MulteFire Market by Device (Small Cells, Switches, Controllers), Application (Industrial Manufacturing, Commercial, Transportation, Public Venues, Healthcare, Oil & Gas and Mining, Power Generation, Hospitality), and Geography - Global forecast 2025-2036

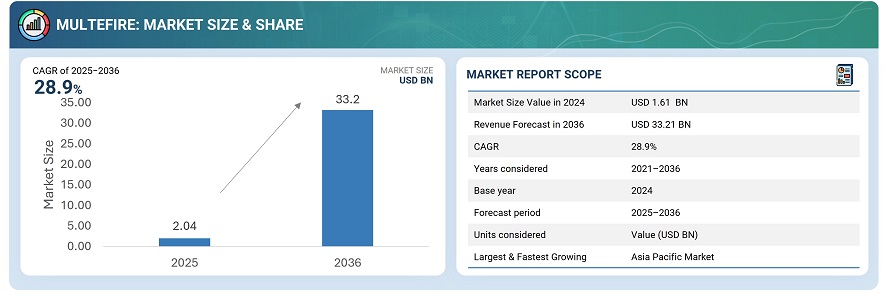

The global MulteFire market was valued at USD 2.04 billion in 2024 and is estimated to reach USD 33.2 billion by 2036, at a CAGR of 28.9% between 2025 and 2036.

The global MulteFire market is driven by the growing demand for private LTE and 5G networks that operate in unlicensed or shared spectrum, offering enterprises greater flexibility and cost efficiency. Rising adoption across industrial automation, smart manufacturing, and IoT applications is fueling market growth. Technological advancements enabling seamless integration with existing wireless infrastructures and improved spectrum utilization are accelerating deployment, while vendors focus on innovation, interoperability, and partnerships to expand their market presence globally.

MulteFire is a wireless technology that enables LTE-based communication to operate in unlicensed and shared spectrum without requiring licensed spectrum access. It combines the performance and security of LTE with the flexibility of Wi-Fi, making it ideal for private networks, industrial IoT, and enterprise connectivity. MulteFire supports reliable, low-latency communication and seamless mobility, enabling enhanced coverage, capacity, and scalability across manufacturing, logistics, and smart city applications.

Market by Device

Small Cells

The small cell segment represents the leading share of the MulteFire market, driven by the technology’s ability to provide secure, high-speed wireless connectivity without dependence on licensed spectrum. Small cells enable private LTE and 5G networks to operate efficiently in unlicensed or shared spectrum bands, making them ideal for enterprises and industrial facilities seeking greater control over their communication infrastructure. They offer low-latency, high-capacity connectivity that supports real-time applications such as machine control, video analytics, and automation. Moreover, MulteFire-based small cells simplify network deployment by reducing reliance on mobile network operators, enabling cost-effective private network rollouts across factories, ports, and campuses.

Switches

Switches play a critical supporting role in the MulteFire ecosystem, facilitating seamless data exchange and connectivity between edge devices and network cores. They are designed to manage traffic flow within MulteFire-enabled private networks, ensuring reliable performance for time-sensitive industrial and enterprise applications. With the rising number of connected devices and sensors in industrial environments, demand for intelligent switches capable of handling high bandwidth and low latency has increased. The integration of advanced switching technologies also enhances network scalability and resilience, supporting complex multi-device environments typical in smart manufacturing and logistics facilities.

Market by Application

Industrial Manufacturing

Industrial manufacturing represents a key application area for MulteFire technology, as factories increasingly adopt wireless connectivity to support digital transformation initiatives. MulteFire enables manufacturers to deploy private LTE/5G networks that offer enhanced coverage, security, and performance compared to Wi-Fi. This connectivity supports a wide range of applications, including automated guided vehicles (AGVs), robotics, condition monitoring, and real-time analytics. By operating independently of public mobile networks, MulteFire ensures data privacy, low latency, and uninterrupted communication essential for industrial automation. The technology’s scalability and ease of deployment make it a preferred solution for modern smart factory setups.

Transportation

The transportation segment is emerging as a high-potential area for MulteFire adoption, driven by the growing need for robust, low-latency connectivity in logistics hubs, airports, seaports, and rail networks. MulteFire facilitates private, secure wireless communication that supports vehicle tracking, asset monitoring, and operational coordination in complex transport environments. Its ability to operate in unlicensed spectrum bands allows operators to establish cost-effective private networks without dependency on traditional mobile carriers. Moreover, as transportation systems become increasingly automated and data-driven, MulteFire provides the connectivity backbone necessary to enable smart mobility solutions and improve operational efficiency across the sector.

Market by Geography

Geographically, the MulteFire market is witnessing strong adoption across North America, Europe, Asia Pacific, and the Rest of the World (ROW). North America leads the market, driven by early technology adoption, robust telecom infrastructure, and growing enterprise investments in private LTE and 5G networks operating in unlicensed and shared spectrum. The region’s strong industrial automation base and focus on enhancing wireless connectivity across manufacturing, logistics, and energy sectors further fuel growth. Europe follows, supported by Industry 4.0 initiatives, spectrum harmonization efforts, and expansion of smart manufacturing facilities. Asia Pacific is rapidly emerging as a high-growth region due to expanding industrial IoT applications and digital transformation across enterprises, while the Middle East, Africa, and South America witness growing investments in smart city and connectivity projects.

Market Dynamics

Driver: Growing demand for scalable and reliable network connectivity in industrial IoT applications

Digital transformation across industries is accelerating the adoption of the Internet of Things (IoT) to enhance operational efficiency, cost-effectiveness, and customer engagement. Industrial IoT (IIoT) enables real-time asset monitoring and process optimization through technologies such as big data analytics and cloud computing. However, achieving reliable, low-latency, and high-bandwidth connectivity is essential for real-time performance. MulteFire technology, supporting enhanced machine communication (eMTC) and NB-IoT standards, addresses these needs by enabling secure, scalable, and efficient industrial networks. The increasing automation in both process and discrete manufacturing sectors continues to drive the demand for advanced IIoT connectivity solutions worldwide.

Restraint: Delays in decision-making on shared spectrum utilization

MulteFire technology operates in unlicensed spectrums, such as the 5 GHz band, and aims to support the 3.5 GHz CBRS band under the General Authorized Access (GAA) framework. However, regulatory uncertainty continues to hinder progress. The Federal Communications Commission (FCC) has yet to finalize Priority Access License (PAL) rules and auction processes for the CBRS spectrum. As a result, commercial deployments remain limited, and several operators are hesitant to invest until regulations are clarified. Although the MulteFire Alliance is developing interoperability test specifications, delays in finalizing spectrum policies and licensing frameworks continue to restrict the market’s growth potential.

Opportunity: Growing opportunities with 5G network deployment

The rapid rise of connected devices is driving demand for ultra-fast and reliable internet connectivity, positioning 5G as the next major advancement beyond 4G. Offering speeds of 1 Gbps or higher, 5G enables high device density, low latency, and real-time communication for advanced industrial and commercial applications. Operating within unlicensed spectrum bands, 5G supports flexible deployments without licensed anchors. The MulteFire Alliance and CBRS Alliance are aligning their specifications with 3GPP 5G standards to ensure seamless interoperability between LTE and 5G NR. These efforts create new opportunities for private networks, edge computing, and next-generation connectivity in shared spectrum environments.

Challenge: Need for a robust ecosystem of multefire-compatible devices

While MulteFire technology offers high speed, capacity, and reliability, its widespread adoption depends on the development of a strong ecosystem of compatible devices and chipsets. To enable seamless network connectivity, MulteFire capabilities must be integrated into smartphones, tablets, dongles, and computers through specialized chipsets. Chipmakers and OEMs play a crucial role in this process, as their participation determines commercialization success. Although chipsets designed for LAA/eLAA may support MulteFire, limited OEM adoption currently restricts market growth. Expanding partnerships with major device manufacturers such as Samsung, Sony, and ZTE remains essential to accelerate ecosystem development and ensure large-scale MulteFire deployment.

Future Outlook

Between 2025 and 2036, the MulteFire market is projected to witness substantial growth, fueled by the increasing demand for private and neutral host networks across industrial, commercial, and enterprise environments. The technology’s ability to deliver LTE and 5G connectivity over unlicensed and shared spectrum will drive adoption in manufacturing, logistics, smart cities, and campus networks. Advancements in spectrum efficiency, network scalability, and integration with Industrial IoT and edge computing will further enhance deployment. As organizations pursue secure, high-capacity wireless communication without reliance on traditional operators, MulteFire is expected to play a pivotal role in shaping the future of enterprise connectivity.

Key Market Players

Top MulteFire companies Qualcomm Technologies, Inc. (US), Nokia (Finland), Telefonaktiebolaget LM Ericsson (Sweden), Huawei Technologies Co., Ltd. (China) and Samsung (South Korea)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 11 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Growth Opportunities in MulteFire Market

4.2 Market, By Application and Region

4.3 Market for Small Cells, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Need for More Scalable and Better Network Connectivity for Industrial IoT (IIoT) Applications

5.2.1.2 Increasing Demand for High-Performance and Easy-to-Deploy Wireless Connectivity Networks

5.2.1.3 Growing Requirement for Cost-Efficient and High-Capacity Networks

5.2.2 Restraints

5.2.2.1 Delay in Making Decisions Related to Utilization of Shared Spectrum

5.2.3 Opportunities

5.2.3.1 Deployment of 5g Network

5.2.3.2 Initiatives of MulteFire Alliance to Promote Use of MulteFire

5.2.4 Challenges

5.2.4.1 Development of Ecosystem of MulteFire-Compatible Devices

6 Market, By Device (Page No. - 35)

6.1 Introduction

6.2 Small Cells

6.2.1 Small Cells to Dominate Market Owing to Growing Interest of Leading Players to Offer MulteFire Small Cells

6.3 Switches

6.3.1 Increasing Adoption of Switches to Manage Flow of Data Across MulteFire Networks Boost Growth of Switch Market

6.4 Controllers

6.4.1 Increasing Need for Affordable and Secure Networks With Better Coverage Capacity, Especially in Industrial Sector, Provides Opportunity for MulteFire Controller Market

7 Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Industrial Manufacturing

7.2.1 Growth of Market for Industrial Application is Fueled By Growing Importance of Industry 4.0 and Rising Need for Secured, Reliable, and High-Performing Connectivity Network for IIoT

7.3 Transportation

7.3.1 Adoption of MulteFire Network is Propelled By Its Superior Wireless Connectivity That Enables Real-Time Communication for Effective Supply Chain Management

7.4 Commercial

7.4.1 Demand for MulteFire Networks Would Surge With Increasing Adoption of Advanced Technologies as Well as Rising Requirements for High-Capacity, Cost-Effective, and Low-Latency Wireless Networks

7.5 Healthcare

7.5.1 High Need for Stable and Reliable Network Owing to Rising Use of Iot-Based Devices in Healthcare Provides Opportunity for Market

7.6 Public Venues

7.6.1 Highly Secure Wireless Coverage Offered By MulteFire Network Provides Growth Opportunities for Market Players

7.7 Hospitality

7.7.1 High Demand From Customers for Reliable Networks Provides Opportunity for Market

7.8 Power Generation

7.8.1 Requirements for Reliable and Secured Networks With Low Latencies Due to Increased Automation Provide Opportunity for Market

7.9 Oil & Gas and Mining

7.9.1 Demand for MulteFire is Driven By Increased Need for Highly Reliable and Secure Communication Network for Constant Real-Time Monitoring in Oil & Gas and Mining Industries

8 Geographic Analysis (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 North America, Being Early Adopter of MulteFire Based Networks, Would Continue to Lead Market During Forecast Period

8.3 Europe

8.3.1 Growing Importance of Industrial IoT and Industry 4.0 Would Boost Market Growth in Coming Years

8.4 Asia Pacific

8.4.1 Increasing Data Traffic and MulteFire Alliance Initiatives to Further Promote Lte-Based Technology for Unlicensed and Shared Spectrums Drive Market

8.5 RoW

8.5.1 Technological Advancements in Oil & Gas Industry Expected to Spur Demand for MulteFire-Based Networks in RoW

9 Competitive Landscape (Page No. - 71)

9.1 Introduction

9.2 Market Ranking, 2018

9.3 Competitive Scenario

9.3.1 Product Launches and Developments

9.3.2 Partnerships and Collaborations

9.3.3 Agreements and Contracts

9.3.4 Acquisitions and Expansions

10 Company Profiles (Page No. - 76)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1 Key Players

10.1.1 Qualcomm

10.1.2 Nokia

10.1.3 Ericsson

10.1.4 Huawei

10.1.5 Samsung Electronics

10.1.6 Baicells Technologies

10.1.7 Casa Systems

10.1.8 Redline Communications

10.1.9 Ruckus Networks

10.1.10 SpiderCloud Wireless (A Corning Company)

10.2 Other Key Players

10.2.1 Airspan

10.2.2 Athonet

10.2.3 ip.access

10.2.4 Qucell

10.2.5 Quortus

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 104)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (37 Tables)

Table 1 MulteFire Market, By Device, 2020–2025 (USD Million)

Table 2 MulteFire Small Cell Market, By Application, 2020–2025 (USD Million)

Table 3 MulteFire Small Cell Market, By Region, 2020–2025 (USD Million)

Table 4 MulteFire Switch Market, By Application, 2020–2025 (USD Million)

Table 5 Market, By Region, 2020–2025 (USD Million)

Table 6 Market, By Application, 2020–2025 (USD Million)

Table 7 Market, By Region, 2020–2025 (USD Million)

Table 8 Market, By Application, 2020–2025 (USD Million)

Table 9 MulteFire Small Cell Market for Industrial Manufacturing Applications, By Region, 2020–2025 (USD Million)

Table 10 MulteFire Switch Market for Industrial Manufacturing Applications, By Region, 2020–2025 (USD Million)

Table 11 Market for Industrial Manufacturing Applications, By Region, 2020–2025 (USD Million)

Table 12 Market for Transportation Applications, By Region, 2020–2025 (USD Million)

Table 13 Market for Transportation Applications, By Region, 2020–2025 (USD Million)

Table 14 Market for Transportation Applications, By Region, 2020–2025 (USD Million)

Table 15 Market for Commercial Applications, By Region, 2020–2025 (USD Million)

Table 16 Market for Commercial Applications, By Region, 2020–2025 (USD Million)

Table 17 Market for Commercial Applications, By Region, 2020–2025 (USD Million)

Table 18 Market for Healthcare Applications, By Region, 2020–2025 (USD Million)

Table 19 Market for Healthcare Applications, By Region, 2020–2025 (USD Million)

Table 20 Market for Healthcare Applications, By Region, 2020–2025 (USD Million)

Table 21 MulteFire Small Cell Market for Public Venues Applications, By Region, 2020–2025 (USD Million)

Table 22 Market for Public Venues Applications, By Region, 2020–2025 (USD Million)

Table 23 Market for Public Venues Applications, By Region, 2020–2025 (USD Million)

Table 24 Market for Hospitality Applications, By Region, 2020–2025 (USD Million)

Table 25 Market for Hospitality Applications, By Region, 2020–2025 (USD Million)

Table 26 Market for Hospitality Applications, By Region, 2020–2025 (USD Million)

Table 27 Market for Power Generation Applications, By Region, 2020–2025 (USD Million)

Table 28 Market for Power Generation Applications, By Region, 2020–2025 (USD Million)

Table 29 Market for Power Generation Applications, By Region, 2020–2025 (USD Million)

Table 30 Market for Oil & Gas and Mining Applications, By Region, 2020–2025 (USD Million)

Table 31 Market for Oil & Gas and Mining Applications, By Region, 2020–2025 (USD Million)

Table 32 MulteFire Controller Market for Oil & Gas and Mining Applications, By Region, 2020–2025 (USD Million)

Table 33 MulteFire Market, By Region, 2020–2025 (USD Million)

Table 34 Product Launches and Developments, 2017–2018

Table 35 Partnerships and Collaborations, 2017–2018

Table 36 Agreements and Contracts, 2018

Table 37 Expansions, 2018

List of Figures (34 Figures)

Figure 1 MulteFire Market: Research Design

Figure 2 Research Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Small Cells to Account for Largest Size of Market in 2020

Figure 7 Commercial Applications to Record Highest CAGR in Market From 2020 to 2025

Figure 8 North America Expected to Be Fastest-Growing Region in Market During Forecast Period

Figure 9 Rising Need for More Scalable and Better Network Connectivity for Industrial IoT (IIoT) Applications Expected to Spur Market Growth During Forecast Period

Figure 10 Industrial Manufacturing Application and North America to Account for Largest Share of Global Market in 2025

Figure 11 North America to Record Highest CAGR in MulteFire Small Cell Market During Forecast Period

Figure 12 Rising Need for More Scalable and Better Network Connectivity for Industrial IoT (IIoT) Applications to Drive Market Growth

Figure 13 Small Cells to Lead Market, By Device, During Forecast Period

Figure 14 Industrial Applications to Account for Largest Size of MulteFire Small Cell Market During Forecast Period

Figure 15 North America to Command MulteFire Small Cell Market During 2020–2025

Figure 16 MulteFire Switch Market in North America to Grow at Highest CAGR During Forecast Period

Figure 17 North America to Command MulteFire Controller Market During 2020–2025

Figure 18 Industrial Manufacturing Applications to Account for Largest Size of Market During Forecast Period

Figure 19 North America to Dominate MulteFire Small Cell Market for Industrial Manufacturing Applications During Forecast Period

Figure 20 North America Would Be Leading Region in MulteFire Small Cell Market for Transport Applications During 2020–2025

Figure 21 MulteFire Small Cell Market for Commercial Applications in North America to Grow Highest CAGR During Forecast Period

Figure 22 North America to Dominate Market During Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Companies Adopted Product Launches and Collaborations as Key Growth Strategies From 2016 to 2018

Figure 27 Ranking of Top 5 Players in Market

Figure 28 Qualcomm: Company Snapshot

Figure 29 Nokia: Company Snapshot

Figure 30 Ericsson: Company Snapshot

Figure 31 Huawei: Company Snapshot

Figure 32 Samsung Electronics: Company Snapshot

Figure 33 Casa Systems: Company Snapshot

Figure 34 Redline Communications: Company Snapshot

The study involved 4 major activities in estimating the current size of the MulteFire market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the ion milling system market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the multifire Market Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the MulteFire market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (device manufacturers and distributors) sides across 4 major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the MulteFire market and other dependent submarkets. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To define, describe and forecast the MulteFire market by device, application, and region, in terms of value

- To describe and forecast the market for devices that include small cells, switches, and controllers, in terms of value

- To forecast the market for various segments, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the MulteFire market

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments in the market

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies2

- To analyze competitive developments such as product launches, agreements, partnerships, contracts, collaborations, and expansions in the MulteFire market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in MulteFire Market