Military Transmit and Receive Module Market by Type (Gallium Nitride, Gallium Arsenide), Application, Frequency (Single-Band and Multi-Band), Communication Medium (Optical, RF, Hybrid), Platform, and Region - Global Forecast to 2028

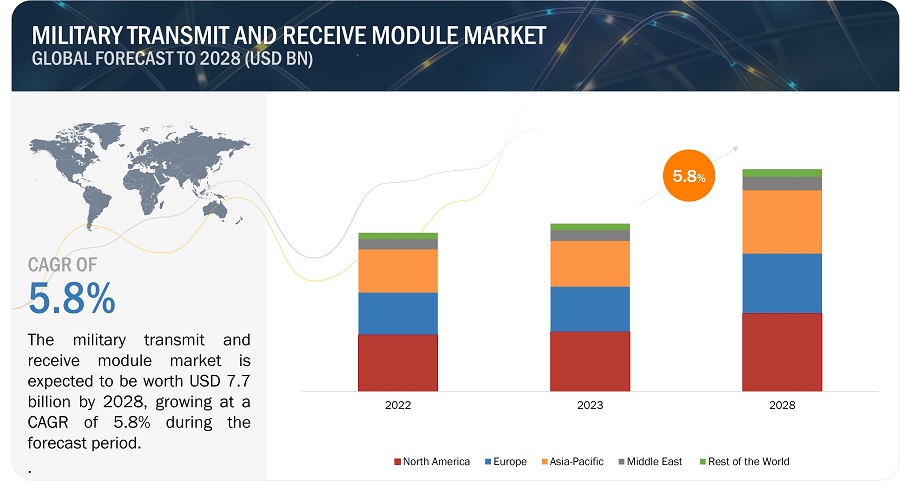

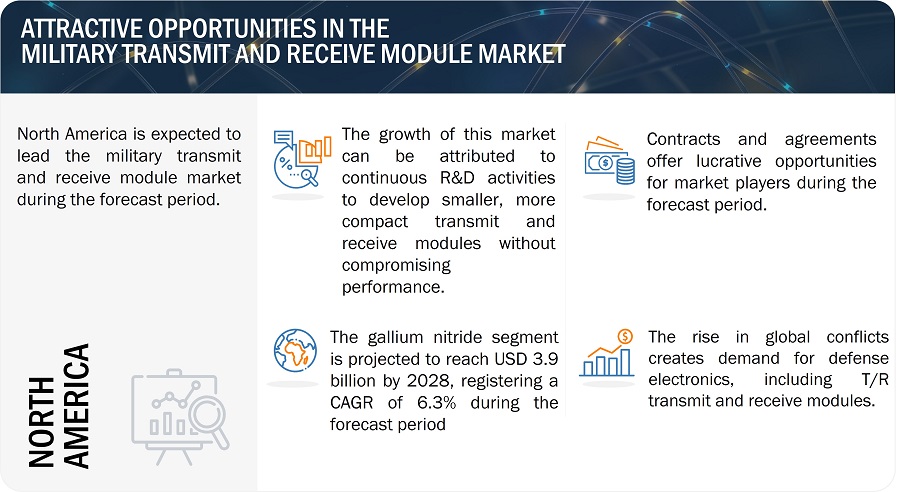

[258 Pages Report] The military transmit and receive module market is estimated to be USD 5.8 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 5.8% from 2023 to 2028. The market is driven by factors such as the development of new transmit and receive module technologies.

Military Transmit and Receive Module Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military transmit and receive module market Dynamics:

Drivers: Development of new transmit and receive module technologies

The demand for compact transmit and receive (T/R) modules is growing rapidly, driven by the development of new T/R module technologies that offer improved size, weight, and power (SWaP) performance. SWaP performance is a critical consideration for military T/R modules due to the following reasons:

- The size of a T/R module affects the size and weight of the overall system. Military systems are often deployed in constrained environments, so minimizing the size and weight of individual components is crucial. Smaller T/R modules allow for more flexibility in system design.

- The weight of a T/R module influences the payload capacity of aircraft, vehicles, and other platforms. As military systems operate in remote locations, it is necessary to lower the weight of equipment to maximize payload capacity. Lighter T/R modules also allow for easier transport and handling.

- The power consumption of a T/R module determines the power budget of the overall system. Lower power T/R modules extend battery life and reduce the need for cooling and other power management infrastructure.

Given these advantages, there are ongoing research and development activities for SWaP T/R modules in the market.

Restraints: Stringent regulations for import and export of gallium

Stringent regulations for the import and export of rare earth metals such as gallium (used in military T/R modules) prevent unauthorized or inappropriate use of technologies in military communications, radar systems, and electronic warfare. These regulations encompass various key aspects, including robust export controls and licensing procedures, requiring companies to obtain specific licenses for exporting these components. However, countries often use regulations and policy tools for geopolitical purposes as part of their foreign policy strategies. Regulations can be leveraged to advance national interests, influence international dynamics, and achieve specific geopolitical objectives. For example, in July 2023, China imposed restrictions on the export of gallium and germanium, two metals used in chipmaking, communications equipment, and defense. After this, exporters needed to apply for licenses from the commerce ministry to continue shipment of the materials out of the country and were required to report details of the overseas buyers and their applications. This move creates a shortage in supply of this rare earth metal in the international market resulting in rising prices of the material. This increases raw material expenses for the manufacturers of transmit and receive modules.

Opportunities: Emphasis on developing lightweight radars

The rapid development of lightweight radars is driven by the growing demand for smaller, more versatile, and affordable unmanned aerial vehicles (UAVs). These radars enable UAVs to perform various functions, such as collision avoidance, terrain mapping, and object detection. In recent years, UAVs have become increasingly popular due to their low cost and reduced risk. The availability of cost-efficient UAVs for airborne surveillance has further prompted radar manufacturers to develop small and compact airborne radars. In June 2019, MetaSensing (Netherlands) demonstrated the SDO-50V2 UAV equipped with the MetaSAR-L-UAV for intelligence activities. These systems are primarily used for stability monitoring in mines, infrastructure, and construction sites. The growing emphasis on developing lightweight radar for UAVs is anticipated to offer lucrative opportunities in the market

Challenges: Vulnerability to radar jamming techniques

Modern defense technologies have led to significant advancements in radar jamming techniques. Radar jamming involves intentionally emitting radio frequency signals to disrupt the enemy’s radar operations by creating noise in the receiver. Airborne radars are more vulnerable to these jamming techniques due to their limited range, small size, and mobile nature. New electronic radar jamming techniques utilize interfering signals that block the receiver with highly concentrated energy signals, preventing the signal from reaching the airborne radar and impeding its effectiveness. In 2019, the US Army awarded BAE Systems (UK) a contract to develop and supply advanced radar jamming technology to enhance air survivability and mission effectiveness for the Army’s rotary-wing aircraft and unmanned aerial systems. Under this contract, the company would undertake research and development to integrate adaptive radio frequency jamming and sensing capabilities. Such innovative radar frequency jamming technologies challenge T/R module providers to improve their products to resist jamming technologies.

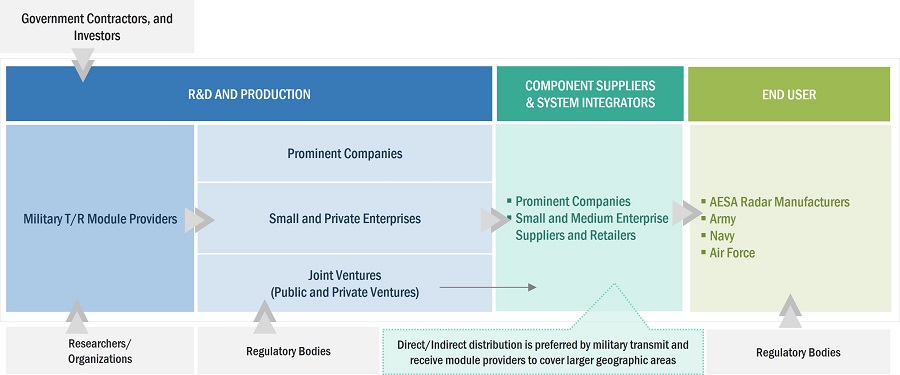

Military Transmit And Receive Module Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of T/R modules with a global presence. They have been operating in the market for several years and have a diversified product portfolio, state-of-the-art technologies, and robust global sales and marketing networks. Prominent companies include Northrop Grumman (US), Thales (France), L3Harris Technologies, Inc. (US), RTX (US), and CAES System LLC (US).

Private and small enterprises have a comparatively limited product portfolio, financial strength, and specialization in specific components and subcomponents. Some companies could enter strategic partnerships and joint ventures with prominent companies to gain a strong foothold in the military transmit and receive module market. Currently, private and small enterprises are looking at funding and investments to develop technologically advanced T/R modules and enter them into service. Private and small enterprises include ALPHA DESIGN TECHNOLOGIES PVT LTD (India), Aethercomm Inc (US), Annapolis Micro Systems, Inc. (US), Mistral Solutions Pvt. Ltd. (India) and Altum RF (Netherlands).

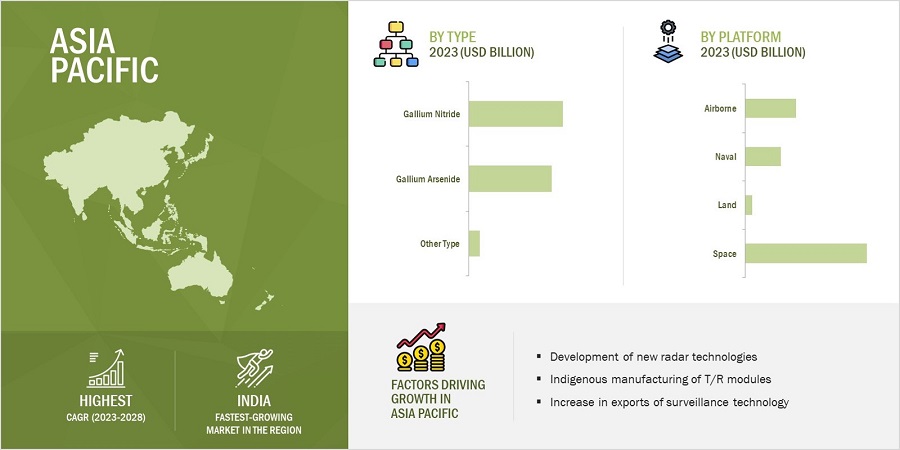

The gallium nitride segment is projected to grow at the highest CAGR rate of 6.3 % for the military transmit and receive module market during the forecast period.

Based on type, the military transmit and receive module market is segmented into gallium nitride, gallium arsenide, and others. The gallium nitride segment is projected to reach USD 3.91 billion by 2028. T/R modules use several high-performance materials, such as gallium nitride (GaN). These materials are expensive and require specialized manufacturing techniques.

The radar segment is estimated to account for the largest share of the Military transmit and receive module market in 2023.

The military transmit and receive module market is divided into four segments based on applications: Radar, Communication, Electronic Warfare, and Others. The radar segment is expected to hold the largest share of the market in 2023, accounting for 48% of the total. Governments worldwide are increasingly investing in the upgrade of aircraft fleets by integrating modern radar systems, driving the demand for military T/R modules.

The Single-band segment is projected to have largest market share for the Military transmit and receive module market in 2023.

The military transmit and receive module market is divided into two segments based on frequency: single-band and multi-band. The single-band segment is expected to hold the largest share of the market in 2023, accounting for 74% of the total. The demand for single-band T/R modules is influenced by ever-expanding usage of wireless communication technologies.

The airborne segment is projected to have largest market share for the Military transmit and receive module market in 2023.

The military transmit and receive module market is divided into four segments based on platform: airborne, naval, land and space. The airborne segment is expected to hold the largest share of the market in 2023, accounting for 42% of the total. This is due to the increasing demand for smaller, more versatile, and affordable unmanned aerial vehicles (UAVs). These radars enable UAVs to perform various functions, such as collision avoidance, terrain mapping, and object detection.

The Asia Pacific market is projected to contribute the highest CAGR from 2023 to 2028

Aisa Pacific is projected to contribute the highest CAGR from 2023 to 2028 in the military transmit and receive module market during the forecast period. Major companies such as mitsubishi electric corporation, National Chung-Shan Institute of Science and Technology, and Bharat Electronics Limited are based in the asia pacific region. These players continuously invest in the R&D of new and advanced technologies for transmit and receive modules.

Military Transmit and Receive Module Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Military transmit and receive module companies is dominated by a few globally established players such as Northrop Grumman (US), Thales (France), L3Harris Technologies, Inc. (US), RTX (US), and CAES System LLC (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, Application, Frequency, Communication Medium, Platform, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

Northrop Grumman Corporation (US), Thales Group (France), L3Harris Technologies, Inc. (US), RTX Corporation (US), and CAES System LLC (US) and many more. |

Military Transmit and Receive Module Market Highlights

This research report categorizes military transmit and receive module market based on Type, Application, Frequency, Medium of Communication, Platform, and Region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By Application: |

|

|

By Frequency: |

|

|

By Communication Medium: |

|

|

By Platform: |

|

|

By Region: |

|

Recent Developments

- In September 2023, The US DoD awarded Northrop Grumman two radar contracts, enhancing air defense and electronic warfare capabilities.

- In November 2023, SIGEN (a consortium between Elettronica Group (Rome) and Thales) and Naviris signed a contract for the modernization of electronic warfare (EW) systems.

- In November 2023, L3Harris Technologies won a contract from the US Navy to continue developing advanced systems to modernize EW capabilities on F/A-18 aircraft, enhancing pilot protection against emerging and future threats.

- In November 2023, Raytheon, an RTX business, has been awarded a four-year contract from DARPA to increase the electronic capability of RF sensors with high-power-density GaN transistors. The improved transistors will have 16 times higher output power than traditional GaN with no increase in operating temperature.

Key Questions Addressed by the Report:

What is the current size of Military transmit and receive module market?

Response: The Military transmit and receive module market is projected to grow from an estimated USD 5.8 billion in 2023 to USD 7.7 billion by 2028, at a CAGR of 5.8% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the military transmit and receive module market?

Response: The organic and inorganic strategies adopted by key players to strengthen their position in the Military transmit and receive module market are high R&D investment, collaborations & expansions, contracts, partnerships, and agreements, to expand their presence in the market further.

What factors support Military transmit and receive module market growth during the forecast period?

Response: Increasing investments in the procurement and development of radar, communication, and electronic warfare systems to strengthen military capabilities is the key factor supporting Military transmit and receive module market growth during the forecast period.

Which region is expected to hold the highest market share in the Military transmit and receive module market?

Response: North America accounted for the largest share of 36 % of the market in 2023.

Who are the leading players in the Military transmit and receive module market?

Response: Northrop Grumman (US), Thales (France), L3Harris Technologies, Inc. (US), RTX (US), and CAES System LLC (US) are the leading players in the Military transmit and receive module market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Development of new transmit and receive (T/R) module technologies- Increase in demand for advanced electronic warfare and communications systems amid rising geopolitical tensions- Focus on military modernization- Integration of advanced radar technologies in air and missile defense systemsRESTRAINTS- High manufacturing cost of T/R modules- Stringent regulations for import and export of galliumOPPORTUNITIES- Emphasis on developing lightweight radars- Ongoing research and development in advanced surveillance technologiesCHALLENGES- Vulnerability to radar jamming techniques- Technical complexities associated with T/R modules

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 TRADE DATA ANALYSISIMPORT DATAEXPORT DATA

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE OF MILITARY T/R MODULES, BY PLATFORMINDICATIVE PRICING ANALYSIS OF MILITARY T/R MODULES

-

5.9 CASE STUDIESUSE OF NORTHROP GRUMMAN'S AN/APG-81 AESA RADAR IN F-35 LIGHTNINGUSE OF THALES' RBE2-AA RADAR IN DASSAULT RAFAELDEVELOPMENT OF UTTAM AESA RADAR

-

5.10 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIASTAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSGALLIUM NITRIDEGALLIUM ARSENIDEACTIVE ELECTRONICALLY SCANNED ARRAYMULTI-BAND, MULTI-MISSION ANTENNASOLID-STATE T/R MODULEBEAMFORMINGCOGNITIVE RADARADVANCED TACTICAL DATA LINK

-

6.3 IMPACT OF MEGATRENDSARTIFICIAL INTELLIGENCEMINIATURIZED T/R MODULECOMMERCIAL-OFF-THE-SHELF T/R MODULE

-

6.4 PATENT ANALYSIS

- 6.5 ROADMAP FOR MILITARY TRANSMIT AND RECEIVE MODULE MARKET

- 7.1 INTRODUCTION

-

7.2 GALLIUM NITRIDE (GAN)COST EFFICIENCY AND IMPROVED PERFORMANCE TO DRIVE GROWTH

-

7.3 GALLIUM ARSENIDE (GAAS)LOW POWER CONSUMPTION AND RADIATION RESISTANCE TO DRIVE GROWTH

- 7.4 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 RADAREFFORTS TOWARD DEFENSE MODERNIZATION TO DRIVE GROWTH

-

8.3 COMMUNICATIONPROCUREMENT OF ADVANCED MILITARY COMMUNICATIONS SYSTEMS TO DRIVE GROWTH

-

8.4 ELECTRONIC WARFAREDEVELOPMENT OF NEW TECHNOLOGIES AND ARCHITECTURES TO DRIVE GROWTH

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 SINGLE-BANDFOCUS ON EFFICIENT AND COMPACT COMMUNICATIONS SOLUTIONS TO DRIVE GROWTH- HF/VHF/UHF (>1 GHz)- L (1–2 GHz)- S (2–4 GHz)- C (4–8 GHz)- X (8–12 GHz)- Ku/K/Ka (12–40 GHz)

-

9.3 MULTI-BANDFLEXIBILITY ACROSS MULTIPLE FREQUENCY BANDS TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 AIRBORNEPROLIFERATION OF T/R MODULES IN AIR RADAR SYSTEMS TO DRIVE GROWTH

-

10.3 NAVALUSE OF ELECTRONIC WARFARE BY MODERN WARSHIPS TO DRIVE GROWTH

-

10.4 LANDDEVELOPMENT OF STATE-OF-THE-ART RADAR SYSTEMS TO DRIVE GROWTH

-

10.5 SPACEEVOLUTION OF MILITARY SPACE TECHNOLOGIES TO DRIVE GROWTH

- 11.1 INTRODUCTION

- 11.2 OPTICAL

- 11.3 RADIO FREQUENCY (RF)

- 11.4 HYBRID

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSISRECESSION IMPACT ANALYSISUS- Large-scale presence of military equipment manufacturers to drive growthCANADA- Boost in defense modernization initiatives to drive growth

-

12.4 EUROPEPESTLE ANALYSISRECESSION IMPACT ANALYSISUK- Rise in military expenditure to drive growthFRANCE- Increase in international deals providing advanced military aircraft to drive growthGERMANY- Surge in demand for aircraft with advanced electronic warfare to drive growthITALY- Innovations in military communications technology to drive growthRUSSIA- Rising threats from NATO countries to drive growthREST OF EUROPE

-

12.5 ASIA PACIFICPESTLE ANALYSISRECESSION IMPACT ANALYSISCHINA- Defense investments and technological showcases to drive growthINDIA- Indigenous manufacturing of T/R modules to drive growthJAPAN- Rising security concerns to drive growthSOUTH KOREA- Increasing procurement of advanced defense electronics to drive growthAUSTRALIA- Modern radar technologies to drive growthREST OF ASIA PACIFIC

-

12.6 MIDDLE EASTPESTLE ANALYSISRECESSION IMPACT ANALYSISGCC COUNTRIES- Saudi Arabia- UAE- QatarISRAEL- Focus on advanced electronic systems to drive growthTURKEY- Expansion of defense portfolio to drive growthREST OF MIDDLE EAST

-

12.7 REST OF THE WORLD (ROW)PESTLE ANALYSISLATIN AMERICA- Increasing procurement of naval ships to drive growthAFRICA- Incorporation of advanced defense electronics to drive growth

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 RANKING ANALYSIS, 2022

- 13.4 MARKET SHARE ANALYSIS, 2022

- 13.5 REVENUE ANALYSIS, 2018–2022

-

13.6 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.7 START-UP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES/DEVELOPMENTSDEALSEXPANSIONS

-

14.1 KEY PLAYERSNORTHROP GRUMMAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRTX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCAES SYSTEMS LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developmentsIAI- Business overview- Products/Solutions/Services offered- Recent developmentsKYOCERA CORPORATION- Business overview- Products/Solutions/Services offeredANALOG DEVICES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developmentsQORVO, INC- Business overview- Products/Solutions/Services offered- Recent developmentsBHARAT ELECTRONICS LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsASELSAN A.S.- Business overview- Products/Solutions/Services offered- Recent developmentsNATIONAL CHUNG-SHAN INSTITUTE OF SCIENCE AND TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developmentsMERCURY SYSTEMS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsKRATOS DEFENSE & SECURITY SOLUTIONS, INC.- Business overview- Products/Solutions/Services offeredCYIENT- Business overview- Products/Solutions/Services offered- Recent developmentsMACOM- Business overview- Products/Solutions/Services offered- Recent developmentsSPECTRUM CONTROL, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsFILTRONIC PLC- Business overview- Products/Solutions/Services offered- Recent developmentsNANJING GUOBO ELECTRONICS CO., LTD.- Business overview- Products/Solutions/Services offered

-

14.2 OTHER PLAYERSIRAY TECHNOLOGY CO., LTD.ASTRA MICROWAVE PRODUCTS LTD.ALPHA DESIGN TECHNOLOGIES PVT LTDAETHERCOMMANNAPOLIS MICRO SYSTEMS, INC.MISTRAL SOLUTIONS PVT. LTD.JARIET TECHNOLOGIES, INC.RF-LAMBDASRC, INC.ALTUM RF

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF MILITARY TRANSMIT AND RECEIVE MODULE MARKET

- TABLE 4 GEOPOLITICAL TENSIONS GLOBALLY

- TABLE 5 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF MILITARY T/R MODULES, BY PLATFORM (USD THOUSAND, 2022)

- TABLE 7 INDICATIVE PRICING ANALYSIS OF MILITARY T/R MODULES, BY KEY PLAYER

- TABLE 8 IMPACT OF PORTER'S FIVE FORCES

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 16 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 17 PATENT ANALYSIS, 2019−2022

- TABLE 18 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 19 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 VOLUME DATA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, (MILLION UNITS), 2019–2022

- TABLE 23 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 24 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 25 SINGLE-BAND: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 SINGLE-BAND: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 28 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 29 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 30 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 44 US: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 45 US: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 46 US: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 47 US: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 48 CANADA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 49 CANADA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 CANADA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 51 CANADA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 53 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 54 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 55 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 59 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 63 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 64 UK: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 65 UK: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 66 UK: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 67 UK: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 FRANCE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 69 FRANCE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 70 FRANCE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 71 FRANCE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 72 GERMANY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 73 GERMANY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 GERMANY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 75 GERMANY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 76 ITALY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 77 ITALY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 ITALY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 79 ITALY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 80 RUSSIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 81 RUSSIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 RUSSIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 83 RUSSIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 85 REST OF EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 REST OF EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 87 REST OF EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 100 CHINA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 101 CHINA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 CHINA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 103 CHINA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 104 INDIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 INDIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 INDIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 107 INDIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 108 JAPAN: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 109 JAPAN: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 JAPAN: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 111 JAPAN: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 113 SOUTH KOREA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 SOUTH KOREA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 115 SOUTH KOREA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 116 AUSTRALIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 117 AUSTRALIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 AUSTRALIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 119 AUSTRALIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 124 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 127 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 131 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 136 SAUDI ARABIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 137 SAUDI ARABIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 SAUDI ARABIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 139 SAUDI ARABIA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 140 UAE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 141 UAE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 UAE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 143 UAE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 144 QATAR: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 145 QATAR: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 QATAR: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 147 QATAR: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 148 ISRAEL: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 ISRAEL: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 ISRAEL: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 151 ISRAEL: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 152 TURKEY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 153 TURKEY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 TURKEY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 155 TURKEY: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 163 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 169 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY SINGLE-BAND FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 170 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 176 AFRICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 177 AFRICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 AFRICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 179 AFRICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 180 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 181 MILITARY TRANSMIT AND RECEIVE MODULE MARKET: DEGREE OF COMPETITION

- TABLE 182 APPLICATION FOOTPRINT

- TABLE 183 FREQUENCY FOOTPRINT

- TABLE 184 REGION FOOTPRINT

- TABLE 185 KEY START-UPS/SMES

- TABLE 186 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 187 MILITARY TRANSMIT AND RECEIVE MODULE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, FEBRUARY 2020–JUNE 2023

- TABLE 188 MILITARY TRANSMIT AND RECEIVE MODULE MARKET: DEALS, FEBRUARY 2020–NOVEMBER 2023

- TABLE 189 MILITARY TRANSMIT AND RECEIVE MODULE MARKET: EXPANSIONS, OCTOBER 2023

- TABLE 190 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 191 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NORTHROP GRUMMAN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 193 NORTHROP GRUMMAN: DEALS

- TABLE 194 THALES: COMPANY OVERVIEW

- TABLE 195 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 THALES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 197 THALES: DEALS

- TABLE 198 THALES: OTHERS

- TABLE 199 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 200 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 202 RTX: COMPANY OVERVIEW

- TABLE 203 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 RTX: DEALS

- TABLE 205 CAES SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 206 CAES SYSTEMS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 CAES SYSTEMS LLC: DEALS

- TABLE 208 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 209 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 211 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 212 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 213 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 LEONARDO S.P.A.: DEALS

- TABLE 215 IAI: COMPANY OVERVIEW

- TABLE 216 IAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 IAI: DEALS

- TABLE 218 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 219 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 221 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ANALOG DEVICES, INC.: DEALS

- TABLE 223 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 224 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 TELEDYNE TECHNOLOGIES INCORPORATED: OTHERS

- TABLE 226 QORVO, INC: COMPANY OVERVIEW

- TABLE 227 QORVO, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 QORVO, INC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 229 BHARAT ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 230 BHARAT ELECTRONICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 BHARAT ELECTRONICS LIMITED: DEALS

- TABLE 232 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 233 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ASELSAN A.S.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 235 ASELSAN A.S.: DEALS

- TABLE 236 NATIONAL CHUNG-SHAN INSTITUTE OF SCIENCE AND TECHNOLOGY: COMPANY OVERVIEW

- TABLE 237 NATIONAL CHUNG-SHAN INSTITUTE OF SCIENCE AND TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 NATIONAL CHUNG-SHAN INSTITUTE OF SCIENCE AND TECHNOLOGY: OTHERS

- TABLE 239 MERCURY SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 240 MERCURY SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 MERCURY SYSTEMS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 242 MERCURY SYSTEMS, INC.: DEALS

- TABLE 243 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 244 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: DEALS

- TABLE 246 CYIENT: COMPANY OVERVIEW

- TABLE 247 CYIENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 CYIENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 249 MACOM: COMPANY OVERVIEW

- TABLE 250 MACOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 MACOM: DEALS

- TABLE 252 SPECTRUM CONTROL, INC.: COMPANY OVERVIEW

- TABLE 253 SPECTRUM CONTROL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 SPECTRUM CONTROL, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 255 FILTRONIC PLC: COMPANY OVERVIEW

- TABLE 256 FILTRONIC PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 FILTRONIC PLC: DEALS

- TABLE 258 NANJING GUOBO ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 259 NANJING GUOBO ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 IRAY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 261 ASTRA MICROWAVE PRODUCTS LTD.: COMPANY OVERVIEW

- TABLE 262 ALPHA DESIGN TECHNOLOGIES PVT LTD: COMPANY OVERVIEW

- TABLE 263 AETHERCOMM: COMPANY OVERVIEW

- TABLE 264 ANNAPOLIS MICRO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 265 MISTRAL SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 266 JARIET TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 267 RF-LAMBDA: COMPANY OVERVIEW

- TABLE 268 SRC, INC.: COMPANY OVERVIEW

- TABLE 269 ALTUM RF: COMPANY OVERVIEW

- FIGURE 1 MILITARY TRANSMIT AND RECEIVE MODULE MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE SECTOR

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 SHARE OF MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION (2019–2028) AND PLATFORM (2023)

- FIGURE 11 GALLIUM NITRIDE TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 12 RADAR SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 13 SINGLE-BAND TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 NAVAL TO SURPASS OTHER PLATFORMS DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 RAPID DEVELOPMENT OF SOLID-STATE T/R MODULE-BASED ACTIVE PHASED ARRAY RADARS

- FIGURE 17 GALLIUM NITRIDE SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 18 RADAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 MULTI-BAND TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 20 NAVAL SEGMENT TO ACQUIRE LARGEST MARKET SHARE IN 2028

- FIGURE 21 INDIA TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET DURING FORECAST PERIOD

- FIGURE 22 MILITARY TRANSMIT AND RECEIVE MODULE MARKET DYNAMICS

- FIGURE 23 REVENUE SHIFT IN MILITARY TRANSMIT AND RECEIVE MODULE MARKET

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM MAPPING

- FIGURE 27 KEY PLAYERS IN ECOSYSTEM

- FIGURE 28 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 AVERAGE SELLING PRICE OF MILITARY T/R MODULES, BY PLATFORM (USD THOUSAND, 2022)

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 34 PATENT ANALYSIS

- FIGURE 35 EVOLUTION OF MILITARY T/R MODULE TECHNOLOGY, 1940–2023

- FIGURE 36 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY TYPE, 2023–2028

- FIGURE 37 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY APPLICATION, 2023–2028

- FIGURE 38 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY FREQUENCY, 2023–2028

- FIGURE 39 X (1–2 GHZ) TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 40 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY PLATFORM, 2023–2028

- FIGURE 41 MILITARY TRANSMIT AND RECEIVE MODULE MARKET, BY REGION, 2023–2028

- FIGURE 42 NORTH AMERICA: MILITARY TRANSMIT AND RECEIVE MODULE MARKET SNAPSHOT

- FIGURE 43 EUROPE: MILITARY TRANSMIT AND RECEIVE MODULE MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MILITARY TRANSMIT AND RECEIVE MODULE MARKET SNAPSHOT

- FIGURE 45 MIDDLE EAST: MILITARY TRANSMIT AND RECEIVE MODULE MARKET SNAPSHOT

- FIGURE 46 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 47 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 52 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 53 THALES: COMPANY SNAPSHOT

- FIGURE 54 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 RTX: COMPANY SNAPSHOT

- FIGURE 56 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 58 IAI: COMPANY SNAPSHOT

- FIGURE 59 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 61 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 62 QORVO, INC: COMPANY SNAPSHOT

- FIGURE 63 BHARAT ELECTRONICS LIMITED: COMPANY SNAPSHOT

- FIGURE 64 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 65 MERCURY SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 66 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 67 CYIENT: COMPANY SNAPSHOT

- FIGURE 68 MACOM: COMPANY SNAPSHOT

- FIGURE 69 FILTRONIC PLC: COMPANY SNAPSHOT

- FIGURE 70 NANJING GUOBO ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

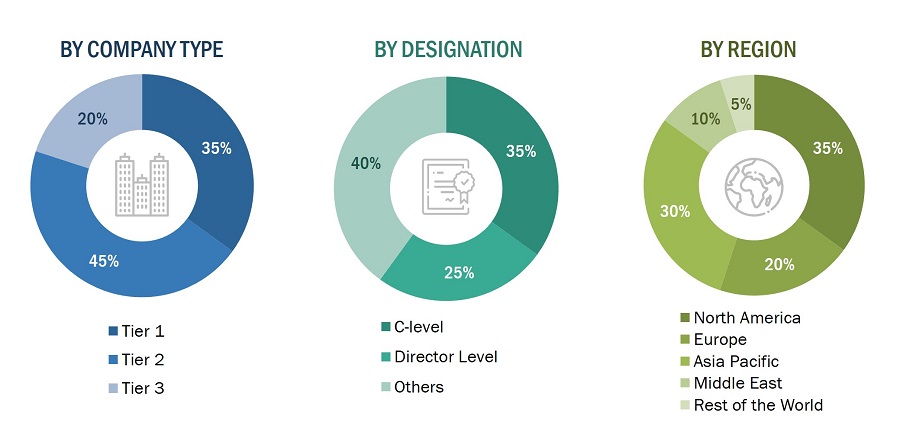

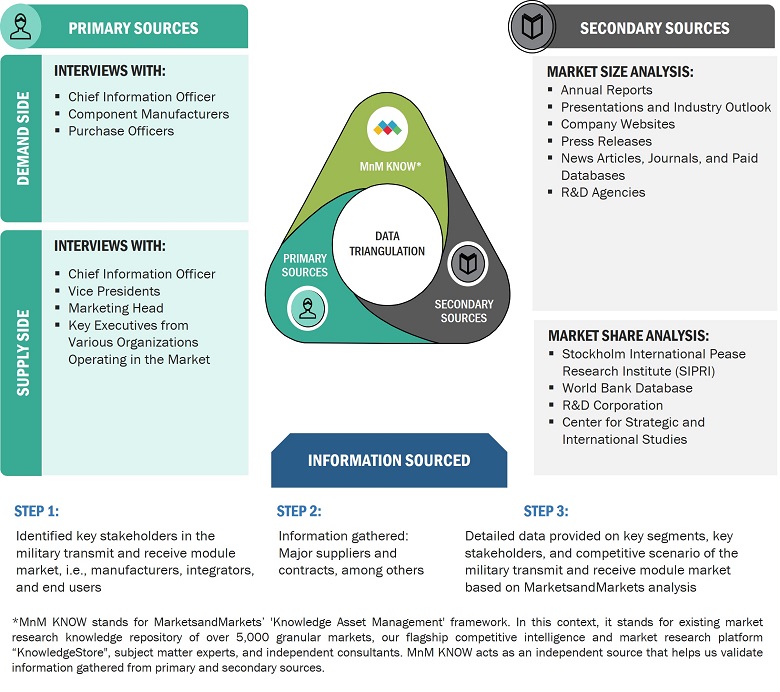

The research study conducted on military transmit and receive module market involved extensive use of secondary sources, including directories, databases of articles, journals on defense electronics, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the military transmit and receive module market. Primary sources include industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of military transmit and receive module market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as World Defense expenditure database; department of defense websites, corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, marketing, product development/innovation teams, component providers, distributors and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to the market. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using military transmit and receive modules were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of military transmit and receive modules and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

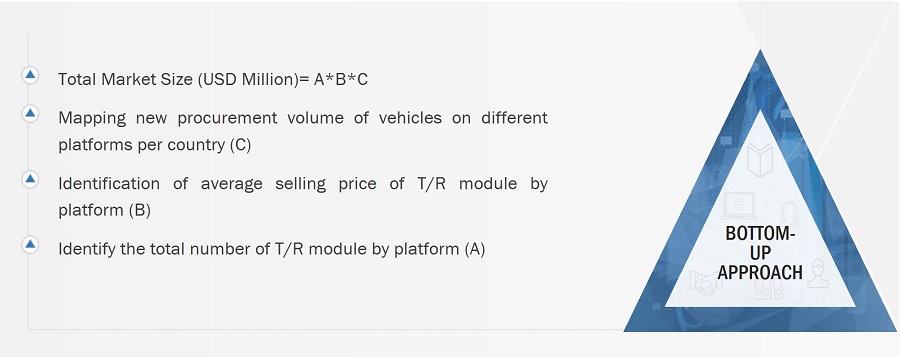

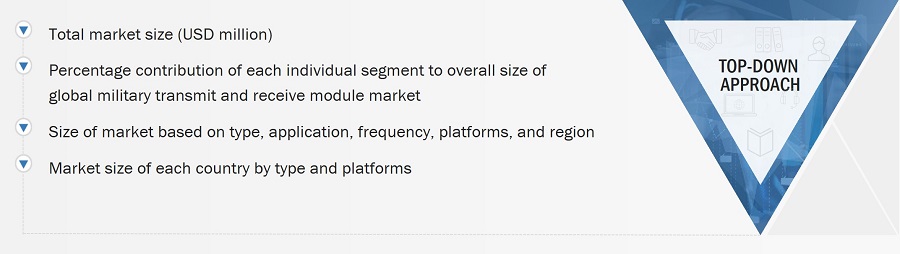

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the military transmit and receive module market. The research methodology used to estimate the market size also includes the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Military transmit and receive module market Size: Bottom-Up Approach

Military transmit and receive module market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below have been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

The figure above demonstrates the core data triangulation procedure used in this report for each market, submarket, and subsegment. Percentage splits of various market segments, i.e., type, application, frequency, communication medium, platform, and region, were used to determine the size of the military transmit and receive module market.

Market Definition

Transmit and Receive (T/R) modules are key components in modern military electronics. These modules provide amplification and electronic beam steering and are applied in radar or communication systems requiring a steerable antenna and are designed to meet stringent military specifications for performance, durability, and reliability in harsh and demanding environments.

The market is segmented by type, application, frequency, medium of communication, platform, and region. The type segment is further segmented into Gallium Nitride, Gallium Arsenide, and Others. The application segment is further segmented into Radar, Communication, Electronic Warfare and Space. The frequency segment is further segmented into Single Band and Multiband. The communication medium segment is further segmented into Optical, RF and Hybrid. The Platform segment is further segmented into Airborne, Naval, Land and Space. The region segment is further segmented into North America, Europe, Asia Pacific, Middle East, and Rest of the World.

Key Stakeholders

- Military Transmit and Receive Module Manufacturers

- Technology Support Providers

- Government Agencies

- Military Organizations

- Investors and Financial Community Professionals

- Research Organizations

Report Objectives

- To define, describe, and forecast the size of the military transmit and receive module market based on type, application, frequency, medium of communication, platform, and region from 2023 to 2028

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East and the Rest of the World (RoW), which comprises Africa and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the military transmit and receive module market across the globe

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, agreements, joint ventures and partnerships, product launches, and research & development (R&D) activities in the market

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

1 Micromarkets are defined as further segments and subsegments of the military transmit and receive module market included in the report.

2 Core competencies of the companies have been captured in terms of the key developments and strategies adopted by players

to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Military Transmit and Receive Module Market