eHealth Market by Solutions (EMR, PACS & VNA, RIS, LIS, CVIS, Telehealth, eRx, HIE, Patient Portal, Medical Apps), Services (Remote Patient Monitoring, Diagnostic Services), End User & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global eHealth market growth forecasted to transform from $69.5 billion in 2020 to $193.8 billion by 2025, driven by a CAGR of 22.8%. Key drivers include the shift towards patient-centric care, increased digitization, regulatory compliance requirements, and cost reduction in healthcare services. Advancements in healthcare IT have spurred the adoption of eHealth solutions such as mHealth apps, telemedicine, EMRs, and EHRs, enhancing remote monitoring, consultation, and data interoperability. However, challenges like reluctance among medical professionals to adopt new technologies and security concerns regarding data breaches persist. North America leads the market, driven by a favorable regulatory environment and significant adoption of healthcare IT solutions. Major players include Allscripts, athenahealth, Epic Systems, IBM, and GE Healthcare. The market is segmented by type, deployment, end-user, and region, with cloud-based solutions expected to grow rapidly due to their flexibility and affordability. Recent industry developments include collaborations for integrating home health platforms with EHR systems and the development of AI-powered electronic health records.

eHealth Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

eHealth Market Dynamics

Driver: Growing need to manage regulatory compliance through the use of eHealth solutions

Over the years, there have been several advancements in the field of healthcare IT, which, in turn, have transformed various eHealth solutions and services into successful and profitable alternatives to manual methods for managing complicated tasks. Healthcare IT systems provide several benefits and capabilities for fulfilling stringent regulatory requirements and handling compliance risks. The changing regulatory requirements in the healthcare industry are resulting in a paradigm shift in the eHealth industry. As eHealth tools are an effective way to achieve the required quality goals while reducing costs, their demand is expected to increase among various stakeholders in the coming years.

In the US, the Patient Protection and Affordable Care Act has led to the restructuring of private insurance, Medicare, and Medicaid programs. As a part of these changes, the Meaningful Use rules of the American Recovery and Reinvestment Act (ARRA) and the Health Information Technology for Economic and Clinical Health Act (HITECH) have mandated the adoption of EMRs to increase data interoperability. This has increased the demand for various healthcare IT solutions within healthcare organisations in the US. Moreover, the Medicare Access and CHIP Reauthorization Act (MACRA) established the merit-based incentive payment system (MIPS), which combined the existing Medicare quality programs. These programmes include the Physician Quality Reporting Program (PQRS), the Value-Based Payment Modifier, and the Medicare EHR Incentive Program. MIPS scoring is based on four performance categories: quality, resource use, clinical practise improvement activities, and meaningful use of certified EHR technology. The utilisation of different eHealth solutions by physicians helps them improve their performance and earn rewards through various payment models under MIPS. In addition, the European Parliament, the Council of the European Union, and the European Commission jointly launched the General Data Protection Regulation (GDPR) (Regulation (EU) 2016/679) to strengthen and unify data protection for all individuals within the European Union (EU). This regulation boosted the implementation of interoperability solutions for securing data portability provisions among health settings. Such developments are increasing the adoption of eHealth solutions such as EHRs, health information exchange solutions, and cloud-based health data transfer services among stakeholders in care settings.

Opportunity: Rising use of eHealth solutions in outpatient care facilities

In response to the rising pressures on health systems to lower the cost of care, a majority of healthcare organisations are focusing on introducing specialised outpatient services. The shift toward an outpatient care model is boosting the adoption of eHealth solutions, as these solutions provide a convenient way of delivering carecialized outpatient services. The shift toward an outpatient care model is boosting the adoption of eHealth solutions, as these solutions provide a convenient way of delivering care. These solutions provide easier access to appointments and integration among care providers for a holistic response to care delivery. In addition, these solutions help physicians address patient needs (for access) and allow for remote monitoring of the patient's health. Owing to the benefits of eHealth solutions, various federal bodies are also supporting the deployment of eHealth solutions in outpatient care settings. For instance, the Government of New South Wales (NSW), through its Community Health and Outpatient Care program, is still operational as a part of the eHealth Strategy for NSW Health: 2016–2026, which focuses on implementing EMR solutions in outpatient care facilities operating throughout NSW. This has boosted the adoption of eHealth solutions among stakeholders in outpatient care facilities to deliver better health services and help enhance patient outcomes. Furthermore, with the benefits of web-based management for constant care, a large number of patients are now moving toward outpatient care needs. For instance, as per a press release by Crain Communications in November 2015, outpatient volume at Flint-based McLaren Health Care Corporation increased to 57% in 2015 from 43% in 2014; this figure is projected to grow to 60% by 2020.

Thus, the rising use of eHealth solutions and services in outpatient care facilities, coupled with the growing patient volumes in these facilities, is expected to favour the adoption of eHealth solutions.

Restraint: Reluctance among medical professionals to adopt advanced eHealth solutions

eHealth solutions and services help in the effective management of several clinical and non-clinical tasks in healthcare organizations. However, their efficient utilisation is largely dependent on the willingness of end users, such as healthcare professionals, to shift to electronic solutions from traditional paper-based patient records. Currently, many traditional healthcare providers (especially in emerging countries) are hesitant to use eHealth solutions, mainly due to a lack of IT knowledge. Many medical professionals lack the technological know-how required to operate advanced healthcare IT solutions and consider creating, maintaining, and using electronic systems a time-consuming task. Moreover, they feel the utilisation of these solutions is a time-consuming task with limited or no clinical benefits. This causes reluctance among healthcare professionals to adopt new and innovative healthcare IT solutions.

The complexity of advanced healthcare IT systems and the lack of user-friendliness have further contributed to physicians' reluctance to adopt these systems. Many physicians regard the use of healthcare IT solutions as a time-consuming task and perceive them as hampering their interaction with patients. Moreover, in rural areas, factors such as the lack of broadband technology and a shortage of experts available to provide technical assistance are responsible for physicians being reluctant about adopting HCIT solutions. All these factors are adversely affecting the uptake of eHealth solutions by healthcare organizations.

Challenge: Security concerns related to privacy, licensure, and data breaches

The healthcare industry is reluctant to adopt eHealth solutions, primarily due to potential regulatory apprehensions and legal liabilities. The electronic exchange of patient data offers greater reach and efficiency in healthcare delivery; however, issues related to data loss and liability due to broader access are associated with the electronic exchange of patient data.

Privacy and security concerns have also increased due to the data privacy requirements legislated through the HIPAA (Health Insurance Portability and Accountability Act). According to the Sixth Annual Benchmark Study on Privacy and Security of Healthcare Data by the Ponemon Institute, data breaches in healthcare enterprises are mostly carried out by criminal attacks and hackers. In the last two years, on average, 90% of all healthcare organisations have witnessed one data breach. In the healthcare industry, medical record breaches hold the top spot in terms of overall data breaches, with 64% of attacks focused on medical files and nearly 45% of attacks targeting billing and insurance records.

In addition to the necessity of maintaining security standards for data protection, patient concerns regarding the security of their data are another major factor restraining the growth of the market. Public clouds also witness similar security issues as traditional IT systems and are therefore not preferred by the healthcare industry (hospitals and care providers) due to concerns regarding data breaches and data loss. The successful implementation of eHealth solutions and services requires awareness and compliance with federal and state legal requirements, which is a major hurdle for the growth of the eHealth industry. Thus, the security concerns related to privacy, licensure, and data breaches among health consumers and healthcare providers are limiting the growth of the market to a certain extent.

However, this issue can be tackled by developing a legal framework for the protection of patient health information. In many countries, systems are in place to protect the privacy and confidentiality of the person receiving care through electronic means. For instance, in Australia, every nurse and midwife must comply with the ANMC (Australian Nursing and Midwifery Council) Accreditation Code of Professional Conduct and Code of Ethics adopted by the NMBA (Nursing and Midwifery Board of Australia). Similarly, the European Union has adopted Directive 95/46/EC for protecting patients with regard to the processing of their personal health data. This multi-layered regulatory system prolongs the introduction of new solutions in the eHealth industry.

The eHealth solutions segment is projected to have a large eHealth industry size during the forecast period.

On the basis of products and services, the eHealth market is segmented into eHealth solutions and eHealth services. The large share of eHealth solutions is primarily attributed to the need to control rising healthcare costs and improve healthcare service efficiency by reducing medical errors, as well as the growing use of telehealth and supportive government initiatives and incentives to encourage the adoption of these solutions.

Web-based eHealth solutions will experience a high growth rate in eHealth industry during the forecast timeframe.

The eHealth market is broadly classified into cloud-based and on-premise deployments. Over the last few years, the healthcare industry has witnessed advancements in the field of information technology. Currently, healthcare organisations are increasingly embracing cloud-based solutions to increase access to patient records from remote locations. Most of the cloud-based solutions are generally based on the Software-as-a-Service (SaaS) model, which utilises a group of servers to spread data-processing tasks across healthcare organizations. This technology is flexible, scalable, and affordable. The above-mentioned factors are expected to drive segmental growth.

To know about the assumptions considered for the study, download the pdf brochure

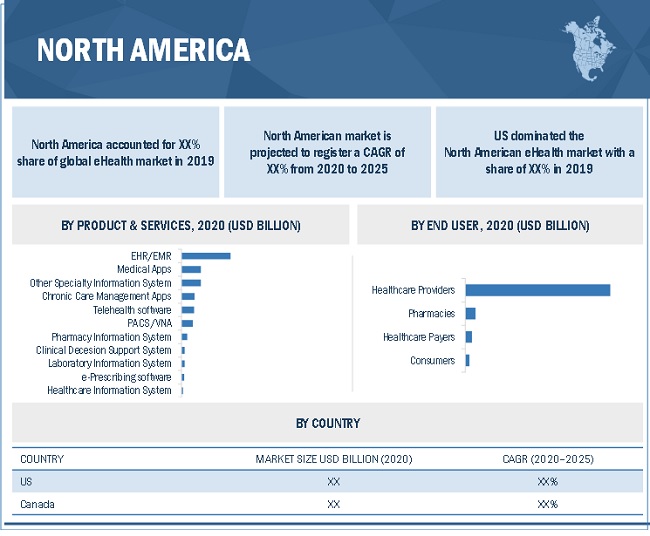

North America holds the largest share in the eHealth industry, by region.

North America accounted for the largest share of the eHealth market at 50.0%. The growth of the regional market can be attributed to the favourable regulatory scenario, the high adoption of HCIT solutions to curtail soaring healthcare costs, regulatory requirements regarding patient safety, and the presence of a large number of healthcare IT companies, such as Cerner Corporation (US), GE Healthcare (US), McKesson Corporation (US), Infor, Inc. (US), and Allscripts Healthcare Solutions (US).

The players in the eHealth market include Allscripts (US), athenahealth (US), Epic Systems (US), IBM (US), GE Healthcare (US), Cerner (US), Optum (US), Philips (Netherlands), Siemens Healthineers (Germany), McKesson (US), Medtronic (Ireland), and Cisco Systems (US).

Scope of the eHealth Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$69.5 billion |

|

Projected Revenue Size by 2025 |

$193.8 billion |

|

Industry Growth Rate |

poised to grow at a CAGR of 22.8% |

|

Market Driver |

Growing need to manage regulatory compliance through use of eHealth solutions |

|

Market Opportunity |

Rising use of eHealth solutions in outpatient care facilities |

The research report categorizes the global eHealth market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

eHealth Solutions

- EHR/EMR Solutions

- Picture Archiving and Communication Systems & Vendor Neutral Archive

- Radiology Information Systems

- Laboratory Information Systems

- Cardiovascular Information Systems

- Pharmacy Information Systems

- Other Specialty Information Systems

- Telehealth Solutions

- E-Prescribing Solutions

- PHR & Patient Portals

- Clinical Decision Support Systems

- Health Information Exchange Solutions

- Chronic Care Management Apps

- Medical Apps

-

eHealth Services

- Remote Monitoring Services

- Diagnosis & Consultation Services

- Healthcare Systems Strengthening Services

- Treatment Services

- Database Management Services

By Deployment

- On-premise

- Cloud-based

By End User

-

Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes, and Assisted Living Centers

- Payers

- Healthcare Consumers

- Pharmacies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- Rest of APAC

- Latin America

- Middle East and Africa

Recent Developments of eHealth Industry:

- In January 2019, Cerner Corporation collaborated with ResMed. This collaboration helped improve the connection between healthcare systems and home care by integrating the Brightree Home Health and Hospice platform with Cerner’s Millennium EHR.

- In October 2019, Allscripts made agreement with Northwell Health. This agreement helped the companies to jointly develop a next-generation, AI-powered electronic health record.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global eHealth market?

The global eHealth market boasts a total revenue value of $193.8 billion by 2025.

What is the estimated growth rate (CAGR) of the global eHealth market?

The global eHealth market has an estimated compound annual growth rate (CAGR) of 22.8% and a revenue size in the region of $69.5 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 eHealth Market DEFINITION

1.2.1 CATEGORY-WISE INCLUSIONS AND EXCLUSIONS IN GLOBAL MARKET

1.3 eHealth Market SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GLOBAL MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.4.1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Breakdown of primaries

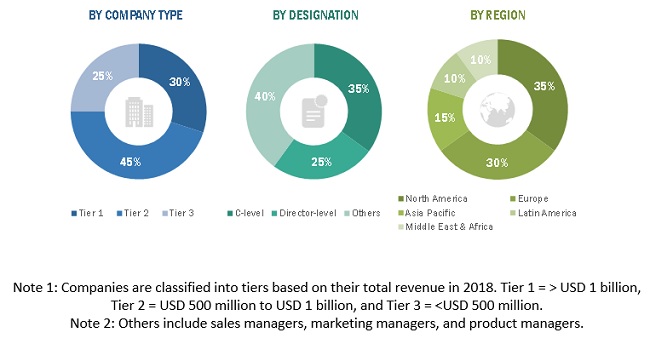

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 eHealth Market SIZE ESTIMATION

FIGURE 5 SUPPLY SIDE ANALYSIS: GLOBAL EHEALTH MARKET (2019)

FIGURE 6 DEMAND SIDE APPROACH: EHR MARKET SIZE (2019)

FIGURE 7 GLOBAL EHEALTH MARKET: TOP-DOWN APPROACH

FIGURE 8 CAGR PROJECTIONS – SUPPLY SIDE ANALYSIS OF GLOBAL EHEALTH MARKET

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EHEALTH INDUSTRY (2019–2025)

2.3 DATA TRIANGULATION APPROACH

2.4 eHealth Market SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF IMPACT OF COVID-19 ON ECONOMIC SCENARIO

FIGURE 3 SCENARIOS FOR RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 4 EHEALTH MARKET, BY SOLUTION & SERVICE, 2020 VS 2025 (USD BILLION)

FIGURE 5 GLOBAL EHEALTH INDUSTRY, BY DEPLOYMENT MODE, 2020 VS. 2025 (USD BILLION)

FIGURE 6 GLOBAL EHEALTH INDUSTRY, BY END USER, 2020 VS. 2025 (USD BILLION)

FIGURE 7 NORTH AMERICA TO CAPTURE LARGEST SHARE OF GLOBAL EHEALTH MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 EHEALTH MARKET OVERVIEW

FIGURE 8 INCREASING GOVERNMENT INITIATIVES SUPPORTING USE OF EHEALTH SOLUTIONS AND SERVICES ARE DRIVING eHealth Market GROWTH

4.2 DEVELOPED VS DEVELOPING ECONOMIES: EHEALTH SERVICES MARKET

FIGURE 9 DEVELOPING ECONOMIES TO REGISTER HIGH CAGRS DUE TO PENETRATION OF TECHNOLOGY IN COMING YEARS

4.3 GEOGRAPHICAL SNAPSHOT OF GLOBAL EHEALTH INDUSTRY

FIGURE 10 EMERGING COUNTRIES TO REGISTER HIGH CAGRS DURING FORECAST PERIOD

4.4 GLOBAL EHEALTH INDUSTRY: REGIONAL MIX

FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 eHealth Market OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 eHealth Market DYNAMICS

FIGURE 12 GLOBAL EHEALTH INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing need to manage regulatory compliance through use of eHealth solutions

5.2.1.2 Need to curtail escalating healthcare costs

FIGURE 13 GLOBAL GERIATRIC POPULATION, BY REGION

5.2.1.3 Increasing government initiatives supporting use of eHealth solutions and services

5.2.1.4 Growing prevalence of chronic diseases

5.2.1.5 Shift toward patient-centric healthcare delivery

5.2.1.6 Shortage of healthcare professionals

5.2.1.7 Growing adoption of big data

TABLE 1 DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Reluctance among medical professionals to adopt advanced eHealth solutions

5.2.2.2 High cost of deployment and maintenance of eHealth solutions

TABLE 2 RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging nations

5.2.3.2 Expanding mHealth, telehealth, and remote patient monitoring markets

5.2.3.3 Rising use of eHealth solutions in outpatient care facilities

TABLE 3 OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Security concerns related to privacy, licensure, and data breaches

5.2.4.2 Lack of skilled IT professionals

5.2.4.3 Integration, intraoperability, and interoperability of eHealth solutions

TABLE 4 CHALLENGES: IMPACT ANALYSIS

5.3 COVID-19 IMPACT ON GLOBAL MARKET

6 INDUSTRY INSIGHTS (Page No. - 62)

6.1 EHEALTH INDUSTRY TRENDS

6.1.1 INTEGRATION THROUGH BIG DATA ANALYTICS

6.1.2 CLOUD COMPUTING IN HEALTHCARE

TABLE 5 KEY CLOUD COMPUTING TOOLS & SAAS AVAILABLE IN MARKET

6.1.3 INCREASING COOPERATION BETWEEN TRADITIONAL HEALTHCARE PLAYERS & IT-DRIVEN COMPANIES

6.2 VENDOR BENCHMARKING: EHEALTH SOLUTIONS MARKET

TABLE 6 EHEALTH SOLUTIONS MARKET: PRODUCT PORTFOLIO ASSESSMENT

6.3 ADOPTION TRENDS

6.3.1 ADOPTION TRENDS IN NORTH AMERICA

6.3.2 ADOPTION TRENDS IN EUROPE

6.3.3 ADOPTION TRENDS IN ASIA PACIFIC

6.3.4 ADOPTION TRENDS IN REST OF THE WORLD

6.4 POTENTIAL EHEALTH TECHNOLOGIES

6.4.1 AI PLATFORMS

6.4.2 APP-ENABLED PATIENT PORTALS

6.5 REGULATORY LANDSCAPE

FIGURE 14 REGULATORY LANDSCAPE—IN TERMS OF LAW STRINGENCY

6.5.1 EUROPE

6.5.2 NORTH AMERICA

6.5.2.1 US

6.6 IMPACT OF COVID-19 ON EHEALTH MARKET SEGMENTS

6.7 PRICING ANALYSIS

6.7.1 EHR

6.7.1.1 North America (2017–2019)

6.7.1.2 EUROPE

6.8 ECOSYSTEM ANALYSIS

7 eHealth Market BY SOLUTION & SERVICE (Page No. - 76)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT:

TABLE 7 MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

7.3 EHEALTH SOLUTIONS

TABLE 8 EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 9 EHEALTH SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.1 ELECTRONIC HEALTH RECORDS/ELECTRONIC MEDICAL RECORDS SOLUTIONS

7.3.2 STRATEGIES ADOPTED BY EHR VENDORS DURING COVID-19

TABLE 10 EMR/EHR SOLUTIONS OFFERED

7.4 INCREASED ADOPTION OF EHR

TABLE 11 STAGES OF EHR ADOPTION

7.5 TECHNOLOGICAL ADVANCEMENTS IN EHR SOLUTIONS

TABLE 12 EHR/EMR SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.1 PICTURE ARCHIVING AND COMMUNICATION SYSTEMS & VENDOR NEUTRAL ARCHIVE SYSTEMS (PACS & VNAS)

TABLE 13 PACS & VNAS OFFERED BY KEY MARKET PLAYERS

TABLE 14 PACS AND VNAS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.2 PHARMACY INFORMATION SYSTEMS

TABLE 15 PHARMACY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS:

TABLE 16 PIS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.3 MEDICAL APPS

TABLE 17 MEDICAL APPS OFFERED BY KEY MARKET PLAYERS

TABLE 18 MEDICAL APPS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.4 LABORATORY INFORMATION SYSTEMS (RIS)

TABLE 19 LIS OFFERED BY KEY MARKET PLAYERS

TABLE 20 LIS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.5 PERSONAL HEALTH RECORD & PATIENT PORTALS

TABLE 21 PHR OFFERED BY KEY MARKET PLAYERS

TABLE 22 PERSONAL HEALTH RECORD (PHR) MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.6 CHRONIC CARE MANAGEMENT APPS

TABLE 23 CHRONIC CARE MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

TABLE 24 CHRONIC CARE MANAGEMENT APPS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.7 CLINICAL DECISION SUPPORT SYSTEMS

7.5.7.1 Increasing adoption of CDSS-enabled EHRs

TABLE 25 TECHNOLOGICAL DEVELOPMENTS BY SOME LEADING VENDORS

TABLE 26 CDSS OFFERED BY KEY eHealth Market PLAYERS

TABLE 27 CDSS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.8 TELEHEALTH SOLUTIONS

TABLE 28 US: STATE-WISE REGULATORY OUTLOOK FOR TELEHEALTH

TABLE 29 TELEHEALTH SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 30 TELEHEALTH SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.9 HEALTHCARE INFORMATION EXCHANGE (HIE)

TABLE 31 HEALTHCARE INFORMATION EXCHANGE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 32 HEALTHCARE INFORMATION EXCHANGE SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.10 RADIOLOGY INFORMATION SYSTEMS (RIS)

TABLE 33 RIS OFFERED BY KEY MARKET PLAYERS

TABLE 34 RIS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.11 E-PRESCRIBING SOLUTIONS

FIGURE 15 COVID-19 IMPACT - GROWING DEMAND FOR EPCS-BASED SOLUTIONS

7.6 US: EVOLUTION OF E-PRESCRIBING

FIGURE 16 E-PRESCRIBING: RULES, LAWS, REGULATIONS, AND INCENTIVES (2007–2020) 103

TABLE 35 E-PRESCRIBING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 36 E-PRESCRIBING SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6.1 CARDIOVASCULAR INFORMATION SYSTEMS

TABLE 37 CARDIOVASCULAR INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

TABLE 38 CVIS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6.2 OTHER SPECIALTY INFORMATION MANAGEMENT SYSTEMS

TABLE 39 SOME OF THE OTHER SPECIALTY INFORMATION MANAGEMENT SYSTEMS OFFERED BY KEY MARKET PLAYERS

TABLE 40 OTHER SPECIALTY INFORMATION MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7 EHEALTH SERVICES

TABLE 41 EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 EHEALTH SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.1 REMOTE MONITORING SERVICES

TABLE 43 REMOTE MONITORING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.2 DIAGNOSIS & CONSULTATION SERVICES

TABLE 44 DIAGNOSIS & CONSULTATION SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.3 DATABASE MANAGEMENT SERVICES

TABLE 45 DATABASE MANAGEMENT SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.4 TREATMENT SERVICES

TABLE 46 TREATMENT SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.5 HEALTHCARE SYSTEM STRENGTHENING SERVICES

TABLE 47 HEALTHCARE SYSTEMS STRENGTHENING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

8 EHEALTH MARKET, BY DEPLOYMENT MODE (Page No. - 115)

8.1 INTRODUCTION

TABLE 48 IBY DEPLOYMENT: GLOBAL EHEALTH INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

8.2 WEB- & CLOUD-BASED SOLUTIONS

8.3 ON-PREMISE SOLUTIONS

9 EHEALTH MARKET, BY END USER (Page No. - 118)

9.1 INTRODUCTION

9.2 COVID-19 IMPACT ON END USERS:

TABLE 49 GLOBAL EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3 HEALTHCARE PROVIDERS

TABLE 50 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.1 HOSPITALS

TABLE 52 MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.2 AMBULATORY CARE CENTERS

TABLE 53 GLOBAL MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.3 HOME HEALTHCARE AGENCIES, NURSING HOMES, AND ASSISTED LIVING FACILITIES

TABLE 54 EHEALTH MARKET FOR HOME HEALTHCARE AGENCIES, NURSING HOMES, AND ASSISTED LIVING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

9.4 PHARMACIES

TABLE 55 GLOBAL EHEALTH INDUSTRY FOR PHARMACIES, BY COUNTRY, 2018–2025 (USD MILLION)

9.5 HEALTHCARE PAYERS

TABLE 56 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2018–2025 (USD MILLION)

9.6 HEALTHCARE CONSUMERS

TABLE 57 GLOBAL MARKET FOR HEALTHCARE CONSUMERS, BY COUNTRY, 2018–2025 (USD MILLION)

9.7 OTHER END USERS

TABLE 58 GLOBAL EHEALTH INDUSTRY FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

10 EHEALTH MARKET, BY REGION (Page No. - 131)

10.1 INTRODUCTION

TABLE 59 EHEALTH INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 17 NORTH AMERICA: EHEALTH MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.2.1 US

TABLE 66 US: KEY MACROINDICATORS

TABLE 67 US: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 68 US: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 US: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 US: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 71 US: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.2.2 CANADA

TABLE 72 CANADA: KEY MACROINDICATORS

TABLE 73 CANADA: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 74 CANADA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 CANADA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 77 CANADA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 78 EUROPE: INITIATIVES ASSOCIATED WITH EHEALTH MARKET

TABLE 79 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY, 2019

FIGURE 18 EUROPE: MARKET SNAPSHOT

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 82 EUROPE: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 EUROPE: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.1 GERMANY

TABLE 86 GERMANY: KEY MACROINDICATORS

TABLE 87 GERMANY: INITIATIVES ASSOCIATED WITH EHEALTH MARKET

TABLE 88 GERMANY: MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 89 GERMANY: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 GERMANY: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 92 GERMANY: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.2 UK

TABLE 93 UK: KEY MACROINDICATORS

TABLE 94 UK: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 95 UK: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 UK: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 UK: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 98 UK: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.3 FRANCE

TABLE 99 FRANCE: KEY MACROINDICATORS

TABLE 100 FRANCE: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 101 FRANCE: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 FRANCE: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 104 FRANCE: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION

10.3.4 ITALY

TABLE 105 ITALY: KEY MACROINDICATORS

TABLE 106 ITALY: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 107 ITALY: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 ITALY: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 ITALY: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 110 ITALY: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.5 SPAIN

TABLE 111 SPAIN: KEY MACROINDICATORS

TABLE 112 SPAIN: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 113 SPAIN: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 SPAIN: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 115 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 116 SPAIN: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 117 ROE: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 118 ROE: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 ROE: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 ROE: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 121 ROE: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 19 ASIA PACIFIC: EHEALTH MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 124 ASIA PACIFIC: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 ASIA PACIFIC: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 127 ASIA PACIFIC: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.1 JAPAN

TABLE 128 JAPAN: KEY MACROINDICATORS

TABLE 129 JAPAN: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 130 JAPAN: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 JAPAN: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 JAPAN: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 133 JAPAN: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.2 CHINA

TABLE 134 CHINA: KEY MACROINDICATORS

TABLE 135 CHINA: EHEALTH INITIATIVES AND FUNDING

TABLE 136 CHINA: MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 137 CHINA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 CHINA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 140 CHINA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.3 INDIA

TABLE 141 INDIA: KEY MACROINDICATORS

TABLE 142 INDIA: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 143 INDIA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 INDIA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 INDIA: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 146 INDIA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.4 AUSTRALIA

TABLE 147 AUSTRALIA: EHEALTH INDUSTRY, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 148 AUSTRALIA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 AUSTRALIA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 151 AUSTRALIA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 152 ROAPAC: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 153 ROAPAC: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 ROAPAC: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 156 ROAPAC: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.5 LATIN AMERICA

TABLE 157 LATIN AMERICA: EHEALTH INDUSTRY, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 158 LATIN AMERICA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 159 LATIN AMERICA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 160 LATIN AMERICA: EHEALTH MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 161 LATIN AMERICA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 162 MIDDLE EAST & AFRICA: EHEALTH MARKET, BY SOLUTION & SERVICE, 2018–2025 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: EHEALTH SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: EHEALTH SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: EHEALTH INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: HEALTHCARE PROVIDERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 193)

11.1 INTRODUCTION

FIGURE 20 AGREEMENTS, COLLABORATIONS, ALLIANCES, AND PARTNERSHIPS HAVE BEEN KEY GROWTH STRATEGIES ADOPTED BY LEADING PLAYERS FROM 2017 TO 2020

11.2 GEOGRAPHICAL ASSESSMENT OF KEY PLAYERS IN EHEALTH MARKET

FIGURE 21 GEOGRAPHIC REVENUE MIX: GLOBAL EHEALTH INDUSTRY (2019)

11.3 MARKET SHARE ANALYSIS

11.3.1 ELECTRONIC MEDICAL RECORD/ELECTRONIC HEALTH RECORD (EMR/EHR) SOLUTIONS

TABLE 167 EMR/EHR SOLUTIONS OFFERED BY KEY MARKET PLAYERS

FIGURE 22 EMR/EHR MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

11.3.2 PICTURE ARCHIVING & COMMUNICATION SYSTEMS (PACS)

TABLE 168 PACS OFFERED BY KEY MARKET PLAYERS

FIGURE 23 PACS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

11.4 COMPETITIVE SITUATIONS AND TRENDS

11.4.1 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS

TABLE 169 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS

11.4.2 PRODUCT LAUNCHES

TABLE 170 PRODUCT LAUNCHES

11.4.3 ACQUISITIONS

12 COMPANY EVALUATION MATRIX (Page No. - 201)

12.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STAR

12.2.2 EMERGING LEADER

12.2.3 PERVASIVE PLAYER

12.2.4 PARTICIPANT

FIGURE 24 EHEALTH MARKET: COMPANY EVALUATION MATRIX, 2019

12.3 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS, 2019

12.3.1 PROGRESSIVE COMPANY

12.3.2 DYNAMIC COMPANY

12.3.3 STARTING BLOCK

12.3.4 RESPONSIVE COMPANY

FIGURE 25 GLOBAL EHEALTH INDUSTRY: START-UP COMPANY EVALUATION MATRIX, 2019

13 eHealth Market RANKING (Page No. - 205)

13.1 Global EHEALTH INDUSTRY RANKING ANALYSIS METHODOLOGY

13.2 HOSPITAL EMR—MARKET RANKING ANALYSIS

13.2.1 Global Market RANKING ANALYSIS FOR ASIA PACIFIC

TABLE 171 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.1.1 Key player analysis of hospital EMR systems market in Japan

TABLE 172 JAPAN: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.1.2 Key player analysis of hospital EMR systems market in China

TABLE 173 CHINA: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.1.3 Key player analysis of hospital EMR systems market in India

TABLE 174 INDIA: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.1.4 Key player analysis of hospital EMR systems market in Australia and New Zealand

TABLE 175 AUSTRALIA AND NEW ZEALAND: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2 eHealth Market RANKING ANALYSIS FOR EUROPE

TABLE 176 EUROPE: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2.1 Key player analysis of hospital EMR systems market in Germany

TABLE 177 GERMANY: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2.2 Key player analysis of hospital EMR systems market in France

TABLE 178 FRANCE: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2.3 Key player analysis of hospital EMR systems market in UK

TABLE 179 UK: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2.4 Key player analysis of hospital EMR systems market in Spain

TABLE 180 SPAIN: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.2.2.5 Key player analysis of hospital EMR systems market in Italy

TABLE 181 ITALY: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

13.3 TELEHEALTH MARKET RANKING ANALYSIS, 2019

FIGURE 26 TELEHEALTH : MARKET RANKING OF KEY PLAYERS, 2019

13.4 REMOTE PATIENT MONITORING MARKET RANKING ANALYSIS, 2019

FIGURE 27 REMOTE PATIENT MONITORING MARKET, BY KEY PLAYER, 2019

FIGURE 28 CLINICAL DECESSION SUPPORT SYSTEM: MARKET RANKING OF PLAYERS, 2019 214

14 COMPANY PROFILES (Page No. - 215)

14.1 GE HEALTHCARE

FIGURE 29 GE HEALTHCARE: COMPANY SNAPSHOT, 2019

14.2 CERNER

FIGURE 30 CERNER: COMPANY SNAPSHOT, 2019

14.3 ALLSCRIPTS

FIGURE 31 ALLSCRIPTS: COMPANY SNAPSHOT, 2019

14.4 MCKESSON

FIGURE 32 MCKESSON: COMPANY SNAPSHOT, 2020

14.5 PHILIPS

FIGURE 33 PHILIPS: COMPANY SNAPSHOT, 2019

14.6 SIEMENS HEALTHINEERS

14.7 IBM

FIGURE 35 IBM: COMPANY SNAPSHOT, 2019

14.8 OPTUM

14.9 MEDTRONIC

FIGURE 36 MEDTRONIC: COMPANY SNAPSHOT, 2019

14.9.2 PRODUCTS & SERVICES OFFERED

14.10 EPIC SYSTEMS

14.11 ATHENAHEALTH

14.12 CISCO SYSTEMS

FIGURE 37 CISCO SYSTEMS: COMPANY SNAPSHOT, 2019

14.13 ECLINICALWORKS

14.14 MEDHOST

14.15 INTERSYSTEMS CORPORATION

14.16 CANTATA HEALTH

14.17 ADVANCED DATA SYSTEMS CORPORATION

14.18 COGNIZANT HEALTHCARE

FIGURE 38 COGNIZANT: COMPANY SNAPSHOT, 2019

14.19 BIOTELEMETRY, INC.

14.20 IHEALTH LAB, INC.

15 APPENDIX (Page No. - 262)

15.1 DISCUSSION GUIDE

15.2 INDUSTRY EXPERTS

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process included a study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the eHealth market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to eHealth Market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, presidents, vice presidents, marketing managers, product managers, sales executives, business development executives, and technology & innovation directors of companies providing eHealth as well as key opinion leaders in eHealth companies, medical device companies, and CROs. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The eHealth Market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends by type and end user).

Data Triangulation

After arriving at the market size, the total eHealth Market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the eHealth Market by type, deployment, end user, and region.

- To provide detailed information about the key factors influencing market growth (such as drivers, opportunities, restraints, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overalleHealth market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the eHealth Market in five main regions (along with major countries)—North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa

- To profile key players in the eHealth Market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers and acquisitions; service launches; expansions; collaborations and agreements; and R&D activities of the leading players in the eHealth Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional eHealth Market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in eHealth Market

Which region to focus for revenue expansion in eHealth Industry?

What are the benefits of the eHealth solutions over the manual methods? and, How is this fueling the global growth for eHealth Market?

How does the emerging trends are feeding the global growth of eHealth Market?