4

MARKET OVERVIEW

Identify untapped market opportunities and strategic shifts across competitive tiers.

52

5

INDUSTRY TRENDS

Uncover how tariff shifts and ecosystem dynamics reshape AUV industry and global trade strategies.

60

5.1.1

PROMINENT COMPANIES

5.1.2

PRIVATE AND SMALL ENTERPRISES

5.2.1

CONCEPT AND RESEARCH

5.2.2

COMPONENT AND MATERIAL DEVELOPMENT

5.2.4

SYSTEM INTEGRATION AND VALIDATION

5.2.5

POST-DEPLOYMENT SERVICE

5.3.3

PRICE IMPACT ANALYSIS

5.3.4

IMPACT ON COUNTRY/REGION

5.3.5

IMPACT ON END-USE INDUSTRIES

5.3.5.1

MILITARY & DEFENSE

5.3.5.3

ENVIRONMENT PROTECTION & MONITORING

5.3.5.5

ARCHAEOLOGY & EXPLORATION

5.3.5.6

SEARCH & SALVAGE OPERATION

5.4.1

IMPORT SCENARIO (HS CODE 900630)

5.4.2

EXPORT SCENARIO (HS CODE 900630)

5.5.1

CELLULA ROBOTICS: GUARDIAN AUV FOR DEFENSE MISSIONS

5.5.2

FUJITSU AND NATIONAL MARITIME RESEARCH INSTITUTE: DIGITAL TWIN UNDERWATER MONITORING

5.5.3

AUSTRALIAN ECONOMIC ACCELERATOR AND UNIVERSITY OF SYDNEY: SOVEREIGN AUV FOR OFFSHORE INFRASTRUCTURE ASSESSMENT

5.6

KEY CONFERENCES AND EVENTS

5.7

TOTAL COST OF OWNERSHIP

5.8

INVESTMENT AND FUNDING SCENARIO

5.9.1

AVERAGE SELLING PRICE TREND, BY TYPE

5.9.2

AVERAGE SELLING PRICE TREND, BY REGION

5.13

MACROECONOMIC OUTLOOK

5.13.2

GDP TRENDS AND FORECAST

5.13.3

TRENDS IN GLOBAL UNDERWATER VEHICLE INDUSTRY

5.13.4

TRENDS IN GLOBAL MARINE INDUSTRY

5.14.1

DIRECT SALES MODEL

5.14.2

LEASING/AUV-AS-A-SERVICE MODEL

5.14.3

DATA-AS-A-SERVICE (DAAS) MODEL

5.14.4

BUILD–OPERATE–TRANSFER (BOT) MODEL

5.14.5

COLLABORATIVE R&D/CO-DEVELOPMENT MODEL

5.14.6

SUBSCRIPTION/SOFTWARE LICENSING MODEL

5.14.7

TURNKEY INTEGRATED SOLUTION MODEL

6

TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

AI-driven maritime technologies revolutionize underwater navigation, data transfer, and defense with groundbreaking innovations.

91

6.1.1

DOPPLER VELOCITY LOG

6.1.2

FIBER-OPTIC GYROSCOPE-BASED INERTIAL NAVIGATION SYSTEM

6.1.3

ULTRA-SHORT BASELINE ACOUSTIC POSITIONING

6.1.4

LONG-BASELINE ACOUSTIC POSITIONING

6.2

COMPLEMENTARY TECHNOLOGIES

6.2.1

UNDERWATER ACOUSTIC BEACON NETWORK

6.2.2

FIBER-OPTIC DATA LINKS FOR SURFACE-TO-SHORE TRANSFER

6.2.3

HIGH-CAPACITY DATA STORAGE MODULE

6.6.1

TOP USE CASES AND MARKET POTENTIAL

6.6.3

CASE STUDIES OF AI IMPLEMENTATION

6.6.4

INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

6.6.5

CLIENTS’ READINESS TO ADOPT AI/GEN AI

6.7.1

BIG DATA AND OCEAN INTELLIGENCE PLATFORMS

6.7.2

CLOUD AND EDGE COMPUTING INTEGRATION

6.7.3

GEN AI AND DIGITAL TWIN ECOSYSTEMS

6.7.4

IOT-ENABLED MARITIME CONNECTIVITY

7

SUSTAINABILITY AND REGULATORY LANDSCAPE

Navigate global sustainability regulations and standards to drive impactful carbon reduction and eco-innovation.

107

7.1

REGIONAL REGULATIONS AND COMPLIANCE

7.1.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

7.2

SUSTAINABILITY INITIATIVES

7.2.1

CARBON IMPACT REDUCTION

7.3

CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8

CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

Identify unmet needs and decision influencers shaping buying criteria across industries.

115

8.1

DECISION-MAKING PROCESS

8.2

BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

8.2.1

KEY STAKEHOLDERS IN BUYING PROCESS

8.3

ADOPTION BARRIERS AND INTERNAL CHALLENGES

8.4

UNMET NEEDS OF VARIOUS END-USE INDUSTRIES

9

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION & VOLUME, UNITS)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million and Units | 12 Data Tables

120

9.2.1

SUPPORTING COASTAL SURVEILLANCE AND MINE COUNTERMEASURE MISSIONS IN CONFINED WATERS

9.2.2

USE CASE: KONGSBERG’S REMUS-100 FOR VERY SHALLOW WATER MINE COUNTERMEASURE MISSIONS

9.3.1

BRIDGING ENDURANCE AND PAYLOAD FOR SCIENTIFIC AND INDUSTRIAL SEAFLOOR MISSIONS

9.3.2

USE CASE: MBARI’S SEAFLOOR MAPPING DEEP-RATED SURVEY VEHICLE FOR FULLY AUTONOMOUS MISSIONS

9.4.1

ENABLING LONG-RANGE AND MODULAR MISSIONS WITH HEAVY-PAYLOAD CAPACITY

9.4.2

USE CASE: BOEING’S ORCA FOR MODULAR MISSION PACKAGES

10

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION & VOLUME, UNITS)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million and Units | 4 Data Tables

128

10.2.1

OPTIMIZING DEEP-SEA ENDURANCE THROUGH HYDRODYNAMIC STABILITY

10.3.1

IMPROVING ENERGY EFFICIENCY THROUGH FLOW-OPTIMIZED HULL DESIGNS

10.4

STREAMLINED RECTANGULAR STYLE

10.4.1

BALANCING PAYLOAD MODULARITY WITH OPERATIONAL STABILITY FOR INDUSTRIAL TASKS

10.5.1

EXPANDING PAYLOAD FLEXIBILITY AND REDUNDANCY FOR MULTI-SENSOR UNDERWATER MISSIONS

11

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

132

11.2.1

FUELING TRANSITION TO ENERGY-DENSE, LOW-MAINTENANCE AUV OPERATIONS

11.2.2

USE CASE: REMUS SERIES LI-ION BATTERY SYSTEMS DEVELOPED BY SAFT/MATHEWS FOR PROLONGED MISSIONS

11.3.1

ENABLING PERSISTENT OCEAN OBSERVATION THROUGH ENERGY-NEUTRAL PROPULSION

11.3.2

USE CASE: TELEDYNE’S SLOCUM G3 GLIDER FOR LONG ENDURANCE WITH BUOYANCY ENGINE AND WINGS FOR COASTAL PROGRAMS

11.4.1

EXPANDING DEEP-SEA MISSION ENDURANCE THROUGH HYDROGEN AND FUEL-CELL INTEGRATION

11.4.2

USE CASE: EARLY PEM FUEL-CELL AUV PROTOTYPES DELIVER ~4 KW FOR PROPULSION WITH HYDROGEN STORED IN METAL HYDRIDE TANKS

12

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 20 Data Tables

136

12.2.1

INTEGRATION OF ADVANCED SONAR AND BUOYANCY SYSTEMS ENHANCES AUV AUTONOMY AND MISSION SAFETY

12.2.2

FORWARD-LOOKING SONAR

12.3

COMMUNICATION & NETWORKING

12.3.1

SHIFT TOWARD HYBRID ACOUSTIC-OPTICAL LINKS STRENGTHENS REAL-TIME UNDERWATER CONNECTIVITY

12.3.2

UNDERWATER ACOUSTIC COMMUNICATION

12.3.3

SUBSEA WIRELESS OPTICAL COMMUNICATION

12.3.4

SURFACE RF & WI-FI COMMUNICATION

12.3.5

SATELLITE COMMUNICATION

12.4

NAVIGATION & GUIDANCE

12.4.1

PRECISION NAVIGATION TECHNOLOGIES DRIVE ACCURACY AND AUTONOMY IN DEEP-SEA AUV MISSIONS

12.4.2

INERTIAL & DEAD-RECKONING

12.4.2.1

INERTIAL NAVIGATION

12.4.2.2

COMPASS-BASED NAVIGATION

12.4.3

ACOUSTIC NAVIGATION

12.5

PROPULSION & MOBILITY

12.5.1

SHIFT TOWARD ELECTRICALLY DRIVEN MODULAR PROPULSION SYSTEMS ENHANCES AUV ENDURANCE AND EFFICIENCY

12.5.2.1

PROPULSION MOTOR

12.5.3

MOTION & CONTROL ACTUATION

12.5.3.1

FIN CONTROL ACTUATOR

12.5.3.2

SERVO/LINEAR ELECTROMECHANICAL ACTUATOR

12.5.4

BUOYANCY & VERTICAL MOTION

12.5.4.2

VARIABLE BUOYANCY SYSTEM

12.6.1

EXPANDING AUV CAPABILITIES FROM DEEP-SEA MAPPING TO CLIMATE MONITORING

12.6.2

ACOUSTIC IMAGING & MAPPING PAYLOAD

12.6.2.1

SIDE-SCAN SONAR IMAGER

12.6.2.2

MULTIBEAM ECHO SOUNDER

12.6.2.3

SYNTHETIC APERTURE SONAR

12.6.2.4

SUB-BOTTOM PROFILER

12.6.3

OPTICAL IMAGING PAYLOAD

12.6.3.1

HIGH-RESOLUTION DIGITAL STILL CAMERA

12.6.4

ENVIRONMENTAL & OCEANOGRAPHIC SENSOR PAYLOAD

12.6.4.2

BIOGEOCHEMICAL SENSOR

12.6.4.3

ACOUSTIC DOPPLER CURRENT PROFILER

12.7.1

INNOVATIONS IN LIGHTWEIGHT AND PRESSURE-RESISTANT CHASSIS MATERIALS ENHANCE STRUCTURAL EFFICIENCY

12.7.3

FIBER-REINFORCED COMPOSITE

12.8.1

ADVANCES IN HIGH-DENSITY ENERGY STORAGE AND EFFICIENT POWER CONVERSION EXTEND AUV MISSION ENDURANCE

12.8.2.2

PRESSURE-TOLERANT SUBSEA BATTERY SYSTEM

12.8.3

POWER MANAGEMENT & DISTRIBUTION

13

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

155

13.2.1

ENHANCING MISSION DURATION AND DATA STABILITY

13.3.1

IMPROVING OPERATIONAL EFFICIENCY AND RAPID UNDERWATER RESPONSE

14

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COST (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION)

Market Size & Growth Rate Forecast Analysis

158

14.2.1

ENABLING ACCESSIBLE SURVEY OPERATIONS AND WIDENING UNDERWATER PARTICIPATION

14.3.1

BALANCING PERFORMANCE AND COST FOR RELIABLE SUBSEA MISSIONS

14.4.1

ADVANCING DEEP-SEA CAPABILITIES AND SUPPORT COMPLEX UNDERWATER OPERATIONS

15

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 8 Data Tables

161

15.2.1

STRENGTHENING MARITIME SURVEILLANCE AND THREAT DETECTION

15.2.2

BORDER SECURITY & SURVEILLANCE

15.2.3

ANTISUBMARINE WARFARE

15.2.4

ANTI-TRAFFICKING & CONTRABAND MONITORING

15.2.5

ENVIRONMENTAL ASSESSMENT

15.2.6

MINE COUNTERMEASURE IDENTIFICATION

15.3.1

IMPROVING SUBSEA ASSET INTEGRITY AND INSPECTION EFFICIENCY

15.3.3

GEOPHYSICAL SURVEY

15.3.4

DEBRIS/CLEARANCE SURVEY

15.3.5

BASELINE ENVIRONMENTAL ASSESSMENT SURVEY

15.4

ENVIRONMENTAL PROTECTION & MONITORING

15.4.1

SUPPORTING MARINE RESOURCE MANAGEMENT AND POLLUTION CONTROL

15.4.5

EMERGENCY RESPONSE

15.5.1

ADVANCING OCEAN DATA COLLECTION AND CLIMATE OBSERVATION

15.6

ARCHAEOLOGY & EXPLORATION

15.6.1

ENABLING SUBMERGED SITE IDENTIFICATION AND DOCUMENTATION

15.7

SEARCH & SALVAGE OPERATION

15.7.1

ENHANCING UNDERWATER OBJECT DETECTION AND RECOVERY PLANNING

16

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION

Comprehensive coverage of 9 Regions with country-level deep-dive of 16 Countries | 318 Data Tables.

171

16.2.1.1

SUSTAINED DEFENSE PROGRAMS AND EXPANSION OF OFFSHORE INDUSTRIES TO DRIVE MARKET

16.2.2.1

ARCTIC OPERATIONS AND CROSS-AGENCY INITIATIVES TO DRIVE MARKET

16.3.1.1

INCREASED ADOPTION OF UNMANNED MARITIME SYSTEMS TO DRIVE MARKET

16.3.2.1

BALTIC SECURITY REQUIREMENTS TO DRIVE MARKET

16.3.3.1

SEABED PROTECTION EFFORTS TO DRIVE MARKET

16.3.4.1

MEDITERRANEAN SURVEILLANCE PROGRAMS TO DRIVE MARKET

16.3.5.1

NATIONAL RESEARCH AND COASTAL MONITORING TO DRIVE MARKET

16.3.6.1

COLD-WATER OPERATIONS TO DRIVE MARKET

16.4.1.1

NATIONAL R&D PROGRAMS TO DRIVE MARKET

16.4.2.1

GOVERNMENT RESEARCH INITIATIVES TO DRIVE MARKET

16.4.3.1

DEFENSE PROCUREMENT AND DOMESTIC CAPABILITY GROWTH TO DRIVE MARKET

16.4.4.1

DEEP-SEA ENGINEERING AND INDUSTRIAL SPECIALIZATION TO DRIVE MARKET

16.4.5.1

INDIGENOUS DEVELOPMENT AND EXPANDING SUBSEA REQUIREMENTS TO DRIVE MARKET

16.4.6

REST OF ASIA PACIFIC

16.5.2.1

ADVANCED DEFENSE PLATFORMS AND SENSOR INNOVATION TO DRIVE MARKET

16.5.3.1

MULTI-ROLE UNDERWATER MISSIONS TO DRIVE MARKET

16.5.4

REST OF MIDDLE EAST

16.6.1.1

MARITIME ENFORCEMENT PRESSURES AND OFFSHORE INSPECTION NEEDS TO DRIVE MARKET

16.6.2.1

DEFENSE MODERNIZATION AND DEEPWATER SURVEY REQUIREMENTS TO DRIVE MARKET

17

COMPETITIVE LANDSCAPE

Gain insights into market leadership dynamics through strategic analysis and valuation of key players.

286

17.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

17.3

REVENUE ANALYSIS, 2021–2024

17.4

MARKET SHARE ANALYSIS, 2024

17.5

BRAND/PRODUCT COMPARISON

17.6

COMPANY VALUATION AND FINANCIAL METRICS

17.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

17.7.5.1

COMPANY FOOTPRINT

17.7.5.2

REGION FOOTPRINT

17.7.5.3

APPLICATION FOOTPRINT

17.8

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

17.8.1

PROGRESSIVE COMPANIES

17.8.2

RESPONSIVE COMPANIES

17.8.5

COMPETITIVE BENCHMARKING

17.8.5.1

LIST OF START-UPS/SMES

17.8.5.2

COMPETITIVE BENCHMARKING OF START-UPS/SMES

17.9

COMPETITIVE SCENARIO

17.9.3

OTHER DEVELOPMENTS

18

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

315

18.1.1.1

BUSINESS OVERVIEW

18.1.1.2

PRODUCTS OFFERED

18.1.1.3

RECENT DEVELOPMENTS

18.1.3

EXAIL TECHNOLOGIES

18.1.6

TELEDYNE TECHNOLOGIES INCORPORATED

18.1.8

GENERAL DYNAMICS CORPORATION

18.1.9

KAWASAKI HEAVY INDUSTRIES, LTD

18.1.10

LOCKHEED MARTIN CORPORATION

18.1.12

L3HARRIS TECHNOLOGIES, INC.

18.1.13

BOSTON ENGINEERING

18.1.16

INTERNATIONAL SUBMARINE ENGINEERING LIMITED

18.2.2

FALMOUTH SCIENTIFIC, INC

18.2.3

MITSUBISHI HEAVY INDUSTRIES, LTD.

18.2.9

OCEANSCAN - MARINE SYSTEMS & TECHNOLOGY

19

RESEARCH METHODOLOGY

383

19.1.1.1

KEY DATA FROM SECONDARY SOURCES

19.1.2.1

PRIMARY INTERVIEW PARTICIPANTS

19.1.2.2

KEY DATA FROM PRIMARY SOURCES

19.1.2.3

BREAKDOWN OF PRIMARY INTERVIEWS

19.2

MARKET SIZE ESTIMATION

19.2.1

BOTTOM-UP APPROACH

19.2.3

BASE NUMBER CALCULATION

19.4.1

SUPPLY-SIDE INDICATORS

19.4.2

DEMAND-SIDE INDICATORS

19.5

RESEARCH ASSUMPTIONS

19.6

RESEARCH LIMITATIONS

20.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

20.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES

TABLE 2

UNMET NEEDS AND WHITE SPACES

TABLE 3

CROSS-SECTOR OPPORTUNITIES

TABLE 4

STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

TABLE 5

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 6

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 7

COMPONENT-LEVEL PRICE IMPACT ANALYSIS

TABLE 8

IMPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 9

EXPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 10

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 11

TOTAL COST OF OWNERSHIP OF AUTONOMOUS UNDERWATER VEHICLES

TABLE 12

AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY TYPE, 2019–2024 (USD/UNIT)

TABLE 13

AVERAGE SELLING PRICE TREND OF SHALLOW AUTONOMOUS UNDERWATER VEHICLES, 2019–2024 (USD/UNIT)

TABLE 14

AVERAGE SELLING PRICE TREND OF LARGE AUTONOMOUS UNDERWATER VEHICLES, 2019–2024 (USD/UNIT)

TABLE 15

AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY REGION, 2019–2024 (USD MILLION)

TABLE 16

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021–2024 (UNITS)

TABLE 17

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025–2030 (UNITS)

TABLE 18

EUROPE: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021–2024 (UNITS)

TABLE 19

EUROPE: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025–2030 (UNITS)

TABLE 20

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021–2024 (UNITS)

TABLE 21

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025–2030 (UNITS)

TABLE 22

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021–2024 (UNITS)

TABLE 23

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025–2030 (UNITS)

TABLE 24

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY REGION, 2021–2024 (UNITS)

TABLE 25

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY REGION, 2025–2030 (UNITS)

TABLE 26

NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 27

NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 28

EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 29

EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 30

ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 31

ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 32

MIDDLE EASTERN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 33

MIDDLE EASTERN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 34

REST OF THE WORLD AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 35

REST OF THE WORLD AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 36

BILL OF MATERIALS FOR AUTONOMOUS UNDERWATER VEHICLES, 2024

TABLE 37

GDP PERCENTAGE CHANGE, BY COUNTRY, 2021–2029

TABLE 38

EVOLUTION OF AUTONOMOUS UNDERWATER VEHICLES

TABLE 40

DEEP-SEA MINERAL EXPLORATION NETWORKS: FUTURE OF AUTONOMOUS SEABED RESOURCE MAPPING

TABLE 41

AUTONOMOUS MCM AUV SYSTEMS: FUTURE OF INTELLIGENT UNDERSEA DEFENSE OPERATIONS

TABLE 42

TOP USE CASES AND MARKET POTENTIAL

TABLE 44

CASE STUDIES OF AI IMPLEMENTATION

TABLE 45

INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

TABLE 46

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 47

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 48

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 49

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 50

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 51

GLOBAL DESIGN, STRUCTURAL, AND OPERATIONAL STANDARDS

TABLE 52

GLOBAL ELECTRICAL, COMMUNICATION, AND CYBERSECURITY STANDARDS

TABLE 53

GLOBAL QUALITY, ENVIRONMENTAL, AND COMPLIANCE STANDARDS

TABLE 54

CARBON IMPACT REDUCTION

TABLE 55

ECO-APPLICATIONS

TABLE 56

CERTIFICATIONS, LABELING, AND ECO-STANDARDS

TABLE 57

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SPEED (%)

TABLE 58

KEY BUYING CRITERIA, BY SPEED

TABLE 59

UNMET NEEDS IN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

TABLE 60

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 61

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 62

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 63

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 64

SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 65

SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 66

SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 67

SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 68

LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 69

LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 70

LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 71

LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 72

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 73

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 74

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (UNITS)

TABLE 75

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (UNITS)

TABLE 76

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 77

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 78

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 79

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 80

COLLISION AVOIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 81

COLLISION AVOIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 82

COMMUNICATION & NETWORKING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 83

COMMUNICATION & NETWORKING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 84

NAVIGATION & GUIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 85

NAVIGATION & GUIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 86

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY INERTIAL & DEAD-RECKONING SYSTEM, 2021–2024 (USD MILLION)

TABLE 87

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY INERTIAL & DEAD-RECKONING SYSTEM, 2025–2030 (USD MILLION)

TABLE 88

PROPULSION & MOBILITY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 89

PROPULSION & MOBILITY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 90

CHASSIS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 91

CHASSIS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 92

POWER & ENERGY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 93

POWER & ENERGY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 94

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY ENERGY STORAGE SYSTEM, 2021–2024 (USD MILLION)

TABLE 95

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY ENERGY STORAGE SYSTEM, 2025–2030 (USD MILLION)

TABLE 96

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY POWER MANAGEMENT & DISTRIBUTION SYSTEM, 2021–2024 (USD MILLION)

TABLE 97

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY POWER MANAGEMENT & DISTRIBUTION SYSTEM, 2025–2030 (USD MILLION)

TABLE 98

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 99

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 100

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 101

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 102

MILITARY & DEFENSE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 103

MILITARY & DEFENSE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 104

OIL & GAS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 105

OIL & GAS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 106

ENVIRONMENTAL PROTECTION & MONITORING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 107

ENVIRONMENTAL PROTECTION & MONITORING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 108

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 109

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 110

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021–2024 (UNITS)

TABLE 111

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025–2030 (UNITS)

TABLE 112

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 113

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 114

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 115

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 116

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 117

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 118

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 119

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 120

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 121

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 122

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 123

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 124

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 125

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 126

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 127

NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 128

NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 129

NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 130

NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 131

NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 132

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 133

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 134

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 135

NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 136

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 137

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 138

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 139

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 140

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 141

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 142

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 143

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 144

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 145

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 146

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 147

US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 148

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 149

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 150

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 151

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 152

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 153

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 154

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 155

CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 156

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 157

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 158

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 159

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 160

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 161

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 162

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 163

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 164

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 165

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 166

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 167

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 168

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 169

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 170

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 171

EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 172

EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 173

EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 174

EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 175

EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 176

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 177

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 178

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 179

EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 180

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 181

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 182

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 183

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 184

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 185

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 186

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 187

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 188

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 189

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 190

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 191

UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 192

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 193

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 194

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 195

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 196

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 197

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 198

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 199

GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 200

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 201

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 202

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 203

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 204

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 205

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 206

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 207

FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 208

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 209

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 210

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 211

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 212

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 213

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 214

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 215

ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 216

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 217

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 218

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 219

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 220

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 221

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 222

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 223

SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 224

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 225

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 226

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 227

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 228

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 229

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 230

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 231

NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 232

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 233

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 234

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 235

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 236

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 237

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 238

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 239

REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 240

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 241

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 242

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 243

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 244

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 245

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 246

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 247

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 248

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 249

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 250

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 251

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 252

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 253

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 254

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 255

ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 256

ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 257

ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 258

ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 259

ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 260

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 261

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 262

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 263

ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 264

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 265

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 266

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 267

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 268

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 269

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 270

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 271

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 272

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 273

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 274

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UUNITS)

TABLE 275

CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 276

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 277

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 278

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 279

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 280

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 281

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 282

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 283

JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 284

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 285

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 286

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 287

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 288

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 289

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 290

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 291

AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 292

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 293

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 294

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 295

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 296

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 297

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 298

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 299

SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 300

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 301

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 302

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 303

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 304

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 305

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 306

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 307

INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 308

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 309

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 310

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 311

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 312

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 313

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 314

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 315

REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 316

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 317

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 318

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 319

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 320

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 321

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 322

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 323

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 324

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 325

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 326

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 327

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 328

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 329

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 330

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 331

MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 332

MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 333

MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 334

MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 335

MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 336

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 337

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 338

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 339

MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 340

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 341

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 342

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 343

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 344

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 345

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 346

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 347

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 348

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 349

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 350

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 351

SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 352

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 353

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 354

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 355

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 356

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 357

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 358

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 359

UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 360

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 361

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 362

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 363

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 364

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 365

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 366

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 367

ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 368

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 369

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 370

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 371

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 372

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 373

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 374

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 375

TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 376

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 377

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 378

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 379

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 380

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 381

REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 382

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 383

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 384

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 385

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 386

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 387

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 388

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 389

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 390

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 391

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 392

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 393

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 394

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 395

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 396

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 397

REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 398

REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 399

REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 400

REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 401

REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 402

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 403

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 404

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (UNITS)

TABLE 405

REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (UNITS)

TABLE 406

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021–2024 (USD MILLION)

TABLE 407

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

TABLE 408

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 409

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 410

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 411

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 412

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 413

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 414

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 415

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 416

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 417

AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 418

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 419

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 420

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 421

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 422

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 423

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 424

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021–2024 (UNITS)

TABLE 425

LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (UNITS)

TABLE 426

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025

TABLE 427

AUTONOMOUS UNDERWATER VEHICLE MARKET: DEGREE OF COMPETITION

TABLE 428

REGION FOOTPRINT

TABLE 429

APPLICATION FOOTPRINT

TABLE 431

SPEED FOOTPRINT

TABLE 432

LIST OF START-UPS/SMES

TABLE 433

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 434

AUTONOMOUS UNDERWATER VEHICLE MARKET: PRODUCT LAUNCHES, 2021–2025

TABLE 435

AUTONOMOUS UNDERWATER VEHICLE MARKET: DEALS, 2021–2025

TABLE 436

AUTONOMOUS UNDERWATER VEHICLE MARKET: OTHER DEVELOPMENTS, 2021–2025

TABLE 437

KONGSBERG: COMPANY OVERVIEW

TABLE 438

KONGSBERG: PRODUCTS OFFERED

TABLE 439

KONGSBERG: DEALS

TABLE 440

KONGSBERG: OTHER DEVELOPMENTS

TABLE 441

SAIPEM S.P.A.: COMPANY OVERVIEW

TABLE 442

SAIPEM S.P.A.: PRODUCTS OFFERED

TABLE 443

SAIPEM S.P.A.: OTHER DEVELOPMENTS

TABLE 444

EXAIL TECHNOLOGIES: COMPANY OVERVIEW

TABLE 445

EXAIL TECHNOLOGIES: PRODUCTS OFFERED

TABLE 446

EXAIL TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 447

EXAIL TECHNOLOGIES: DEALS

TABLE 448

EXAIL TECHNOLOGIES: OTHER DEVELOPMENTS

TABLE 449

BAE SYSTEMS: COMPANY OVERVIEW

TABLE 450

BAE SYSTEMS: PRODUCTS OFFERED

TABLE 451

BAE SYSTEMS: PRODUCT LAUNCHES

TABLE 452

BAE SYSTEMS: DEALS

TABLE 453

BAE SYSTEMS: OTHER DEVELOPMENTS

TABLE 454

SAAB AB: COMPANY OVERVIEW

TABLE 455

SAAB AB: PRODUCTS OFFERED

TABLE 457

SAAB AB: OTHER DEVELOPMENTS

TABLE 458

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

TABLE 459

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

TABLE 460

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

TABLE 461

TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

TABLE 462

TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

TABLE 463

HII: COMPANY OVERVIEW

TABLE 464

HII: PRODUCTS OFFERED

TABLE 466

HII: OTHER DEVELOPMENTS

TABLE 467

GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

TABLE 468

GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

TABLE 469

GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

TABLE 470

KAWASAKI HEAVY INDUSTRIES, LTD: COMPANY OVERVIEW

TABLE 471

KAWASAKI HEAVY INDUSTRIES, LTD: PRODUCTS OFFERED

TABLE 472

KAWASAKI HEAVY INDUSTRIES, LTD: DEALS

TABLE 473

KAWASAKI HEAVY INDUSTRIES, LTD: OTHER DEVELOPMENTS

TABLE 474

LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

TABLE 475

LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

TABLE 476

TKMS: COMPANY OVERVIEW

TABLE 477

TKMS: PRODUCTS OFFERED

TABLE 478

TKMS: OTHER DEVELOPMENTS

TABLE 479

L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

TABLE 480

L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

TABLE 481

L3HARRIS TECHNOLOGIES, INC.: DEALS

TABLE 482

L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

TABLE 483

BOSTON ENGINEERING: COMPANY OVERVIEW

TABLE 484

BOSTON ENGINEERING: PRODUCTS OFFERED

TABLE 485

BOSTON ENGINEERING: OTHER DEVELOPMENTS

TABLE 486

BOEING: COMPANY OVERVIEW

TABLE 487

BOEING: PRODUCTS OFFERED

TABLE 488

BOEING: OTHER DEVELOPMENTS

TABLE 489

XYLEM INC: COMPANY OVERVIEW

TABLE 490

XYLEM INC: PRODUCTS OFFERED

TABLE 491

XYLEM INC: DEALS

TABLE 492

XYLEM INC: OTHER DEVELOPMENTS

TABLE 493

INTERNATIONAL SUBMARINE ENGINEERING LIMITED: COMPANY OVERVIEW

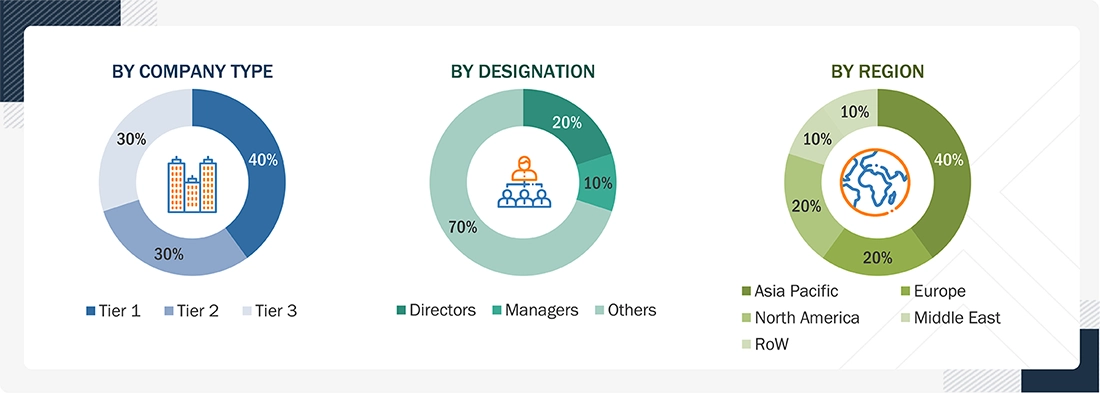

TABLE 494

INTERNATIONAL SUBMARINE ENGINEERING LIMITED: PRODUCTS OFFERED

TABLE 495

INTERNATIONAL SUBMARINE ENGINEERING LIMITED: PRODUCT LAUNCHES

TABLE 496

INTERNATIONAL SUBMARINE ENGINEERING LIMITED: OTHER DEVELOPMENTS

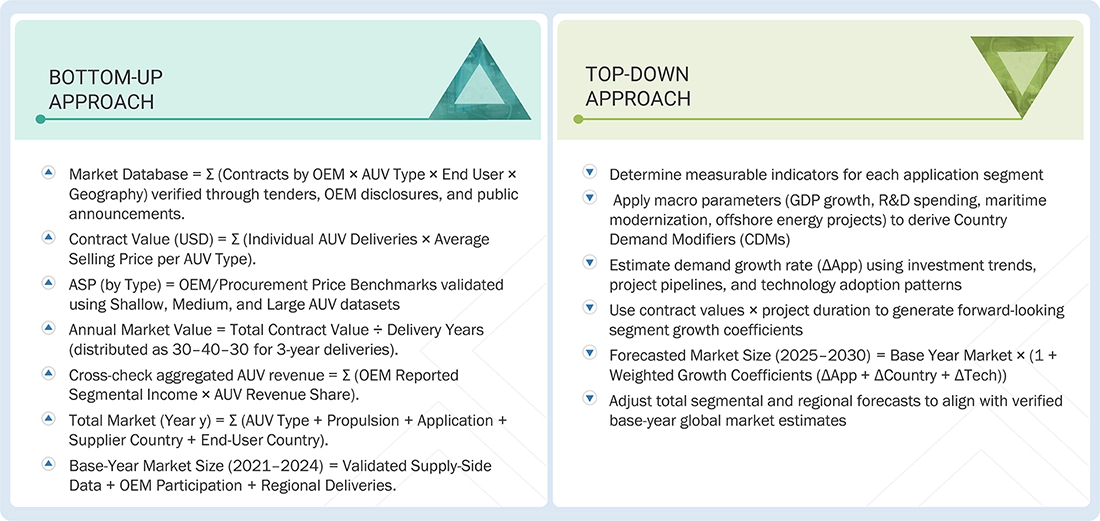

TABLE 497

NORTHROP GRUMMAN: COMPANY OVERVIEW

TABLE 498

NORTHROP GRUMMAN: PRODUCTS OFFERED

TABLE 499

NORTHROP GRUMMAN: OTHER DEVELOPMENTS

TABLE 500

MSUBS: COMPANY OVERVIEW

TABLE 501

FALMOUTH SCIENTIFIC, INC: COMPANY OVERVIEW

TABLE 502

MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

TABLE 503

ECOSUB ROBOTICS: COMPANY OVERVIEW

TABLE 504

EELUME AS: COMPANY OVERVIEW

TABLE 505

HYDROMEA: COMPANY OVERVIEW

TABLE 506

GRAAL TECH SRL: COMPANY OVERVIEW

TABLE 507

BALTROBOTICS: COMPANY OVERVIEW

TABLE 508

OCEANSCAN - MARINE SYSTEMS & TECHNOLOGY: COMPANY OVERVIEW

TABLE 509

RTSYS: COMPANY OVERVIEW

FIGURE 1

AUTONOMOUS UNDERWATER VEHICLE MARKET SEGMENTATION

FIGURE 2

KEY INSIGHTS AND MARKET HIGHLIGHTS

FIGURE 3

KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

FIGURE 4

DISRUPTIVE TRENDS SHAPING MARKET

FIGURE 5

HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

FIGURE 6

ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 7

GROWING DEMAND FOR RELIABLE UNDERWATER SURVEILLANCE, INSPECTION, AND DATA-COLLECTION CAPABILITIES TO DRIVE MARKET

FIGURE 8

MILITARY & DEFENSE TO SECURE LEADING POSITION DURING FORECAST PERIOD

FIGURE 9

MINI SEGMENT TO HOLD HIGHER SHARE THAN MICRO/SMALL SEGMENT IN 2025

FIGURE 10

PROPULSION & MOBILITY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 11

UNDERWATER ACOUSTIC COMMUNICATION TO ACQUIRE LARGEST SHARE IN 2025

FIGURE 12

AUTONOMOUS UNDERWATER VEHICLE MARKET DYNAMICS

FIGURE 13

ECOSYSTEM ANALYSIS

FIGURE 14

VALUE CHAIN ANALYSIS

FIGURE 15

IMPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 16

EXPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 17

INVESTMENT AND FUNDING SCENARIO, 2021−2024 (USD MILLION)

FIGURE 18

INVESTMENT AND FUNDING SCENARIO, BY COUNTRY, 2021−2025 (USD MILLION)

FIGURE 19

AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY TYPE, 2019–2024 (USD/UNIT)

FIGURE 20

AVERAGE SELLING PRICE TREND OF SHALLOW AUTONOMOUS UNDERWATER VEHICLES, 2019–2024 (USD/UNIT)

FIGURE 21

AVERAGE SELLING PRICE TREND OF LARGE AUTONOMOUS UNDERWATER VEHICLES, 2019–2024 (USD/UNIT)

FIGURE 22

AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY REGION, 2019–2024 (USD MILLION)

FIGURE 23

TECHNOLOGY ROADMAP FOR AUTONOMOUS UNDERWATER VEHICLES

FIGURE 24

PATENT ANALYSIS

FIGURE 25

FUTURE APPLICATIONS

FIGURE 26

IMPACT OF AI/GEN AI

FIGURE 27

ADOPTION READINESS OF DIGITAL MEGATRENDS

FIGURE 28

DECISION-MAKING FACTORS

FIGURE 29

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SPEED

FIGURE 30

KEY BUYING CRITERIA, BY SPEED

FIGURE 31

ADOPTION BARRIERS AND INTERNAL CHALLENGES

FIGURE 32

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025–2030 (USD MILLION)

FIGURE 33

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025–2030 (USD MILLION)

FIGURE 34

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

FIGURE 35

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

FIGURE 36

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED, 2025–2030 (USD MILLION)

FIGURE 37

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

FIGURE 38

AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025–2030

FIGURE 39

NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

FIGURE 40

EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

FIGURE 41

ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

FIGURE 42

MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

FIGURE 43

REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

FIGURE 44

REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021–2024 (USD MILLION)

FIGURE 45

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 46

BRAND/PRODUCT COMPARISON

FIGURE 47

FINANCIAL METRICS (EV/EBITDA)

FIGURE 48

COMPANY VALUATION (USD BILLION)

FIGURE 49

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 50

COMPANY FOOTPRINT

FIGURE 51

COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

FIGURE 52

KONGSBERG: COMPANY SNAPSHOT

FIGURE 53

SAIPEM S.P.A.: COMPANY SNAPSHOT

FIGURE 54

EXAIL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 55

BAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 56

SAAB AB: COMPANY SNAPSHOT

FIGURE 57

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

FIGURE 58

HII: COMPANY SNAPSHOT

FIGURE 59

GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

FIGURE 60

KAWASAKI HEAVY INDUSTRIES, LTD: COMPANY SNAPSHOT

FIGURE 61

LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

FIGURE 62

TKMS: COMPANY SNAPSHOT

FIGURE 63

L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 64

BOEING: COMPANY SNAPSHOT

FIGURE 65

XYLEM INC: COMPANY SNAPSHOT

FIGURE 66

NORTHROP GRUMMAN: COMPANY SNAPSHOT

FIGURE 67

RESEARCH DESIGN MODEL

FIGURE 68

RESEARCH DESIGN

FIGURE 69

KEY INDUSTRY INSIGHTS

FIGURE 70

BOTTOM-UP APPROACH

FIGURE 71

TOP-DOWN APPROACH

FIGURE 72

DATA TRIANGULATION

User

Sep, 2019

Have you profiled L3Harris technologies? I believe they are one of the top vendors in the AUV market. Apart from the one's mentioned in the company profile chapter what other companies have profiled?.

Tracey

Jul, 2018

I want to speak to the analyst who wrote this to get more insight for an article about the growth and potential (and pitfalls) of the underwater drone market. Also would like to understand the methodology for the same. .

Andrew

Oct, 2017

Hi, We are a start up company and would very much like to view this report but we don't have 5k or 8k to do so, do you have any deals that you can offer us as a start up company? Also would like to understand the payloads such as cameras, sensors, etc. and their use in Torpedo's. .

User

Sep, 2019

Can you provide me comparitive qualitative and quantitave analysis of ROV and AUV? Make sure to provide unit shipments and ASP of ROV and AUV. Also provide me the top 10 vendors in the ROV market. .

User

Sep, 2019

Is there any scope for new entrants in the market? If yes please provide me few start-ups in the market along with entry barriers in the market. Information on best practices in the market will also be well appriciated..

User

Nov, 2019

Have you provided information on ASP and unit shipment of each type of AUV i.e., shallow, medium and large? Can you also provide me both qualitative and quantitative information on each type and its application along with top vendors in each type?.

Pat

Oct, 2015

Neptune has recently completed its first deep water AUV survey in oil and gas. However, I would appreciate more information on defense, scientific and geography markets across all water depths as we have not had much visibility on this and believe we can use our vehicle for numerous purposes..

Bhushan

Oct, 2016

How AUVs are associated with the environmental protection and oceanography? .

Allison

Oct, 2017

Hello, I am a PhD student in Engineering/Oceanography concentrating on the technological development of AUVs. Would it be possible to request a sample of this report? Are there any discounts available for students at academic institutions who are using this information for research? .

sandy

Sep, 2015

Have been involved for many years now in providing Logistic/Customs Support Services to Clients who operate AUV Systems Worldwide. What are the latest trends of AUVs in military and defense and oil & gas industries.

admiral

Jun, 2015

What are the various Technologies and Types covered in the research. Also I would like to understand the opportunities and how government initiatives would be a driving factor for this market>?.

Michal

May, 2017

I would like to understand about acquisitions and or technology purchases made by market players (purchases of startups, R&D firms or purchases of licenses form universities etc..) in the AUV market. Have you covered this in your scope?.

User

Mar, 2019

Does your report have information on AUV batteries and various types of AUV batteries? Also can you provide me quantitative information on various AUV batteries? It should also include upcoming AUV battery technologies along with top vendor in each AUV battery type. .

Jerry

Feb, 2019

Hello. I am the founder of a newly formed autonomous underwater vehicle and I am interested in this report so we can better identify our target markets and customers. Also I would like to know the major areas that have been covered in this market. .

Ibrahim

Jan, 2019

We are a team of Electrical Engineering students from ITB (Bandung Institute of Technology) developing an AUV with an open source system for our capstone design project. The project is being developed for academicals maritime research purposes needed in Indonesia as it is the largest archipelago in the world. We request access for this pdf because we need a source of information for researching the global market for AUV development, as the Indonesian market for undersea exploration is currently very limited..