Modified Starch Market Trends, Growth & Forecast [Latest]

Modified Starch Market By Type (Physically Modified Starch, Chemically Modified Starch, Enzymatically Modified Starch), Application (Food, Industrial, Animal Feed, Pharmaceutical & Personal Care), Form (Dry, Liquid), Source, Function, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

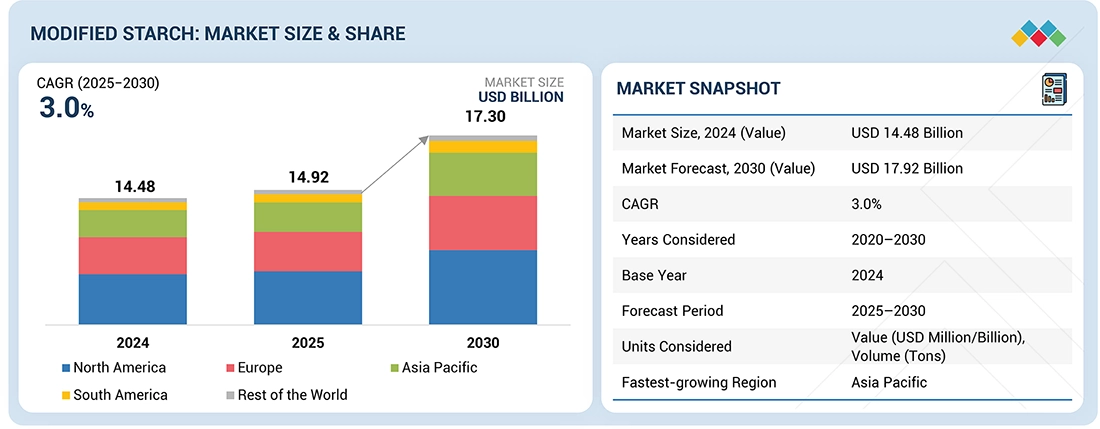

The modified starch market is projected to reach USD 17.30 billion by 2030 from USD 14.92 billion in 2025, at a CAGR of 3.0%. The market is witnessing significant growth due to the increasing awareness about the natural ingredients and cost-effectiveness offered by them, along with the enhanced functionalities they provide in comparison to native starch.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific modified starch market is estimated to account for a 56.9% revenue share in 2025.

-

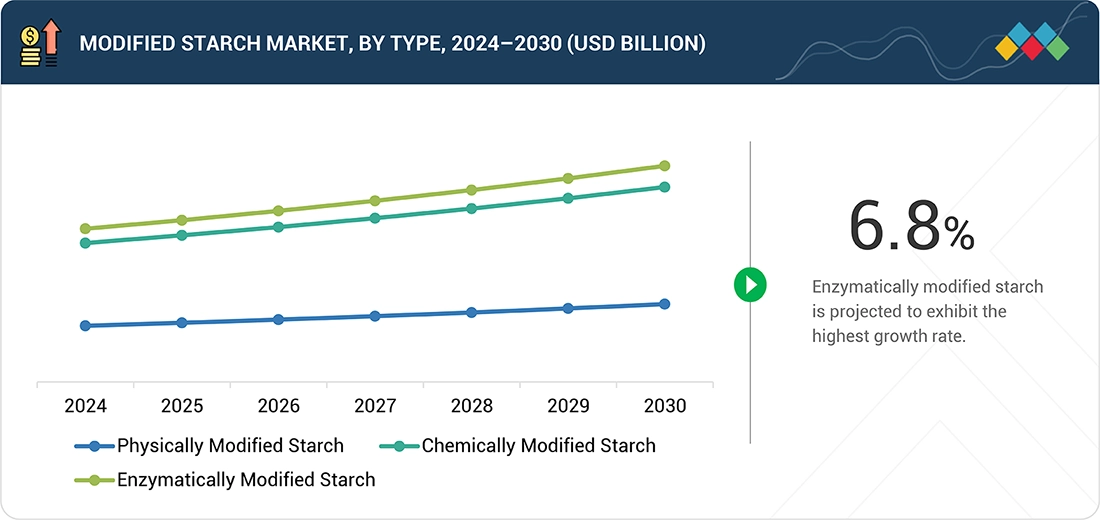

BY TYPEBy type, the enzymatically modified starch segment is set to register a higher CAGR of 6.8%.

-

BY APPLICATIONBy application, the industrial applications segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY SOURCEBy source, the corn/maize segment is estimated to dominate the market.

-

BY FORMBy form, the dry segment is estimated to hold a significant market share.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSADM (US), Cargill (US), Ingredion (US), Tate & Lyle (UK), Roquette Frères (France), and Avebe U.A. (Netherlands) were identified as some of the star players in the modified starch market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies Qingdao CBH Co., Ltd, Shubham Starch Chem Pvt. Ltd., and Everest Starch, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The modified starch market is expected to grow rapidly driven by rising demand for convenience and processed foods, expanding use in industrial applications (paper, textiles, adhesives), continuous innovations in starch modification technologies, and increased investments by major manufacturers to expand capacity and develop specialty high-functionality starches.

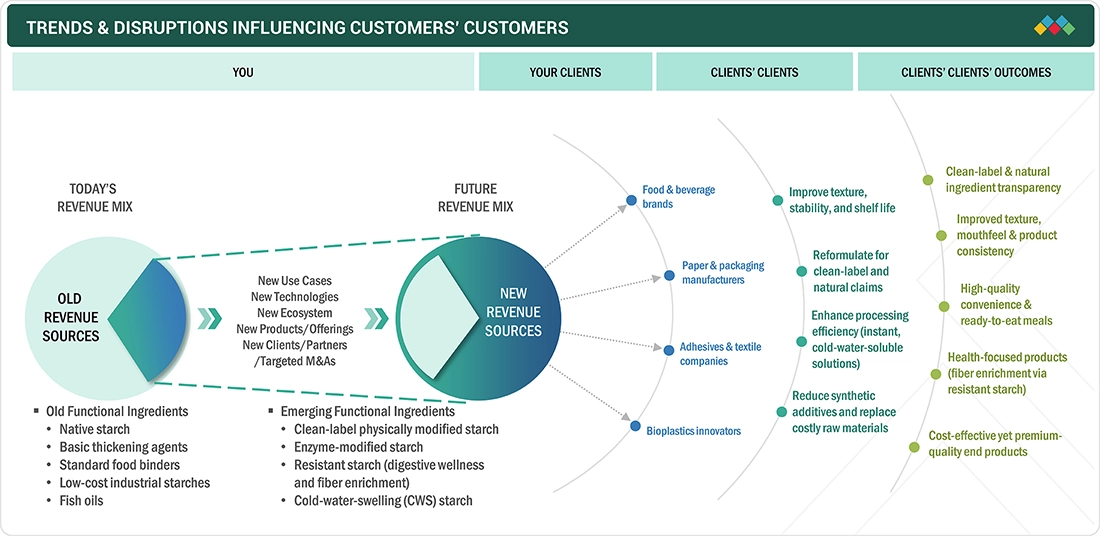

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The revenue impact for modified starch players comes from shifts in the needs of their customers’ customers. As food brands, paper makers, adhesives, textiles, and bioplastics companies push for clean-label, efficiency, and better functionality, demand moves from basic native starches to advanced modified and specialty starches. These changing end-user trends boost the relevance of new hotbets like clean-label modified starch, resistant starch, and cold-water-swelling starch, ultimately shaping the growth and revenues of modified starch manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for convenience and processed food

-

Functional properties and versatility of modified starch in food applications

Level

-

Limited availability and high cost of natural additives

-

Growth of alternative solutions such as gum arabic

Level

-

Emerging alternative sources for modified starch

-

Untapped applications across food, pharma, industrial, and bioplastics segments

Level

-

Stringent regulatory approval requirements

-

Rising raw material costs (cassava, corn, potato)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for convenience and processed food

Convenience foods are a part of daily diets for consumers in most developed countries. Convenience foods require extensive processing and preparation, which is facilitated by the use of technological innovations in preservation, packaging, freezing, and artificial flavorings & ingredients, among others. Based on their annual consumption rates, it is evident that convenience foods are popular in North American and European countries. Globalization and the resultant changing lifestyles have also led to an increase in the consumption of convenience food in other countries around the world, especially in the booming markets of Asia, subsequently leading to an increased demand for modified starch.

Restraint: Growth of alternative solutions such as gum arabic

The application of starch derivatives is growing in the food & beverages sector. The global beverages sector is witnessing growth as an application of modified starches. However, the growth and preference of gum Arabic over modified starch act as a restraint for the growth of this market. Studies have shown that beverages stabilized with sources of gum arabic attain better stability than those with modified starches. Apart from beverages, gum arabic is also rising as a threat to modified starches in confectionery, where it is utilized to prevent sugar crystallization.

Opportunity: Emerging alternative sources for modified starch

The US ethanol policy and the growing demand for wheat as a raw material for biofuel generation in European countries have indirectly posed problems for the modified starch market. The availability of corn, primarily exported by the US, and wheat, Europe’s prime starch commodity, is expected to decrease owing to the ethanol policies in these regions. This, coupled with the increasing demand for modified starch in various industry sectors, necessitates the need to tap other sources of starch. Cassava is one such source that has already been addressed. Although it has been extensively introduced into the industry, its full potential is yet to be tapped. Similarly, rice, yam, and tubers, which are abundantly available in Asia, Africa, South America, and Oceania, need to be researched. Bean starch is an example of an untapped source for food applications, which needs focus and presents an opportunity for innovation in the modified starch industry. Modified bean starch may improve the quality of fresh, gluten-free bread. It has been known to boost its elasticity, potentially offering better texture in the final loaf. Such findings could lead to enhanced products for the already blossoming gluten-free food market.

Challenge: Stringent regulatory approval requirements

The Asian markets are the most lenient in their regulations regarding health claims that may be used for modified starch. The US market, however, has stricter regulations, and there are no health claims for food additives; however, structure or function claims are permitted. European markets have the strictest regulations regarding health claims for modified starch. Manufacturers and distributors face challenges in production & distribution due to these strict laws & regulations.

modified-starch-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Focus on clean-label and specialty starches derived from various sources for dairy, bakery, and beverages | Innovation in functional ingredients | Ability to meet the rising demand for healthier food formulations |

|

Development of modified starches for food applications (thickeners, stabilizers, texturizers) | Delivering the viscosity, texture, and stability of traditional cook-up starches without the need for cooking |

|

Food-grade and nutrition-focused starch derivatives | Provides unique technical and texture properties suited to sauces that require stability under challenging conditions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The modified starch ecosystem consists of manufacturers, regulatory bodies, end-use industries, and technology providers. It is a mature yet steadily evolving ecosystem driven by innovations in starch modification, cleaner-label requirements, and broader industrial adoption. Leading manufacturers and solution providers play a central role in developing high-functionality starches, while regulatory agencies ensure product safety and compliance. Key end users in food, beverages, paper, textiles, and consumer goods drive continuous demand for performance-enhancing and cost-efficient starch solutions, shaping growth opportunities across the value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Modified Starch Market, by Type

Physically modified starch is gaining strong market traction due to its instant solubility and ease of use in food and industrial applications. Unlike native starches, it is processed through heat and drying to rupture the granules, allowing it to dissolve in cold water without requiring further cooking, making it ideal for instant foods, ready-to-mix beverages, and pharmaceutical tablets.

Modified Starch Market, by Source

Corn starch dominates the modified starch market because of its abundant availability, low production cost, strong global supply chain, and versatility across food and industrial applications. Its consistent quality, high starch yield, and well-established processing technologies make it the preferred base for most modified starch formulations.

Modified Starch Market, by Form

The dry segment is estimated to dominate the modified starch market. The powder or dry segment is the most widely used, as it can be easily incorporated into various kinds of products, such as food, beverages, cosmetics, beauty, and personal care. Modified starch in the powder form is easy to store for a longer period, as starch is more stable in its dry form and easy to transport, as it does not require specialized equipment. Also, manufacturers find it easy to handle.

Modified Starch Market, by Application

The modified starch market, by application, is projected to dominate the food & beverages segment. The segment is projected to grow at the highest CAGR during the forecast period. The dominance of this application can be attributed to the growing significance of varied functionality and continued usage of starch in a diverse range of food & beverage applications. Modified starch, by providing livestock with the essential nutrients, improves their digestion and overall health.

REGION

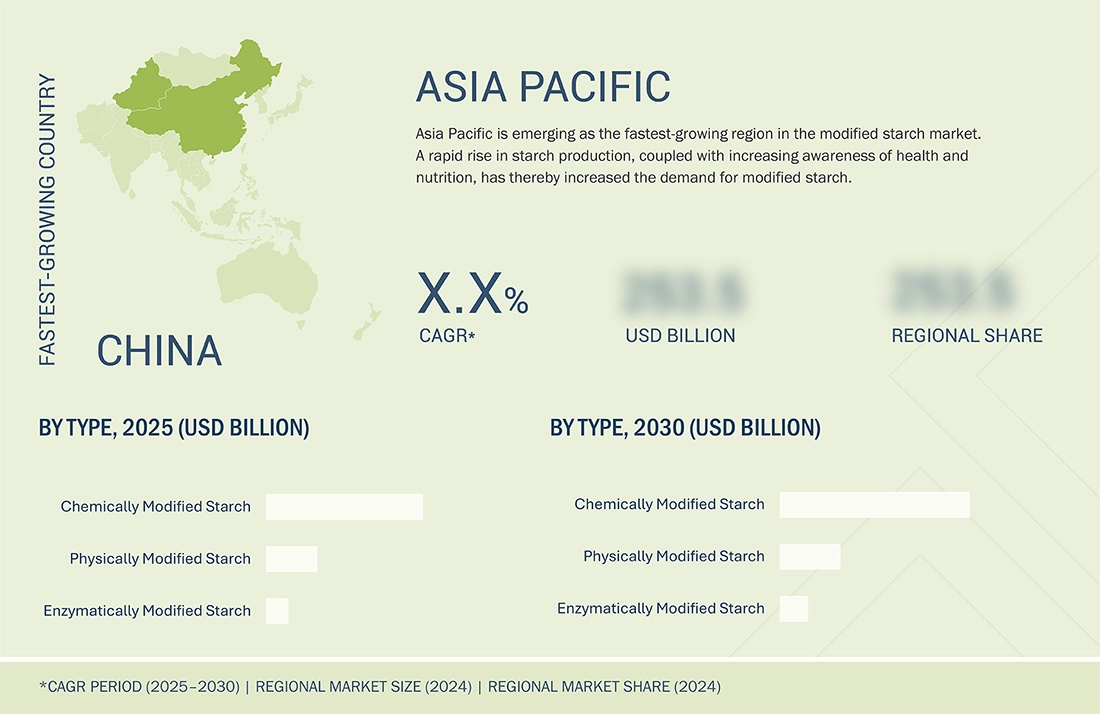

Asia Pacific to be fastest-growing region in global modified starch market during the forecast period

The Asia Pacific modified starch market is projected to register the highest CAGR during the forecast period. This dominance is attributed to factors such as the region’s large-scale production and consumption of modified starch in food and beverages and various industrial applications. Asian countries, especially China, have emerged as leading destinations, thereby facilitating the market shift from developed economies to developing economies. In relatively saturated markets such as the US and Europe, value-based pricing and raw material sourcing have emerged as major strategies for companies looking to establish a strong foothold in these markets.

modified-starch-market: COMPANY EVALUATION MATRIX

In the modified starch market matrix, ADM (US), Cargill (US), Ingredion (US), Tate & Lyle (UK), and Roquette Frères (France) lead with a strong market share and extensive product footprint, driven by their strong geographical presence, significant formulation and distribution capabilities, and strong ties with food manufacturers. Qingdao CBH Co., Ltd (Emerging Leader) is gaining visibility with its specialized modified starch offerings, strengthening its position through strong product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ADM (US)

- Cargill (US)

- Ingredion (US)

- Tate & Lyle (UK)

- Roquette Frères (France)

- Avebe U.A (Netherlands)

- Grain Processing Corporation (US)

- Emsland (Germany)

- AGRANA (Austria)

- SMS Corporation (Thailand)

- Global Bio-Chem Technology Group (Hong Kong)

- SPAC Starch (India)

- Qingdao CBH Company (China)

- Tereos (France)

- KMC (Denmark)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 14.48 Billion |

| Market Forecast, 2030 (Value) | USD 17.30 Billion |

| Growth Rate | CAGR of 3.0% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Tons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World |

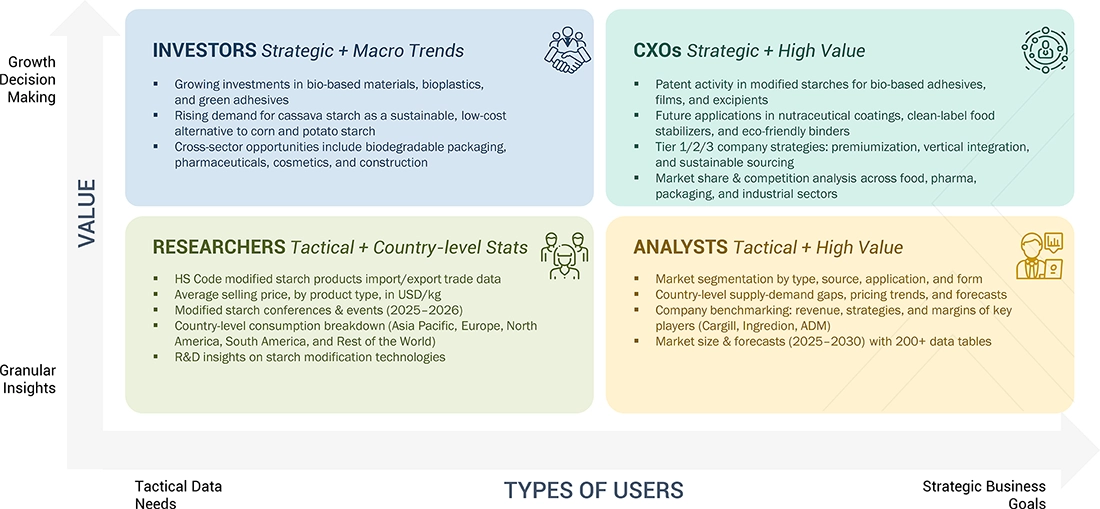

WHAT IS IN IT FOR YOU: modified-starch-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based modified starch based Ingredients Manufacturers |

|

|

| Supplement Segment Assessment |

|

|

RECENT DEVELOPMENTS

- November 2024 : Tate & Lyle completed the purchase of CP Kelco (specialty gums & pectins manufacturer) from J.M. Huber on November 15, 2024, creating a larger specialty food & beverage ingredients platform (with gellan, pectin, carrageenan, and gums).

- December 2024 : Ingredion agreed to acquire a 49% stake in AGRANA’s AGFD ?andarei starch facility and form a JV to expand starch production capacity in Romania (announced in December 2024; received regulatory clearance in June 2025). The companies planned a joint investment of approximately EUR 35 million to expand capacity and competitiveness.

- March 2025 : Cargill highlighted a first-of-its-kind dent-corn modified starch to improve sauce color/texture and a cost-effective pectin replacer for gummies/jellies, a product innovation showcased at AAHAR/India.

Table of Contents

-

5.1 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

- 5.2 MACROECONOMICS INDICATORS

-

5.3 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTRAW MATERIAL SOURCING AND STRAIN IDENTIFICATIONPROCESSING AND MANUFACTURING OPERATIONSDISTRIBUTION & LOGISTICSEND-USER SEGMENTS AND CONSUMPTION PATTERNSVALUE ADDED ACROSS THE VALUE CHAIN

-

5.4 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF PRODUCT TYPE, BY KEY PLAYERS (2024)AVERAGE SELLING PRICE TREND, BY REGION (2021-2024)

-

5.6 TRADE ANALYSISEXPORT SCENARIO (HS CODE 3002) – MAJOR EXPORTING COUNTRIES & REGIONSIMPORT SCENARIO (HS CODE 3002) – MAJOR IMPORTING COUNTRIES & REGIONS

- 5.7 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

-

5.11 IMPACT OF 2025 US TARIFF –MODIFIED STARCH MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRY/REGION*- US- Europe- Asia PacificIMPACT ON END-USE INDUSTRIES

-

6.1 KEY TECHNOLOGIESFERMENTATIONFILTRATIONFREEZE-DRYING (LYOPHILIZATION)MICROENCAPSULATION & NANOENCAPSULATION

-

6.2 COMPLEMENTARY TECHNOLOGIESIOT-BASED FERMENTATION MONITORINGENZYMATIC HYDROLYSIS

-

6.3 ADJACENT TECHNOLOGIESGENOME-SCALE METABOLIC MODELINGBIOINFORMATICSDIGITAL FERMENTATION CONTROL

-

6.4 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.5 FUTURE & EMERGING PRODUCTS OF MODIFIED STARCH

-

6.6 IMPACT OF GEN AI ON STARCH INDUSTRYINTRODUCTIONUSE OF GEN AI IN STARCH INDUSTRYCASE STUDY ANALYSISIMPACT ON MODIFIED STARCH MARKETADJACENT ECOSYSTEM WORKING ON GEN AI

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

-

7.1 REGIONAL REGULATIONSREGULATORY BODIES AND FRAMEWORKSCERTIFICATION AND ACCREDITATION BODIESLABELLING REQUIREMENTS AND CLAIMSANTICIPATED REGULATORY CHANGES OVER THE NEXT 5-10 YEARS

-

7.2 SUSTAINABILITY INITIATIVESSUSTAINABLE SOURCINGCARBON FOOTPRINT REDUCTION INITIATIVESCIRCULAR ECONOMY APPROACHESCERTIFICATION, TRACEABILITY & TRANSPARENCY

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 BIODEGRADABLE PACKAGING, CERTIFICATIONS, LABELING, ECO-STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 9.1 INTRODUCTION

-

9.2 PHYSICALLY MODIFIED STARCHPREGELATINIZED STARCHGRANULAR COLD-WATER-SWELLING STARCHHEAT–MOISTURE TREATED STARCHANNEALED STARCH

-

9.3 CHEMICALLY MODIFIED STARCHCROSS-LINKED STARCHSTABILIZED / SUBSTITUTED STARCH- ETHERIFIED (E.G., HYDROXYPROPYLATED)- ESTERIFIED (E.G., ACETYLATED, OCTENYL SUCCINATE)OXIDIZED STARCHCATIONIC STARCHANIONIC STARCHCROSS-LINKED STARCHSTABILIZED / SUBSTITUTED STARCH

- 9.4 ENZYMATICALLY MODIFIED STARCH

- 9.5 OTHERS (DUAL / MULTI-MODIFIED STARCH)

- 10.1 INTRODUCTION

- 10.2 CORN/MAIZE

- 10.3 CASSAVA

- 10.4 POTATO

- 10.5 WHEAT

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 FOOD & BEVERAGEBAKERY & CONFECTIONERYDAIRY & FROZEN DESSERTSMEAT, POULTRY & SEAFOODSNACKS & CONVENIENCE FOODSBEVERAGESOTHERS (SAUCES, DRESSINGS & CONDIMENTS & BABY FOOD / NUTRITION)

-

11.3 INDUSTRIAL APPLICATIONSPAPER & PACKAGINGTEXTILESADHESIVESOIL & GAS / MININGCONSTRUCTION & BUILDING

-

11.4 FEEDRUMINANT FEEDSWINE FEEDPOULTRY FEEDOTHER FEED APPLICATIONS

- 11.5 PHARMACEUTICAL & PERSONAL CARE

- 11.6 OTHER APPLICATIONS

- 12.1 INTRODUCTION

- 12.2 DRY

- 12.3 LIQUID

- 13.1 INTRODUCTION

- 13.2 THICKENING

- 13.3 STABILIZERS

- 13.4 TEXTURIZERS

- 13.5 BINDERS

- 13.6 EMULSIFIERS

- 13.7 OTHER FUNCTIONS

-

14.1 NORTH AMERICAUSCANADAMEXICO

-

14.2 EUROPEGERMANYUKFRANCESPAINITALYREST OF EUROPE

-

14.3 ASIA PACIFICCHINAJAPANINDIAAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

14.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

14.5 RST OF THE WORLDMIDDLE EASTAFRICA

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN, 2022 - 2025

- 15.3 REVENUE ANALYSIS, 2022 – 2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

-

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- Type Footprint- Source Footprint- Application Footprint

-

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed list of key start-up/SMEs- Competitive benchmarking of key start-ups/SMEs

-

15.9 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSEXPANSIONSOTHERS

-

16.1 KEY PLAYERSADMCARGIL, INCORPORATED.INGREDIONTATE & LYLEROQUETTE FRERESAVEBE U.A.GRAIN PROCESSING CORPORATIONEMSLAND GROUPAGRANASMS CORPORATIONGLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITEDSPAC STARCH PRODUCTS (INDIA) LTD.QINGDAO CBH CO., LTDTEREOSKMC

-

16.2 STARTUPS/SMESBENEOANGEL STARCH & FOOD PVT.LTDSHUBHAM STARCH CHEM PVT LTD.EVEREST STARCH (INDIA) PVT LTD.SHEEKHARR STARCH PVT. LTD.SANSTAR BIO-POLYMERS LTD.UNIVERSAL BIO-POLYMERSSONISH STARCH TECHNOLOGY CO. LTD.VENUS STARCH SUPPLIERSGROMOTECH AGROCHEM PVT LTD.

-

17.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key Industry Insights- Breakdown of Primaries

-

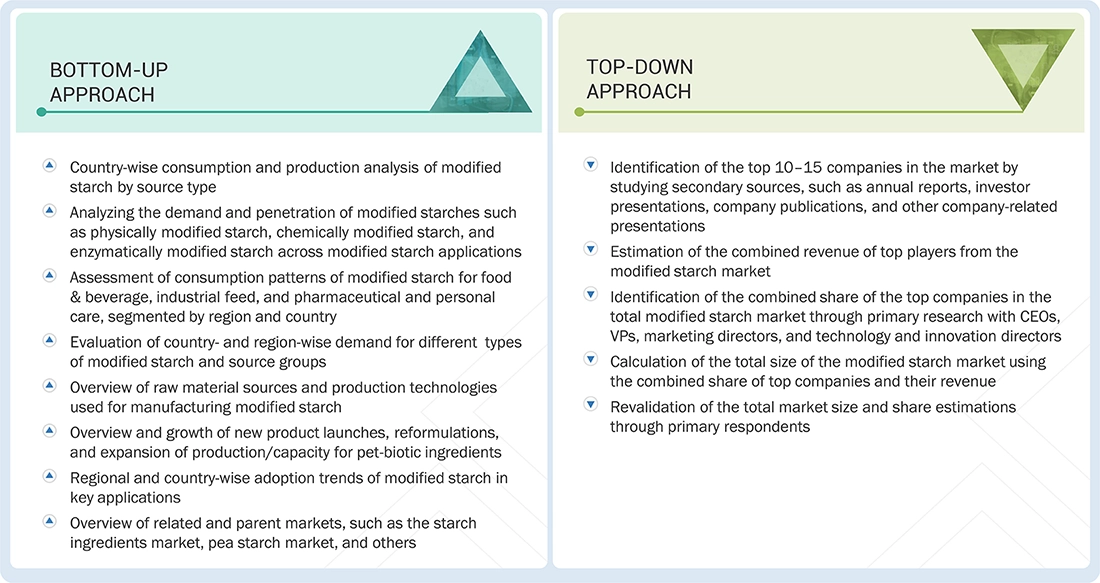

17.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACH- Approach For Capturing Market Share By Bottom-Up AnalysisTOP-DOWN APPROACH- Approach For Capturing Market Share By Top-Up Analysis

- 17.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 17.4 RESEARCH ASSUMPTIONS

- 17.5 RISK ASSESSMENT

- 17.6 LIMITATIONS

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.3 AVAILABLE CUSTOMIZATIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

Methodology

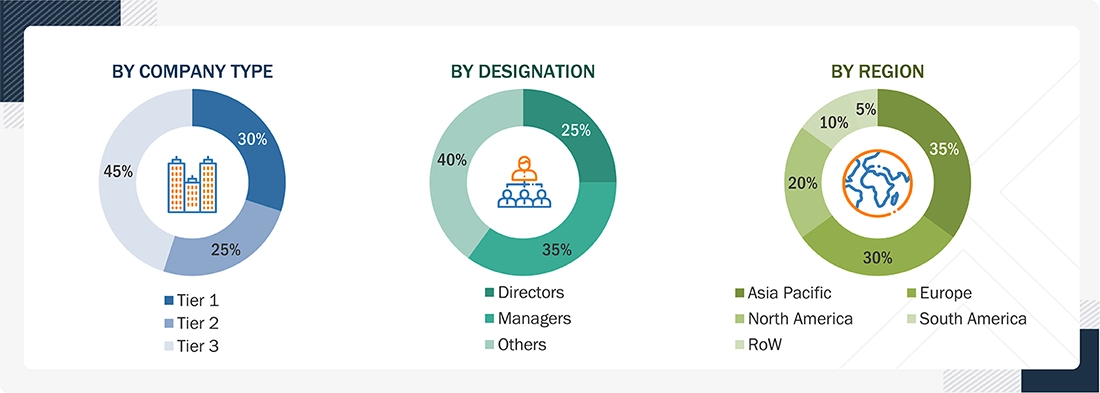

This study employed two primary approaches to estimate the current size of the modified starch market. Exhaustive secondary research was done to collect information on the type, application, source, form, and functions (qualitative) segments of the market. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study used extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, pet food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the modified starch market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to understand the various trends related to type, application, form, and functions (qualitative), and region.

Stakeholders from the demand side, including distributors, importers, exporters, and end-use sectors such as food and dietary supplement manufacturers, were interviewed to understand the buyers’ perspective on suppliers, products, and the outlook for their business, which will impact the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, based on the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million ≤ revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million. RoW includes Africa and the Middle East.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Cargill, Incorporated (US) |

Product Development Manager |

|

Ingredion (US) |

Sales Manager |

|

Roquette (France) |

Marketing Head |

|

ADM (US) |

Marketing Head |

|

SMS Corporation (Thailand) |

Senior Sales Manager |

|

SPAC Industries India Pvt. Ltd. (India) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the modified starch market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Modified Starch Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall modified starch market and obtain precise statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

Modified starches are derived from native starches through various processing techniques, including physical, enzymatic, wet and dry chemical treatments, drum drying, and extrusion. These methods alter the properties of native starch such as freeze–thaw stability, resistance to acids or alkalis, and tolerance to shear to create products that meet diverse industrial and functional requirements. Modified starches serve multiple purposes, including thickening, stabilizing, binding, and emulsifying. In addition to their widespread use in food products, they are also utilized across numerous non-food industries and in the animal feed sector due to their enhanced performance characteristics.

Key Stakeholders

Modified starch and native starch manufacturers and processors

- Intermediate suppliers, such as traders and distributors of modified starch

- Manufacturers of food & beverage ingredients, processed food manufacturers, and livestock feed manufacturers

- Other manufacturing industries, such as the personal care, pharmaceutical, and papermaking industries

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Starch Europe

- The Food and Agriculture Organization (FAO)

- Food and Drug Administration (FDA)

- US Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Agriculture and Agri-Food Canada

- National Corn Grower Association – World of Corn

- The International Food Additives Council (IFAC)

- Food Processing Suppliers Association (FPSA)

Report Objectives

- To determine and project the size of the modified starch market based on type, application, source, form, and functions (qualitative), and region, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe modified starch market into key countries

- Further breakdown of the Rest of Asia Pacific modified starch market into key countries

- Further breakdown of the Rest of South America modified starch market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Modified Starch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Modified Starch Market