Molecular Quality Controls Market Product (Independent Control, Instrument Specific Control (PCR, DNA Sequencing), Application (Infectious Disease Diagnostics), Analyte type, End User (Hospitals, Diagnostic Lab), Region- Global Forecast to 2028

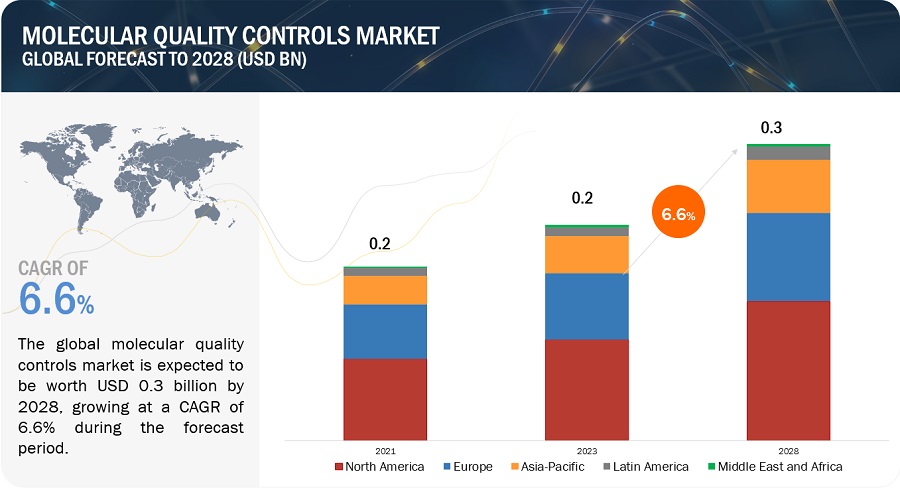

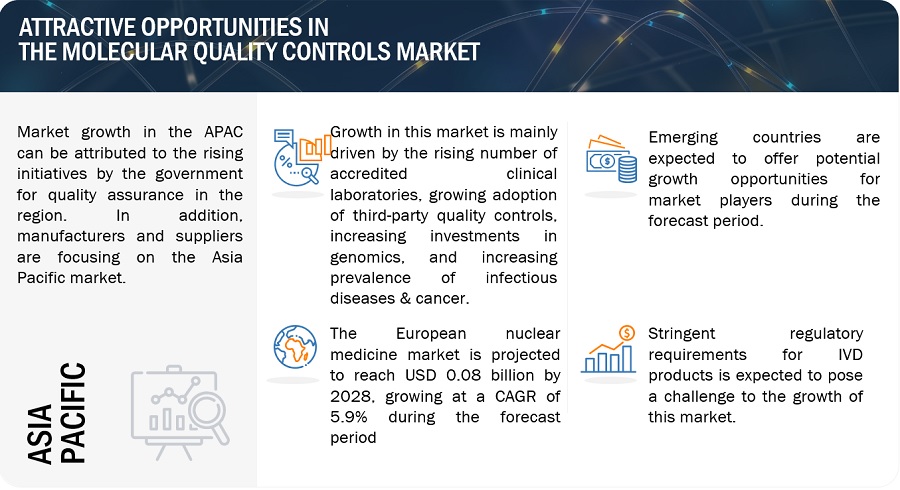

The global molecular quality controls market, valued at US$0.2 billion in 2022, stood at US$0.2 billion in 2023 and is projected to advance at a resilient CAGR of 6.6% from 2023 to 2028, culminating in a forecasted valuation of US$0.3 billion by the end of the period. The growth of this market is primarily driven by the increasing number of accredited clinical laboratories, growing adoption of third-party quality controls, and increasing government funding for genomic projects. Rising demand for multi-analyte controls and growth opportunities in emerging countries are expected to offer opportunities for market players during the forecast period.

On the other hand, the additional costs involved in the quality control process and budget constraints in hospitals and laboratories, are expected to restrain the market growth to some extent in the coming years.

Global Molecular Quality Controls Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Molecular Quality Controls Market Dynamics

Driver: Growing preference for personalized medicines

Genomics has played a key role in the emergence of personalized medicine. Personalized medicine provides tailored treatments and prevention procedures to suit each individual’s condition for optimal results. This field of medicine offers the most promising approach to tackle diseases that have not been well-known for responding effectively to the existing treatments or cures. As per the Personalized Medicine report published in the PMC (Personalized Medicine Coalition):

- In 2022, FDA’s Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities (NMEs), among these two NMEs were therapeutic products and others were diagnostic agents. 12 of the 35 new therapeutic molecular entities approved by the US FDA and 5 new cell-based therapies were personalized medicine.

The cost of genome sequencing has dropped dramatically in the last six years, approximately a million-fold. The Human Genome Project was completed by thousands of researchers in 13 years and cost USD 2.7 billion (Source: WIRED, September 2022). According to a blog published in Sequencing in 2022, due to the growing interest in DNA sequencing numerous bioinformatics companies are focused on creating new technologies, sequencers, and consumables aiming to offer genetic testing at affordable costs.

Restraint: Budgetary constraints in clinical laboratories

Setting up a QC process in a clinical laboratory requires significant investments. Laboratories also need to maintain dedicated personnel to manage the QC system. Moreover, QC procedures incur similar costs, regardless of the volume of tests performed. Hence, the cost of adopting QC procedures is very high for clinical laboratories working with low volumes of diagnostic tests. This, coupled with budgetary constraints in many hospitals and laboratories in developed and developing economies, is expected to result in the lower adoption of QC practices.

Opportunity: Rising demand for multi-analyte controls

Technological advancements have led to the development of a new range of multi-analyte and multi-instrument controls. These innovative controls consolidate multiple instrument-specific controls into a single control, thereby enabling clinical laboratories to cut down costs. In addition, these controls save the time involved in separate QC procedures for each individual analyte. A number of multi-analyte controls are available in the market, such as the Amplicheck Series (BD Company), AcroMetrix Series (Thermo Fisher Scientific), Seraseq Controls (SeraCare), and Introl Series (Maine Molecular Quality Controls). These controls help laboratories to perform quality control for multiple parameters, including cardiac and tumor markers and DNA/RNA of multiple infectious disease-causing agents in a single run.

Challenge: Stringent regulatory requirements for IVD products

Regulatory and legal requirements applied to IVD (including molecular diagnostics) in the US and European countries are becoming more stringent. In the US, IVD products are defined under 21 CFR 809 and regulated under guidelines like medical devices. The FDA released new FDA guidance documents. Under US federal regulations, device manufacturers must submit a 510 (k) application for any further modifications to a device. New applications may require software updates or new software installation in an existing device or any other changes made to these devices. In the past few years, the FDA requirements, particularly with regard to 510(k) notifications, have increased, requiring more data and details than earlier. This change, resulting in unpredictable premarket submission requirements, is extremely unfavorable for IVD manufacturers that require 510(k) clearance.

Molecular Quality Controls Market Ecosystem Map

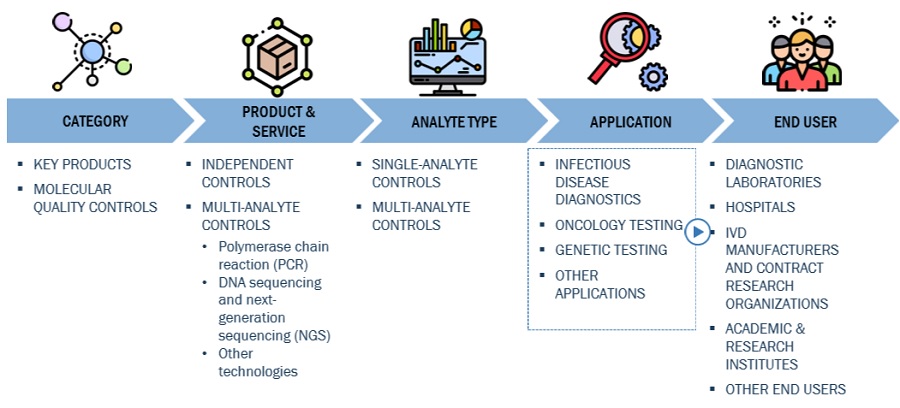

The independent controls segment of the Molecular Quality Controls Industry has accounted for the highest market share during the forecast period

On the basis of product, the molecular quality controls market is segmented into instrument specific controls and independent controls. The independent controls segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the longer shelf-life and reduced cost of operation.

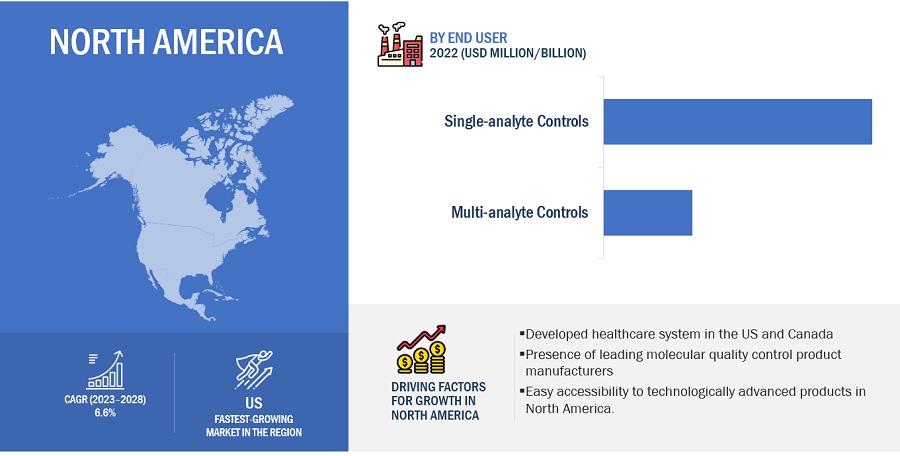

The single-analyte controls has accounted for the highest share of the Molecular Quality Controls Industry during the forecast period.

Based on analyte type, the molecular quality controls market is segmented into multi-analyte controls and single-analyte controls. Single-analyte controls accounted for the highest share of the market in 2022. The large share of this segment can be attributed to the low risk of cross-reactivity and the significant use of singleplex assays in hospitals.

The infectious disease diagnostic segment accounted for the highest share of the Molecular Quality Controls Industry in 2022

On the basis of application, the molecular quality controls market is segmented into genetic testing, oncology testing, infectious disease diagnostics, and other applications (including microbiology, tissue typing, DNA fingerprinting, cardiovascular disease testing and neurology disease testing). The infectious disease diagnostics segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the development of advanced assays for different infectious diseases.

The diagnostic laboratories segment accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on end users, the molecular quality controls market is segmented into diagnostic laboratories, hospitals, IVD manufacturers & CROs, academic & research institutes, and other end users (blood banks, local public health laboratories, home health agencies, and nursing homes). The diagnostic laboratories segment accounted for the largest share of the market in 2022. This can be attributed to the increasing number of accredited diagnostic laboratories worldwide and the growing number of laboratory tests performed in diagnostic laboratories.

North America accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on region, the molecular quality controls market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2022. The large share of this regional segment is mainly due to the developed healthcare system in the US and Canada and the presence of many leading molecular quality control product manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), Anchor Molecular (US), Thermo Fisher Scientific, Inc. (US), Randox Laboratories Ltd. (UK), LGC Limited (UK), Abbott Laboratories (US), Fortress Diagnostics (UK), SERO AS (Norway), Anchor Molecular (US), Vircell S.L. (Spain), Ortho Clinical Diagnostics, Inc. (US), QuidelOrthoCorporation (US), Sun Diagnostics, LLC (US), Seegene Inc. (South Korea), ZeptoMetrix, LLC (US), Qnostics (UK), Bio-Techne Corporation (US), Microbiologics, Inc. (US), Steck LLC (US), Helena Laboratories Corporation (US), Microbix Biosystems Inc. (Canada), Molbio Diagnostics Pvt. Ltd. (India), SpeeDx Pty. Ltd. (Australia), Maine Molecular Quality Controls, Inc. (US), and Grifols, S.A. (Spain).

Scope of the Molecular Quality Controls Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.2 billion |

|

Projected Revenue by 2028 |

$0.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.6% |

|

Market Driver |

Growing preference for personalized medicines |

|

Market Opportunity |

Rising demand for multi-analyte controls |

This study categorizes the global molecular quality controls market to forecast revenue and analyze trends in each of the following submarkets

By Product

- INDEPENDENT CONTROLS

-

INSTRUMENT-SPECIFIC CONTROLS

- POLYMERASE CHAIN REACTION (PCR)

- DNA SEQUENCING & NGS

- OTHER TECHNOLOGIES

By Analyte Type

- SINGLE-ANALYTE CONTROLS

- MULTI-ANALYTE CONTROLS

By Application

- INFECTIOUS DISEASE DIAGNOSTICS

- ONCOLOGY TESTING

- GENETIC TESTING

- OTHER APPLICATIONS

By End User

- DIAGNOSTIC LABORATORIES

- HOSPITALS

- IVD MANUFACTURERS & CONTRACT RESEARCH ORGANIZATIONS

- ACADEMIC & RESEARCH INSTITUTES

- OTHER END USERS

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of APAC (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Molecular Quality Controls Industry

- In 2023, Thermo Fisher Scientific (US) acquired The Binding Site Group to expands the company’s existing specialty diagnostics portfolio with the addition of pioneering innovation in diagnostics and monitoring for multiple myeloma.

- In 2022, Microbiologics Inc. (US) acquired the Cryologics (US) to extend the company’s capacity to serve quality control microbiologists dedicated to the safety of pharmaceutical and personal care products.

- In 2021, LGC SeraCare expanded its line of SARS-CoV-2 molecular quality solutions to include AccuPlex SARS-CoV-2 Variant Panel 1.

- In 2020, Roche entered a 15-year non-exclusive partnership with Illumina to broaden the adoption of NGS-based testing in oncology.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global molecular quality controls market?

The global molecular quality controls market boasts a total revenue value of $0.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global molecular quality controls market?

The global molecular quality controls market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $0.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Rising number of accredited clinical laboratories- Growing adoption of third-party quality controls- Increasing investments in genomics- Growing preference for personalized medicine- Increasing prevalence of infectious diseases and cancer- Rising demand for external quality assessment supportRESTRAINTS- Budgetary constraints in clinical laboratories- Unfavorable reimbursements for molecular testsOPPORTUNITIES- Rising demand for multi-analyte controls- Growth opportunities in emerging marketsCHALLENGES- Stringent regulatory requirements for IVD products

-

5.2 INDUSTRY TRENDSLYOPHILIZED/FREEZE-DRIED CONTROLS

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 TRADE ANALYSISTRADE ANALYSIS FOR DIAGNOSTIC & LABORATORY REAGENTS- Import data for diagnostic & laboratory reagents, by country, 2018–2021 (USD million)- Export data for diagnostic & laboratory reagents, by country, 2018–2021 (USD million)

-

5.9 TARIFF AND REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY ANALYSIS- North America- Europe- Asia Pacific

-

5.10 PATENT ANALYSISINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSISPATENT PUBLICATION TRENDS

- 5.11 KEY CONFERENCES AND EVENTS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 TRENDS AND DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 INDEPENDENT CONTROLSMINIMIZED LOT CROSSOVERS FOR LABORATORIES AND LOW OPERATION COSTS TO DRIVE MARKET

-

6.3 INSTRUMENT-SPECIFIC CONTROLSPOLYMERASE CHAIN REACTION- Rising applications in proteomics and genomics to propel marketDNA SEQUENCING AND NGS- Increasing advancements in sequencing technologies to drive marketOTHER TECHNOLOGIES

- 7.1 INTRODUCTION

-

7.2 SINGLE-ANALYTE CONTROLSRISING ADOPTION OF SINGLEPLEX ASSAYS IN HOSPITALS TO SUPPORT MARKET GROWTH

-

7.3 MULTI-ANALYTE CONTROLSGROWING PREFERENCE FOR COST-EFFECTIVE CONTROLS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 INFECTIOUS DISEASE DIAGNOSTICSRISING INCIDENCE OF INFLUENZA, TB, AND HIV TO DRIVE MARKET

-

8.3 ONCOLOGY TESTINGGROWING FOCUS ON PERSONALIZED MEDICINE TO PROPEL MARKET

-

8.4 GENETIC TESTINGABILITY TO DIAGNOSE RARE DISEASES TO SUPPORT MARKET GROWTH

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 DIAGNOSTIC LABORATORIESINCREASING NUMBER OF ACCREDITED DIAGNOSTIC LABORATORIES TO DRIVE MARKET

-

9.3 HOSPITALSABILITY TO CONDUCT LARGE VOLUME OF DIAGNOSTIC PROCEDURES TO PROPEL MARKET

-

9.4 IVD MANUFACTURERS AND CONTRACT RESEARCH ORGANIZATIONSADVANCEMENTS IN MOLECULAR TECHNOLOGIES TO SUPPORT MARKET GROWTH

-

9.5 ACADEMIC & RESEARCH INSTITUTESRISING FOCUS ON ACCURATE RESEARCH RESULTS TO DRIVE MARKET

- 9.6 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Growing number of accredited clinical laboratories to drive marketCANADA- Rising funding investments for genomic research to propel marketNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Rising volume of diagnostic tests in clinical settings to drive marketUK- Growth in life sciences industry to propel marketFRANCE- Rising prevalence of cancer and endocrine disorders to support market growthITALY- Rising incidence of age-associated chronic ailments to support market growthSPAIN- Increasing demand for prenatal and genetic testing to support market growthRUSSIA- Growing acceptance of molecular diagnostics-based personalized medicine to propel marketREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICJAPAN- Established healthcare system and rising demand for high-quality IVD tests to drive marketCHINA- Rising R&D investments for advanced molecular tests to drive marketINDIA- Rising need to secure NABL accreditations to support market growthAUSTRALIA- High prevalence of infectious diseases to fuel marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 LATIN AMERICABRAZIL- Improving healthcare infrastructure to support market growthMEXICO- Improving accessibility and affordability of healthcare services to support market growthREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICAGOVERNMENT INITIATIVES TO IMPROVE HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS OF LEADING MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPANY FOOTPRINT ANALYSIS

-

11.8 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSLGC LIMITED- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developments- MnM viewMICROBIOLOGICS, INC.- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products offered- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developmentsZEPTOMETRIX, LLC- Business overview- Products offered- Recent developmentsQUIDELORTHO CORPORATION- Business overview- Products offered- Recent developmentsQNOSTICS- Business overview- Products offered- Recent developmentsMAINE MOLECULAR QUALITY CONTROLS, INC.- Business overview- Products offered- Recent developmentsRANDOX LABORATORIES LTD.- Business overview- Products offered- Recent developmentsDANAHER CORPORATION- Business overview- Products offeredBIO-TECHNE CORPORATION- Business overview- Products offered- Recent developmentsFORTRESS DIAGNOSTICS- Business overview- Products offeredMICROBIX BIOSYSTEMS- Business overview- Products offered- Recent developmentsGRIFOLS, S.A.- Business overview- Products offered- Recent developmentsANCHOR MOLECULAR- Business overview- Products offeredSPEEDX PTY. LTD.- Business overview- Products offered- Recent developmentsSEEGENE INC.- Business overview- Products offered- Recent developmentsHELENA LABORATORIES CORPORATION- Business overview- Products offered

-

12.2 OTHER PLAYERSSERO AS- Business overview- Products offeredVIRCELL, S.L.- Business overview- Products offered- Recent developmentsSTRECK LLC- Business overview- Products offeredSUN DIAGNOSTICS, LLC- Business overview- Products offeredMOLBIO DIAGNOSTICS PVT. LTD.- Business overview- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 MOLECULAR QUALITY CONTROLS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 3 THIRD-PARTY INDEPENDENT QUALITY CONTROLS OFFERED BY KEY COMPANIES

- TABLE 4 GOVERNMENT FUNDING INITIATIVES FOR GENOMICS RESEARCH (2019−2022)

- TABLE 5 US: NUMBER OF PERSONALIZED MEDICINES AVAILABLE (2008–2020)

- TABLE 6 LYOPHILIZED OR FREEZE-DRIED QUALITY CONTROLS OFFERED BY KEY COMPANIES

- TABLE 7 PRICE RANGE FOR MOLECULAR QUALITY CONTROLS, BY TYPE (2022)

- TABLE 8 MOLECULAR QUALITY CONTROLS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 11 US: CLASSIFICATION OF QUALITY CONTROL MATERIAL

- TABLE 12 US: CLASSIFICATION, TIME, AND COMPLEXITY OF REGISTRATION

- TABLE 13 CANADA: CLASSIFICATION OF IVD PRODUCTS

- TABLE 14 CANADA: CLASSIFICATION, TIME, AND COMPLEXITY OF REGISTRATION

- TABLE 15 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- TABLE 16 MOLECULAR QUALITY CONTROLS MARKET: LIST OF PATENTS/PATENT APPLICATIONS (2020–2023)

- TABLE 17 MOLECULAR QUALITY CONTROLS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MOLECULAR QUALITY CONTROL PRODUCTS (%)

- TABLE 19 KEY BUYING CRITERIA FOR MOLECULAR QUALITY CONTROL PRODUCTS

- TABLE 20 QUALITY CONTROLS FOR MOLECULAR DIAGNOSTICS OFFERED BY KEY MARKET PLAYERS

- TABLE 21 MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 22 INDEPENDENT MOLECULAR QUALITY CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 INDEPENDENT MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 25 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 27 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS MARKET FOR PCR, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS MARKET FOR DNA SEQUENCING & NGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 INSTRUMENT-SPECIFIC MOLECULAR QUALITY CONTROLS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2 021–2028 (USD MILLION)

- TABLE 31 SINGLE-ANALYTE CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 32 SINGLE-ANALYTE MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 MULTI-ANALYTE CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 34 MULTI-ANALYTE MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 36 NUMBER OF COVID-19 CASES, BY COUNTRY (FEBRUARY 2023)

- TABLE 37 MOLECULAR QUALITY CONTROLS MARKET FOR INFECTIOUS DISEASE DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 39 MOLECULAR QUALITY CONTROLS MARKET FOR ONCOLOGY TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 MOLECULAR QUALITY CONTROLS MARKET FOR GENETIC TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 MOLECULAR QUALITY CONTROLS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 43 MOLECULAR QUALITY CONTROLS MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 MOLECULAR QUALITY CONTROLS MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 MOLECULAR QUALITY CONTROLS MARKET FOR IVD MANUFACTURERS AND CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 MOLECULAR QUALITY CONTROLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 MOLECULAR QUALITY CONTROLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 MOLECULAR QUALITY CONTROLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 US: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 56 US: INSTRUMENT-SPECIFIC CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 57 US: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 58 US: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 US: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 CANADA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 61 CANADA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 62 CANADA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 63 CANADA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 CANADA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 GERMANY: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 72 GERMANY: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 GERMANY: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 74 GERMANY: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 GERMANY: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 UK: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 77 UK: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 78 UK: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 79 UK: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 UK: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 FRANCE: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 82 FRANCE: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 83 FRANCE: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 84 FRANCE: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 FRANCE: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 ITALY: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 87 ITALY: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 88 ITALY: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 89 ITALY: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 ITALY: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 SPAIN: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 92 SPAIN: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 93 SPAIN: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 94 SPAIN: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 SPAIN: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 RUSSIA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 97 RUSSIA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 98 RUSSIA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 99 RUSSIA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 100 RUSSIA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 JAPAN: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 113 JAPAN: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 114 JAPAN: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 115 JAPAN: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 JAPAN: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 CHINA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 CHINA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 119 CHINA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 120 CHINA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 CHINA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 INDIA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 123 INDIA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 124 INDIA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 125 INDIA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 INDIA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 AUSTRALIA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 128 AUSTRALIA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 129 AUSTRALIA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 130 AUSTRALIA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 AUSTRALIA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 139 LATIN AMERICA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, ‘ 2021–2028 (USD MILLION)

- TABLE 143 BRAZIL: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 144 BRAZIL: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 145 BRAZIL: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 146 BRAZIL: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 147 BRAZIL: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 MEXICO: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 149 MEXICO: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 150 MEXICO: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 151 MEXICO: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 152 MEXICO: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 REST OF LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 154 REST OF LATIN AMERICA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 155 REST OF LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 REST OF LATIN AMERICA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: INSTRUMENT-SPECIFIC MOLECULAR CONTROLS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2021–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 163 MOLECULAR QUALITY CONTROLS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 164 MOLECULAR QUALITY CONTROLS MARKET: COMPANY FOOTPRINT ANALYSIS

- TABLE 165 MOLECULAR QUALITY CONTROLS MARKET: ANALYTE TYPE FOOTPRINT ANALYSIS

- TABLE 166 MOLECULAR QUALITY CONTROLS MARKET: APPLICATION FOOTPRINT ANALYSIS

- TABLE 167 MOLECULAR QUALITY CONTROLS MARKET: REGIONAL FOOTPRINT ANALYSIS

- TABLE 168 MOLECULAR QUALITY CONTROLS MARKET: END USER FOOTPRINT ANALYSIS

- TABLE 169 PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–JUNE 2023)

- TABLE 170 DEALS (JANUARY 2020–JUNE 2023)

- TABLE 171 OTHER DEVELOPMENTS (JANUARY 2020–JUNE 2023)

- TABLE 172 LGC LIMITED: BUSINESS OVERVIEW

- TABLE 173 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 174 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 175 MICROBIOLOGICS, INC.: BUSINESS OVERVIEW

- TABLE 176 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 177 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 178 ZEPTOMETRIX, LLC: BUSINESS OVERVIEW

- TABLE 179 QUIDELORTHO CORPORATION: BUSINESS OVERVIEW

- TABLE 180 QNOSTICS: BUSINESS OVERVIEW

- TABLE 181 MAINE MOLECULAR QUALITY CONTROLS, INC.: BUSINESS OVERVIEW

- TABLE 182 RANDOX LABORATORIES LTD.: BUSINESS OVERVIEW

- TABLE 183 DANAHER CORPORATION: BUSINESS OVERVIEW

- TABLE 184 BIO-TECHNE CORPORATION: BUSINESS OVERVIEW

- TABLE 185 FORTRESS DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 186 MICROBIX BIOSYSTEMS: BUSINESS OVERVIEW

- TABLE 187 GRIFOLS, S.A.: BUSINESS OVERVIEW

- TABLE 188 ANCHOR MOLECULAR: BUSINESS OVERVIEW

- TABLE 189 SPEEDX PTY. LTD.: BUSINESS OVERVIEW

- TABLE 190 SEEGENE INC.: BUSINESS OVERVIEW

- TABLE 191 HELENA LABORATORIES CORPORATION: BUSINESS OVERVIEW

- TABLE 192 SERO AS: BUSINESS OVERVIEW

- TABLE 193 VIRCELL, S.L.: BUSINESS OVERVIEW

- TABLE 194 STRECK LLC.: BUSINESS OVERVIEW

- TABLE 195 SUN DIAGNOSTICS, LLC: BUSINESS OVERVIEW

- TABLE 196 MOLBIO DIAGNOSTICS PVT. LTD.: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 INSIGHTS FROM INDUSTRY EXPERTS

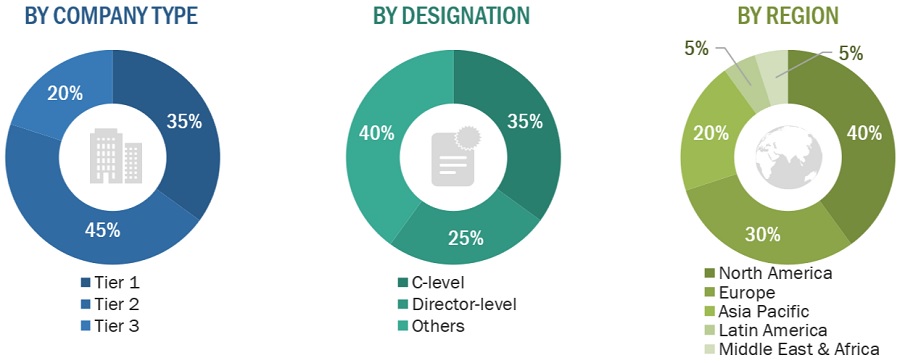

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 MOLECULAR QUALITY CONTROLS MARKET: REVENUE SHARE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION: PARENT MARKET

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 MOLECULAR QUALITY CONTROLS MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 MOLECULAR QUALITY CONTROLS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 MOLECULAR QUALITY CONTROLS MARKET, BY ANALYTE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 MOLECULAR QUALITY CONTROLS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 MOLECULAR QUALITY CONTROLS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF MOLECULAR QUALITY CONTROLS MARKET

- FIGURE 16 RISING PREVALENCE OF INFECTIOUS DISEASES AND CANCER TO DRIVE MARKET

- FIGURE 17 INSTRUMENT-SPECIFIC CONTROLS SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 INFECTIOUS DISEASE DIAGNOSTICS SEGMENT IN JAPAN ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 MOLECULAR QUALITY CONTROLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 NUMBER OF LABORATORIES WITH CLIA ACCREDITATION, BY ORGANIZATION (MAY 2023)

- FIGURE 23 FDA-APPROVED PERSONALIZED MEDICINES (2015–2022)

- FIGURE 24 COST OF SEQUENCING PROCEDURES (2016−2021)

- FIGURE 25 GLOBAL CANCER INCIDENCE, 2018–2040 (MILLION)

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- FIGURE 28 MOLECULAR QUALITY CONTROLS MARKET: ECOSYSTEM MARKET MAP

- FIGURE 29 MOLECULAR QUALITY CONTROLS MARKET: TOP PATENT OWNERS AND APPLICANTS (JANUARY 2011–JUNE 2023)

- FIGURE 30 MOLECULAR QUALITY CONTROLS MARKET: TOP APPLICANT JURISDICTIONS (JANUARY 2011–JUNE 2023)

- FIGURE 31 MOLECULAR QUALITY CONTROLS MARKET: PATENT ANALYSIS (JANUARY 2011–FEBRUARY 2023)

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MOLECULAR QUALITY CONTROL PRODUCTS

- FIGURE 33 KEY BUYING CRITERIA FOR MOLECULAR QUALITY CONTROL PRODUCTS

- FIGURE 34 MOLECULAR QUALITY CONTROLS MARKET: REVENUE SHIFT

- FIGURE 35 NORTH AMERICA: MOLECULAR QUALITY CONTROLS MARKET SNAPSHOT

- FIGURE 36 US: NUMBER OF LABORATORIES WITH CLIA ACCREDITATION, BY ORGANIZATION (MAY 2023)

- FIGURE 37 ASIA PACIFIC: MOLECULAR QUALITY CONTROLS MARKET SNAPSHOT

- FIGURE 38 INDIA: INCREASING NUMBER OF LABORATORIES WITH NABL ACCREDITATIONS (2012–2020)

- FIGURE 39 MOLECULAR QUALITY CONTROLS MARKET: REVENUE SHARE ANALYSIS OF LEADING PLAYERS

- FIGURE 40 MOLECULAR QUALITY CONTROLS MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 41 MOLECULAR QUALITY CONTROLS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 42 MOLECULAR QUALITY CONTROLS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 43 LCG LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 44 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 46 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 47 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 48 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 49 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 50 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 51 MICROBIX BIOSYSTEMS: COMPANY SNAPSHOT (2022)

- FIGURE 52 GRIFOLS, S.A.: COMPANY SNAPSHOT (2022)

- FIGURE 53 SEEGENE INC: COMPANY SNAPSHOT (2022)

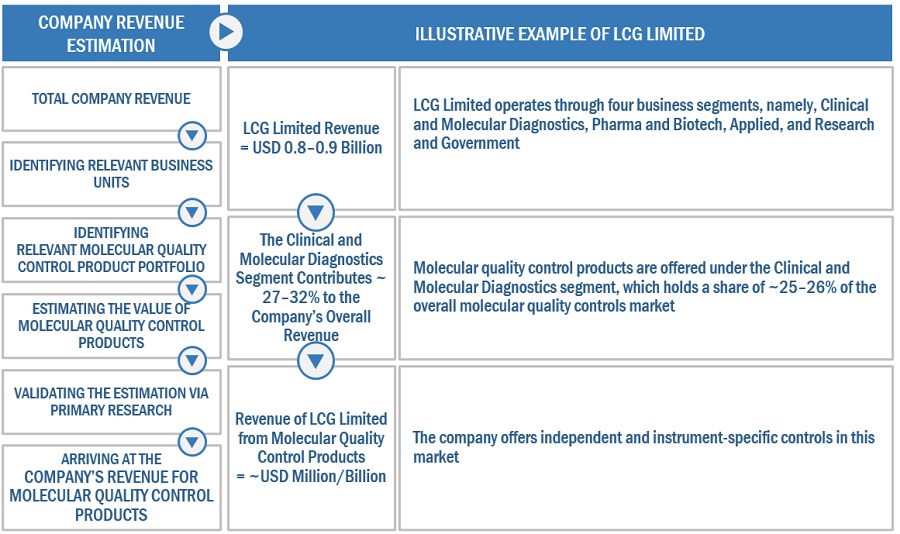

This study involved three major activities in estimating the size of the molecular quality controls market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the Clinical and Laboratory Standards Institute (CLSI), World Health Organization (WHO), Clinical Laboratory Improvement Amendments (CLIA), National Accreditation Board for Testing and Calibration Laboratories (NABL), Centers for Disease Control and Prevention (CDC), Organisation for Economic Co-operation and Development (OECD), Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), European Medicines Agency (EMA), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the molecular quality controls market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the smart pills market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the molecular quality controls market and to estimate the size of various other dependent submarkets in the overall molecular quality controls market.

The research methodology used to estimate the market size includes the following details:

- The market value of molecular quality controls for infectious disease diagnostics, oncology testing, and genetic testing applications have been extracted from the repository and validated through secondary and primary research.

- The market shares of the infectious disease diagnostics, oncology testing, and genetic testing applications in the global molecular quality controls market were derived and added up to reach the market value.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions, and other segments of the molecular quality controls market. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Molecular quality control is a quality control material made up of synthetic or biological components (such as whole blood, serum, plasma, urine, and spinal fluid sourced from human or animal origin) that can be used to evaluate and monitor analytical processes during molecular testing procedures for clinical diagnostics and research applications. The focus of these quality controls is to test the molecular diagnostic products in order to identify defects and report them to management authorities.

Key Stakeholders

- Molecular quality control manufacturers, vendors, and distributors

- Manufacturers and distributors of molecular diagnostic instruments and assays

- Group purchasing organizations (GPOs)

- Original equipment manufacturers (OEMs)

- Diagnostic laboratories

- Hospitals and clinics

- Contract research organizations (CROs)

- IVD manufacturers and distributors

- Blood banks

- Research institutes and government organizations

- Market research and consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists

Report Objectives

- To define, describe, segment, and forecast the global molecular quality controls market by product, analyte type, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall molecular quality controls market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the market segments in five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies2 in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as product launches, partnerships, collaborations, mergers, and acquisitions are the principal growth strategies adopted by market players in this period

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molecular Quality Controls Market

Nice share thanks for the details in quality control