mHealth Solutions Market by Apps (Women Health, Diabetes, Mental Health), Connected Devices (Glucose & Blood Pressure Monitor, Peak Flow Meter), Services (Remote Monitoring, Consultation), End User (Providers, Patients, Payers) & Region - Global Forecasts to 2028

Updated on : March 27, 2023

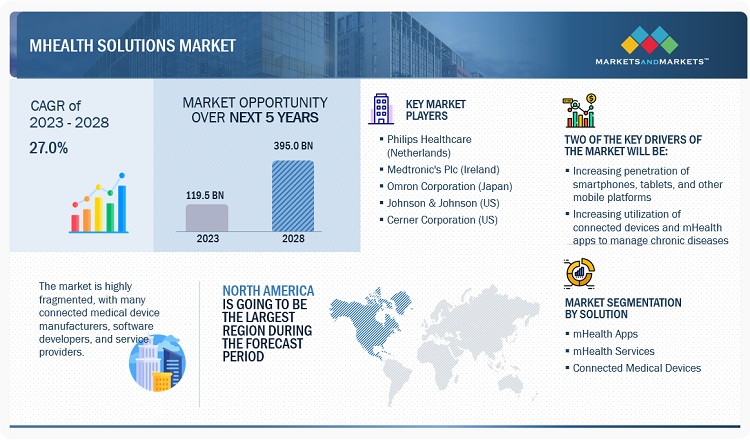

The global mHealth solutions market in terms of revenue was estimated to be worth $119.5 billion in 2023 and is poised to reach $395.0 billion by 2028, growing at a CAGR of 27.0% from 2023 to 2028.

The global market is expected to grow significantly in the coming years. Factors such as the increasing penetration of smartphones, tablets, and other mobile platforms; increasing utilization of connected devices and mHealth apps for the management of chronic diseases; cost containment in healthcare delivery; robust penetration of 3G and 4G networks; and rising focus on patient-centric healthcare delivery and increase in demand for home healthcare services are expected to drive market growth in the coming years.

On the other hand, lack of standards and regulations, the paucity of reimbursements, low guidance from physicians in selecting apps due to unawareness of technology, and resistance from traditional healthcare providers are expected to limit market growth to a certain extent.

Attractive Opportunities in mHealth Solutions Market

To know about the assumptions considered for the study, Request for Free Sample Report

mHealth Solutions Market Dynamics

Drivers: Growing penetration of 4G & 5G networks to ensure uninterrupted healthcare

The adoption of mHealth technology largely depends on technological advancements on the telecommunications front. In the past few years, the mHealth market has benefited from the growing penetration of high-speed connectivity, including 3G, 4G, and broadband services. In 2018, the number of broadband registered subscribers was 5.2 billion; it was expected to reach 6.5 billion subscribers in 2021.

The increasing utilization of mobile platforms in the healthcare industry to improve the accessibility of patient information and significant investments in the digital healthcare market are driving the adoption of 5G in the healthcare market. High-speed 5G networks can help quickly and reliably transport huge data files of medical imagery, improving both access to care and the quality of care. While augmented reality (AR), virtual reality (VR), and spatial computing are already being used in healthcare on a limited basis, 5G may eventually further enhance a doctor’s ability to deliver innovative, less invasive treatments. 5G has lower latency and higher capacity, which helps healthcare systems to offer remote monitoring for more patients. Furthermore, the high standard of virtual care and the presence & potential of 5G are expected to improve healthcare delivery significantly. On the other hand, 5G Enhanced Mobile Broadband (eMBB) technology?has helped ensure remote support and quality healthcare while reducing the chances of patient exposure to contagions (especially during the COVID-19 pandemic).

The high penetration of 4G/5G networks in the North American region supports video calling and high-speed data transfer to help deliver telemedicine services. 5G networks enable superior customer experience in terms of better picture quality, reduced image distortion for video calls, and quicker data transfer than those offered by 4G networks.

Wi-Fi has emerged as a dominant standard for wireless LANs worldwide. With a range of services running over Medical Mobility (MM) networks, it is possible to access real-time patient data through connected devices. As Bluetooth and Wi-Fi technologies become more pervasive, the healthcare industry will benefit from this technology evolution and enable greater penetration of connected medical devices in the coming years, thus paving the route for growth opportunities in mHealth.

Restraints: Resistance from traditional healthcare providers & limited guidance from physicians

The effective utilization of mobile apps and wireless technology can change the face of mHealth service delivery. However, patients typically find it difficult to look for healthcare apps due to the lack of guidance or support from their doctors. Many experienced or traditional healthcare providers are hesitant to adopt healthcare IT solutions or mHealth apps in their daily practices. Most of this reluctance is due to a lack of IT knowledge. Some healthcare professionals also feel that utilizing these apps is time-consuming, with limited or no clinical benefits. Furthermore, the lack of a standard metric to measure the benefits of these solutions has resulted in a general reluctance (among doctors and physicians) to utilize and prescribe these advanced technologies.

Thus, while physicians recognize the potential benefits of mobile healthcare apps, they remain wary of formally recommending apps to patients without evidence of their benefits, clear professional guidelines regarding their use in practice, and confidence in the security of personal health information that may be generated or transmitted by the app. Thus, patients do not use mHealth apps and devices to their full extent. This is expected to limit market growth to a certain extent.

The adoption of mobile medical apps by professionals can be potentially improved by increasing awareness among healthcare professionals and offering inputs or incentives to physicians for recommending mHealth technologies to their patients. Engaging physicians can also create awareness during phases of app development and clinical pilot testing of these apps. This would also help in ensuring the clinical relevance of the app and promoting its utility for achieving maximum clinical benefits.

Although the adoption of healthcare apps is gradually increasing, a lack of physician acceptance may result in lower-than-expected growth of the mHealth apps and solutions market in the coming years

Opportunities: Growing adoption of mHealth solutions in other mobile platforms

The prime aim of mHealth is to provide remote healthcare solutions leveraging advanced telecommunication technologies. Currently, this market is restricted to smartphone-linked solutions, although a few companies, such as Samsung, have introduced new platforms and smart TVs in the healthcare market. Other mHealth devices include next-generation watches, wearable medical devices, and portable medical devices capable of running medical software applications. Considering the fast adoption of mHealth, such new additions of hardware solutions in the market are expected to find greater acceptance among healthcare professionals and patients as long as they can offer remote monitoring or consultation services. However, the best possible way is to convert the daily used mobile gadgets into medical devices so that no additional cost is incurred in using the technology. The device manufacturer and software developer can seize these untapped market opportunities to introduce breakthrough technologies in the mHealth market.

Challenges: Lack of data security and concerns regarding data theft and healthcare fraud

Security concerns about proprietary data and applications are considered a major hindrance to the growth of the market. Since mobile healthcare is an emerging market, there are no standard frameworks to secure data stored and shared using healthcare apps. One of the major risks of using mHealth is the theft of Protected Health Information (PHI), such as health insurance numbers, by third parties who can commit healthcare fraud using confidential information. On the other hand, many organizations lack the resources to secure these technologies.

Since mobile phones play a critical role in the mHealth market, a simple loss or theft of a mobile device loaded with unencrypted patient data could cause a security breach with serious consequences. Such privacy breaches could lead to enforcement actions by the Department of Health and Human Services (HHS) under the Health Insurance Portability and Accountability Act (HIPAA) in the US. Although mobile healthcare offers various advantages, its security issues slow the adoption of mobile technology in the healthcare arena.

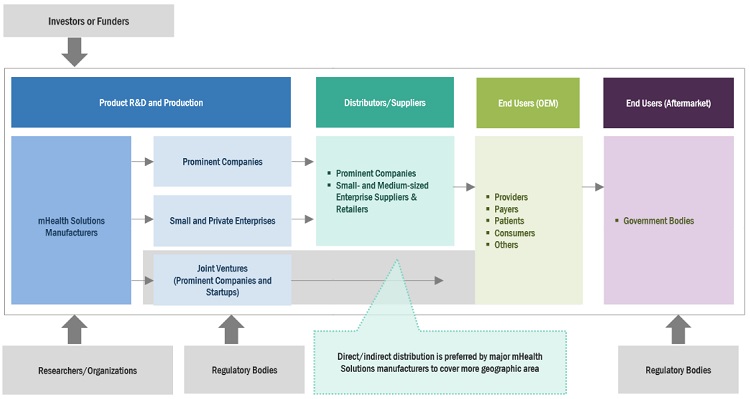

mHealth Solutions Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of mHealth Solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), and My mHealth Limited (UK).

mHealth Services to register the highest growth in the product & service segment of mHealth Solutions market in 2022.

On the basis of product & service, the healthcare provider solutions segment to register highest growth. The mHealth services segment is expected to grow at the highest CAGR during the forecast period. The rising global adoption of smartphones, availability of high-speed networks, and rising demand for remote patient monitoring and consultation are the key factors driving the growth of the mHealth services segment

Healthcare providers is the highest growing end user segment of the mHealth solutions market

Based on end user, the healthcare providers segment is expected to grow at a significant CAGR during the forecast period.The easy availability of mobile phones has extended even to low and middle-income countries. Thus, most diseases and chronic conditions can be virtually screened globally. Chronic diseases demand frequent hospital visits, regular check-ups, and multiple lifestyle changes deemed necessary by a physician. mHealth can help efficiently influence the patient’s awareness of their condition, lifestyle interventions, clinical decisions, medication adherence, screening regimens, and rehabilitation support. Individuals suffering from chronic diseases have sought mHealth as a convenient and affordable approach to managing their disease. Owing to these factors, the market for providers in the mHealth solutions space is growing steadily.

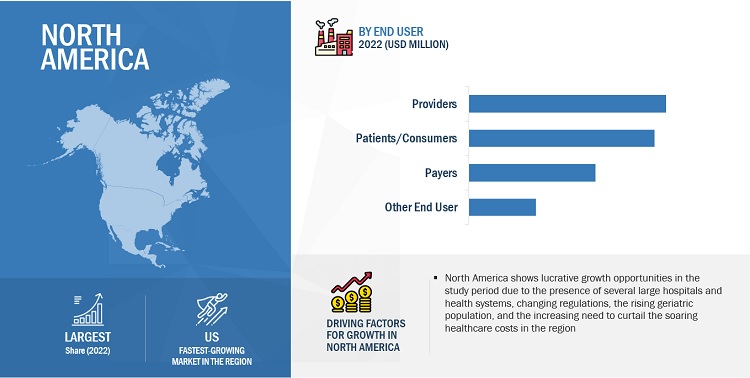

North America accounted for the largest share of the mHealth Solutions market during the forecast period.

In 2022, North America accounted for the largest share of the market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America can be attributed to factors such as the increasing penetration of smartphones and mHealth solutions, growing use of connected devices and mHealth apps for managing chronic diseases, and increasing healthcare expenditure

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such as Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), and My mHealth Limited (UK).

mHealth Solutions Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Product & Services, End user, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), Omron Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), Vodafone Group Plc (UK), Qualcomm Technologies, Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), Omada Health (US), and My Mhealth Limited (UK). |

The study categorizes the mHealth Solutions market based on product & services, end user at regional and global level.

By Product & Service

- Introduction

-

mHealth Apps

-

Healthcare Apps

-

Chronic care management apps

- Mental health & behavioral disorder management apps

- Diabetes management apps

- Blood pressure & ECG monitoring apps

- Cancer management apps

- Other chronic care management apps

-

General health & fitness apps

- Health tracking apps

- Obesity & weight management apps

- Fitness & nutrition apps

- Medication management apps

-

Women’s health apps

- Pregnancy apps

- Breastfeeding apps

- Fertility apps

- Other women’s health apps

- Personal health record apps

- Other healthcare apps

-

Chronic care management apps

-

Medical Apps

- Patient management & monitoring apps

- Medical reference apps

- Communication & consulting apps

- Continuing medical education apps

-

Healthcare Apps

-

Connected Medical devices

-

Vital Signs Monitoring Devices

- Blood pressure monitors

- Blood glucose meters

- ECG/heart rate monitors

- Pulse oximeters

- Peak flow meters

- Sleep apnea monitors

- Multiparameter trackers

- Fetal monitoring devices

- Neurological monitoring devices

- Other connected medical devices

-

Vital Signs Monitoring Devices

-

mHealth Services

- Remote monitoring services

- Diagnosis & Consultation services

- Treatment services

- Healthcare system strengthening services

- Fitness & wellness services

- Prevention services

By End User

- Introduction

- Healthcare Providers

- Healthcare Payers

- Patients/Consumers

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments

- In February 2023 Vodafone (UK) partnered with Charité Berlin, Leipzig University Hospital (Berlin).The collaboration with Charité Berlin (one of Europe’s largest university hospitals), Leipzig University Hospital, and 16 other leading research and medical experts across Germany enabled Vodafone to explore future medical applications using 6G.

- In January 2023 Koninklijke Philips (Netherlands) partnered with Masimo (US). The partnership aimed to augment patient monitoring capabilities in home telehealth applications with the Masimo W1 advanced health-tracking watch.

- In January 2023, Garmin (US) launched Instinct Crossover in India, which delivers Garmin’s full suite of wellness features, including Sleep Score and Advanced Sleep Monitoring, and Health Monitoring activities.

Frequently Asked Questions (FAQ):

What is the projected market value of the global mHealth solutions market?

The global market of mHealth solutions is projected to reach USD 395.0 billion.

What is the estimated growth rate (CAGR) of the global mHealth solutions market for the next five years?

The global mHealth solutions market is projected to grow at a Compound Annual Growth Rate (CAGR) of 27.0% from 2023 to 2028.

What are the major revenue pockets in the mHealth solutions market currently?

In 2022, North America accounted for the largest share of the market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America can be attributed to factors such as the increasing penetration of smartphones and mHealth solutions, growing use of connected devices and mHealth apps for managing chronic diseases, and increasing healthcare expenditure

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

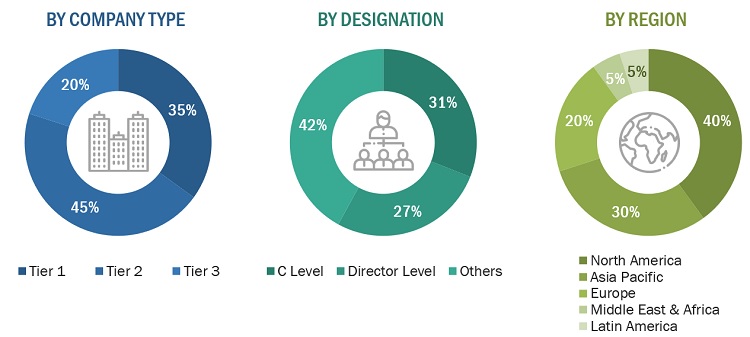

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the mHealth solutions market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the mHealth solutions market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), ambulatory centers, diagnostic centers, TPAs, and stakeholders in corporate & government bodies.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

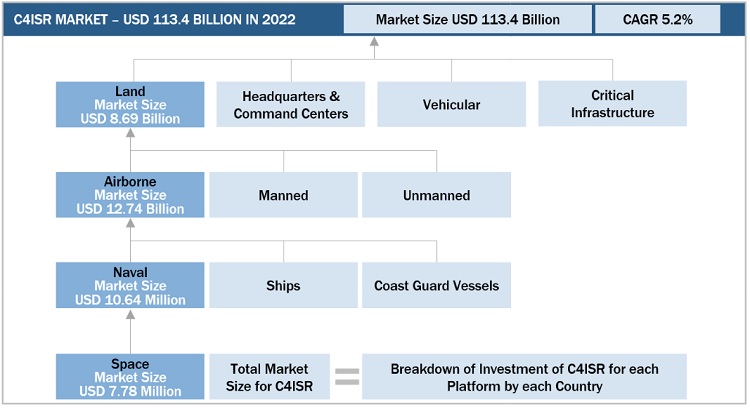

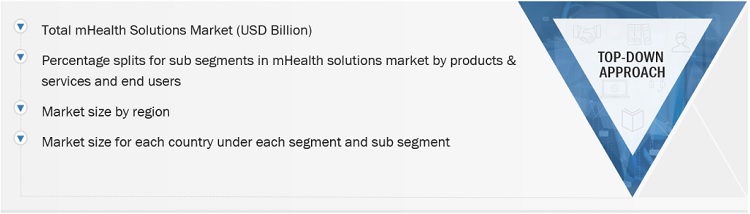

Market Size Estimation

The total size of the mHealth Solutions market was arrived at after data triangulation from different approaches. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The individual shares of each mHealth product & service, and end-user segment were determined by assigning weights based on their utilization/adoption rate. Regional splits of the overall mHealth market and its subsegments are based on the adoption or utilization rates of the given products and services in the respective regions or countries

Global MHealth Solutions Market Size: Top-Down Approach

Market Definition

Mobile health (mHealth) refers to the use of mobile devices for collecting and distributing health-related data, remote delivery of care, and near real-time monitoring of patients. Connected medical devices and mHealth apps and solutions help clinicians document more accurate and complete records, improve productivity, access information, and communicate findings & treatments.

Key Stakeholders

- Healthcare application developers

- Medical device vendors

- Mobile network providers

- Connectivity providers

- Mobile platform developers

- Insurance providers (payers)

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Research and consulting firms

- Research institutes

- Contract research organizations (CROs)

- Contract manufacturing organizations (CMOs)

- Venture capitalists

Objectives of the Study

- To define, describe, segment, and forecast the mHealth solutions market by product & service, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall mHealth solutions market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the mHealth solutions market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the mHealth solutions market and comprehensively analyze their core competencies2 and market shares.

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, investments, joint ventures, sales contracts, and R&D activities of the leading players in the mHealth solutions market

- To benchmark players within the mHealth solutions market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoAPAC mHealth solutions market into South Korea, Australia, New Zealand, and others

- Further breakdown of the RoE mHealth solutions market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the RoLA mHealth solutions market into Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in mHealth Solutions Market

Thanks for the extensive information. The healthcare-based mobile app market is multiplying. Experts are integrating new technologies into mobile applications to offer advanced levels of client interface and experience. As of 2019, most connected mHealth solutions market uses mobile apps to provide better client services.