Methyl Methacrylate Adhesives Market by Substrate (Metal, Plastic, Composite), End Use Industry (Automotive & Transportation, Marine, Wind Energy, Building & Construction, General Assembly), and Region - Global Forecast to 2023

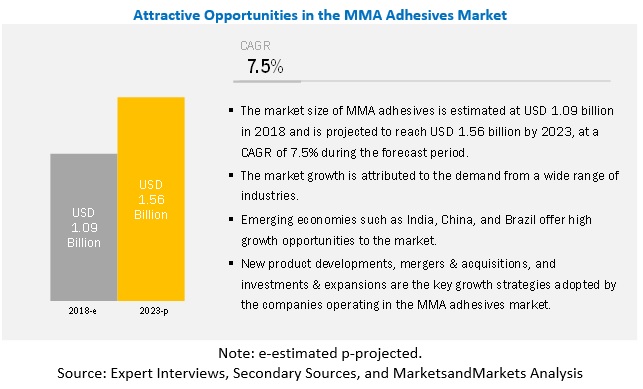

The market size of MMA Adhesives is estimated at USD 1.09 billion in 2018 and is projected to reach USD 1.56 billion by 2023, at a CAGR of 7.5% from 2018 to 2023.

Increasing demand for MMA adhesives from the automotive & transportation industry is one of the major drivers for the MMA Adhesives market. Automotive & transportation is the largest application because of the increasing use of advanced materials for component manufacturing, which develops a need for bonding technology that can bond dissimilar materials with adjustable assembly time. Metal is the largest substrate, in terms of value, and is expected to dominate the market in the future.

The composites segment is projected to register the highest CAGR during the forecast period

Composite are projected to be the fastest-growing substrate type in the global MMA adhesives market, in terms of value. This high growth can be attributed to the growing demand for MMA adhesives for bonding composite components, such as deflectors, bumpers, roofs, composite tanks, blades, car seats, interior body panel structures, and instrument panels of trucks, cars, rails, buses, and tanks.

The automotive & transportation end-use industry is projected to register the highest CAGR during the forecast period

The market size of MMA adhesives for automotive & transportation end-use industry, in terms of value, is projected to grow at the highest growth rate. This is due to the increasing penetration of MMA adhesives as a technology for bonding composites to metals and metals to metal components. MMA adhesives offer the benefit of bonding materials having different strength and different coefficient of thermal expansion. It distributes the load evenly to the entire bonding area. MMA adhesives require minimal or no surface preparation along with the benefits of excellent fatigue, superior toughness, endurance, and excellent impact resistance.

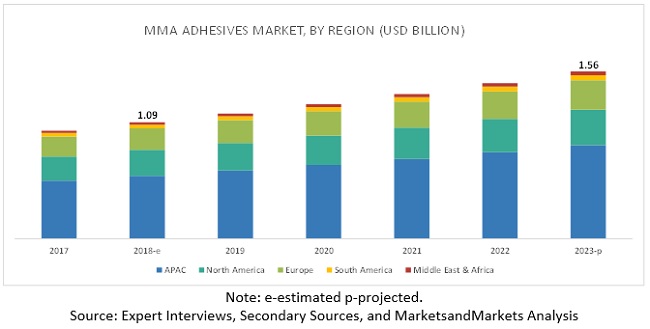

By region, the MMA Adhesives market in APAC is projected to register the highest CAGR during the forecast period

APAC is projected to be the fastest-growing market for MMA adhesives. The market in this region is mainly driven by the demand from automotive & transportation, wind energy, and marine end-use industries. Automotive & transportation industry is one of the major applications of MMA adhesives in this region. The economic growth in the APAC region, particularly in emerging markets such as India, Taiwan, Indonesia, Malaysia, Thailand, and Vietnam is contributing to the increase in the number of infrastructure projects, which is expected to drive the demand for MMA adhesives in the building & construction application.

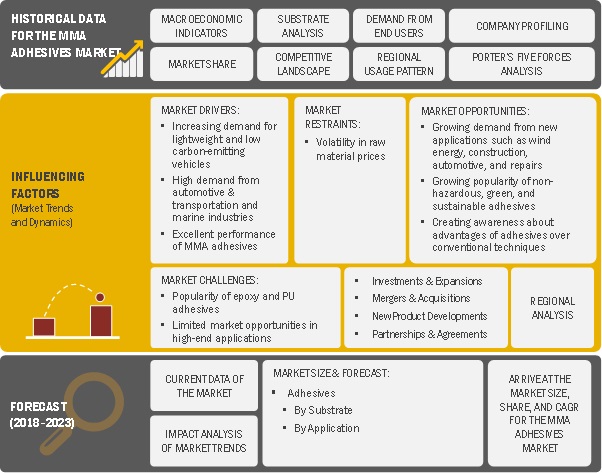

Market Dynamics

The major driver of the MMA adhesives market is the increasing demand for lightweight, energy-efficient, and high-performance vehicles. Automotive is one of the largest end-use industries for MMA adhesives. These adhesives play a major role in the manufacturing of automobiles, as they have the ability to improve aesthetics as well as reduce the weight of vehicles, thereby enhancing fuel efficiency and limiting carbon emissions. Earlier, adhesives were only used for laminating, bonding, and assembling of automotive interior components. Now they are developed to ensure compliance with stringent environmental regulations formulated to keep carbon emissions to a minimum. The use of MMA adhesives improves vehicle durability and reduces weight, while enhancing cost savings. These adhesives offer additional stiffness and rigidity to vehicles without impacting the riding comfort for passengers.

However, many end-use industries, such as transportation, wind energy, marine, assembly, and construction, have been using mechanical fasteners and adhesives, including acrylics, epoxies, and PU as alternatives to MMA adhesives. These alternatives have high popularity as they are easily available in the market and the engineers have technical expertise in using these techniques. These adhesives offer competitive performance at lower prices than MMA adhesives. Per unit cost of using these alternatives are comparatively lesser than MMA adhesives. Thus, in such conditions, it is difficult for MMA adhesive to increase its penetration in various applications.

Research Design

Leading Players

Henkel is engaged in the consumer and industrial business. The company operates through various segments, including adhesive technologies, beauty care, laundry & home care and corporate. The companys adhesive technologies segment is a global leader in the adhesives market across all the industry segments. It manufactures MMA adhesives under this segment. The company has operations in North America, Latin America, Asia-Pacific, Europe, the Middle East, and Africa. Strategically, the company has adopted inorganic strategies to increase its share in the MMA adhesives market.

H.B. Fuller is a leading global adhesives manufacturer, formulator, and marketer. The company operates through five segments, namely, Americas adhesives, construction products, EIMEA (Europe, India, and the Middle East & Africa), engineering adhesives, and Asia Pacific. The company manufactures adhesives for various applications such as assembly, packaging, converting, nonwoven & hygiene, performance wood, flooring, textile, flexible packaging, graphic arts, envelope, and electronics. It markets thermoset-based film adhesive under brand Flexel. H.B.Fuller has a strong customer base and operates in 37 countries of Europe, North America, and APAC. As of 2017, it had more than 6,000 employees, globally.

Recent Developments

- In April 2017, Sika launched SikaFast-3300 and SikaFast-3500 structural methyl methacrylate adhesives for transportation and industrial assembly applications.

- In June 2016, Henkel the company launched Henkel Adhesives Innovation Center (HAIC) in Shanghai, China. With this, the company targets to expand its R&D capabilities for adhesives and provide innovative market-driven solutions to local customers of APAC thereby strengthening the foothold of Henkel in the MMA adhesives market.

- In March 2015, ITW Plexus launched a new product, MA515, which is used for bonding small and medium-sized composite and thermoplastic assemblies. It is used to eliminate the problems associated with the bonding of materials such as carbon fiber, polyamide, and poly-dicyclopentadiene (PDCPD). This development is expected to help meet the demand for MMA adhesives, globally.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

20162023 |

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Substrate and Application |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Illinois Tool Works Inc. (US), Bostik (Arkema) (France), SCIGRIP (UK), Scott Bader (UK), H.B. Fuller (US), Henkel (Germany). |

The MMA Adhesives market report has been segmented in the following segments:

MMA Adhesives Market, by Substrate:

- Metal

- Plastic

- Composite

- Others

MMA Adhesives Market, by End-use Industry:

- Automotive & Transportation

- Building & Construction

- Marine

- Wind Energy

- General Assembly

- Others

MMA Adhesives Market, by Region:

- APAC

- China

- India

- Japan

- South Korea

- Thailand

- Rest of APAC

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Rest of Europe

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Others

- Middle East & Africa

- South Africa

- Rest of Middle East & Africa

Key Questions Addressed by the Report

- What is the mid-to-long term impact of the developments undertaken in the industry?

- What are the upcoming technologies used in MMA adhesives industry?

- Which segment has the potential to register the highest market share?

- What is the current competitive landscape in the MMA adhesives market in terms of new technologies, developments, and capabilities?

- What will be the growth prospects of the MMA adhesives market?

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of product portfolio of each company

Country-wise Analysis

- Further breakdown of Rest of APAC countries into Taiwan, Vietnam, Singapore, Philippines, Australia, and New Zealand.

- Further breakdown of Rest of Europe into the Netherlands, Switzerland, Greece, Hungary, Romania, Croatia, Bulgaria, Denmark, Finland, Austria, Norway, and Ukraine.

- Further breakdown of Rest of the Middle East & Africa into the Algeria, Egypt, Iraq, Nigeria, Kenya, and Morocco

- Further breakdown of Rest of South America into Chile, Uruguay, Ecuador, and Paraguay.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities for Market Players

4.2 MMA Adhesives Market, By Substrate

4.3 MMA Adhesives Market in APAC

4.4 MMA Adhesives Market, By Country

4.5 MMA Adhesives Market: Developed vs. Developing Countries

4.6 APAC: Methyl Methacrylate Adhesives Market, By Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand for Lightweight and Low Carbon-Emitting Vehicles

5.2.1.2 High Demand From Automotive & Transportation and Marine Industries

5.2.1.3 Excellent Performance of MMA Adhesives

5.2.2 Restraints

5.2.2.1 Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Growing Demand From New Applications Such as Wind Energy, Construction, Automotive, and Repairs

5.2.3.2 Growing Popularity of Non-Hazardous, Green, and Sustainable Adhesives

5.2.3.3 Creating Awareness About Advantages of Adhesives Over Conventional Techniques

5.2.4 Challenges

5.2.4.1 Popularity of Epoxy and Pu Adhesives

5.2.4.2 Limited Market Opportunities in High-End Applications

5.3 Porters Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

6 Macroeconomic Overview and Key Indicators (Page No. - 42)

6.1 Introduction

6.1.1 Global GDP Trends and Forecasts

6.1.2 Growth Indicators in the Automotive Industry

7 MMA Adhesives Market, By Substrate (Page No. - 45)

7.1 Introduction

7.2 Metal

6.1.2 Improved Asthetics to Drive the Demand

7.3 Plastic

6.1.2 Plastics Replacing Metals in Various Applications to Drive the Demand

7.4 Composite

6.1.2 Growth in Use of Composites to Replace Metals

7.5 Others

8 MMA Adhesives Market, By End-Use Industry (Page No. - 52)

8.1 Introduction

8.2 Automotive & Transportation

8.2.1 Improved Productivity, and Reduced Manufacturing Costs Offered By MMA Adhesives

8.3 Building & Construction

8.3.1 Growth Indicators in the Automotive Industry

8.4 Marine

8.4.1 Increasing Use of Plastic and Composites in Fabricating Boats is Boosting the Demand

8.5 Wind Energy

8.5.1 Increasing Focus on Green Energy Sources is Expected to Drive the Demand

8.6 General Assembly

8.6.1 Growing Use of Home and Industrial Applicances

8.7 Others

9 MMA Adhesives Market, By Region (Page No. - 62)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Automotive and Transportation Industry Highly Dominates the Us Structural Adhesives Market

9.2.2 Canada

9.2.2.1 Automotive and Construction are Major Applications

9.2.3 Mexico

9.2.3.1 Wind Energy Sector is Expected to Be the Fastest-Growing

9.3 Europe

9.3.1 Germany

9.3.1.1 Automotive and Construction Industry Will Continue to Drive the MMA Adhesives Market

9.3.2 France

9.3.2.1 Higher Growth of the Automotive Industry is Expected to Drive the Demand

9.3.3 Spain

9.3.3.1 Growing Demand From New Applications to Drive the Market

9.3.4 UK

9.3.4.1 Construction is One of the Major Applications Which Drives the Market

9.3.5 Russia

9.3.5.1 Increased Acceptance of MMA Adhesives to Drive the Market

9.3.6 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 China Accounted for the Largest Share of the MMA Adhesives Market in APAC

9.4.2 India

9.4.2.1 Growing Demand From New Applications Such as Wind Energy, Construction, Automotive, and Repairs

9.4.3 Japan

9.4.3.1 Japan Witnessing A Low Growth Due to the Maturity of the Adhesives Market

9.4.4 South Korea

9.4.4.1 Growing Demand From Applications Such as Automotive and Construction to Drive the Demand

9.4.5 Thailand

9.4.5.1 Rapid Industrialization and Increasing Consumer Spending are Expected to Boost the Demand for MMA Adhesives

9.4.6 Rest of APAC

9.5 South America

9.5.1 Brazil

9.5.1.1 Brazil Accounted for the Largest Share of the South American MMA Adhesives Market

9.5.2 Rest of South America

9.6 Middle East & Africa

9.6.1 South Africa

9.6.1.1 Limited Penetrationan and Acceptance From End Users of MMA Adhesives to Pose A Challenge

9.6.2 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 95)

10.1 Introduction

10.2 Competitive Scenario

10.3 New Product Launches

10.4 Mergers & Acquisitions

10.5 Investments & Expansions

10.6 Partnerships & Agreements

11 Company Profiles (Page No. - 99)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Illinois Tool Works Inc.

11.2 Henkel AG & Co. Kgaa

11.3 H.B. Fuller Company

11.4 3M Company

11.5 Arkema S.A. (Bostik)

11.6 Huntsman International LLC.

11.7 Sika AG

11.8 Scigrip

11.9 Scott Bader Company Ltd.

11.10 Lord Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Key Companies

11.11.1 Dowdupont

11.11.2 Novachem Corporation Ltd.

11.11.3 ND Industries, Inc.

11.11.4 Kisling AG

11.11.5 Delo Industrial Adhesives

11.11.6 Hernon Manufacturing

11.11.7 Parson Adhesives

11.11.8 Chemique Adhesives

11.11.9 Permabond LLC

11.11.10 Adhesive Systems, Inc.

11.11.11 L&L Products

11.11.12 Engineered Bonding Solutions, LLC.

12 Appendix (Page No. - 125)

12.1 Discussion Guide

12.2 Available Customizations

12.3 Related Reports

12.4 Author Details

List of Tables (83 Tables)

Table 1 MMA Adhesives Market Snapshot (2018 vs. 2023)

Table 2 GDP Trends and Forecasts, By Key Country, 20162022 (USD Billion)

Table 3 Automotive Production in Key Countries, 20162017 (Million Unit)

Table 4 Methyl Methacrylate Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 5 Methyl Methacrylate Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 6 Methyl Methacrylate Adhesives Market Size in Metal Bonding, By Region, 20162023 (USD Million)

Table 7 Methyl Methacrylate Adhesives Market Size in Metal Bonding, By Region, 20162023 (Kiloton)

Table 8 Methyl Methacrylate Adhesives Market Size in Plastic Bonding, By Region, 20162023 (USD Million)

Table 9 Methyl Methacrylate Adhesives Market Size in Plastic Bonding, By Region, 20162023 (Kiloton)

Table 10 Methyl Methacrylate Adhesives Market Size in Composite Bonding, By Region, 20162023 (USD Million)

Table 11 Methyl Methacrylate Adhesives Market Size in Composite Bonding, By Region, 20162023 (Kiloton)

Table 12 Methyl Methacrylate Adhesives Market Size in Other Substrates Bonding, By Region, 20162023 (USD Million)

Table 13 Methyl Methacrylate Adhesives Market Size in Other Substrates Bonding, By Region, 20162023 (Kiloton)

Table 14 Methyl Methacrylate Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 15 Methyl Methacrylate Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 16 Methyl Methacrylate Adhesives Market Size in Automotive & Transportation, By Region, 20162023 (USD Million)

Table 17 Methyl Methacrylate Adhesives Market Size in Automotive & Transportation, By Region, 20162023 (Kiloton)

Table 18 Methyl Methacrylate Adhesives Market Size in Building & Construction, By Region, 20162023 (USD Million)

Table 19 Methyl Methacrylate Adhesives Market Size in Building & Construction, By Region, 20162023 (Kiloton)

Table 20 Methyl Methacrylate Adhesives Market Size in Marine, By Region, 20162023 (USD Million)

Table 21 Methyl Methacrylate Adhesives Market Size in Marine, By Region, 20162023 (Kiloton)

Table 22 Methyl Methacrylate Adhesives Market Size in Wind Energy, By Region, 20162023 (USD Million)

Table 23 Methyl Methacrylate Adhesives Market Size in Wind Energy, By Region, 20162023 (Kiloton)

Table 24 Methyl Methacrylate Adhesives Market Size in General Assembly, By Region, 20162023 (USD Million)

Table 25 Methyl Methacrylate Adhesives Market Size in General Assembly, By Region, 20162023 (Kiloton)

Table 26 Methyl Methacrylate Adhesives Market Size in Other End-Use Industries, By Region, 20162023 (USD Million)

Table 27 Methyl Methacrylate Adhesives Market Size in Other End-Use Industries, By Region, 20162023 (Kiloton)

Table 28 Methyl Methacrylate Adhesives Market Size, By Region, 20162023 (USD Million)

Table 29 Methyl Methacrylate Adhesives Market Size, By Region, 20162023 (Kiloton)

Table 30 North America: MMA Adhesives Market Size, By Country, 20162023 (USD Million)

Table 31 North America: MMA Adhesives Market Size, By Country, 20162023 (Kiloton)

Table 32 North America: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 33 North America: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 34 North America: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 35 North America: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 36 US: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 37 US: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 38 US: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 39 US: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 40 Europe: MMA Adhesives Market Size, By Country, 20162023 (USD Million)

Table 41 Europe: MMA Adhesives Market Size, By Country, 20162023 (Kiloton)

Table 42 Europe: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 43 Europe: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 44 Europe: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 45 Europe: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 46 Germany: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 47 Germany: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 48 Germany: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 49 Germany: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 50 APAC: MMA Adhesives Market Size, By Country, 20162023 (USD Million)

Table 51 APAC: MMA Adhesives Market Size, By Country, 20162023 (Kiloton)

Table 52 APAC: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 53 APAC: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 54 APAC: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 55 APAC: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 56 China: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 57 China: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 58 China: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 59 China: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 60 India: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 61 India: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 62 India: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 63 India: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 64 Japan: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 65 Japan: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 66 Japan: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 67 Japan: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 68 South America: MMA Adhesives Market Size, By Country, 20162023 (USD Million)

Table 69 South America: MMA Adhesives Market Size, By Country, 20162023 (Kiloton)

Table 70 South America: MMA Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 71 South America: MMA Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 72 South America: MMA Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 73 South America: MMA Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 74 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By Country, 20162023 (USD Million)

Table 75 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By Country, 20162023 (Kiloton)

Table 76 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By Substrate, 20162023 (USD Million)

Table 77 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By Substrate, 20162023 (Kiloton)

Table 78 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 79 Middle East & Africa: Methyl Methacrylate Adhesives Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 80 New Product Launches, 20132018

Table 81 Mergers & Acquisitions, 20132018

Table 82 Investments & Expansions, 20132018

Table 83 Partnerships & Agreements, 20132018

List of Figures (41 Figures)

Figure 1 MMA Adhesives Market Segmentation

Figure 2 MMA Adhesives Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 MMA Adhesives Market: Data Triangulation

Figure 6 APAC to Dominate the MMA Adhesives Market

Figure 7 Electrical & Electronics to Be the Fastest-Growing End-Use Industry

Figure 8 Composite & Plastic MMA Adhesives to Be the Most Preferred Segments

Figure 9 APAC Was the Largest MMA Adhesives Market in 2017

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players

Figure 11 MMA Adhesives Market for Composites to Register the Highest Cagr

Figure 12 Automotive & Transportation Was the Largest End-Use Industry of MMA Adhesives

Figure 13 India is Emerging as A Lucrative Market for MMA Adhesives

Figure 14 MMA Adhesives Market to Register A Higher Cagr in Developing Countries

Figure 15 India to Register the Highest Cagr

Figure 16 Overview of Factors Governing the MMA Adhesives Market

Figure 17 MMA Adhesives Market: Porters Five Forces Analysis

Figure 18 Metal to Dominate the MMA Adhesives Market

Figure 19 Electrical & Electronics Industry to Drive the MMA Adhesives Market

Figure 20 India to Be the Fastest-Growing MMA Adhesives Market, 20182023

Figure 21 North America: MMA Adhesives Market Snapshot

Figure 22 Europe: MMA Adhesives Market Snapshot

Figure 23 APAC: MMA Adhesives Market Snapshot

Figure 24 Companies Adopted Organic and Inorganic Growth Strategies Between 2013 and 2018

Figure 25 Illinois Tool Works Inc.: Company Snapshot

Figure 26 Illinois Tool Works Inc.: SWOT Analysis

Figure 27 Henkel AG & Co. Kgaa: Company Snapshot

Figure 28 Henkel AG & Co. Kgaa: SWOT Analysis

Figure 29 H.B. Fuller Company: Company Snapshot

Figure 30 H.B. Fuller Company: SWOT Analysis

Figure 31 3M Company: Company Snapshot

Figure 32 3M Company: SWOT Analysis

Figure 33 Arkema S.A. (Bostik): Company Snapshot

Figure 34 Arkema (Bostik): SWOT Analysis

Figure 35 Huntsman International LLC.: Company Snapshot

Figure 36 Huntsman International, LLC.: SWOT Analysis

Figure 37 Sika AG: Company Snapshot

Figure 38 Sika AG: SWOT Analysis

Figure 39 Scigrip: SWOT Analysis

Figure 40 Scott Bader Company Ltd.: SWOT Analysis

Figure 41 Lord Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Methyl Methacrylate Adhesives Market

Trend and forecast of MMA market

Have an interest in this report, seeking more information and best pricing to see if our Q2 budget can allow. Thank you

General information on Composite Adhesives Market

MMA applications in single lap joints for marine industry.