Modular Construction Market

Modular Construction Market by Type (Permanent, Relocatable), Material (Wood, Steel, Concrete), Module, End-use Industry (Residential, Office, Educational, Hospitality, Healthcare, Retail & Commercial), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The modular construction market is expected to reach USD 142.87 billion by 2030 from USD 109.60 billion in 2025, at a CAGR of 5.4% during the forecast period. The global modular construction market is growing rapidly, amid increasing urbanization, a shift toward more sustainable building practices, and increased demand for faster, cheaper construction. According to the US Green Building Council, buildings in the United States account for approximately 39% of CO2 emissions, 40% of energy use, and 13% of water consumption, highlighting exactly why greener methods matter. This indicates why the need for greener and more effective and efficient ways of construction, like modular construction, will be more in demand in the US and other developing countries in the coming years. The estimated global population in the mid to late 2080s will be around 10.3 billion, and already, almost half the world’s population, around 45%, resides in urban areas and is expected to rise sharply by 2050. Modular construction distinguishes itself in this regard because of its efficiency, cost-effectiveness, and minimal site disruptions. Population growth, urbanization, and increasing industrialization in developing economies, especially in the Asia-Pacific region, where urbanization rates are 67% in China and 36.87% in India, alongside advancements in prefabrication, digital design, and intelligent construction management, are propelling modular construction as a sustainable, scalable, and efficient solution for global urban development.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific dominated the modular construction market in 2024 with a share of 36.0%.

-

By TypeBy type, the relocatable segment is expected to register the highest CAGR of 6.4% from 2025 to 2030, in terms of value.

-

By MaterialBy material, the steel segment is expected to register the highest CAGR of 6.0% from 2025 to 2030, in terms of value.

-

By End-use IndustryBy end-use industry, the hospitality segment is expected to dominate the market.

-

Competitive Landscape - Key PlayersSkanska, Laing O'Rourke, ATCO Ltd., and Modulaire Group were identified as Star players in the modular construction market, as they have focused on innovation, have broad industry coverage, and strong operational & financial strength.

-

Competitive Landscape- StartupsALHO Group, BROAD Group, and Kwikspace have distinguished themselves among startups and SMEs through their strong product portfolios and business strategies.

The modular construction industry is growing rapidly and is becoming more efficient as the global construction sector increasingly adopts building methods that are quicker, more cost-effective, and environmentally sustainable. Conventional construction technologies face challenges such as slow execution time, lack of skilled labor, cost escalation, and inconsistent construction quality, making them amenable to off-site modular construction. Modular construction facilitates the production of standardized building components in controlled settings, which are subsequently assembled on-site, thereby minimizing material waste, construction duration, and safety hazards. Increasing requirements for housing, healthcare, educational, and office spaces are expected to drive the market growth. Increasing awareness of green and energy-efficient design in lower-carbon footprint structures will inspire governments and developers worldwide to adopt modular construction solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The modular construction industry is driving end-use industries as it serves a need for faster delivery of projects, reduced costs, and superior quality work. The need for faster deployment with minimum disruption to site operations in healthcare and education sectors is a driving force for going for modular solutions in these sectors. Moreover, there is a perceptible shift towards greater efficiency, minimizing waste generation, and increasing energy efficiency in buildings by going for modular solutions in the education and healthcare sectors, as well as other sectors like residential, hospitality, and logistics, hence driving the modular construction market as a whole. Various schemes of governments related to affordable housing, urban development projects, and green building projects also contribute towards driving the modular construction market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid construction and cost savings driving modular adoption

-

Surging infrastructure investments

Level

-

Transportation, logistics, and on-site assembly risks

-

Lack of awareness and perception barriers in developing economies

Level

-

Rapid population growth and urbanization fuel demand

-

Rising high-rise and supertall developments creating strong demand

Level

-

Supply chain volatility and raw material price fluctuations

-

Skilled workforce gap and hybrid talent shortage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid construction and cost savings driving modular adoption

A main driving force in the current uptake of modular construction is the inherent ability of modular approaches to accelerate projects while enhancing the efficiency of costs, quality, and sustainability. Compared to traditional approaches, which rely on a sequence that is slow and weather-driven, modular projects enable parallel execution of manufacturing activities, whether it is the manufacturing of modules or components, alongside the execution of activities like the establishment of infrastructure works, utilities, and even foundation works. This approach typically shortens the execution timeframe by 30-50%, turning months-long projects into week-long projects. The efficiency of the modular approach is gradually being adopted by governments and public institutions in order to handle the shortage of housing units, healthcare infrastructure, and the need for improved productivity in the construction sector, based on initiatives like the Construction 2025 strategy adopted in the UK. Practical projects have demonstrated the validity of the efficiency claims, including the 550-unit Camp Hill scheme developed by Elements Europe in Birmingham, which reduced deliveries by 3,700 units and incorporated a 56% decrease in traffic movements, reducing emissions while achieving a 35% net life-cycle carbon savings. High-rise projects, urgent infrastructure development, and the like, including Broad Sustainable Building’s 26-story tower completed in five days, Wuhan’s 1,600-bed Leishenshan Hospital completed in less than a week, demonstrate the strength of the modular approach. When the benefits of improved quality, reductions in waste, improved labor costs, and financing terms are incorporated, the efficiency pushes the global shift towards modular construction.

Restraint: Transportation, logistics, and on-site assembly risks

Transportation and assembly issues are a major challenge for the modular construction market. Modular buildings are made in factories and then transported to construction sites, often over long distances. These modules are large, heavy, and already finished, so they need special trucks, careful route planning, permits, and exact delivery timing. Modules can become damaged while being transported or stored, leading to delays, increased repair costs, or even replacement. On-site module assembly requires a high level of precision. Walls, flooring, and structural components must all fit perfectly to ensure safety and functionality. Even small mistakes during lifting or installation can lead to problems such as leaks, weak joints, or long-term durability issues. These issues get worse in tall buildings or complex projects, where crane operations are demanding, and tolerances are stringent.

Opportunity: Rapid population growth and urbanization fuel demand

Rapid population growth and faster urbanization have thus created continuous opportunities in modular construction. The global population is estimated to have reached over 8.2 billion in 2025 and is anticipated to peak at nearly 10.3 billion by the mid-2080s, thereby substantially elevating the need for housing, commercial structures, and infrastructure (Source: United Nations, World Population Prospects 2024). Urbanization exacerbates this pressure, as cities already house approximately 45% of the global population, an increase from 20% in 1950, with projections indicating further growth by 2050 (Source: United Nations, World Urbanization Prospects 2025). Meeting such needs with economies of scale requires construction methods that promise speedier delivery and cost clarity with less on-site disruption: a task for which modular construction is well-positioned. This effect is especially strong in the Asia-Pacific region, spurred by rapid industrialization and rising incomes. The urbanization rate in China was about 67% in 2024, according to the National Bureau of Statistics of China, while India stood at about 36.87%, according to the World Bank. Governments and private developers, in their efforts to tackle housing shortages, infrastructural deficiencies, and urban density issues, find modular construction ideally suited to fulfill future development requirements economically and sustainably.

Challenge: Supply chain volatility and raw material price fluctuations

The modular construction sector is being pinched by the nuances in supply chain variability, caused in turn by the fluctuating prices of key raw materials such as steel, aluminum, rebar, and concrete. Since margins are already low, predictability in costs is imperative for maintaining the modular construction industry's quickness to market. But tariffs and associated trading barriers being planned in the 2025 period have introduced drastic variations in prices. As far as 2025 is concerned, the tariffs for steel and aluminum rose to 25%, while imports soared to 50% in some instances, leading to unpredictable market responses. Steel prices rose 5.4% from April, while steel prices remained 7.9% above their respective pre-tariff prices in September. Rebar prices, in the meantime, surged more than 26% in some instances. Neither is the increasing geopolitical instability helpful, creating further turmoil in the global supply chain for precision components. The Modular Building Institute states, in fact, that tariffs increase the construction costs of homes, decrease their affordability, and subvert the supply chain.

MODULAR CONSTRUCTION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Created the modular classroom complex for 1,200 students, including temperature-controlled corridors, special rooms such as Home Economics, Biology, Chemistry, and Criminal Justice, and optimal site planning around the oval drive. | Facilitated fast construction, personalized learning environments, and optimal use of the land; disruption to ongoing renovations was minimal. |

|

Delivered 71 approved modular classrooms for LAUSD after the 2025 Palisades Fire disaster. This includes 33 classrooms, 1 admin building, 3 restrooms, and ADA ramps. These projects were executed under tight deadlines and with challenging site conditions. | Schools with safe, code-compliant learning environments were quickly reopened, and modular construction demonstrated a notable level of disaster response efficiency. |

|

Delivered a 4,920 sq ft modular wing with four classrooms for Glastonbury Public School, connected by a climate-controlled hallway that included green space, a chair lift, sprinkler fire protection, and information technology infrastructure. | Provided quick and economical expansion for the school, ensured comfort, safety, and aesthetic harmony, and ensured faster completion of the project within budget. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The modular construction market operates within a complex ecosystem comprising developers, architects, manufacturers, contractors, technology providers, and regulatory bodies. The pace for standardization, high-quality modules, and fast project completion module manufacture is set by off-site module manufacturers. Technologies such as BIM, AI, and robotics further optimize design, manufacturing, and construction. The critical supply chain players, material supplies/logistics professionals, manage material supply on time and at controlled cost. The regulatory authority members and associations then set the pace for adoption of this technology based on safety standards and environmental considerations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Modular Construction Market, By Type

The permanent type dominated the modular construction market in 2024. The growing popularity of permanent modular construction aligns with the increasing application of modular construction in residential, commercial, medical, and educational settings. The permanent modular buildings have the unique advantage of being durable, with malleable, resilient designs and a lifespan approximately equal to that of buildings of traditional construction, but with the benefits of accelerated assembly, cost efficiency, and quality assurance through factory-made modules. Large-scale developers, as well as government agencies, have shown a growing trend of selecting permanent modular construction types for the construction of low-cost housing, medical, educational, and mixed-use projects that meet strict government requirements and specifications on sustainability and performance requirements on a regular basis.

Modular Construction Market, By Material

Concrete was the most prominent material in the modular construction market in 2024, with properties that make it structurally strong and long-lasting, and fire-resistant. This would make it the preferred choice for permanent buildings across sectors, from residential to commercial, healthcare, and education. Concrete modular systems will provide solid thermal and acoustic insulation, and are ideal for dense urban developments, along with multi-story designs. In contrast to traditional cast-in-place techniques, precast concrete modules exhibit superior manufacturing precision, enhanced quality control, and expedited on-site assembly. The dominance of concrete in extensive and long-term modular projects has significantly persisted in 2024, driven by a rising desire for sustainable and durable building, alongside advancements in precast and high-performance concrete technology.

Modular Construction Market, By End-use Industry

The residential sector emerged as the largest end-use industry of the modular construction market in 2024, due to the increasing urban migration of people, a shortage of housing, and the demand for faster and more economical ways of construction. Modular construction projects can decrease the duration of projects, ensure consistent cost estimates, and minimize the disturbance caused during the construction period, making them a viable solution for projects of a massive scale, like affordable housing, multi-family dwelling units, dorms, and senior living, to name a few. Government initiatives regarding the subsidization of affordable housing, especially in urban and suburban areas, caused the adoption rate to increase considerably.

REGION

Asia Pacific to be the fastest-growing region in the modular construction market during the forecast period

The Asia Pacific is emerging as the fastest-growing region for the modular construction market. With growing cities, huge infrastructure development schemes, and increasing awareness for sustainable, energy-efficient buildings, the Asia Pacific is gaining traction. The industrialization of China, India, and Southeast Asia, coupled with a growing population in each of these nations, ensures a definite need for faster, more efficient means of building homes, offices, healthcare buildings, and educational institutions. Asia Pacific governments are actively moving to encourage a fallback to off-site or modular construction through housing schemes, smart city development projects, and a stricter emphasis on product in housing. The growth of industrial parks, logistics buildings, or other projects in remote locations ensures a definite need in those locations for permanent or relocatable modular buildings. The impact of increased technology in digital design, BIM, or factory-based manufacturing in modular buildings ensures predictability, satisfaction with product quality, and sufficient improvements in expense. This has been well reflected in China, which witnessed a 26-story, 15,000-square-meter residential project prepared by Broad Sustainable Building in Xiangyin in a mere five days, in January 2024.

MODULAR CONSTRUCTION MARKET: COMPANY EVALUATION MATRIX

Skanska (Star) is a global leader in the construction industry, integrating modular building concepts into its company. The combination of factory-made buildings and the latest technology in design provides durable and permanent modular buildings. The company focuses on sustainability and modular construction benefits clients in significantly shortening project durations and reducing expenses to achieve net-zero goals. Red Sea International (Emerging Leader) concentrates on modular and relocatable buildings, primarily in isolated or harsh conditions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Skanska (Sweden)

- Laing O'Rourke (UK)

- ATCO Ltd. (Canada)

- Modulaire Group (UK)

- Red Sea International (Saudi Arabia)

- VINCI (France)

- Bouygues Group (France)

- Bechtel Corporation (US)

- Fluor Corporation (US)

- Lendlease Corporation (Australia)

- KLEUSBERG Group (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 104.00 Billion |

| Market Forecast in 2030 (Value) | USD 142.87 Billion |

| Growth Rate | 5.40% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Square Feet) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: MODULAR CONSTRUCTION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Modular Construction Developers |

|

|

| Permanent Modular Construction (PMC) Manufacturers |

|

|

| Relocatable Modular Construction (RMC) Manufacturers |

|

|

RECENT DEVELOPMENTS

- December 2025 : Laing O'Rourke was confirmed as one of four partners in the Midlands Rail Hub Alliance, alongside VolkerRail, AtkinsRealis, and Siemens Mobility, to design and deliver major rail upgrades that improve capacity and connectivity across Birmingham and the West Midlands.

- July 2025 : Skanska signed a 10-year lease with AFRY for about 15,000 sq. m. of office space at the Solna Link building in Arenastaden, Sweden, which will become AFRY’s new headquarters.

- September 2024 : ATCO Ltd. acquired NRB Modular Solutions, enhancing its modular construction and retaining skills in Canada, and gaining better market and facility access in Canada and the US.

- May 2024 : Laing O'Rourke was selected as a construction partner in National Grid's Great Grid Partnership, a USD 12.1 billion framework agreement for the supply chain in connection with new and existing power infrastructure projects.

- December 2022 : Modulaire Group announced the acquisition of Mobile Mini UK, expanding its presence across the UK with a national distribution network focused on delivering steel storage and accommodations units to different sectors.

Table of Contents

Methodology

The study involved four major activities for estimating the current global size of the modular construction market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of modular construction through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the modular construction market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the modular construction market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

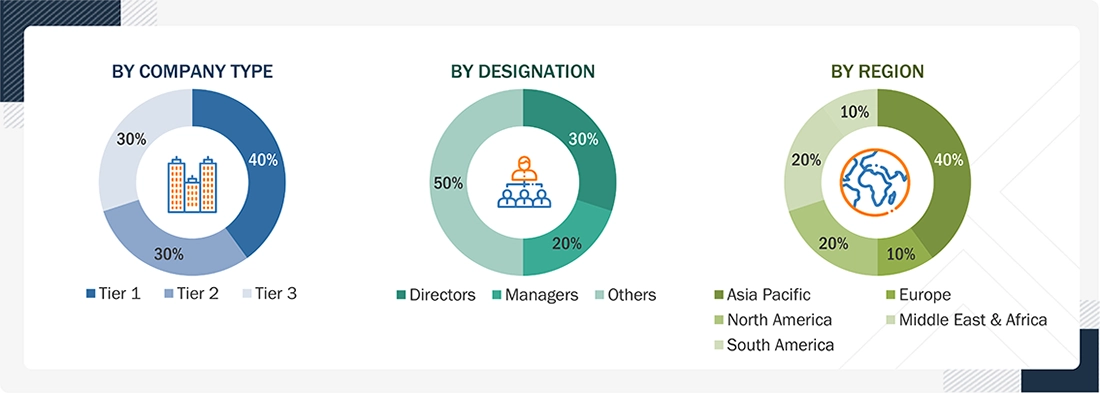

Various primary sources from both the supply and demand sides of the modular construction market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the modular construction industry. The breakdown of the profiles of primary respondents is as follows:

BREAKDOWN OF PRIMARY INTERVIEWS

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 =

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the modular construction market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the modular construction market. The data was triangulated by studying various factors and trends from both the demand- and supply-side. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

The modular construction market refers to the industry sector encompassing the design, fabrication, and assembly of building components in controlled factory environments for subsequent installation at construction sites. This approach to construction involves the prefabrication of standardized modules or components, which are then transported and assembled on-site to create structures ranging from residential homes and commercial buildings to industrial facilities and infrastructure projects.

Key Stakeholders

- Raw material suppliers

- Modular construction manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- Contractors, architects, and engineers

- End users

- Traders and distributors

Report Objectives

- To estimate and forecast the modular construction market, in terms of value and volume.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth.

- To define, describe, and forecast the market size, based on type, material, end-use industry, and region.

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries.

- To strategically analyze micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market.

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To analyze competitive developments, such as merger & acquisition, expansion & investment, agreement, and new product development in the modular construction market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the modular construction report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the modular construction market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Modular Construction Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Modular Construction Market