Minimal Residual Disease Testing Market Size, Share & Trends by Technology (PCR, Flow Cytometry, NGS), Application (Leukemia, Lymphoma, Solid Tumors), End User (Hospitals, Specialty Clinics, Diagnostic Labs, Research and Academic Institutes) & Region - Global Forecast to 2027

Minimal Residual Disease Testing Market Size, Share & Trends

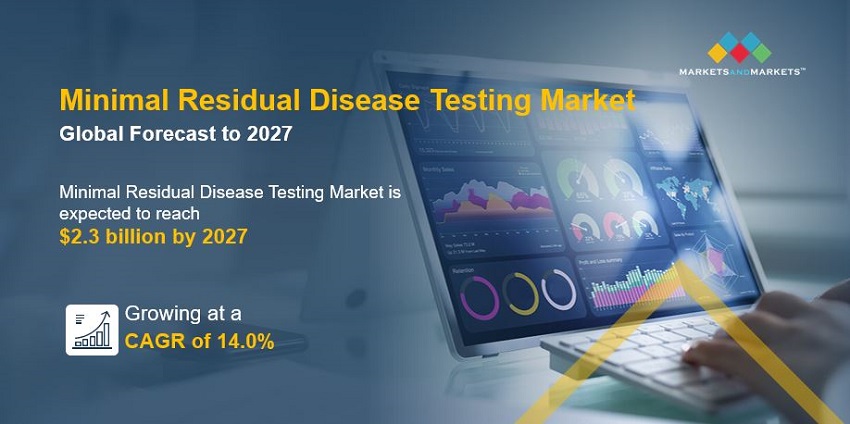

The size of global minimal residual disease testing market in terms of revenue was estimated to be worth $1.2 billion in 2022 and is poised to reach $2.3 billion by 2027, growing at a CAGR of 14.0% from 2022 to 2027. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Market is driven by the rising incidence and prevalence of cancer and hematological malignancies.

To know about the assumptions considered for the study, Request for Free Sample Report

Minimal Residual Disease Testing Market Dynamics

Driver: Rising incidence of hematological malignancies

Over the years, the incidence of hematologic cancer has increased significantly, which includes leukemia and lymphoma. According to the Leukemia & Lymphoma Society 2020-2021, an estimated 1,519,907 people in the US are living with or in remission from leukemia, lymphoma, myeloma, myelodysplastic syndromes (MDS), or myeloproliferative neoplasms (MPNs). Also, the rising geriatric population across the globe is also a key factor supporting the increasing incidence of hematologic malignancies, as this population segment is more prone to various chronic diseases. Such cancer patients require continuous monitoring of disease during treatment. Also, the monitoring of minimal residual diseases (MRD) has become a routine clinical practice post-cancer treatment. As a result, the preference for minimal residual disease testing will likely rise in the forecast period, proportional to the growth in cancer prevalence.

Restraint: Complex regulatory framework and high cost of minimal residual disease testing kits

Regulatory and legal requirements applied to minimal residual tests are becoming more stringent. The FDA requirements and the time required to obtain premarket approval have increased, particularly regarding 510(k) applications with the FDA facing challenges when there is no standardized method for an analyte. On the other hand, the implementation of minimal residual disease testing products in diagnostic laboratories requires high capital investments. For instance, the cost of advanced minimal residual disease testing products varies between USD 20,000 and USD 50,000. In developing countries such as India and Brazil, owing to budget constraints, small and medium-sized organizations and academic laboratories cannot afford advanced and high-priced MRD kits. These factors restrain the market growth.

Opportunity: Growth opportunities in minimal residual disease testing in emerging countries

Developing economies such as India, South Korea, Brazil, Turkey, Russia, and South Africa are expected to offer potential growth opportunities for major players operating in the market. This can be attributed to the rising geriatric population, the growing incidence of hematologic cancers, rising health expenditure per capita, and improving healthcare infrastructure. In addition to the factors mentioned above, the Asia Pacific region has emerged as an adaptive and business-friendly hub due to relatively less stringent regulations and data requirements.

Challenge: Unclear reimbursement scenario and policies for patients

The procedure of paying for pricey molecular testing and the knowledge of the several specialists needed to interpret test results and create treatment programmes are convoluted and even. This is particularly problematic with more expensive modern methods like liquid biopsy which also includes testing minimal residual disease. The price of molecular testing services is frequently unknown to doctors, pathologists and patients until they are paid or billed. This results in a confusion between the patients and the providers.

Additionally, payers’s biomarker coverage policies have complex organizational structures that are quite challenging to comprehend. While some only pay for the most fundamental testsor those related to certain clinical disordersand genes, others pay for a wide variety of testing. Due to significant variety, it is also very difficult to evaluate and keep track of different coverage policies.

The PCR segment accounted for the highest growth rate in the minimal residual disease testing industry, by technology, during the forecast period

The minimal residual disease testing market is segmented into flow cytometry, polymerase chain reaction (PCR), next-generation sequencing (NGS). The PCR segment accounted for the highest growth rate in the market. The main elements contributing to the substantial proportion of this segment are the device’s simplicity of use, the accessibility of test kits and a better degree of sensitivity.

Hematological Malignancies applications segment of minimal residual disease testing industry, accounted for the highest CAGR

Based on application, the minimal residual disease testing market is segmented into hematological malignancies, solid tumors, and other applications. The hematological malignancies application segment accounted for the largest share. Leukemia, lymphoma and their various sub-types are becoming very common, and people are becoming more aware of the importance of ongoing patient monitoring, all of which are factors supporting the expansion of this market.

Hospitals & specialty clinics segment to dominate the minimal residual disease testing industry

Based on end users, the minimal residual disease testing market has been segmented into hospitals & specialty clinics, diagnostic laboratories, academic & research institutes, and other end users. The hospitals & specialty clinics segment accounted for the largest share of this market, while diagnostic laboratories are growing at the highest rate. The presence of cutting-edge diagnostic tools and qualified specialist to conduct these tests is what accounts for the big share of this market.

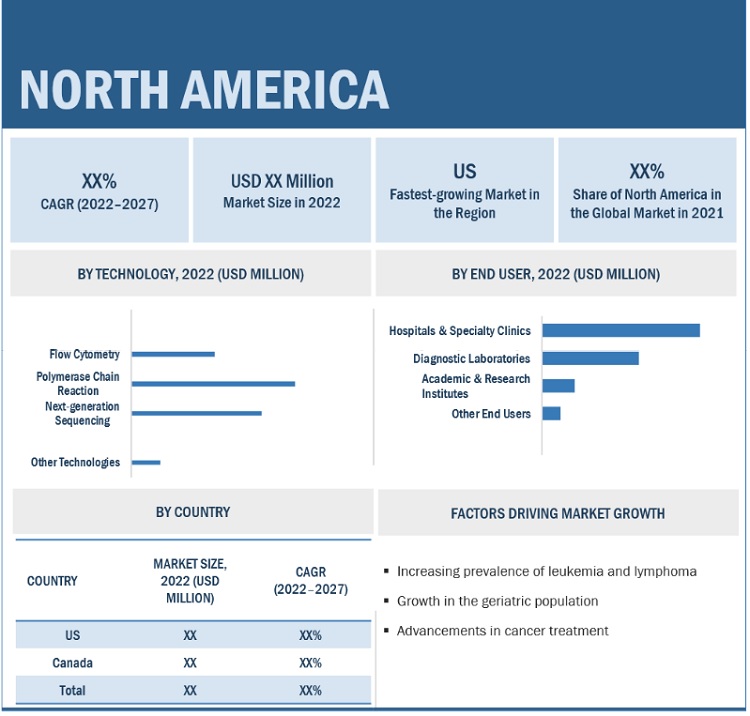

North America is the largest region in the minimal residual disease testing industry for liquid biopsy

Growth in the developed markets of North America is primarily driven by The large share of this regional segment can be attributed to the significant increase of leukemia and lymphoma, highly developed healthcare culture in the US and Canada, the presence of numerous top national clinical laboratories, and the easy accessibility to cutting-edge technology.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players operating in this market are Labcorp Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Guardant Health (US), Sysmex Corporation (Japan), NeoGenomics Laboratories, Inc. (US), Adaptive Biotechnologies Corporation (US), ArcherDX, Inc. (US), Asuragen Inc. (US), Arup Laboratories Inc. (US).

Scope of the Minimal Residual Disease Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$1.2 billion |

|

Projected Revenue Size by 2027 |

$2.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 14.0% |

|

Market Driver |

Rising incidence of hematological malignancies |

|

Market Opportunity |

Growth opportunities in minimal residual disease testing in emerging countries |

This report categorizes the minimal residual disease testing market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- Flow Cytometry

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Other Technologies

By Application

- Hematological Malignancies

- Leukemia

- Lymphoma

- Solid Tumors

- Other Applications

By End User

- Hospitals and Specialty Clinics

- Diagnostic Laboratories

- Academic & Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Minimal Residual Disease Testing Industry

- In February 2019, Bio-Rad Laboratories, Inc. (US) announced the launch of the first FDA-cleared digital PCR system and test for monitoring chronic myeloid leukemia treatment response.In May 2022, QIAGEN N.V. (Netherlands) launched the therascreen EGFR Plus RGQ PCR Kit, a new in vitro diagnostic test for sensitive EGFR mutation analysis.

- In August 2022, Roche launched the Digital LightCycler System, the company’s first digital polymerase chain reaction (PCR) system. This next-generation system detects diseases and is designed to accurately quantify trace amounts of specific DNA and RNA targets not typically detectable by conventional PCR methods.

- In February 2021, Guardant launched the Guardant Reveal Liquid Biopsy Test for residual disease and recurrence monitoring in patients with early-stage colorectal cancer.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the minimal residual disease testing market?

The minimal residual disease testing market boasts a total revenue value of $2.3 billion by 2027.

What is the estimated growth rate (CAGR) of the minimal residual disease testing market?

The global minimal residual disease testing market has an estimated compound annual growth rate (CAGR) of 14.0% and a revenue size in the region of $1.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

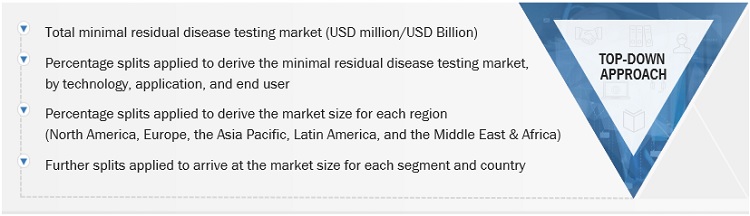

This study involved four major activities in estimating the current size of the minimal residual disease testing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

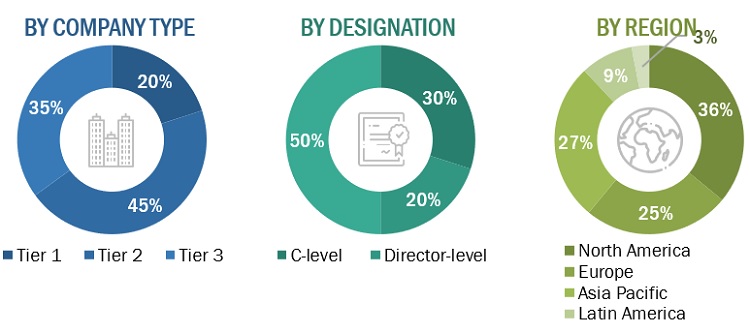

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the minimal residual disease testing market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global minimal residual disease testing market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global minimal residual disease testing market by technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Minimal residual disease testing market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the minimal residual disease testing market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Minimal Residual Disease Testing Market