET IN INJECTION MOLDING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 METALLOCENE POLYETHYLENE MARKET IN INJECTION MOLDING, BY REGION, 2019–2022 (KILOTON)

- TABLE 43 METALLOCENE POLYETHYLENE MARKET IN INJECTION MOLDING, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 METALLOCENE POLYETHYLENE MARKET IN EXTRUSION COATING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 METALLOCENE POLYETHYLENE MARKET IN EXTRUSION COATING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 METALLOCENE POLYETHYLENE MARKET IN EXTRUSION COATING, BY REGION, 2019–2022 (KILOTON)

- TABLE 47 METALLOCENE POLYETHYLENE MARKET IN EXTRUSION COATING, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 METALLOCENE POLYETHYLENE MARKET IN OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 METALLOCENE POLYETHYLENE MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 METALLOCENE POLYETHYLENE MARKET IN OTHER APPLICATIONS, BY REGION, 2019–2022 (KILOTON)

- TABLE 51 METALLOCENE POLYETHYLENE MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 METALLOCENE POLYETHYLENE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 METALLOCENE POLYETHYLENE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 METALLOCENE POLYETHYLENE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 55 METALLOCENE POLYETHYLENE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 59 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 60 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 63 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 64 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 65 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 67 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 68 CHINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 CHINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 CHINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 71 CHINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 72 JAPAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 JAPAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 JAPAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 75 JAPAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 76 INDIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 INDIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 INDIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 79 INDIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 80 SOUTH KOREA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 SOUTH KOREA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 SOUTH KOREA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 83 SOUTH KOREA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 84 MALAYSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 85 MALAYSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 MALAYSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 87 MALAYSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 88 INDONESIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 INDONESIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 INDONESIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 91 INDONESIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 92 REST OF ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 95 REST OF ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 96 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 99 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 100 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 103 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 104 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 107 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 108 US: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 US: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 US: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 111 US: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 112 CANADA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 CANADA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 115 CANADA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 116 MEXICO: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 MEXICO: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 MEXICO: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 119 MEXICO: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 120 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 123 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 124 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 127 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 128 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 129 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 131 EUROPE: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 132 GERMANY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 GERMANY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 GERMANY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 135 GERMANY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 136 ITALY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 ITALY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 ITALY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 139 ITALY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 140 FRANCE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 FRANCE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 FRANCE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 143 FRANCE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 144 UK: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 UK: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 UK: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 147 UK: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 148 RUSSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 RUSSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 RUSSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 151 RUSSIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 152 REST OF EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 153 REST OF EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 REST OF EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 155 REST OF EUROPE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 168 TURKEY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 TURKEY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 TURKEY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 171 TURKEY: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 172 IRAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 173 IRAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 IRAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 175 IRAN: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 176 SAUDI ARABIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 177 SAUDI ARABIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 SAUDI ARABIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 179 SAUDI ARABIA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 180 UAE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 181 UAE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 UAE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 183 UAE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 184 SOUTH AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 185 SOUTH AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 SOUTH AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 187 SOUTH AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 192 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 195 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 196 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 199 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 200 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 201 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 202 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 203 SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 204 BRAZIL: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 205 BRAZIL: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 206 BRAZIL: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 207 BRAZIL: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 208 ARGENTINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 209 ARGENTINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 210 ARGENTINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 211 ARGENTINA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 212 CHILE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 213 CHILE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 214 CHILE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 215 CHILE: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 216 REST OF SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 219 REST OF SOUTH AMERICA: METALLOCENE POLYETHYLENE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 220 OVERVIEW OF STRATEGIES ADOPTED BY METALLOCENE POLYETHYLENE MANUFACTURERS

- TABLE 221 COMPANY APPLICATION FOOTPRINT, 2022

- TABLE 222 COMPANY END-USE INDUSTRY FOOTPRINT, 2022

- TABLE 223 COMPANY REGION FOOTPRINT, 2022

- TABLE 224 METALLOCENE POLYETHYLENE MARKET: PRODUCT LAUNCHES, 2017–2022

- TABLE 225 METALLOCENE POLYETHYLENE MARKET: DEALS, 2017–2022

- TABLE 226 METALLOCENE POLYETHYLENE MARKET: OTHERS, 2017–2022

- TABLE 227 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 228 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 229 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 230 TOTAL ENERGIES: COMPANY OVERVIEW

- TABLE 231 SABIC: COMPANY OVERVIEW

- TABLE 232 INEOS: COMPANY OVERVIEW

- TABLE 233 BOREALIS AG: COMPANY OVERVIEW

- TABLE 234 PRIME POLYMER CO., LTD.: COMPANY OVERVIEW

- TABLE 235 NOVA CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 236 BRASKEM: COMPANY OVERVIEW

- TABLE 237 MITSUI & CO., LTD.: COMPANY OVERVIEW

- TABLE 238 CHEVRON PHILLIPS CHEMICAL COMPANY LLC.: COMPANY OVERVIEW

- TABLE 239 DAELIM CO., LTD.: COMPANY OVERVIEW

- TABLE 240 W. R. GRACE & CO.: COMPANY OVERVIEW

- TABLE 241 REPSOL: COMPANY OVERVIEW

- TABLE 242 GAIL: COMPANY OVERVIEW

- TABLE 243 LG CHEM: COMPANY OVERVIEW

- TABLE 244 UBE CORPORATION: COMPANY OVERVIEW

- TABLE 245 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 METALLOCENE POLYETHYLENE MARKET SEGMENTATION

- FIGURE 2 METALLOCENE POLYETHYLENE MARKET: REGIONS COVERED

- FIGURE 3 METALLOCENE POLYETHYLENE MARKET: RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 RESEARCH METHODOLOGY: DATA TRIANGULATION

- FIGURE 7 MLLDPE SEGMENT TO REGISTER HIGHEST GROWTH RATE BETWEEN 2023 AND 2028

- FIGURE 8 FILMS SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2023 AND 2028

- FIGURE 9 ASIA PACIFIC TO LEAD METALLOCENE POLYETHYLENE MARKET DURING FORECAST PERIOD

- FIGURE 10 METALLOCENE POLYETHYLENE MARKET TO WITNESS SIGNIFICANT GROWTH BETWEEN 2023 AND 2028

- FIGURE 11 MLLDPE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 12 FILMS SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 13 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC METALLOCENE POLYETHYLENE MARKET IN 2022

- FIGURE 14 METALLOCENE POLYETHYLENE MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METALLOCENE POLYETHYLENE MARKET

- FIGURE 16 GLOBAL DEMAND FOR PACKAGING SOLUTIONS, 2017 & 2022

- FIGURE 17 VALUE CHAIN ANALYSIS OF METALLOCENE POLYETHYLENE MARKET

- FIGURE 18 REVENUE SHIFT & NEW REVENUE POCKETS FOR METALLOCENE POLYETHYLENE MANUFACTURERS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 20 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 21 ECOSYSTEM/MARKET MAP OF METALLOCENE POLYETHYLENE

- FIGURE 22 NUMBER OF PATENTS YEAR-WISE (2014–2022)

- FIGURE 23 CHINA ACCOUNTED FOR HIGHEST PATENT COUNT

- FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 25 AVERAGE SELLING PRICE OF METALLOCENE POLYETHYLENE, BY REGION (USD/KT)

- FIGURE 26 MLLDPE SEGMENT TO LEAD METALLOCENE POLYETHYLENE MARKET DURING FORECAST PERIOD

- FIGURE 27 FILMS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 28 INDIA & CHINA TO BE EMERGING MARKETS FOR MPE DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC: METALLOCENE POLYETHYLENE MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: METALLOCENE POLYETHYLENE MARKET SNAPSHOT

- FIGURE 31 EUROPE: METALLOCENE POLYETHYLENE MARKET SNAPSHOT

- FIGURE 32 TOP PLAYERS – REVENUE ANALYSIS (2019–2022)

- FIGURE 33 RANKING OF TOP FIVE PLAYERS IN METALLOCENE POLYETHYLENE MARKET, 2022

- FIGURE 34 COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 METALLOCENE POLYETHYLENE MARKET: COMPANY FOOTPRINT

- FIGURE 36 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 37 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- FIGURE 39 TOTAL ENERGIES: COMPANY SNAPSHOT

- FIGURE 40 SABIC: COMPANY SNAPSHOT

- FIGURE 41 INEOS: COMPANY SNAPSHOT

- FIGURE 42 BOREALIS AG: COMPANY SNAPSHOT

- FIGURE 43 BRASKEM: COMPANY SNAPSHOT

- FIGURE 44 MITSUI & CO., LTD.: COMPANY SNAPSHOT

- FIGURE 45 REPSOL: COMPANY SNAPSHOT

- FIGURE 46 GAIL: COMPANY SNAPSHOT

- FIGURE 47 LG CHEM: COMPANY SNAPSHOT

- FIGURE 48 UBE CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 SUMITOMO CHEMICAL CO., LTD: COMPANY SNAPSHOT

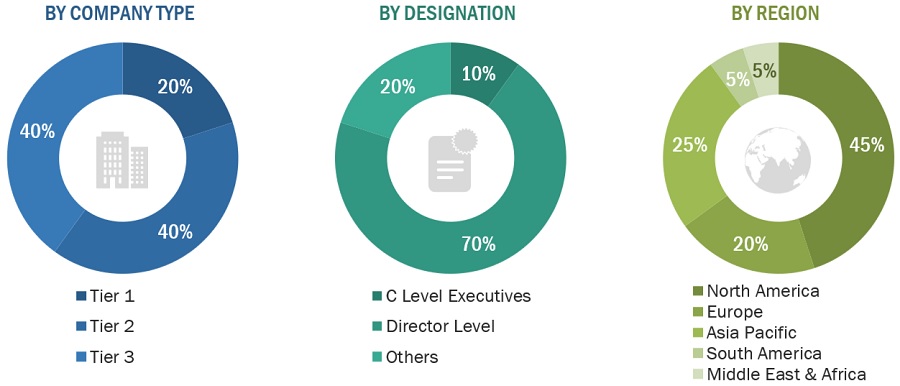

The study involved four major activities in estimating the current size of the metallocene polyethylene (mPE) market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the metallocene polyethylene (mPE) value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, which were referred to for identifying and collecting information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

The metallocene polyethylene (mPE) market comprises stakeholders, such as raw material suppliers, manufacturers, raw material manufacturers, distributors, traders, suppliers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the metallocene polyethylene (mPE) market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various companies and organizations operating in the metallocene polyethylene (mPE) market. Primary sources from the demand side included directors, marketing heads, and purchase managers from multiple end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the metallocene polyethylene (mPE) market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the metallocene polyethylene (mPE) market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Metallocene polyethylene (mPE) uses a liquid, such as water or refrigerant rather than air, to cool the data center. This allows the cooling solution to be brought closer to the heat source, thus requiring less fan power. Liquid cooling can solve the high-density server cooling problem because it connects more than 3,000 times as much heat as air does and requires less energy, increasing data center’s densities. Liquid cooling in data centers is implemented with a broad range of technologies. These technologies range from heat transfer from the source using inductive methods, such as cold plates to immersion cooling, where the heat transfer takes place on the surface of the electronic component.

Key stakeholders

- Manufacturers of mPE, Resins, Metallocene Catalysts, Feedstock Chemicals, Packaging Films, and Fibers

- Manufacturers of films & sheets, fiber, wires & cables, and pipes & panels

- Traders of Metallocene

- Association of Packaging and Processing Technologies

- Government and Regional Agencies and Research Organizations

Report Objectives

- To estimate and forecast the Metallocene Polyethylene (mPE) market in terms of value and volume.

- To define, describe, and forecast the mPE market based on product type, application, and region.

- To forecast the mPE market based on 5 main regions, namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To identify and analyze drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the mPE market.

- To strategically profile key players in the market and comprehensively analyze their core competencies.

- To provide a detailed competitive landscape of the mPE market, along with an analysis of business and corporate strategies, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of the product portfolio of each company in the metallocene polyethylene (mPE) market

- A further breakdown of a region of the metallocene polyethylene (mPE) market concerning a particular country

- Details and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Metallocene Polyethylene (mPE) Market

Interested in pricing data for PE grade products/market

General information on Polyethylene Market

Metallocene polymer and lab report

Market data on Global MLDPE film market

General information on polyethylene products

Market outlook data on Metallocene LLDPE, 2018 to next five years.