Mining Remanufacturing Components Market By Component (Engine, Hydraulic Cylinder, Axle, Transmission, Differential, Torque Convertor, Final Drive), Equipment (Excavator, Mine Truck, Wheel Loader, Dozer), Industry, Region - Global Forecast to 2027

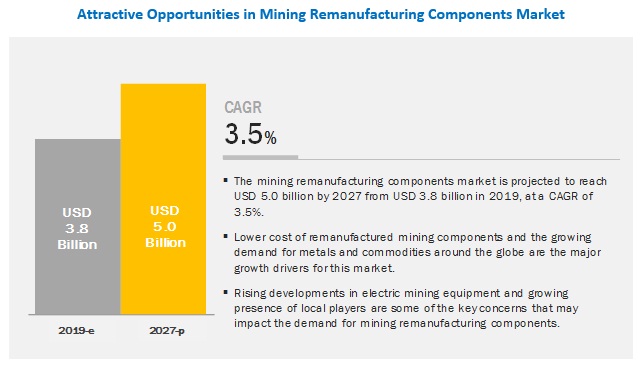

[132 Pages Report] The Mining Remanufacturing Components Market is projected to reach USD 5.0 billion by 2027 from USD 3.8 billion in 2019, at a CAGR of 3.5% during the forecast period. The mining remanufacturing components are driven primarily by the growing mining equipment parc & equipment working hours and lower cost of remanufactured mining components as compared with OE products.

Hydraulic cylinder is expected to be the largest market, by components, during the forecast period

The major driving factor for global market is cost. A remanufactured component can cost 25-35% lower than a new one and has similar performance. This reduces the lead time and increases the operational efficiency of the equipment. Rising mining activities in developing countries and growing demand for resource exploration are driving the mining industry and thus, impacting the mining remanufactured components market.

The hydraulic cylinder is estimated to account for the largest market share during the forecast period. Hydraulic cylinder has to undergo through harsh extraction environment & extreme pressure for carrying heavy mining work and goes through a rigorous application and challenging operating environment. Working in extreme conditions causes oil leakage and wear & tear of the hydraulic cylinders causing a reduction in the average operating hours. All these factors create a positive outlook for the remanufacturing of hydraulic cylinders.

The demand for remanufactured components is projected to be highest in hydraulic excavators over the forecast period

The hydraulic excavator is a heavy mining equipment which is used to dig out soil from the ground or to move large objects. It tremendously enhances the productivity of any mining work. These excavators are available in a wide range of sizes and capacities ranging from 20 metric ton (MT) to 77 metric ton (MT) payload capacity, depending on the magnitude of the work to be done. Excavators consist of a chassis, boom, and bucket. It is used commonly for transportation of large amounts of materials, such as minerals.

The Americas and Asia Oceania together account for the highest population of hydraulic excavators. According to Indian Construction Equipment Manufacturer Association (ICEMA), the demand for earth moving & mining equipment during FY 2017-18 was significant, recording an increase of 23%, with a growth of 24% for hydraulic excavators. The rising demand for the equipment indicates an increase in application and usage of mining equipment, creating a positive outlook for global market.

Coal mining remanufacturing components market is estimated to be the largest market from 2019 to 2027

The count of mining equipment used in the coal industry is more in comparison to metal and mineral industry. According to the World Coal Association, 7,269 MT hard coal and 787 MT lignite coals are produced globally with Asia Oceania holding the largest share in 2017. Increasing demand for electricity in countries such as China, India, and Australia have resulted in driving the requirement for coal. Rising coal demand is directly proportional to the utilization of mining equipment. The growing coal production in this region is expected to drive this market.

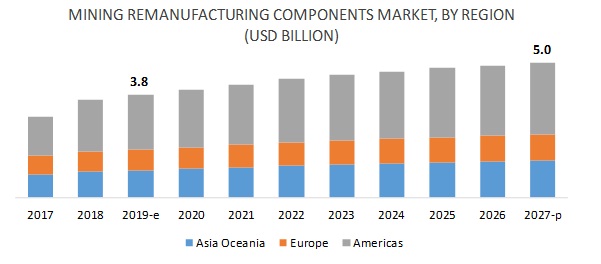

The Americas is expected to account for the largest market share during the forecast period

A positive measure adopted by the US, such as low-interest rates and increasing demand for commodities has boosted investment in the mining industry. The growth is attributed to the presence of large deposits of gold, iron, coal, copper, crushed rocks, zinc-lead, and rare earth materials in this region. In 2017, the US metal mining production generated a revenue of USD 26.3 billion. In 2017, Canada’s gold extraction stood at USD 8.7 billion, while revenues from coal were USD 6.2 billion, copper at USD 4.7 billion, potash at USD 4.6 billion, and iron generating USD 3.8 billion. The positive outlook of the mining industry in this region has increased the demand and sales of mining equipment, which in turn drives the mining component remanufacturing market growth.

Key Market Players

Some of the key players in the global market are Caterpillar (US), Komatsu (Japan), Hitachi Construction Machinery (Japan), Liebherr (Switzerland), Epiroc (Sweden), Atlas Copco (Sweden), JCB (UK), Volvo Construction Equipment (Sweden), SRC Holdings Corporation (US), and Swanson Industries (US).

Caterpillar adopted the strategies of expansion and new product development to retain its leading position in this market; whereas, Komatsu adopted partnership as the key strategy to sustain its market position.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2027 |

|

Forecast Units |

Value (USD million/billion) and Volume (‘000/million units) |

|

Segments Covered |

Market by Components, Equipment Type, Industry, and Region |

|

Geographies Covered |

Asia Oceania, Europe, The Americas |

|

Companies Covered |

Caterpillar (US), Komatsu (Japan), Hitachi Construction Machinery (Japan), Liebherr (Switzerland), Epiroc (Sweden), Atlas Copco (Sweden), JCB (UK), Volvo Construction Equipment (Sweden), SRC Holdings Corporation (US), Swanson Industries (US), Total 20 major players covered |

This research report categorizes the mining remanufacturing components market based on components, equipment type, industry, and region.

Global Market, By Components

- Engine

- Axle

- Transmission

- Hydraulic Cylinder

- Differential

- Final Drive

- Torque Converter

Global Market, By Equipment

- Hydraulic Excavator

- Mine/Haul Truck

- Wheel Loader

- Wheel Dozer

- Crawler Dozer

Global Market, By Industry

- Coal

- Metal

- Minerals

Key Questions Addressed by the Report

- What would be the regional demand for remanufactured components in the mining industry during the next seven years?

- Existing and upcoming market trends in remanufactured components demand by equipment type next few years?

- What would be the Industry-wise demand for remanufactured components in mining equipment in coming years?

- Insights about trends in average working hours of mining equipment; and hence, average life of component replacement.

- Future electrification trends in the mining equipment industry, and how would it impact the remanufactured components market in the coming years?

- Competitive leadership mapping of key players represented in a four-quadrant box representing the visionary leaders as well as dynamic differentiators

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Mining Remanufacturing Components Market: Trend, Forecast & Opportunity

4.2 Mining Remanufacturing Components Market, By Region

4.3 Mining Remanufacturing Components Market, By Component

4.4 Mining Remanufacturing Components Market, By Equipment

4.5 Mining Remanufacturing Components Market, By Industry

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Lower Cost of Remanufactured Mining Component

5.2.1.2 Inventory Issues With OEMs for Mining Equipment

5.2.2 Restraints

5.2.2.1 Growing Presence of Local Players

5.2.3 Opportunities

5.2.3.1 Growing Demand for Metals and Commodities Around the Globe

5.2.4 Challenges

5.2.4.1 Rising Development of Electric Mining Equipment

6 Mining Remanufacturing Components Market, By Component (Page No. - 41)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, and Americas

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions

6.1.3 Industry Insights

6.2 Engine

6.2.1 Asia Oceania is the Fastest Growing Market for Engine Remanufacturing

6.3 Hydraulic Cylinder

6.3.1 Americas is the Largest Market for Hydraulic Cylinder Remanufacturing

6.4 Axle

6.4.1 Asia Oceania is the Second Largest Market for Axle Remanufacturing

6.5 Differential

6.5.1 US and Mexico Have Witnessed Promising Demand for Differential Remanufacturing in Recent Years

6.6 Transmission

6.6.1 Average Replacement Life of Transmission is 10,000–11,500 Operating Hours

6.7 Torque Convertor

6.7.1 Remanufacturing of Torque Convertors is Cost Effective and Reduces Lead Time

6.8 Final Drive

6.8.1 Asia Oceania is the Fastest Growing Market for Final Drive Remanufacturing

7 Mining Remanufacturing Components Market, By Industry (Page No. - 52)

Note: The chapter is further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, and Americas

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions & Definitions

7.1.3 Industry Insights

7.2 Coal

7.2.1 Asia Oceania is the Largest and Fastest Growing Market for in the Coal Mining Remanufacturing Components

7.3 Metal

7.3.1 Americas Leads the Market for Metal Mining Remanufacturing Components

7.4 Other Minerals

7.4.1 Increase in Mining Activities is Driving the Demand for Mining Equipment

8 Mining Remanufacturing Components Market, By Equipment (Page No. - 59)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, and Americas)

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

8.2 Hydraulic Excavator

8.2.1 Hydraulic Excavator is the Fastest Growing Market

8.3 Mine/Haul Truck

8.3.1 Mine/Haul Truck Accounts for the Largest Share in the Mining Equipment Market

8.4 Wheel Loader

8.4.1 Asia Oceania is the Largest Market for the Wheel Loaders

8.5 Wheel Dozer

8.5.1 The Americas is the Second Largest Market for Wheel Dozers

8.6 Crawler Dozers

8.6.1 Asia Oceania is the Fastest Growing Market for Crawler Dozers

9 Mining Remanufacturing Components Market, By Region (Page No. - 68)

Note: The Chapter is Further Segmented at Regional Level and Country Level By Component- Engine, Axle, Differential, Hydraulic Cylinder, Transmission, Torque Convertor, and Final Drive

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Industry Insights

9.2 Asia Oceania

9.2.1 Australia

9.2.1.1 Hydraulic Cylinder Accounts for Largest Market in Australia

9.2.2 China

9.2.2.1 Increase in Mining Activities in This Region is Primary Reason for the Growth of the Market

9.2.3 India

9.2.3.1 India is Expected to Be the Fastest Growing Market for Mining Remanufacturing Components

9.2.4 Japan

9.2.4.1 Final Drive Accounts for Second Largest Market in Japan

9.3 Europe

9.3.1 France

9.3.1.1 Axle is the Third Largest Market for Mining Remanufacturing Components in France

9.3.2 Germany

9.3.2.1 Germany is the Second Largest Market in Europe

9.3.3 Spain

9.3.3.1 Engine is the Fastest Growing Market in Spain

9.3.4 UK

9.3.4.1 Engine is the Fastest Growing Market in UK

9.3.5 Italy

9.3.5.1 Hydraulic Cylinder Accounts for Largest Market in Italy

9.3.6 Russia

9.3.6.1 Russia Accounts for Maximum Share in Europe for Mining Remanufacturing Components

9.4 Americas

9.4.1 US

9.4.1.1 US Accounts for Maximum Share in the Americas for Mining Remanufacturing Components

9.4.2 Mexico

9.4.2.1 Engine is the Fastest Growing Market in Mexico

9.4.3 Canada

9.4.3.1 Final Drive is the Second Largest Market in Canada

9.4.4 Argentina

9.4.4.1 Torque Convertor is the Second Largest Market in Argentina

9.4.5 Peru

9.4.5.1 Peru is the Second Largest Market in the Americas

9.4.6 Chile

9.4.6.1 Engine is the Fastest Growing Market in Chile

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Mining Remanufacturing Components: Market Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Terminology

10.3.1.1 Visionary Leaders

10.3.1.2 Innovators

10.3.1.3 Dynamic Differentiators

10.3.1.4 Emerging Companies

10.3.2 Strength of Product Portfolio

10.3.3 Business Strategy Excellence

10.4 Competitive Scenario

10.4.1 Expansions

10.4.2 Mergers & Acquisitions

10.4.3 New Product Development

10.4.4 Supply Contract/Partnerships/Joint Ventures/ Collaborations

11 Company Profiles (Page No. - 103)

(Business overview, Products offered, Recent developments & SWOT analysis)*

11.1 Caterpillar

11.2 Liebherr

11.3 Hitachi Construction Machinery

11.4 Komatsu

11.5 Epiroc

11.6 Atlas Copco

11.7 JCB

11.8 VOLVO Construction Equipment

11.9 SRC Holdings Corporation

11.10 Swanson Industries

11.11 Additional Companies

11.11.1 Americas

11.11.1.1 John Deere

11.11.1.2 Brake Supply

11.11.1.3 Axletech

11.11.1.4 Cardinal Mining Equipment

11.11.1.5 Detroit Reman

11.11.1.6 Hydraulex

11.11.1.7 Pivot Equipment Parts

11.11.1.8 All Type Hydraulic

11.11.2 Asia Oceania

11.11.2.1 PT Sanggar Sarana Baja

11.11.3 Europe

11.11.3.1 Sandvik

*Details on Business overview, Products offered, Recent developments & SWOT analysis might not be captured in case of unlisted companies.

12 Appendix (Page No. - 125)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.2 Available Customizations

12.2.1 Global Market, By Equipment Type

12.2.1.1 Mining Trucks

12.2.1.2 Hydraulic Excavators

12.2.1.3 Wheel Loaders

12.2.1.4 Wheel Dozer

12.2.1.5 Crawler Dozer

12.2.2 Global Market, By Component & Equipment Type

12.2.2.1 Engine

12.2.2.2 Hydraulic Pumps

12.2.2.3 Axle

12.2.2.4 Differential

12.2.2.5 Transmission

12.2.2.6 Torque Converter

12.2.2.7 Final Drive

12.2.3 Detailed Analysis and Profiling of Additional Market Players (Up to 3)

12.3 Related Reports

12.4 Author Details

List of Tables (81 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Global Market, By Component, 2017–2027 (Units)

Table 3 Global Market, By Component, 2017–2027 (USD Million)

Table 4 Engine: Market, By Region, 2017–2027 (Units)

Table 5 Engine: Market, By Region, 2017–2027 (USD Million)

Table 6 Hydraulic Cylinder: Market, By Region, 2017–2027 (Units)

Table 7 Hydraulic Cylinder: Market, By Region, 2017–2027 (USD Million)

Table 8 Axle: Market, By Region, 2017–2027 (Units)

Table 9 Axle: Market, By Region, 2017–2027 (USD Million)

Table 10 Differential: Market, By Region, 2017–2027 (Units)

Table 11 Differential: Market, By Region, 2017–2027 (USD Million)

Table 12 Transmission: Market, By Region, 2017–2027 (Units)

Table 13 Transmission: Market, By Region, 2017–2027 (USD Million)

Table 14 Torque Convertor: Market, By Region, 2017–2027 (Units)

Table 15 Torque Convertor: Market, By Region, 2017–2027 (USD Million)

Table 16 Final Drive: Market, By Region, 2017–2027 (Units)

Table 17 Final Drive: Market, By Region, 2017–2027 (USD Million)

Table 18 Global Market, By Industry, 2017–2027 (Units)

Table 19 Global Market, By Industry, 2017–2027 (USD Million)

Table 20 Coal: Market, By Region, 2017–2027 (Units)

Table 21 Coal: Market, By Region, 2017–2027 (USD Million)

Table 22 Metal: Market, By Region, 2017–2027 (Units)

Table 23 Metal: Market, By Region, 2017–2027 (USD Million)

Table 24 Other Mineral: Market, By Region, 2017–2027 (Units)

Table 25 Other Mineral: Market, By Region, 2017–2027 (USD Million)

Table 26 Global Market, By Mining Equipment, 2017–2027 (Units)

Table 27 Global Market, By Equipment, 2017–2027 (USD Million)

Table 28 Hydraulic Excavators: Market, By Region, 2017–2027 (Units)

Table 29 Hydraulic Excavators: Market, By Region, 2017–2027 (USD Million)

Table 30 Mine/Haul Trucks: Market, By Region, 2017–2027 (Units)

Table 31 Mine/Haul Trucks: Market, By Region, 2017–2027 (USD Million)

Table 32 Wheel Loaders: Market, By Region, 2017–2027 (Units)

Table 33 Wheel Loaders: Market, By Region, 2017–2027 (USD Million)

Table 34 Wheel Dozers: Market, By Region, 2017–2027 (Units)

Table 35 Wheel Dozers: Market, By Region, 2017–2027 (USD Million)

Table 36 Crawler Dozers: Market, By Region, 2017–2027 (Units)

Table 37 Crawler Dozers: Market, By Region, 2017–2027 (USD Million)

Table 38 Global Market, By Region, 2017–2027 (Units)

Table 39 Global Market, By Region, 2017–2027 (USD Million)

Table 40 Asia Oceania: Market, By Country, 2017–2027 (Units)

Table 41 Asia Oceania: Market, By Country, 2017–2027 (USD Million)

Table 42 Australia: Market, By Component, 2017–2027 (Units)

Table 43 Australia: Market, By Component, 2017–2027 (USD Million)

Table 44 China: Market, By Component, 2017–2027 (Units)

Table 45 China: Market, By Component, 2017–2027 (USD Million)

Table 46 India: Market, By Component, 2017–2027 (Units)

Table 47 India: Market, By Component, 2017–2027 (USD Million)

Table 48 Japan: Market, By Component, 2017–2027 (Units)

Table 49 Japan: Market, By Component, 2017–2027 (USD Million)

Table 50 Europe: Market, By Country, 2017–2027 (Units)

Table 51 Europe: Market, By Country, 2017–2027 (USD Million)

Table 52 France: Market, By Component, 2017–2027 (Units)

Table 53 France: Market, By Component, 2017–2027 (USD Million)

Table 54 Germany: Market, By Component, 2017–2027 (Units)

Table 55 Germany: Market, By Component, 2017–2027 (USD Million)

Table 56 Spain: Market, By Component, 2017–2027 (Units)

Table 57 Spain: Market, By Component, 2017–2027 (USD Million)

Table 58 UK: Market, By Component, 2017–2027 (Units)

Table 59 UK: Market, By Component, 2017–2027 (USD Million)

Table 60 Italy: Market, By Component, 2017–2027 (Units)

Table 61 Italy: Market, By Component, 2017–2027 (USD Million)

Table 62 Russia: Market, By Component, 2017–2027 (Units)

Table 63 Russia: Market, By Component, 2017–2027 (USD Million)

Table 64 Americas: Market, By Country, 2017–2027 (Units)

Table 65 Americas: Market, By Country, 2017–2027 (USD Million)

Table 66 US: Market, By Component, 2017–2027 (Units)

Table 67 US: Market, By Component, 2017–2027 (USD Million)

Table 68 Mexico: Market, By Component, 2017–2027 (Units)

Table 69 Mexico: Market, By Component, 2017–2027 (USD Million)

Table 70 Canada: Market, By Component, 2017–2027 (Units)

Table 71 Canada: Market, By Component, 2017–2027 (USD Million)

Table 72 Argentina: Market, By Component, 2017–2027 (Units)

Table 73 Argentina: Market, By Component, 2017–2027 (USD Million)

Table 74 Peru: Market, By Component, 2017–2027 (Units)

Table 75 Peru: Market, By Component, 2017–2027 (USD Million)

Table 76 Chile: Market, By Component, 2017–2027 (Units)

Table 77 Chile: Market, By Component, 2017–2027 (USD Million)

Table 78 Expansions, 2014–2019

Table 79 Mergers & Acquisitions, 2016–2019

Table 80 Expansions, 2014-2019

Table 81 Supply Contracts, 2016–2018

List of Figures (33 Figures)

Figure 1 Market Segmentation: Mining Remanufacturing Components

Figure 2 Global Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Global Market, By Component

Figure 6 Data Triangulation

Figure 7 Global Market Outlook

Figure 8 Market, By Component, 2019 vs. 2027 (USD Million)

Figure 9 Growing Demand for Coal, Precious Metals, and Other Commodities and Lower Cost of Remanufactured Mining Components Offer Attractive Opportunities in this Market

Figure 10 Americas to Dominate the Market During the Forecast Period

Figure 11 Hydraulic Cylinder Leads the Market for Mining Remanufacturing Components in 2019

Figure 12 Mine/Haul Trucks Hold the Largest Share of this Market in 2019

Figure 13 Coal Industry Holds the Largest Share of this Market in 2019

Figure 14 Global Mining Equipment Market, By Region, 2018 vs. 2025 (USD Billion)

Figure 15 Market, By Component, 2019–2027 (USD Million)

Figure 16 Market, By Industry, 2019 vs. 2027 (USD Million)

Figure 17 Global Market, By Mining Equipment, 2019–2027 (USD Million)

Figure 18 Market, By Region, 2019–2027 (USD Million)

Figure 19 Growth of Mining Industry Drives this Market in Asia Oceania

Figure 20 The Market in Mexico is Expected to Witness the Highest Growth

Figure 21 Mining Remanufacturing Components Ranking Analysis in 2018

Figure 22 Mining Remanufacturing Components Manufacturers: Competitive Leadership Mapping (2018)

Figure 23 Mining Remanufacturing Components Manufacturers: Company-Wise Product Offering Analysis

Figure 24 Mining Remanufacturing Components: Company-Wise Business Strategy Analysis

Figure 25 Companies Adopted Expansion and Mergers & Acquisition as the Key Growth Strategy, 2016–2019

Figure 26 Caterpillar: Company Snapshot

Figure 27 Liebherr: Company Snapshot

Figure 28 Hitachi Construction Machinery: Company Snapshot

Figure 29 Komatsu: Company Snapshot

Figure 30 Epiroc: Company Snapshot

Figure 31 Atlas Copco: Company Snapshot

Figure 32 JCB: Company Snapshot

Figure 33 VOLVO Construction Equipment: Company Snapshot

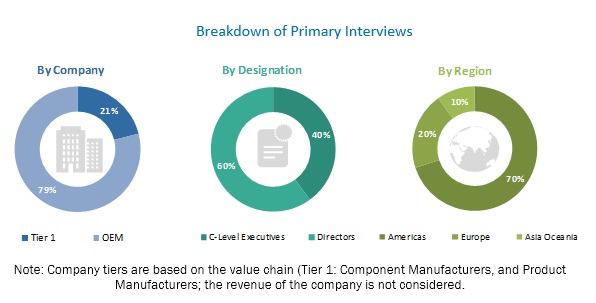

The study involved three main activities for estimating the current size of the mining remanufacturing components market. Exhaustive secondary research was done to collect information about this market, by components type, by equipment type, by industry, by region. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. A bottom-up approach was employed to estimate the overall market size for different segments considered in this study.

Secondary Research

The secondary sources referred for this research study include Off-Highway Equipment industry organizations such as Association of Equipment Manufacturers (AEM); Japan Mining Industry Association (JMIA); Euromines (European Metals and Minerals Mining Association); National Mining Association (NMA); Automotive Parts Remanufacturers Association (APRA); Remanufacturing Industries Council (RIC); Mining Equipment Manufacturers of South Africa (MEMSA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and regional component-related associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs and system manufacturers) and the supply-side (mining equipment manufacturers) across three major regions, namely, Asia Oceania, Europe, the Americas. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the outcomes as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the global market. The country-level mining equipment parc (hydraulic excavators, mining/haul trucks, wheeled loaders, crawler dozer, and wheeled dozer) is multiplied with the country-level average operating hours per year of each mining equipment, which were derived through extensive secondary sources and multiple primary interviews. This provided the country-level total operating hours for each mining equipment per year. Further, the division of country-level total operating hours for each mining equipment per year from the average replacement life of each component for all the considered mining equipment (which was derived and validated from primary interviews) resulted in the country-level mining remanufactured components market, in terms of volume. This was further added to obtain the regional-level market size and global market for remanufactured mining components, in terms of volume. To arrive at the market size, in terms of value, the country-level market was multiplied with the average selling price of each component under study scope. The summation of country-level market sizes resulted in the regional-level market, and the summation of regional-level markets resulted in the global market, by component, in terms of value. A similar approach was followed to derive the market, by equipment (hydraulic excavators, mining/haul trucks, wheeled loaders, crawler dozer, and wheeled dozer) and end-user industry (coal, metal, and mineral).

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast the global market, in terms of value (USD million)

- To define, describe, and forecast the global market, in terms of volume and value, by component (engine, hydraulic cylinder, axle, differential, transmission, torque converter, and final drive) at country and regional level

- To define, describe, and forecast the market, in terms of volume and value, by equipment type (hydraulic excavators, mining/haul trucks, wheeled loaders, crawler dozer, and wheeled dozer) at the regional level

- To define, describe, and forecast the market, in terms of volume and value, based on end-user industry (coal, metal, and mineral) at the regional level

- To define, describe, and forecast the market, in terms of volume and value, based on region (Asia Oceania, Europe, and the Americas)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the mining remanufacturing components

- To analyze the market ranking of the key players operating in the global market

- To analyze the competitive landscape and prepare a competitive leadership mapping for the global players operating in this market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Global Market, By Equipment Type

- Mining Truck

- Hydraulic Excavator

- Wheel Loader

- Wheel Dozer

- Crawler Dozer

Note: The market of mining remanufacturing components can be provided for select mentioned equipment type in terms of volume, and value at country-level

Global Market, By Component & Equipment Type

- Engine

- Hydraulic Pumps

- Axle

- Differential

- Transmission

- Torque Converters

- Final Drive

Note: The market of each considered component in the study can be provided for each mentioned equipment type in terms of volume, and value at the regional level

Growth opportunities and latent adjacency in Mining Remanufacturing Components Market