Hydraulic Cylinder Market by Function (Double-acting & Single-acting), Specification (Welded, Tie Rod, Telescopic, and Mill Type), Application, Bore Size (<50 MM, 50–150 MM, & >150 MM), Industry and Region 2027

Updated on : November 21, 2024

Hydraulic Cylinder Market Size

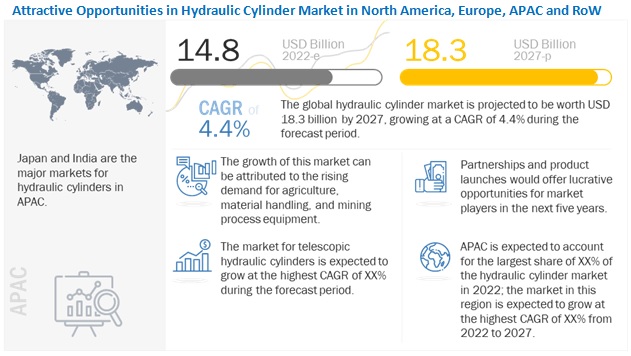

Global hydraulic cylinder market in terms of revenue was estimated to be worth USD 14.3 billion in 2021 and is poised to reach USD 18.3 billion by 2027, growing at a CAGR of 4.4% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

The market growth can be attributed majorly to the increasing demand for heavy construction and mining vehicles from construction, mining, and oil & gas industries. Increasing adoption of material handling equipment across industries worldwide is a major booster for the growth of the market. The hydraulic cylinder market has been segmented by function, specification, bore size, application, industry, and geography.

The major factors driving the market include the increasing potential of the construction industry, which induces increased adoption of automated heavy construction vehicles equipped with hydraulic cylinders for various operations. The increasing adoption of material handling equipment across industries such as agriculture, construction, and mining has also increased the demand for hydraulic cylinders worldwide. Government initiatives to revive infrastructural projects across countries have helped the demand for hydraulic cylinders to grow, owing to their increased adoption in construction and material handling industries. Increasing farm mechanization across regions, especially in APAC, and globally increasing mining exploration activities have also promoted the growth of the hydraulic cylinder market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the Hydraulic Cylinder Market in North America, Europe, APAC and RoW

With the onset of the COVID-19 pandemic, the world witnessed a health and economic crisis, forcing many businesses to shut down their manufacturing plants and halt most of the operations during the initial 1 to 2 months. During this crisis, the main objective of the companies was to sustain their business by finding safer ways to continue manufacturing operations or find other sustainable ways to get the revenue stream flowing. During this period, the industrial equipment and mobile equipment segments experienced a decline in demand owing to disruptions in the global supply chain. However, post the pandemic, there has been a significant revival in the demand for hydraulic cylinders worldwide. Owing to the surge in demand, industrial equipment and mobile equipment segments have made a strong comeback and are almost back to pre-COVID-19 levels. As a result, the hydraulic cylinder industry can be seen growing steadily.

Hydraulic Cylinder Market Trends and Dynamics

DRIVERS:Significant demand from construction industry

Construction projects are becoming larger and more complex. Though the COVID-19 pandemic had affected the construction industry, post the pandemic, there has been a significant revival in the industry which is driven by the increasing infrastructure spending in APAC and rebounding European infrastructure investments. Rising urbanization in emerging markets such as China, India, Indonesia, Nigeria, and other countries is accelerating infrastructure investments. Many new infrastructure development plans and projects are in the pipeline, mostly in developing countries such as India and China, which are likely to drive the demand for construction equipment. In the construction industry, hydraulic cylinders are used in equipment such as backhoes, excavators, trenchers, road construction planers, grinders, concrete or asphalt laying machines, concrete cutting saws, dozers, motor graders, dumpers, and skid steers. These cylinders offer resistance against corrosion, abrasion, extreme temperatures, and weather changes and can be used continuously for extended periods. These advantages have increased their demand in the construction industry.

RESTRAINT: High manufacturing and maintenance costs

The manufacturing of a hydraulic cylinder requires metal forging and precise engineering to create a high-quality hydraulic cylinder. Hydraulic cylinders consist of several components, which include pistons, cylinder barrels, piston rods, cylinder bases, cylinder heads, and cylinder seals, to be fitted together. There are cost barriers for small and medium-sized enterprises (SMEs) to enter the hydraulic cylinder market. Besides the initial manufacturing cost of hydraulic cylinders, they also incur maintenance costs over time. Hydraulic cylinders need to be maintained regularly to avoid oil leakages and other malfunctions. The quality and finish of the cylinder rod need to be examined regularly. If the rod is bent, it can cause a load shift. Additionally, incorrect rod strength or diameter can also cause failure. The cylinder tube needs to be examined regularly, as the cylinder walls might undergo wear and tear, decreasing its thickness. This condition is known as a balloon tube. These factors lead to increased maintenance costs, thus posing a restraint in the adoption of hydraulic cylinders.

OPPORTUNITIES: Increasing demand for lifting equipment in shipping industry

Dockyards usually have numerous shipping containers of varied sizes and weights, which are stacked hundreds of feet high. There are numerous containers worldwide with standard sizes of 20, 40, 45, 48, and 53 feet and weigh around 30 to 42 tons. To ship these heavy containers, lifting equipment are used. Shipping is the most important mode of transport worldwide that facilitates international trade. The majority of items, from electronics, automobiles, textiles, and raw metals to oil & gas, are transported by ships. The facilitating institutional and technological factors such as the adoption of industrial IoT and support from governments are propelling the growth of the shipping industry, which fuels the need for lifting equipment at ports. Though the adoption of lifting equipment is still at a nascent stage, it is expected to rise significantly in the coming years and, therefore, is expected to be a potent source of demand for hydraulic cylinders.

CHALLENGES: Availability of substitutes

Hydraulic cylinders are operated by fluid, mostly oil. The leakage of these fluids causes environmental contamination. Thus, end users looking to maintain a clean and healthy environment prefer cleaner alternatives against hydraulic cylinders. One such option is the use of pneumatic cylinders, which use the pressure of compressed gas to produce a force in a reciprocating linear motion. Since pneumatic cylinders use a gas, even if there is any leakage, it does not contaminate the surrounding. Pneumatic cylinders are used in agricultural and material handling applications, which require the personnel to be in close proximity to these cylinders. Thus, the availability of cleaner substitutes acts as a challenge for the growth of the hydraulic cylinder market.

Hydraulic Cylinder Market Share

Double-Acting Hydraulic Cylinders to Account for Larger Share of Hydraulic Cylinder Market During Forecast Period

The double-acting segment is expected to hold a larger share of the hydraulic cylinder market during the forecast period from 2022 to 2027. Owing to the retraction property of these cylinders, they are used in aerospace, automotive, agriculture, and several other industries. These cylinders have a higher demand in mobile applications such as lifting equipment, earth moving equipment, forklifts, and heavy trucks. Double-acting hydraulic cylinders are suitable in presses and chippers for opening and closing drawers and all types of raising and lowering devices such as excavators and cranes.

Welded Hydraulic Cylinders to Account for Largest Share Of Hydraulic Cylinder Market During Forecast Period

Welded hydraulic cylinders held the largest share of the hydraulic cylinder market in 2021. The large market size of welded hydraulic cylinders can be attributed to their dominance in mobile hydraulic applications such as construction equipment, material handling equipment, mining equipment, and forklifts. These are mainly preferred where space is a constraint due to their short length and compact design, enabling them to fit better into the tight confines of machinery. They are more durable than tie-rod cylinders and do not suffer from failures due to tie rod stretch at high pressures and long strokes.

Mobile Equipment to Hold Larger Share of Hydraulic Cylinder Market During Forecast Period

The mobile equipment segment held a larger share of the hydraulic cylinder market in 2021. Mobile equipment, such as excavators, loaders, and cranes, require hydraulic cylinders to operate. The applications of hydraulic cylinders in the mobile equipment industry include earthmoving, material handling, mining, and defense. An increase in industrialization and construction activities will further increase the demand for hydraulic cylinders in mobile applications.

To know about the assumptions considered for the study, download the pdf brochure

Hydraulic Cylinders With Bore Size of 50–150 MM to Hold Largest Market Share During Forecast Period

Hydraulic cylinders with a bore size ranging from 50 to 150 mm held the largest share of the hydraulic cylinder market in 2021. These hydraulic cylinders find applications in many types of construction, earthmoving, material handling, and agricultural equipment. Increasing construction activities, rapidly developing storage and material handling infrastructure, and the modernization of agriculture equipment have fueled the demand for hydraulic cylinders with a bore size ranging from 50 to 150 mm.

Agriculture Industry to Register Highest CAGR in Hydraulic Cylinder Market During Forecast Period

The market for the agriculture industry is expected to grow at the highest CAGR during the forecast period;. The agriculture industry is growing with the increasing use of machines for performing complex tasks – from planting vegetables to plowing fields. From pecan tree shakers to sugar cane harvesters and automated bale trailers to sprayer booms, hydraulic cylinders are deployed in almost all the agriculture equipment for lifting and movement control. The globally increasing population and the deteriorating environmental conditions have put pressure on the agriculture industry to meet the food demand. This has increased investments in machines for precision agriculture, which is expected to drive the demand for hydraulic cylinders.

Hydraulic Cylinder Market Regional Analysis

APAC to Witness Highest CAGR in Hydraulic Cylinder Market During Forecast Period

The hydraulic cylinder market in APAC held the largest share and is expected to grow at the highest CAGR from 2022 to 2027. The growing demand for agricultural, construction, and mining equipment in this region is supporting the growth of the market. The growing demand for food from the growing population in this region and the increasing industrialization in emerging countries are fueling the growth of the agriculture and construction industries in the region. Japan and Australia are the major markets for hydraulic cylinders in APAC. Japan is home to major automotive manufacturers and suppliers who are challenged by rising labor costs and higher lead time associated with manual processes. To overcome these challenges, companies are adopting automated and semi-automated material handling equipment. Australia is rich in minerals, and the mining of these minerals is fueling the demand for mining equipment.

Hydraulic Cylinder Market Key Players

- Parker-Hannifin Corporation (US),

- Caterpillar (US),

- KYB Corporation (Japan),

- Bosch Rexroth (Germany),

- Eaton (Ireland),

- Enerpac Tool Group (US),

- SMC Corporation (Japan),

- HYDAC (Germany),

- Wipro Enterprises (India), and T

- he Jiangsu Hengli Hydraulic Co., Ltd. (China) are few hydraulic cylinder companies in the global market.

Hydraulic Cylinder Market Report Scope

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 14.3 Billion |

| Projected Market Size | USD 18.3 Billion |

| Growth Rate | 4.4% |

| Base Year Considered | 2021 |

| Historical Data Available for Years | 2018–2027 |

|

Forecast Period |

2022–2027 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Significant demand from construction industry |

| Key Market Opportunity | Increasing demand for lifting equipment in shipping industry |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Bore Size of 50–150 MM |

| Highest CAGR Segment | Agriculture Industry |

| Largest Application Market Share | Mobile Application |

This research report categorizes the global Hydraulic Cylinder Market based on Function, Specification, Application, Bore size, Industry, and Region.

Hydraulic Cylinder Market By Function:

- Single-acting

- Double-acting

By Specification

- Welded

- Tie Rod

- Telescopic

- Mill Type

By Application

- Industrial

- Mobile

By Bore Size

- <50 MM

- 50–150 MM

- >150 MM

By Industry

- Construction

- Aerospace

- Material Handling

- Agriculture

- Mining

- Automotive

- Marine

- Oil & Gas

- Others

Hydraulic Cylinder Market By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments in Hydraulic Cylinder Industry

- In June 2021, SMC Corporation launched an updated Compact Guide Cylinder product line, the MGPK Series, which is designed to be compact and feature a 28% reduction in volume and 41% reduction in weight compared with the previous models.

- In June 2021, Jiangsu Hengli announced the successful completion of its 500T Heave Compensator Project, comprising 1 main hydraulic cylinder, 3 accumulators, and 2 nitrogen pressure vessels. This will allow minimum weight and ensure reliable strength, thereby providing better operations and performance even under harsh ocean conditions.

- In January 2021, Weber-Hydraulik introduced a specially designed product line of hydraulic cylinders to be used as support cylinders for mobile cranes.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the global Hydraulic Cylinder Market during 2022-2027?

The global Hydraulic Cylinder Market is expected to record the CAGR of 4.4% from 2022–2027.

Does this report include the impact of COVID-19 on the global Hydraulic Cylinder Market?

Yes, the report includes the impact of COVID-19 on the global Hydraulic Cylinder Market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the global Hydraulic Cylinder Market?

The major factors driving the market include the increasing potential of the construction industry, which induces increased adoption of automated heavy construction vehicles equipped with hydraulic cylinders for various operations. The increasing adoption of material handling equipment across industries such as agriculture, construction, and mining has also increased the demand for hydraulic cylinders worldwide.

Which are the significant players operating in the global Hydraulic Cylinder Market?

Parker-Hannifin Corporation (US), Caterpillar (US), KYB Corporation (Japan), Bosch Rexroth (Germany), Eaton (Ireland), Enerpac Tool Group (US), SMC Corporation (Japan), HYDAC (Germany), Wipro Enterprises (India), and The Jiangsu Hengli Hydraulic Co., Ltd. (China) are a few major players in global Hydraulic Cylinder Market.

Which country will lead the global Hydraulic Cylinder Market in the future?

India is expected to grow at the highest growth rate, yet the US is expected to keep leading the global Hydraulic Cylinder Market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 HYDRAULIC CYLINDER MARKET: INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 SEGMENTS COVERED

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 MARKET, BY REGION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 HYDRAULIC CYLINDER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM HYDRAULIC CYLINDERS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Arriving at market size by bottom-up approach (demand side)

FIGURE 5 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Arriving at market size by top-down approach (supply side)

FIGURE 6 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 9 ANALYSIS OF IMPACT OF COVID-19 ON HYDRAULIC CYLINDER MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 10 DOUBLE-ACTING HYDRAULIC CYLINDERS TO ACCOUNT FOR LARGER SHARE OF HYDRAULIC CYLINDER MARKET DURING FORECAST PERIOD

FIGURE 11 WELDED HYDRAULIC CYLINDERS TO ACCOUNT FOR LARGEST SHARE OF HYDRAULIC CYLINDER MARKET DURING FORECAST PERIOD

FIGURE 12 MOBILE EQUIPMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 13 HYDRAULIC CYLINDERS WITH BORE SIZE OF 50–150 MM TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 14 AGRICULTURE INDUSTRY TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 15 HYDRAULIC CYLINDER MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 HYDRAULIC CYLINDER MARKET, 2022–2027 (USD MILLION)

FIGURE 16 GROWTH OF CONSTRUCTION INDUSTRY TO BOOST MARKET

4.2 MARKET, BY SPECIFICATION

FIGURE 17 WELDED HYDRAULIC CYLINDERS TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY FUNCTION

FIGURE 18 DOUBLE-ACTING HYDRAULIC CYLINDERS TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 19 MOBILE EQUIPMENT TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

4.5 MARKET, BY BORE SIZE

FIGURE 20 CYLINDERS WITH BORE SIZE OF 50–150 MM TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.6 MARKET, BY INDUSTRY

FIGURE 21 CONSTRUCTION INDUSTRY TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.7 MARKET, BY GEOGRAPHY

FIGURE 22 APAC TO HOLD LARGEST SHARE OF HYDRAULIC CYLINDER MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 HYDRAULIC CYLINDER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 24 DRIVERS AND THEIR IMPACT ON MARKET

5.2.1.1 Significant demand from construction industry

5.2.1.2 Increasing demand for material handling equipment

5.2.1.3 Growing use in mining equipment

5.2.1.4 Rising demand for agricultural equipment

5.2.2 RESTRAINTS

FIGURE 25 RESTRAINTS AND THEIR IMPACT ON GLOBAL MARKET

5.2.2.1 Increased concerns regarding oil leaks

5.2.2.2 High manufacturing and maintenance costs

5.2.3 OPPORTUNITIES

FIGURE 26 OPPORTUNITIES AND THEIR IMPACT ON GLOBAL HYDRAULIC CYLINDER MARKET

5.2.3.1 Increasing demand for lifting equipment in shipping industry

5.2.3.2 Growing focus on developing smart hydraulic cylinders

5.2.3.3 Continuous R&D and technological advancements in hydraulic cylinders

5.2.4 CHALLENGES

FIGURE 27 CHALLENGES AND THEIR IMPACT ON GLOBAL MARKET

5.2.4.1 Availability of substitutes

5.3 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING ASSEMBLY STAGE

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END USERS

5.3.5 AFTER-SALES SERVICE

5.4 ECOSYSTEM

FIGURE 29 GLOBAL HYDRAULIC CYLINDER MARKET: ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYDRAULIC CYLINDER MANUFACTURERS

FIGURE 30 REVENUE SHIFT FOR HYDRAULIC CYLINDER MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON HYDRAULIC CYLINDER MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 CASE STUDIES

5.7.1 WINTERSHELL HOLDING GMBH USED R7 ELECTROHYDRAULIC UNIT BY BOSCH REXROTH FOR PERFECT PUMPING EXPERIENCE

5.7.2 HAEGER, INC. USED TIE ROD CYLINDER BY EATON FOR ITS HARDWARE INSERTION MACHINES FOR RELIABLE PERFORMANCE

5.8 TECHNOLOGY TRENDS

5.8.1 DRIVE-CONTROLLED PUMP (DCP)

5.8.2 HYBRID ACTUATION SYSTEM (HAS)

5.8.3 SMART USER INTERFACE

5.8.4 DIGITAL DISPLACEMENT (DD) HYDRAULICS

5.8.5 SERVO HYDRAULIC SYSTEM

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICES OF MARKET PLAYERS, BY FUNCTION

FIGURE 31 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FUNCTION

TABLE 5 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FUNCTION (USD)

5.10 PATENTS ANALYSIS

FIGURE 32 ANALYSIS OF PATENTS GRANTED FOR HYDRAULIC CYLINDER MARKET

5.10.1 SOME PATENTS PERTAINING TO HYDRAULIC CYLINDERS, 2019–2021

5.11 TRADE ANALYSIS

5.11.1 EXPORTS SCENARIO OF HYDRAULIC CYLINDERS

FIGURE 33 HYDRAULIC CYLINDER EXPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.11.2 IMPORTS SCENARIO OF HYDRAULIC CYLINDERS

FIGURE 34 HYDRAULIC CYLINDER IMPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.12 STANDARDS

5.12.1 INTERNATIONAL ORGANIZATION OF STANDARDIZATION (ISO) STANDARDS FOR HYDRAULIC CYLINDERS

5.12.2 AMERICAN NATIONAL STANDARDS INSTITUTE/NATIONAL FLUID POWER ASSOCIATION (ANSI/NFPA) STANDARDS FOR HYDRAULIC CYLINDERS

5.12.3 DEUTSCHES INSTITUT FÜR NORMUNG (DIN) STANDARDS FOR HYDRAULIC CYLINDERS

5.12.4 OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION (OSHA) STANDARDS FOR HYDRAULIC CYLINDERS

5.12.5 DNV STANDARDS FOR HYDRAULIC CYLINDERS

5.13 KEY CONFERENCES AND EVENTS DURING 2022–2023

TABLE 6 HYDRAULIC CYLINDER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 HYDRAULIC CYLINDER MARKET, BY FUNCTION (Page No. - 82)

6.1 INTRODUCTION

FIGURE 35 MARKET SEGMENTATION, BY FUNCTION

TABLE 11 HYDRAULIC CYLINDER MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

FIGURE 36 DOUBLE-ACTING HYDRAULIC CYLINDERS TO HOLD LARGER MARKET SIZE IN 2020

6.2 DOUBLE-ACTING HYDRAULIC CYLINDERS

FIGURE 37 WORKING MECHANISM OF DOUBLE-ACTING HYDRAULIC CYLINDERS

6.2.1 ADVANTAGES OF DOUBLE-ACTING HYDRAULIC CYLINDERS

6.2.2 DISADVANTAGES OF DOUBLE-ACTING HYDRAULIC CYLINDERS

TABLE 13 DOUBLE-ACTING MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 DOUBLE-ACTING MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

6.3 SINGLE-ACTING HYDRAULIC CYLINDERS

FIGURE 38 WORKING MECHANISM OF SINGLE-ACTING HYDRAULIC CYLINDERS

6.3.1 ADVANTAGES OF SINGLE-ACTING HYDRAULIC CYLINDERS

6.3.2 DISADVANTAGES OF SINGLE-ACTING HYDRAULIC CYLINDERS

TABLE 15 SINGLE-ACTING MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 16 SINGLE-ACTING MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7 HYDRAULIC CYLINDER MARKET, BY SPECIFICATION (Page No. - 89)

7.1 INTRODUCTION

FIGURE 39 MARKET SEGMENTATION, BY SPECIFICATION

FIGURE 40 WELDED HYDRAULIC CYLINDERS TO HOLD LARGEST SIZE IN GLOBAL HYDRAULIC CYLINDER MARKET DURING 2022–2027

TABLE 17 HYDRAULIC CYLINDER MARKET, BY SPECIFICATION, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY SPECIFICATION, 2022–2027 (USD MILLION)

7.2 WELDED CYLINDERS

7.2.1 ADVANTAGES OF WELDED HYDRAULIC CYLINDERS

7.3 TIE ROD CYLINDERS

7.3.1 ADVANTAGES OF TIE ROD HYDRAULIC CYLINDERS

7.4 TELESCOPIC CYLINDERS

7.4.1 ADVANTAGES OF TELESCOPIC HYDRAULIC CYLINDERS

7.5 MILL TYPE HYDRAULIC CYLINDERS

7.5.1 ADVANTAGES OF MILL TYPE HYDRAULIC CYLINDERS

8 HYDRAULIC CYLINDER MARKET, BY APPLICATION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 41 MARKET SEGMENTATION, BY APPLICATION

TABLE 19 HYDRAULIC CYLINDER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 42 MOBILE EQUIPMENT TO HOLD LARGER SIZE OF HYDRAULIC CYLINDER MARKET IN 2022

8.2 MOBILE

8.2.1 MOBILE HYDRAULIC CYLINDERS TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 21 HYDRAULIC CYLINDER MARKET FOR MOBILE EQUIPMENT APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 MARKET FOR MOBILE EQUIPMENT APPLICATION, BY REGION, 2022–2027 (USD MILLION)

8.3 INDUSTRIAL

8.3.1 MARKET FOR INDUSTRIAL HYDRAULIC CYLINDERS IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 MARKET FOR INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9 HYDRAULIC CYLINDER MARKET, BY BORE SIZE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 43 MARKET SEGMENTATION, BY BORE SIZE

TABLE 25 HYDRAULIC CYLINDER MARKET, BY BORE SIZE, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY BORE SIZE, 2022–2027 (USD MILLION)

FIGURE 44 HYDRAULIC CYLINDERS WITH BORE SIZE OF 50 MM TO 150 MM TO ACCOUNT FOR LARGEST MARKET SIZE DURING 2022–2027

TABLE 27 MARKET, BY BORE SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 28 MARKET, BY BORE SIZE, 2022–2027 (THOUSAND UNITS)

9.2 <50 MM

9.2.1 BENEFITS OF HYDRAULIC CYLINDERS WITH <50 MM BORE

9.3 50–150 MM

9.3.1 BENEFITS OF HYDRAULIC CYLINDERS WITH 50–150 MM BORE

9.4 >150 MM

9.4.1 BENEFITS OF HYDRAULIC CYLINDERS WITH >150 MM BORE

10 HYDRAULIC CYLINDER MARKET, BY INDUSTRY (Page No. - 103)

10.1 INTRODUCTION

FIGURE 45 MARKET SEGMENTATION, BY INDUSTRY

FIGURE 46 CONSTRUCTION INDUSTRY TO HOLD LARGEST SIZE OF HYDRAULIC CYLINDER MARKET IN 2022

TABLE 29 HYDRAULIC CYLINDER MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2 CONSTRUCTION

10.2.1 CONSTRUCTION INDUSTRY TO LEAD MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD

TABLE 31 MARKET FOR CONSTRUCTION INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR CONSTRUCTION INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 33 DOUBLE-ACTING MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 DOUBLE-ACTING MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 35 SINGLE-ACTING MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 SINGLE-ACTING MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 HYDRAULIC CYLINDER MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.2.2 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY

10.3 AEROSPACE

10.3.1 MARKET FOR AEROSPACE INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 MARKET FOR AEROSPACE INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 40 HYDRAULIC CYLINDER MARKET FOR AEROSPACE INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 41 DOUBLE-ACTING MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 DOUBLE-ACTING MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 43 SINGLE-ACTING MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 SINGLE-ACTING MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.3.2 IMPACT OF COVID-19 ON AEROSPACE INDUSTRY

10.4 MATERIAL HANDLING

10.4.1 WELDED HYDRAULIC CYLINDER MARKET FOR MATERIAL HANDLING INDUSTRY TO HOLD LARGEST SIZE DURING FORECAST PERIOD

TABLE 47 MARKET FOR MATERIAL HANDLING INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR MATERIAL HANDLING INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 49 DOUBLE-ACTING MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 DOUBLE-ACTING MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 SINGLE-ACTING MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 SINGLE-ACTING MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 HYDRAULIC CYLINDER MARKET FOR MATERIAL HANDLING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.4.2 IMPACT OF COVID-19 ON MATERIAL HANDLING INDUSTRY

10.5 AGRICULTURE

10.5.1 INCREASING DEMAND FOR HIGH-TECH AGRICULTURAL MACHINERY AND EQUIPMENT TO FUEL GROWTH OF HYDRAULIC CYLINDER IN AGRICULTURE INDUSTRY

FIGURE 47 DOUBLE-ACTING MARKET FOR AGRICULTURE INDUSTRY TO HOLD LARGER SIZE IN 2022

TABLE 55 MARKET FOR AGRICULTURE INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 56 HYDRAULIC CYLINDER MARKET FOR AGRICULTURE INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 57 DOUBLE-ACTING MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 DOUBLE-ACTING MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 59 SINGLE-ACTING MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 SINGLE-ACTING MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.5.2 IMPACT OF COVID-19 ON AGRICULTURE INDUSTRY

10.6 MINING

10.6.1 INCREASING DEMAND FOR AUTOMATED SOLUTIONS TO FUEL DEMAND FOR HYDRAULIC CYLINDER IN MINING INDUSTRY

TABLE 63 HYDRAULIC CYLINDER MARKET FOR MINING INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR MINING INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 65 DOUBLE-ACTING MARKET FOR MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 DOUBLE-ACTING MARKET FOR MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 67 SINGLE-ACTING MARKET FOR MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 SINGLE-ACTING MARKET FOR MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.6.2 IMPACT OF COVID-19 ON MINING INDUSTRY

10.7 AUTOMOTIVE

10.7.1 INCREASING APPLICATION OF HYDRAULIC CYLINDER IN AUTOMOTIVE INDUSTRY TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

FIGURE 48 DOUBLE-ACTING HYDRAULIC CYLINDERS TO HOLD LARGER SIZE IN HYDRAULIC CYLINDERS MARKET FOR AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

TABLE 71 MARKET FOR AUTOMOTIVE INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 72 HYDRAULIC CYLINDER MARKET FOR AUTOMOTIVE INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 73 DOUBLE-ACTING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 DOUBLE-ACTING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 75 SINGLE-ACTING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 SINGLE-ACTING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 HYDRAULIC CYLINDER MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.7.2 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

10.8 MARINE

10.8.1 WELDED CYLINDER MARKET FOR MARINE INDUSTRY TO HOLD LARGEST SIZE DURING FORECAST PERIOD

TABLE 79 MARKET FOR MARINE INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR MARINE INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 81 DOUBLE-ACTING MARKET FOR MARINE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 DOUBLE-ACTING MARKET FOR MARINE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 83 SINGLE-ACTING MARKET FOR MARINE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 SINGLE-ACTING MARKET FOR MARINE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

FIGURE 49 EUROPE TO HOLD LARGEST SIZE OF HYDRAULIC CYLINDER MARKET FOR MARINE INDUSTRY IN 2027

TABLE 85 HYDRAULIC CYLINDER MARKET FOR MARINE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR MARINE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.8.2 IMPACT OF COVID-19 ON MARINE INDUSTRY

10.9 OIL & GAS

10.9.1 TELESCOPIC CYLINDER MARKET FOR OIL & GAS INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 87 MARKET FOR OIL & GAS INDUSTRY, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 88 MARKET FOR OIL & GAS INDUSTRY, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 89 DOUBLE-ACTING MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 DOUBLE-ACTING MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 91 SINGLE-ACTING MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 SINGLE-ACTING MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 93 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 HYDRAULIC CYLINDER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.9.2 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

10.10 OTHERS

10.10.1 INCREASING APPLICATION OF HYDRAULIC CYLINDERS IN PAPER & PULP AND WASTE MANAGEMENT INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES

TABLE 95 MARKET FOR OTHER INDUSTRIES, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 96 MARKET FOR OTHER INDUSTRIES, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 97 DOUBLE-ACTING MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 DOUBLE-ACTING MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 99 SINGLE-ACTING MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 SINGLE-ACTING MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 101 MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 141)

11.1 INTRODUCTION

FIGURE 50 INDIA TO EXHIBIT HIGHEST CAGR IN OVERALL HYDRAULIC CYLINDER MARKET DURING FORECAST PERIOD

TABLE 103 HYDRAULIC CYLINDER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 51 SNAPSHOT OF MARKET IN NORTH AMERICA

11.2.1 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

11.2.2 US

11.2.2.1 US to hold largest market size in North America during forecast period

11.2.3 CANADA

11.2.3.1 Canadian market to be driven by growing mining industry

11.2.4 MEXICO

11.2.4.1 Mexican market to be driven by growing oil & gas industry

TABLE 105 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 HYDRAULIC CYLINDER MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 52 SNAPSHOT OF MARKET IN EUROPE

11.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

11.3.2 GERMANY

11.3.2.1 Increasing number of passenger vehicles to drive market in Germany

FIGURE 53 PASSENGER CAR REGISTRATION IN EUROPEAN COUNTRIES, 2020

11.3.3 FRANCE

11.3.3.1 Rising demand for material handling equipment to drive hydraulic cylinder market in France

11.3.4 UK

11.3.4.1 Growing marine industry to boost demand for hydraulic cylinders in UK

11.3.5 NETHERLANDS

11.3.5.1 Rising demand from oil & gas and maritime industries to create demand for hydraulic cylinders in Netherlands

11.3.6 REST OF EUROPE

11.3.6.1 Rapid infrastructure development and increasing demand for automation solutions to drive demand for hydraulic cylinders

TABLE 111 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 HYDRAULIC CYLINDER MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 116 MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4 APAC

FIGURE 54 SNAPSHOT OF HYDRAULIC CYLINDER MARKET IN APAC

11.4.1 IMPACT OF COVID-19 ON MARKET IN APAC

11.4.2 JAPAN

11.4.2.1 Japan to be leading market in APAC, in terms of size, during forecast period

11.4.3 AUSTRALIA

11.4.3.1 Increasing growth in mining industry to boost market for hydraulic cylinders in Australia

11.4.4 CHINA

11.4.4.1 China to be fastest-growing market in APAC

11.4.5 INDIA

11.4.5.1 Rising demand for hydraulic cylinders from construction industry to boost market in India

11.4.6 SOUTH KOREA

11.4.6.1 Growth of shipbuilding industry in South Korea to boost demand for hydraulic cylinders

11.4.7 REST OF APAC

11.4.7.1 Increasing demand for modern agricultural machinery and equipment to fuel demand for hydraulic cylinders

TABLE 117 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 MARKET IN APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 MARKET IN APAC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 122 MARKET IN APAC, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5 ROW

11.5.1 IMPACT OF COVID-19 ON MARKET IN ROW

11.5.2 SOUTH AMERICA

11.5.2.1 Brazil

11.5.2.1.1 Brazil to hold largest size of market in South America during forecast period

11.5.2.2 Argentina

11.5.2.2.1 Increasing deployment of material handling solutions to boost hydraulic cylinder market in Argentina

11.5.2.3 Chile

11.5.2.3.1 Rising demand for mining equipment to create demand for hydraulic cylinders in Chile

11.5.2.4 Peru

11.5.2.4.1 Market in Peru to grow at highest CAGR during forecast period

TABLE 123 MARKET IN SOUTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 MARKET IN SOUTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

11.5.3.1 Rising investments in oil & gas sector to drive market in Middle East

11.5.4 AFRICA

11.5.4.1 Growing demand for mining equipment to create demand for hydraulic cylinders in Africa

TABLE 125 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 127 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 129 MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 130 HYDRAULIC CYLINDER MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 166)

12.1 OVERVIEW

12.1.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN HYDRAULIC CYLINDER MARKET

12.2 MARKET REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 55 REVENUE ANALYSIS OF KEY MARKET PLAYERS IN LAST FIVE YEARS

12.3 MARKET SHARE ANALYSIS

TABLE 131 MARKET: DEGREE OF COMPETITION

12.4 COMPANY EVALUATION QUADRANT, 2021

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 56 HYDRAULIC CYLINDER MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

12.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 57 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

12.5.5 MARKET: COMPANY FOOTPRINT

TABLE 132 FUNCTION FOOTPRINT

TABLE 133 SPECIFICATION FOOTPRINT

TABLE 134 APPLICATION FOOTPRINT

TABLE 135 BORE SIZE FOOTPRINT

TABLE 136 INDUSTRY FOOTPRINT

TABLE 137 REGION FOOTPRINT

TABLE 138 COMPANY FOOTPRINT

12.5.6 HYDRAULIC CYLINDER MARKET: STARTUP/SME MATRIX

TABLE 139 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 140 HYDRAULIC CYLINDER: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 PRODUCT LAUNCHES

TABLE 141 MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–AUGUST 2021

12.6.2 DEALS

TABLE 142 MARKET: DEALS, JANUARY 2019–NOVEMBER 2021

13 COMPANY PROFILES (Page No. - 189)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 ENERPAC TOOL GROUP

TABLE 143 ENERPAC TOOL GROUP: BUSINESS OVERVIEW

FIGURE 58 ENERPAC TOOL GROUP: COMPANY SNAPSHOT

TABLE 144 ENERPAC TOOL GROUP: PRODUCT OFFERINGS

TABLE 145 ENERPAC TOOL GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 146 ENERPAC TOOL GROUP: DEALS

13.1.2 BOSCH REXROTH

TABLE 147 BOSCH REXROTH: BUSINESS OVERVIEW

FIGURE 59 BOSCH REXROTH: COMPANY SNAPSHOT

TABLE 148 BOSCH REXROTH: PRODUCT OFFERINGS

TABLE 149 BOSCH REXROTH: DEALS

13.1.3 CATERPILLAR

TABLE 150 CATERPILLAR: BUSINESS OVERVIEW

FIGURE 60 CATERPILLAR: COMPANY SNAPSHOT

TABLE 151 CATERPILLAR: PRODUCT OFFERINGS

TABLE 152 CATERPILLAR: DEALS

13.1.4 EATON

TABLE 153 EATON: BUSINESS OVERVIEW

FIGURE 61 EATON: COMPANY SNAPSHOT

TABLE 154 EATON: PRODUCT OFFERINGS

13.1.5 KYB CORPORATION

TABLE 155 KYB CORPORATION: BUSINESS OVERVIEW

FIGURE 62 KYB CORPORATION: COMPANY SNAPSHOT

TABLE 156 KYB CORPORATION: PRODUCT OFFERINGS

13.1.6 PARKER-HANNIFIN CORPORATION

TABLE 157 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 63 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 158 PARKER-HANNIFIN CORPORATION: PRODUCT OFFERINGS

TABLE 159 PARKER-HANNIFIN CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 160 PARKER-HANNIFIN CORPORATION: DEALS

13.1.7 SMC CORPORATION

TABLE 161 SMC CORPORATION: BUSINESS OVERVIEW

FIGURE 64 SMC CORPORATION: COMPANY SNAPSHOT

TABLE 162 SMC CORPORATION: PRODUCT OFFERINGS

TABLE 163 SMC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

13.1.8 JIANGSU HENGLI HYDRAULIC

TABLE 164 JIANGSU HENGLI HYDRAULIC: BUSINESS OVERVIEW

TABLE 165 JIANGSU HENGLI HYDRAULIC: PRODUCT OFFERINGS

TABLE 166 JIANGSU HENGLI HYDRAULIC: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 167 JIANGSU HENGLI HYDRAULIC: DEALS

13.1.9 WIPRO ENTERPRISES

TABLE 168 WIPRO ENTERPRISES: BUSINESS OVERVIEW

FIGURE 65 WIPRO ENTERPRISES: COMPANY SNAPSHOT

TABLE 169 WIPRO ENTERPRISES: PRODUCT OFFERINGS

TABLE 170 WIPRO ENTERPRISES: DEALS

13.1.10 HYDAC

TABLE 171 HYDAC: BUSINESS OVERVIEW

TABLE 172 HYDAC: PRODUCT OFFERINGS

13.1.11 STANDEX INTERNATIONAL

TABLE 173 STANDEX INTERNATIONAL: BUSINESS OVERVIEW

TABLE 174 STANDEX INTERNATIONAL: PRODUCT OFFERINGS

13.1.12 TEXAS HYDRAULICS INC.

TABLE 175 TEXAS HYDRAULIC INC.: BUSINESS OVERVIEW

TABLE 176 TEXAS HYDRAULICS INC.: PRODUCT OFFERINGS

13.1.13 WEBER-HYDRAULIK GMBH

TABLE 177 WEBER-HYDRAULIK GMBH: BUSINESS OVERVIEW

TABLE 178 WEBER-HYDRAULIK GMBH: PRODUCT OFFERINGS

TABLE 179 WEBER-HYDRAULIK GMBH: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 180 WEBER-HYDRAULIK GMBH: DEALS

13.1.14 BURNSIDE AUTOCYL

TABLE 181 BURNSIDE AUTOCYL: BUSINESS OVERVIEW

TABLE 182 BURNSIDE AUTOCYL: PRODUCT OFFERINGS

13.1.15 PACOMA GMBH

TABLE 183 PACOMA GMBH: BUSINESS OVERVIEW

TABLE 184 PACOMA GMBH: PRODUCT OFFERINGS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 JARP INDUSTRIES

TABLE 185 JARP INDUSTRIES: COMPANY OVERVIEW

13.2.2 KAPPA ENGINEERING

TABLE 186 KAPPA ENGINEERING: COMPANY OVERVIEW

13.2.3 LIGON HYDRAULIC CYLINDER GROUP

TABLE 187 LIGON HYDRAULIC CYLINDER GROUP: COMPANY OVERVIEW

13.2.4 MARREL

TABLE 188 MARREL: COMPANY OVERVIEW

13.2.5 PRINCE MANUFACTURING

TABLE 189 PRINCE MANUFACTURING: COMPANY OVERVIEW

13.2.6 HOLMATRO

TABLE 190 HOLMATRO: COMPANY OVERVIEW

13.2.7 AGGRESSIVE HYDRAULICS, INC.

TABLE 191 AGGRESSIVE HYDRAULICS INC.: COMPANY OVERVIEW

13.2.8 LEHIGH FLUID POWER, INC.

TABLE 192 LEHIGH FLUID POWER, INC.: COMPANY OVERVIEW

13.2.9 BAILEY INTERNATIONAL, LLC

TABLE 193 BAILEY INTERNATIONAL, LLC: COMPANY OVERVIEW

13.2.10 YUASA CO., LTD.

TABLE 194 YUASA CO., LTD.: COMPANY OVERVIEW

14 ADJACENT & RELATED MARKETS (Page No. - 234)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 INDUSTRIAL VALVES MARKET, BY FUNCTION

14.3.1 INTRODUCTION

TABLE 195 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2017–2020 (USD BILLION)

TABLE 196 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2021–2026 (USD BILLION)

14.4 ON/OFF VALVES

14.4.1 ON/OFF VALVES ACCOUNTED FOR LARGER MARKET SHARE IN 2020

14.5 CONTROL VALVES

14.5.1 CONTROL VALVES TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

15 APPENDIX (Page No. - 238)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

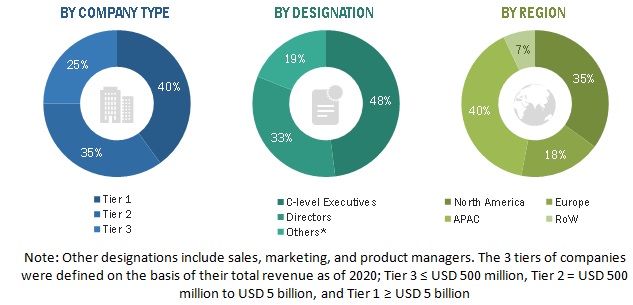

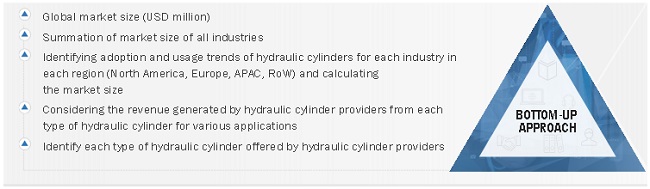

The study involved four major activities in estimating the current size of the global Hydraulic Cylinder Market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the global Hydraulic Cylinder Market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries as well as hydraulic cylinder have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from hydraulic cylinder manufacturers, such as Parker-Hannifin Corporation (US), Caterpillar (US), Eaton (Ireland), KYB Corporation (Japan), Bosch Rexroth (Germany), SMC Corporation (Japan), Jiangsu Hengli Hydraulic Co., Ltd. (China), Wipro Enterprises (India), Enerpac Tool Group (US), and HYDAC (Germany) and others; research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the global Hydraulic Cylinder Market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hydraulic Cylinder Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global Hydraulic Cylinder Market based on function, specification, application, bore size, end-user industries, and geography.

- To describe and forecast the market, in terms of value, by region—North America, Europe, APAC, and RoW

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the global Hydraulic Cylinder Market

- To analyze opportunities for stakeholders in the global Hydraulic Cylinder Market by identifying the high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships, of the leading players

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydraulic Cylinder Market