Motor Management Market by Product & Service (Hardware and Software & Solution Services), Type (Synchronous Motor and Asynchronous Motor), Control, Voltage Range, Application, Industry, and Geography - Global Forecast to 2023

[167 Pages Report] The rate of adoption of motor management depends on the degree of automation in the industrial space. Control devices and software offer several benefits for motor management such as energy savings, precise control, and less wear and tear through the efficient monitoring of load conditions.

Motors are an integral part of industrial processes. Almost 65% of the total electricity consumption within industries is accounted for by motors. Motor failure could result in discontinuation of the overall functioning of industries for a period of time until it is resolved. Motor management provides comprehensive solutions for industrial processes and is scalable from an individual motor to a large plant. It combines various management and control devices through the communication network. The data provided by motor management using sensors deployed in electric motors are utilized for preventive maintenance, thereby leading to reduction in unplanned downtime and increased equipment efficiency in an industrial plant. Fully automated functionality is provided to motors by using microcontrollers programmed with software for instance, Siemens AG (Germany) has developed motor management operating software, such as SIMOCODE ES V14 based on the TIA Portal, SIMOCODE pro in SIMATIC PCS 7 and SIMATIC PDM, and SIMOCODE pro integrated in Win-SIMOCODE-DP, which helps in parameterization, diagnostics, and maintenance relevant monitoring functions. Another software package of General Electric (US), EnerVista Launchpad, allows configuring electric motors in real time by communicating using serial, Ethernet, or modem connections.

The motor management market for control devices and software is expected to be worth USD 4.03 Billion by 2023, growing at a CAGR of 5.35% between 2017 and 2023. The market is propelled by the rising demand for smart, multifunctional, integrated motor control, and protection devices as well as the need for reducing unplanned industrial downtime.

In this report, the motor management market has been segmented on the basis of type, product & service, voltage range, control, application, industry, and geography. The market for hardware equipment for motor management is expected to be worth USD 4.03 billion by 2023, growing at a CAGR of 5.35% between 2017 and 2023. The motor management and control device components comprise soft starters with microcontrollers, circuit breakers and fuses, overload relays and contractors, resistors, reactors and capacitors, variable speed drives, switches, and Ethernet controllers. The increasing automation in various industries worldwide is likely to drive the growth of the global motor management market in the near future.

The motor management market for automatic control purpose held the largest market size in 2016. Along with the fully automated functionality of motors with microcontrollers, they are equipped with software such as SynRM software (ABB Ltd.), InstaSPIN (Texas Instrument), and EnerVista Software (GE). With the help of sensors, features such as fault detection and protection can be provided to the motors without any human intervention.

The motor management market for the oil & gas industry held the largest market size in 2016. The Gulf of Mexico is a major source of oil and natural gas for the US. Moreover, Mexico also has plans to invest in the utilities sector to increase its power generation capacity, with the help of natural gas as the main fuel. According to the Oil & Gas Journal (OGJ), the UK had 2.8 billion barrels of proven crude oil reserves in 2015. The Mariner field discovered in the UK 1981 is a major project that is currently under development. The UK’s Department Of Energy And Climate Change (DECC) approved the development of the oilfield in February 2013, and the start of the extraction was initially planned for 2017. However, it has been delayed by Statoil (Norway) till mid-2018. Saudi Arabia has 16% of the proven oil reserves in the world and is the largest exporter of petroleum products. It also had the second-largest crude production capacity after the US in 2014. Thus, the high potential for growth across various regions is expected to drive the motor management market for the oil & gas industry in the near future.

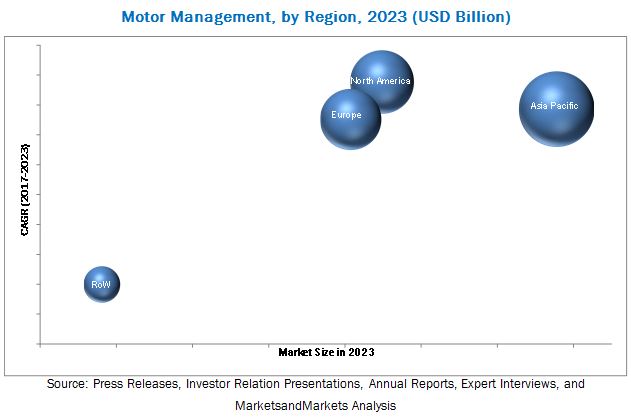

The motor management market in North America is expected to grow at a high CAGR between 2017 and 2023. The industrial infrastructure installed in North American industries is a couple of decades old, and companies in the region are currently focusing on upgrading this aging infrastructure. The replacement of existing control systems with a modern version of motor management devices would increase plant efficiency and reduce plant downtime for maintenance. Moreover, North America aims to reduce its emissions by 30% from 2005 to 2030 as part of a clean power plan proposed by the Environmental Protection Agency (EPA). The steadily growing adoption of motor management in industries such as food & beverages, construction, power generation, and also some mining projects in the region is a key driver for this market.

The major challenge for the motor management market is that the process industries are undergoing drastic changes and increasingly adopting automation. The increasing complexities in and expenditure on the business processes has led to the adoption of such technologies. Motor management have been gaining tremendous popularity for the automation and management of electric motors involved in running the processes in an industry. Still, there are many organizations which hesitate to automate their process activities due to the lack of awareness of the benefits offered by automation and are reluctant to bring any changes in their processes. This is the main factor responsible for the lesser adoption of motor management. Due to the high implementation cost, small companies are still using manual switches in electric motors. The resistance to change and perceived threat of employment insecurity by deploying motor management creates a challenge for the adoption of motor management. However, the rising focus on improving the efficiency of motor-driven equipment and preventive maintenance to avoid unplanned downtime is expected to help boost the market for motor management and controlled devices despite the tough competition from conventional motor controllers.

Market players such as General Electric (US), Texas Instruments (US), Siemens AG (Germany), Schneider Electric SE (France), and ABB Ltd. (Switzerland). Analog Devices, Inc., (US), Eaton Corporation Plc (Ireland), Mitsubishi Electric Corporation (Japan), Rockwell Automation (US), and Hitachi, Ltd (Japan) are focusing on product launches, research and development, acquisitions, and collaborations to enhance their product offerings and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Motor Management and Control Device Market, 2017–2023 (USD Million)

4.2 Motor Management and Control Device Market, By Type (2017–2023)

4.3 Motor Management and Control Device Market, By Motor Voltage (2017)

4.4 Motor Management and Control Device Market, By Motor Control (2017)

4.5 Motor Management and Control Device Market, By Application (2017)

4.6 Motor Management and Control Device Market, By Industry and Region (2017)

4.7 Motor Management and Control Device Market, By Geography (2017)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Rising Demand for Smart, Multifunctional, Integrated Motor Control and Protection Devices

5.1.1.2 Need for Reducing Unplanned Industrial Downtime

5.1.2 Opportunities

5.1.2.1 Increasing Adoption of Industrial Automation

5.1.2.2 Improved Software to Create New Possibilities in the Motors Management and Control Device Market

5.1.3 Challenges

5.1.3.1 Dominance of Conventional Motor Management and Controllers

5.1.3.2 Lack of Awareness Regarding Motor Management and Control Devices

5.1.3.3 Decreasing Greenfield Investments in the Oil & Gas Industry

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.1.1 Raw Material Suppliers

6.1.2 Original Equipment Manufacturers & Assemblers

6.1.3 Industries

6.2 Standards

6.2.1 Nema Standard Classification for Motor Management and Control Devices

6.2.2 International Electrotechnical Commission (IEC) for Motor Management and Control Devices

6.2.3 Others

7 Market, By Product & Service (Page No. - 46)

7.1 Introduction

7.2 Hardware

7.3 Software & Solution Services

8 Market, By Type (Page No. - 51)

8.1 Introduction

8.2 Asynchronous Motors

8.3 Synchronous Motors

9 Market, By Control (Page No. - 54)

9.1 Introduction

9.2 Automatic Controls

9.3 Semi-Automatic Controls

9.4 Manual Controls

10 Market, By Voltage Range (Page No. - 57)

10.1 Introduction

10.2 Low Voltage (60 to 240 Volt AC)

10.3 Medium Voltage (250 to 395 Volt AC)

10.4 High Voltage (396 to 485 Volt AC)

11 Market, By Application (Page No. - 60)

11.1 Introduction

11.2 Pumps

11.3 Compressors

11.4 Material Handling

11.5 Other Applications

12 Market, By Industry (Page No. - 88)

12.1 Introduction

12.2 Metals & Mining Industry

12.3 Oil & Gas Industry

12.4 Power Generation Industry

12.5 Water Supply and Wastewater Treatment Industry

12.6 Food & Beverages Industry

12.7 Agriculture

12.8 Chemicals Industry

12.9 Cement Industry

12.10 Other Industries

13 Geographic Analysis (Page No. - 104)

13.1 Introduction

13.2 North America

13.2.1 US

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Rest of Europe

13.4 Asia Pacific

13.4.1 China

13.4.2 Japan

13.4.3 India

13.4.4 Rest of Asia Pacific

13.5 Rest of World

13.5.1 Middle East and Africa

13.5.2 South America

14 Competitive Landscape (Page No. - 116)

14.1 Overview

14.2 Market Ranking Analysis of Motor Management and Control Device Market

14.3 Motor Management and Control Device Market, Competitive Leadership Mapping, 2017

14.3.1 Introduction

14.3.2 Visionary Leaders

14.3.3 Dynamic Differentiators

14.3.4 Innovators

14.3.5 Emerging Companies

14.3.6 Motor Management and Control Device Market

14.4 Strength of Product Portfolio

14.5 Business Strategy Excellence

*Top 25 Companies Analyzed for This Study are - ABB Ltd. (Switzerland), Ametek, Inc. (US), Anaheim Automation Inc. (US), Analog Devices, Inc. (US), Arm Holdings PLC (UK), Bartec GmbH (Germany), Bosch Rexroth AG (Germany), Boston Engineering (US), C3controls (US), Eaton Corporation PLC (Ireland), Fanox Electronic S.L (Spain), Fuji Electric Co. Ltd (Japan), General Electric (US), Hitachi, Ltd.(Japan), Iar System (Sweden), Larsen & Toubro (L&T) (India), Mitsubishi Electric Corporation (Japan), Nanotec Electronic GmbH & Co. Kg (Germany), Renesas Electronics (Japan), Rockwell Automation (US), Schneider Electric SE (France), Siemens AG (Germany), Texas Instruments (US), Velmex Inc. (US), Weg Sa (Brazil)

14.6 Competitive Situation and Trends

15 Company Profiles (Page No. - 124)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

15.1 Introduction

15.2 ABB Ltd

15.3 Analog Devices, Inc.

15.4 Eaton Corporation

15.5 General Electric (GE)

15.6 Hitachi Ltd.

15.7 Mitsubishi Electric Corporation

15.8 Rockwell Automation

15.9 Schneider Electric SE

15.10 Siemens AG

15.11 Texas Instruments Inc.

15.12 Key Innovators

15.12.1 Ametek, Inc.

15.12.2 Fuji Electric Co., Ltd.

15.12.3 Larsen & Toubro

15.12.4 Nanotec Electronic GmbH & Co. Kg

15.12.5 Weg Sa

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 158)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (72 Tables)

Table 1 Motor Management Market, By Product & Service, 2014–2023 (USD Million)

Table 2 Motor Management Market for Hardware, By Component, 2014–2023 (USD Million)

Table 3 Motor Management Market for Software & Solution Services, By Type, 2014–2023 (USD Million)

Table 4 Motor Management Market, By Motor Type, 2014–2023 (USD Million)

Table 5 Motor Management Market, By Motor Control Type, 2014–2023 (USD Million)

Table 6 Motor Management Market, By Voltage Range, 2014–2023 (USD Million)

Table 7 Motor Management Market, By Application, 2014–2023 (USD Million)

Table 8 Motor Management Market for Pumps, By Region, 2014–2023 (USD Million)

Table 9 Motor Management Market for Pumps for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 10 Motor Management Market for Pumps for Metals & Mining, By Region, 2014–2023 (USD Million)

Table 11 Motor Management Market for Pumps for Power Generation, By Region, 2014–2023 (USD Million)

Table 12 Motor Management Market for Pumps for Chemicals, By Region, 2014–2023 (USD Million)

Table 13 Motor Management Market for Pumps for Cement, By Region, 2014–2023 (USD Million)

Table 14 Motor Management Market for Pumps for Food & Beverages, By Region, 2014–2023 (USD Million)

Table 15 Motor Management Market for Pumps for Agriculture, By Region, 2014–2023 (USD Million)

Table 16 Motor Management Market for Pumps for Water Supply and Wastewater Treatment, By Region, 2014–2023 (USD Million)

Table 17 Motor Management Market for Pumps for Other Industries, By Region, 2014–2023 (USD Million)

Table 18 Motor Management Market for Compressors, By Region, 2014–2023 (USD Million)

Table 19 Motor Management Market for Compressors for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 20 Motor Management Market for Compressors for Metals & Mining, By Region, 2014–2023 (USD Million)

Table 21 Motor Management Market for Compressors for Power Generation, By Region, 2014–2023 (USD Million)

Table 22 Motor Management Market for Compressors for Chemicals, By Region, 2014–2023 (USD Million)

Table 23 Motor Management Market for Compressors for Cement, By Region, 2014–2023 (USD Million)

Table 24 Motor Management Market for Compressors for Food & Beverages, By Region, 2014–2023 (USD Million)

Table 25 Motor Management Market for Compressors for Agriculture, By Region, 2014–2023 (USD Million)

Table 26 Motor Management Market for Compressor for Water Supply and Wastewater Treatment, By Region, 2014–2023 (USD Million)

Table 27 Motor Management Market for Compressors for Other Industries, By Region, 2014–2023 (USD Million)

Table 28 Motor Management Market for Material Handling, By Region, 2014–2023 (USD Million)

Table 29 Motor Management Market for Material Handling for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 30 Motor Management Market for Material Handling for Metals & Mining, By Region, 2014–2023 (USD Million)

Table 31 Motor Management Market for Material Handling for Power Generation, By Region, 2014–2023 (USD Million)

Table 32 Motor Management Market for Material Handling for Chemicals, By Region, 2014–2023 (USD Million)

Table 33 Motor Management Market for Material Handling for Cement, By Region, 2014–2023 (USD Million)

Table 34 MMCD Market for Material Handling for Food & Beverages, By Region, 2014–2023 (USD Million)

Table 35 MMCD Market for Material Handling for Agriculture, By Region, 2014–2023 (USD Million)

Table 36 MMCD Market for Material Handling for Water Supply and Wastewater Treatment, By Region, 2014–2023 (USD Million)

Table 37 MMCD Market for Material Handling for Other Industries, By Region, 2014–2023 (USD Million)

Table 38 MMCD Market for Others, By Region, 2014–2023 (USD Million)

Table 39 MMCD Market for Others for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 40 MMCD Market for Others for Metals & Mining, By Region, 2014–2023 (USD Million)

Table 41 MMCD Market for Others for Power Generation, By Region, 2014–2023 (USD Million)

Table 42 MMCD Market for Others for Chemicals, By Region, 2014–2023 (USD Million)

Table 43 MMCD Market for Others for Cement, By Region, 2014–2023 (USD Million)

Table 44 MMCD Market for Others for Food & Beverages, By Region, 2014–2023 (USD Million)

Table 45 MMCD Market for Others for Agriculture, By Region, 2014–2023 (USD Million)

Table 46 MMCD Market for Others for Water Supply and Wastewater Treatment, By Region, 2014–2023 (USD Million)

Table 47 MMCD Market for Other Applications for Other Industries, By Region, 2014–2023 (USD Million)

Table 48 MMCD Market, By Industry, 2014–2023 (USD Million)

Table 49 MMCD Market for Metals & Mining Industry, By Application, 2014–2023 (USD Million)

Table 50 MMCD Market for Metals & Mining Industry, By Region, 2014–2023 (USD Million)

Table 51 MMCD Market for the Oil & Gas Industry, By Application, 2014–2023 (USD Million)

Table 52 MMCD Market for Oil & Gas Industry, By Region, 2014–2023 (USD Million)

Table 53 MMCD Market for Power Generation Industry, By Application, 2014–2023 (USD Million)

Table 54 MMCD Market for Power Generation Industry, By Region, 2014–2023 (USD Million)

Table 55 MMCD Market for Water Supply and Wastewater Treatment Industry, By Application, 2014–2023 (USD Million)

Table 56 MMCD Market for Water Supply and Wastewater Treatment Industry, By Region, 2014–2023 (USD Million)

Table 57 MMCD Market for Food & Beverages Industry, By Application, 2014–2023 (USD Million)

Table 58 MMCD Market for Food & Beverages Industry, By Region, 2014–2023 (USD Million)

Table 59 MMCD Market for Agriculture Industry, By Application, 2014–2023 (USD Million)

Table 60 MMCD Market for Agriculture Industry, By Region, 2014–2023 (USD Million)

Table 61 MMCD Market for Chemicals Industry, By Application, 2014–2023 (USD Million)

Table 62 MMCD Market for Chemicals Industry, By Region, 2014–2023 (USD Million)

Table 63 MMCD Market for Cement Industry, By Application, 2014–2023 (USD Million)

Table 64 MMCD Market for Cement Industry, By Region, 2014–2023 (USD Million)

Table 65 MMCD Market for Other Industries, By Application, 2014–2023 (USD Million)

Table 66 MMCD Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 67 MMCD Market, By Region, 2014–2023 (USD Million)

Table 68 MMCD Market in North America, By Country, 2014–2023 (USD Million)

Table 69 MMCD Market in Europe, By Country, 2014–2023 (USD Million)

Table 70 MMCD Market in Asia Pacific, By Country, 2014–2023 (USD Million)

Table 71 MMCD Market in RoW, By Region, 2014–2023 (USD Million)

Table 72 Ranking of Key Players in the MMCD Market, 2016

List of Figures (72 Figures)

Figure 1 Markets Covered in the Motor Management and Control Device Market Report

Figure 2 Research Design

Figure 3 Motor Management Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Motor Management Market Size Estimation Methodology: Top-Down Approach

Figure 5 Motor Management Market Breakdown Data Triangulation Approach

Figure 6 Assumptions of the Research Study

Figure 7 Hardware Expected to Hold the Largest Size of the MMCD Market During 2017–2023

Figure 8 Asynchronous Motor Expected to Hold the Largest Share of the MMCD Market During 2017–2023

Figure 9 Automatic Control Expected to Hold the Largest Share of the MMCD Device in During 2017–2023

Figure 10 Low-Voltage Electric Motors Expected to Lead the MMCD Market During the 2017–2023

Figure 11 Pump Application Expected to Dominate the MMCD Market During the 2017–2023

Figure 12 MMCD Market for the Metals & Mining Industry Expected to Grow at the Highest Rate During 2017–2023

Figure 13 Asia Pacific Expected to Dominate the MMCD Market During 2017–2023

Figure 14 Attractive Growth Opportunities in the MMCD Market (2017–2023)

Figure 15 Asynchronous MMCD Market Expected to Grow at A High CAGR Between 2017 and 2023

Figure 16 Low-Voltage Motors Expected to Lead the MMCD Market in 2017

Figure 17 Automatic Motor Management and Controllers Expected to Lead the Market in 2017

Figure 18 Pumps Application Expected to Lead the Motor Management and Controllers Market in 2017

Figure 19 Oil & Gas Industry Expected to Hold the Largest Share of the MMCD Market in 2017

Figure 20 US to Hold the Largest Share of the MMCD Market in 2017

Figure 21 Drivers, Restraints, Opportunities, and Challenges for the MMCD Market

Figure 22 Snapshot: Crude Oil Monthly Price, USD/Barrel (2013–2017)

Figure 23 Motor Management and Control Devices Supply Chain Analysis

Figure 24 Hardware Expected to Hold the Larger Size of the MMCD Market By 2023

Figure 25 Soft Starters With Microcontrollers Expected to Lead the MMCD Hardware Market During the Forecast Period

Figure 26 Sensing & Fault Detection Expected to Hold the Largest Size of the MMCD Software Market Between 2017 and 2023

Figure 27 Asynchronous Motor Expected to Hold the Larger Size of the MMCD Market Between 2017 and 2023

Figure 28 Automatic Control Expected to Hold the Largest Size of the MMCD Market During the Forecast Period

Figure 29 MMCD Market for Low-Voltage Electric Motors Expected to Hold the Largest Market Size By 2023

Figure 30 Pumps Application Expected to Hold the Largest Size of the MMCD Market During the Forecast Period

Figure 31 MMCD Market for Pumps Application in North America Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 North America Expected Lead the MMCD Market for the Pump Application for the Oil & Gas Industry During the Forecast Period

Figure 33 Asia Pacific to Lead the MMCD Market for the Pumps Application for the Chemicals Industry During the Forecast Period

Figure 34 Europe to Lead the MMCD Market for Pumps for Other Industries During the Forecast Period

Figure 35 Asia Pacific Expected to Lead the MMCD Market for Compressors During the Forecast Period

Figure 36 Asia Pacific to Lead the MMCD Market for Compressors for Metals & Mining Industry During the Forecast Period

Figure 37 APAC to Lead the MMCD Market for the Compressor Application for the Cement Industry During the Forecast Period

Figure 38 APAC to Lead the MMCD Market for the Compressor Application for the Water Supply and Wastewater Treatment Industry During the Forecast Period

Figure 39 APAC to Lead the MMCD Market for the Material Handling Application in Asia Pacific During the Forecast Period

Figure 40 APAC to Lead the MMCD Market for the Material Handling Application for the Metals & Mining Industry During the Forecast Period

Figure 41 APAC to Lead the MMCD Market for the Material Handling Application for the Cement Industry During the Forecast Period

Figure 42 APAC to Witness the Highest CAGR for MMCD in Material Handling in Water Treatment Industry During the Forecast Period

Figure 43 APAC to Lead the MMCD Market for Other Applications for the Power Generation During the Forecast Period

Figure 44 APAC to Lead the MMCD Market for Other Applications for the Cement Industry During the Forecast Period

Figure 45 APAC to Witness the Highest CAGR for MMCD in Other Applications for the Agriculture Industry During the Forecast Period

Figure 46 Metals & Mining Industry Expected to Hold the Largest Size of the MMCD Market By 2023

Figure 47 North America Expected to Dominate the MMCD Market for the Oil & Gas Industry Between 2017 and 2023

Figure 48 MMCD Material Handling Market for the Power Generation Industry to Grow at the Highest CAGR By 2023

Figure 49 MMCD Market for the Water Supply and Wastewater Treatment in Europe Expected to Grow at the Highest Rate By 2023

Figure 50 MMCD Market for Compressors in the Food & Beverages Industry to Grow at the Highest CAGR By 2023

Figure 51 Asia Pacific Expected to Hold the Largest Size of the MMCD Market for the Agriculture Industry During the Forecast Period

Figure 52 North America Expected to Witness the Highest CAGR for the MMCD Market for Cement Industry During the Forecast Period

Figure 53 Rest of APAC to Witness the Highest Growth Rate in the MMCD Market During the Forecast Period

Figure 54 North America: MMCD Market Snapshot

Figure 55 MMCD Market in Europe: Snapshot

Figure 56 Germany Likely to Dominate the European MMCD Market During the Forecast Period

Figure 57 MMCD Market in Asia Pacific: Snapshot

Figure 58 Middle East & Africa to Lead the MMCD Market in RoW During the Forecast Period

Figure 59 Product Development Was the Key Growth Strategy Adopted By the Companies Between 2014 and 2017

Figure 60 Competitive Leadership Mapping, 2017

Figure 61 Market Evolution Framework: New Product Developments Fuelled the Growth of the Motor Management and Control Market

Figure 62 Product Launches & Developments—The Key Strategies Adopted By Players Between 2014 and 2017

Figure 63 ABB Ltd.: Company Snapshot

Figure 64 Analog Devices, Inc.: Company Snapshot

Figure 65 Eaton Corporation: Company Snapshot

Figure 66 General Electric (GE),: Company Snapshot

Figure 67 Hitachi Ltd.: Company Snapshot

Figure 68 Mitsubishi Electric Corporation Company Snapshot

Figure 69 Rockwell Automation: Company Snapshot

Figure 70 Schneider Electric Se: Company Snapshot

Figure 71 Siemens AG: Company Snapshot

Figure 72 Texas Instruments Inc.,: Company Snapshot

The motor management market for control devices and software was valued at USD 2.95 Billion in 2016 and is expected to reach USD 4.03 Billion by 2023, at a CAGR of 5.35% between 2017 and 2023.

The objective of the report is to provide a detailed analysis of the motor management market based on type, product & service, voltage range, control, application, industry, and region. The report provides detailed information regarding the major factors influencing the growth of the motor management market. It also gives a detailed overview of the value chain of the motor management and profiles the market leaders through competitive leadership mapping.

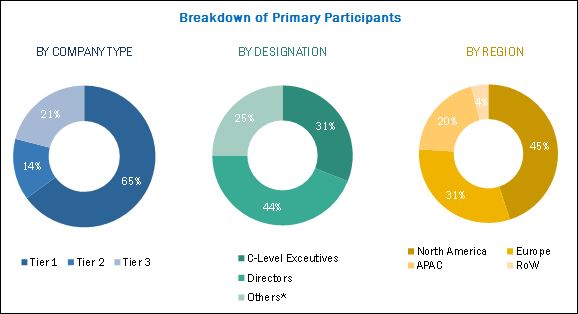

The research methodology used to estimate and forecast the motor management market begins with capturing data on key vendor revenue through secondary sources such as Organization of the Petroleum Exporting Countries (OPEC), Motion Control & Motor Association (MCMA), National Electrical Manufacturers Association (NEMA), press releases, investor relation presentations, annual reports, etc. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up approach is employed to arrive at the overall size of the global motor management market from the revenue of key players. After arriving at the overall market size, the total market is split into several segments and subsegments. These are further verified through primary research by conducting extensive interviews with people holding key positions, such as CEOs, VPs, directors, and executives. Market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primaries is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The motor management ecosystem comprises equipment providers, system integrators, software providers, and distributors. Major players involved in the manufacturing of control devices for the motor management market are General Electric (US), Texas Instruments (US), Siemens AG (Germany), Schneider Electric SE (France), ABB Ltd. (Switzerland), Analog Devices, Inc., (US), Eaton Corporation Plc (Ireland), Mitsubishi Electric Corporation (Japan), Rockwell Automation (US), and Hitachi, Ltd (Japan).

Target Audience of the Report:

- Energy efficiency consultancies

- Government and research organizations

- Investors/shareholders

- Manufacturing industries

- Motor control center manufacturers, dealers, and suppliers

- Petroleum companies

- Process industries and power industry associations

- Research organizations and consulting companies

- System integrators

- Technology consultants

- Value added resellers

“This study answers several questions for stakeholders, primarily, which market segments to focus on in the next two to six years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the global motor management market segmented on the basis of type, product & service, voltage range, control, application, industry, and region.

Motor Management Market, by Type

- Synchronous Motor

- Asynchronous Motor

Motor Management Market, by Product & Service

- Hardware

- Software & Solution Services

Motor Management Market, by Voltage Range

- Low Voltage

- Medium Voltage

- High Voltage

Motor Management Market, by Control:

- Automatic

- Semi-Automatic

- Manual

Motor Management Market, by Application

- Pumps

- Compressors

- Material Handling

- Others

Motor Management Market, by Industry

- Oil & Gas

- Metals & Mining

- Power Generation

- Chemicals

- Cement

- Food & Beverages

- Agriculture

- Water Supply and Wastewater Treatment

- Others

Motor Management Market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Motor Management Market