Mobile Robots Market Size, Share & Industry Growth Analysis Report by Type (Professional and Personal & Domestic Robots), Application (Agricultural, Cleaning, Educational, Healthcare, Manufacturing, Warehousing & Logistics) and Region (North America, Europe, APAC, ROW) - Global Forecast to 2028

Updated on : October 22, 2024

Mobile Robots Market Size & Growth

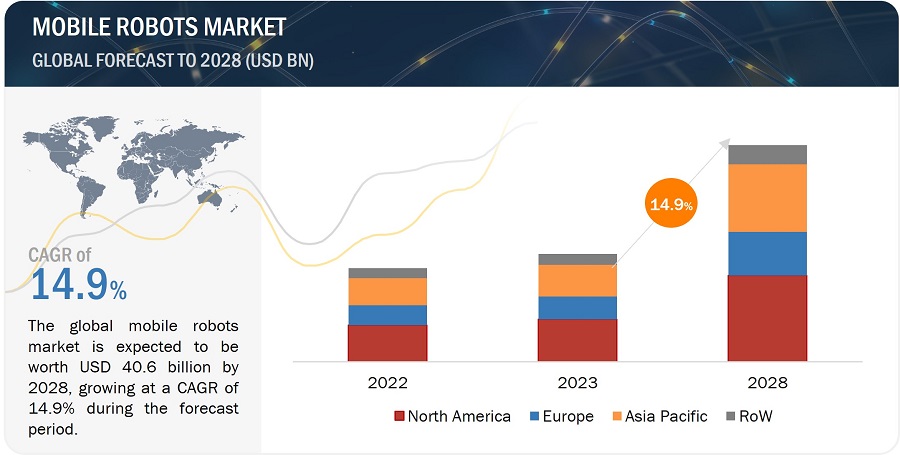

Global mobile robots market size is estimated to be worth USD 20.3 billion in 2023 and is projected to reach USD 40.6 billion by 2028, growing at a CAGR of 14.9% during the forecast period from 2023 to 2029.

The mobile robots market is growing rapidly due to advancements in AI, machine learning, and sensor technology, enhancing robots’ capabilities in navigation and interaction. A major growth driver is the rising demand for automation across sectors like logistics, healthcare, and manufacturing, where mobile robots improve efficiency and reduce costs. The e-commerce surge, particularly, has fueled the adoption of autonomous mobile robots (AMRs) in warehouses for inventory and order fulfillment. Key trends include the rise of collaborative robots (cobots) that safely work alongside humans and robotics-as-a-service (RaaS) models, allowing businesses to implement robotics without large upfront costs. Integration with 5G technology is also significant, boosting real-time data processing and connectivity for applications in dynamic environments. Additionally, mobile robots are increasingly equipped for complex terrains, extending their use in agriculture, disaster response, and defense, supporting the market’s ongoing expansion across diverse industries.

The growing demand for mobile robots in healthcare and personal applications, coupled with rapid advancements in robotics and artificial intelligence technologies, is contributing to this market growth.

Mobile Robots Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Mobile Robots Market Trends and Dynamics

Driver: Increasing adoption of mobile robots for healthcare and personal use

Robotics has witnessed a quantum leap with the introduction of technologies such as augmented reality, deep learning, and artificial intelligence (AI). With the growing geriatric population and the rising number of nuclear families worldwide, demand for advanced technologies and virtual assistants, such as companion robots, is also increasing as these technologies simplify the process of performing a task. These technologies have been well adopted by several market players to introduce advanced products and gain a competitive edge in the mobile robots market. For instance, Shenzhen Huiyu Education Technology (China) offers Honeybot, a companion robot that uses augmented reality (AR) for learning. Similarly, Blue Frog Robotics (France) offers Buddy, a companion robot designed using AI. Mobile robots are increasingly being integrated into households to perform tasks such as cleaning, home security, and entertainment. With the advancements in artificial intelligence and robotics, these robots are becoming smarter, more intuitive, and capable of adapting to human environments. The growing adoption of mobile robots for personal use is driven by the desire for time-saving solutions, improved productivity, and enhanced lifestyle experiences.

Restraint: Limited adaptability of mobile robots to unstructured environments

Till date, robots have performed successfully in manipulated and controlled environments, such as manufacturing factories and process industries. With mobile robots applications in various fields, such as mining, logistics, and medical, there is a growing need for technically advanced robots to perform complex tasks. Therefore, there is a need to develop hardware (arms and hands), and force and vision sensors to make robots interact with the environment with tactile manipulation as humans do. In the real world, the human environment has various challenging activities, which are beyond the control of robots that are currently manufactured. Researchers are studying various approaches to overcome the limitation of robot manipulation in the real world. Mobile robots often struggle with the limited adaptability in unstructured environments due to challenges in perception, navigation, and manipulation. Unstructured environments pose difficulties for robots in accurately perceiving and sensing the surroundings, especially when dealing with varying terrains, unpredictable obstacles, and changing lighting conditions.

Opportunity: Adoption of industry 4.0 technologies in warehousing and industrial automation

The Mobile Robots market has a significant opportunity as Industry 4.0 technologies are adopted in warehousing and industrial automation. Industry 4.0 involves the integration of digital technologies, data connectivity, and automation into industrial processes. As businesses strive for improved efficiency, productivity, and agility, they are increasingly relying on mobile robots as a crucial element of their digital transformation initiatives. Mobile robots play a vital role in facilitating intelligent and interconnected warehouses by automating tasks such as material handling, picking, and logistics operations. They can seamlessly integrate with other Industry 4.0 technologies like the Internet of Things (IoT), cloud computing, and artificial intelligence (AI) systems, enabling real-time data exchange, advanced analytics, and intelligent decision-making. The adoption of Industry 4.0 technologies in warehousing and industrial automation not only enhances operational efficiency but also improves inventory accuracy, reduces errors, and enables predictive maintenance. With the growth of e-commerce and the increasing complexity of supply chains, there is a growing demand for mobile robots in these sectors. Mobile robots offer scalability, flexibility, and adaptability, making them an asset in the ever-changing landscape of Industry 4.0. As businesses continue to invest in digital transformation and automation, the Mobile Robots market can provide innovative and advanced solutions that align with the demands of Industry 4.0.

Challenge: Integration of mobile robots with existing system

The Mobile Robots market faces a significant challenge when it comes to integrating mobile robots with existing systems. Numerous industries already have established systems, processes, and infrastructure in place, making it complex to achieve a seamless integration of mobile robots. Challenges such as compatibility issues, interoperability issues, and the need for system reconfiguration can impede the integration process. Mobile robots often need to interface with different components like enterprise resource planning (ERP) systems, warehouse management systems (WMS), and other automation technologies. Ensuring smooth data exchange, communication protocols, and synchronization with existing systems requires careful planning, technical expertise, and coordination among various stakeholders. The integration challenges can lead to delays, increased costs, and disruptions to operations. To overcome these challenges, collaboration between mobile robot manufacturers, system integrators, and end-users is essential. This collaboration can involve the development of standardized interfaces, the establishment of clear integration protocols, and the provision of comprehensive support to enable seamless integration. By addressing the integration challenge, the Mobile Robots market can enhance its value proposition, drive adoption, and facilitate the efficient deployment of mobile robot solutions across diverse industries.

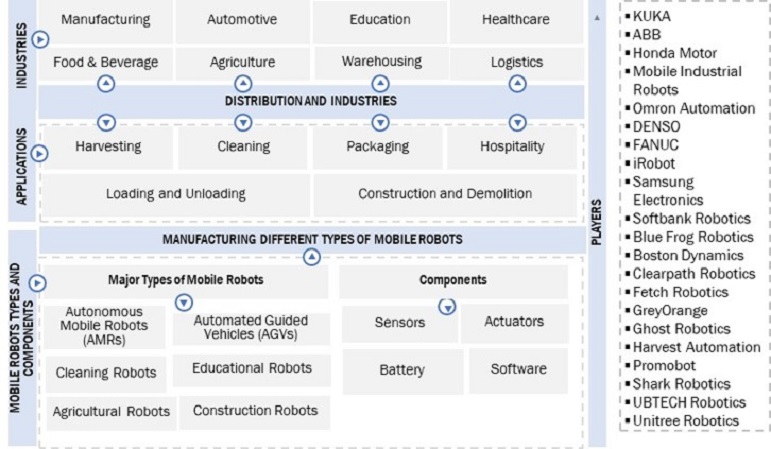

Mobile Robots Market Ecosystem

Mobile Robots Market: Key Trends

KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark) and Omron Automation (US) are the top players in the mobile robots market. These mobile robot companies boast robotics trends with a comprehensive product portfolio and solid geographic footprint.

Mobile Robots Market Segmentation

Personal & Domestic Robots type to grow at the highest CAGR during 2023-2028.

The market for personal and domestic robots is expected to grow due to advancing technology and increased affordability of robotic solutions that can enhance the day-to-day life of the consumer. Personal robots, including robotic assistants, companions, and entertainment devices, offer convenience, efficiency, and an improved quality of life. They can assist with household chores, provide companionship, and even offer healthcare support. Similarly, domestic robots focus on specific tasks within the home environment, such as cleaning, gardening, or security monitoring. The rising adoption of automation and smart home technologies, combined with the expanding range of functionalities provided by personal and domestic robots, is fueling the growing demand for these products. As consumers increasingly recognize the benefits and value that these robots bring, their popularity is expected to skyrocket, establishing them as the segment with the highest growth potential in the market.

Agriculture application to grow at the highest CAGR during forecast period.

As the global population continues to increase and the importance of sustainable food production intensifies, the agriculture industry is actively seeking innovative solutions to enhance productivity and efficiency. Mobile robots offer significant potential to revolutionize farming practices by automating various tasks, including planting, harvesting, crop monitoring, and precision spraying. These robots excel in navigating challenging terrains, collecting real-time data, and executing operations with precision, thereby improving efficiency, reducing labor costs, and optimizing resource utilization. Moreover, mobile robots empower farmers to make data-driven decisions, boost productivity, and minimize environmental impact. The growing adoption of automation and robotics in agriculture, combined with the demand for advanced farming techniques, fuels the mobile robots market growth.

Mobile Robots Industry Regional Analysis

Asia Pacific is expected to grow at the highest CAGR in the mobile robots industry during the forecast period.

Asia Pacific region is projected to experience significant growth in the field of mobile robots. Industries in the region are actively seeking automation solutions to improve efficiency and reduce production costs. Countries like Japan, South Korea, and China have made notable technological advancements, contributing to the development of sophisticated robotics technologies that have made mobile robots more accessible and practical. Moreover, the Asia Pacific region faces challenges related to an aging workforce and increasing labor costs, which have further amplified the appeal of utilizing mobile robots for repetitive and physically demanding tasks. Additionally, the growth of e-commerce and logistics industries has created a surge in demand for automation in warehousing and last-mile deliveries across the region.

Mobile Robots Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Mobile Robots Companies - Key Market Players

The major companies in the mobile robots companies include

- KUKA (Germany),

- ABB (Switzerland),

- Honda Motor (Japan),

- Mobile Industrial Robots (Denmark)

- Omron Automation (US)

These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the mobile robots market.

Mobile Robots Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 20.3 Billion in 2023 |

|

Projected Market Size |

USD 40.6 Billion by 2028 |

|

Growth Rate |

CAGR of 14.9% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Type and Application |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark) and Omron Automation (US). |

Mobile Robots Market Highlights

In this report, the overall mobile robots market has been segmented based on type and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Mobile Robots Industry

- In April 2023, ABB transformed AMR performance with launch of Visual simultaneous localization and mapping (SLAM) Technology, this AI-enabled navigation technology allows AMRs to make intelligent decisions in dynamic and challenging environments.

- In March 2023, KUKA introduces an upgraded version of its KMP 600-S diffDrive, extending the company's range of mobile platforms. The KUKA KMP 600-S diffDrive mobile platform presents an advanced automated guided vehicle system, offering high-speed capabilities for production intralogistics.

- In July 2022, LG Mobile Industrial Robots announced a collaboration with Modula for advance warehouse automation, and delivering a fully autonomous storage, picking and material handling solution.

Frequently Asked Questions (FAQ) On Mobile Robots Market:

What is the current size of the global mobile robots market?

The mobile robots market is estimated to be worth USD 20.3 billion in 2023 and is projected to reach USD 40.6 billion by 2028, at a CAGR of 14.9% during the forecast period. The Increased demand for mobile robots for healthcare and personal use and rapid advancements in robotics and artificial intelligence are major factors driving the growth of the global mobile robots market.

Who are the global mobile robots market winners?

Companies such as KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark) and Omron Automation (US) fall under the winners’ category.

Which region is expected to hold the highest share of the mobile robots market share?

North America will dominate the mobile robots market in 2028. Countries in North America are showing growth from nascent sectors such as telepresence, inspection and maintenance, and home security, along with major sectors such as medical, defense, marine, logistics, and education and research. Moreover, increasing demand for mobile robots in military applications and increasing demand for personal applications, such as education and entertainment, drives the mobile robots market in North America.

What are the major drivers and opportunities related to the mobile robots market share?

Surging demand for mobile robots in healthcare and warehousing & logistics application and growing demand for customized mobile robots are some of the major drivers and opportunities for the mobile robots market.

What are the major strategies adopted by mobile robot companies?

The agitator companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the mobile robots market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing usage of mobile robots for healthcare and personal use- Rapid adoption of mobile robots for e-commerce and logistics applications- Continuous advancements in robotics and artificial intelligenceRESTRAINTS- Limited adaptability of mobile robots to unstructured environments- Need for substantial upfront investment and technological limitations of mobile robotsOPPORTUNITIES- Adoption of industry 4.0 to automate warehousing and industrial plants- Increasing demand for customized mobile robotsCHALLENGES- Integration of mobile robots with existing systems- Lack of skilled workforce to operate mobile robots

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TRENDPRICING ANALYSIS OF AUTONOMOUS MOBILE ROBOTS OFFERED BY KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGPREDICTIVE ANALYTICSWIRELESS COMMUNICATIONIOT AND INDUSTRY 4.0HUMAN–ROBOT COLLABORATIONCLOUD ROBOTICS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2023–2025

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS RELATED TO MOBILE ROBOTSSAFETY STANDARDS FOR MOBILE ROBOTS

- 6.1 INTRODUCTION

-

6.2 TRENDS RELATED TO MOBILE ROBOTSHUMAN–ROBOT COLLABORATION AND INTERACTIONWIRELESS COMMUNICATIONRECONFIGURABLE ROBOTSEDGE COMPUTING AND CLOUD ROBOTICSSIMULTANEOUS LOCALIZATION AND MAPPING (SLAM)

-

6.3 EMERGING APPLICATION AREAS OF MOBILE ROBOTSFOOD DELIVERYHOSPITALITY AND CUSTOMER SERVICEDISASTER RESPONSE AND RESCUECONSTRUCTION AND BUILDING AUTOMATIONWASTE MANAGEMENT

- 7.1 INTRODUCTION

-

7.2 HARDWARESENSORSACTUATORSPOWER SUPPLIESCONTROL SYSTEMSOTHERS

- 7.3 SOFTWARE & SERVICES

- 8.1 INTRODUCTION

-

8.2 PROFESSIONAL ROBOTSAUTONOMOUS MOBILE ROBOTS- Can navigate in known environments without human interventionAUTOMATED GUIDED VEHICLES- Used for material handling in various industries to reduce damages and labor costsOTHERS

-

8.3 PERSONAL & DOMESTIC ROBOTSLARGELY ADOPTED FOR CLEANING APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 AGRICULTURALMOBILE ROBOTS MAJORLY USED FOR LIVESTOCK MANAGEMENT, FEEDING, AND CLEANING APPLICATIONS

-

9.3 CLEANINGMOBILE ROBOTS MAKE FOR MORE HYGIENIC ALTERNATIVE TO TRADITIONAL CLEANING METHODS

-

9.4 EDUCATIONALMOBILE ROBOTS PROMOTE COLLABORATIVE LEARNING IN EDUCATION

-

9.5 HEALTHCAREMOBILE ROBOTS SUPPORT PATIENTS AND MEDICAL STAFF

-

9.6 MANUFACTURINGMOBILE ROBOTS EASE WORKFLOW IN OPERATIONS

-

9.7 WAREHOUSING & LOGISTICSMOBILE ROBOTS ADOPTED FOR MATERIAL HANDLING

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rapid technological advancements and innovation in field of robotics to propel market growthCANADA- Thriving industrial ecosystem to support market growthMEXICO- Evolving economy and growing adoption of mobile robots in manufacturing to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- Government initiatives to boost automation to lead to adoption of mobile robotsGERMANY- Rising adoption of automation solutions by several manufacturing firms to boost market growthFRANCE- Rising investments in automation and robotics solutions to create opportunities for market playersREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Increasing demand from healthcare and manufacturing sectors to support market growthCHINA- Aging population and growing acceptance of robotics in eldercare to create substantial demand for mobile robotsSOUTH KOREA- Rising trend of automation in manufacturing sector to create opportunities for market playersREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing adoption of mobile robots for educational and cleaning applications to drive marketSOUTH AMERICA- Rising adoption of mobile robots for agricultural and educational applications to accelerate market growth

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 MOBILE ROBOTS MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

-

12.1 KEY PLAYERSKUKA AG- Business overview- Products offered- Recent developments- MnM viewABB- Business overview- Products offered- Recent developments- MnM viewHONDA MOTOR CO., LTD.- Business overview- Products offered- Recent developments- MnM viewMOBILE INDUSTRIAL ROBOTS- Business overview- Products offered- Recent developments- MnM viewOMRON CORPORATION- Business overview- Products offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products offered- Recent developmentsFANUC CORPORATION- Business overview- Products offered- Recent developmentsIROBOT CORPORATION- Business overview- Products offered- Recent developmentsSAMSUNG- Business overview- Products offered- Recent developmentsSOFTBANK ROBOTICS- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSANYBOTICSBLUE FROG ROBOTICSBOSTON DYNAMICSCLEARPATH ROBOTICS INC.HANGZHOU DEEP ROBOTICSSEIKO EPSON CORPORATIONFETCH ROBOTICS, INC.GREYORANGEGHOST ROBOTICS CORPORATIONHARVEST AUTOMATIONPROMOBOTSHARK ROBOTICSUBTECH ROBOTICS CORP LTDUNITREE ROBOTICSYASKAWA ELECTRIC CORPORATION

- 13.1 RFID MARKET

- 13.2 INTRODUCTION

-

13.3 TAGSUSED TO IDENTIFY ASSETS OR PERSON

-

13.4 READERSFIXED READERS- Fixed readers make for rugged and cost-efficient solutionsHANDHELD READERS- Adopted due to their mobility

-

13.5 SOFTWARE & SERVICESINCREASING ADOPTION OF DATA ANALYSIS AND CLOUD-BASED DATA STORAGE TO DRIVE DEMAND FOR SOFTWARE AND SERVICES

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 MOBILE ROBOTS MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF AUTONOMOUS MOBILE ROBOTS WITH VARIOUS PAYLOAD CAPACITIES

- TABLE 3 AVERAGE SELLING PRICE OF AUTONOMOUS MOBILE ROBOTS, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF AUTONOMOUS MOBILE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD CAPACITY

- TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 DORMAN PRODUCTS DEPLOYED PALLET TRANSPORT 1500 ROBOT OFFERED BY FETCH ROBOTICS TO REDUCE TRAVEL WASTE

- TABLE 9 SADDLE CREEK DEPLOYED MOBILE ROBOTS OFFERED BY LOCUS ROBOTICS TO HANDLE INCREASED ORDER VOLUME

- TABLE 10 MANUFACTURING FIRM DEPLOYED MOBILE ROBOTS OFFERED BY OTTO MOTORS TO AUTOMATE MATERIAL TRANSPORTATION

- TABLE 11 HANDLING SPECIALTY PROVIDED CUSTOM-ENGINEERED AUTOMATED GUIDED VEHICLES TO CLIENT

- TABLE 12 LIST OF PATENTS RELATED TO MARKET

- TABLE 13 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SAFETY STANDARDS FOR MOBILE ROBOTS

- TABLE 19 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 20 MOBILE ROBOTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 PROFESSIONAL ROBOTS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 PROFESSIONAL ROBOTS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 PROFESSIONAL ROBOTS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 PROFESSIONAL ROBOTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 AUTONOMOUS MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 26 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY NAVIGATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY NAVIGATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 30 MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 36 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 AUTOMATED GUIDED VEHICLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 AUTOMATED GUIDED VEHICLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 AUTOMATED GUIDED VEHICLES MARKET, BY NAVIGATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 44 AUTOMATED GUIDED VEHICLES MARKET, BY NAVIGATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 45 AUTOMATED GUIDED VEHICLES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 46 AUTOMATED GUIDED VEHICLES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 47 AUTOMATED GUIDED VEHICLES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 AUTOMATED GUIDED VEHICLES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 PERSONAL & DOMESTIC ROBOTS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 PERSONAL & DOMESTIC ROBOTS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 PERSONAL & DOMESTIC ROBOTS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 PERSONAL & DOMESTIC ROBOTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 MOBILE ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 AGRICULTURAL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 AGRICULTURAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 AGRICULTURAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 AGRICULTURAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 CLEANING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 CLEANING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 CLEANING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 CLEANING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 EDUCATIONAL: MOBILE ROBOTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 EDUCATIONAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 EDUCATIONAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 EDUCATIONAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 HEALTHCARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 68 HEALTHCARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MANUFACTURING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 72 MANUFACTURING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 WAREHOUSING & LOGISTICS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 WAREHOUSING & LOGISTICS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 WAREHOUSING & LOGISTICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 WAREHOUSING & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHERS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 OTHERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 MOBILE ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MOBILE ROBOTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 OVERVIEW OF STRATEGIES ADOPTED BY MOBILE ROBOTS VENDORS

- TABLE 110 AUTONOMOUS MOBILE ROBOTS MARKET SHARE ANALYSIS, 2022

- TABLE 111 COMPANY FOOTPRINT

- TABLE 112 TYPE: COMPANY FOOTPRINT

- TABLE 113 APPLICATION: COMPANY FOOTPRINT

- TABLE 114 REGION: COMPANY FOOTPRINT

- TABLE 115 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 116 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 117 MARKET: PRODUCT LAUNCHES, 2021−2023

- TABLE 118 MOBILE ROBOTS MARKET: DEALS, 2021−2023

- TABLE 119 KUKA AG: COMPANY OVERVIEW

- TABLE 120 KUKA AG: PRODUCT OFFERINGS

- TABLE 121 KUKA AG: PRODUCT LAUNCHES

- TABLE 122 KUKA AG: DEALS

- TABLE 123 ABB: COMPANY OVERVIEW

- TABLE 124 ABB: PRODUCT OFFERINGS

- TABLE 125 ABB: PRODUCT LAUNCHES

- TABLE 126 ABB: DEALS

- TABLE 127 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 128 HONDA MOTOR CO., LTD.: PRODUCT OFFERINGS

- TABLE 129 HONDA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 130 MOBILE INDUSTRIAL ROBOTS: COMPANY OVERVIEW

- TABLE 131 MOBILE INDUSTRIAL ROBOTS: PRODUCT OFFERINGS

- TABLE 132 MOBILE INDUSTRIAL ROBOTS: PRODUCT LAUNCHES

- TABLE 133 MOBILE INDUSTRIAL ROBOTS: DEALS

- TABLE 134 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 135 OMRON CORPORATION: PRODUCT OFFERINGS

- TABLE 136 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 137 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 138 DENSO CORPORATION: PRODUCT OFFERINGS

- TABLE 139 DENSO CORPORATION: DEALS

- TABLE 140 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 141 FANUC CORPORATION: PRODUCT OFFERINGS

- TABLE 142 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 143 FANUC CORPORATION: DEALS

- TABLE 144 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 145 IROBOT CORPORATION: PRODUCT OFFERINGS

- TABLE 146 IROBOT CORPORATION: PRODUCT LAUNCHES

- TABLE 147 IROBOT CORPORATION: DEALS

- TABLE 148 SAMSUNG: COMPANY OVERVIEW

- TABLE 149 SAMSUNG: PRODUCT OFFERINGS

- TABLE 150 SAMSUNG: PRODUCT LAUNCHES

- TABLE 151 SAMSUNG: DEALS

- TABLE 152 SOFTBANK ROBOTICS: COMPANY OVERVIEW

- TABLE 153 SOFTBANK ROBOTICS: PRODUCT OFFERINGS

- TABLE 154 SOFTBANK ROBOTICS: PRODUCT LAUNCHES

- TABLE 155 SOFTBANK ROBOTICS: DEALS

- TABLE 156 RFID MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 157 RFID MARKET, BY OFFERING, 2022–2030 (USD MILLION)

- FIGURE 1 MOBILE ROBOTS MARKET: SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS THROUGH SALES OF MOBILE ROBOTS

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 MARKET, 2019−2028

- FIGURE 8 PROFESSIONAL ROBOTS SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2022

- FIGURE 9 CLEANING SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- FIGURE 10 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2022

- FIGURE 11 ADOPTION OF INDUSTRY 4.0 TECHNOLOGIES IN WAREHOUSING AND INDUSTRIAL PLANTS TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 12 PROFESSIONAL ROBOTS TO ACCOUNT FOR LARGER SHARE OF MARKET DURING 2023–2028

- FIGURE 13 CLEANING SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2023

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 17 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 18 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 19 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 20 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 MOBILE ROBOTS MARKET: ECOSYSTEM MAP

- FIGURE 22 AVERAGE SELLING PRICE OF AUTONOMOUS MOBILE ROBOTS, 2019−2028

- FIGURE 23 AVERAGE SELLING PRICE OF AUTONOMOUS MOBILE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD CAPACITY

- FIGURE 24 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MOBILE ROBOTS VENDORS

- FIGURE 25 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 28 IMPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 31 NO. OF PATENTS GRANTED ANNUALLY OVER LAST 10 YEARS RELATED TO MARKET

- FIGURE 32 MOBILE ROBOTS MARKET, BY TYPE

- FIGURE 33 PROFESSIONAL ROBOTS SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 34 MARKET, BY APPLICATION

- FIGURE 35 CLEANING SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET FOR HEALTHCARE APPLICATIONS FROM 2023 TO 2028

- FIGURE 37 MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 EUROPE: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

- FIGURE 42 AUTONOMOUS MOBILE ROBOTS MARKET: SHARE OF KEY PLAYERS

- FIGURE 43 MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 MOBILE ROBOTS MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 45 KUKA AG: COMPANY SNAPSHOT

- FIGURE 46 ABB: COMPANY SNAPSHOT

- FIGURE 47 HONDA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 IROBOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 52 SOFTBANK GROUP: COMPANY SNAPSHOT

- FIGURE 53 RFID MARKET, BY OFFERING

- FIGURE 54 TAGS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF RFID MARKET DURING FORECAST PERIOD

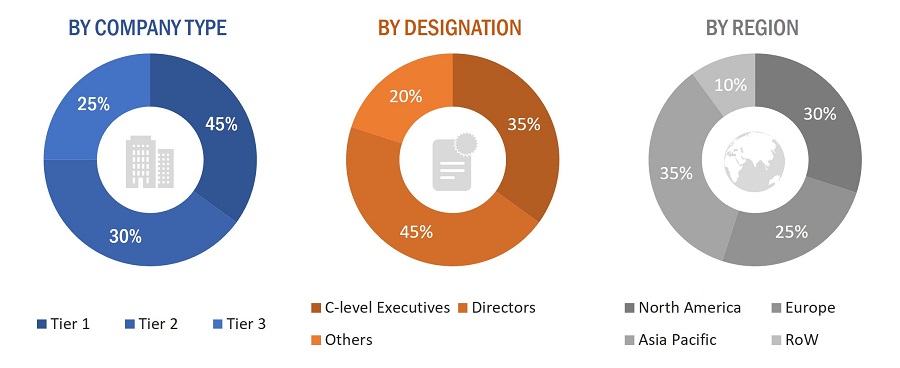

The study involves four major activities that estimate the size of the mobile robots market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the mobile robots market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analysed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply-side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from mobile robots providers, such as KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark) and Omron Automation (US); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Mobile robots are robotic systems that possess the capability to move and navigate autonomously or semi-autonomously in diverse environments, whether indoors or outdoors. These robots are equipped with mobility features like wheels, tracks, or legs, which enable them to traverse various terrains and overcome obstacles. To perceive their surroundings and make informed decisions, mobile robots are typically outfitted with sensors, cameras, and other perception systems. They may also incorporate artificial intelligence and advanced algorithms to execute tasks such as navigation, mapping, object detection, and manipulation. The applications of mobile robots span across a wide range of industries, including manufacturing, logistics, healthcare, agriculture, and household chores.

Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Original equipment manufacturers (OEMs)

- Traders and suppliers

- OEM technology solution providers

- Technology investors

- Associations and industrial bodies

The main objectives of this study are as follows:

- To define, describe, and forecast the mobile robots market based on type and application

- To describe and forecast the size of the market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To provide a detailed overview of the value chain pertaining to the mobile robots market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the mobile robots market

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Mobile Robots Market

Just trying to get a sense of the size of the mobile robot market and market trends. Specifically robotic crawlers for inspection, surveillance, rescue and submerged.

I'm doing my master thesis about this topic. A free sample would help me to complete the thesis.

Need sample brochure of the report. Presenting at World Future Society this week on robotics.

My focus is ground based commercial robot applications with cloud connected intelligence. Telepresence robots are one of the big OTS categories, and I am looking for market size and projections. However, I also want to learn about any companies enabling 3rd party development, and what they are doing. We are still an unfunded startup, so purchase is not possible at this time. I can provide substantial publicity, and may be able to assist you with sponsorship of the conference! This could be worth a great deal more than a copy of the report.

I am studying Industrial engineering & management and currently an intern. I do research into AMRs. I was wondering if you can help me out with some data from various suppliers.

We sell autonomous navigating solution. We would like to know about the market size. We ensure you that we will be a key player of the market.

I am looking into many areas. I am very interested in any information on desktop sized robotic arms, industrial cleaning robotics to midsized are (shopping mall). Packaging designing robotics and any other information beyond that would be great as well.