Nanorobotics Market

Nanorobotics Market by Type (Nano-manipulator, Nanorobotic System), Deployment (In-vivo, In-vitro/Ex-vivo, Others), Technology (Magnetic Actuation, Biohybrid/Biological Propulsion, Acoustic/Ultrasound Propulsion, Others)-Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The nanorobotics market is projected to grow from USD 2.27 billion in 2025 to USD 4.52 billion by 2032, at a CAGR of 10.6% from 2026 to 2032. The market is experiencing significant growth due to increasing government support, investment in nanorobotics, and a rising focus on nanotechnology and regenerative medicine. Furthermore, the growing use of AI-guided imaging systems, which enhance nanorobotics navigation and monitoring, presents an opportunity for market growth.

KEY TAKEAWAYS

-

By RegionThe North America nanorobotics market accounted for a 42.0% revenue share in 2025.

-

By TypeBy type, the nanoorbotics system segment is expected to register the highest CAGR of 15.4%.

-

By DeploymentBy deployment, the in-vivo segment is projected to grow at the fastest rate from 2026 to 2032.

-

By TechnologyBy technology, the magnetic actuation segment is expected to dominate the market in 2026.

-

By ApplicationBy application, the nano surgery & tissue repair segment is expected to register the highest CAGR of 13.0%.

-

By End UserBy end user, reserarch institutes & universities segment is expected to dominate the market in 2026.

-

Competitive LandscapeCompanies such as JEOL LTD., Bruker, and Thermo Fisher Scientific Inc. were identified as some of the star players in the nanorobotics market (global), given their strong market share and product footprint.

-

Competitive LandscapeCompanies such as Stereotaxis, Inc., SmarAct GmbH, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The nanorobotics market is expected to grow steadily over the coming years, driven by increasing adoption across healthcare, life sciences, and advanced industrial research. Rising demand for precision medical treatments, targeted drug delivery, and minimally invasive diagnostics is encouraging research institutions and companies to invest in nanorobotics systems. In addition, growing use of nanorobotics in materials science, semiconductor research, and nanoscale manufacturing is supporting market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Nanorobotics is transitioning from a research-centric market to an application-driven platform economy, where value creation is increasingly defined by integration with AI, imaging, and clinical workflows. Players that align nanorobotics innovation with real-world clinical and industrial imperatives will capture a share of the future revenue mix.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising focus on nanotechnology and regenerative medicine

-

Increasing government support and level of investment in nanorobotics

Level

-

Lack of clear regulatory frameworks and high development & manufacturing costs

Level

-

Growing demand of oncology and precision therapeutics

-

Increasing Use of AI-Guided Imaging Systems Enhancing Nanorobotics Navigation and Monitoring

Level

-

Commercialization of nanorobotics systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on nanotechnology and regenerative medicine

The regenerative medicine industry has experienced rapid growth in recent years. The challenges of imaging tissue-engineered cells and tissues can be overcome using light and electron microscopy techniques.

Restraint: Lack of clear regulatory frameworks and high development & manufacturing costs

The nanorobotics market faces significant restraints due to the lack of well-defined, globally harmonized regulatory frameworks and the high cost of developing and manufacturing nanoscale robotic systems.

Opportunity: Growing demand of oncology and precision therapeutics

The growing global emphasis on early disease detection and real-time in vivo diagnostics presents a significant opportunity for the nanorobotics market. Healthcare systems increasingly prioritize early-stage diagnosis to improve patient outcomes, reduce treatment costs, and enable preventive and personalized care.

Challenge: Commercialization of nanorobotics systems

As the field is still in its early stages, a lot of research is conducted in nanorobotics in line with the rising demand for advanced and improved nano-manipulating robots and bio-nanorobotic systems in the market

NANOROBOTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supports nanorobotics research platforms used in in-vitro biological studies and materials research, where controlled nanorobotic systems are explored for cell interaction, nanoscale positioning, and experimental automation in advanced research labs. | Enables precise nanoscale control, improves experimental repeatability, and supports development of next-generation nanorobotic applications in life sciences and materials R&D. |

|

Provides tools and integrated environments that support nanorobotics-based workflows for automated nanoscale sample interaction, targeted analysis, and controlled manipulation in biomedical and pharmaceutical research. | Improves workflow automation, increases research efficiency, and accelerates development of nanorobotics-enabled medical and analytical solutions. |

|

Enables nanorobotics systems for controlled nanoscale motion and interaction, particularly in biological research and advanced materials testing, supporting development of autonomous and semi-autonomous nanoscale systems.` | Enhances precision, supports innovation in nanorobotic system design, and enables scalable research for future medical and industrial applications. |

|

Supports nanorobotics system development for precision positioning, nanoscale motion control, and automated interaction in industrial and research environments, especially for advanced materials and electronics R&D. | Enables high accuracy, improves consistency in nanoscale operations, and supports commercialization of nanorobotics technologies. |

|

Provides platforms and solutions that enable nanorobotics-based experimentation and system validation, particularly for medical research, micro-engineering, and advanced materials development. | Improves system reliability, supports innovation in nanorobotics design, and accelerates translation from research to commercial applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The nanorobotics market operates within a dynamic and interconnected ecosystem driven by advancements in technology, evolving regulatory frameworks, and increasing demand across various industries. This ecosystem comprises research & development, manufacturers, integrators, distributors, and end users & customers, each playing a pivotal role in shaping the market landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Nanorobotics Market, By Type

Nano-manipulator holds the largest market share, owing to their proven commercialization and widespread adoption across semiconductor manufacturing, materials science, and life-science research.

Nanorobotics Market, By Deployment

The in-vivo exhibits the highest CAGR during the forecast period, due to rising demand for precision medicine, increasing burden of chronic diseases, and growing investment in nanomedicine and translational research.

Nanorobotics Market, By End User

The research institutes & universities holds largest market share in 2025. Driving factors include strong government and institutional funding for nanotechnology research, continuous demand for high-precision experimental tools, and minimal regulatory constraints. Academic environments also act as incubation hubs for translational research and spin-off innovation, positioning this segment as the largest revenue contributor.

REGION

Asia Pacific to grow at the fastest rate in the global nanorobotics market during the forecast period

Asia Pacific is projected to register the highest CAGR from 2026 to 2032. The rising R&D funding for the development of microscopes, increasing nanotechnology research, low material costs, and growing expertise and academic excellence in emerging Asia Pacific countries such as Japan, India, and China are the major factors driving the nanorobotics market growth in Asia Pacific. For instances, in 2023, UT researchers achieved a breakthrough and received a 2023 R&D100 Award for their innovative project. Led by Sergei Kalinin, UT’s Weston Fulton Professor in materials science and engineering, the team collaborated with Oak Ridge National Laboratory (ORNL) to develop an advanced method combining physics-informed active learning (AL) with autonomous microscopy.

NANOROBOTICS MARKET: COMPANY EVALUATION MATRIX

In the nanorobotics market matrix, Bruker(Star) leads with a strong global presence and a comprehensive portfolio of nanorobotics. Oxford Instruments (Emerging Leader) is rapidly gaining momentum through its nanorobotics product portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- JEOL LTD. (Japan)

- Thermo Fisher Scientific Inc. (US)

- Bruker (Germany)

- Hitachi High-Tech Corporation (Japan)

- ZEISS Group (Germany)

- EV Group (Austria)

- Park Systems (South Korea)

- Nanolive (Switzerland)

- CIQTEK Co., Ltd (China)

- Toronto Nano Instrumentation Inc. (Canada)

- Klocke Nanotechnik GmbH (Germany)

- Kleindiek Nanotechnik GmbH (Germany)

- SmarAct GmbH (Germany)

- Nanosurf (Switzerland)

- Oxford Instruments (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.27 Billion |

| Market Forecast in 2032 (Value) | USD 4.52 Billion |

| Growth Rate | CAGR of 7.6% from 2025-2033 |

| Years Considered | 2022-2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2032 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: NANOROBOTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Medical Device & Biotech Company | Use-case mapping of nanorobotics systems across in-vitro research, targeted drug delivery, and minimally invasive therapeutic applications; assessment of technology readiness and regulatory pathways. | Clear identification of high-potential medical applications, reduced technology adoption risk, and improved go-to-market planning for nanorobotics-enabled healthcare solutions. |

RECENT DEVELOPMENTS

- December 2025 : Hitachi High-Tech Corporation launched the HT7800II, a 120 kV transmission electron microscope ("TEM") that combines high-quality, reproducible data acquisition with improved efficiency for observation work in a wide range of fields. The HT7800II offers high-resolution, high-contrast performance and excellent

- July 2025 : Thermo Fisher Scientific Inc. has launched a new electron microscope, Scios 3 FIB-SEM, which offers increased productivity for both industry and academia through enhanced lamella preparation enabled by advances in FIB column performance.

- January 2025 : Park Systems acquired Lyncée Tec SA, a Swiss pioneer in Digital Holographic Microscope (DHM®) technology. This acquisition by Park Systems strengthens its optical metrology business, following its 2022 acquisition of Accurion GmbH, the world’s leading manufacturer of Imaging Spectroscopic Ellipsometers (ISE).

- October 2024 : ZEISS opened the ZEISS Microscopy semiconductor applications lab in Dresden, a state-of-the-art facility dedicated to addressing physical analysis challenges and pushing the limits of nanoscale analysis with the ZEISS Crossbeam

Table of Contents

Methodology

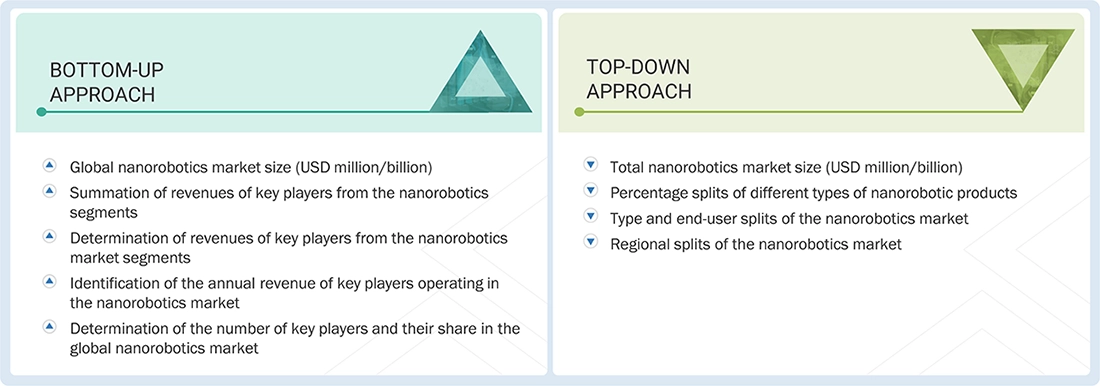

The study involved major activities in estimating the current size of the nanorobotics market. Exhaustive secondary research was done to collect information on the nanorobotics market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market sizes of the nanorobotics market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was primarily conducted to gather critical information on the industry's supply chain and value chain, the total pool of key players, and market classification and segmentation based on industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been gathered and analyzed to determine the overall market size, which has also been validated by primary research.

Primary Research

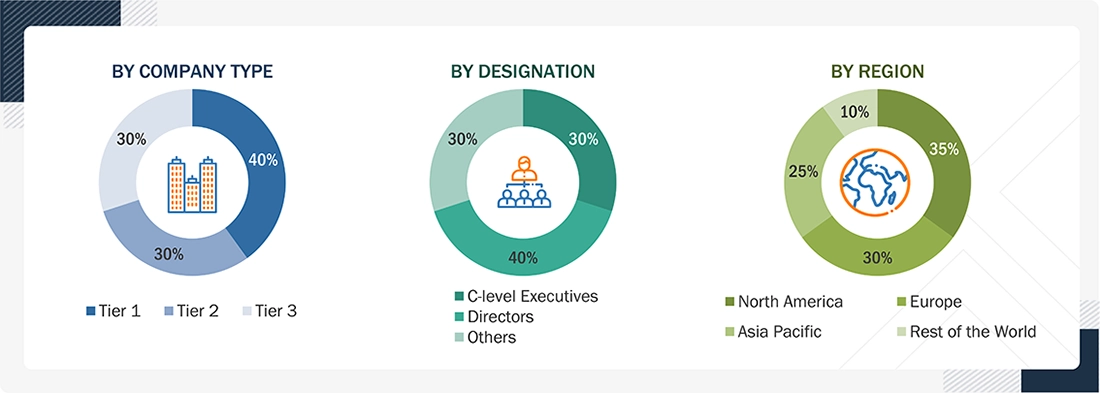

Extensive primary research was conducted after understanding and analyzing the current market scenario for nanorobotics through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand and supply sides in four key regions: North America, Europe, the Asia Pacific, and the rest of the world. Nearly 25% of the primary interviews were held with the demand side and 75% with the supply side. The primary data were gathered primarily through telephonic interviews, which accounted for 80% of the total primary interviews. Surveys and e-mails were also utilized to gather data.

Note: The three tiers of companies are defined based on their total revenue as of 2024: tier 1: revenue of USD 500 million or more; tier 2: revenue between USD 100 million and USD 500 million; and tier 3: revenue of USD 100 million or less. Other designations include sales and marketing executives, researchers, and members of various nanorobotics organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report used both top-down and bottom-up approaches to estimate and validate the size of the nanorobotics market and related submarkets. Secondary research identified key players in this market, and their market shares in the respective regions were determined through primary and secondary research.

This research methodology included analyzing the annual and financial reports of top companies, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) to obtain key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures below show the overall market-size estimation process used for this study.

Bottom-Up Approach

- More than 30 companies offering nanorobotics were identified, and their offerings were mapped based on their product, output type, connectivity, technology, type, end use, and region.

- The global nanorobotics market size was derived through the data sanity method. The revenues of nanorobotics providers were analyzed from annual reports and press releases and aggregated to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the nanorobotics segment.

- Each company's percentage was assigned after analyzing various factors, including its product offerings, range of nanorobotic-related offerings, geographical presence, R&D expenditures and initiatives, and recent developments/strategies adopted for growth in the nanorobotics market.

- For the CAGR, the market trend analysis of nanorobotics was carried out by understanding the industry penetration rate and the demand and supply of nanorobotics in different sectors

- Estimates at every level were verified and cross-checked by discussing them with key opinion leaders, including the sales head, directors, operation managers across the market, and domain experts of MarketsandMarkets.

- Various paid and unpaid information sources were studied, such as annual reports, press releases, white papers, and databases.

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of nanorobotics, splitting the market based on type, deployment, technology, application, and end user, and listing key developments in key market areas

- Identifying all major players in the nanorobotics market by type, deployment, technology, application, and end user, and their penetration in various applications through secondary research, and verifying with a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which all identified players serve nanorobotics to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Nanorobotics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the nanorobotics market from the estimation process described above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (where applicable) to complete the overall market engineering process and obtain exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the nanorobotics market was validated using both top-down and bottom-up approaches.

Market Definition

The nanorobotics market refers to the global ecosystem of technologies, systems, and solutions focused on the design, development, and application of nanoscale robotic systems capable of performing controlled tasks at the molecular or cellular level. Key use cases span targeted drug delivery, nanosurgery, tissue repair, in vitro and in vivo research, precision diagnostics, materials science, and advanced nanoscale experimentation.

Key Stakeholders

- Nanotechnology-based medical device companies

- Research and development (R&D) organizations

- Hospitals and clinics

- Diagnostic centers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Government and other regulatory bodies

- Forums, alliances, and associations

- Analysts and strategic business planners

- Venture capitalists and investors

- Market research and consulting firms

Report Objectives

- To define and forecast the size of the nanorobotics in terms of value, based on type, deployment, technology, application, end user, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World

- To define, describe, segment, and forecast the size of the nanorobotics market, in terms of volume, based on type

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the nanorobotics market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the nanorobotics market

Available customizations:

Based on the market data provided, MarketsandMarkets offers customizations tailored to the company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nanorobotics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Nanorobotics Market

Muhammed

May, 2019

What are the upcoming trends for the Nanorobotics market? Will it complete the all the current industrial demands like miniaturization along with high product efficiency..

Fernando

Jun, 2019

HI, I am exploring a new medical micro/nanorobotics start-up venture, I would identify the international players on Bio-Nanorobotics..