Servo Motors and Drives Market by System (Linear, Rotary), Communication Type (Fieldbus, Industrial Ethernet, Wireless), Voltage (Low, Medium, High), Brake Technology, Material, Product Type, End-users, Offering and Region - Global Forecast to 2027

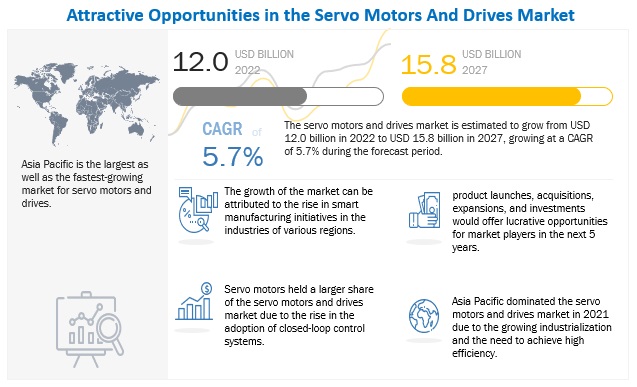

The servo motors and drives market in terms of revenue was estimated to be worth $12.0 billion in 2022 and is projected to reach $15.8 billion by 2027, growing at a CAGR of 5.7% during the forecast period.

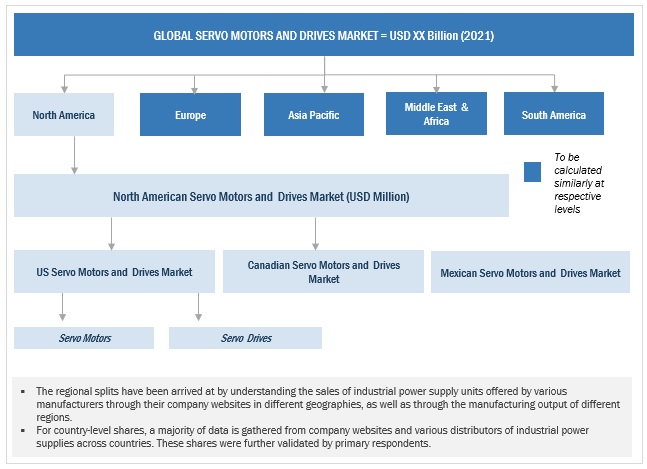

The rise in smart manufacturing initiatives to improve reliability and increase productivity in industrial processes is supporting the growth of the servo motors and drives market in various countries. Asia Pacific is estimated to be the largest market for servo motors and drives in 2021 due to the undergoing developments in the field of automation in the countries such as Japan, South Korea, and China.

To know about the assumptions considered for the study, Request for Free Sample Report

Servo Motors and Drives Market Dynamics

Driver: Rising need for motion control systems in automated production plants of SMEs

Small and medium enterprises (SMEs) are playing a major role in the business world. About 90% of the businesses in the world are SMEs. Several manufacturing companies in the SME category have been concentrating on features such as quality, speed, and flexibility in industrial machinery.

Small and medium enterprises (SMEs) in this context can implement servo systems as motion control systems to improve the productivity of manufacturing facilities. Automotive, packaging, and textile are a few of the industries where automated production plants are controlled by servo systems, which is boosting their productivity and cost-efficiency. For instance, Survey by Automation, which is a subsidiary of the International Society of Automation has found that prices of robot technologies will be reduced by 76% by 2025 from that of 2010. This trend will eliminate the major barrier of cost for SMEs. These trends are expected to drive the servo motors and drives market.

Restraint: Huge investment involved in integrating new automation technologies into current infrastructure

Huge investment is involved in integrating new automation technologies into current infrastructure. Factory automation involves integrating new technologies into the current infrastructure. Upgrading the automation technologies involves high costs to transform the whole infrastructure. Small and medium companies have the issue of funds for investing in Industry 4.0 technologies. This investment can be a barrier for several manufacturers. Servo motors in this context involve high overall system and installation costs when compared to other motors due to the feedback components.

Opportunities: Need for feedback control in servo systems driving demand for encoders

The rise in automated systems in a wide range of industries and applications has increased the demand for motion controllers for measuring the speed, torque, and position in maintaining the quality and efficiency of the processes in the industries. The usage of encoders reduces the number of wires and connections needed for control and ensures safe operations in machines and automated systems. Moreover, it facilitates a reduction in manual labor, improves quality, minimizes repetitive work, and decreases overall costs. Servo Systems are designed with encoders, thereby improving the accuracy and reliability of the processes in a manufacturing facility.

The designs of Encoders are also becoming more rugged and reliable making them suitable to withstand harsh environments. There are also other alternatives for encoders such as potentiometers for usage in servo motors but due to low accuracy and shorter life span of a potentiometer, the encoder is chosen. the rise in demand for feedback control systems is supported by growing automation, which is increasing the adoption of encoders in servomotors.

Challenges: Shortage of skilled workforce to handle complexities in automated manufacturing facilities

The growing automation has involved new technologies being integrated into manufacturing facilities. This has increased complexities for the industries to hire a skilled workforce to handle the machinery and respond to changes in technologies involved in the facilities. Plex Systems, which is a Rockwell Automation Company, published a report based on the global survey with 321 manufacturers on the “State of Smart Manufacturing” to observe the current challenges and opportunities of the manufacturers in implementing smart manufacturing in their facilities. As per the survey, the shortage of skilled workforce was one of the factors, which is an obstacle for the market to grow. Organizations must provide continuous learning options for the workforce to shift to new modes of operation. This has become the major challenge for the growth of the servo motors and drives market in the automation field.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Rotary Systems segment, by system type, is expected to be the largest segment during the forecast period

The rotary systems segment is expected to be the largest segment during the forecast period. The development of direct-drive rotary servo motors has resulted in the elimination of the need for gearboxes, pulleys, and other mechanical equipment. This has led to faster settling times, reduced energy consumption, and better control of the load directly connected to the servo motor. Rotary servo motors offer benefits such as high-resolution precision feedback, low energy consumption, and high torque density. This has made rotary servo motors useful for applications in food processing, packaging, healthcare, and transportation, textile, printing, and automotive.

By voltage, low voltage segment is expected to be the most significant contributor to the global servo motors and drives market during the forecast period

By voltage, the servo motors and drives market has been segmented into low voltage (Below 400 V), medium voltage (Between 400 V and 690 V), high voltage (Above 690 V) is expected to be the largest segment during the forecast period. Low-voltage servo motors and drives are best compatible for use in mobile applications that demand high acceleration and braking processes, low noise, and high efficiency. The ease of operation, low setup and maintenance costs, and high reliability are projected to drive the market for low-voltage servo motors and drives.

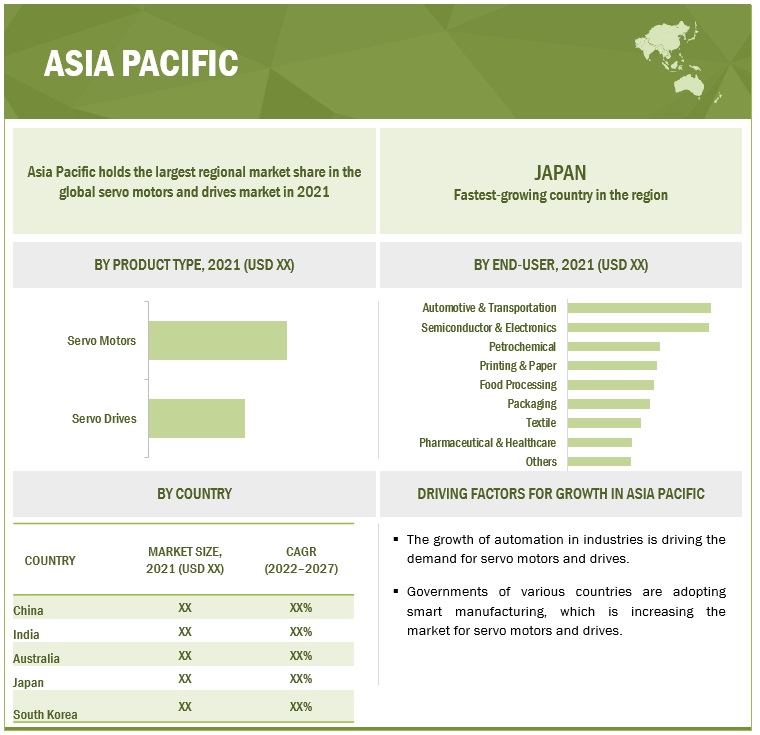

“Asia Pacific: The largest and fastest servo motors and drives market”

Asia Pacific is expected to dominate the global servo motors market between 2022–2027, followed by Europe and the North America. The servo motors and drives market in Asia Pacific is undergoing developments in the field of automation mainly in robotics in countries such as Japan, South Korea, and China. In other economies such as India and Indonesia, the robotics industry is in the nascent stage. This trend in the robotics field has increased the demand for servo motors as they are mainly used for motion control purposes in robots for applications such as pick and place operations. The growth of servo motors and drives is supported by the adoption of smart manufacturing initiatives for various applications in the Asia Pacific region.

Key Market Players

The servo motors and drives market is dominated by a few major players that have a wide regional presence. The major players in the servo motors and drives market are Yaskawa Electric (Japan), Mitsubishi Electric (Japan), Siemens (Germany), Rockwell Automation (US), and Schneider Electric (France). Between 2018 and 2022, the companies adopted growth strategies such as product launches, acquisitions, expansions, and investments to capture a larger share of the servo motors and drives market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Offering, Product type, Voltage, System type, Brake technology, Communication type, Material of Construction, End-user and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Yaskawa Electric (Japan), Mitsubishi Electric (Japan), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), ABB (Switzerland), NIDEC (Japan), Delta Electronics (Taiwan), FANUC (Japan), Fuji Electric (Japan), Kollmorgen Corporation (US), Parker Hannifin Corporation (US), Omron Corporation (OMRON) (US), SEW Eurodrive (Germany), LENZE (Germany), Bosch Rexroth AG (Germany), WEG (Brazil), AMETEK (US), Rozum Robotics Inc. (Belarus), ADTECH (SHENZHEN) Technology Co. Ltd (China) |

This research report categorizes the servo motors and drives market by Offering, Product type, Voltage, System type, Brake technology, Communication type, Material of Construction, End-user and Region

On the basis of offering type:

- Hardware

- Software and Services

On the basis of product type:

- Servo Motors

- Servo Drives

On the basis of voltage:

- Low Voltage

- Medium Voltage

- High Voltage

On the basis of by system type:

- Linear

- Rotary

On the basis of by brake technology:

- Spring

- Permanent magnet

- Others

On the basis of by communication type:

- Fieldbus

- Industrial Ethernet

- Wireless

On the basis of by material of construction:

- Stainless steel

- Others

On the basis of by end user:

- Automotive and transportation

- Semiconductor and Electronics

- Food Processing

- Textile

- Petrochemical

- Pharmaceutical and Healthcare

- Packaging

- Printing and Paper

- Others

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In July 2022, Yaskawa launched JL-L000A communications ASIC for supporting MECHATROLINK-4, which is a new-generation industrial network for achieving four times the transmission efficiency. This communication interface will be compatible with the controllers and servo packs.

- In April 2021, Siemens introduced new servo motors to its Sinamics S210 single-cable servo drive system suitable for a wide range of applications, especially for use in the pharmaceutical and food industries.

- In October 2021, Rockwell Automation launched an NSF-certified HMI terminal for operators to monitor production and new hygienic servo motors named Kinetix VPH hygienic servo motors for minimizing contamination risks in food and pharmaceutical industries.

Frequently Asked Questions (FAQ):

What is the current size of the servo motors and drives market?

The current market size of global servo motors and drives market is USD 11.4 billion in 2021.

What is the major drivers for servo motors and drives market?

The global servo motors and drives market is driven by The rising trends of automation and Industry 4.0, are improving the productivity and reliability of production processes in industries of various countries. This has made various end-user companies across the world take smart manufacturing initiatives such as introducing industrial robots, and industrial IoT (IIoT) in their business operations.

Which is the fastest-growing region during the forecasted period in servo motors and drives market?

Asia Pacific is the fastest-growing region during the forecasted period owing the Asia Pacific is undergoing developments in the field of automation mainly in robotics in countries such as Japan, South Korea, and China. The Increasing concern on the automation investments in various countries is likely to increase the demand for servo motors and drives.

Which is the fastest-growing segment, by system type during the forecasted period in servo motors and drives market?

The system type segment is witnessing a high demand during the forecasted period owing to the need for improving productivity of processes in various industries due to the advantages such as low energy consumption, and high torque density. This has increased the usage of rotary systems in industries such as food processing, packaging, healthcare, textile, printing, and automotive & transportation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 SERVO MOTORS AND DRIVES MARKET, BY OFFERING: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY COMMUNICATION TYPE: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY PRODUCT TYPE: INCLUSIONS & EXCLUSIONS

1.2.4 MARKET, BY BRAKE TECHNOLOGY: INCLUSIONS & EXCLUSIONS

1.2.5 MARKET, BY SYSTEM TYPE: INCLUSIONS & EXCLUSIONS

1.2.6 MARKET, BY VOLTAGE: INCLUSIONS & EXCLUSIONS

1.2.7 MARKET, BY MATERIAL OF CONSTRUCTION: INCLUSIONS & EXCLUSIONS

1.2.8 MARKET, BY END-USER: INCLUSIONS & EXCLUSIONS

1.2.9 MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 SERVO MOTORS AND DRIVES MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY AND PRIMARY RESEARCH

2.2.2 SECONDARY DATA

2.2.2.1 List of key secondary sources

2.2.2.2 Key data from secondary sources

2.2.3 PRIMARY DATA

2.2.3.1 Key data from primary sources

2.2.3.2 Breakdown of primaries

2.3 RESEARCH SCOPE

2.4 DEMAND-SIDE ANALYSIS

FIGURE 2 PARAMETERS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR SERVO MOTORS AND DRIVES

2.4.1 DEMAND-SIDE ANALYSIS: BOTTOM-UP APPROACH

FIGURE 3 SERVO MOTORS AND DRIVES MARKET: REGION/COUNTRY-WISE ANALYSIS

2.4.1.1 Approach used to obtain market size using bottom-up analysis (demand side)

2.4.1.2 Calculation of demand-side analysis of servo motors and drives market

2.4.1.3 Key assumptions while calculating demand-side market size

2.4.2 SUPPLY-SIDE ANALYSIS: TOP-DOWN APPROACH

FIGURE 4 SERVO MOTORS AND DRIVES MARKET: TOP-DOWN APPROACH

2.4.2.1 Approach used to obtain market size using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR COMPANY IN SERVO MOTORS AND DRIVES MARKET

2.4.2.2 Calculations for supply-side analysis

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF SERVO MOTORS AND DRIVES

2.4.2.3 Assumptions while calculating supply-side market size

FIGURE 7 COMPANY REVENUE ANALYSIS, 2021

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 56)

TABLE 1 SERVO MOTORS AND DRIVES MARKET SNAPSHOT

FIGURE 8 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2021

FIGURE 9 HARDWARE SEGMENT HOLDS LARGER SHARE OF MARKET IN 2022

FIGURE 10 SERVO MOTORS TO CONTINUE TO ACCOUNT FOR LARGER SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 11 LOW-VOLTAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

FIGURE 12 ROTARY SYSTEMS SEGMENT TO CONTINUE TO HOLD LARGER SHARE IN MARKET DURING FORECAST PERIOD

FIGURE 13 PERMANENT MAGNET SEGMENT TO CONTINUE TO BE LARGEST IN MARKET DURING FORECAST PERIOD

FIGURE 14 FIELDBUS SEGMENT TO CONTINUE TO BE LARGEST IN MARKET, BY COMMUNICATION TYPE, DURING FORECAST PERIOD

FIGURE 15 STAINLESS STEEL SEGMENT TO HOLD LARGER SIZE OF MARKET, BY MATERIAL OF CONSTRUCTION, IN 2027

FIGURE 16 AUTOMOTIVE & TRANSPORTATION SEGMENT TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SERVO MOTORS AND DRIVES MARKET

FIGURE 17 GROWING AUTOMATION IN INDUSTRIES IS INCREASING SMART MANUFACTURING INITIATIVES, WHICH IS DRIVING DEMAND FOR SERVO MOTORS AND DRIVES

4.2 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC TO BE FASTEST-GROWING SERVO MOTORS AND DRIVES MARKET DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY END-USER AND COUNTRY

FIGURE 19 AUTOMOTIVE & TRANSPORTATION AND CHINA WERE LARGEST SHAREHOLDERS OF SERVO MOTORS AND DRIVES MARKET IN ASIA PACIFIC IN 2021

4.4 MARKET, BY OFFERING

FIGURE 20 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF SERVO MOTORS AND DRIVES MARKET IN 2027

4.5 MARKET, BY PRODUCT TYPE

FIGURE 21 SERVO MOTORS TO HOLD LARGER SHARE OF MARKET IN 2027

4.6 MARKET, BY VOLTAGE

FIGURE 22 LOW VOLTAGE SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

4.7 MARKET, BY SYSTEM TYPE

FIGURE 23 ROTARY SYSTEMS TO HOLD LARGEST SHARE OF MARKET IN 2027

4.8 MARKET, BY BRAKE TECHNOLOGY

FIGURE 24 PERMANENT MAGNET SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

4.9 MARKET, BY MATERIAL OF CONSTRUCTION

FIGURE 25 STAINLESS STEEL SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2027

4.10 MARKET, BY COMMUNICATION TYPE

FIGURE 26 FIELDBUS TO HOLD LARGEST SHARE OF SERVO MOTORS AND DRIVES MARKET IN 2027

4.11 MARKET, BY END-USER

FIGURE 27 AUTOMOTIVE & TRANSPORTATION INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising need for motion control systems in automated production plants

FIGURE 29 OPERATIONAL INDUSTRIAL ROBOTS FROM PAST SIX YEARS

5.2.1.2 Increasing adoption of servo motors due to better features compared with stepper motors

TABLE 2 COMPARISON BETWEEN SERVO MOTORS AND STEPPER MOTORS

5.2.2 RESTRAINTS

5.2.2.1 High investment involved in integrating new automation technologies into current infrastructure

5.2.2.2 Lower cost of other motion control motors compared with servo motors

5.2.3 OPPORTUNITIES

5.2.3.1 Need for feedback control in servo systems driving demand for encoders

5.2.3.2 Growth in adoption of smart manufacturing initiatives in industries

TABLE 3 PRIORITIES OF MANUFACTURERS IN IMPLEMENTING SMART MANUFACTURING INITIATIVES

5.2.4 CHALLENGES

5.2.4.1 Supply-chain disruptions in steel industry

FIGURE 30 GLOBAL YEAR-ON-YEAR PRODUCTION TREND FOR IRON AND STEEL

5.2.4.2 Shortage of skilled workforce to handle complexities in automated manufacturing facilities

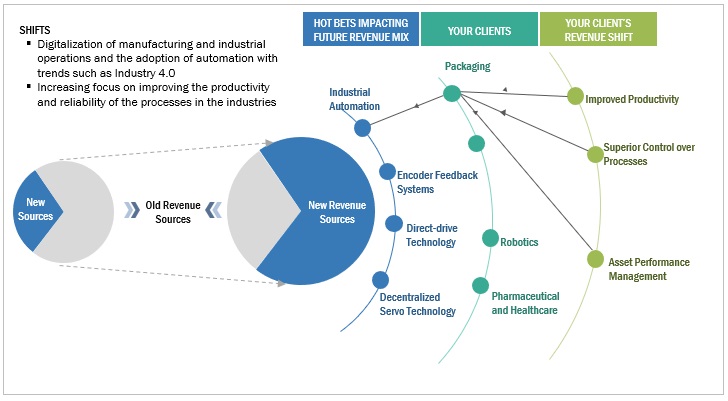

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 31 REVENUE SHIFT FOR SERVO MOTORS AND DRIVES

5.4 VALUE CHAIN ANALYSIS

FIGURE 32 VALUE CHAIN ANALYSIS: SERVO MOTORS AND DRIVES MARKET

5.4.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.4.2 COMPONENT MANUFACTURERS

5.4.3 MANUFACTURERS/ASSEMBLERS

5.4.4 END-USERS

5.4.5 POST-SALES SERVICE PROVIDERS

5.5 MARKET MAP

FIGURE 33 MARKET MAP: MARKET

TABLE 4 MARKET: ROLE IN ECOSYSTEM

5.6 AVERAGE SELLING PRICE TREND

TABLE 5 AVERAGE SELLING PRICE OF SERVO MOTORS AND DRIVES, BY PRODUCT TYPE (KEY PLAYERS)

5.7 TECHNOLOGY ANALYSIS

5.7.1 DUAL UNIVERSAL FEEDBACK

5.7.2 DIRECT-DRIVE MOTOR TECHNOLOGY

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO

TABLE 6 EXPORT SCENARIO FOR HS CODE 8501, BY COUNTRY, 2019–2021 (USD THOUSAND)

5.8.2 IMPORT SCENARIO

TABLE 7 IMPORT SCENARIO FOR HS CODE: 8501, BY COUNTRY, 2019–2021 (USD THOUSAND)

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 CODES AND REGULATIONS RELATED TO SERVO MOTORS AND DRIVES

TABLE 13 NORTH AMERICA: CODES AND REGULATIONS

TABLE 14 ASIA PACIFIC: CODES AND REGULATIONS

TABLE 15 EUROPE: CODES AND REGULATIONS

TABLE 16 GLOBAL: CODES AND REGULATIONS

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 17 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF SUBSTITUTES

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 THREAT OF NEW ENTRANTS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER

TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USERS (%)

5.11.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA OF TOP END-USERS

TABLE 19 KEY BUYING CRITERIA, BY END-USER

5.12 INNOVATIONS AND REGISTERED PATENTS

TABLE 20 SERVO MOTORS AND DRIVES: INNOVATIONS AND REGISTERED PATENTS, 2022–2019

5.13 CASE STUDY ANALYSIS

5.13.1 MOTION CONTROL MOTORS AND DRIVES DESIGNED WITH CUTTING-EDGE TECHNOLOGY ACCELERATE BOTTLE LABELING

5.13.2 TROUBLESHOOTING MOTION CONTROL SYSTEM USING MOOG ANIMATICS SMART MOTOR DATA

5.14 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 21 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 SERVO MOTORS AND DRIVES MARKET, BY OFFERING (Page No. - 95)

6.1 INTRODUCTION

FIGURE 37 HARDWARE SEGMENT HELD LARGER MARKET SHARE IN 2021

TABLE 22 MARKET, BY OFFERING, 2020–2027 (USD MILLION)

6.2 HARDWARE

TABLE 23 HARDWARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 SENSORS

6.2.1.1 Adoption of MEMS-based sensors to boost market growth

6.2.2 CONTROLLER MODULES

6.2.2.1 Controller modules improve efficiency of servo motors by tracking commanded inputs and blocking errors

6.2.3 ENCODERS

6.2.3.1 Increasing demand for industrial robots to boost adoption of high-resolution rotary encoders

6.2.4 ELECTRONIC AMPLIFIERS

6.2.4.1 Development of enhancement-mode GaN field-effect transistor-based class D amplifiers to boost use of electronic amplifiers

6.2.5 OTHER COMPONENTS

6.3 SOFTWARE AND SERVICES

6.3.1 SERVO SOFTWARE AUTOMATE VARIOUS TASKS INVOLVED IN RUNNING AND MONITORING CONNECTED FIELD DEVICES

TABLE 24 SOFTWARE AND SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 SERVO MOTORS AND DRIVES MARKET, BY PRODUCT TYPE (Page No. - 101)

7.1 INTRODUCTION

FIGURE 38 MARKET, BY PRODUCT TYPE, 2021

TABLE 25 MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

7.2 SERVO MOTORS

7.2.1 RISING DEMAND FOR CLOSED-LOOP CONTROL TO IMPROVE RELIABILITY OF INDUSTRIAL PROCESSES

TABLE 26 SERVO MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 SERVO DRIVES

7.3.1 GROWING NEED FOR SERVO DRIVES TO CONTROL SERVO MOTORS

TABLE 27 SERVO DRIVES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE (Page No. - 104)

8.1 INTRODUCTION

FIGURE 39 LOW-VOLTAGE SEGMENT HELD LARGEST SHARE OF MARKET IN 2021

TABLE 28 MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

8.2 LOW VOLTAGE (BELOW 400 V)

8.2.1 EASE OF OPERATION AND LOW SETUP & MAINTENANCE COSTS TO DRIVE MARKET

TABLE 29 LOW VOLTAGE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 MEDIUM VOLTAGE (BETWEEN 400 V AND 690 V)

8.3.1 MEDIUM-VOLTAGE SERVO DRIVES OFFER BENEFITS SUCH AS ECONOMIES OF SCALE AND HIGH RELIABILITY

TABLE 30 MEDIUM VOLTAGE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 HIGH VOLTAGE (ABOVE 690 V)

8.4.1 HIGH-VOLTAGE SERVO DRIVES OFFER PROGRAMMABLE SETTINGS THAT LEAD TO IMPROVED QUALITY ASSURANCE

TABLE 31 HIGH VOLTAGE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 SERVO MOTORS AND DRIVES MARKET, BY SYSTEM TYPE (Page No. - 109)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY SYSTEM TYPE, 2021

TABLE 32 MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

9.2 LINEAR SYSTEMS

9.2.1 DIRECT-DRIVE LINEAR SERVO MOTORS OFFER BENEFITS SUCH AS IMPROVED THROUGHPUT AND BETTER PRECISION

TABLE 33 LINEAR SYSTEMS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 ROTARY SYSTEMS

9.3.1 NEED TO IMPROVE PRODUCTIVITY OF PROCESSES IN VARIOUS INDUSTRIES TO DRIVE PENETRATION

TABLE 34 ROTARY SYSTEMS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 SERVO MOTORS AND DRIVES MARKET, BY BRAKE TECHNOLOGY (Page No. - 113)

10.1 INTRODUCTION

FIGURE 41 PERMANENT MAGNET TECHNOLOGY HELD LARGEST SHARE OF MARKET IN 2021

TABLE 35 MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

10.2 SPRING

10.2.1 SPRING BRAKES ARE MAINLY USED IN ROBOTICS, ELEVATORS, AND LIFTING MACHINES

TABLE 36 SPRING: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 PERMANENT MAGNET

10.3.1 PERMANENT MAGNET BRAKES IDEAL FOR ROBOTS AND HANDLING EQUIPMENT

TABLE 37 PERMANENT MAGNET: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.4 OTHERS

TABLE 38 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 SERVO MOTORS AND DRIVES MARKET, BY MATERIAL OF CONSTRUCTION (Page No. - 118)

11.1 INTRODUCTION

FIGURE 42 MARKET, BY MATERIAL OF CONSTRUCTION, 2021

TABLE 39 MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

11.2 STAINLESS STEEL

11.2.1 ABILITY OF STAINLESS STEEL TO HANDLE HARSH ENVIRONMENTS TO DRIVE DEMAND

TABLE 40 STAINLESS STEEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 OTHERS

TABLE 41 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

12 SERVO MOTORS AND DRIVES MARKET, BY COMMUNICATION TYPE (Page No. - 121)

12.1 INTRODUCTION

FIGURE 43 MARKET, BY COMMUNICATION TYPE, 2021

TABLE 42 MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

12.2 FIELDBUS

12.2.1 REDUCTION OF CABLE INSTALLATIONS FOR COMMUNICATION TO DRIVE DEMAND

TABLE 43 FIELDBUS: MARKET, BY REGION, 2020–2027 (USD MILLION)

12.3 INDUSTRIAL ETHERNET

12.3.1 FEATURES SUCH AS HIGH-SPEED TRANSMISSION TO DRIVE DEMAND

TABLE 44 INDUSTRIAL ETHERNET: MARKET, BY REGION, 2020–2027 (USD MILLION)

12.4 WIRELESS

12.4.1 RELIABLE COMMUNICATION TECHNOLOGIES SUCH AS WLAN AND BLUETOOTH TO DRIVE MARKET

TABLE 45 WIRELESS: MARKET, BY REGION, 2020–2027 (USD MILLION)

13 SERVO MOTORS AND DRIVES MARKET, BY END-USER (Page No. - 125)

13.1 INTRODUCTION

FIGURE 44 MARKET, BY END-USER, 2021

TABLE 46 MARKET, BY END-USER, 2020–2027 (USD MILLION)

13.2 AUTOMOTIVE & TRANSPORTATION

13.2.1 NEW TECHNOLOGIES IN MOBILITY TO DRIVE DEMAND

TABLE 47 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.3 SEMICONDUCTOR & ELECTRONICS

13.3.1 SERVO MOTORS FACILITATE SEMICONDUCTOR MANUFACTURING PROCESSES

TABLE 48 SEMICONDUCTOR & ELECTRONICS: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.4 FOOD PROCESSING

13.4.1 HIGH-PRECISION REQUIREMENTS IN FOOD PROCESSING INDUSTRY TO CREATE DEMAND

TABLE 49 FOOD PROCESSING: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.5 TEXTILE

13.5.1 HIGH-QUALITY PRODUCTION OFFERED BY SERVO MOTORS TO ACCELERATE DEMAND

TABLE 50 TEXTILE: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.6 PETROCHEMICAL

13.6.1 ABILITY OF SERVO MOTORS TO WORK IN HARSH ENVIRONMENTS TO DRIVE MARKET

TABLE 51 PETROCHEMICAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.7 PHARMACEUTICAL & HEALTHCARE

13.7.1 REQUIREMENT OF SERVO MOTORS FOR PROPER HANDLING OF PRODUCTION PROCESSES TO DRIVE MARKET

TABLE 52 PHARMACEUTICAL & HEALTHCARE: SERVO MOTORS AND DRIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

13.8 PACKAGING

13.8.1 NEED FOR SPEED, PRECISION, AND RELIABILITY IN PACKAGING APPLICATIONS TO DRIVE MARKET

TABLE 53 PACKAGING: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.9 PRINTING & PAPER

13.9.1 FLEXIBILITY IN PRINTING OPERATIONS TO BOOST DEMAND

TABLE 54 PRINTING & PAPER: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.10 OTHERS

TABLE 55 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

14 REGIONAL ANALYSIS (Page No. - 134)

14.1 INTRODUCTION

FIGURE 45 MARKET: REGIONAL SNAPSHOT

FIGURE 46 REGIONAL ANALYSIS OF SERVO MOTORS AND DRIVES MARKET, 2021

TABLE 56 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2020–2027(MILLION UNITS)

14.2 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: SNAPSHOT OF MARKET

14.2.1 BY OFFERING

TABLE 58 ASIA PACIFIC: MARKET, BY OFFERING, 2020–2027 (USD MILLION)

14.2.2 BY PRODUCT TYPE

TABLE 59 ASIA PACIFIC: SERVO MOTORS AND DRIVES MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

14.2.3 BY VOLTAGE

TABLE 60 ASIA PACIFIC: SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

14.2.4 BY SYSTEM TYPE

TABLE 61 ASIA PACIFIC: SERVO MOTORS AND DRIVES MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

14.2.5 BY BRAKE TECHNOLOGY

TABLE 62 ASIA PACIFIC: SERVO MOTORS AND DRIVES MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

14.2.6 BY MATERIAL OF CONSTRUCTION

TABLE 63 ASIA PACIFIC: MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

14.2.7 BY COMMUNICATION TYPE

TABLE 64 ASIA PACIFIC: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

14.2.8 BY END-USER

TABLE 65 ASIA PACIFIC: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.2.9 BY COUNTRY

TABLE 66 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.2.9.1 Japan

14.2.9.1.1 Developments in robotics to drive demand

TABLE 67 JAPAN: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.2.9.2 China

14.2.9.2.1 Rise in demand for electric vehicles to boost market growth

TABLE 68 CHINA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.2.9.3 India

14.2.9.3.1 Government initiatives to automate industries to propel market

TABLE 69 INDIA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.2.9.4 South Korea

14.2.9.4.1 Rise in developments in electric vehicles to boost demand

TABLE 70 SOUTH KOREA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.2.9.5 Rest of Asia Pacific

TABLE 71 REST OF ASIA PACIFIC: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3 EUROPE

FIGURE 48 EUROPE: SNAPSHOT OF MARKET

14.3.1 BY OFFERING

TABLE 72 EUROPE: MARKET, BY OFFERING, 2020–2027 (USD MILLION)

14.3.2 BY PRODUCT TYPE

TABLE 73 EUROPE: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

14.3.3 BY VOLTAGE

TABLE 74 EUROPE: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

14.3.4 BY SYSTEM TYPE

TABLE 75 EUROPE: MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

14.3.5 BY BRAKE TECHNOLOGY

TABLE 76 EUROPE: MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

14.3.6 BY MATERIAL OF CONSTRUCTION

TABLE 77 EUROPE: MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

14.3.7 BY COMMUNICATION TYPE

TABLE 78 EUROPE: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

14.3.8 BY END-USER

TABLE 79 EUROPE: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3.9 BY COUNTRY

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.3.9.1 Germany

14.3.9.1.1 Growing demand for passenger cars and light commercial vehicles to drive market

TABLE 81 GERMANY: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3.9.2 France

14.3.9.2.1 Increasing use of servo robots in automotive industry to spur market growth

TABLE 82 FRANCE: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3.9.3 UK

14.3.9.3.1 Rising government initiatives such as ‘Made Smarter’ to drive market

TABLE 83 UK: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3.9.4 Italy

14.3.9.4.1 Surging demand for renewable energy to drive adoption of explosion-proof servo motors

TABLE 84 ITALY: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.3.9.5 Rest of Europe

TABLE 85 REST OF EUROPE: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 49 NORTH AMERICA: SNAPSHOT OF MARKET

14.4.1 BY OFFERING

TABLE 86 NORTH AMERICA: MARKET, BY OFFERING, 2020–2027 (USD MILLION)

14.4.2 BY PRODUCT TYPE

TABLE 87 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

14.4.3 BY VOLTAGE

TABLE 88 NORTH AMERICA: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

14.4.4 BY SYSTEM TYPE

TABLE 89 NORTH AMERICA: MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

14.4.5 BY BRAKE TECHNOLOGY

TABLE 90 NORTH AMERICA: MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

14.4.6 BY MATERIAL OF CONSTRUCTION

TABLE 91 NORTH AMERICA: MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

14.4.7 BY COMMUNICATION TYPE

TABLE 92 NORTH AMERICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

14.4.8 BY END-USER

TABLE 93 NORTH AMERICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.4.9 BY COUNTRY

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.4.9.1 US

14.4.9.1.1 Advancements in medical equipment and devices to boost demand

TABLE 95 US: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.4.9.2 Canada

14.4.9.2.1 Adoption of automation in automobile industry to spur market growth

TABLE 96 CANADA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.4.9.3 Mexico

14.4.9.3.1 Adoption of in-line manufacturing by food & beverage industry to drive demand

TABLE 97 MEXICO: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.5 MIDDLE EAST & AFRICA

14.5.1 BY OFFERING

TABLE 98 MIDDLE EAST & AFRICA: SERVO MOTORS AND DRIVES MARKET, BY OFFERING, 2020–2027 (USD MILLION)

14.5.2 BY PRODUCT TYPE

TABLE 99 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

14.5.3 BY VOLTAGE

TABLE 100 MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

14.5.4 BY SYSTEM TYPE

TABLE 101 MIDDLE EAST & AFRICA: MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

14.5.5 BY BRAKE TECHNOLOGY

TABLE 102 MIDDLE EAST & AFRICA: MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

14.5.6 BY MATERIAL OF CONSTRUCTION

TABLE 103 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

14.5.7 BY COMMUNICATION TYPE

TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

14.5.8 BY END-USER

TABLE 105 MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.5.9 BY COUNTRY

TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.5.9.1 Saudi Arabia

14.5.9.1.1 Initiatives to implement smart manufacturing to drive Industry 4.0 revolution

TABLE 107 SAUDI ARABIA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.5.9.2 South Africa

14.5.9.2.1 Rise in demand for robotics process automation to boost demand

TABLE 108 SOUTH AFRICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.5.9.3 Rest of Middle East & Africa

TABLE 109 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.6 SOUTH AMERICA

14.6.1 BY OFFERING

TABLE 110 SOUTH AMERICA: MARKET, BY OFFERING, 2020–2027 (USD MILLION)

14.6.2 BY PRODUCT TYPE

TABLE 111 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

14.6.3 BY VOLTAGE

TABLE 112 SOUTH AMERICA: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

14.6.4 BY SYSTEM TYPE

TABLE 113 SOUTH AMERICA: MARKET, BY SYSTEM TYPE, 2020–2027 (USD MILLION)

14.6.5 BY BRAKE TECHNOLOGY

TABLE 114 SOUTH AMERICA: MARKET, BY BRAKE TECHNOLOGY, 2020–2027 (USD MILLION)

14.6.6 BY MATERIAL OF CONSTRUCTION

TABLE 115 SOUTH AMERICA: MARKET, BY MATERIAL OF CONSTRUCTION, 2020–2027 (USD MILLION)

14.6.7 BY COMMUNICATION TYPE

TABLE 116 SOUTH AMERICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD MILLION)

14.6.8 BY END-USER

TABLE 117 SOUTH AMERICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.6.9 BY COUNTRY

TABLE 118 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.6.9.1 Brazil

14.6.9.1.1 Ongoing developments to integrate automation into industries to drive demand

TABLE 119 BRAZIL: MARKET, BY END-USER, 2020–2027 (USD MILLION)

14.6.9.2 Rest of South America

TABLE 120 REST OF SOUTH AMERICA: MARKET, BY END-USER, 2020–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 173)

15.1 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 121 REVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF SERVO MOTORS AND DRIVES

15.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

FIGURE 50 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN SERVO MOTORS AND DRIVES MARKET, 2021

TABLE 122 SERVO MOTORS AND DRIVES MARKET: DEGREE OF COMPETITION

FIGURE 51 SERVO MOTORS AND DRIVES MARKET SHARE ANALYSIS, 2021

15.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 52 REVENUE ANALYSIS OF TOP 5 PLAYERS IN SERVO MOTORS AND DRIVES MARKET FROM 2017 TO 2021

15.4 COMPANY EVALUATION MATRIX/QUADRANT

15.4.1 STARS

15.4.2 PERVASIVE PLAYERS

15.4.3 EMERGING LEADERS

15.4.4 PARTICIPANTS

FIGURE 53 SERVO MOTORS AND DRIVES MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

15.5 STARTUP/SME EVALUATION QUADRANT

15.5.1 PROGRESSIVE COMPANIES

15.5.2 RESPONSIVE COMPANIES

15.5.3 DYNAMIC COMPANIES

15.5.4 STARTING BLOCKS

FIGURE 54 SERVO MOTORS AND DRIVES MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

15.6 COMPETITIVE BENCHMARKING

TABLE 123 SERVO MOTORS AND DRIVES MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 124 SERVO MOTORS AND DRIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

15.7 SERVO MOTORS AND DRIVES MARKET: COMPANY FOOTPRINT

TABLE 125 SYSTEM TYPE: COMPANY FOOTPRINT

TABLE 126 PRODUCT TYPE: COMPANY FOOTPRINT

TABLE 127 BY END-USER: COMPANY FOOTPRINT

TABLE 128 REGION: COMPANY FOOTPRINT

TABLE 129 COMPANY FOOTPRINT

15.8 COMPETITIVE SCENARIO

TABLE 130 SERVO MOTORS AND DRIVES MARKET: NEW PRODUCT LAUNCHES, NOVEMBER 2020–JULY 2022

TABLE 131 SERVO MOTORS AND DRIVES MARKET: OTHERS, MAY 2022–JUNE 2022

16 COMPANY PROFILES (Page No. - 188)

(Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

16.1 YASKAWA ELECTRIC

TABLE 132 YASKAWA ELECTRIC: BUSINESS OVERVIEW

FIGURE 55 YASKAWA ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 133 YASKAWA ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 134 YASKAWA ELECTRIC: PRODUCT LAUNCHES

TABLE 135 YASKAWA ELECTRIC: OTHERS

16.2 MITSUBISHI ELECTRIC

TABLE 136 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 56 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 137 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 138 MITSUBISHI ELECTRIC: OTHERS

16.3 SIEMENS

TABLE 139 SIEMENS: BUSINESS OVERVIEW

FIGURE 57 SIEMENS: COMPANY SNAPSHOT, 2021

TABLE 140 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 141 SIEMENS: PRODUCT LAUNCHES

16.4 SCHNEIDER ELECTRIC

TABLE 142 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 58 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 143 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.5 ROCKWELL AUTOMATION

TABLE 144 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 59 ROCKWELL AUTOMATION: COMPANY SNAPSHOT, 2021

TABLE 145 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

16.6 ABB

TABLE 147 ABB: BUSINESS OVERVIEW

FIGURE 60 ABB: COMPANY SNAPSHOT, 2021

TABLE 148 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 ABB: PRODUCT LAUNCHES

TABLE 150 ABB: OTHERS

16.7 NIDEC

TABLE 151 NIDEC: BUSINESS OVERVIEW

FIGURE 61 NIDEC: COMPANY SNAPSHOT, 2021

TABLE 152 NIDEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 153 NIDEC: PRODUCT LAUNCHES

16.8 DELTA ELECTRONICS

TABLE 154 DELTA ELECTRONICS: BUSINESS OVERVIEW

FIGURE 62 DELTA ELECTRONICS: COMPANY SNAPSHOT, 2021

TABLE 155 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 156 DELTA ELECTRONICS: PRODUCT LAUNCHES

16.9 FANUC

TABLE 157 FANUC: BUSINESS OVERVIEW

FIGURE 63 FANUC: COMPANY SNAPSHOT, 2021

TABLE 158 FANUC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.10 FUJI ELECTRIC

TABLE 159 FUJI ELECTRIC: BUSINESS OVERVIEW

FIGURE 64 FUJI ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 160 FUJI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.11 KOLLMORGEN

TABLE 161 KOLLMORGEN: BUSINESS OVERVIEW

FIGURE 65 KOLLMORGEN: COMPANY SNAPSHOT, 2021

TABLE 162 KOLLMORGEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 KOLLMORGEN: PRODUCT LAUNCHES

16.12 PARKER HANNIFIN CORPORATION

TABLE 164 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 66 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT, 2021

TABLE 165 PARKER HANNIFIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 166 PARKER HANNIFIN CORPORATION: PRODUCT LAUNCHES

16.13 OMRON CORPORATION (OMRON)

TABLE 167 OMRON CORPORATION (OMRON): BUSINESS OVERVIEW

FIGURE 67 OMRON CORPORATION (OMRON): COMPANY SNAPSHOT, 2021

TABLE 168 OMRON CORPORATION (OMRON): PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 OMRON CORPORATION (OMRON): PRODUCT LAUNCHES

16.14 SEW EURODRIVE

TABLE 171 SEW EURODRIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.15 LENZE

TABLE 172 LENZE: BUSINESS OVERVIEW

FIGURE 68 LENZE: COMPANY SNAPSHOT, 2021

TABLE 173 LENZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 174 LENZE: PRODUCT LAUNCHES

16.16 BOSCH REXROTH

16.17 WEG

16.18 AMETEK

16.19 ROZUM ROBOTICS

16.2 ADTECH (SHENZHEN) TECHNOLOGY CO., LTD.

*Details on Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 242)

17.1 INSIGHTS FROM INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 CUSTOMIZATION OPTIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

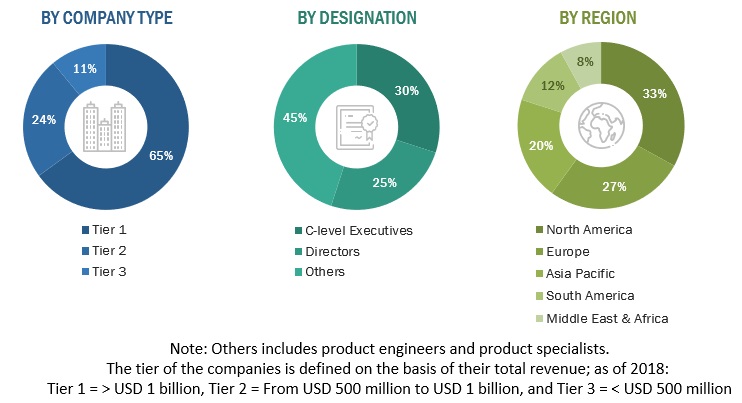

The study involved major activities in estimating the current size of the servo motors and drives market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the servo motors and drives market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global servo motors and drives market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The servo motors and drives market comprises several stakeholders such as servo motors and drives manufacturers, boiler manufacturers, manufacturers of subcomponents of servo motors and drives, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand of servo motors in the industrial machinery for integration of automation across a wide variety of end users. The supply side is characterized by rising demand for contracts from various industries, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the servo motors and drives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Servo motors and drives Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the servo motors and drives market size based on offering, product type, voltages, system type, brake technology, communication type, materials of construction, end-user

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the servo motors and drives market

- To strategically analyze the servo motors and drives market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 5 main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the servo motors and drives market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Servo Motors and Drives Market

Would like to know Global Annual Production Volume and Global Annual Sales Amount of each major AC Servo manufacturer. Hope your reports shows above data in the past and future forecast.

DC motor market size, trend, average selling price, Servo motor/drive market size, trend, average selling price

We need Servo Motors and Drives Market supply Voltage data for Low and Medium level. Also for Components like Sensors, Controller Modules, Encoders, Amplifiers.

To seek a simplified report, need only about North America market (servo motor and driver). What could be the price for procuring this level of information . Thanks William

Interested in Tables about Motor Drives in Japan. (especially Table 18) Point 10.14, 10.20, 10.21 (Mitsubishi, Toshiba and Yaskawa). What would be cost of procurring this level of information. Thank you very much.

Dear Sir/Madam This is Rinseki Azuma,a consultant from BCG Tokyo. We are interested in this report, but would like to check if the detail level meets our needs. Can we have more detail explanation of the value chain part(Figure 9 without actual number) and an example of one company from Part 9? Your prompt reply will be appreciated.

I am looking for specific market report about market size & potential of motion control products. In our scope motion control refer to both servo motor & drive, controller,actuators ,etc

Need overview of the marketshare of the different manufacturers in the different regions. This would be very beneficial for our compny. Would like to know more about your report?

Interested in knowing following information : 1.Servo Motor Market ( AC Servo Motor 2012-18) 2. Geographic Analysis 3. Servo Motors And Driver Market. Share with me any sample data if you have any covering this information.

Dear M&M team, I would be interested in details about: 6.2 Servo Motors Market, By Components 6.2.1 Sensors 6.2.1.1 Pressure Sensors 6.2.1.2 Temperature Sensors 6.2.1.3 Position Sensors 6.2.1.4 Image Sensors 6.2.2 Controller Modules 6.2.3 Encoders Thanks& Regards, Benjamin Mang

Would like to know if the report contains production of Servo motors per Manufacturers, i.e. Siemens produced more than250000 servo motors in 2015. Do you have similar numbers for all the manufacturers with updated data.?

I need the market growth and demand analysis data for servo motors and drives specially in india with the latest marekt trends and major companies operating in this business.

Sensorless control of Synchron and Servo Motors. What percentage of servo motors globaly is equiped with IoT and without IoT. State sponsored startup (spinn off of Technical university of Munich), Thank you.

I am particularly interested in China market. In past few years, the use of servo motor in injection molding machine have grown significantly. I do like to know which industries/applications will be the next hotspot for servo motor, and which kind of servo motor do they need. Maybe you could compare China market to a more developed market such as US or Europe to see which application is widely used in the developed market but not in China market. Then it might be the next hotspot we are looking for. Also we want to get detailed information of two companies: Inovance(not in the current report) and Delta Electronics. Wed like to see the strategy and financial data of their servo motor operation.

I would like to know if the report covers followings information: -Product Type: ①Direct Drive Servo(Torque Servo Motor), ②Linear Servo Motor. -Geography: ①China, ②Singapore, ③USA, ③Germany.

Dear Markets-and-Markets in which segements do you divide voltage range for DC brushed, DC brushless and AC brushless servo motors and drives? I especially look for a market report of drives and motors with extra low supply voltage specifically less than 100 volts (DC). With best regards. Walter

I am looking for a report that details servo motor consumption in the United States by major cities and/or state. Can you provide an analysis with this sort of granular detail?

Do you have data for Motor & Drive Component, Software & Service, (AC/DC, Linear Servo Motor, Adjustable Speed Drives. Would be interested after looking at the sample copy of this report.

A team at our facility asked me to get a sample of this report and to ask if it is available at a reduced price. It is older than others we are looking at. Is it available at half price now? Thanks, John