Microirrigation Systems Market

Microirrigation Systems Market by Type (Drip & Micro-sprinkler), Crop Type (Orchard crops & vineyards, Field Crops, Plantation Crops), End User (Farmers, Industrial Users ), & Region( NA, Europe, APAC, South America, RoW) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

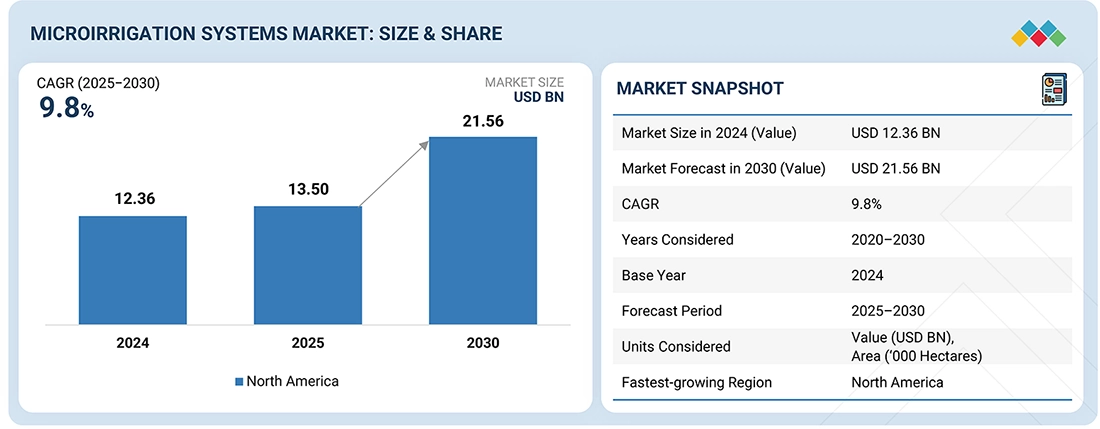

The microirrigation systems market is estimated to be USD 13.50 billion in 2025 and is projected to reach USD 21.56 billion by 2030, registering a CAGR of 9.8% from 2025 to 2030. Market growth is increasingly shaped by long-term structural factors rather than short-term agricultural cycles, including chronic water scarcity, climate volatility, and tightening environmental regulations across both developed and emerging economies. Adoption is particularly strong in water-stressed regions, export-oriented agricultural zones, and areas dominated by high-value crops such as fruits, vegetables, orchards, and vineyards, where reliable irrigation is critical for yield stability and quality. As a result, demand is rising not only for new installations but also for system upgrades, retrofitting of existing infrastructure, and replacement of inefficient legacy irrigation systems, supporting sustained long-term growth of the global micro-irrigation systems market.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for 49.5% of the microirrigation systems market in 2024.

-

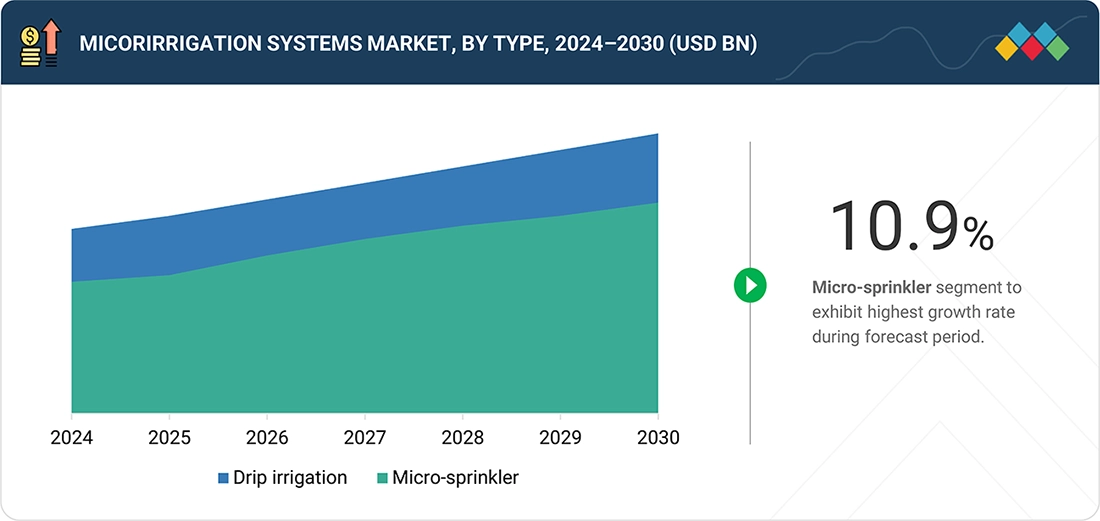

By TypeBy type, the micro-sprinkler segment is expected to register the highest CAGR of 9.7% during the forecast period.

-

By Crop TypeBy crop type, the orchard crops & vineyards segment dominated with a market share of 58.6% in 2024.

-

By End UserBy end user, the industrial users will grow at a higher rate, supported by growth in the commercial farming.

-

Competitive Landscape – Key PlayersKey players operating in the microirrigation systems market include Jain Irrigation Systems Ltd., The Toro Company, Netafim, and Nelson Irrigation supported by strong brand equity and regional distribution.

-

Competitive Landscape – StartupsEmerging companies such as Rain Drip and Metro Irrigation, are gaining traction in drip and sprinkler irrigation segments.

The microirrigation systems market is projected to grow from USD 13.50 billion in 2025 to USD 21.56 billion by 2030, at a CAGR of 9.8% during the forecast period. This growth is driven less by short-term technology trends and more by fundamental changes in global water management practices, regulatory rules, and farm economics. Across regions, the increasing need to conserve water, follow environmental regulations, and control rising input costs is leading growers to use micro-irrigation as a necessary structure rather than just an optional upgrade.

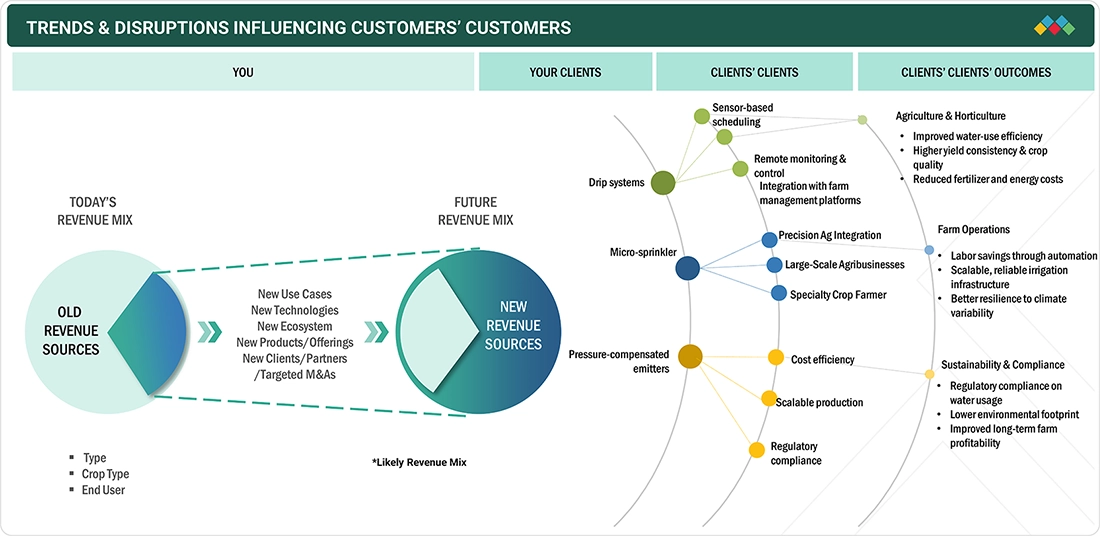

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global micro-irrigation systems market currently focuses on key applications like drip and micro-sprinkler systems for orchards, vineyards, and high-value crops. In the future, revenue growth will come more from new use cases, improved technologies, and integrated solutions than from just selling more products. This shows a fundamental change in the market. The adoption of automation, IoT-enabled controls, fertigation, and data-driven irrigation management is shifting the market from hardware sales to integrated irrigation platforms. The increase in greenhouse farming, water-scarce areas, and large-scale commercial agriculture is changing demand worldwide. At the same time, users are putting more emphasis on water efficiency, energy savings, reliability, and meeting regulations. This is driving ongoing demand in agriculture, landscaping, and institutional applications around the globe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Need for efficient use of water resources in drought conditions

-

•Demand for technologically advanced irrigation systems

Level

-

§ High initial investment

-

§ Need for continous maintainence

Level

-

§Global presence of agricultural and food companies

-

§Public and private support for irrigation projects in developing countries

Level

-

§Delayed reimbursement of subsidies

-

§Absence of monitoring agencies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for efficient use of water resources in drought conditions

Protection of agricultural fields against drought has become a possibility with the use of advanced irrigation systems. Appropriate irrigation scheduling techniques have given various successes among farmers. Irrigation scheduling by advanced technology is gaining importance, and many farmers are increasingly applying these techniques successfully. Through microirrigation, farmers manage to sustain the same production levels even in a drought year, as minimal usage of water resources also ensures high yield with the use of such systems. This is a key factor contributing to the growth of the microirrigation systems market in tropical countries where droughts occur frequently.

Restraint: High initial investment

Micro-irrigation systems work best for high-investment agricultural areas like orchards, nurseries, greenhouses, and vineyards. Conventional irrigation methods often don’t work well in these settings. The high initial cost of installing micro-irrigation systems makes them less appealing for low-value crops, where the returns may not justify the expense. The main cost issue with micro-irrigation is the upfront investment. This includes tubing, emitters, pumps, filtration systems, and control equipment, especially for large operations. Total system costs can vary widely based on crop type, regional conditions, water quality, field layout, and how much automation is needed, as well as the complexity of the filtration and fertigation components used in the system.

Opportunity: Global presence of agricultural and food companies

Several global food companies have adopted measures to market their products as sustainably produced in the last few years. This is a differentiating factor in the end products, which has proved profitable for companies and enhanced their market share. Microirrigation systems are one of how these companies can ensure that their raw materials are produced in a sustainable manner. Microirrigation systems reduce the quantity of water consumed by crops, which limits environmental degradation and water table depletion. This is an opportunity for the microirrigation systems market as these agricultural and food companies operate on large scales, either through their farms or through contract farming with small farmers. In the case of contract farming, these companies provide equipment, such as drips and sprinklers, to resource-poor farmers that are essential for the production of crops with desired characteristics.

Challenge: Delayed reimbursement of subsidies

In the agrarian countries of Asia, governments allocate a large amount of money for the technological development of agriculture in the form of increased usage of machinery and equipment. In the case of microirrigation systems, the components are sold at subsidized prices to small and medium farmers. Most microirrigation system components are sold at subsidized prices to encourage farmers to improve their yield from limited land areas in addition to maximizing their profits. Multinational companies operating in many countries must deal with subsidy policies in these regions, making it challenging to sustain day-to-day operations smoothly. A major challenge for market players is to recover the amount of revenue reduced due to those subsidized prices of drip or micro-sprinklers. There is often a delay in receiving the reimbursement from the government.

MICROIRRIGATION SYSTEMS MARKET TRENDS, GROWTH, AND FORECAST [LATEST]: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Comprehensive drip and micro-irrigation solutions for orchards, vineyards, field crops, and protected cultivation, with strong focus on fertigation and cost-efficient system design | Improved water and nutrient-use efficiency, lower input costs, better yield stability, and scalable solutions across diverse farm sizes |

|

Advanced precision irrigation systems for high-value crops, orchards, vineyards, and greenhouses, integrating drip irrigation with automation and climate-resilient technologies | Consistent irrigation performance, labor savings, improved crop quality, resilience under water-stressed and variable water-quality conditions |

|

Drip and micro-irrigation solutions for specialty crops, orchards, vineyards, and commercial landscaping, integrated with automation and smart controls. | Improved water-use efficiency, uniform crop irrigation, reduced labor requirements, and higher return on irrigation investment |

|

Micro-sprinkler and rotator-based irrigation systems for orchards, vineyards, and row crops, designed for durability, modularity, and easy retrofitting | Uniform water distribution, reduced maintenance time, lower system lifecycle costs, and improved operational reliability |

|

Drip and micro-irrigation systems for agriculture, greenhouses, and turf & landscape applications with strong focus on precision and system reliability | Reduced water wastage, improved crop and landscape performance, regulatory compliance on water usage, and lower maintenance needs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global micro-irrigation systems market is changing as water-use efficiency becomes a key focus for both agricultural and non-agricultural users around the world. Farmers in different regions are increasingly using drip and micro-sprinkler systems to optimize water application, improve irrigation uniformity, and boost productivity in both open-field farming and controlled-environment agriculture. These systems are especially important for specialty crops, orchards, vineyards, and row crops, where precise moisture control directly affects yield quality, resource efficiency, and overall farm economics. Market growth is also driven by labor shortages, rising input costs, and a growing demand for low-maintenance and automated irrigation solutions. At the same time, the expanding use of micro-irrigation in commercial landscaping, turf management, and institutional applications is widening the addressable market beyond traditional agriculture. As goals for sustainability, climate resilience, and cost reduction become central to global farming and land management practices, micro-irrigation systems are now seen as essential infrastructure for long-term productivity, resource conservation, and competitiveness throughout the global agricultural value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Microirrigation Market, By Type

The drip irrigation segment continues to lead the market because it delivers reliable agricultural and financial results across many crops and locations. Unlike surface or traditional sprinkler systems, drip irrigation allows for a steady, low-volume application of water that meets the needs of plant roots. This makes it especially useful for perennial crops, specialty farming, and areas that face ongoing water shortages. Worldwide, drip irrigation has become the top choice for farms that want to boost yields while using less water, follow stricter water regulations, and manage rising costs. Its modular design can be adjusted based on crop spacing, soil type, and terrain. It also works well with fertigation and digital farm management tools, which improves nutrient efficiency and control over operations. Local manufacturing, lower costs in emerging markets, and strong government backing for water-saving irrigation further support its growth. As global agriculture focuses more on resilience, sustainability, and returns on investment, drip irrigation is set to remain a key technology in the micro-irrigation field.

Microirrigation Market, By Crop Type

At a global level, orchards and vineyards make up the largest crop segment in the micro-irrigation systems market. This growth is mainly due to the nature of perennial farming, not just regional policies. Tree crops and vineyards need steady, multi-year water management plans to keep plants healthy, maintain yields, and protect fruit quality over long production cycles. Micro-irrigation systems, particularly drip and micro-sprinkler solutions, fit these needs well because they allow for accurate and consistent water and nutrient delivery to specific root zones. Worldwide, orchard and vineyard operators face greater challenges from climate variability, water scarcity, and higher labor costs. This makes automated and sensor-enabled irrigation systems an important investment instead of just a nice addition. The ability to adjust irrigation for different growth stages, soil types, and land conditions helps ensure even crop development and less long-term stress on plants. Although the initial costs are higher, the long lifespan of orchards and vineyards lets growers reap significant returns over time through better yield consistency, improved quality, and less waste of resources. Consequently, the ongoing growth in fruit and wine production worldwide keeps orchards and vineyards as the top application segment in the global micro-irrigation systems market.

Microirrigation Market, By End User

Globally, farmers make up the largest group of users in the micro-irrigation systems market. This shows the clear connection between how well irrigation works and productivity on farms. Farmers in many different areas are using micro-irrigation to respond to the increasing pressure on water resources, rising costs, and the need for steady yields in changing weather conditions. Drip and micro-sprinkler systems allow precise control over water and nutrients, helping farmers use their inputs more efficiently while keeping crop quality consistent. The demand from farmers is driven by the need to protect the long-term financial health of their farms instead of just focusing on short-term output. In both developed and developing markets, farmers are looking for irrigation solutions that cut down water loss, increase resilience to drought and heat, and support precision farming. The rise of automation, sensor-based scheduling, and digital irrigation tools is speeding up this trend, especially in areas where there are labor shortages. As sustainability, cost management, and the ability to adapt to climate change become key to agricultural strategies worldwide, farmers are likely to stay the main users influencing demand and innovation in the global micro-irrigation systems market.

REGION

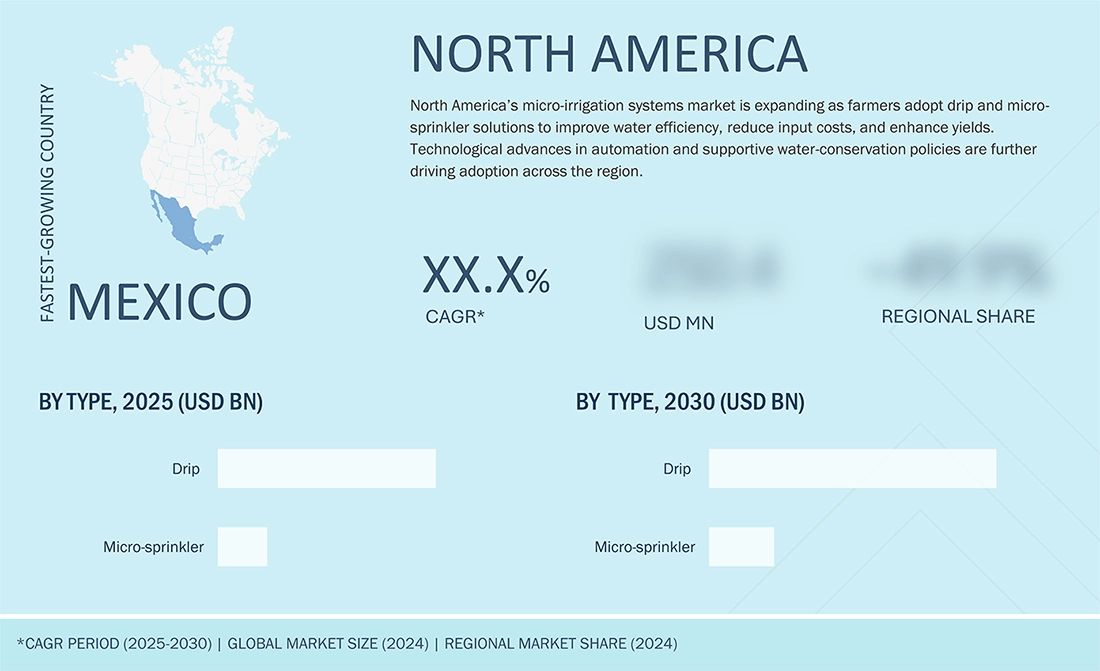

North America to be fastest-growing region in Microirrigation Systems market during forecast period

The region has been a significant user of micro-irrigation technologies, especially drip irrigation systems. This is due to the large-scale farming of high-value crops, modern farming methods, and early use of precision agriculture solutions. Freshwater resources are important for the environment, the economy, and regulations across North America. However, their availability and distribution vary greatly between regions. This unevenness has raised worries about water scarcity, particularly in agricultural areas with limited water, like the US Midwest and parts of the western United States. As a result, both large commercial growers and small farmers are increasingly adopting micro-irrigation systems. These systems help improve water efficiency, reduce losses from runoff and evaporation, and meet tighter water-management regulations. Additionally, the rising awareness of sustainable farming practices, higher input costs, and the need to maintain long-term farm productivity are speeding up adoption across different farm sizes. Government incentives, conservation programs, and more automated and digitally enabled irrigation solutions support this market growth. Together, these factors make North America a key area for the micro-irrigation systems market, with growth driven by technological improvements and ongoing water-management challenges.

MICROIRRIGATION SYSTEMS MARKET TRENDS, GROWTH, AND FORECAST [LATEST]: COMPANY EVALUATION MATRIX

The global micro-irrigation systems market exhibits a well-defined competitive structure shaped by technology leadership, portfolio breadth, manufacturing scale, and global distribution reach. Market leadership is anchored by Jain Irrigation Systems, Netafim, The Toro Company, Nelson Irrigation, and Rain Bird Corporation, all of which maintain strong positions through comprehensive micro-irrigation offerings, deep agronomic expertise, and extensive dealer and distributor networks across major agricultural regions. These players compete by continuously expanding product portfolios across drip, micro-sprinkler, filtration, fertigation, and increasingly smart and automated irrigation solutions. Their global manufacturing footprints and localized service capabilities allow them to address diverse crop types, climatic conditions, and regulatory requirements. Overall, this market structure supports sustained innovation, steady consolidation, and long-term growth of the global micro-irrigation systems market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Jain Irrigation Systems Ltd. (India)

- Nelson Irrigation (US)

- Rain Bird Corporation (US)

- The Toro Company (US)

- Netafim (Israel)

- Finolex Plasson (India)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Rivulis (Israel)

- HUNTER INDUSTRIES (US)

- Antelco (Australia)

- T-L Irrigation (US)

- Elgo Irrigation Ltd. (Israel)

- Irritec S.p.A (Italy)

- Microjet (South Africa)

- Mahindra EPC Irrigation Limited (India)

- Rain drip (US)

- Metro Irrigation (India)

- Kothari Group (India)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Heibei Plentirain Irrigation Equipment Ltd (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.36 Billion |

| Market Forecast in 2030 (Value) | USD 21.56Billion |

| Growth Rate | CAGR of 9.8% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume ('000 Hectares) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America & ROW |

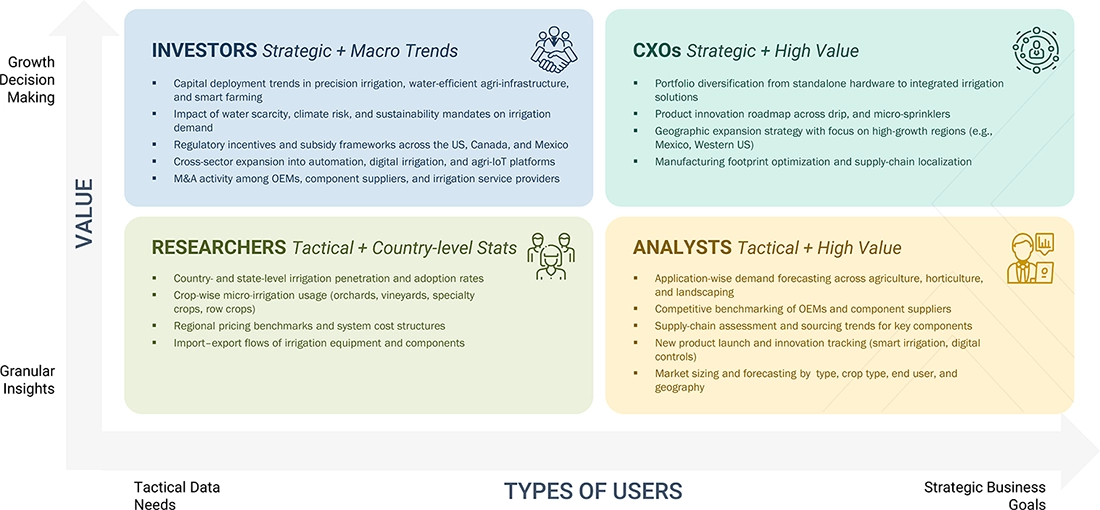

WHAT IS IN IT FOR YOU: MICROIRRIGATION SYSTEMS MARKET TRENDS, GROWTH, AND FORECAST [LATEST] REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Micro-Irrigation Market Landscape |

|

|

| Application & Crop Economics Assessment |

|

|

| End-User & Route-to-Market Dynamics |

|

|

RECENT DEVELOPMENTS

- November 2025 : Nelson Irrigation’s R7 Rotator® Sprinkler strengthens its position in the micro-sprinkler segment by addressing two critical grower priorities namely operational efficiency and total system cost reduction. As the latest addition to the Rotator family, the R7 combines full-coverage irrigation performance with 7 Series modularity and Quick Clean (QC) technology, enabling fast flushing and reconnection that significantly reduces maintenance time and labor requirements.

- February 2025 : Netafim has launched a patented Hybrid Dripline system, positioning it as the first integral dripline with a built-in outlet, combining the advantages of integral and on-line dripper systems into a single solution. This innovation addresses key operational pain points in orchards, vineyards, and greenhouse cultivation, where labor availability, installation complexity, and system reliability increasingly constrain irrigation efficiency.

- January 2024 : Lindsay Corporation announced a $50 million investment over the next two years to enhance its largest global manufacturing facility in Lindsay, Nebraska. The initiative aims to improve safety, quality, and efficiency while accelerating the development of innovations like the Smart Pivot.

- March 2023 : The completion of Jain Irrigation Systems Limited’s merger with Rivulis, backed by Temasek, marks a transformational consolidation move in the global micro-irrigation industry. By combining Jain’s international irrigation business with Rivulis, the transaction creates a global irrigation and climate solutions leader with an estimated USD 750 million in annual revenue.

Table of Contents

Methodology

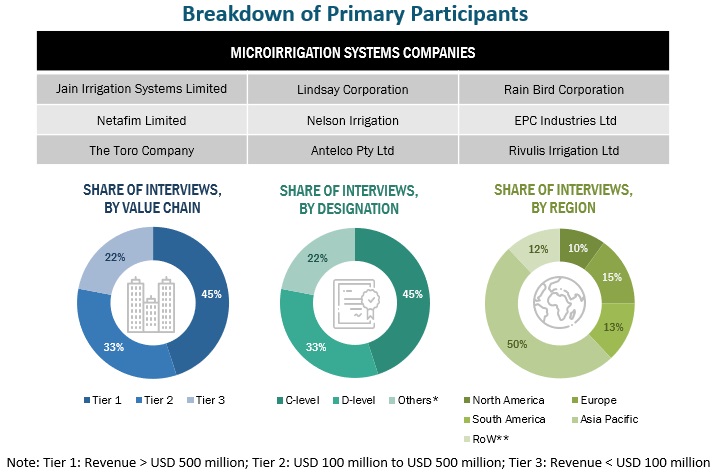

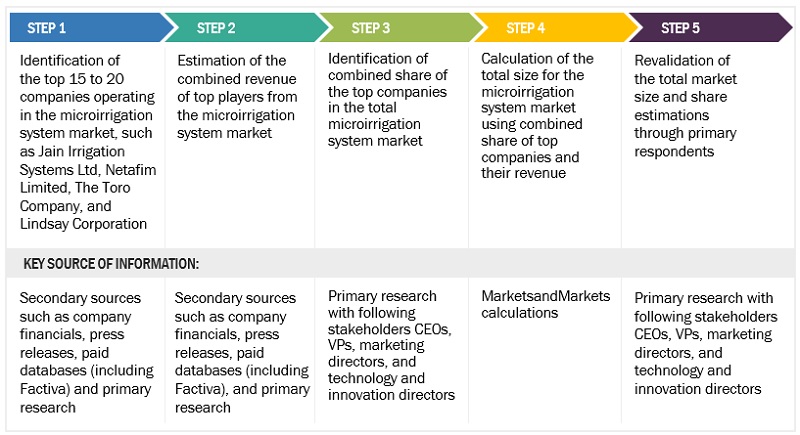

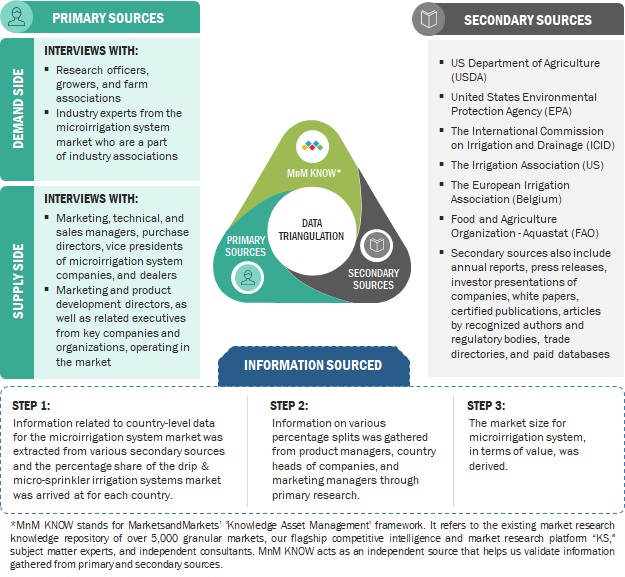

This research study involved the extensive use of secondary sources—directories and databases, such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the global microirrigation systems market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information, as well as to assess prospects.

Secondary Research

The secondary sources referred to for this research study include government sources (such as the Food and Agriculture Organization (FAO), the International Commission on Irrigation & Drainage (ICID), The Organization for Economic Co-operation and Development (OECD), United States Department of Agriculture (USDA), and the World Bank, corporate filings (such as annual reports, press releases, investor presentations, and financial statements)), and trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall microirrigation systems market size, which was further validated by primary research.

Primary Research

The market comprises several stakeholders in the supply chain; these include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the agriculture industry. The primary sources from the supply side include research institutions involved in R&D activities, key opinion leaders, and manufacturers of microirrigation systems.

To know about the assumptions considered for the study, download the pdf brochure

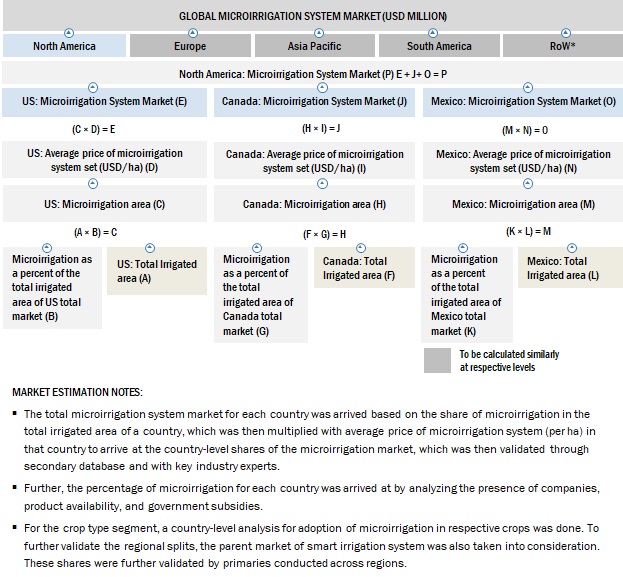

Microirrigation Systems Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the microirrigation systems market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The microirrigation systems market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the microirrigation systems market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market Size Estimation: Bottom-up Approach

The figure represents the overall market size estimation process employed through the bottom-up approach for this study.

The bottom-up approach was implemented for data extracted from secondary research to validate the market segment sizes obtained, which is explained below:

- The market for microirrigation systems was identified based on factors, such as COVID-19 impact on the trade and supply of agricultural inputs, company presence, and their revenues and product availability; crop production, exports, and imports; the adoption of organic farming based on key crops, and average usage of drip & micro-sprinkler irrigation systems on crop application rates in the industry.

- For each country, the increase in microirrigation area was considered, along with the replacement rate of microirrigation equipment in the existing area to arrive at the market demand. This area with potential market demand was then multiplied with the average selling price (ASP) of microirrigation equipment per hectare to arrive at the country's market size. Similar ASP was considered across all the countries in the region, with certain price variations done based on product availability and export/import dependency of the country for drip equipment. After arriving at each country's market value, these market values were summed to arrive at the regional microirrigation systems market size. This was checked with the microirrigation systems market share splits provided by the industry experts. A similar approach was performed for other regions as well.

- Following this, the market size for each region was estimated by summing up the country-level data. Further, the market size at the global level was estimated by summing up the regional level data, which has been validated through primary interviews conducted with microirrigation system manufacturers, government institutions, research organizations, suppliers, and distributors.

- The global number for microirrigation systems was arrived at after giving certain weightage factors for secondary sources, and primary sources obtained.

Market Size Estimation: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Microirrigation Systems Market Size Estimation Methodology: Top-Down Approach

The top-down approach was used to triangulate the data obtained through this study:

The top-down approach was also implemented for the data extracted from secondary research to validate the share of the market segment obtained. For the calculation of the global microirrigation systems market, the revenues of the major players operating in the microirrigation systems market were considered. The global share of the major players in the microirrigation systems market was validated with the primary respondents. The regional splits were arrived at by considering the presence and number of products sold by the company in the particular region alongside the land area being brought under microirrigation systems.

Data Triangulation

After arriving at the overall microirrigation systems market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall microirrigation systems market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides

Market Definition

According to US EPA (United States Environmental Protection Agency), microirrigation is a low-pressure, low-flow-rate type of irrigation that can reduce the likelihood of overwatering a landscape. This form of irrigation delivers water directly to where it is needed most-the root zone of plants. It also delivers the water slowly and over a longer period of time, preventing runoff and reducing evaporation. Microirrigation systems use 20 to 50 percent less water than conventional sprinkler systems and can reduce residential or commercial landscape irrigation water use.

According to F.R. Lamm, J.E. Ayars, and F.S. Nakayama in the book titled ‘Microirrigation for Crop Production: Design, Operation and Management,’ microirrigation is defined as:

“Microirrigation is the slow application of water on, above, or below the soil by surface drip, subsurface drip, bubbler, and micro sprinkler systems. Water is applied as discrete or continuous drips, tiny streams, or miniature spray through emitters or applicators placed along a water delivery line adjacent to the plant row.”

Microirrigation systems include drip method and micro-sprinkler method of irrigation systems. The approach in both systems involves a controlled supply of water in small quantities with the required consistency. Microirrigation is low pressure and low-volume irrigation system suitable for high-return value crops such as fruit and vegetable crops. Microirrigation is a modern method of irrigation; by this method, water is irrigated through drippers, micro-sprinklers, foggers, and other emitters on the surface or subsurface of the land

Key Stakeholders

- Microirrigation systems manufacturers

- Microirrigation systems importers and exporters

- Microirrigation systems traders, distributors, and suppliers

- Government and research organizations

-

Government regulatory agencies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Environmental Protection Agency (EPA)

- Department of Environment, Food, and Rural Affairs (DEFRA)

Report Objectives

Market Intelligence

- To determine and project the size of the microirrigation systems market with respect to type, crop type, end user, and region

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide the regulatory framework and market entry process related to the microirrigation systems market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- To identify and profile the key players in the microirrigation systems market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across countries

To provide insights on key product innovations and investments in the microirrigation systems market

Customization Options

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe's microirrigation systems market forecast into Germany, UK, the Netherlands, and other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific market into South Korea, Malaysia, and Vietnam.

- Further breakdown of the Rest of the South American microirrigation systems market forecast into Cuba and Uruguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Microirrigation Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Microirrigation Systems Market

User

Nov, 2019

Interested in purchasing the report, does it have data on drip sensors..

Mohammed

Jun, 2017

Interested in global drip irrigation market with deep dive in US, Latin America, India and China markets.

Chiranjeevi

May, 2018

Looking for the current market size of the drip irrigation sector in India. .