Mounted Bearing Market by Product (Ball Bearing, Roller Bearing), Market Channel (OE Market, Aftermarket), Housing Block (Plummer Block, Flanged Block, Take-up Block), Equipment, End-use Industry and Region - Global Forecast to 2027

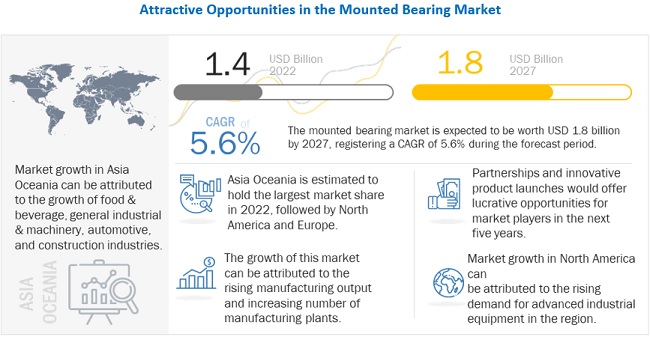

[273 Pages Report] The global mounted bearing market size is projected to grow from USD 1.4 billion in 2022 to USD 1.8 billion by 2027, at a CAGR of 5.6%. The base year for the report is 2021, and the forecast period is from 2022 to 2027. The global market is driven by adoption of mounted bearings in numerous industries; increased efficiency and long life with less maintenance requirements of mounted bearing; growing demand for specialized bearings for cost optimization; and increasing development and adoption of sensor-based bearing units and IoT.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact On Mounted Bearing Market:

Almost all the industries faced challenges because of the COVID-19 outbreak. The pandemic resulted in a sharp decline in demand for and investments in mounted bearings worldwide in 2020. Various industries, such as mining, construction, and food and beverage, struggled due to the abrupt halt in production. Suspension of production and focus on the health safety of employees and workers have disrupted the supply chain of various industries. A sudden impact on the economy, along with restrictions on the movement of people and goods, has caused a sharp contraction in GDPs as well as various manufacturing sectors’ output worldwide. Production and sales continuously declined due to the pandemic. Companies across different industries followed various measures to keep their business sustainable. Many companies have even shifted their line of operations during the pandemic.

The COVID-19 pandemic has had a negative impact on the revenue generation of mounted bearing manufacturers. For instance, NSK’s revenue declined from USD 9.0 billion in 2019 to USD 7.7 billion in 2020. Similarly, Rexnord Corporation’s revenue declined from USD 3.2 billion in 2019 to USD 2.9 in 2020. However, Timken showcased positive growth in its revenue in 2020 with USD 3.7 billion as compared to USD 3.5 billion in 2019.

Market Dynamics:

Driver: Adoption of mounted bearings in major industries

The increasing adoption of mounted bearings in major industries such as food & beverages, mining & minerals, and pulp & paper drive the mounted bearing market.

According to the US Department of Agriculture (USDA), food processing plants accounted for a share of 15% of the value of shipments from the US in 2018. Meat processing, dairy, and beverages contributed 24%, 13%, and 12%, respectively, to the total food processing shipment in the same year. Improved economic conditions and increased consumption would likely boost the demand for machinery for food processing. The USDA invested USD 500 million for the expansion of meat and poultry processing capacity. It invested USD 150 million in existing small poultry processing facilities to help them cope with their declining business due to the COVID-19 outbreak. The USDA also invested USD 100 million to develop a better food system to support small poultry and meat processing plants. The investment is to reduce the financial burden arising due to overtime inspection fees for small meat, poultry, and egg processing plants, thus enabling farmers with local alternatives as well as a greater capacity to process livestock. According to the US Department of Agriculture, the American agricultural industry witnessed a rise in export levels in 2021. The export of the US farm and food products totaled USD 177 billion, which is an 18% rise compared to 2020. China was the major exporter, with the export of agriculture products worth USD 33 billion, which is 25% more compared to 2020, followed by Mexico with USD 25.5 billion, a 39% rise from 2020. Stringent food safety standards and the adoption of new technologies drive the demand for premium mounted bearings. The achievement of efficient material handling through conveyers is also expected to increase the demand for mounted bearings in the food processing industry. Despite the COVID-19 outbreak, 20 major material handling system companies witnessed a rise in revenues in 2020. Major players such as Daifuku Co., Ltd., Dematic (KION Group), Vanderlande, and Knapp AG generated a revenue of USD 25.9 billion in 2020, which was USD 23.2 billion in 2019, representing an 11.7% increase. Mounted bearings are used in packaging and pallet wrapping applications as well.

Restraint: Availability of counterfeit products

Counterfeit bearings are a major restraint in the mounted bearing market. Counterfeit bearings lead to higher costs, risks, and reduced machine reliability with frequent bearing failures. These bearings are manufactured using low-grade materials that are often processed on aging machines operated by minimum-wage operatives. Packaging of these counterfeit bearings makes them look like a replica of original products, making it tough for customers to differentiate between the counterfeit and original products. These poor-quality products fail more often when put into service, thus increasing the associated maintenance and purchasing costs–and these increased costs are invariably much higher than the amount saved on the unit price of the bearings when they were purchased. According to industry experts, in most cases, distributors are held responsible for the distribution of counterfeit bearings, and counterfeit suppliers intend to make much more profit on the transactions than they would have done supplying the original bearings. Counterfeit products are present in large numbers and are not limited to certain regions. It is also common to find large-size products, hence they are not limited to small-size bearings. The counterfeit bearing production exists in many countries. Various customs seizures of these counterfeit bearings in the US and European Union originate from China. Raids are being conducted against counterfeit sellers in Europe, the US, and different countries of Africa, Latin America, and Asia. But such raids are helpful only to a certain degree.

Opportunity: Increasing development and adoption of sensor-based bearing unit and IoT

Sensors are essential in industrial automation as well as motion control systems. They are the vital link between the data collected through physical systems and the communication link that transmits data to the monitoring facilities or cloud. Sensors are used to keep a check on the performances of bearings, as a failed bearing could lead to costly downtime. The smart sensor technology provides an early indication of any potential problem through assessing the condition of bearings such as vibrations as well as temperature information. It has application in bulk material handling conveyors that are typically found in the industries such as aggregate, mining, grain handling as well as cement along with the food and beverage as well as air handling sectors.

The IIoT (Industrial IoT) sensor is a complex combination of software and hardware. IIoT sensors could be used as acoustic and chemical sensors to liquid levels and temperature monitoring sensors. A proximity sensor is another type of sensor, which is mounted onto bearings. IoT sensors are not limited to the collection and sending of data but include processing and decision-making functions as well. This added function saves engineering time as well as cost.

Challenge: Increasing reliability and contamination issue

The risk of failure is a major challenge for the manufacturers of mounted bearings. The sudden failure of bearings could lead to unplanned downtime and premature replacement of bearings. Some of the major reasons for the failure of bearings are:

Excessive load: Excessive loads usually cause premature fatigue. Tight fits and improper preloading can also ring about early failure.

Overheating: Symptoms are discoloration of the rings, balls, and cages from gold to blue. Temperatures in excess of 400°F can anneal the ring and ball materials. The resulting loss in hardness reduces the bearing capacity causing early failure. In extreme cases, balls and rings will deform. The temperature rise can also degrade or destroy the lubricant.

True brinelling: Brinelling occurs when loads exceed the elastic limit of the ring material. Brinell marks show as indentations in the raceways, which increases bearing vibration (noise). Severe Brinell marks can cause premature fatigue failure.

Normal fatigue failure: Spalling can occur on the inner ring, outer ring, or balls. This type of failure is progressive and, once initiated, will spread because of further operation. It will always be accompanied by a marked increase in vibration, indicating an abnormality.

To know about the assumptions considered for the study, download the pdf brochure

Agriculture, farming, & fishery segment is expected to be the fastest during the forecast period

Several years of strong supplies, associated with slow growth in demand, have exerted downward pressure on the international prices of most agricultural commodities, with cereal, beef, and sheep meat prices showing short-term rebounds. Productivity growth in agriculture is expected to stay ahead of food demand. The growing global population will continue to use increasing amounts of agricultural products as food, feed, and for industrial purposes. Much of the additional food demand over the coming decade will originate in regions with high population growth, in particular, Sub-Saharan Africa, South Asia, and the Middle East and North Africa. In the agriculture industry, the demand for machinery and equipment is growing to ease operations, increase productivity, and enhance efficiency. The mechanization of various activities and the increased performance of machines and equipment has enabled the processing of heavier objects and the cultivation of larger areas. Some of the key equipment used are horizontal and vertical conveyors, worm conveyors, various auxiliary transmissions, ploughs, and harvesters. As a result, the demand for equipment parts and bearings in the industry is growing, which will drive the mounted bearing market. Healthy demand for equipment that uses mounted bearings has also been seen in the farming and fishery industries.

Conveyor segment will have a major share in the mounted bearing market during the forecast period

The conveyors segment is estimated to be the largest in the global mounted bearings market, by equipment type. The growth of the segment can be attributed to the extensive use of conveyors in the construction, manufacturing, paper, automotive, mining, and mineral industries. Conveyors can be used to transfer light as well as heavy or bulky material efficiently. Large conveyor applications in industries require multiple types of bearings, which drives the growth of this segment in the mounted bearings market.

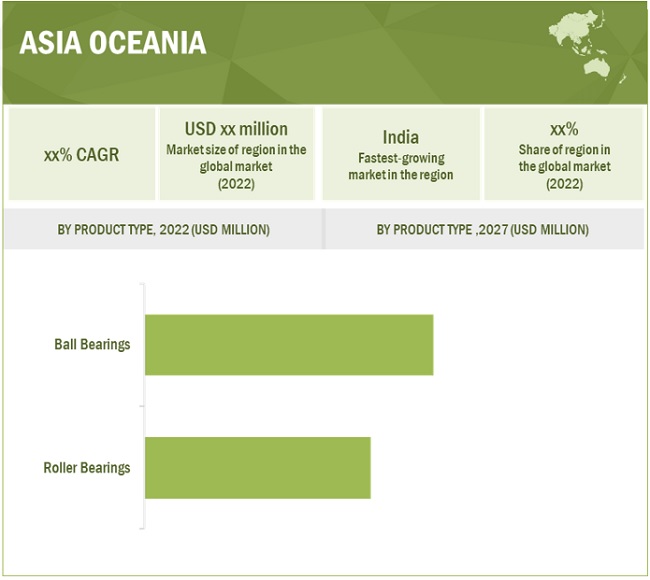

The Asia Oceania mounted bearing market is projected to hold the largest share by 2027.

Growing focus on infrastructure developments to accommodate the growing population would represent a suitable business environment for manufacturers in the steel, cement, and metal processing sectors. Major economies are expected to outline economic packages to boost the growth of small and medium companies to combat the downward economic trend due to the COVID-19 pandemic. Countries such as China and Japan would be key growth drivers of the Asia Oceania mounted bearing market. Companies have established manufacturing bases in this region, and countries in this region act as major export hubs. Bearing manufacturers such as SKF (Sweden), JTEKT Corporation (Japan), FYH Inc.(Japan), and NTN (Japan) have a strong presence in this region. These manufacturers are rapidly expanding their presence in this region to increase their market share for industrial bearings.

The market in the region is competitive; the development of low-cost bearing solutions is likely to increase as companies in the manufacturing industry are looking for measures to reduce production costs.

Key Market Players

The global mounted bearing market is dominated by major players such as SKF (Sweden), Schaeffler (Germany), Timken (US), and NSK (Japan). These companies offer a wide variety of mounted bearing fulfilling all major functions and applications in various end-use industries. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Product type, housing block type, end-use industry type, equipment type, market channel, and Region |

|

Geographies covered |

Asia Oceania, Europe, Latin America, Middle East & Africa, and North America |

|

Companies Covered |

SKF (Sweden), Schaeffler (Germany), Timken (US), NSK (Japan), and NTN (Japan). |

This research report categorizes the mounted bearing market based on product type, housing type, end-use industry type, equipment type, market channel, and region.

Based on the Product Type:

- Ball Bearing

-

Roller Bearing

- Spherical

- Cylindrical

- Tapered

- Others

Based on the Housing Block Type:

- Plummer Block

- Flanged Block

- Take-up Block

- Others

Based on the End-use Industries Type:

- Food & Beverage

- Agriculture

- Farm & Fish

- Construction & Mining

- Cement & Aggregate

- Automotive

- Chemical & Pharmaceutical

- Energy

- General Industrial & Machinery

- Transportation

- Pulp & Paper

- Others

Based on the Equipment Type:

- Ball Mill Drives

- Fans & Blowers

- Gearbox & Transmission

- Conveyors

- Crushers

- Mixer Drives

- Others

Based on the Market Channel:

- OE Market

- Aftermarket

Based on the region:

-

Asia Oceania

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Oceania

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- United Kingdom

- Rest of Europe

-

LATAM

- Brazil

- Argentina

- Rest of LATAM

-

MEA

- Iran

- South Africa

- Rest of MEA

Recent Developments

- In September 2021, SKF launched a new line of spherical roller bearings in North America. These bearings are specifically designed to increase uptime and lower production costs, and their application in slab, billet, and bloom reduces environmental impact during continuous casting operations.

- In July 2021, NSK Ltd. developed a third-generation ultra-high-speed ball bearing for electric vehicle (EV) motors capable of operating at over 1.8 million dmN*1. The new bearing is the world's fastest grease-lubricated deep groove ball bearing for automotive applications, enabling longer vehicle range and higher energy (fuel) economy.

- In July 2021, NTN Bearing Corporation released its latest innovation, the KIZEI spherical roller bearing. KIZEI spherical roller bearings, developed by the NTN-SNR team in Annecy, France, are the first spherical roller bearings with metallic shields that protect the bearings from solid contamination such as dust, pebbles, and other debris.

- In May 2021, NSK Ltd. developed a new series of NSK spherical roller bearings with a patented cage design, which provides the general industry with new levels of productivity, reliability, and load capacity. The optimized cage reduces internal stress and eliminates the need for a guide ring. Its potential applications for the new ECA series extend from conveyors, gearboxes, and steelmaking machinery, to presses and machines used in mining.

Frequently Asked Questions (FAQ):

Which countries are considered in the Asia Oceania region?

The report includes the following Asia Oceania countries

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Oceania

We are interested in the regional mounted bearing market for various housing type. Does this report cover the housing segment?

Yes, the mounted bearing market for housing block type is covered at a global level. However, regional level markets can be provided as separate customization.

Does this report include the impact of COVID-19 on the mounted bearing market ecosystem?

Yes, the market includes qualitative insights on the COVID-19 impact on the mounted bearing ecosystem.

Does this report contain the market size of different industries, especially for food & beverage?

Yes, the market size of various industries (food & beverage, agriculture, farm & fish, construction & mining, cement & aggregate, automotive, chemical & pharmaceutical, energy, general industrial & machinery, other transportation, pulp & paper, and others) is extensively covered in terms of value.

Does this report contain the market size of different product types, especially for ball bearings and spherical roller bearings?

Yes, the market size of product type [(ball bearings and roller bearings (spherical roller bearings, cylindrical roller bearing, tapered roller bearing, and others)] is extensively covered in value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN MOUNTED BEARING MARKET

1.2.2 END-USE INDUSTRIES & SUBCATEGORIES

1.3 MARKET SCOPE

1.3.1 MARKET COVERED

FIGURE 1 MOUNTED BEARING: MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 MARKET – GLOBAL FORECAST TO 2027

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 2 MOUNTED BEARING MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.2 KEY SECONDARY SOURCES FOR BASE NUMBERS

2.1.2.1 Key secondary sources for market sizing

2.1.3 KEY DATA FROM SECONDARY SOURCES

2.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.2.1 PRIMARY PARTICIPANTS

2.3 MARKET SIZE ESTIMATION

2.3.1 DATA TRIANGULATION APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 TOP-DOWN APPROACH: MARKET

FIGURE 6 TOP-DOWN APPROACH: MARKET

2.4 MARKET BREAKDOWN

2.5 FACTOR ANALYSIS

TABLE 2 IMPACT OF VARIOUS FACTORS ON GROWTH OF MARKET

2.6 ASSUMPTIONS

FIGURE 7 GENERAL ASSUMPTIONS

FIGURE 8 MARKET: SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT & RANGES

TABLE 3 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 9 MOUNTED BEARING: MARKET OVERVIEW

FIGURE 10 INDUSTRIAL PRODUCTION IN 2021, BY COUNTRY (USD BILLION)

TABLE 4 LIST OF EQUIPMENT WITH MOUNTED BEARINGS USED IN VARIOUS INDUSTRIES

FIGURE 11 MOUNTED BEARING MARKET DYNAMICS

FIGURE 12 ASIA OCEANIA ESTIMATED TO BE LARGEST MARKET FOR MOUNTED BEARINGS IN 2022

FIGURE 13 CONVEYORS SEGMENT PROJECTED TO HOLD LARGEST SHARE BY 2027

FIGURE 14 COVID-19 IMPACT ON MARKET

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 MOUNTED BEARING MARKET TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD (2022–2027)

FIGURE 15 INCREASING APPLICATIONS OF MOUNTED BEARINGS ACROSS INDUSTRIES TO DRIVE MARKET GROWTH

4.2 MARKET SHARE, BY REGION

FIGURE 16 ASIA OCEANIA ESTIMATED TO LEAD MARKET IN 2022

4.3 MARKET, BY END-USE INDUSTRY

FIGURE 17 FOOD & BEVERAGE SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD (USD MILLION)

4.4 MARKET, BY EQUIPMENT TYPE

FIGURE 18 CONVEYORS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027 (USD MILLION)

4.5 MARKET, BY HOUSING BLOCK TYPE

FIGURE 19 PLUMMER BLOCK SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE BY 2027 (USD MILLION)

4.6 MARKET, BY MARKET CHANNEL

FIGURE 20 OE MARKET SEGMENT PROJECTED TO GROW AT HIGHER RATE DURING FORECAST PERIOD OF 2022 TO 2027

4.7 MARKET, BY PRODUCT TYPE

FIGURE 21 BALL BEARINGS SEGMENT TO REGISTER HIGHER CAGR THAN ROLLER BEARINGS SEGMENT FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MOUNTED BEARING MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Adoption of mounted bearings in major industries

FIGURE 23 US AGRICULTURAL ýEXPORT, 2011-2021 (USD MILLION)

5.2.1.2 Increased efficiency and long life with less maintenance requirements

5.2.2 RESTRAINTS

5.2.2.1 Availability of counterfeit products

TABLE 5 SEIZURE OF COUNTERFEIT BEARINGS IN CHINESE CUSTOMS DEPARTMENT

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for specialized bearings for cost optimization

5.2.3.2 Increasing development and adoption of sensor-based bearing units and IoT

TABLE 6 ADVANTAGES OF ADOPTION OF SMART SENSORS

5.2.4 CHALLENGES

5.2.4.1 Increasing reliability and contamination issues

5.3 TECHNOLOGY OVERVIEW

5.3.1 INTRODUCTION

5.3.2 SMART SENSOR MOUNTED BEARINGS

FIGURE 24 SMART SENSOR MOUNTED BEARINGS

5.3.3 CONNECTED MOUNTED BEARINGS

5.3.4 SUB-MICRON COATING, POLYMER COATED, AND ENGINEERED PLASTIC BEARINGS

5.3.5 FOOD GRADE MOUNTED BEARINGS

FIGURE 25 FOOD LINE BALL BEARING UNITS

5.3.6 KEY TRENDS IN MOUNTED BEARING MARKET

5.3.6.1 Self-aligning bearing unit

FIGURE 26 SELF-ALIGNING PEDESTAL AND FLANGE BEARING HOUSING

5.3.6.2 Non-metallic mounted bearings

5.3.6.3 Ceramic bearings

5.3.6.4 Self-lubricating mounted bearings

FIGURE 27 SELF-LUBRICATING ASSEMBLY

5.3.7 INSIGHTS ON MATERIALS USED FOR MANUFACTURING BEARING HOUSING

5.4 CASE STUDY ANALYSIS

5.4.1 BEVERAGE PRODUCER ELIMINATED RELUBRICATION AND SAVED USD 18,350 WITH SKF FOOD LINE BALL BEARING UNITS. PRODUCT OFFERED – MOUNTED BALL BEARING

5.4.2 APPLICATION - PAPER MILL SIGNIFICANT REDUCTION IN THE NEED FOR BEARING REPLACEMENT. PRODUCT OFFERED- SKF DRIVE-UP METHOD

5.4.3 NEWSPRINT MANUFACTURER REDUCES DOWNTIME. PRODUCT OFFERED NOWEAR COATED BEARINGS

5.4.4 CEMENT INDUSTRY – APPLICATION IN CEMENT BUCKET ELEVATOR PRODUCT OFFERED: SPLIT BLOCK CYLINDRICAL BEARING

5.4.5 APPLICATION IN HYDRAULIC FRACTURING OPERATIONS PRODUCT OFFERED FOR BOLT-FLANGE BEARING

5.4.6 STEEL INDUSTRY – APPLICATION IN HOT ROLL TRANSFER LINE PRODUCT OFFERED – SAF SPLIT PILLOW BLOCK BEARING

5.4.7 FOOD & BEVERAGE INDUSTRY – APPLICATION IN FILLING AND CAPPING OPERATIONS IN BEVERAGE PLANT. PRODUCT OFFERED - SOLID BLOCK MOUNTED BALL BEARING

5.4.8 FOOD & BEVERAGE INDUSTRY – APPLICATION IN MILK BOTTLE CONVEYOR. PRODUCTS OFFERED - PILLOW BLOCK, 2 AND 4 BOLT FLANGES, AND TAKE-UP UNIT HOUSINGS

5.4.9 REFURBISHMENT OF SHAFT BEARING HOUSING FOR AGGREGATE INDUSTRY BY SKF

5.5 TRADE ANALYSIS

TABLE 7 TOP COUNTRIES AND THEIR ROLLER OR BALL BEARINGS IMPORT DATA, 2020

TABLE 8 TOP COUNTRIES AND THEIR ROLLER OR BALL BEARINGS EXPORT DATA, 2020

5.6 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 MOUNTED BEARING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.7 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS OF MARKET

5.7.1 PLANNING AND REVISING FUNDS

5.7.2 MOUNTED BEARING SUPPLIERS

5.7.3 MOUNTED BEARING DEVELOPMENT

5.7.4 OEMS/DISTRIBUTORS

5.8 PORTER’S FIVE FORCES

TABLE 10 IMPACT OF PORTER’S FIVE FORCES ON MARKET

5.8.1 INTENSITY OF COMPETITIVE RIVALRY

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 THREAT OF NEW ENTRANTS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 5 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 5 APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR TOP 5 APPLICATIONS

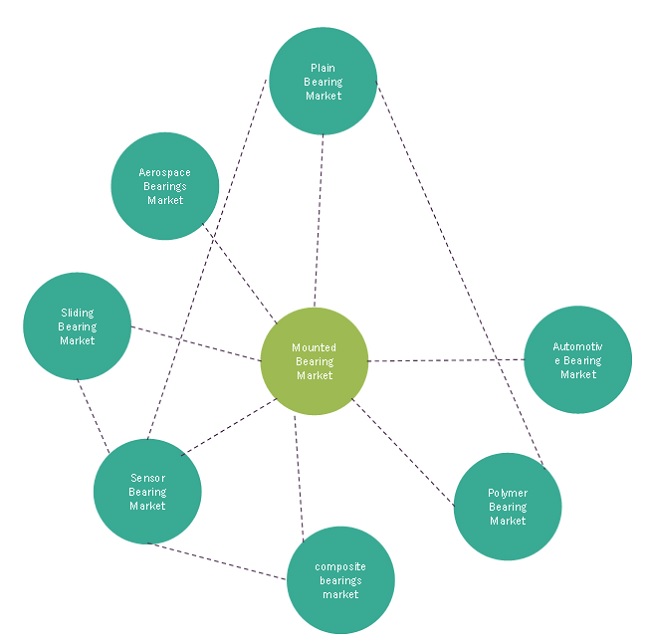

5.10 MOUNTED BEARING MARKET ECOSYSTEM

FIGURE 31 MARKET: ECOSYSTEM ANALYSIS

TABLE 13 ROLE OF COMPANIES IN MOUNTED BEARING ECOSYSTEM

5.11 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN ANALYSIS: AUTOMOTIVE CYBERSECURITY MARKET

5.11.1 TIER 2 SUPPLIERS

5.11.2 TIER 1 SUPPLIERS

5.11.3 OEMS

5.12 REGULATORY LANDSCAPE

TABLE 14 LEGAL REQUIREMENTS FOR BEARING MATERIALS

5.13 PATENT ANALYSIS

5.13.1 SEALED BEARING MODULE

5.13.2 SPACER AND SENSOR MODULE TO DETECT VIBRATIONAL BEHAVIOR OF MECHANICAL COMPONENTS

5.13.3 TAPERED ROLLER BEARING WITH PRESSURIZED RIB RING

TABLE 15 PATENT ANALYSIS: MARKET

5.14 MOUNTED BEARING MARKET SCENARIO

5.14.1 GLOBAL MARKET, MOST LIKELY SCENARIO

TABLE 16 GLOBAL MARKET (MOST LIKELY), BY REGION, 2022–2027 (USD MILLION)

5.14.2 GLOBAL MARKET, OPTIMISTIC SCENARIO

TABLE 17 GLOBAL MARKET (OPTIMISTIC), BY REGION, 2022–2027 (USD MILLION)

5.14.3 GLOBAL MARKET, PESSIMISTIC SCENARIO

TABLE 18 GLOBAL MARKET (PESSIMISTIC), BY REGION, 2022–2027 (USD MILLION)

5.15 IMPACT ANALYSIS OF COVID-19

5.15.1 COVID-19 HEALTH ASSESSMENT

FIGURE 33 COUNTRY-WISE SPREAD OF COVID-19

5.15.2 EFFECTS ON GDPS OF COUNTRIES

FIGURE 34 IMPACT OF COVID-19 ON COUNTRIES IN 2020

TABLE 19 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.15.3 IMPACT ON MARKET

TABLE 20 IMPACT OF COVID-19 ON MOUNTED BEARING SUPPLY CHAIN

6 MOUNTED BEARING MARKET, BY PRODUCT TYPE (Page No. - 105)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

FIGURE 35 RESEARCH METHODOLOGY

6.1.2 OPERATIONAL DATA

FIGURE 36 TYPES OF BEARINGS

TABLE 21 TYPES AND STRUCTURE OF BEARINGS MANUFACTURED BY SKF

FIGURE 37 TYPES OF LOAD ON BEARINGS

TABLE 22 TYPES OF BEARINGS AND THEIR PERFORMANCE COMPARISON

6.1.3 KEY INDUSTRY INSIGHTS

FIGURE 38 MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 23 MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

6.2 BALL BEARINGS

6.2.1 VERSATILITY AND COST-EFFECTIVENESS OF BALL BEARINGS DRIVE DEMAND

TABLE 25 BALL BEARINGS: MOUNTED BALL BEARINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 BALL BEARINGS: MOUNTED BALL BEARINGS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 ROLLER BEARINGS

FIGURE 39 MOUNTED ROLLER BEARINGS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

6.3.1 DEMAND FROM HEAVY INDUSTRIES FOR HEAVY RADIAL AND AXIAL LOADS FUELS ROLLER BEARINGS SEGMENT GROWTH

TABLE 27 MOUNTED ROLLER BEARINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MOUNTED ROLLER BEARINGS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 MOUNTED ROLLER BEARINGS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 MOUNTED ROLLER BEARINGS MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.2 TAPERED ROLLER BEARINGS

6.3.3 SPHERICAL ROLLER BEARINGS

6.3.4 CYLINDRICAL ROLLER BEARINGS

6.3.5 OTHERS

7 MOUNTED BEARING MARKET, BY EQUIPMENT TYPE (Page No. - 116)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

FIGURE 40 RESEARCH METHODOLOGY

7.1.2 OPERATIONAL DATA

TABLE 31 MOUNTED BEARINGS USED IN MIXER DRIVE SYSTEMS

TABLE 32 INDUSTRY VS. EQUIPMENT MATRIX

FIGURE 41 FOOD AND BEVERAGE MANUFACTURING SALES IN US, BY FOOD ITEMS, 2019 (USD BILLION)

7.1.3 KEY INDUSTRY INSIGHTS

FIGURE 42 MARKET, BY EQUIPMENT TYPE, 2022 VS. 20227 (USD MILLION)

TABLE 33 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 34 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

7.2 BALL MILL DRIVES

7.2.1 USE OF BALL MILL DRIVES IN MATERIAL HANDLING DRIVES DEMAND FOR MOUNTED BEARINGS

TABLE 35 BALL MILL DRIVES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 BALL MILL DRIVES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 FANS & BLOWERS

7.3.1 USE OF FANS & BLOWERS IN VARIOUS INDUSTRIES WILL BOOST DEMAND FOR MOUNTED BEARINGS

TABLE 37 FANS & BLOWERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 FANS & BLOWERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 GEARBOXES & TRANSMISSIONS

7.4.1 INCREASING USE OF GEARBOX & TRANSMISSION SYSTEMS IN VARIOUS INDUSTRIES TO DRIVE MARKET

TABLE 39 GEARBOXES & TRANSMISSIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 GEARBOXES & TRANSMISSIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 CONVEYORS

7.5.1 DEMAND FOR SMOOTH MATERIAL HANDLING ACROSS DIFFERENT INDUSTRIES DRIVING MARKET

TABLE 41 CONVEYORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 CONVEYORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 CRUSHERS

7.6.1 HEAVY LOAD COMPRESSING OF MATERIALS IN CONSTRUCTION FUELS CRUSHERS SEGMENT GROWTH

TABLE 43 CRUSHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 CRUSHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 MIXER DRIVES

7.7.1 NEED FOR MIXER DRIVES IN PROCESSING INDUSTRIES WILL ENHANCE MARKET GROWTH

TABLE 45 MIXER DRIVES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 MIXER DRIVES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHERS

7.8.1 GROWING DEMAND FOR CRANES AND ELEVATORS TO DRIVE OTHER EQUIPMENT MARKET

TABLE 47 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MOUNTED BEARING MARKET, BY END-USE INDUSTRY (Page No. - 130)

8.1 INTRODUCTION

FIGURE 43 MARKET, BY END-USE INDUSTRY, 2022 VS. 2027 (USD MILLION)

TABLE 49 MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 50 MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.1.1 KEY FACTS ABOUT INDIAN FOOD & BEVERAGE INDUSTRY:

8.1.2 RESEARCH METHODOLOGY

FIGURE 44 RESEARCH METHODOLOGY

8.1.3 OPERATIONAL DATA

TABLE 51 COMPARATIVE MAPPING OF TECHNOLOGICAL TRENDS AND BEARING PROPERTIES IN AEROSPACE

8.1.4 KEY INDUSTRY INSIGHTS

8.2 AGRICULTURE, FARMING, & FISHERY

FIGURE 45 GLOBAL CROP PRODUCTION, BY CROP TYPE, 2019–2020 VS 2020–2021 (MILLION METRIC TONS)

8.2.1 GROWING ADOPTION OF MACHINERY IN FARMING AND AGRICULTURE BOOSTS MOUNTED BEARING MARKET

TABLE 52 AGRICULTURE, FARMING, & FISHERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 AGRICULTURE, FARMING, & FISHERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 AUTOMOTIVE

FIGURE 46 GLOBAL AUTOMOTIVE PRODUCTION, BY VEHICLE TYPE, 2018 -2021 (MILLION UNITS)

TABLE 54 GLOBAL BEV AND PHEV SALES (‘000 UNITS)

8.3.1 GROWING PART AND COMPONENT MANUFACTURING IN AUTOMOTIVE INDUSTRY DRIVES MARKET

TABLE 55 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 CEMENT & AGGREGATE

TABLE 57 TOP 5 CEMENT PRODUCING COMPANIES IN 2020

8.4.1 INCREASING USE OF EQUIPMENT REQUIRING MOUNTED BEARING IN CEMENT & AGGREGATE INDUSTRY TO BOOST MARKET

TABLE 58 CEMENT & AGGREGATE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 CEMENT & AGGREGATE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CHEMICAL & PHARMACEUTICAL

FIGURE 47 GLOBAL CHEMICAL SALES, BY COUNTRY, 2020 (USD BILLION)

8.5.1 ASIA OCEANIA ESTIMATED TO LEAD MOUNTED BEARING MARKET IN CHEMICAL & PHARMACEUTICAL SEGMENT

TABLE 60 CHEMICAL & PHARMACEUTICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 CHEMICAL & PHARMACEUTICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 CONSTRUCTION & MINING

TABLE 62 TOP 10 COMPANIES IN MINING INDUSTRY IN 2021

FIGURE 48 GOLD PRODUCTION IN 2021, BY COUNTRY (TONS)

8.6.1 GROWTH IN CONSTRUCTION & MINING FAVORABLE FOR MARKET

TABLE 63 CONSTRUCTION & MINING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 CONSTRUCTION & MINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 ENERGY

FIGURE 49 OIL PRODUCTION, BY REGION, 2020 (TERA WATT-HOUR)

8.7.1 ENERGY SEGMENT GROWTH IN NORTH AMERICA AND MIDDLE EAST & AFRICA BOOSTS DEMAND FOR MOUNTED BEARINGS

TABLE 65 ENERGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 ENERGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 FOOD & BEVERAGE

FIGURE 50 EMPLOYEE SHARE IN FOOD AND BEVERAGES MANUFACTURING INDUSTRY, BY SECTOR, 2019

TABLE 67 US: FOOD & BEVERAGE PROCESSING RELATED IMPORTS, 2020, (USD BILLION)

8.8.1 ADOPTION OF AUTOMATION EQUIPMENT IN FOOD & BEVERAGE INDUSTRY FUELS MARKET GROWTH

TABLE 68 FOOD & BEVERAGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 FOOD & BEVERAGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 GENERAL INDUSTRIAL & MACHINERY

8.9.1 SEGMENT GROWTH DRIVEN BY INCREASING DEMAND FOR MACHINERY AND TOOLS FOR PRODUCT MANUFACTURING

TABLE 70 GENERAL INDUSTRIAL & MACHINERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 GENERAL INDUSTRIAL & MACHINERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.10 TRANSPORTATION

8.10.1 MARINE INDUSTRY TO DOMINATE OTHER TRANSPORTATION SEGMENT

TABLE 72 TRANSPORTATION: MOUNTED BEARING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 TRANSPORTATION: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 TRANSPORTATION: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.10.2 AEROSPACE

TABLE 76 MATERIALS USED TO MANUFACTURE AEROSPACE BEARINGS

FIGURE 51 AEROSPACE AND DEFENSE TRADE BALANCE OF US, 2010-2020 (USD BILLION)

8.10.3 MARINE

8.10.4 RAILWAY

FIGURE 52 NEW ROLLING STOCK ORDERS, BY REGION, BY VOLUME (UNITS), 2020-2021 (FIRST SIX MONTHS)

8.11 PULP & PAPER

FIGURE 53 PULP PRODUCTION, 2018 VS. 2019 (’000 TONS)

8.11.1 NORTH AMERICA TO BE LARGEST MARKET FOR MOUNTED BEARINGS IN PULP & PAPER SEGMENT

TABLE 77 PULP & PAPER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 PULP & PAPER: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.12 OTHERS

8.12.1 ASIA OCEANIA PROJECTED TO LEAD OTHERS SEGMENT BY 2027

TABLE 79 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MOUNTED BEARING MARKET, BY HOUSING BLOCK TYPE (Page No. - 156)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

FIGURE 54 RESEARCH METHODOLOGY

9.1.2 OPERATIONAL DATA

FIGURE 55 SECTIONAL VIEW OF CAST IRON PLUMMER AND FLANGED HOUSING

FIGURE 56 SECTIONAL VIEW OF STEEL SHEET PLUMMER AND FLANGED HOUSING

9.1.3 KEY INDUSTRY INSIGHTS

FIGURE 57 MARKET, BY HOUSING BLOCK TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 81 MARKET, BY HOUSING BLOCK TYPE, 2018–2021 (USD MILLION)

TABLE 82 MARKET, BY HOUSING BLOCK TYPE, 2022–2027 (USD MILLION)

9.2 PLUMMER BLOCK

9.2.1 PLUMMER BLOCK SEGMENT HOLDS LARGEST SHARE IN MOUNTED BEARING MARKET

TABLE 83 PLUMMER BLOCK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 PLUMMER BLOCK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 FLANGED BLOCK

9.3.1 GROWTH IN DEMAND FOR CONVEYOR AND POWER TRANSMISSION SYSTEMS TO DRIVE MARKET

TABLE 85 FLANGED BLOCK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 FLANGED BLOCK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 TAKE-UP BLOCK

9.4.1 GROWTH IN DEMAND FOR MATERIAL HANDLING AND FOOD PROCESSING EQUIPMENT TO DRIVE MARKET

TABLE 87 TAKE-UP BLOCK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 TAKE-UP BLOCK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHERS

9.5.1 GROWING MANUFACTURING INDUSTRIES IN ASIA OCEANIA TO DRIVE MARKET

TABLE 89 OTHERS HOUSING BLOCK TYPE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 OTHERS HOUSING BLOCK TYPE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MOUNTED BEARING MARKET, BY MARKET CHANNEL (Page No. - 164)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

FIGURE 58 RESEARCH METHODOLOGY

10.1.2 KEY INDUSTRY INSIGHTS

FIGURE 59 MARKET, BY MARKET CHANNEL, 2022 VS. 2027 (USD MILLION)

TABLE 91 MARKET, BY MARKET CHANNEL, 2018–2021 (USD MILLION)

TABLE 92 MARKET, BY MARKET CHANNEL, 2022–2027 (USD MILLION)

10.2 OE MARKET

10.2.1 HIGH-VOLUME ORDERS BY LEADING OEMS FROM MANUFACTURING INDUSTRIES KEY TO OE MARKET GROWTH

TABLE 93 OE MARKET: BY REGION, 2018–2021 (USD MILLION)

TABLE 94 OE MARKET: BY REGION, 2022–2027 (USD MILLION)

10.3 AFTERMARKET

10.3.1 GROWING DEALER AND DISTRIBUTOR NETWORK MAY DRIVE AFTERMARKET SEGMENT

TABLE 95 AFTERMARKET: BY REGION, 2018–2021 (USD MILLION)

TABLE 96 AFTERMARKET: BY REGION, 2022–2027 (USD MILLION)

11 MOUNTED BEARING MARKET, BY HOUSING MATERIAL TYPE (Page No. - 170)

11.1 INTRODUCTION

11.2 CAST STEEL

11.3 STAINLESS STEEL

TABLE 97 CHEMICAL COMPOSITION OF STAINLESS-STEEL ALLOY

11.4 CAST IRON

11.5 COMPOSITES

TABLE 98 CHEMICAL RESISTANCE RATINGS OF POLYPROPYLENE

11.6 OTHERS

TABLE 99 ANTI-CORROSION CAPABILITY OF DIFFERENT HOUSED MATERIALS

12 MOUNTED BEARING MARKET, BY REGION (Page No. - 173)

12.1 INTRODUCTION

FIGURE 60 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 100 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA OCEANIA

FIGURE 61 ASIA OCEANIA: MARKET SNAPSHOT

TABLE 102 ASIA OCEANIA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 103 ASIA OCEANIA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 104 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 ASIA OCEANIA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 ASIA OCEANIA: COVID-19 IMPACT

12.2.2 CHINA

FIGURE 62 CHINA MANUFACTURING INDUSTRY, VALUE ADDED, 2015-2020 (USD TRILLION)

12.2.2.1 Government initiatives to boost market growth in China

TABLE 106 CHINA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 107 CHINA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.2.3 INDIA

FIGURE 63 AUTOMOTIVE PRODUCTION IN INDIA, 2020 VS 2021 (UNITS)

TABLE 108 INDIA GROSS VALUE-ADDED ESTIMATES AT BASIC PRICES IN Q1 (APRIL-JUNE) OF 2020–2021 (AT 2011–2012 PRICE)

FIGURE 64 INDIA: CONSUMPTION OF FINISHED STEEL (MILLION TONS)

12.2.3.1 Growing FDI to drive Indian mounted bearing market

TABLE 109 INDIA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 110 INDIA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.2.4 JAPAN

TABLE 111 JAPAN EXPORTS BY INDUSTRY IN 2021 (USD BILLION)

12.2.4.1 Presence of leading players key to market growth in Japan

TABLE 112 JAPAN: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.2.5 SOUTH KOREA

FIGURE 65 SOUTH KOREA: CONTRIBUTION OF MANUFACTURING INDUSTRY TO GDP, 2015–2020, (USD BILLION)

12.2.5.1 Increasing focus on renewable energy sources spurs demand for mounted bearings in South Korea

TABLE 114 SOUTH KOREA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 115 SOUTH KOREA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.2.6 AUSTRALIA

12.2.6.1 Food & beverage and mining industries significant influencers of mounted bearing market in Australia

TABLE 116 AUSTRALIA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 117 AUSTRALIA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.2.7 REST OF ASIA OCEANIA

12.2.7.1 Growth of manufacturing industry in Southeast Asian countries boosts market growth

TABLE 118 REST OF ASIA OCEANIA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 119 REST OF ASIA OCEANIA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 66 EUROPE: MOUNTED BEARING MARKET SNAPSHOT

TABLE 120 EUROPE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 EUROPE: COVID-19 IMPACT

12.3.2 GERMANY

FIGURE 67 GERMANY: GROSS VALUE ADDED BY SELECTED INDUSTRIES (Q1 2019–Q2 2020)

12.3.2.1 Growth of automotive sector results in growth of mounted bearing market in Germany

TABLE 124 GERMANY: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 125 GERMANY: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3.3 FRANCE

FIGURE 68 FRANCE: MANUFACTURING INDUSTRY, VALUE ADDED (% OF GDP)

12.3.3.1 Government investments in aerospace sector to affect market positively in France

TABLE 126 FRANCE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Growth in agriculture, food & beverage, and tobacco industries promotes growth in Italian market

TABLE 128 ITALY: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 129 ITALY: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Major demand for mounted bearings in Russia witnessed from mining and energy industries

TABLE 130 RUSSIA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 131 RUSSIA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3.6 UK

FIGURE 69 UK: PRODUCT SALES, 2015-2020 (USD MILLION)

12.3.6.1 Food processing, automotive, and fabricated metal sectors spark growth of UK market

TABLE 132 UK: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 133 UK: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 134 AUTOMOTIVE PRODUCTION BY MAKER/BRAND IN UK IN 2021

12.3.7 REST OF EUROPE

12.3.7.1 Iron & steel, textile, chemical, and automotive sectors dominate demand for mounted bearings in Rest of Europe

TABLE 135 REST OF EUROPE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.4 NORTH AMERICA

FIGURE 70 NORTH AMERICA: MOUNTED BEARING MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 NORTH AMERICA: COVID-19 IMPACT

12.4.2 CANADA

12.4.2.1 Energy industry in Canada vital to growth of mounted bearing market

TABLE 139 CANADA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 140 CANADA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.4.3 MEXICO

12.4.3.1 USMCA agreement to help drive growth of mounted bearing market in Mexico

TABLE 141 MEXICO: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 142 MEXICO: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.4.4 US

12.4.4.1 US estimated to be largest market in North America

TABLE 143 US: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 144 US: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

FIGURE 71 MIDDLE EAST & AFRICA: MOUNTED BEARING MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 IRAN

12.5.1.1 Investments in industries to counter US sanctions could benefit market in Iran

TABLE 147 IRAN: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 148 IRAN: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.5.2 SOUTH AFRICA

12.5.2.1 Increasing FDI will have positive impact on market in South Africa

TABLE 149 SOUTH AFRICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 150 SOUTH AFRICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.5.3 REST OF MIDDLE EAST & AFRICA

12.5.3.1 Recommencement of construction post-2020 to boost market growth in Rest of Middle East & Africa

TABLE 151 REST OF MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

FIGURE 72 LATIN AMERICA: MOUNTED BEARING MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 Growth of manufacturing industry to result in growth of market in Latin America

TABLE 155 BRAZIL: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Argentina may offer opportunities for mounted bearings in food and beverages industry

TABLE 157 ARGENTINA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 158 ARGENTINA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.6.3 REST OF LATIN AMERICA

12.6.3.1 Localized production of machinery could boost market in Rest of Latin America

TABLE 159 REST OF LATIN AMERICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 160 REST OF LATIN AMERICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 212)

13.1 OVERVIEW

FIGURE 73 KEY DEVELOPMENTS BY LEADING PLAYERS IN MOUNTED BEARING MARKET

13.2 MARKET SHARE ANALYSIS

TABLE 161 MARKET SHARE ANALYSIS, 2021

13.3 COVID-19 IMPACT ON MOUNTED BEARING COMPANIES

13.4 COMPETITIVE SCENARIO

13.4.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

TABLE 162 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2019–2022

13.4.2 NEW PRODUCT DEVELOPMENTS

TABLE 163 NEW PRODUCT DEVELOPMENTS, 2019–2022

13.4.3 MERGERS & ACQUISITIONS, 2019–2022

TABLE 164 MERGERS & ACQUISITIONS, 2019–2022

13.4.4 EXPANSIONS, 2019–2022

TABLE 165 EXPANSIONS, 2019–2022

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 74 MOUNTED BEARING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

13.6 PRODUCT FOOTPRINT

TABLE 166 COMPANY PRODUCT FOOTPRINT

TABLE 167 COMPANY INDUSTRY FOOTPRINT

TABLE 168 COMPANY APPLICATION FOOTPRINT

TABLE 169 COMPANY REGION FOOTPRINT

13.7 STARTUP/SME EVALUATION MATRIX, 2021

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 75 MOUNTED BEARING MARKET: SME MATRIX, 2021

13.8 WINNERS VS. TAIL-ENDERS

TABLE 170 WINNERS VS. TAIL-ENDERS

14 COMPANY PROFILES (Page No. - 225)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

14.1.1 SKF

TABLE 171 SKF: BUSINESS OVERVIEW

FIGURE 76 SKF: COMPANY SNAPSHOT

TABLE 172 SKF: PRODUCTS OFFERED

TABLE 173 SKF: NEW PRODUCT LAUNCHES

TABLE 174 SKF: OTHERS

TABLE 175 SKF: CUSTOMERS

TABLE 176 SKF: SUPPLY AGREEMENTS

14.1.2 TIMKEN

TABLE 177 TIMKEN: BUSINESS OVERVIEW

FIGURE 77 TIMKEN: COMPANY SNAPSHOT

TABLE 178 TIMKEN: PRODUCTS OFFERED

TABLE 179 TIMKEN: DEALS

TABLE 180 TIMKEN: CUSTOMERS

14.1.3 NSK LTD.

TABLE 181 NSK LTD.: BUSINESS OVERVIEW

FIGURE 78 NSK LTD.: COMPANY SNAPSHOT

TABLE 182 NSK LTD.: PRODUCTS OFFERED

TABLE 183 NSK LTD.: PRODUCT LAUNCHES

TABLE 184 NSK LTD.: DEALS

TABLE 185 NSK LTD.: OTHERS

TABLE 186 NSK LTD.: CUSTOMERS

14.1.4 SCHAEFFLER AG

TABLE 187 SCHAEFFLER AG: BUSINESS OVERVIEW

FIGURE 79 SCHAEFFLER AG: COMPANY SNAPSHOT

TABLE 188 SCHAEFFLER AG: PRODUCTS OFFERED

TABLE 189 SCHAEFFLER AG: DEALS

TABLE 190 SCHAEFFLER AG: CUSTOMERS

14.1.5 NTN BEARING CORPORATION

TABLE 191 NTN BEARING CORPORATION: BUSINESS OVERVIEW

FIGURE 80 NTN BEARING CORPORATION: COMPANY SNAPSHOT

TABLE 192 NTN BEARING CORPORATION: PRODUCTS OFFERED

TABLE 193 NTN BEARING CORPORATION: PRODUCT LAUNCHES

TABLE 194 NTN BEARING CORPORATION: CUSTOMERS

14.1.6 REGAL REXNORD

TABLE 195 REGAL REXNORD: BUSINESS OVERVIEW

FIGURE 81 REGAL REXNORD: COMPANY SNAPSHOT

TABLE 196 REGAL REXNORD: PRODUCTS OFFERED

TABLE 197 REGAL REXNORD: DEALS

14.1.7 PT INTERNATIONAL

TABLE 198 PT INTERNATIONAL: BUSINESS OVERVIEW

TABLE 199 PT INTERNATIONAL: PRODUCTS OFFERED

14.1.8 JONES BEARING COMPANY

TABLE 200 JONES BEARING COMPANY: BUSINESS OVERVIEW

TABLE 201 JONES BEARING COMPANY: PRODUCTS OFFERED

14.1.9 ASAHI SEIKO CO., LTD.

TABLE 202 ASAHI SEIKO CO., LTD.: BUSINESS OVERVIEW

TABLE 203 ASAHI SEIKO CO., LTD.: PRODUCT OFFERING

14.1.10 FYH INC.

TABLE 204 FYH INC.: BUSINESS OVERVIEW

TABLE 205 FYH INC.: PRODUCTS OFFERED

14.1.11 RBC BEARINGS

TABLE 206 RBC BEARINGS: BUSINESS OVERVIEW

FIGURE 82 RBC BEARINGS: COMPANY SNAPSHOT

TABLE 207 RBC BEARINGS: PRODUCTS OFFERED

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14.2 OTHER REGIONAL KEY PLAYERS

14.2.1 ASIA PACIFIC

14.2.1.1 JTEKT Corporation

TABLE 208 JTEKT CORPORATION: BUSINESS OVERVIEW

14.2.1.2 Luoyang Longda Bearing Co., Ltd.

TABLE 209 LUOYANG LONGDA BEARING CO., LTD.: BUSINESS OVERVIEW

14.2.2 NORTH AMERICA

14.2.2.1 Spyraflo Inc.

TABLE 210 SPYRAFLO INC.: BUSINESS OVERVIEW

14.2.2.2 Baart Industrial Group

TABLE 211 BAART INDUSTRIAL GROUP: BUSINESS OVERVIEW

14.2.2.3 RBI Bearing, Inc.

TABLE 212 RBI BEARING, INC.: BUSINESS OVERVIEW

14.2.2.4 Triangle Manufacturing Company

TABLE 213 TRIANGLE MANUFACTURING COMPANY: BUSINESS OVERVIEW

14.2.2.5 Altra Industrial Motion

TABLE 214 ALTRA INDUSTRIAL MOTION: BUSINESS OVERVIEW

14.2.2.6 Emerson Bearing Company

TABLE 215 EMERSON BEARING COMPANY: BUSINESS OVERVIEW

14.2.3 EUROPE

14.2.3.1 ZKL Group

TABLE 216 ZKL GROUP: BUSINESS OVERVIEW

14.2.3.2 igus GmbH

TABLE 217 IGUS GMBH: BUSINESS OVERVIEW

14.2.3.3 NBC Group

TABLE 218 NBC GROUP: BUSINESS OVERVIEW

15 APPENDIX (Page No. - 263)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.2.1 DEMAND-SIDE DISCUSSION GUIDE

15.2.2 SUPPLY-SIDE DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 CURRENCY & PRICING

15.6 RELATED REPORTS

15.7 AUTHOR DETAILS

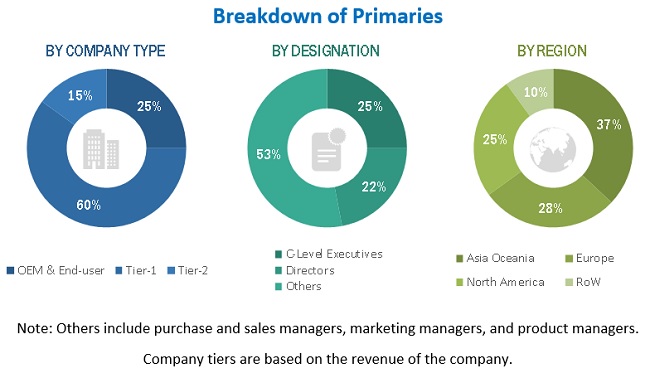

The study involved four major activities in estimating the current size of the mounted bearing market. Extensive primary research was conducted after obtaining an understanding of this market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- [(in terms of end-use industries) country-level government associations, and trade associations] and supply-side (mounted bearings and components providers) across major regions, namely, North America, Europe, Latin America, Middle East & Africa, and Asia Oceania.

Secondary Research

As a part of the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. Secondary sources include annual reports, press releases & investor presentations of companies, white papers, coating journals, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of players, and market classification & segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

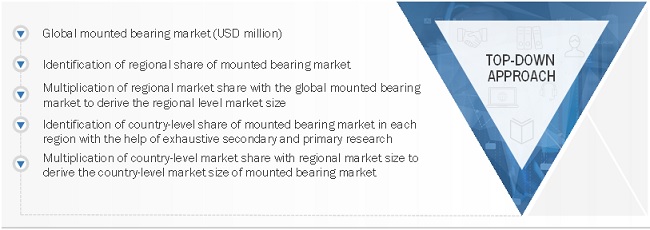

As a part of the complete market engineering process, both, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to estimate the market size and forecast all segments and subsegments listed in this report for the next five years (2022–2027). Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report

Primary Research

Extensive primary research was conducted after obtaining an understanding of the mounted bearing market through secondary research. Several primary interviews were conducted with market experts from demand- (OEMs) and supply-side (mounted bearing manufacturer) across major regions, namely, North America, Europe, Asia Oceania, LATAM, and MEA. Primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the opinions of in-house subject matter experts, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

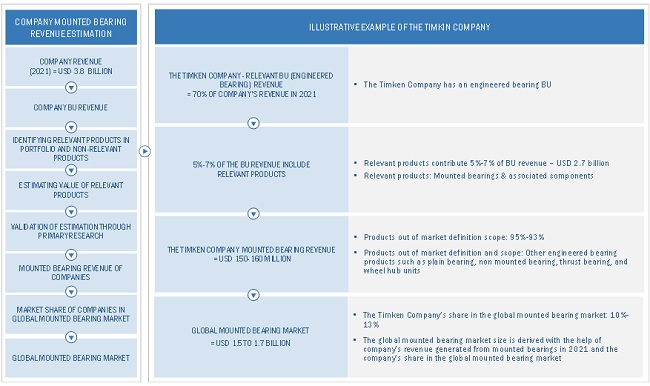

The top-down approach was used to estimate and validate the size of the mounted bearing market. To derive the global market size, mounted bearing revenue generated by Timken in 2021, and the company’s market share was taken into account. This was divided by the market share of the company in the global market in 2021. The market share and revenue generated by the company were derived with the help of extensive secondary research and confirmed by multiple primary respondents.

The global mounted bearing market was then segmented into region-level markets. With the help of primary insights and secondary research, the market share of each region was derived. The market share of each region was then multiplied with the global market to derive the region-level market size. To derive the country-level market size of mounted bearings, extensive secondary research was carried out. The market share was then confirmed with primary respondents from various countries, which was then multiplied with the region-level market size of the global market to derive the country-level market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Mounted Bearing Market: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and project (2022–2027) the mounted bearing market based on product type, housing block type, end-use industry type, market channel, equipment type, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the market’s growth.

- To segment the global market and forecast its market size, by value (USD million) based on product type [(ball bearings and roller bearings (spherical roller bearings, cylindrical roller bearing, tapered roller bearing, and others)]

- To segment the market and forecast its market size, by value (USD million), based on market channel (OE Market and Aftermarket)

- To segment the global market and forecast its market size, by value (USD million), based on housing type (plummer block bearings, flange block bearings, take-up block bearings, and others)

- To segment the market and forecast its market size, by value (USD million) based on equipment type (ball mill drives, fans & blowers, gearbox & transmission, conveyors, crushers, mixer drives, and others)

- To segment this market and forecast its market size, by value (USD million) based on end-use industry (food & beverage, agriculture, farm & fish, construction & mining, automotive, chemical & pharmaceutical, energy, general industrial & machinery, transportation, pulp & paper, and others)

- To forecast the size of various segments of the mounted bearings market based on five regions—Asia Oceania, Europe, Middle East & Africa, North America, and Latin America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To track and analyze competitive developments, such as joint ventures, collaborations, partnerships, mergers & acquisitions, new product developments, and expansions, in this market.

Bearing units & Its impact on Mounted Bearing Market

Bearing units are an essential component of mounted bearings, so there is a strong link between the bearing unit market and the mounted bearing market. Mounted bearings are bearings that have been pre-assembled into a housing, making installation and replacement easier. These bearings are found in a variety of industrial applications, such as machinery, equipment, and conveyor systems. Bearing units, which typically consist of a bearing and a housing, are the core components of mounted bearings. The bearing unit is intended to support and reduce friction between rotating and stationary machine components. Depending on the application and requirements, bearing units can be made of a variety of materials such as steel, cast iron, and plastic.

The mounted bearing market is a large and rapidly expanding industry, fueled by rising demand for industrial machinery and equipment. Bearing units are an essential component of mounted bearings, so their demand is closely related to the growth of the market. The demand for bearing units is expected to rise in tandem with the demand for mounted bearings.

By extending the reach of Bearing units companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Performance: The development of more advanced bearing unit designs, materials, and manufacturing processes can improve the performance of the entire system, leading to increased demand for mounted bearings.

- Efficiency: Bearing units can also impact the efficiency of mounted bearings. Advanced bearing unit designs can reduce friction, heat, and wear, leading to improved energy efficiency and reduced maintenance costs.

- Cost: The cost of manufacturing bearing units decreases due to advancements in technology and processes, the cost of mounted bearings may also decrease, making them more affordable for customers.

- Durability: The development of more durable bearing unit materials and designs can improve the lifespan of the entire mounted bearing system, reducing the need for maintenance and replacement.

The top players in the Bearing units Market are SKF, Timken, NTN Corporation, Schaeffler Group, NSK Ltd., Rexnord Corporation.

Some of the key industries that are going to get impacted because in the future because of Bearing units are,

- Aerospace: The aerospace industry relies heavily on precision bearings to ensure the safe and efficient operation of aircraft.

- Automotive: The automotive industry is a significant consumer of bearings, with bearings used in everything from engines and transmissions to wheels and steering systems.

- Wind Energy: The wind energy industry relies on large, high-performance bearings to support the rotation of wind turbine blades.

- Medical Equipment: Medical equipment often requires bearings with high precision, durability, and reliability.

- Robotics: Robotics is another industry that relies heavily on bearings to ensure the smooth and efficient movement of robotic arms, joints, and other components.

Speak to our analyst today to know more about "Bearing units Market"

Available Customizations

- Mounted bearing market, additional countries (Up to 3)

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mounted Bearing Market