Polypropylene Catalyst Market by Type(Ziegler Natta, Metallocene and Others), Manufacturing Process(Bulk Phase Process, Gas Phase Process and Others), Region - Global Forecast to 2025

Updated on : March 21, 2024

Polypropylene Catalyst Market

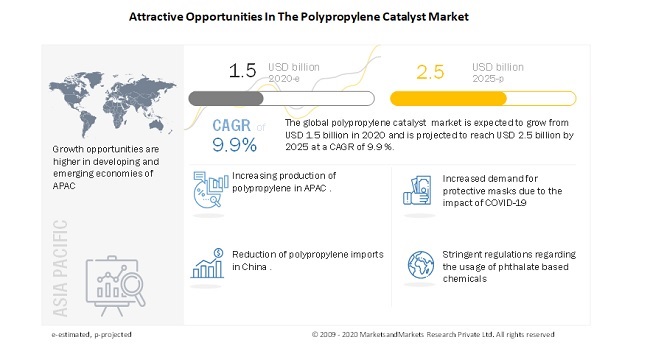

Polypropylene Catalyst Market was valued at USD 1.5 billion in 2020 and is projected to reach USD 2.5 billion by 2025, growing at 9.9% cagr from 2020 to 2025. The factors promoting the growth of the market are the increasing number of polypropylene production plants in countries such as China, India, and South Korea.

To know about the assumptions considered for the study, Request for Free Sample Report

COVD-19 impact on the polypropylene catalyst market:

The polypropylene catalyst market is impacted by the COVID 19, due to the disruption in the polypropylene industry globally:

- The demand for polypropylene catalyst has declined in Q1 & Q2 in 2020 and is expected to register a decline in 2020 due to weak demand for a polypropylene from the end-use industries, such as automobiles, construction and home appliances. The demand for polypropylene in the food packaging and medical applications have increased during the COVID-19 pandemic. However, the surge in the demand is inadequate to offset the sharp decline in the automobile and home appliance applications. It is estimated that the demand for polypropylene could fall by 15% in 2020. This fall in the demand for polypropylene translates to lower demand for polypropylene catalyst during the COVID-19 pandemic.

- In addition to, the oil price fall, earlier in 2020, COVID-19 also dragged down the prices of polypropylene due to a drop in demand from end-use industries, hence impacting the market of polypropylene catalyst.

- The polypropylene demand in the medical application has increased as the COVID-19 cases increased. Polypropylene fibers are a key component in the N95 masks and the demand for masks has surged in most affected countries. The polypropylene demand in food packaging also increased with the both take-away orders from restaurants and from store items increased. The stockpiling of necessary items in countries, such as the US, and the UK and other European countries also were key factors leading to the increase in the demand for polypropylene in packaging application. It is expected that the demand for polypropylene will return to normal by 2021.

- APAC is the least affected due to COVID-19 with regard to demand of polypropylene. The COVID-19 pandemic had crippled the healthcare sectors of many developed countries; these countries were falling short of medical supplies required to tackle the pandemic. China opened its economy in March when the pandemic started spreading widely in other countries. The country had a stronghold over supplies of masks, gowns, and other medical supplies. It increased its production of medical supplies, such as PPE kits and masks, to meet their increasing demand COVID-19 affected countries. The US-China geopolitical tensions and the failing quality tests of medical supplies from China led to other countries, such as India, Pakistan, and Vietnam, producing PPE kits. The surge in the production of PPE kits, gloves, and masks contributed to the increasing demand for polypropylene-based breathable films and non-woven fabrics. It is to be noted, that the demand for polypropylene breathable films in APAC is expected to register a growth of 14.6% in 2020 and reach a market size of USD 122.5 million by the end of 2020. This development in APAC has helped to reduce the impact of COVID-19 on the demand for polypropylene in 2020

Polypropylene Catalyst Market Dynamics

Driver: Increasing production of polypropylene in APAC

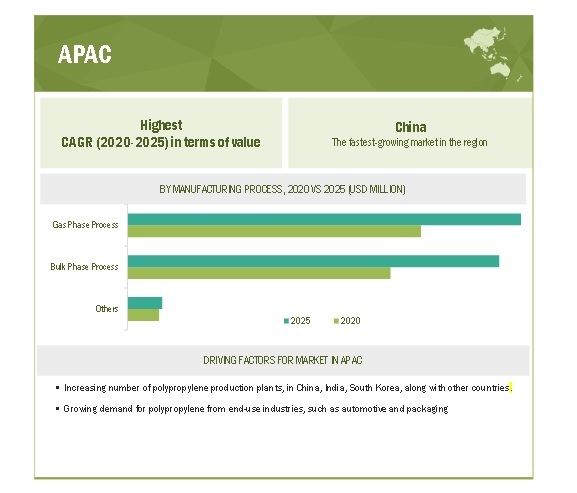

The demand for polypropylene Catalyst is growing because of the increasing consumption of polypropylene in the emerging markets of APAC, such as China, India, and South Korea, as well as in countries in other regions, such as Belgium, Canada, and Saudi Arabia. Construction of new manufacturing facilities or de-bottlenecking of existing polypropylene plants is expected to be carried out in these countries that will play a major role in propelling the demand for polypropylene catalyst. China is expected to account for the largest share of capacity additions for polypropylene in the near future. In 2020, LyondellBasell, the largest licensor of polyolefin technologies, provided a “Spheripol” technology license to different polypropylene manufacturing companies, including Quanzhou Grand Pacific Chemical Co. Ltd (China), Ulsan PP Co., Ltd (South Korea), Indian Oil Corporation Ltd. (India), Advanced Global Investment Company (Saudi Arabia), and Hyosung Vina Chemicals Co., Ltd (Vietnam). These developments will increase the demand and consumption of polypropylene catalysts during the forecast period.

Restraint: Stringent regulations regarding the usage of phthalate-based chemicals

In developed countries, the governments have imposed several regulations pertaining to the usage of chemicals and other additives in the manufacturing of consumer goods. PP, PE, polystyrene, acrylonitrile butadiene styrene, and other plastics are prevalently used in the manufacturing of consumer articles, such as toys, bags, and other products. However, certain chemicals, for instance, phthalates are used in the manufacturing of these plastics, which has a severe effect on humans and the environment.

Opportunities: Increased demand for protective masks due to the impact of COVID-19.

Surgical and N95 masks are used to prevent the spread of respiratory infections. These are an essential part of the personal protective equipment (PPE) used by health care professionals and are also used by the common public. These masks are designed to trap droplets released from coughing and sneezing. The filtering property of the mask is due to the application of a multilayered structure made from non-woven fabric, most commonly, polypropylene. Owing to the rapid spread of the COVID–19, there has been a surge in demand for these types of masks, globally. This is expected to boost the production of polypropylene to be used in surgical and N95 masks, hence creating opportunities for polypropylene catalyst producers and suppliers to fulfill the growing demand.

Challenges: Reduction of polypropylene imports in China

One of the major challenges faced by the petrochemical industry is decreasing demand for the major importer China. This is because of the current impact of COVID-19 and China’s aim to become self-sufficient in polypropylene production. The Chinese government has pledged to become self-sufficient in most of the petrochemicals that are currently being imported, and by 2025, there is a good chance that the country will become a net exporter of homo and co-polymer grades of polypropylene. This strategy will help China push itself up the manufacturing value chain and eliminate the middle-income trap. But, on the contrary, this will negatively impact the petrochemical business of South Korea, Singapore, and Saudi Arabia, who heavily rely on China’s import of polypropylene. The drop in demand in China will have a global impact on the petrochemical industry, and its stakeholders need to find new markets and opportunities to tackle this challenge in the near future. These manufacturers are also expected to focus on high-value products, thereby, changing the revenue mix of the polypropylene products.

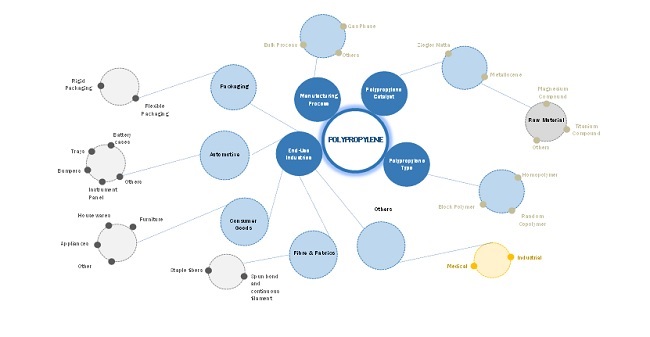

ECOSYSTEM DIAGRAM

To know about the assumptions considered for the study, download the pdf brochure

Ziegler Natta type segment projected to lead the polypropylene catalyst market from 2020 to 2025

The Ziegler Natta type segment accounted for the largest share in the overall polypropylene catalyst market. The factors that drive these segment of catalyst are that it offers polypropylene that have long isotactic sequence and are chaper than other options available. Also these usage of these catalyst eliminates deactivation, solvents, and polymer-purification steps .

The gas phase process is estimated to be the largest manufacturing process in the polypropylene catalyst market

The gas phase process led the overall polypropylene catalyst market in 2019 in terms of value. The reason for this manufacturing process leading the market is that it it does not need any type of liquid diluent and thus, there is no residual catalyst that remains in the reactor. This process os also cost effective when compared to the bulk phase process.

APAC is estimated to account for the highest share of the global Polypropylene Catalyst market both in terms of value and volume.

APAC is projected to have the largest share in the global Polypropylene Catalyst from 2020 to 2025. The growing production of polypropylene in countries such China, India and South Korea is driving the demand in the region.

Key Market Players

Key players in the market LyondellBasell Industries (the Netherlands), W.R. Grace & Co. (US), Clariant (Switzerland), Evonik (Germany), INEOS (UK), Sumitomo Chemicals (Japan), China Petrochemical Corporation (China), Japan Polypropylene Corporation (Japan), Evonik (Germany), and TOHO Titanium (Japan), and Mitsui Chemicals (Japan).

Scope of the report

|

Report Metric |

Details |

|

Years Considered |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Polyprop |

Value (USD Million) and Volume (Ton) |

|

Segments |

Polyproylene catalyst by Type, Manufacturing proces and Region |

|

Regions |

APAC, Europe, North America, South America, and the Middle East & Africa |

|

Companies |

LyondellBasell Industries (the Netherlands), W.R. Grace & Co. (US), Clariant (Switzerland), Evonik (Germany), INEOS (UK), Sumitomo Chemicals (Japan), China Petrochemical Corporation (China), Japan Polypropylene Corporation (Japan), Evonik (Germany), and TOHO Titanium (Japan), and Mitsui Chemicals (Japan), are the key players covered. |

This research report categorizes the global polypropylene catalyst market based on by type, by manufacturing process and region.

Based on type

- Ziegler Natta

- Metallocene

- Others (single-site catalysts, mixed di-ether-succinate catalysts, and custom catalysts)

Base on manufacturing process

- Bulk Phase Process

- Gas Phase Process

- Others (Hybrid and Slurry)

Based on region

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In July 2020, LyondellBasell Industries, one of the largest polyolefin technology license providers, announced that Quanzhou Grand Pacific Chemical Co. Ltd. (QGPC), a fully-owned Chinese subsidiary of Grand Pacific Petrochemical Corporation (GPPC) of Taiwan will use its Spheripol technology at a new polypropylene production facility. The new plant will produce 450 KTA of polypropylene, which will be built in Quanzhou, P.R. China.

- In September 2019, W.R. Grace has licensed its UNIPOL PP Process Technology to Bharat Petroleum Corporation Limited (BPCL). The technology will be used to produce 450 KTA of propylene at BPCL’s plant in Mumbai, India.

- In June 2020, Clariant launched the next-generation phthalate-free olefin polymerization catalysts PolyMax 600 Series. It was developed in partnership with McDermott’s Lummus Novolen Technology. The product has been developed to serve the growing demand for safer polypropylene solutions.

Frequently Asked Questions (FAQ):

What are the major applications for Polypropylene Catalyst?

The major applications for Polypropylene Catalyst are to optimise the polypropylene yield and imporves the manufacturing process..

What are the major types of Polypropylene Catalyst available?

The major types of polypropylene catalyst available in the market are Ziegler Natta and Metallocene. Among the two Ziegler Natta is the one which is majorly used by the manufactures.

What are the factors driving the growth of the Polypropylene Catalyst market?

The major factor driving the growth of the polypropylene catalyst market is the increasing polypropylene production in the APAC region..

Are there any restraints faced by the players in the Polypropylene Catalyst market?

The primary factor restraining the Polypropylene Catalyst market growth is the strict regulations associated with usage of phthalate based polypropylene in consumer products

Are there any upcoming opportunities for the players in the Polypropylene Catalyst market?

COVID-19 has created an opportunity for polypropylene catalyst market in the medical sector due to the increased usage of protective mask that uses non woven polypropylene fabrics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 SCOPE INCLUSIONS AND EXCLUSIONS: POLYPROPYLENE CATALYST MARKET

1.4 YEARS CONSIDERED IN THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 POLYPROPYLENE CATALYST MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.2 KEY DATA FROM SECONDARY SOURCES

2.2.1 PRIMARY DATA

2.3 KEY DATA FROM PRIMARY SOURCES

2.4 KEY INDUSTRY INSIGHTS

2.5 BREAKDOWN OF PRIMARY INTERVIEWS

2.6 MARKET SIZE ESTIMATION

2.6.1 DEMAND SIDE

2.6.2 SUPPLY SIDE

2.7 DATA TRIANGULATION

FIGURE 2 POLYPROPYLENE CATALYST MARKET: DATA TRIANGULATION

2.8 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 3 ZIEGLER-NATTA CATALYST TYPE DOMINATED THE POLYPROPYLENE CATALYST MARKET

FIGURE 4 GAS PHASE PROCESS WAS THE LARGEST TECHNOLOGY SEGMENT

FIGURE 5 APAC ACCOUNTED FOR THE LARGEST SHARE IN THE POLYPROPYLENE CATALYST MARKET

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYPROPYLENE CATALYST MARKET

FIGURE 6 GROWING NUMBER OF POLYPROPYLENE PRODUCTION PLANTS IN APAC TO DRIVE THE MARKET

4.2 APAC: POLYPROPYLENE CATALYST MARKET, BY MANUFACTURING PROCESS AND COUNTRY, 2019

FIGURE 7 GAS PHASE PROCESS AND CHINA ACCOUNTED FOR THE LARGEST SHARES IN THE MARKET

4.3 POLYPROPYLENE CATALYST MARKET, BY COUNTRY

FIGURE 8 CHINA TO BE THE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE POLYPROPYLENE CATALYST MARKET

5.2.1 DRIVERS

5.2.1.1 R&D activities for new product and development of specialty polypropylene account for about one-fourth of the overall polypropylene innovations

5.2.1.2 Increasing production of polypropylene in APAC

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations regarding the usage of phthalate-based chemicals

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing focus on metallocene catalyst-based polypropylene production

5.2.3.2 Availability of alternative raw material source for polypropylene production leading to a larger investment in shale gas-based process

5.2.3.3 Increased demand for protective masks due to the impact of COVID-19

5.2.4 CHALLENGES

5.2.4.1 Development of cost-effective and hazard-free catalysts to support sustainable development

5.2.4.2 Reduction of polypropylene imports in China

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 10 POLYPROPYLENE CATALYST MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM MAP

5.5 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMERS’ BUSINESS

TABLE 1 SHIFTS IMPACTING YCC AND YC

5.7 AVERAGE PRICING ANALYSIS

5.8 PATENT ANALYSIS

FIGURE 11 NUMBER OF GRANTED PATENTS PER YEAR (ZIEGLER-NATTA)

FIGURE 12 NUMBER OF GRANTED PATENTS PER YEAR (METALLOCENE)

FIGURE 13 NUMBER OF GRANTED PATENTS, BY JURISDICTION (ZIEGLER-NATTA)

FIGURE 14 NUMBER OF GRANTED PATENTS, BY JURISDICTION (METALLOCENE)

FIGURE 15 NUMBER OF GRANTED PATENTS, BY KEY PLAYER (ZIEGLER-NATTA)

FIGURE 16 NUMBER OF GRANTED PATENTS, BY KEY PLAYER (METALLOCENE)

5.9 TECHNOLOGY ANALYSIS

5.1 COVID-19 IMPACT ON POLYPROPYLENE CATALYST MARKET

5.11 FORECAST IMPACT FACTORS

5.12 MACROECONOMIC OVERVIEW

5.12.1 GLOBAL GDP OUTLOOK

FIGURE 17 WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS, PERCENTAGE CHANGE

FIGURE 18 GLOBAL CHEMICAL PRODUCTION FORECAST, 2019-2030, USD BILLION

FIGURE 19 WORLDWIDE POLYPROPYLENE PRODUCTION GROWTH (KILOTON)

6 POLYPROPYLENE CATALYST MARKET, BY TYPE (Page No. - 60)

6.1 INTRODUCTION

FIGURE 20 ZIEGLER-NATTA IS THE LARGEST TYPE OF POLYPROPYLENE CATALYST

TABLE 2 POLYPROPYLENE CATALYST MARKET SIZE, BY TYPE, 2015–2022 (TON) (HISTORICAL)

TABLE 3 POLYPROPYLENE CATALYST MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 4 POLYPROPYLENE CATALYST MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 5 POLYPROPYLENE CATALYST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.2 ZIEGLER-NATTA

6.2.1 MOST MANUFACTURERS USE ZIEGLER-NATTA CATALYST FOR THE PRODUCTION OF POLYPROPYLENE

6.3 METALLOCENE

6.3.1 INDUSTRY EXPERTS CONSIDER METALLOCENE CATALYST AS AN ALTERNATIVE TO ZIEGLER-NATTA

6.4 OTHERS

7 POLYPROPYLENE CATALYST MARKET, BY MANUFACTURING PROCESS (Page No. - 64)

7.1 INTRODUCTION

FIGURE 21 GAS PHASE PROCESS TO LEAD THE POLYPROPYLENE CATALYST MARKET

TABLE 6 POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 7 POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 8 POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 9 POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

7.2 GAS PHASE

7.2.1 BEING COST-EFFECTIVE IS DRIVING THE MARKET FOR GAS PHASE PROCESS, GLOBALLY

TABLE 10 GAS PHASE PATENTED PROCESSES AND COMPANIES

TABLE 11 GAS PHASE: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (TON) (HISTORICAL)

TABLE 12 GAS PHASE: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 13 GAS PHASE: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 14 GAS PHASE: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 BULK PROCESS

7.3.1 DEMAND FOR BULK PHASE IS EXPECTED TO BE LOWER THAN THAT FOR GAS PHASE DUE TO LATTER’S SUPERIOR OUTPUT

TABLE 15 BULK PHASE PATENTED PROCESSES AND COMPANIES

TABLE 16 BULK PROCESS: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015-2022 (TON) (HISTORICAL)

TABLE 17 BULK PROCESS: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 18 BULK PROCESS: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018-2025 (TON)

TABLE 19 BULK PROCESS: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.4 OTHERS

TABLE 20 OTHER PROCESSES: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (TON) (HISTORICAL)

TABLE 21 OTHER PROCESSES: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 22 OTHER PROCESSES: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 23 OTHER PROCESSES: POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 POLYPROPYLENE CATALYST MARKET, BY REGION (Page No. - 72)

8.1 INTRODUCTION

FIGURE 22 CHINA TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

TABLE 24 POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (TON) (HISTORICAL)

TABLE 25 POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 26 POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 27 POLYPROPYLENE CATALYST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2 APAC

FIGURE 23 APAC: POLYPROPYLENE CATALYST MARKET SNAPSHOT

TABLE 28 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (TON) (HISTORICAL)

TABLE 29 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 30 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 31 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 32 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 33 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 35 APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Move toward becoming self-sufficient in polypropylene business will drive the demand for polypropylene catalyst

TABLE 36 NEW POLYPROPYLENE PRODUCTION CAPACITY ADDITIONS (CHINA)

TABLE 37 CHINA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 38 CHINA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 39 CHINA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 40 CHINA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Market is expected to have a slower growth rate due to reducing demand for domestic polypropylene

TABLE 41 JAPAN: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 42 JAPAN: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 43 JAPAN: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 44 JAPAN: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.2.3 INDIA

8.2.3.1 Various upcoming polypropylene production plants to drive the market during the forecast period

TABLE 45 NEW POLYPROPYLENE PRODUCTION CAPACITY ADDITIONS (INDIA)

TABLE 46 INDIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 47 INDIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 48 INDIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 49 INDIA: POLYPROPYLENE CATALYST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Country is expected to be the second-fastest growing market for polypropylene catalyst in the region

TABLE 50 NEW POLYPROPYLENE PRODUCTION CAPACITY ADDITIONS (SOUTH KOREA)

TABLE 51 SOUTH KOREA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 52 SOUTH KOREA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 53 SOUTH KOREA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 54 SOUTH KOREA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.2.5 REST OF APAC

TABLE 55 REST OF APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 56 REST OF APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 57 REST OF APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 58 REST OF APAC: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 24 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (TON) (HISTORICAL)

TABLE 60 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 61 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 62 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 64 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 65 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 66 NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.3.1 US

8.3.1.1 Upcoming polypropylene production plants in the country will drive the polypropylene catalyst market during the forecast period

TABLE 67 NEW POLYPROPYLENE PRODUCTION CAPACITY ADDITIONS

TABLE 68 US: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 69 US: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 70 US: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 71 US: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.3.2 REST OF NORTH AMERICA

TABLE 72 REST OF NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 73 REST OF NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 74 REST OF NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 75 REST OF NORTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4 EUROPE

TABLE 76 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (TON) (HISTORICAL)

TABLE 77 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 78 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 79 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 80 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 81 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 82 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 83 EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Demand for polypropylene from automotive industry will drive the demand for polypropylene catalyst

TABLE 84 GERMANY: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 85 GERMANY: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 86 GERMANY: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 87 GERMANY: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4.2 BELGIUM

8.4.2.1 Bulk process to be the fastest-growing manufacturing process

TABLE 88 BELGIUM: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 89 BELGIUM: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 90 BELGIUM: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 91 BELGIUM: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Polypropylene catalyst market to witness a slower growth rate than other countries in the region

TABLE 92 FRANCE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 93 FRANCE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 94 FRANCE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 95 FRANCE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4.4 THE COMMONWEALTH OF INDEPENDENT STATES (CIS)

8.4.4.1 Upcoming polypropylene production plants in these countries will drive the market for catalysts

TABLE 96 CIS: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 97 CIS: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 98 CIS: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 99 CIS: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.4.5 REST OF EUROPE

TABLE 100 REST OF EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 101 REST OF EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 102 REST OF EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 103 REST OF EUROPE: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.5 SOUTH AMERICA

TABLE 104 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (TON) (HISTORICAL)

TABLE 105 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 106 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 107 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 108 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 109 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 110 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 111 SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Expansion of polypropylene production capacity to drive the market for polypropylene catalyst

FIGURE 25 BRAZIL’S POLYPROPYLENE IMPORT AND EXPORT, 2015 -2019, (TON)

TABLE 112 TOP 5 EXPORTING AND IMPORTING DESTINATIONS OF POLYPROPYLENE FOR BRAZIL, 2019

TABLE 113 BRAZIL: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 114 BRAZIL: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 115 BRAZIL: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 116 BRAZIL: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.5.2 REST OF SOUTH AMERICA

TABLE 117 REST OF SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 118 REST OF SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 119 REST OF SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 120 REST OF SOUTH AMERICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

TABLE 121 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (TON) (HISTORICAL)

TABLE 122 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 123 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 124 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 125 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 126 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 128 MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.6.1 SAUDI ARABIA

8.6.1.1 Increasing investment in the expansion of the polyolefin capacity in the country supports the market growth

FIGURE 26 SAUDI ARABIA’S POLYPROPYLENE IMPORT AND EXPORT, 2015-2019, (TON)

TABLE 129 SAUDI ARABIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 130 SAUDI ARABIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 131 SAUDI ARABIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 132 SAUDI ARABIA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.6.2 SOUTH AFRICA

8.6.2.1 Increasing demand for polypropylene from several end-use industries will support the market growth

TABLE 133 SOUTH AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (TON) (HISTORICAL)

TABLE 134 SOUTH AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 135 SOUTH AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (TON)

TABLE 136 SOUTH AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

8.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 137 REST OF MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS 2015–2022 (TON) (HISTORICAL)

TABLE 138 REST OF MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION) (HISTORICAL)

TABLE 139 REST OF MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS 2018–2025 (TON)

TABLE 140 REST OF MIDDLE EAST & AFRICA: POLYPROPYLENE CATALYST MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 116)

9.1 OVERVIEW

9.2 MARKET STRUCTURE

FIGURE 27 COMPANIES ADOPTED EXPANSIONS AND ACQUISITIONS AS KEY GROWTH STRATEGIES FROM 2017 TO 2020

9.3 COMPETITIVE SCENARIO

9.3.1 EXPANSION

TABLE 141 EXPANSIONS, 2017–2020

9.3.2 ACQUISITION

TABLE 142 ACQUISITIONS, 2017–2020

9.3.3 NEW PRODUCT DEVELOPMENT

TABLE 143 NEW PRODUCT DEVELOPMENTS, 2017-2020

9.3.4 PARTNERSHIP/AGREEMENT/SUPPLY CONTRACT

TABLE 144 PARTNERSHIPS/AGREEMENTS/SUPPLY CONTRACTS, 2017-2020

9.4 COMPANY EVALUATION QUADRANT DEFINITION

9.4.1 STAR

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE

9.4.4 PARTICIPANT

FIGURE 28 COMPANY EVALUATION QUADRANT, 2019

9.5 MARKET SHARE ANALYSIS

FIGURE 29 MARKET SHARE OF LEADING COMPANIES, 2019

9.6 MARKET EVALUATION MATRIX

9.7 REVENUE ANALYSIS OF TOP PLAYERS

10 COMPANY PROFILES (Page No. - 124)

10.1 LYONDELLBASELL INDUSTRIES

10.1.1 BUSINESS OVERVIEW

FIGURE 30 LYONDELLBASELL INDUSTRIES: COMPANY SNAPSHOT

10.1.2 PRODUCTS OFFERED

10.1.3 RECENT DEVELOPMENTS

10.1.4 MNM VIEW

10.1.5 IMPACT OF COVID-19 ON BUSINESS SEGMENTS

10.2 W.R. GRACE

10.2.1 BUSINESS OVERVIEW

FIGURE 31 W.R. GRACE: COMPANY SNAPSHOT

10.2.2 PRODUCTS OFFERED

10.2.3 RECENT DEVELOPMENTS

10.2.4 MNM VIEW

10.2.5 IMPACT OF COVID-19 ON BUSINESS SEGMENTS

10.3 CLARIANT

10.3.1 BUSINESS OVERVIEW

FIGURE 32 CLARIANT: COMPANY SNAPSHOT

10.3.2 PRODUCTS OFFERED

10.3.3 RECENT DEVELOPMENTS

10.3.4 MNM VIEW

10.3.5 IMPACT OF COVID-19 ON BUSINESS SEGMENTS

10.4 MITSUI CHEMICALS

10.4.1 BUSINESS OVERVIEW

FIGURE 33 MITSUI CHEMICALS: COMPANY SNAPSHOT

10.4.2 PRODUCTS OFFERED

10.4.3 RECENT DEVELOPMENTS

10.4.4 MNM VIEW

10.4.5 IMPACT OF COVID-19 ON BUSINESS SEGMENTS

10.5 CHINA PETROCHEMICAL CORPORATION

10.5.1 BUSINESS OVERVIEW

FIGURE 34 CHINA PETROCHEMICAL CORPORATION: COMPANY SNAPSHOT

10.5.2 PRODUCTS OFFERED

10.5.3 MNM VIEW

10.6 EVONIK

10.6.1 BUSINESS OVERVIEW

FIGURE 35 EVONIK: COMPANY SNAPSHOT

10.6.2 PRODUCTS OFFERED

10.6.3 MNM VIEW

10.7 SUMITOMO CHEMICALS

10.7.1 BUSINESS OVERVIEW

FIGURE 36 SUMITOMO CHEMICALS: COMPANY SNAPSHOT

10.7.2 PRODUCTS OFFERED

10.7.3 RECENT DEVELOPMENTS

10.8 TOHO TITANIUM

10.8.1 BUSINESS OVERVIEW

FIGURE 37 TOHO TITANIUM: COMPANY SNAPSHOT

10.8.2 PRODUCTS OFFERED

10.9 JAPAN POLYPROPYLENE CORPORATION

10.9.1 BUSINESS OVERVIEW

10.9.2 PRODUCTS OFFERED

10.10 INEOS

10.10.1 BUSINESS OVERVIEW

10.10.2 PRODUCTS OFFERED

11 ADJACENT AND RELATED MARKETS (Page No. - 144)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 POLYPROPYLENE MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.3.3 POLYPROPYLENE MARKET, BY TYPE

TABLE 145 POLYPROPYLENE MARKET SIZE, BY TYPE, 2015–2022 (USD BILLION)

11.3.4 POLYPROPYLENE MARKET, BY APPLICATION

TABLE 146 POLYPROPYLENE MARKET SIZE, BY APPLICATION, 2015–2022 (USD BILLION)

11.3.5 POLYPROPYLENE MARKET, BY END-USE INDUSTRY

TABLE 147 POLYPROPYLENE MARKET SIZE, BY END-USE INDUSTRY, 2015–2022 (USD BILLION)

11.3.6 POLYPROPYLENE MARKET, BY REGION

TABLE 148 POLYPROPYLENE MARKET SIZE, BY REGION, 2015–2022 (USD BILLION)

11.4 POLYURETHANE ADDITIVES MARKET

11.4.1 MARKET DEFINITION

11.4.2 MARKET OVERVIEW

11.4.3 POLYURETHANE ADDITIVES MARKET, BY TYPE

TABLE 149 POLYURETHANE ADDITIVES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.4.4 POLYURETHANE ADDITIVES MARKET, BY APPLICATION

TABLE 150 POLYURETHANE ADDITIVES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11.4.5 POLYURETHANE ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 151 POLYURETHANE ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

11.4.6 POLYURETHANE ADDITIVES MARKET, BY REGION

TABLE 152 POLYURETHANE ADDITIVES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.5 REFINERY CATALYSTS MARKET

11.5.1 MARKET DEFINITION

11.5.2 MARKET OVERVIEW

11.5.3 REFINERY CATALYSTS MARKET, BY TYPE

TABLE 153 REFINERY CATALYSTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.5.4 REFINERY CATALYSTS MARKET, BY REGION

TABLE 154 REFINERY CATALYSTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12 APPENDIX (Page No. - 152)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current polypropylene catalyst market size. Exhaustive secondary research was done to collect information related to the polypropylene catalyst market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The polypropylene catalyst market comprises several stakeholders, such as raw material suppliers, technology developers, derivative manufacturers, and regulatory organizations in the supply chain. Moreover, the development of applications characterizes the demand side of this market. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

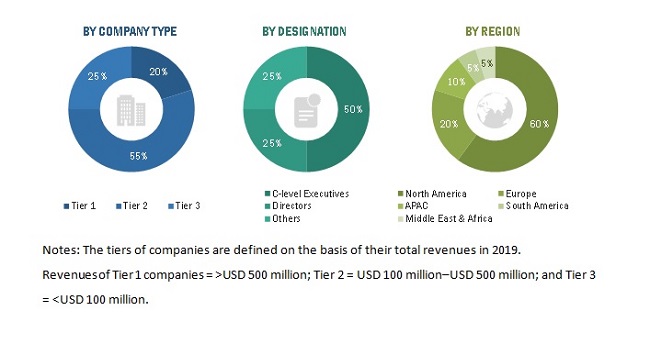

Breakdown of Primary Interviews:

To know about the assumptions considered for the study, download the pdf brochure

Notes: The tiers of companies are defined on the basis of their total revenues in 2019.

Revenues of Tier 1 companies = >USD 500 million; Tier 2 = USD 100 million–USD 500 million; and Tier 3 = < USD P 100 million.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the polypropylene catalyst market and estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable. In order to complete the overall market estimation process and arrive at the exact statistics for all segments and subsegments, the data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size of the polypropylene catalyst market, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the polypropylene catalyst market size based on type, manufacturing process.

- To forecast the market size of different segments with respect to five regions, namely, APAC, North America, Europe, South America, and the Middle East and Africa.

- To forecast the polypropylene catalyst market size for different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying its high-growth segments

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the Polypropylene Catalyst market

Company Information:

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Polypropylene Catalyst Market

General information on Polypropylene Catalysts Market

Information on the polypropelene market

Information on PP Catalysts Market and Type