MLOps Market by Component (Platform and Services), Deployment Mode (Cloud and On-premises), Organization Size (Large Enterprises and SMEs), Vertical (BFSI, Healthcare and Life Sciences, Retail and eCommerce, Telecom) and Region - Global Forecast to 2027

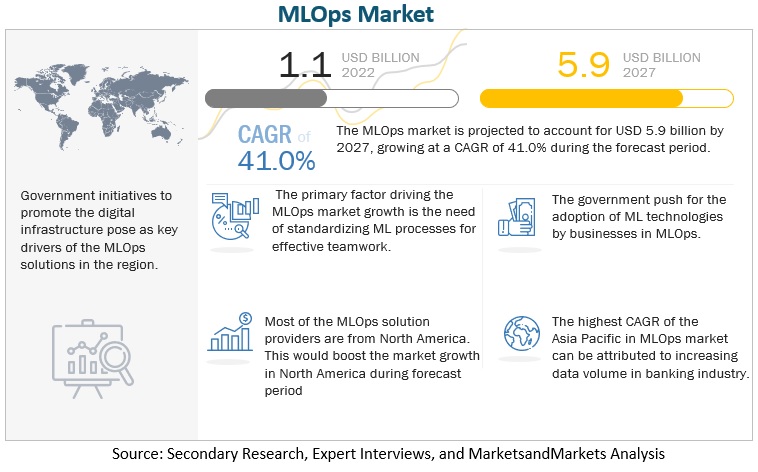

[219 Pages Report] The MLOps market size is projected to grow from USD 1.1 billion in 2022 to USD 5.9 billion by 2027, at a CAGR of 41.0% during the forecast period. Standardizing ML processes for effective teamwork has fueled the demand of MLOps. Moreover, monitorability and scalability is expected to drive the market growth for MLOps Market. Particularly MLOps reduces friction between DevOps and IT, promotes tighter cooperation between data teams, makes ML pipelines repeatable, and accelerates up release velocity.

To know about the assumptions considered for the study, Request for Free Sample Report

MLOps Market Dynamics:

Driver: Standardizing ML processes for effective teamwork

Manual data reprocessing and collecting are ineffective and might produce unsatisfactory results. MLOps helps for automating the whole ML model workflow. This includes data gathering, model construction, testing, retraining, and deployment. MLOps help companies save time and reduce error rates. Collaboration is seen between IT and business personnel, as well as data scientists and engineers, for the company-wide adoption of ML models. Businesses can standardize ML operations and establish a standardized language for all participants due to MLOps principles. This reduces compatibility problems and quickens the construction and deployment of modelling processes.

Restraint: Lack of expertise

In order to gather and integrate the vast volumes of data from multiple internal and external data sources, as well as to merge the data silos, organisations should now use MLOps in data management. However, they are unable to embrace MLOps models due to knowledge gaps and a lack of worker capabilities. Organizations frequently operate in silos; thus, the necessity for MLOps models is becoming increasingly crucial in order to acquire a broader picture of many applications and verticals. Surveys have frequently demonstrated the inadequate knowledge and abilities of the employees in enterprises, according to numerous reports and research. Organizations should prioritise and make significant investments in training and certifications to address this issue, ensuring that the workforce has the necessary understanding of MLOps models and strategies and can put those tactics into practise for effective data management.

Opportunity: Expanded Use of Machine Leading in the Financial Sector

The customer data that financial companies hold is enormous. To generate a 360-degree image of the consumer, they might gather data on purchases, expenditure patterns, platform utilization, and geo-locational choices in along with traditional banking details, including bank account balances. This permits the bank to provide services and products that are specifically customized to the needs and preferences of the consumer. Data analysis and the creation of individualized service and promotional offerings may be done extremely effectively with the aid of machine learning algorithms.

Challenge: Raw Data Manipulation

Raw data is utilized to generate predictions and extract final outcomes when a model is put into production. Therefore, it becomes challenging to determine the model's correctness and continually assess it. Manually labelling the new data delays the process and is ineffective for ongoing retraining tasks. It also depends on the issue and the task's objectives whether to use the trained model to label the fresh data or to utilize unsupervised learning rather than supervised learning. There are some data kinds where labelling is not necessary. Due to this, businesses find it challenging to integrate MLOps into their routine operations to handle their raw data, which might result in data manipulation.

By component, platform segment holds largest market size during forecast period

Technological developments have created a new edge of digitalization where advanced MLOps solutions are adopted at a large scale in various enterprises across the globe. MLOps solutions help in increasing the overall productivity of the remote workforce and reduce the costs associated with traveling and engagement. Thus, the solutions play a crucial role in reducing the overall OPEX and Capital Expenditure (CAPEX). Effective enterprise collaboration offers a seamless video experience for various application areas, such as marketing, client engagement, knowledge sharing, team collaboration, and employee training. The advanced MLOps solutions also comply with regulations, such as HIPPA and GDPR, making it easier for highly regulated industries to adopt these solutions.

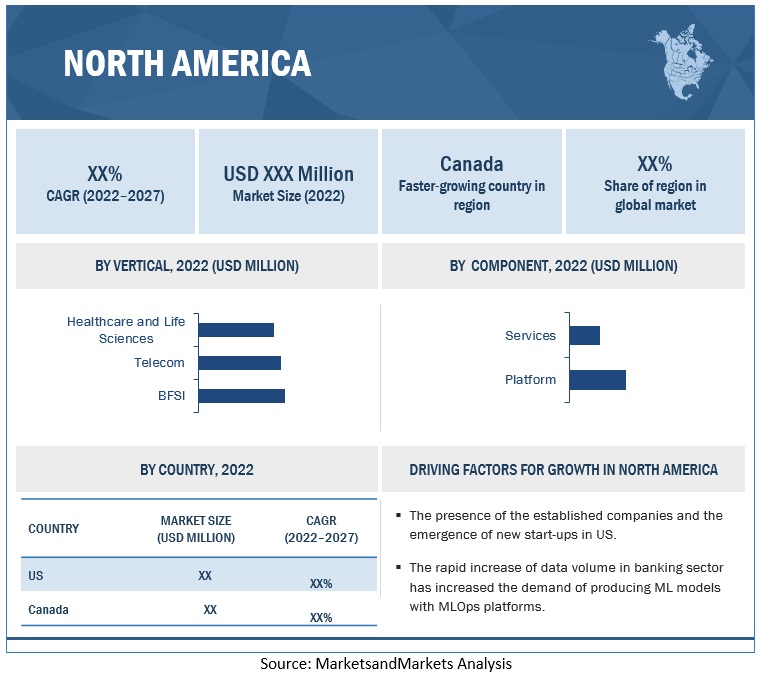

North America is expected to hold largest market share during forecast period

North America is one of the leading markers for MLOps in terms of market share. Countries, such as the US and Canada, are adopting ML technology in multiple application areas, propelling the growth of MLOps in this region. In the North American MLOps market, the US is considered one of the major contributors. The presence of prominent technology providers, such as IBM (US), Google (US), Microsoft (US), HPE (US), and AWS (US), is complementing the growth of the market in this region. The presence of such established MLOps companies and the emergence of new start-ups will strengthen the outlook of this region and enable it to witness a significant increase in investments and early adoption of Artificial Intelligence technology.

To know about the assumptions considered for the study, download the pdf brochure

Market Players:

The major players in the MLOps market IBM (US), Microsoft (US), Google (US), AWS (US), HPE (US), GAVS Technologies (US), DataRobot (US), Cloudera (US), Alteryx (US), Domino Data Lab (US), Valohai (US), H2O.ai (US), MLflow (Netherlands), Neptune.ai (Europe), Comet (US), SparkCognition (US), Hopsworks (Europe), Datatron (US), Weights & Biases (US), Katonic.ai (Australia), Modzy (US), Iguazio (Israel), Teliolabs (US), ClearML (Israel), Akira.AI (India), and Blaize (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions, to expand their footprint in the MLOps market.

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2018–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD) Million/Billion |

| Segments covered | Component, Deployment mode, Organization size, Vertical |

| Region covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

| Companies covered |

Major Vendors - - IBM (US), Microsoft (US), Google (US), AWS (US), HPE (US), GAVS Technologies (US), DataRobot (US), Cloudera (US), and Alteryx (US) Startup/SME Vendors - Domino Data Lab (US), Valohai (US), H2O.ai (US), MLflow (Netherlands), Neptune.ai (Europe), Comet (US), SparkCognition (US), Hopsworks (Europe), Datatron (US), Weights & Biases (US), Katonic.ai (Australia), Modzy (US), Iguazio (Israel), Teliolabs (US), ClearML (Israel), Akira.AI (India), and Blaize (US). |

This research report categorizes the MLOps market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

- Platform

- Services

Based on Deployment Mode:

- On-Premises

- Cloud

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Vertical:

- Banking, Financial Services, and Insurance

- Retail and eCommerce

- Government and Defense

- Healthcare and Life Sciences

- Manufacturing

- Telecom

- IT and ITeS

- Energy and Utilities

- Transportation and Logistics

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- KSA

- UAE

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2022, Cloudera announced its strategic partnership with Meralco to create a unique solution, a flagship analytics platform that analyzes Meralco’s data and runs several ML models.

- In June 2022, DataRobot announced the release of advanced AI Cloud with new and improved business impact.

- In May 2022, GAVS Technologies announced its partnership with NTT Ltd. This partnership incorporated integration of ZIF AIOps platform to NTT Ltd.'s Infrastructure Managed Services (IMS).

- In February 2022, HPE and Ayar Labs announced a multi-year strategic collaboration to usher in a new age of data centre innovation through the development of silicon photonics solutions based on optical I/O technology.

- In September 2021, DataRobot collaborated with Foxtons, the top estate agency in London to expedite its data analytics and modelling capabilities in order to better serve consumers and make more strategic data-driven business choices.

- In January 2021, Alteryx partners with Snowflake, to serve the market growing demand. The partnership integrates Alteryx data science and automation capabilities with Snowflake’s platform to serve collective customers base with automated data pipelining, faster data processing, and boosts analytics at scale.

Frequently Asked Questions (FAQ):

What is the definition of the MLOps market?

According to Databricks, MLOps stands for Machine Learning Operations. MLOps is a core function of Machine Learning engineering, focused on streamlining the process of taking machine learning models to production, and then maintaining and monitoring them. MLOps is a collaborative function, often comprising data scientists, devops engineers, and IT.

What is the market size of the MLOps market?

The MLOps market size is projected to grow from USD 1.1 billion in 2022 to USD 5.9 billion by 2027, at a CAGR of 41.0% during the forecast period.

What are the major drivers in the MLOps market?

Standardizing ML processes, for efffective teamwork, monitorability, and scalability are the major drivers. Models drift over time as the situation changes; therefore, it is crucial to keep a watch on the behavior and efficiency. MLOps provide enterprises the ability to consistently track and get insights into model performance. ML models are kept under surveillance and dynamically retrained on a regular basis or following a particular instance. Retraining a model is carried out to ensure it continually produces the most reliable data.

Who are the key companies operating in the MLOps market?

The key companies profiled in the MLOps market report include IBM (US), Microsoft (US), Google (US), AWS (US), HPE (US), GAVS Technologies (US), DataRobot (US), Cloudera (US), Alteryx (US), Domino Data Lab (US), Valohai (US), H2O.ai (US), MLflow (Netherlands), Neptune.ai (Europe), Comet (US), SparkCognition (US), Hopsworks (Europe), Datatron (US), Weights & Biases (US), Katonic.ai (Australia), Modzy (US), Iguazio (Israel), Teliolabs (US), ClearML (Israel), Akira.AI (India), and Blaize (US).

What are the opportunities for new market entrants in the MLOps market?

The opportunities in the MLOps market are a growing inclination toward industry-specific solutions, increasing government initiatives, developing partnerships, penetration of advanced technologies, and increasing content protection policies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

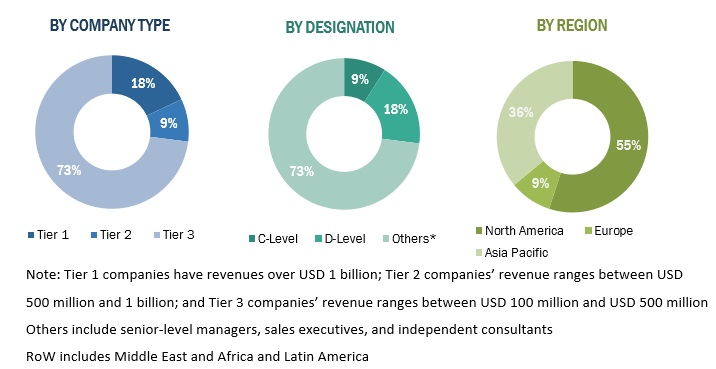

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun and Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the MLOps market. The study involved four major activities in estimating the current size of the MLOps market. Exhaustive secondary research was done to collect information on the MLOps industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for the companies offering MLOps solutions and services is arrived at based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources include annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the MLOps market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Connected Toys, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Connected Toys, which is expected to affect the overall MLOps market growth. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Note: Tier 1 companies have revenues over USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million and 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million Others include senior-level managers, sales executives, and independent consultants RoW includes Middle East and Africa and Latin America

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MLOps market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the overall MLOps market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global MLOps market based on component, application, organization size, deployment type, vertical, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the MLOps market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MLOps Market