IVD Quality Control Market Size, Growth, Share & Trends Analysis

In Vitro Diagnostics (IVD) Quality Control Market by Product & Service (QC (Plasma, Serum, Blood), Solutions), Technology (Immunoassay, MDx, Microbiology, Hematology), Manufacturer (Third-party, OEM), End User (Hospitals, Labs) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

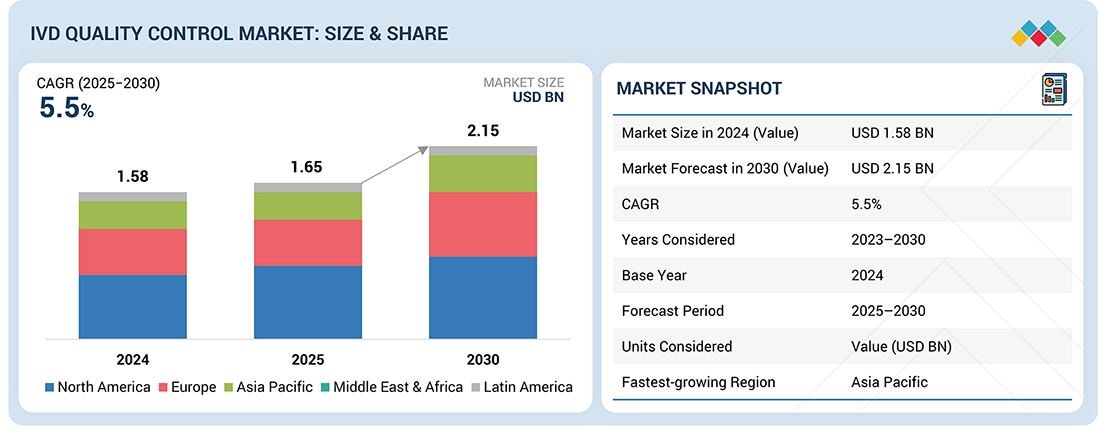

The IVD quality control market is expected to reach USD 2.15 billion by 2030, up from USD 1.65 billion in 2025, growing at a CAGR of 5.5% from 2025 to 2030. Several key factors are driving this substantial growth. The rising number of accredited clinical laboratories is increasing demand for standardized and reliable quality control products. Additionally, the growing dependence on third-party quality controls offers laboratories greater flexibility, impartial performance evaluation, and wider compatibility across various platforms. The increasing need for external quality assessment programs further emphasizes the importance of accurate and reproducible diagnostic results. Moreover, demographic changes, such as an aging population, have resulted in a higher incidence of chronic and infectious diseases, boosting the need for diagnostic testing. Furthermore, the adoption of Point-of-Care (PoC) instruments in developed regions is fueling greater demand for robust quality control solutions that ensure timely and accurate results in diverse clinical settings.

KEY TAKEAWAYS

-

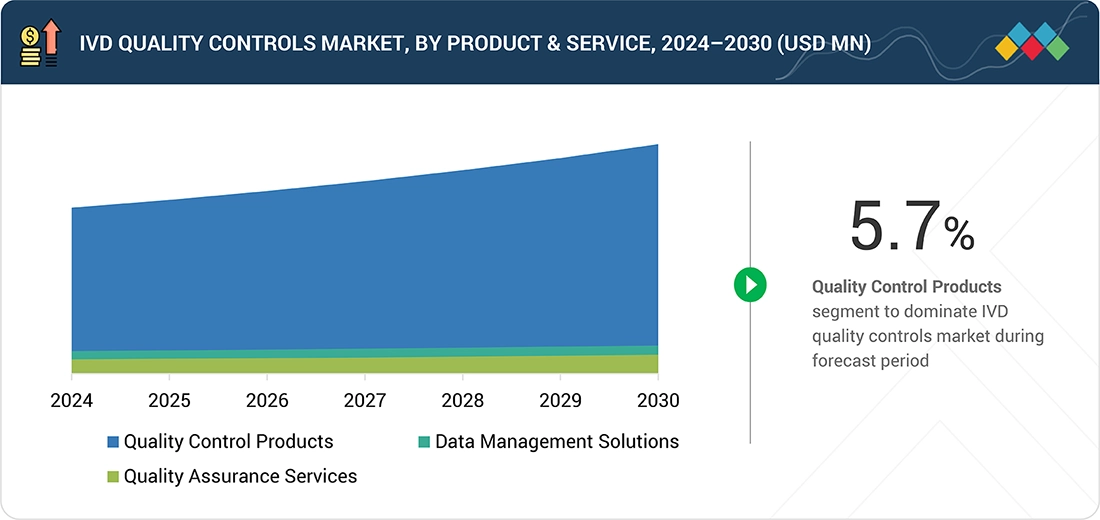

BY PRODUCT & SERVICEThe IVD quality controls market is segmented into quality control products, data management solutions, and quality assurance services. Quality control products, such as third-party controls, reference standards, and proficiency testing samples, are essential for ensuring the accuracy and reliability of diagnostic tests. They are commonly used in clinical chemistry, immunoassays, hematology, molecular diagnostics, and other diagnostic platforms to verify instrument performance and comply with regulatory standards.

-

BY TECHNOLOGYThe market for IVD quality controls spans several technologies, including immunoassays, clinical chemistry, molecular diagnostics, microbiology, hematology, coagulation & hemostasis, and other technologies. The immunoassay segment maintains dominance in the IVD quality controls market due to its high sensitivity, specificity, and reproducibility, which are essential for accurate results. The growing prevalence of chronic and infectious diseases has driven increased demand for immunoassay-based testing. In addition to immunoassays, other technologies like clinical chemistry, molecular diagnostics, and microbiology also play a vital role in the IVD quality controls market. Clinical chemistry and microbiology controls are used to verify the accuracy of diagnostic tests, while molecular diagnostics controls are increasingly important for precision testing in genetic and cancer-related conditions. Hematology and coagulation & hemostasis technologies further expand the range of applications where quality controls are necessary to monitor patient health effectively.

-

BY MANUFACTURE TYPEKey segments include third-party and OEM controls, with third-party controls experiencing significant growth due to the rising demand for independent controls that provide unbiased performance verification and wider compatibility across various testing platforms.

-

BY END USERThe hospital sector dominates demand due to the substantial volume of diagnostic testing performed in both inpatient and outpatient environments. The increasing number of hospital admissions, particularly among the elderly and individuals with chronic illnesses, generates a significant need for dependable and precise diagnostic outcomes, thereby necessitating the consistent application of quality control measures. Moreover, hospitals are subject to rigorous regulatory and accreditation standards that mandate compliance with quality benchmarks, further emphasizing the importance of comprehensive quality control. Following hospitals, clinical laboratories, academic and research institutions, and other end users also contribute to the expanding requirement for IVD quality controls. Clinical laboratories uphold high testing standards across various diagnostic fields, while academic and research institutions drive innovation and progress in testing, all of which depend on the implementation of quality controls to ensure reliability and accuracy of results.

-

BY REGIONAsia Pacific is expected to grow the fastest, with a CAGR of 7.2%, driven by the increasing prevalence of chronic diseases, infectious conditions, an aging population, and rising investments in diagnostics across countries like China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. For instance, leading companies such as Thermo Fisher and Bio-Rad have expanded their portfolios and entered into partnerships and collaborations to strengthen their diagnostic offerings and meet the increasing demand for IVD quality control solutions.

The IVD quality control market is expected to witness significant growth over the next decade, driven by the increasing demand for accurate and standardized diagnostic results, expanding healthcare infrastructure, and ongoing advancements in diagnostic technologies. Quality control products, such as serum/plasma controls, whole blood controls, and urine controls, are widely adopted to ensure reliable and reproducible diagnostic outcomes. The rising prevalence of chronic and infectious diseases, along with the focus on early detection and preventive care, further boosts the demand for IVD quality control solutions. Additionally, the growing number of accredited clinical laboratories and advances in Point-of-Care (PoC) testing are speeding up the adoption of quality control systems to support efficient and accurate diagnostics. The integration of innovative diagnostic tools like molecular diagnostics and immunoassays enables faster and more precise results, especially in critical disease areas. With the expanding use of third-party controls and the shift toward more flexible, unbiased, and compatible testing platforms, the market is also experiencing a surge in demand for external quality control assessments.

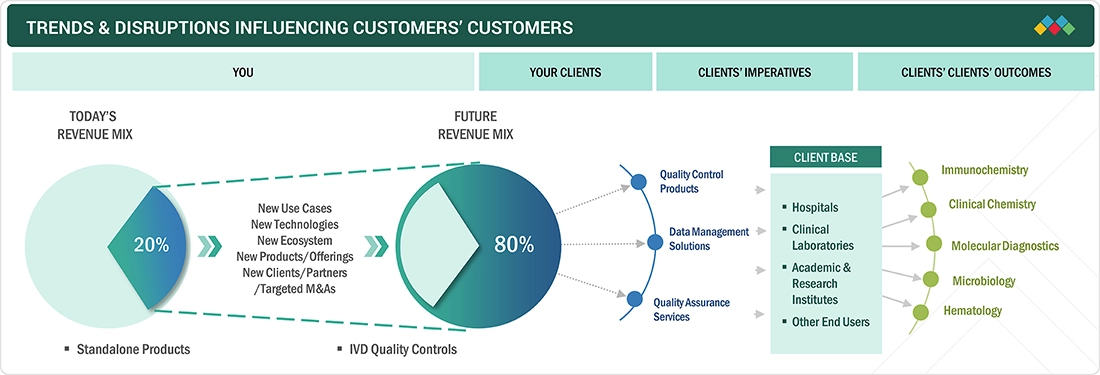

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

There is a growing shift toward more adaptable and cost-effective quality control solutions in the IVD market, driven by the changing needs of clinical laboratories, hospitals, and diagnostic centers. These end users are central to the demand for IVD quality control products, including control materials, data management tools, and quality assurance services. As healthcare providers face increasing pressure for faster and more accurate results, there is a noticeable rise in the use of third-party and multianalyte quality controls, which provide greater versatility and compatibility across various testing platforms. Additionally, the expansion of point-of-care (POC) testing and rapid diagnostics is transforming the landscape, especially in developed markets. As more healthcare facilities and laboratories adopt digital technologies, there is a growing emphasis on integrating data management systems that enable real-time monitoring of quality control performance. This integration ensures compliance with strict regulatory standards while also improving operational efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

2.15

-

Growing adoption of third-party quality controls

Level

-

Additional costs and budget constraints in hospitals and laboratories

-

Unfavorable reimbursement scenario for IVD tests

Level

-

Rising demand for multianalytes controls

-

Increasing growth opportunities in emerging economies

Level

-

Stringent product approval process

-

Lack of regulations for clinical laboratory accreditation in several emerging countries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Increasing number of accredited clinical laboratories

The increasing number of accredited clinical laboratories is a key driver for the growth of the IVD quality controls market. Accreditation programs, such as ISO 15189, CAP, and other regional certification standards, require laboratories to implement strict quality management systems, ensuring the accuracy, consistency, and reliability of diagnostic testing. As more laboratories seek accreditation to meet regulatory requirements and improve their credibility, the demand for high-quality control products, data management solutions, and quality assurance services is growing. Accredited labs rely heavily on quality control solutions to maintain testing accuracy, stay compliant, and participate in external quality assessment (EQA) programs. These controls are critical for ensuring reproducible results across various instruments and testing sites, helping laboratories achieve consistent performance. This trend is especially significant in regions with strict healthcare regulations and high testing volumes, where maintaining high standards is vital for both clinical and regulatory success.

Restraint: Additional costs and budget constraints in hospitals and laboratories

A major challenge in the IVD quality control market is the high cost burden on hospitals and laboratories. Setting up strong quality control systems needs a big investment in QC products, data management tools, and quality assurance services. This financial pressure is especially hard for smaller hospitals and labs, especially those in developing areas or with limited budgets. These facilities might find it difficult to dedicate enough resources for high-quality multianalyte controls, automated QC devices, or advanced digital monitoring systems.

Opportunity: Rising demand for multianalytes controls

With the increasing integration of advanced diagnostic technologies, such as automated systems, molecular diagnostics, and point-of-care platforms, the demand for flexible and multifunctional quality control solutions is rising. This trend creates an opportunity for market players to innovate by developing multianalyte controls that support various diagnostic platforms and instrument types, catering to laboratories of all sizes. Furthermore, pairing these controls with digital tools for data management and real-time monitoring can further streamline laboratory operations, increase reliability, and ensure compliance with regulatory standards.

Challenge: Stringent product approval process

A major hurdle for companies in the IVD quality controls market is the demanding regulatory approval process that new products must undergo. Regulatory bodies such as the FDA, CE marking agencies, and various regional authorities enforce rigorous standards to ensure the safety, reliability, and clinical accuracy of all quality control materials. This often involves a lengthy and resource-intensive process, requiring extensive documentation, validation studies, and performance evaluations. For companies, especially small and medium-sized enterprises (SMEs), this can create significant delays and increase costs, restricting their ability to quickly introduce innovative products to the market.

IVD Quality Control Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provider of third-party quality control materials for immunoassays, molecular diagnostics, and clinical chemistry testing | Ensures consistency across instruments and platforms, reduces inter-laboratory variability, and strengthens regulatory compliance |

|

Offers quality control solutions integrated with analyzers and reagents for molecular and immunodiagnostic testing | Improves test accuracy and reproducibility, supports streamlined laboratory workflows, and enhances overall reliability in high-throughput settings |

|

Uses internal and external quality control materials in hematology, clinical chemistry, and immunoassay systems | Optimizes analyzer performance, supports early error detection, and boosts confidence in patient result |

|

Develops reference materials and proficiency testing schemes for diagnostic laboratories | Facilitates standardization across labs, aids in method validation, and ensures traceability to international quality standards |

|

Incorporates comprehensive quality control products into its molecular and immunodiagnostic platforms | Enhances reliability of clinical decision-making, minimizes false positives/negatives, and supports compliance with global accreditation guidelines |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The IVD quality controls market ecosystem encompasses a wide range of key players. At the center, manufacturers of IVD control products play a crucial role, including entities responsible for research, development, refinement, and product launches. The ecosystem also involves distribution channels, such as third-party vendors and online platforms, which work with manufacturers to promote molecular diagnostic products. The end users, who depend on these quality control products, are vital to the overall supply chain, as they directly influence the demand for these solutions. Meanwhile, investors, financial backers, and regulatory authorities have a significant impact on the market, shaping strategies and ensuring products meet necessary health standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

IVD Quality Controls Market, By Product & Service

The IVD quality controls market is segmented into quality control products, data management solutions, and quality assurance services. Quality control products, such as third-party controls, reference standards, and proficiency testing samples, play a key role in ensuring the accuracy and reliability of diagnostic tests. These products are widely applied across clinical chemistry, immunoassays, hematology, molecular diagnostics, and other diagnostic platforms to validate instrument performance and comply with regulatory requirements.

IVD Quality Controls Market, By Technology

The IVD quality controls market by technology is segmented into immunoassays, clinical chemistry, molecular diagnostics, microbiology, hematology, coagulation & hemostasis, and other technologies. The immunoassay segment holds a dominant position in the market, driven by its extensive use in diagnostic laboratories and the high demand for accurate and reliable testing. Its essential role in detecting a wide range of diseases, along with continuous technological advancements, has contributed to its broad adoption.

IVD Quality Controls Market, By Manufacturer Type

The IVD quality controls market by manufacturer type is divided into third-party controls and original equipment manufacturer controls. The third-party controls segment is seeing significant growth due to the increasing demand for independent controls that ensure unbiased performance verification and offer wide compatibility across different testing platforms.

IVD Quality Controls Market, By End User

The IVD quality controls market by end user is segmented into hospitals, clinical laboratories, academic & research institutes, and other end users. The hospitals segment leads the market in demand, driven by the high volume of diagnostic testing conducted in both inpatient and outpatient settings. The growing number of hospital admissions, particularly among aging populations and patients with chronic conditions, increases the need for reliable and accurate diagnostic results, which in turn necessitates the consistent use of quality controls.

REGION

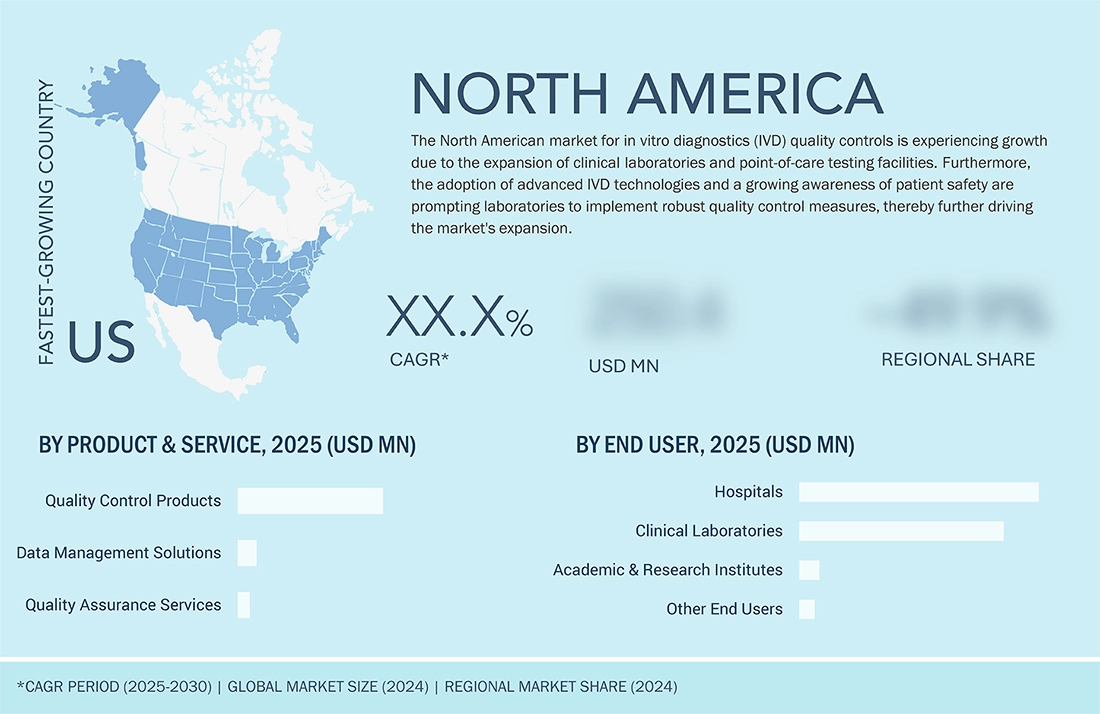

The North American IVD quality controls market is growing due to increasing regulatory requirements, rising demand for accurate and reliable diagnostic testing, and the expansion of clinical laboratories and point-of-care testing facilities. Additionally, the adoption of advanced IVD technologies and growing awareness about patient safety are driving laboratories to implement robust quality control measures, further fueling market growth

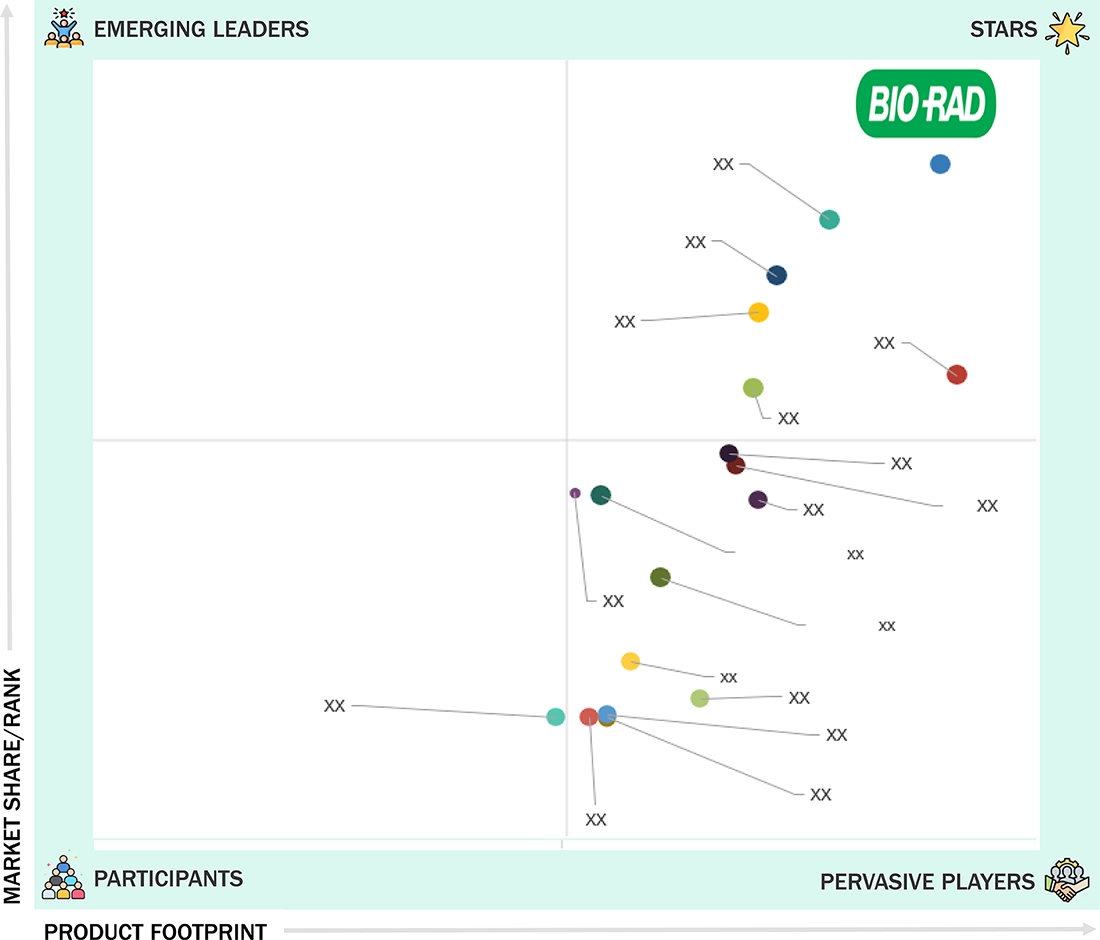

IVD Quality Control Market: COMPANY EVALUATION MATRIX

Bio-Rad Laboratories, Inc. (US) is a leading company in the IVD quality controls market, offering one of the most comprehensive ranges of independent and instrument-specific controls across clinical chemistry, immunoassays, hematology, molecular diagnostics, and microbiology. The company’s global presence, combined with ongoing product innovation, enables it to meet the changing needs of diagnostic labs and healthcare providers. Bio-Rad focuses on laboratory standardization, accuracy, and regulatory compliance while ensuring compatibility across multiple instruments, which helps promote the widespread use of its controls in various clinical environments. Strong investments in R&D, a broad distribution network, and a customer-focused approach further enhance its leadership in the quality controls market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| 2.15 | USD 1.58 Billion |

| Revenue Forecast in 2030 | USD 2.15 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

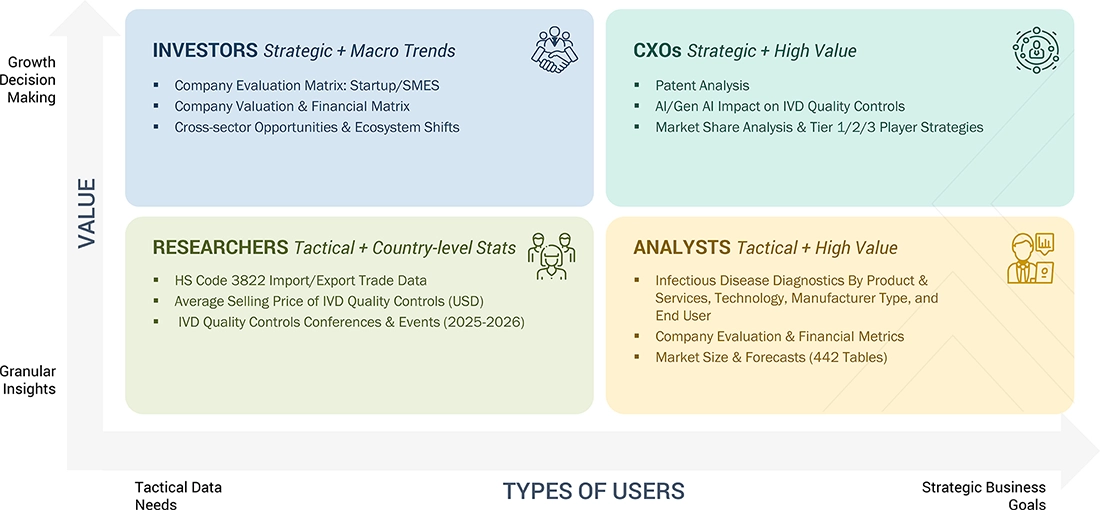

WHAT IS IN IT FOR YOU: IVD Quality Control Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| 2.15 | Product matrix, which provides a detailed comparison of product portfolio of each company in IVD quality controls market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities |

| Company Information | Additional five company profiles of players operating in IVD quality controls market | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning |

| Geographic Analysis | Additional country-level analysis of IVD quality controls market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities |

RECENT DEVELOPMENTS

- 2.15 : ZeptoMetrix (US) launched NATtrol Influenza A H5N1 Quantitative Stock, a molecular diagnostic quality assurance product that uses phage-like particle encapsulated RNA technology. It is designed to enhance accuracy and reliability in H5N1 detection while supporting laboratories in validating end-to-end testing workflows.

- March 2025 : Microbix Biosystems Inc. (Canada) signed a Memorandum of Understanding (MOU) with the Australian Centre for the Prevention of Cervical Cancer (ACPCC) and its Australian HPV Reference Laboratory (Australia). Under this agreement, Microbix will provide its PROCEEDxFLOQ brand Quality Assessment Products (QAPs) to support the quality management of testing for high-risk Human Papillomavirus (HPV) infections.

- November 2024 : Bio-Techne Corporation (US) obtained In Vitro Diagnostic Regulation (IVDR) certification for its R&D Systems Hematology Controls and Calibrators, confirming compliance with European Union standards for in-vitro diagnostic devices.

- September 2024 : LGC Limited (UK) partnered with AccuGenomics, Inc. (US) to promote innovation in molecular diagnostics by combining LGC’s quality control expertise with AccuGenomics’ NGS monitoring technologies. The collaboration aims to create reliable quality control solutions for cancer NGS testing, supporting precision medicine and providing more accurate, actionable results for patients.

Table of Contents

Methodology

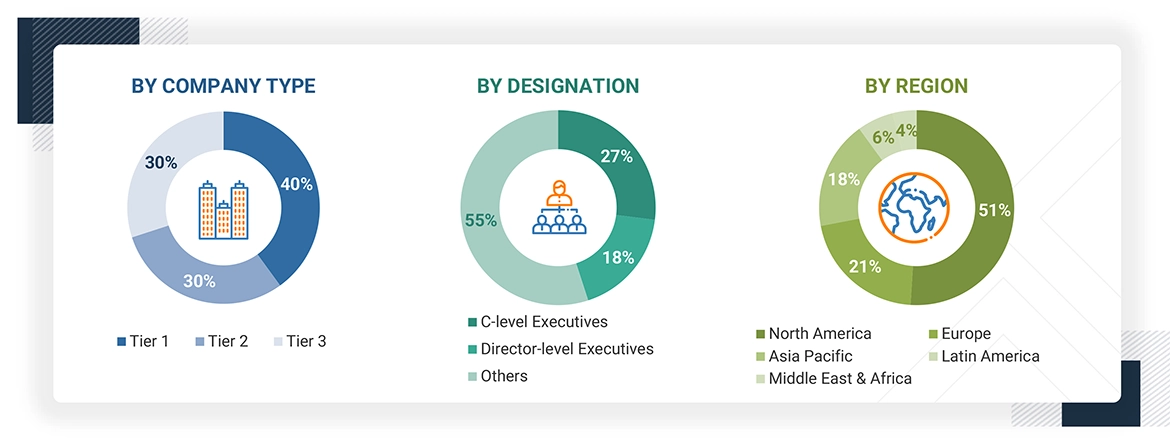

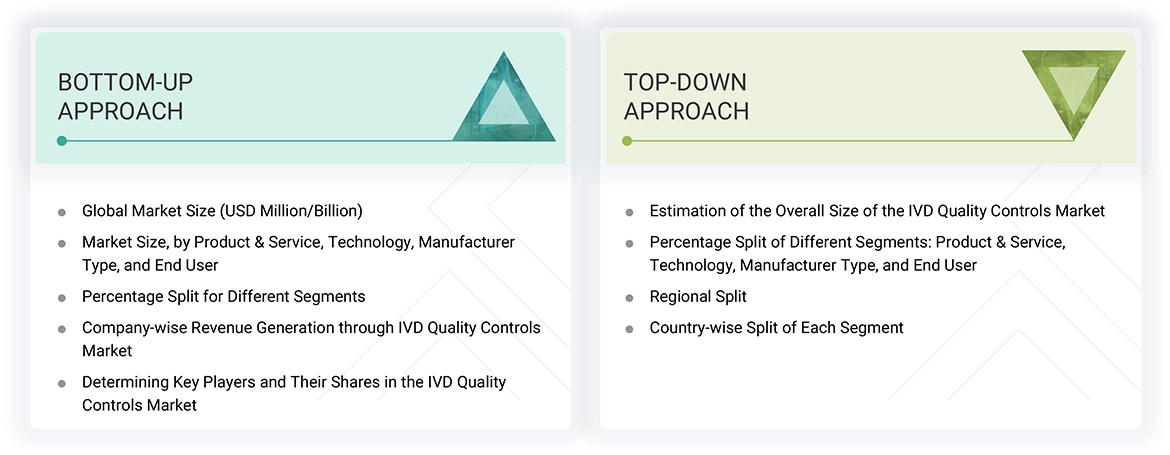

The study involved major activities in estimating the current market size for the global IVD quality controls market.

Exhaustive secondary research was done to collect information on the IVD quality controls market. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the IVD quality controls market.

The four steps involved in estimating the market size are as follows:

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenue. Here’s the breakdown of tiers: Tier 1 = > USD 100 million, tier 2 = USD 10 million to USD 100 million, and tier 3 = < USD 10 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the IVD quality controls market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

IVD quality controls are standardized materials used to monitor, evaluate, and ensure the accuracy, reliability, and precision of diagnostic testing processes in clinical laboratories. These controls are designed to mimic patient samples and are produced from human-derived matrices such as serum, plasma, urine, or whole blood. IVD quality controls provide a benchmark for validating test system performance, detecting errors, and ensuring regulatory compliance across diverse diagnostic platforms.

Stakeholders

- Senior Management

- End Users

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global IVD quality controls market by product & service, technology, manufacturer type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall IVD quality controls market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the IVD quality controls market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

What are the recent trends affecting the IVD quality controls market?

The market is experiencing increasing adoption of multianalyte and third-party quality controls, as well as the integration of digital and AI-driven data management systems for real-time QC monitoring and predictive analytics. There's also a rising focus on laboratory accreditation and regulatory compliance, prompting adoption of robust QC products and services.

What are the major types of products & services in the IVD quality controls market?

The market is segmented into quality control products, data management solutions, and quality assurance services. In 2024, quality control products held the largest share due to rising diagnostic test volumes and regulatory requirements.

Who are the key players in the IVD quality controls market?

Key players include Bio-Rad Laboratories, Thermo Fisher Scientific, Abbott, LGC Limited, F. Hoffmann-La Roche, Randox Laboratories, Siemens Healthineers, QuidelOrtho Corporation, Danaher Corporation, Sysmex Corporation, Bio-Techne, Microbix Biosystems, Microbiologics, ZeptoMetrix, Fortress Diagnostics, Helena Laboratories, and Streck, Inc.

How is the IVD quality controls market segmented based on manufacturer type?

The market is segmented into third-party controls and OEM controls. Third-party controls held the largest share in 2024 due to their platform flexibility, extended shelf-life, and unbiased performance evaluation.

Which region is lucrative for the IVD quality controls market?

Asia Pacific is a high-growth region, driven by improved healthcare infrastructure, increasing diagnostic testing, expanding clinical labs, and growing awareness of accurate diagnostics and quality assurance.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the In Vitro Diagnostics (IVD) Quality Control Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in In Vitro Diagnostics (IVD) Quality Control Market

harsh

Sep, 2019

Nice share...http://www.mexcontrol.com/.