Aerospace Bearings Market by Type (Plain Bearing, Ball Bearing, Roller Bearing, Others), Application (landing gear, cockpit control, aerostructure, aircraft system, engine & APU system, Others), Sales Channel, Material, and Region - Global Forecast to 2028

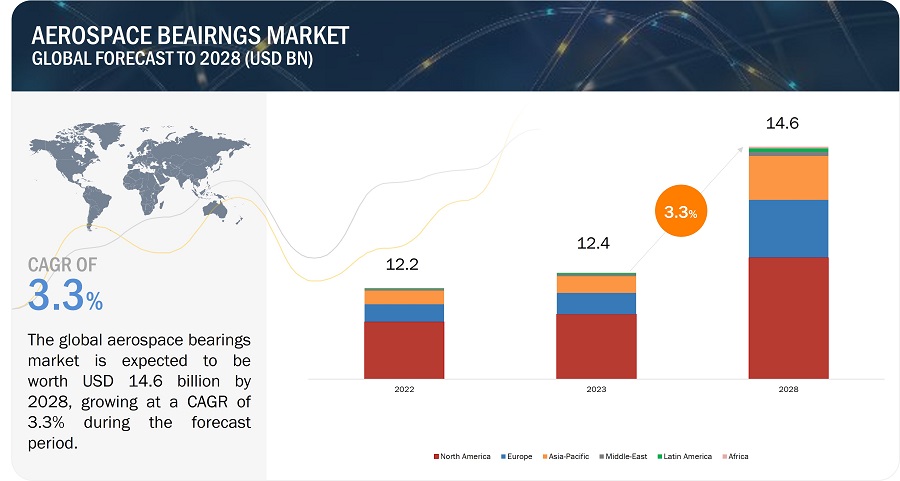

[234 Pages Report] The global aerospace bearings market size is estimated to be USD 12.4 billion in 2023 and is expected to reach USD 14.6 billion by 2028 at a CAGR of 3.3% from 2023 to 2028. The aerospace bearings market is a critical component of the aerospace industry, providing essential support for various aircraft systems. Bearings are used in engines, landing gears, flight control systems, and other applications where smooth and reliable rotational movement is required. The market is driven by several factors, including the growing demand for more fuel-efficient and powerful aircraft, advancements in materials and technologies, and increasing air travel worldwide. The aerospace industry's emphasis on reducing weight and enhancing operational efficiency has led to the development of lightweight, high-performance bearings with improved durability and resistance to extreme operating conditions. Key players in the aerospace bearings market include SKF Group, Timken Company, NTN Corporation, Schaeffler Group, and GGB Bearing Technology, among others. These companies compete by offering a wide range of bearings tailored to meet the stringent requirements of the aerospace sector. In recent years, there has been a focus on integrating smart technologies into aerospace bearings, enabling real-time monitoring and predictive maintenance. Additionally, sustainability and environmental concerns have driven research and development efforts to create eco-friendly bearing solutions.

As the aerospace industry continues to evolve, the aerospace bearings market is expected to grow steadily, driven by technological advancements, increasing aircraft production, and the need for more reliable and efficient aerospace systems.

Aerospace Bearings Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aerospace Bearings Market Dynamics

Driver: Growing fleet of commercial and combat aircraft to drive the aerospace bearings after market

The aerospace bearings market is poised for growth due to the increasing demand for commercial and combat aircraft worldwide. As the global aviation industry expands, there is a parallel need for reliable and high-performance bearings to ensure the smooth functioning of aircraft components, such as engines, landing gear, and control systems. This growing fleet of aircraft, both in the commercial and military sectors, is a key driver for the aerospace bearings market. In the commercial aviation sector, the rising number of air passengers and the need to replace aging aircraft are major factors driving the demand for new planes. This has led to significant orders from airlines and leasing companies, resulting in the expansion of aircraft fleets. As a result, there is a corresponding increase in the demand for aerospace bearings to support these aircraft. Similarly, in the military sector, countries are investing in the development and modernization of their defense forces. This includes the procurement of advanced combat aircraft to enhance their air capabilities. These military aircraft require durable and high-performance bearings to withstand extreme conditions and provide optimal performance. As a result, the growing fleet of combat aircraft contributes to the growth of the aerospace bearings market.

Overall, the increasing number of commercial and combat aircraft is driving the demand for aerospace bearings. Manufacturers in the aerospace industry are focusing on developing innovative bearings that offer enhanced performance, reliability, and durability to meet the evolving requirements of the aviation sector. The threats and rise of geopolitical conflict between nations have persuaded the adoption of advanced fighter aircraft to upgrade the present fleet and boost their aerial defense abilities. Nations are buckling up in their defense spending, even though it is an expensive sector. Hence, as thermal management is very important in the military sector, the demand for heat exchangers suitable for military applications would rise.

Restraints: Impact of counterfeiting

Counterfeiting poses a significant threat to the aerospace bearings market, with potential detrimental effects on safety, reliability, and financial losses. Counterfeit aerospace bearings refer to unauthorized imitations or replicas of genuine bearings that are falsely labeled and sold as legitimate products. The impact of counterfeiting on the aerospace bearings market is multifaceted and can be summarized as follows.

Firstly, counterfeits compromise safety and reliability. Aerospace bearings play a critical role in ensuring the smooth operation of aircraft components, and any substandard or counterfeit bearings can result in catastrophic failures. Counterfeit bearings may lack the necessary quality standards and certifications, leading to increased risks of accidents and failures during flight. This jeopardizes passenger safety and can cause substantial damage to aircraft systems.

Secondly, counterfeiting undermines trust and brand reputation. Established aerospace bearing manufacturers invest heavily in research, development, and quality control to ensure their products meet stringent industry standards. Counterfeit bearings not only infringe upon intellectual property rights but also erode customer trust in genuine manufacturers. This can lead to reputational damage and loss of market share for legitimate companies.

Lastly, counterfeiting imposes financial losses on the aerospace bearings market. Counterfeit bearings are often sold at significantly lower prices, attracting unsuspecting customers seeking cheaper alternatives. This diverts revenue away from legitimate manufacturers, impacting their sales and profitability. Additionally, the costs associated with detecting and combating counterfeiting, including legal actions and brand protection measures, further strain the resources of genuine manufacturers.

In response to the impact of counterfeiting, aerospace bearing manufacturers collaborate with regulatory authorities, implement stricter supply chain controls, and educate customers to raise awareness about the risks of counterfeit products. These efforts aim to safeguard the integrity of the aerospace bearings market, protect end-users, and maintain the highest standards of safety and reliability in the aviation industry.

Opportunities: Focus on the greener aerospace sector and its impact on the bearing supply chain

The increasing focus on creating a greener aerospace sector presents a significant opportunity for the aerospace bearings market. The aviation industry is striving to reduce its environmental footprint by adopting sustainable practices and technologies. This includes the development of more fuel-efficient aircraft, electric propulsion systems, and lightweight materials. Aerospace bearings play a crucial role in enabling these advancements by reducing friction, improving efficiency, and supporting the overall performance of aircraft components. As the demand for greener aviation solutions grows, there will be an increased need for advanced aerospace bearings that offer improved energy efficiency and contribute to the overall sustainability goals of the aerospace industry. This presents a promising opportunity for bearing manufacturers to innovate and provide eco-friendly solutions, driving the growth of the aerospace bearings market.

Challenges: Delay in obtaining accreditations

The aerospace bearings market faces challenges due to delays in obtaining accreditations. Aerospace bearings need to meet stringent quality and safety standards to ensure their reliability in critical applications. However, obtaining necessary accreditations and certifications from regulatory bodies can be a time-consuming process, leading to delays in product launches and market entry. These delays can hinder the competitiveness of manufacturers and impede their ability to meet customer demands. Additionally, the complex nature of accreditations and the evolving regulatory landscape pose further challenges. To overcome these hurdles, proactive engagement with regulatory authorities and streamlining accreditation processes are crucial for the aerospace bearings market to maintain pace with industry requirements.

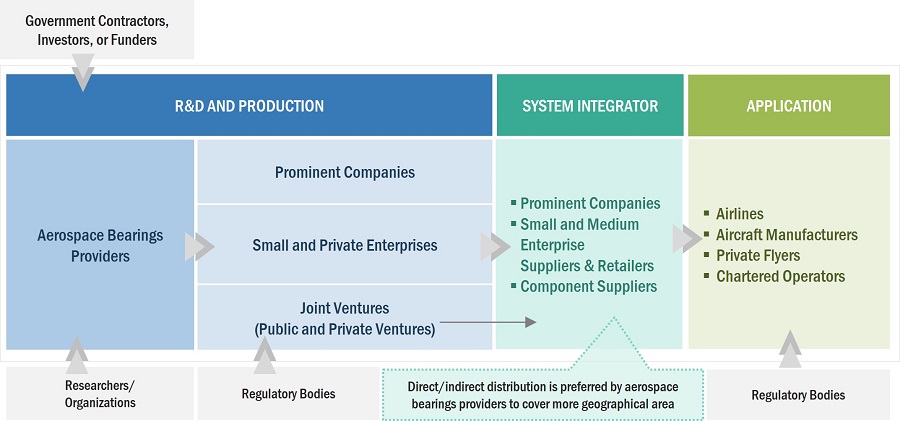

Aerospace Bearings Market Ecosystem

The aerospace bearings market report ecosystem consists of various key stakeholders and elements. It involves aerospace bearing manufacturers, suppliers, distributors, and end-users such as aircraft manufacturers and maintenance, repair, and overhaul (MRO) providers. Market research firms and industry analysts play a crucial role in collecting and analyzing data, trends, and market insights to generate comprehensive reports on the aerospace bearings market. These reports provide valuable information on market size, growth factors, competitive landscape, and future projections. Government regulatory bodies also contribute to the ecosystem by enforcing quality standards and intellectual property rights protection. Overall, the aerospace bearings market report ecosystem facilitates informed decision-making and strategic planning for industry participants. Collaboration and coordination among these stakeholders are essential for the smooth operation and growth of the aerospace bearings market ecosystem. Prominent companies in this market are SKF (Sweden), Timken Company (US), NTN Corporation (Japan), Schaeffler Group (Germany), and GGB Bearing (UK), among others.

Based on Application, the engine, and APU segment is estimated to account for the largest market share of the aerospace bearings market.

The engine and APU (Auxiliary Power Unit) segment is projected to hold the largest market share in the aerospace bearings market. With the continuous advancements in aircraft engine technology and the growing demand for more powerful and efficient engines, there is a significant need for high-performance bearings. These bearings play a critical role in supporting the rotating components of engines and APUs, ensuring smooth operation and optimal performance. As a result, the engine and APU segment is expected to maintain its dominance and capture the largest market share in the aerospace bearings industry.

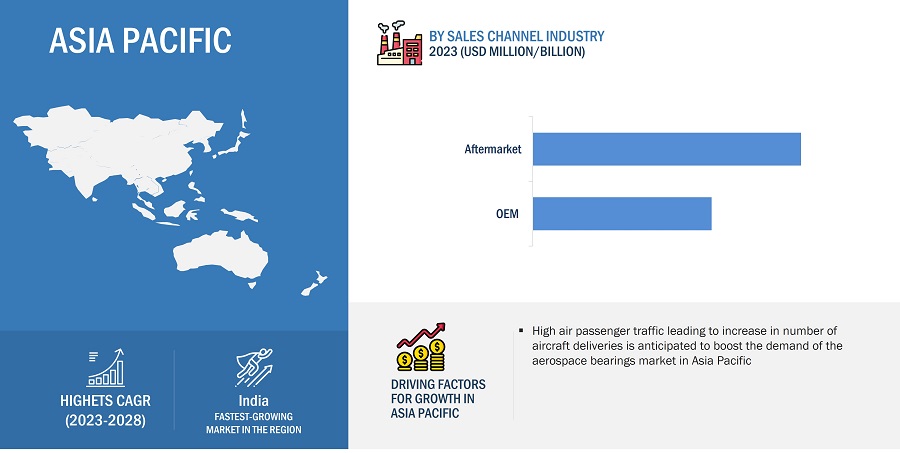

Based on sales channels, the aftermarket segment is anticipated to dominate the market.

Based on the sales channel, the aftermarket segment is expected to dominate the aerospace bearings market in the forecast period. The aftermarket segment includes maintenance, repair, and overhaul (MRO) services for existing aircraft fleets, where replacement of worn-out or damaged bearings is a common requirement. The increasing focus on aircraft maintenance and the need for replacement parts will drive the demand for aerospace bearings in the aftermarket segment.

The metal segment of the aerospace bearings market by material is projected to dominate the market.

The metal segment is poised to lead the aerospace bearings market. Metal bearings, such as steel and titanium, offer excellent strength, durability, and resistance to high temperatures and loads, making them ideal for demanding aerospace applications. The metal segment benefits from the increasing demand for reliable and high-performance bearings in aircraft engines, landing gear systems, and other critical aerospace components. With their superior properties and extensive use in aerospace systems, metal bearings are expected to dominate the market and continue to be the preferred choice for aerospace applications.

The commercial aviation segment of the aerospace bearings market by aircraft type is projected to dominate the market.

Based on aircraft type, the commercial aviation segment is projected to be the leading driver of the aerospace bearings market in the forecast period. The growing demand for air travel, the expansion of airline fleets, and the need for regular maintenance and replacement of bearings in commercial aircraft will contribute to the dominance of the commercial aviation segment in the market.

The Asia Pacific market is projected to lead with highest CAGR in the aerospace bearings market.

In the forecast period, the Asia Pacific region is expected to lead the aerospace bearings market with the highest CAGR. The region's dominance can be attributed to factors such as increasing air passenger traffic, rising disposable incomes, and significant investments in the aviation industry. Additionally, the presence of major aircraft manufacturers and expanding defense budgets in countries like China and India contribute to the market growth in the Asia Pacific region.

Aerospace Bearings Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The aerospace bearings market is dominated by a few globally established players such as Prominent companies, including SKF (Sweden), Timken Company (US), NTN Corporation (Japan), Schaeffler Group (Germany), and GGB Bearing (UK), among others are some of the leading players operating in the aerospace bearings market, are the key manufacturers that secured aerospace bearings contracts in the last few years. A major focus was given to the contracts and new product development due to the changing requirements of commercial, government, and military users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Application, By Sales Channel, By Aircraft Type, By Material, By Type, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

SKF (Sweden), NSK Ltd. (Japan), JTEKT Corporation (Japan), Schaeffler AG (Germany), and NTN Corporation (Japan), among others. |

Aerospace Bearings Market Highlights

The study categorizes the aerospace bearings market based on Application, Aircraft Type, End-use, Material, and Region.

|

Segment |

Subsegment |

|

By Material |

|

|

By Application |

|

|

By Type |

|

|

By Sales Channel |

|

|

By Aircraft Type |

|

|

By Region |

|

Recent Developments

- In 2020, NTN Corporation and NTT Data Corporation announced a joint development collaboration in the field of IoT (Internet of Things) technologies. The collaboration aimed to develop solutions for predictive maintenance and remote monitoring of industrial equipment.

- In September 2022, The Timken Company, a global leader in engineered bearings and industrial motion products, acquired GGB Bearing Technology (GGB), a division of Enpro, Industries (including exclusive negotiations with respect to the French operations of GGB).

- In November 2020, SKF and NTN Corporation announced a strategic partnership to enhance their product portfolios and explore opportunities for collaboration in areas such as research and development, supply chain optimization, and sales network cooperation.

Frequently Asked Questions (FAQ):

Which are the major companies in the aerospace bearings market? What are their major strategies to strengthen their market presence?

Some of the key players in the aerospace bearings market are SKF (Sweden), Timken Company (US), NTN Corporation (Japan), Schaeffler Group (Germany), and GGB Bearing (UK), among others, are the key manufacturers that secured aerospace bearings system contracts in the last few years.

What are the drivers and opportunities for the aerospace bearings market?

The primary driver of the aircraft bearing market is the increasing demand for new aircraft and the need to replace or upgrade existing bearings. This is fueled by factors such as rising air passenger traffic, fleet modernization efforts, and the emphasis on safety and fuel efficiency. Additionally, advancements in materials and technology, including lightweight polymers and improved optical properties, create opportunities for enhanced bearing solutions. The aftermarket segment also presents an opportunity for growth, driven by the aging aircraft fleet and retrofitting activities. Overall, the aircraft bearing market offers significant potential for manufacturers and suppliers to meet the evolving demands of the aviation industry.

Which region is expected to grow at the highest rate in the next five years?

The market in the Asia-Pacific region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for aerospace bearings in the region. This growth can be attributed to factors such as increasing air passenger traffic, rising disposable incomes, expanding airline fleets, and the growing demand for new aircraft in the region. Additionally, the presence of emerging economies, advancements in aerospace manufacturing capabilities, and investments in infrastructure development contribute to the strong growth prospects of the Asia Pacific region in the aircraft-bearing market.

Which type of aerospace bearings is expected to lead significantly in the coming years?

The military aviation aircraft type is expected to exhibit the highest CAGR in the aircraft bearing market over the forecasted period from 2023 to 2028. This growth can be attributed to factors such as increasing defense spending, modernization programs, and the need to upgrade and replace aging military aircraft. The demand for specialized bearings for military applications, including canopies and windshields, drives the growth of the military aviation aircraft type in the aircraft bearing market. Additionally, advancements in materials, technology, and increasing geopolitical tensions contribute to the strong growth prospects in the military aviation segment.

Which application of aerospace bearings is expected to lead significantly in the coming years?

The engine and APU segment is set to dominate the aerospace bearings market. With the increasing demand for more efficient and powerful engines in the aerospace industry, there is a growing need for high-performance bearings. Engine bearings play a crucial role in supporting the rotating components and ensuring smooth operation. Additionally, the APU segment, responsible for powering the aircraft's systems when the engines are not operational, requires reliable bearings. As a result, manufacturers focusing on these segments are expected to lead the market, capitalizing on the industry's evolving needs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing fleet of commercial and combat aircraft- Surge in deliveries of military aircraft- Increased use of UAVs and hybrid VTOLsRESTRAINTS- Impact of counterfeiting- High cost of raw materialsOPPORTUNITIES- Improved focus on greener aerospace sector- Emergence of advanced air mobilityCHALLENGES- Obstacles in obtaining accreditations- Dependence on military budget- Legal and regulatory barriers

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR AEROSPACE BEARING MANUFACTURERS

- 5.4 PRICING ANALYSIS

-

5.5 AEROSPACE BEARINGS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSPARTS SUPPLIERSBEARING MANUFACTURERSEND USERS (AIRCRAFT MANUFACTURERS, AIRLINE COMPANIES, AND MROS)

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 TRADE DATA ANALYSIS

-

5.10 CASE STUDY ANALYSISTIMKEN DESIGNS BEARINGS FOR NEW MARS ROVER (2020)KAMAN CORPORATION RECEIVES ADDITIONAL CONTRACT ON K-MAX HELICOPTERS (2018)TRANS-PACIFIC RECEIVES BEARINGS ORDER FOR A CHINA-BASED AEROSPACE COMPANY (2015)

-

5.11 TECHNOLOGY ANALYSISROTARY BEARINGS WITH ENGINEERED IOTADVANCEMENTS IN LUBRICANTS PERFORMANCEINNOVATIONS IN BEARING PERFORMANCEEMERGING DEMAND FOR INTEGRATED AND SUSTAINABLE BEARINGS

- 5.12 VOLUME DATA

-

5.13 REGULATORY LANDSCAPEREGULATORY LANDSCAPE FOR AEROSPACE BEARING INDUSTRY

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSCERAMIC AND COMPOSITE BEARINGSINTEGRATED HEALTH MONITORINGIMPROVED LUBRICATIONMINIATURE AND LIGHTER MATERIALSADDITIVE MANUFACTURINGSMART BEARINGS

- 6.3 AEROSPACE BEARINGS SPECIFICATIONS

-

6.4 IMPACT OF MEGATRENDSIMPLEMENTATION OF INDUSTRY 4.0GLOBALIZATION OF SUPPLY CHAINIMPACT OF ADVANCED AIR MOBILITY

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PLAIN BEARINGROD END/ROD END BEARINGJOURNAL BEARINGSPHERICAL BEARING

-

7.3 BALL BEARINGANGULAR CONTACTTHIN SECTIONPRECISION/MINIATUREDEEP GROOVETHRUSTSELF-ALIGNINGROD ENDJOURNAL

-

7.4 ROLLER BEARINGCYLINDRICALTHIN CONTACTNEEDLE ROLLERSELF-ALIGNINGTRACK ROLLERTAPERED ROLLER

-

7.5 OTHERSSELF-LUBRICATINGSWAGED & LOADER SLOTTRUNNION

- 8.1 INTRODUCTION

- 8.2 LANDING GEAR SYSTEM

- 8.3 COCKPIT CONTROL

- 8.4 AEROSTRUCTURE

-

8.5 AIRCRAFT SYSTEMHYDRAULIC SYSTEMSELECTRIC SYSTEMSAIR MANAGEMENT SYSTEMSFLIGHT CONTROL SYSTEMS

- 8.6 ENGINE & APU

- 8.7 DOOR

- 8.8 AIRCRAFT INTERIOR

- 9.1 INTRODUCTION

-

9.2 COMMERCIAL AVIATIONNARROW-BODY AIRCRAFT (NBA)- Growth in air passenger traffic to drive demandWIDE-BODY AIRCRAFT (WBA)- Increase in passenger travel to drive demandREGIONAL TRANSPORT AIRCRAFT (RTA)- Increasing use of regional transport aircraft in US and India to drive demandCOMMERCIAL HELICOPTERS- Increasing usage for multiple purposes to drive demand

-

9.3 MILITARY AVIATIONFIGHTER AIRCRAFT- Growing concerns over border tensions to drive demandTRANSPORT AIRCRAFT- Increasing requirements in military operations to drive demandMILITARY HELICOPTERS- Increasing use in medical evacuation, parachute drop, and search and rescue operations to drive demandSPECIAL MISSION AIRCRAFT- Growing defense spending and territorial disputes to drive demand

-

9.4 BUSINESS & GENERAL AVIATIONBUSINESS JETS- Exclusive premium features to drive demandULTRA & LIGHT AIRCRAFT- Rising demand and versatility of ultra & light aircraft to reshape general and business aviation markets

- 9.5 UNMANNED AERIAL VEHICLE (UAV)

- 10.1 INTRODUCTION

-

10.2 METALSTAINLESS STEELALUMINUM ALLOYSBI-METAL

- 10.3 METAL POLYMER & ENGINEERING PLASTIC

- 10.4 FIBER-REINFORCED COMPOSITE

- 10.5 CERAMIC

- 11.1 INTRODUCTIONS

-

11.2 OEMINCREASING AIRCRAFT DELIVERIES POST COVID-19 TO DRIVE SEGMENT

-

11.3 AFTERMARKETGROWING AIRCRAFT FLEET SIZE TO DRIVE SEGMENT

-

12.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

12.2 NORTH AMERICAINTRODUCTIONPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading OEMs and MRO providers to drive marketCANADA- Aircraft modernization programs to drive market

-

12.3 EUROPEINTRODUCTIONPESTLE ANALYSIS: EUROPEUK- Requirement for maintenance and overhaul services of existing aircraft fleet to drive marketGERMANY- Increasing procurement of airplanes to drive marketFRANCE- Growing aerospace manufacturing capabilities to drive marketRUSSIA- Government support for localization of aerospace bearing production to drive marketITALY- Rising aerospace component manufacturing capabilities to drive marketSPAIN- Rising focus on advanced aerospace bearing solutions to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICINTRODUCTIONPESTLE ANALYSIS: ASIA PACIFICCHINA- Rising domestic aerospace bearing manufacturing capabilities to drive marketINDIA- Government support for investments and partnerships in aerospace bearing industry to drive marketJAPAN- Presence of key players to drive marketAUSTRALIA- Growing investments in aviation sector to drive marketSOUTH KOREA- Increasing air traffic and growing number of local airlines to drive marketREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLDINTRODUCTIONPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST- Developing aerospace manufacturing hubs and localization efforts to drive marketLATIN AMERICA- Increasing focus on aerospace bearing technology adoption and industry growth to drive marketAFRICA- Enhancing aerospace bearing manufacturing capabilities and collaborations to drive market

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS

- 13.3 REVENUE ANALYSIS

- 13.4 COMPETITIVE BENCHMARKING

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

13.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORK

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSNTN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGGB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSKF- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNSK LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJTEKT CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewNATIONAL PRECISION BEARING- Business overview- Products/Solutions/Services offered- Recent developmentsRBC BEARINGS, INC.- Business overview- Products/Solutions/Services offeredPACAMOR KUBAR BEARINGS- Business overview- Products/Solutions/Services offeredAST BEARINGS LLC- Business overview- Products/Solutions/Services offeredKAMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsREGAL BELOIT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTHE TIMKEN COMPANY- Business overview- Recent developmentsSCHAEFFLER AG- Business overview- Products/Solutions/Services offeredNACHI-FUJIKOSHI CORP.- Business overview- Products/Solutions/Services offeredMINEBEAMITSUMI INC.- Business overview- Products/Solutions/Services offeredLYC BEARING CORPORATION- Business overview- Products/Solutions/Services offeredSCHATZ BEARING CORPORATION- Business overview- Products/Solutions/Services offeredBARDEN BEARINGS- Business overview- Products/Solutions/Services offeredRADIAL BEARING CORPORATION- Business overview- Products/Solutions/Services offeredCSC BEARING EUROPE GMBH- Business overview- Products/Solutions/Services offered

-

14.3 OTHER PLAYERSALPINE BEARINGREXNORD CORPORATIONCGB PRECISION PRODUCTSSAPPORO PRECISION INC.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 AEROSPACE BEARINGS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 REGIONAL OUTLOOK ON GROWTH OF AIR TRAFFIC, FLEET, AND AIRCRAFT DELIVERIES

- TABLE 4 RAW MATERIAL SUPPLIERS

- TABLE 5 PARTS SUPPLIERS

- TABLE 6 BEARING MANUFACTURERS

- TABLE 7 END USERS

- TABLE 8 MRO SERVICE PROVIDERS

- TABLE 9 PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AEROSPACE BEARINGS (%)

- TABLE 11 KEY BUYING CRITERIA FOR AEROSPACE BEARINGS

- TABLE 12 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017–2021 (USD MILLION)

- TABLE 13 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017–2021 (USD MILLION)

- TABLE 14 BALL BEARINGS, TOP EXPORTERS, 2021

- TABLE 15 BALL BEARINGS, TOP IMPORTERS, 2021

- TABLE 16 AEROSPACE BEARINGS OEM MARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 17 AEROSPACE BEARINGS AFTERMARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 RADIAL HEAVY-DUTY, SINGLE-ROW BEARINGS

- TABLE 23 SELF-ALIGNING, LIGHT- AND HEAVY-DUTY BEARINGS

- TABLE 24 RADIAL PRECISION, DOUBLE-ROW BEARINGS

- TABLE 25 NEEDLE ROLLER BEARINGS

- TABLE 26 SELF-LUBRICATED SPHERICAL BEARINGS

- TABLE 27 PATENTS

- TABLE 28 AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 29 AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 PLAIN BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 31 PLAIN BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 BALL BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 33 BALL BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 ROLLER BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 35 ROLLER BEARING: AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 37 AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 AIRCRAFT SYSTEM: AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 39 AIRCRAFT SYSTEM: AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 41 AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 42 COMMERCIAL AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 43 COMMERCIAL AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 44 MILITARY AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 45 MILITARY AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 46 BUSINESS & GENERAL AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 47 BUSINESS & GENERAL AVIATION: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 48 AEROSPACE BEARINGS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 49 AEROSPACE BEARINGS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 50 STAINLESS STEEL BEARING PROPERTIES

- TABLE 51 METAL: AEROSPACE BEARINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 52 METAL: AEROSPACE BEARINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 54 AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 55 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 56 AEROSPACE BEARINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 57 AEROSPACE BEARINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: AEROSPACE BEARINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 US: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 67 US: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 68 US: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 69 US: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 US: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 71 US: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 73 CANADA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 74 CANADA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 75 CANADA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 77 CANADA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 79 EUROPE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 81 EUROPE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 83 EUROPE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: AEROSPACE BEARINGS SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 85 EUROPE: AEROSPACE BEARINGS SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 UK: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 87 UK: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 88 UK: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 89 UK: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 UK: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 91 UK: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 93 GERMANY: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 95 GERMANY: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 GERMANY: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 97 GERMANY: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 98 FRANCE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 99 FRANCE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 100 FRANCE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 101 FRANCE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 FRANCE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 103 FRANCE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 104 RUSSIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 105 RUSSIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 106 RUSSIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 107 RUSSIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 RUSSIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 109 RUSSIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ITALY: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 111 ITALY: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 112 ITALY: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 113 ITALY: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 ITALY: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 115 ITALY: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 116 SPAIN: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 117 SPAIN: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 118 SPAIN: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 119 SPAIN: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 SPAIN: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 121 SPAIN: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 125 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 127 REST OF EUROPE: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 137 CHINA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 139 CHINA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 CHINA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 141 CHINA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 142 INDIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 143 INDIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 144 INDIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 145 INDIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 INDIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 147 INDIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 148 JAPAN: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 149 JAPAN: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 150 JAPAN: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 151 JAPAN: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 JAPAN: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 153 JAPAN: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 155 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 156 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 157 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 159 AUSTRALIA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 160 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 161 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 162 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 163 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 165 SOUTH KOREA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 174 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 179 REST OF THE WORLD: AEROSPACE BEARINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: AEROSPACE BEARINGS OEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 192 AFRICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2020–2022 (USD MILLION)

- TABLE 193 AFRICA: AEROSPACE BEARINGS MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 194 AFRICA: AEROSPACE BEARINGS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 195 AFRICA: AEROSPACE BEARINGS OEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 196 AFRICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 197 AFRICA: AEROSPACE BEARINGS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 198 AEROSPACE BEARINGS MARKET: DEGREE OF COMPETITION

- TABLE 199 KEY STRATEGIES ADOPTED BY PLAYERS IN AEROSPACE BEARINGS MARKET, 2019–2022

- TABLE 200 PRODUCT FOOTPRINT

- TABLE 201 APPLICATION FOOTPRINT

- TABLE 202 AEROSPACE BEARINGS MARKET: PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2022

- TABLE 203 AEROSPACE BEARINGS MARKET: DEALS, JANUARY 2019–DECEMBER 2022

- TABLE 204 AEROSPACE BEARINGS MARKET: EXPANSIONS, JANUARY 2019–DECEMBER 2022

- TABLE 205 NTN CORPORATION: COMPANY OVERVIEW

- TABLE 206 NTN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 NTN CORPORATION: DEALS

- TABLE 208 GGB: COMPANY OVERVIEW

- TABLE 209 GGB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 GGB: DEALS

- TABLE 211 SKF: COMPANY OVERVIEW

- TABLE 212 SKF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 SKF: DEALS

- TABLE 214 SKF: OTHERS

- TABLE 215 NSK LTD.: COMPANY OVERVIEW

- TABLE 216 NSK LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 NSK LTD.: OTHERS

- TABLE 218 JTEKT CORPORATION: COMPANY OVERVIEW

- TABLE 219 JTEKT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 NATIONAL PRECISION BEARING: COMPANY OVERVIEW

- TABLE 221 NATIONAL PRECISION BEARING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NATIONAL PRECISION BEARING: PRODUCT LAUNCHES

- TABLE 223 RBC BEARINGS, INC.: COMPANY OVERVIEW

- TABLE 224 RBC BEARINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 PACAMOR KUBAR BEARINGS: COMPANY OVERVIEW

- TABLE 226 PACAMOR KUBAR BEARINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 AST BEARINGS LLC: COMPANY OVERVIEW

- TABLE 228 AST BEARINGS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 KAMAN CORPORATION: COMPANY OVERVIEW

- TABLE 230 KAMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 KAMAN CORPORATION: DEALS

- TABLE 232 REGAL BELOIT CORPORATION: COMPANY OVERVIEW

- TABLE 233 REGAL BELOIT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 REGAL BELOIT CORPORATION: PRODUCT LAUNCHES

- TABLE 235 THE TIMKEN COMPANY: COMPANY OVERVIEW

- TABLE 236 THE TIMKEN COMPANY: DEALS

- TABLE 237 THE TIMKEN COMPANY: OTHERS

- TABLE 238 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 239 SCHAEFFLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 NACHI-FUJIKOSHI CORP.: COMPANY OVERVIEW

- TABLE 241 NACHI-FUJIKOSHI CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 MINEBEAMITSUMI INC.: COMPANY OVERVIEW

- TABLE 243 MINEBEAMITSUMI INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 LYC BEARING CORPORATION: COMPANY OVERVIEW

- TABLE 245 LYC BEARING CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 SCHATZ BEARING CORPORATION: COMPANY OVERVIEW

- TABLE 247 SCHATZ BEARING CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BARDEN BEARINGS: COMPANY OVERVIEW

- TABLE 249 BARDEN BEARINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 RADIAL BEARING CORPORATION: COMPANY OVERVIEW

- TABLE 251 RADIAL BEARING CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CSC BEARING EUROPE GMBH: COMPANY OVERVIEW

- TABLE 253 CSC BEARING EUROPE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 ALPINE BEARING: COMPANY OVERVIEW

- TABLE 255 REXNORD CORPORATION: COMPANY OVERVIEW

- TABLE 256 CGB PRECISION PRODUCTS: COMPANY OVERVIEW

- TABLE 257 SAPPORO PRECISION INC.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 MAJOR AIRCRAFT MANUFACTURERS’ QUARTERLY REVENUE, 2022–2023

- FIGURE 7 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- FIGURE 8 METAL SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 9 ENGINE & APU SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 AFTERMARKET SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN OEM SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN AEROSPACE INDUSTRY TO DRIVE MARKET

- FIGURE 13 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 14 AFTERMARKET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AEROSPACE BEARINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 REVENUE SHIFTS IN AEROSPACE BEARINGS MARKET

- FIGURE 18 AVERAGE SELLING PRICE RANGE: OEM AEROSPACE BEARINGS MARKET, BY APPLICATION (2022)

- FIGURE 19 AVERAGE SELLING PRICE RANGE: AEROSPACE BEARINGS MARKET, BY APPLICATION (2022)

- FIGURE 20 AEROSPACE BEARINGS MARKET ECOSYSTEM MAP

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AEROSPACE BEARINGS

- FIGURE 24 KEY BUYING CRITERIA FOR AEROSPACE BEARINGS

- FIGURE 25 BALL BEARING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 26 ENGINE & APU SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 METAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 OEM SEGMENT TO RECORD HIGHER GROWTH RATE THAN AFTERMARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 30 AEROSPACE BEARINGS MARKET: REGIONAL SNAPSHOT

- FIGURE 31 NORTH AMERICA: AEROSPACE BEARINGS MARKET SNAPSHOT

- FIGURE 32 EUROPE: AEROSPACE BEARINGS MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: AEROSPACE BEARINGS MARKET SNAPSHOT

- FIGURE 34 AEROSPACE BEARINGS MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 35 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019–2022 (USD MILLION)

- FIGURE 36 AEROSPACE BEARINGS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 AEROSPACE BEARINGS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 38 NTN CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 SKF: COMPANY SNAPSHOT

- FIGURE 40 NSK LTD.: COMPANY SNAPSHOT

- FIGURE 41 JTEKT CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 RBC BEARINGS, INC.: COMPANY SNAPSHOT

- FIGURE 43 KAMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 REGAL BELOIT CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 THE TIMKEN COMPANY: COMPANY SNAPSHOT

- FIGURE 46 SCHAEFFLER AG: COMPANY SNAPSHOT

- FIGURE 47 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

- FIGURE 48 MINEBEAMITSUMI INC.: COMPANY SNAPSHOT

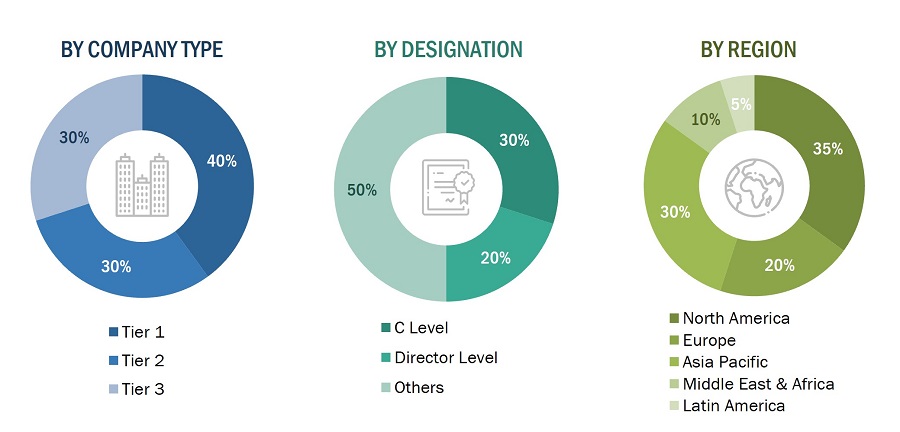

The study involved four major activities in estimating the current size of the aerospace bearings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the aerospace bearings market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. These included government sources, such as the International Air Transport Association (IATA), Federal Aviation Administration (FAA), and General Aviation Manufacturers Association (GAMA); corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after obtaining information regarding the aerospace bearings market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from aerospace bearings vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using aerospace bearings, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aerospace bearings and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

Manufacturers |

MRO |

|

GGB Bearings Technology |

Accurate Bushing Company, Inc |

|

National Precision Bearing |

Carter Manufacturing Limited |

|

SKF Group |

Bowman International |

|

JTEKT Corporation |

Schatz Bearing Corp |

Market Size Estimation

The research methodology used to estimate the size of the aerospace bearings market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the aerospace bearings market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

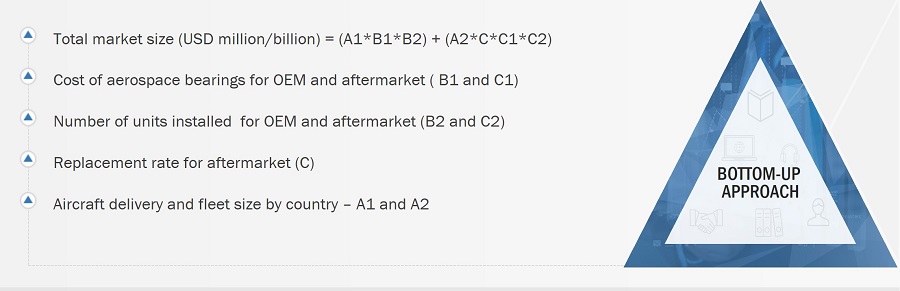

Global aerospace bearings market size: Bottom-Up Approach

The aerospace bearings market, by application and aircraft type, was used as a primary segment for estimating and projecting the global market size from 2023 to 2028.

The market size was calculated by adding the mass subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are delineated below:

- Aerospace bearings Market = Volume * Average selling price of the aerospace bearings

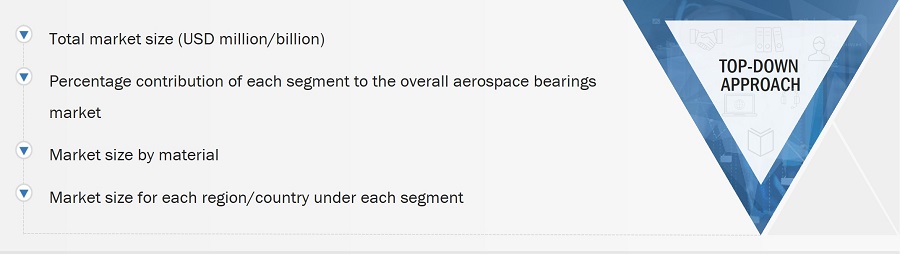

Global aerospace bearings market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing aerospace bearings and their subsystems are included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to aerospace bearings were mapped and summed up.

Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of aerospace bearings in each segment was estimated.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the aerospace bearings market based on application, aircraft type, sales channel, Type, Material, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerospace bearings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

The aerospace bearings market report considers the bearings installed in aircraft and helicopters in the commercial, military, and business & general aviation sectors. Bearings are utilized in several aircraft applications, ranging from landing gear to APU systems. These bearings are a critical mechanical component in an aircraft, and their failure may lead to a catastrophic event. They are subjected to continuous loads and undergo wear and tear.

Market Stakeholders

- Raw Material Suppliers

- Aerospace bearings Manufacturers

- Technology Support Providers

- Distributors

- Maintenance, Repair, and Overhaul (MRO) Companies

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

- Research Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aerospace bearings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aerospace bearings market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerospace Bearings Market