ATP Assays Market by Product (Consumables (Reagents, Microplate), Instruments (Luminometer, Spectrophotometer)), Application (Contamination, Disease Testing, Drug Discovery), End User (Hospitals, Pharmaceuticals, F&B, Academics) & Region - Global Forecast to 2028

ATP Assays Market Size, Growth Drivers & Restraints

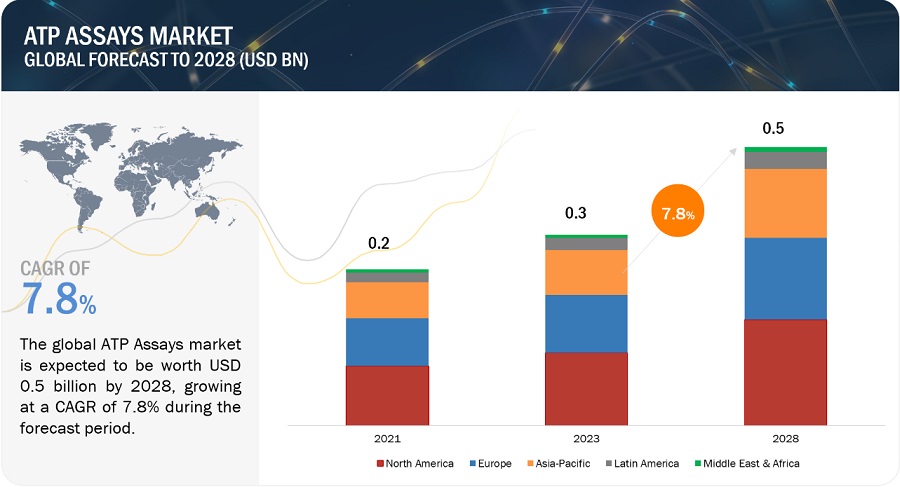

The global atp assays market, valued at US$0.2 billion in 2021, stood at US$0.3 billion in 2023 and is projected to advance at a resilient CAGR of 7.8% from 2023 to 2028, culminating in a forecasted valuation of US$0.5 billion by the end of the period. The expansion of this market is primarily propelled by the shift from culture-based tests to rapid tests, rising demand for cell-based assays in research, and the rising demand for ATP assays in pharmaceutical companies. However, lack of ability to differentiate between extracellular and intracellular ATP are factors restraining the growth of this market.

ATP Assays Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

ATP Assays Market Dynamics

Driver: Increasing food safety concerns

Technological advancements have supported the food supply to be more distinct than ever before. To ensure best-quality products with lowest health risks, several governments and companies have declared regulations to stipulate tolerable levels of contaminants, residues, and additives in food products. Under the Food Safety Modernization Act (FSMA), food processing facilities should have food safety programs in place and collect quantitative data to determine that their cleaning and sanitation programs are working. It lowers the risk of foodborne illnesses, closures, and recalls and can also increase efficiency and decrease costs. According to the WHO, in 2022, unsafe food containing harmful bacteria, viruses, parasites, or chemical substances, resulted in more than 200 diseases, ranging from diarrhea to cancers. An estimated 600 million (almost 1 in 10 people in the world) fall ill after eating contaminated food, and 420,000 die every year, resulting in the loss of 33 million healthy life years (DALYs).

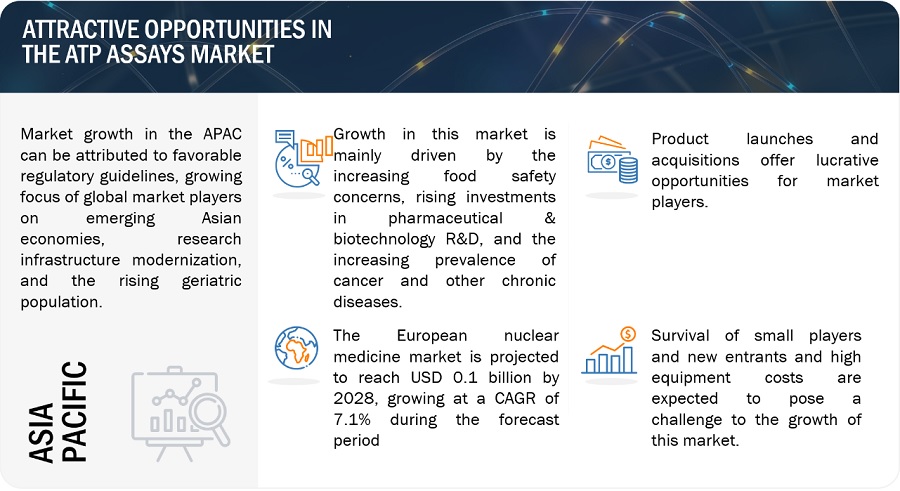

Restraint: High cost of instruments

Cell biology implies extensive research on the development of new therapies, such as stem cell and gene therapies. The instruments, reagents, and other products associated with these research activities are made to be of high quality to obtain accurate results. In biopharmaceutical companies, the overall cost of production of biopharmaceuticals increases significantly due to the use of expensive systems. The cost of research in cell biology is high because of the need to maintain high-quality standards (use of high-grade, expensive products) and comply with guidelines set up by regulatory authorities. Furthermore, it becomes difficult for small hospitals, diagnostic laboratories, and research & academic laboratories to acquire these instruments owing to budget constraints. In addition, the maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This is a major factor limiting the adoption of instruments utilized for ATP assays in both clinical and research applications, especially in emerging markets.

Opportunity: Technological enhancements in ATP assay probes

ATP is a universal mediator of metabolism and signaling across unicellular and multicellular species. There is a basic interdependence between the dynamics of ATP and the physiology that arises at the intracellular and extracellular levels. Thus, characterizing and recognizing ATP dynamics offers valuable mechanistic insights into processes that varies from neurotransmission to the chemotaxis of immune cells. Therefore, there is a requirement for a methodology to interrogate both the temporal and spatial components of ATP dynamics from the subcellular to organismal levels in live specimens. In the last several decades, a number of molecular probes that are detailed to ATP have been developed. These probes have been combined with imaging approaches, mostly optical microscopy, to allow the qualitative and quantitative detection of this critical molecule.

Challenge: Survival of small players and new entrants

The survival of small players and new emerging players in the ATP assays market is a substantial challenge. Established players such as Thermo Fisher Scientific. (US), Merck KGaA (Germany), Lonza (Switzerland), PerkinElmer (US), and NEOGEN Corporation (US) hold for a major share of the market. These players have a robust product portfolio and deep brand recognition. As a result, it is difficult for small players and new entrants to participate with established players. Also, as large investments are wanted for the R&D and launch of innovative products in the market, it is hard for small players to sustain their operations and compete with established players that have huge R&D budgets.

ATP Assays Market Ecosystem Map

By product, the instruments segment is accounted for the second largest share of the ATP assays industry during the forecast period

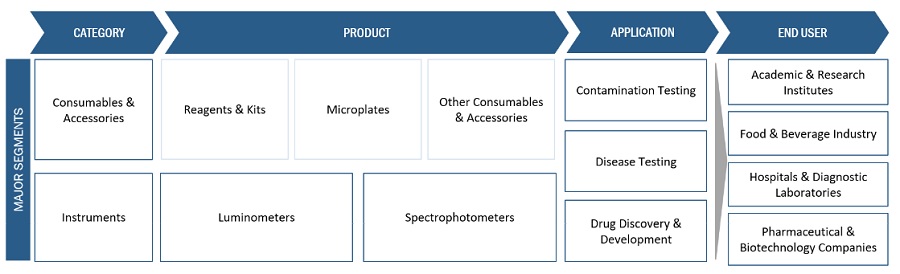

Based on products, within the ATP assays market, there are consumables & accessories as well as instruments, with consumables & accessories holding a significant portion. This predominance is attributed to the widespread utilization of ATP assays in research institutes to assess cell viability, the growing demand for tumor testing and cell proliferation (especially in cancer) driven by the increase in chronic diseases, and the frequent procurement of consumables by pharmaceutical and biotechnology companies.

The contamination testing accounted for the largest share of the ATP assays industry during the forecast period.

Based on applications, The ATP assays market is divided into segments including contamination testing, disease testing, and drug delivery & development. The significant share of the contamination testing segment can be attributed to various factors. These factors include the escalating regulatory requirements imposed on pharmaceutical and food & beverage companies to ensure uncontaminated production, and the surge in drug discovery activities driven by the COVID-19 pandemic

The pharmaceutical & biotechnology companies segment accounted for the largest share of the ATP assays industry in 2022, by end user

Based on end users, The ATP assays market is categorized into pharmaceutical & biotechnology companies, the food & beverage industry, hospitals & diagnostic laboratories, and academic & research institutes. The dominance of this segment can be attributed to several significant factors. These factors include the substantial presence of pharmaceutical players who are making noteworthy investments in this market, the increasing regulatory approvals for cell culture-based vaccines that necessitate the use of ATP assays in contamination testing, the expansion of commercial activities by various pharmaceutical companies, the growing demand for cell and gene therapies to address chronic diseases, extensive research and development endeavors in the pharmaceutical & biopharmaceutical sector, the heightened production of drugs for COVID-19, the rising adoption of cell-based assays for drug development, and the user-friendly nature of ATP assays in contamination testing.

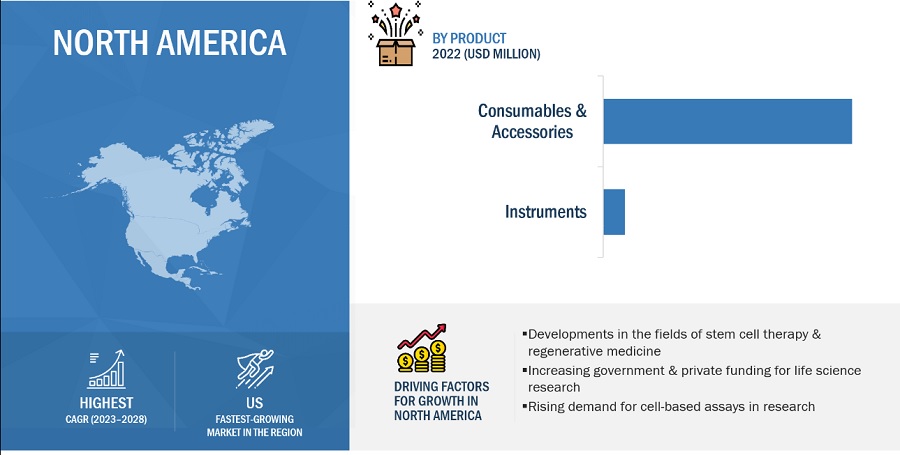

North America to witness significant growth in ATP assays industry from 2023 to 2028

On the basis of region, the ATP Assays market is divided into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In 2023, North America projected to lead market share of the market. This can be attributed to the use of advanced technologies in microbial detection, rising demand for cell-based assays in research, and the presence of high-quality infrastructure for clinical and laboratory research are also supporting market growth

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are Thermo Fisher Scientific, Inc. (US), Promega Corporation (US), Merck KGaA (Germany), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Abcam plc (UK), Lonza Group (Switzerland), Neogen Corporation (US), 3M (US), Danaher Corporation (US), PromoCell GmbH (Germany), Geno Technology, Inc. (US), Abnova Corporation (Taiwan), AAT Bioquest, Inc. (US), BioThema AB (Sweden), Elabscience Biotechnology Inc. (US), MBL International Corporation (US), Biotium (US), Creative Bioarray (US), Canvax Biotech S.L. (Spain), Ruhof Corporation (US), Charm Sciences, Inc. (US), Bio Shield Tech, LLC (US), Cayman Chemical (US), and Cell Signaling Technology,Inc. (US).

Scope of the ATP Assays Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$0.3 billion |

|

Projected Revenue Size by 2028 |

$0.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.8% |

|

Market Driver |

Increasing food safety concerns |

|

Market Opportunity |

Technological enhancements in ATP assay probes |

The study categories the ATP Assays Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables & Accessories

- Reagent

- Microplates

- Other Consumables & Accessories

- Instruments

- Luminometers

- Spectrophotometers

By Application

- Contamination Testing

- Disease Testing

- Drug Discovery and Development

By End User

- Pharmaceutical & Biotechnology companies

- Food and Beverage Industry

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutions

By Region

-

North America

- US

- Canada

-

Europe

- France

- Spain

- UK

- Italy

- Germany

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

Recent Developments of ATP Assays Industry:

- In January 2022, Agilent Technologies launched Seahorse XF Pro Analyzer, enabling operators at any skill level to access the most advanced cellular metabolism analysis technology for understanding cellular fate, fitness, and function.

- In May 2021, Neogen Corporation launched AccuPoint Advanced NG. It remains the only sanitation monitoring system in the market to utilize a flat tip sampler for maximized recovery of ATP and feature RFID technology for streamlined testing processes.

- In October 2021, Abcam has doubled the footprint of its immunoassay kit R&D and manufacturing facility in Eugene, Oregon. This enhanced capacity is another component of Abcam’s growth journey in the US and will further enable its commitment to support the research and biopharma sector globally.

- In May 2020, Thermo Fisher launched the Orbitrap 240 Mass Spectrometer. It is designed to give proteomics, metabolomics, and biopharmaceutical characterization to small molecules, which aid in research and high-throughput analyses. The new system helps drive discovery and identification with increased accuracy for confident scale-up along with operational simplicity and speed.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global ATP assays market between 2023 and 2028?

The global atp assays market is projected to grow from USD 0.3 billion in 2023 to USD 0.5 billion by 2028, demonstrating a robust CAGR of 7.8%.

What are the key factors driving the ATP assays market?

Key factors driving the ATP assays market include increasing food safety concerns, advancements in ATP assay probes, and the rising demand for contamination testing in pharmaceutical and food & beverage industries.

What are the main challenges facing the ATP assays market?

Challenges include the high cost of instruments and the difficulty faced by small players and new entrants in competing with established companies due to high R&D investments.

Which regions are expected to show growth in the ATP assays market?

North America is projected to witness significant growth in the ATP assays market, attributed to advanced microbial detection technologies, increased research activities, and high-quality clinical and laboratory infrastructure.

What are the key products in the ATP assays market?

Key products in the ATP assays market include consumables & accessories (such as reagents and microplates) and instruments like luminometers and spectrophotometers, widely used in cell viability testing and contamination detection.

How is the food & beverage industry contributing to the ATP assays market?

The food & beverage industry plays a significant role in the ATP assays market, driven by stringent regulatory requirements for contamination testing and the growing emphasis on food safety to prevent foodborne illnesses.

What recent technological advancements are influencing the ATP assays market?

Recent technological advancements include the development of ATP assay probes with enhanced capabilities for detecting both intracellular and extracellular ATP dynamics, improving the accuracy and efficiency of cell-based assays in research.

What is the role of pharmaceutical & biotechnology companies in the ATP assays market?

Pharmaceutical & biotechnology companies dominate the ATP assays market, with significant investments in cell-based assays for drug discovery, contamination testing, and research related to chronic diseases and cell therapies.

How does contamination testing impact the ATP assays market?

Contamination testing is a crucial application in the ATP assays market, with increasing regulatory pressure on pharmaceutical and food companies to ensure contamination-free production, further driving demand for ATP-based testing solutions.

What opportunities exist for new players in the ATP assays market?

Technological advancements in ATP assays offer opportunities for new entrants to develop innovative solutions; however, competing with established players remains a challenge due to the high R&D investments required for product development and launch.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing food safety concerns globally- Growing demand for ATP assays in pharmaceutical & biotechnology companies- Rising investments in pharmaceutical & biotechnology R&D- Increasing prevalence of cancer globally- Shift from culture-based tests to rapid tests- Rising incidence and prevalence of chronic and infectious diseasesRESTRAINTS- High cost of instruments and reagents- Inability to differentiate between extracellular and intracellular ATPOPPORTUNITIES- Technological enhancements in ATP assay probes- Growth prospects in emerging economiesCHALLENGES- Low survival rate for small players and new entrants

-

5.3 INDUSTRY TRENDSINCREASING REGULATIONS FOR FOOD BUSINESSESADOPTION OF ATP TESTING FOR MONITORING ENVIRONMENTAL CONTAMINATION CAUSED BY SARS-COV-2

-

5.4 TECHNOLOGY ANALYSISHOMOGENEOUS TIME-RESOLVED FLUORESCENCE TECHNOLOGY FOR RAPID SCREENING OF ATP CONCENTRATIONSEASE OF USE OF LIQUID CHROMATOGRAPHY-TANDEM MASS SPECTROMETRY ANALYZERS IN CLINICAL LABORATORIESADVANCED ASSAY STABILITY (AAS) SYSTEMS TO MATCH ROOM TEMPERATURE WHILE PERFORMING ASSAYSOTHER TECHNOLOGICAL INNOVATIONS

-

5.5 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Rest of the World

-

5.6 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ATP ASSAYSINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSISLIST OF PATENTS/PATENT APPLICATIONS IN ATP ASSAYS MARKET

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 ECOSYSTEM MARKET MAP

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY PLAYERAVERAGE SELLING PRICE TREND

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR ATP ASSAYS

- 6.1 INTRODUCTION

-

6.2 CONTAMINATION TESTINGINCREASING REQUIREMENTS TO MEET REGULATORY MANDATES FOR QUALITY TESTING TO DRIVE MARKET

-

6.3 DISEASE TESTINGGROWING DISEASE INCIDENCE AND RISING PATIENT AWARENESS TO DRIVE MARKET

-

6.4 DRUG DISCOVERY & DEVELOPMENTINCREASING R&D PIPELINE FOR PHARMACEUTICAL DRUGS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 CONSUMABLES & ACCESSORIESREAGENTS & KITS- Growing prevalence of infectious diseases and increasing use of contamination testing to drive segmentMICROPLATES- Increasing demand in drug discovery and preclinical safety studies to drive segmentOTHER CONSUMABLES & ACCESSORIES

-

7.3 INSTRUMENTSLUMINOMETERS- Low cost, quick output, and ease of usage to drive segmentSPECTROPHOTOMETERS- Higher cost of spectrophotometers to limit market

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO DOMINATE ATP ASSAYS END USER MARKET DURING STUDY PERIOD

-

8.3 FOOD & BEVERAGE INDUSTRYRISING INCIDENCE OF FOOD CONTAMINATION AND GROWING NEED FOR FOOD SAFETY TO DRIVE MARKET

-

8.4 HOSPITALS & DIAGNOSTIC LABORATORIESGROWING DEMAND FOR EARLY DISEASE DIAGNOSIS TO DRIVE MARKET

-

8.5 ACADEMIC & RESEARCH INSTITUTESINCREASING USE IN CELL CULTURE EXPERIMENTS AND CANCER RESEARCH TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to dominate North American ATP assays market during forecast periodCANADA- Government funding programs for life science research to drive market

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Large-scale outsourcing of clinical diagnostic testing by hospitals to commercial service providers to drive marketUK- Increasing R&D expenditure in pharmaceutical companies and growing life science industry to drive marketFRANCE- Highly profitable agro-food sector and increased focus on biotechnology R&D to drive marketITALY- Presence of well-developed healthcare system and high cancer burden to drive marketSPAIN- Growth in personalized medicines and clinical diagnostics to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing pharmaceutical R&D investments to drive marketJAPAN- Higher incidence of cancer and greater geriatric population to drive marketINDIA- Growing adoption of ATP assay techniques in research and clinical applications to drive marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing research activities and growing pharmaceutical industry to drive marketMEXICO- Increase in research centers and manufacturing units to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAGROWING FUNDING INITIATIVES AND INCREASING STRATEGIC PARTNERSHIPS TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- 10.4 MARKET RANKING OF KEY PLAYERS IN ATP ASSAYS MARKET

-

10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

-

10.7 COMPANY FOOTPRINTPRODUCT FOOTPRINTAPPLICATION FOOTPRINTEND USER FOOTPRINTGEOGRAPHICAL FOOTPRINT

-

10.8 COMPETITIVE SCENARIOS AND TRENDSKEY PRODUCT LAUNCHESKEY DEALSOTHER KEY DEVELOPMENTS

-

11.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewPROMEGA CORPORATION- Business overview- Products offered- Recent developments- MnM viewNEOGEN CORPORATION- Business overview- Products offered- Recent developments- MnM viewPERKINELMER INC.- Business overview- Products offered- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- Recent developments- MnM viewPROMOCELL GMBH- Business overview- Products offeredDANAHER CORPORATION- Business overview- Products offered- Recent developmentsLONZA- Business overview- Products offeredABCAM PLC- Business overview- Products offered3M- Business overview- Products offeredABNOVA CORPORATION- Business overview- Products offeredGENO TECHNOLOGY INC.- Business overview- Products offeredAAT BIOQUEST, INC.- Business overview- Products offered- Recent developmentsBIOTHEMA AB- Business overview- Products offeredBIOTIUM- Business overview- Products offeredCREATIVE BIOARRAY- Business overview- Products offeredCANVAX- Business overview- Products offeredELABSCIENCE BIOTECHNOLOGY INC.- Business overview- Products offeredMBL INTERNATIONAL CORPORATION- Business overview- Products offered

-

11.2 OTHER PLAYERSRUHOF CORPORATIONCHARM SCIENCESBIO SHIELD TECH, LLCCAYMAN CHEMICALCELL SIGNALING TECHNOLOGY, INC.

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: ATP ASSAYS MARKET

- TABLE 3 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 4 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 5 US HEALTHCARE EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 6 ATP ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 7 ESTIMATED NEW CANCER CASES IN US, 2023

- TABLE 8 ATP ASSAYS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 AVERAGE SELLING PRICE, BY KEY PLAYER

- TABLE 10 REGIONAL PRICING ANALYSIS OF ATP ASSAYS, 2021 (USD)

- TABLE 11 ATP ASSAYS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 12 ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 13 ATP ASSAYS MARKET FOR CONTAMINATION TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 ATP ASSAYS MARKET FOR DISEASE TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 ATP ASSAYS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 17 KEY ATP CONSUMABLES & ACCESSORIES AVAILABLE

- TABLE 18 ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 REAGENTS & KITS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 MICROPLATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 24 ATP ASSAYS MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 KEY ATP INSTRUMENTS AVAILABLE

- TABLE 26 LUMINOMETERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 29 ATP ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ATP ASSAYS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ATP ASSAYS MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ATP ASSAYS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ATP ASSAYS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: ATP ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 US: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 41 US: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 US: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 43 US: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 US: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 CANADA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 46 CANADA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 CANADA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 48 CANADA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: ATP ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 56 GERMANY: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 57 GERMANY: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 GERMANY: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 GERMANY: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 GERMANY: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 UK: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 62 UK: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 UK: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 UK: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 UK: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 FRANCE: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 FRANCE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 FRANCE: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 ITALY: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 72 ITALY: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 ITALY: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 ITALY: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 ITALY: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 SPAIN: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 77 SPAIN: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 SPAIN: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 SPAIN: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 SPAIN: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: ATP ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 CHINA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 CHINA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 CHINA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 CHINA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 CHINA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 JAPAN: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 98 JAPAN: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 JAPAN: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 JAPAN: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 JAPAN: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 INDIA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 103 INDIA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 INDIA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 INDIA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 INDIA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: ATP ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 BRAZIL: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 119 BRAZIL: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 BRAZIL: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 BRAZIL: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 122 BRAZIL: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 123 MEXICO: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 124 MEXICO: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 MEXICO: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 MEXICO: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 MEXICO: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 REST OF LATIN AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 132 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 138 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ATP ASSAYS MARKET

- TABLE 139 COMPANY FOOTPRINT: ATP ASSAYS MARKET (2022)

- TABLE 140 PRODUCT FOOTPRINT: ATP ASSAYS MARKET (2022)

- TABLE 141 APPLICATION FOOTPRINT: ATP ASSAYS MARKET (2022)

- TABLE 142 END USER FOOTPRINT: ATP ASSAYS MARKET (2022)

- TABLE 143 REGIONAL FOOTPRINT: ATP ASSAYS MARKET (2022)

- TABLE 144 KEY PRODUCT LAUNCHES, JANUARY 2019–JUNE 2023

- TABLE 145 KEY DEALS, JANUARY 2019–JUNE 2023

- TABLE 146 OTHER KEY DEVELOPMENTS, JANUARY 2019–JUNE 2023

- TABLE 147 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 148 MERCK KGAA: COMPANY OVERVIEW

- TABLE 149 PROMEGA CORPORATION: COMPANY OVERVIEW

- TABLE 150 NEOGEN CORPORATION: COMPANY OVERVIEW

- TABLE 151 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 152 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 153 PROMOCELL GMBH: COMPANY OVERVIEW

- TABLE 154 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 155 LONZA: COMPANY OVERVIEW

- TABLE 156 ABCAM PLC: COMPANY OVERVIEW

- TABLE 157 3M: COMPANY OVERVIEW

- TABLE 158 ABNOVA CORPORATION: COMPANY OVERVIEW

- TABLE 159 GENO TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 160 AAT BIOQUEST, INC.: COMPANY OVERVIEW

- TABLE 161 BIOTHEMA AB: COMPANY OVERVIEW

- TABLE 162 BIOTIUM: COMPANY OVERVIEW

- TABLE 163 CREATIVE BIOARRAY: COMPANY OVERVIEW

- TABLE 164 CANVAX: COMPANY OVERVIEW

- TABLE 165 ELABSCIENCE BIOTECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 166 MBL INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- FIGURE 1 ATP ASSAYS MARKET SEGMENTATION

- FIGURE 2 ATP ASSAYS MARKET: REGIONAL SEGMENTATION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: DEMAND-SIDE PARTICIPANTS

- FIGURE 8 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC INC.

- FIGURE 10 GLOBAL ATP ASSAYS MARKET: BY PRODUCT

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 CAGR PROJECTIONS: ATP ASSAYS MARKET

- FIGURE 13 TOP-DOWN APPROACH

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 ATP ASSAYS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ATP ASSAYS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ATP ASSAYS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF ATP ASSAYS MARKET

- FIGURE 19 INCREASING FOOD SAFETY CONCERNS TO DRIVE MARKET

- FIGURE 20 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ATP ASSAYS MARKET IN 2022

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE IN ATP ASSAYS MARKET DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA TO DOMINATE GLOBAL ATP ASSAYS MARKET IN 2028

- FIGURE 23 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 24 ATP ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014–2028 (USD BILLION)

- FIGURE 26 GLOBAL CANCER INCIDENCE AND MORTALITY, 2020

- FIGURE 27 PATENT PUBLICATION TRENDS (JANUARY 2011–JUNE 2023)

- FIGURE 28 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ATP ASSAY PATENTS (JANUARY 2011–JUNE 2023)

- FIGURE 29 ATP ASSAYS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 ATP ASSAYS MARKET: ECOSYSTEM MARKET MAP

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ATP ASSAY PRODUCTS

- FIGURE 32 KEY BUYING CRITERIA FOR END USERS

- FIGURE 34 NORTH AMERICA: ATP ASSAYS MARKET SNAPSHOT

- FIGURE 35 UK: PHARMACEUTICAL R&D EXPENDITURE, 2011–2020 (USD MILLION)

- FIGURE 36 ASIA PACIFIC: ATP ASSAYS MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN ATP ASSAYS MARKET

- FIGURE 38 ATP ASSAYS MARKET RANKING, BY KEY PLAYER, 2022

- FIGURE 39 ATP ASSAYS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 40 ATP ASSAYS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 42 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 43 NEOGEN CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 44 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 46 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 47 LONZA: COMPANY SNAPSHOT (2022)

- FIGURE 48 ABCAM PLC: COMPANY SNAPSHOT (2022)

- FIGURE 49 3M: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the ATP assays market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side and demand side are detailed below. Industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the ATP assays industry were interviewed to obtain and verify both the qualitative and quantitative aspects of this research study. A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps.

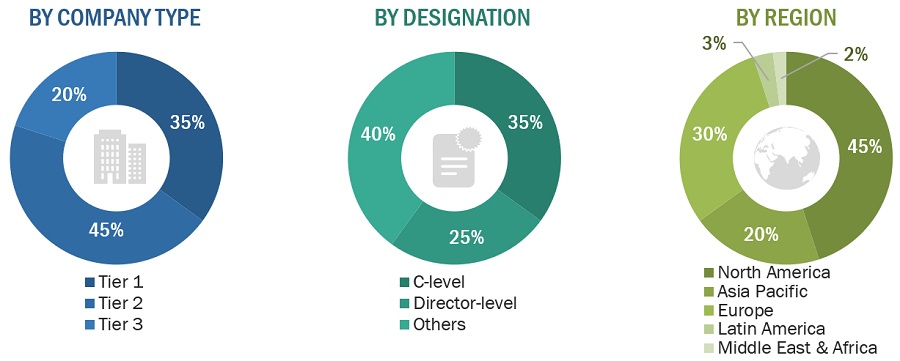

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

PerkinElmer, Inc. |

Assistant Manager Sales |

|

Thermo Fisher Scientific,Inc. |

Assistant Project Manager |

|

BioThema AB |

Business Development Manager |

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis) primary interviews, and top-down approach (assessment of Individual shares of each ATP assay product, application, and end-user segment).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Market Definition

ATP assays are procedures that can measure cell viability based on the detection of ATP using detection methods such as colorimetric, fluorescent, and bioluminescence. These assays are used to measure the presence of microorganisms through the detection of adenosine triphosphate (ATP). These assays are used for live cell quantification, contamination testing, and disease testing based on the amount of ATP present in different samples such as blood, urine, animal tissue, and food & beverage samples.

Key Stakeholders

- Senior Management

- Finance/Purchase Department

- Operations Department

- R&D Department

Objectives of the Study

- To define, describe, segment, and forecast the ATP assays market by product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall ATP assays market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate and forecast the size of the ATP assays market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the ATP assays market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships, of the leading players in the ATP assays market

- To benchmark players within the ATP assays market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe ATP assays market into Switzerland, the Netherlands, Belgium, and others.

- Further breakdown of the Middle East & Africa ATP assays market into Saudi Arabia, the UAE, and others.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ATP Assays Market