Network Security Firewall Market by Component, Solution (Signaling Firewall (SS7 and Diameter Firewall) and SMS Firewall (A2P and P2A Messaging)), Service (Professional Services and Managed Services), Deployment, and Region - Global Forecast to 2025

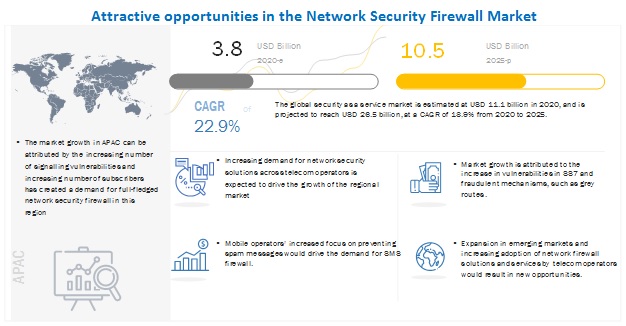

[275 Pages Report] The global network security firewall market size is expected to grow from USD 3.8 billion in 2020 to USD 10.5 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 22.9% during the forecast period. An increased demand for network security and privacys; advent of NextGen technologies for network security; new vulnerabilities in SS7; and administrative regulations and advancement of digital transformation in the telecom industry are major driving factors for the network security firewall market.

COVID-19 Impact on the Network Security Firewall Market

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new Business Continuity Plan (BCP) for various organizations. Companies that are vying for large contracts and contracts in regulated and critical sectors are bound to have robust Business Continuity Planning (BCP) and cyber resiliency practices in place. Organizations are also enacting various concepts such as bring your own device (BYOD) and work from home (WFH) to modernize their work cultures.

Organizations are facing an increase in attacks on corporate emails, with attackers posing as legitimate agencies, trying to trick people into sharing their account access credentials, or opening malicious email attachments. Hence, a well bound combination of network firewalls, email security, and best practices among workforce is essential to avoid compromising the enterprise networks. With employees connecting remotely to enterprise networks through VPNs, it is essential that load balancing is appropriately implemented and network functions are configured properly to avoid networks failures and congestions. Misconfigured firewalls and load balancers could expose the network to potential phishing and Distributed Denial of Service (DDoS) attacks, which could lead to a major breach resulting in business losses.

By firewall type, the SMS firewall to be a significant contributor to the network security firewall market during the forecast period

The SMS firewall solution segment is expected to hold a larger market size during the forecast period, as increasing number of telecom organizations are adopting A2P messaging solutions. Additionally, SMS firewall solutions are used in network security firewall applications for the detection of malware over the operators network. The deployment type segment is categorized into cloud, on-premises, and Network Function Virtualization (NFV). Additionally, enterprises are deploying their firewall solution virtually which is more secure as compared to on-premises and data becomes more assured.

Professional services segment to grow at the highest CAGR during the forecast period

Professional services are offered by specialists and experts in network security to ensure secure business functions. Professional services comprise deployment and integration, support and maintenance, and consulting services for a network firewall. Moreover, the service providers evaluate the complete project life cycle and help with staffing and assignment of the right person for the right process. The professional service providers design tailored solutions for telecom operators to align with their business goals. The vendors offering these services use the latest techniques, security trends, and skills to ensure optimum security requirements of the telecom enterprise. These services help ensure that vendors deliver superior levels of service, and security so that the network can be secured. Vendors also offer risk assessment and assistance during deployment through industry-defined practices.

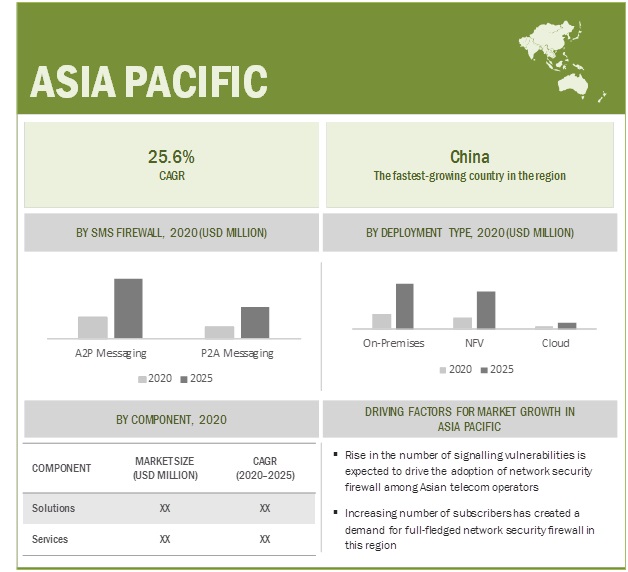

APAC to be the highest growth markets during the forecast period

APAC has witnessed advanced and dynamic adoption of innovative technologies and has always been a lucrative market for telecom service providers. The telecom market in APAC has grown at a significant pace with continuously evolving network operators. Countries across the region have a large number of MNOs that are using traditional or first-generation network firewall, which is unable to provide complete network security against fraudulent mechanisms on SS7 and diameter protocols. As per Global Cybersecurity Index (GCI) 2017 by International Telecommunication Union (ITU), Singapore and Malaysia are among the top five countries globally which have shown commitment toward building national policies for protection against cybercrimes.

Market Dynamics

Driver: Increased demand for network security and privacy

Increased number of subscribers on the internet has led to the growth of huge data generated from each subscribers account. With the use of additional technologies such as Artificial Intelligence (AI), big data, Machine Learning (ML), cloud computing, and IoT, the raw data generated from these individual subscribers can be used for further business or research purpose. Furthermore, to handle such transactions of data, the telecom operators have set up large network infrastructures. However, only setting up a large infrastructure is not enough for carrier providers, as they need to focus on the security aspects of the networks too. Due to increased interconnected networks globally, the risk of security breach has amplified as the attackers have found new ways to exploit the existing network with the help of various network vulnerabilities. This is evident from the fact that in May 2017, O2 Telefonica became a victim of mobile network hacking. The hackers took advantage of the SS7 signaling system, which was used to interconnect with various foreign networks. Furthermore, the attackers used traditional banking-fraud phishing techniques, and spyware to poison subscribers account to steal account details, passwords, and other personal information. Once they received the subscribers credentials, the attackers diverted the account holders mobile access to the fraudsters handset, so that the fraudsters could misuse their accounts. Perhaps deploying a signaling firewall with GSMA regulations and guidelines would have saved the fraudulent attacks carried by the attackers. But O2 Telefonica attack incident has set an example among other operators to set up/install GSMA approved signaling firewall into their existing networks.

Restraints: Lack of preventive firewall maintenance

Network security firewalls are present in most organizations, but they have probably weakened due to the unknown threat over time and are not as effective as they should be. There are many firewall providers in the market who are instrumental in providing enriched feature solutions. However, not much emphasis is given to maintenance and upgradation services. With continuously evolving network infrastructure and communication technologies, traditional firewall solutions are not effectively countering frauds, therefore adversely affecting the operators revenue. For instance, in 2014, a study conducted by Firemon LLC stated that firewalls configured with IPv4 protocols are not compatible with IPv6 protocols, which threatens to expose millions of devices connected to the internet.

Opportunities: Operator investment for dynamic network infrastructure

With increasing network attacks, many operators have turned their focus onto securing their carrier network. For instance, after O2 Telefonica bank attack, the Spain-based operator employed 1,000 security staff and 650 analysts in 7 Security Operations Centers (SOCs) around the globe. Moreover, British Telecom (BT), authorized to accredit its systems and networks for UK government use and has 3,000 security professionals in 15 SOCs across the globe. BT denotes the use of AI to keep its customers data safe, and its machine-assisted cyber threat hunting technology uses visual interfaces to identify and understand cybersecurity threats for large amounts of data. Such kind of investment to improve the network security measures has increased the demand for network security firewalls worldwide.

Challenge: Interworking of signaling control protocols complicates security

Over the years, the operators have witnessed signaling network evolution from SS7 to diameter, and diameter to SIP. During this evolution, the previous network has passed on a few security problems to the evolved one. For instance, the diameter network imitates the same security problems from SS7, because of the same roaming procedures being copied, hence the same attacks are expected to take place. But in diameter, the issue is bigger as the visibility of sender sending the requests is hidden due to network topology hiding. Furthermore, in SS7, the answer message never returns to the attacker, whereas in diameter, the attacker gets the answerback. Moreover, the challenge of security in diameter signaling is due to its sheer complexity with nesting of grouped AVPs, or value parameters, and different encoding schemes are creating additional layers. Further GSMA, a global body for setting rules and regulations for network security, provided risk classifications for diameter. It showcased risk classifications for diameter run to 3 Excel pages, ranging from 250 up to 1,000 entries, whereas the risk classifications to review SS7 vulnerabilities ran single page entry.

Key Market Players

Major vendors in the network security firewall market include Sinch (Sweden), Cellusys (Ireland), Adaptive Mobile Security Limited (Ireland), Mobileum (US), Tata Communication (India), AMD Telecom (Europe) are some of the key market players.

Scope of the report:

|

Report Metrics |

Details |

|

Market size available for years |

20142025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) Million |

|

Segments covered |

Component (Solutions & Services), Solutions (Signaling and SMS Firewall) Services (Professional and Managed), Type (Packet Filtering, Stateful Packet Inspection, NGFW, and UTM), Deployment, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East and Africa, and Latin America |

|

Companies covered |

Sinch (Sweden), Cellusys (Ireland), AdaptiveMobile (Ireland), Mobileum (US), Tata Communication (India), AMD Telecom (Greece), Openmind Networks (Ireland), Anam (Ireland), SAP (Germany), Orange (France), Telecom Italia Sparkle (Italy), Twilio (US), BICS (Belgium), Route Mobile (India), PROTEI (Russia), Omobio (Sri Lanka), Sophos (UK), HPE (US), Nokia (Europe), Enghouse Network (US), Fortinet (US),Checkpoint Software (US), Mavenir (US), Sonicwall (US), Infobip(UK), Global Wavelet (US), Juniper Networks (US), Palo Alto Networks (US) and NetNumber (US). |

This research report categorizes the network security firewall market based on component (solutions and services), type (Packet Filtering, Stateful Packet Inspection, NGFW, UTM), deployment (on-premises, cloud, and NFV), and region.

By component:

- Solutions

- Services

By Solution:

- Signaling firewall

- SMS firewall

By Signaling firewall:

- SS7 firewall

- Diameter firewall

- Others

By SMS firewall:

- A2P messaging

- P2A messaging

By Service:

- Professional service

- Managed service

By Professional Service:

- Deployment and integration

- Consulting

- Support and maintenance

By Deployment Type:

- On-Premises

- Cloud

- Network Function Virtualization

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

By Type:

- Packet Filtering

- Stateful Packet Inspection

- Next Generation Firewall

- Unified Threat Management

Recent Developments:

- In October 2018, Mobileum acquired Evolved Intelligence, a global provider of analytics-based roaming and risk management solutions. The acquisition also serves to strengthen Mobileums presence in Europe. The existing Evolved Intelligence (EI) platform of Evolved Intelligence and architecture would be maintained and developed for further integration with the Mobileum Active Intelligence platform.

- In May 2018, Anam partnered with HGC to offer its industry-leading SMS Firewall and A2P Managed Services to Vietnamobile, which is one of the Hutchison Group networks. The joint initiative would generate increased A2P revenues and deliver improved customer satisfaction by addressing SMS Spam on the back of a secured SMS infrastructure.

- In April 2018, Orange International Carriers partnered with Anam to launch a new SMS product (SMS Protect), aimed at helping partners secure their network against frauds and bypass. This product covers multi-signaling carriers availability, domestic and international traffic, and SS7 and SMPP traffic.

Frequently Asked Questions (FAQ):

What is Network Security Firewall?

Network security firewall is deployed at network perimeters and boundaries to control the traffic between networks and block any undesired traffic. The firewall performs inspection, classification, and filtering based on network policies, establishing connections between applications and content/data transferred between networks. Network security firewall also provides defenses in the form of intrusion detection and prevention, application-layer scanning, and others, which monitor fraudulent mechanisms and block sophisticated attack attempts.

What types of attacks does Network Security Firewall prevent?

Subscriber Denial of Service (DoS), Network information disclosure, Black route signaling, Subscriber information disclosure, and fraudulent attacks.

What is Network Function Virtualization deployment

Network function virtualization refers to the virtualization of all networking components, such as compute, network, and storage, of enterprises and service providers to organize them, improve network agility, and lower operational cost. In a nutshell, the networking features are abstracted from the networking hardware to a single device, enabling network administrators to manage the entire networking infrastructure from a single software console.

What are the solutions required for Network Security Firewall

Network security firewall solutions provide end-to-end network protection from advanced malicious attacks. The solutions segment is categorized into signaling and SMS firewall solutions. SMS firewall is a rules-based system allowing an operator to finely control which traffic is permitted to be transported through the operators network. It protects consumers and increases SMS revenue. These firewalls offer a comprehensive set of features, such as message screening, monitoring and reporting, gray and black route protection, real-time streaming analysis and filtering, flexible configurations of filters, contextual awareness, and stateful inspection to the mobile network operators. Security firewall solutions such as SS7, diameter GTP, and SIP firewall provide carrier-grade security, which addresses the unique scaling, performance, and connectivity needs of mobile carriers.

Who are the prominent players of Network Security Firewall

Sinch (Sweden), Cellusys (Ireland), AdaptiveMobile (Ireland), Mobileum (US), Tata Communication (India), AMD Telecom (Greece), Openmind Networks (Ireland), Anam (Ireland), SAP (Germany), Orange (France), Telecom Italia Sparkle (Italy) are some of the players in the Network Security Firewall Market.

What are the top trends in Network Security Firewall market?

Trends that are impacting the Network Security Firewall market include:

- Increased Demand for Network Security and Privacy

- Advent of Nextgen Technologies for Network Security

- New Vulnerabilities in SS7

- Administrative Regulations Encouraging the Demand for Network Security Firewall

- Advancement of Digital Transformation in the Telecommunication Industry

Opportunities for the Network Security Firewall market:

- Operator Investment for Dynamic Network Infrastructure

- Increasing Adoption of Network Function Virtualization

- Lack of Unified Network Security Firewall Vendor

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20142019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 6 NETWORK SECURITY FIREWALL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATION FROM NETWORK SECURITY FIREWALL SOLUTION AND SERVICE VENDORS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

TABLE 3 COMPETITIVE LEADERSHIP MAPPING MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS AND LIMITATIONS OF THE STUDY

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 61)

TABLE 4 NETWORK SECURITY FIREWALL MARKET SIZE AND GROWTH, 20142019 (USD MILLION, Y-O-Y %)

TABLE 5 PRE-COVID-19: MARKET SIZE AND GROWTH, 20192025 (USD MILLION, Y-O-Y %)

TABLE 6 POST-COVID-19: MARKET SIZE AND GROWTH, 20192025 (USD MILLION, Y-O-Y %)

FIGURE 9 MARKET TO WITNESS SIGNIFICANT GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 10 MARKET, TOP 3 SEGMENTS, 2020

FIGURE 11 SMS FIREWALL SEGMENT TO HAVE THE HIGHEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE OPPORTUNITIES IN THE NETWORK SECURITY FIREWALL MARKET

FIGURE 12 RISING ADOPTION OF NEXT-GENERATION TECHNOLOGIES TO DRIVE THE MARKET GROWTH

4.2 MARKET IN NORTH AMERICA, BY SOLUTION AND COUNTRY

FIGURE 13 SMS FIREWALL AND UNITED STATES TO HOLD THE HIGHEST MARKET SHARES IN 2020

4.3 NETWORK SECURITY MARKET, BY REGION

FIGURE 14 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 15 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS OVER THE NEXT 5 YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NETWORK SECURITY FIREWALL MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand for network security and privacy

5.2.1.2 Advent of NextGen technologies for network security

5.2.1.3 New vulnerabilities in SS7

5.2.1.4 Administrative regulations encouraging the demand for network security firewall

5.2.1.5 Advancement of digital transformation in the telecommunication industry

5.2.2 RESTRAINTS

5.2.2.1 Lack of preventive firewall maintenance

5.2.3 OPPORTUNITIES

5.2.3.1 Operator investment for dynamic network infrastructure

5.2.3.2 Increasing adoption of network function virtualization

5.2.3.3 Lack of unified network security firewall vendor

5.2.4 CHALLENGES

5.2.4.1 Interworking of signaling control protocols complicates security

5.2.4.2 Growing grey route fraudulent mechanism

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 USE CASES

5.4.1 WIND HELLAS

5.4.2 ETISALAT

5.4.3 TELENOR

5.4.4 VIMPELCOM

5.4.5 TELKOM INDONESIA

5.5 REGULATIONS

5.5.1 FEDERAL COMMUNICATION COMMISSION

5.5.2 AUSTRALIAN REGULATORY BODY

5.5.3 SECURITY STANDARDS COUNCIL

5.5.4 CANADIAN RADIO TELEVISION AND TELECOMMUNICATIONS COMMISSION AND CWTA

5.5.5 SINGAPORE PERSONAL DATA PROTECTION COMMISSION

5.5.6 NEW ZEALANDS TELECOMMUNICATIONS INTERCEPTION CAPABILITY AND SECURITY ACT

5.5.7 DEPARTMENT OF TELECOMMUNICATIONS AND TELECOM REGULATORY AUTHORITY OF INDIA

5.5.8 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

5.6 GUIDELINES

5.6.1 GLOBAL SYSTEM FOR MOBILE COMMUNICATIONS ASSOCIATION

5.7 TELCOS ON NETWORK SECURITY FIREWALL

5.7.1 DEUTSCHE TELEKOM

5.7.2 VODAFONE

5.7.3 TELEFONICA

5.7.4 ORANGE

5.8 NEW TYPES OF ATTACKS

5.8.1 SUBSCRIBER DENIAL OF SERVICE

5.8.2 NETWORK INFORMATION DISCLOSURE

5.8.3 BLACK ROUTE SIGNALING

5.8.4 SUBSCRIBER INFORMATION DISCLOSURE

5.8.5 FRAUD

6 NETWORK SECURITY FIREWALL MARKET, BY COMPONENT (Page No. - 84)

6.1 INTRODUCTION

FIGURE 17 SOLUTIONS SEGMENT TO DOMINATE THE MARKET BY COMPONENT DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 8 PRE-COVID-19: MARKET SIZE, BY COMPONENT, 20202025 (USD MILLION)

TABLE 9 POST-COVID-19: MARKET SIZE, BY COMPONENT, 20202025 (USD MILLION)

TABLE 10 POST-COVID-19: COMPONENT MARKET SIZE, FOR MARKET, 20192025 (USD MILLION)

6.2 SOLUTIONS

6.2.1 INCREASING NEED TO PROTECT OPERATORS NETWORK FROM SIGNALING ATTACKS TO DRIVE THE SOLUTIONS MARKET

6.2.2 SOLUTIONS: COVID-19 IMPACT

FIGURE 18 BY SIZE, NORTH AMERICA TO DOMINATE THE NETWORK SECURITY FIREWALL SOLUTIONS SEGMENT DURING THE FORECAST PERIOD

TABLE 11 NETWORK SECURITY FIREWALL SOLUTIONS COMPONENT MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 12 PRE-COVID-19: NETWORK SECURITY FIREWALL MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 13 POST-COVID-19: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.3 SERVICES

6.3.1 FOCUS ON PROTECTING TELECOM NETWORKS FROM FRAUDULENT ATTACKS TO DRIVE THE SERVICES SEGMENT

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 19 ASIA PACIFIC TO GROW TO MORE THAN DOUBLE ITS SIZE IN THE SERVICES SEGMENT OF THE MARKET DURING THE FORECAST PERIOD

TABLE 14 NETWORK SECURITY FIREWALL SERVICES COMPONENT MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 15 PRE-COVID-19: NETWORK SECURITY FIREWALL MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 16 POST-COVID-19: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7 NETWORK SECURITY FIREWALL, BY SOLUTION (Page No. - 91)

7.1 INTRODUCTION

FIGURE 20 SMS FIREWALL SOLUTION TO DOMINATE THE NETWORK SECURITY FIREWALL MARKET DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 18 PRE-COVID-19: MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 19 POST-COVID-19: MARKET SIZE, BY SOLUTION, 20202025 (USD MILLION)

7.2 SMS FIREWALL

7.2.1 SMS FIREWALL: COVID-19 IMPACT

FIGURE 21 A2P MESSAGING TO HOLD A LARGER MARKET SHARE IN THE SMS FIREWALL SOLUTION SEGMENT DURING THE FORECAST PERIOD

TABLE 20 SMS FIREWALL SOLUTION MARKET SIZE, BY SOLUTION TYPE, 20142019 (USD MILLION)

TABLE 21 PRE-COVID-19: SMS FIREWALL SOLUTION MARKET SIZE, BY SOLUTION TYPE, 20192025 (USD MILLION)

TABLE 22 POST-COVID-19: SMS FIREWALL SOLUTION MARKET SIZE, BY SOLUTION TYPE, 20202025 (USD MILLION)

7.2.2 A2P MESSAGING

7.2.2.1 Major verticals to increasingly adopt A2P messaging for communication purposes

7.2.3 A2P MESSAGING: COVID-19 IMPACT

FIGURE 22 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE A2P MESSAGING SEGMENT DURING THE FORECAST PERIOD

TABLE 23 A2P MESSAGING MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 24 PRE-COVID-19: A2P MESSAGING MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 25 POST-COVID-19: A2P MESSAGING MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.2.4 P2A MESSAGING

7.2.4.1 P2A messaging enabling end users to seamlessly connect with brands, organizations, and service providers

7.2.5 P2A MESSAGING: COVID-19 IMPACT

TABLE 26 P2A MESSAGING MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 27 PRE-COVID-19: P2A MESSAGING MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 28 POST-COVID-19: P2A MESSAGING MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3 SIGNALING FIREWALL

7.3.1 SIGNALING FIREWALL: COVID-19 IMPACT

FIGURE 23 SS7 FIREWALL TO DOMINATE THE SIGNALING FIREWALL SOLUTION SEGMENT DURING THE FORECAST PERIOD

TABLE 29 SIGNALING FIREWALL MARKET SIZE, BY FIREWALL TYPE, 20142019 (USD MILLION)

TABLE 30 PRE-COVID-19: SIGNALING FIREWALL MARKET SIZE, BY FIREWALL TYPE, 20192025 (USD MILLION)

TABLE 31 POST-COVID-19: SIGNALING FIREWALL MARKET SIZE, BY FIREWALL TYPE, 20202025 (USD MILLION)

7.3.2 SS7 FIREWALL

7.3.2.1 SS7 firewall protecting mobile operators networks from real-time SS7-based signaling attacks

7.3.3 SS7 FIREWALL: COVID-19 IMPACT

FIGURE 24 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN THE SS7 FIREWALL SEGMENT DURING THE FORECAST PERIOD

TABLE 32 SS7 FIREWALL MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 33 PRE-COVID-19: SS7 FIREWALL MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 34 POST-COVID-19: SS7 FIREWALL MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3.4 DIAMETER FIREWALL

7.3.4.1 Diameter firewall to identify and prevent a wide range of attacks

7.3.5 DIAMETER FIREWALL: COVID-19 IMPACT

FIGURE 25 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE DIAMETER FIREWALL SEGMENT DURING THE FORECAST PERIOD

TABLE 35 DIAMETER FIREWALL MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 36 PRE-COVID-19: DIAMETER FIREWALL MARKET SIZE, BY REGION, 20192025(USD MILLION)

TABLE 37 POST-COVID-19: DIAMETER FIREWALL MARKET SIZE, BY REGION, 20202025(USD MILLION)

7.3.6 OTHERS

FIGURE 26 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE IN THE OTHERS SEGMENT DURING THE FORECAST PERIOD

TABLE 38 OTHERS MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 39 PRE-COVID-19: OTHERS MARKET SIZE, BY REGION, 20192025(USD MILLION)

TABLE 40 POST-COVID-19: OTHERS MARKET SIZE, BY REGION, 20202025(USD MILLION)

8 NETWORK SECURITY FIREWALL MARKET, BY SERVICE (Page No. - 107)

8.1 INTRODUCTION

FIGURE 27 MANAGED SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 41 MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 42 PRE-COVID-19: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 43 POST-COVID-19: MARKET SIZE, BY SERVICE, 20202025 (USD MILLION)

8.2 PROFESSIONAL SERVICES

8.2.1 PROFESSIONAL SERVICES: COVID-19 IMPACT

FIGURE 28 DEPLOYMENT AND INTEGRATION TO DOMINATE THE PROFESSIONAL SERVICES SEGMENT DURING THE FORECAST PERIOD

TABLE 44 PROFESSIONAL SERVICES MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 45 PRE-COVID-19: PROFESSIONAL SERVICES MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 46 POST-COVID-19: PROFESSIONAL SERVICES MARKET SIZE, BY SERVICE TYPE, 20202025 (USD MILLION)

8.2.2 DEPLOYMENT AND INTEGRATION

8.2.2.1 Need for deployment and integration services to protect the entire network infrastructure from threats

8.2.3 DEPLOYMENT AND INTEGRATION: COVID-19 IMPACT

TABLE 47 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 48 PRE-COVID-19: DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 49 POST-COVID-19: DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.2.4 CONSULTING SERVICES

8.2.4.1 Consulting services help enterprises formulate security strategies, prevent revenue loss, and minimize risks

8.2.5 CONSULTING SERVICES: COVID-19 IMPACT

TABLE 50 CONSULTING SERVICES MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 51 PRE-COVID-19: CONSULTING SERVICES MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 52 POST-COVID-19: CONSULTING SERVICES MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.2.6 SUPPORT AND MAINTENANCE

8.2.6.1 Increased deployment of firewalls has increased support and maintenance requirements

8.2.7 SUPPORT AND MAINTENANCE: COVID-19 IMPACT

TABLE 53 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 54 PRE-COVID-19: SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 55 POST-COVID-19: SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.3 MANAGED SERVICES

8.3.1 VENDORS PROVIDING MANAGED SERVICES OFFER A COMPLETE SUITE OF DEDICATED FIREWALL SERVICES

8.3.2 MANAGED SERVICES: COVID-19 IMPACT

FIGURE 29 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE MANAGED SERVICES SEGMENT DURING THE FORECAST PERIOD

TABLE 56 MANAGED SERVICES MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 57 PRE-COVID-19: MANAGED SERVICES MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 58 POST-COVID-19: MANAGED SERVICES MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9 NETWORK SECURITY FIREWALL MARKET, BY TYPE (Page No. - 119)

9.1 INTRODUCTION

9.2 PACKET FILTERING

9.2.1 HIGH-SPEED FILTERING TO DRIVE PACKET FILTER FIREWALL TECHNOLOGY ADOPTION

9.2.2 PACKET FILTERING: COVID-19 IMPACT

9.3 STATEFUL PACKET INSPECTION

9.3.1 GREATER SECURITY BY STATEFUL PACKET INSPECTION TO SPUR ITS ADOPTION

9.3.2 STATEFUL FILTERING: COVID-19 IMPACT

9.4 NEXT GENERATION FIREWALL

9.4.1 ADVANCED CAPABILITIES OF NEXT GENERATION FIREWALL TO BOOST ITS GROWTH

9.4.2 NEXT GENERATION FIREWALL: COVID-19 IMPACT

9.5 UNIFIED THREAT MANAGEMENT

9.5.1 UNIFIED THREAT MANAGEMENT FIREWALL TO PROMOTE FILTERING BASED ON BUSINESS REQUIREMENTS

9.5.2 UNIFIED THREAT MANAGEMENT: COVID-19 IMPACT

10 NETWORK SECURITY FIREWALL MARKET, BY DEPLOYMENT (Page No. - 122)

10.1 INTRODUCTION

FIGURE 30 ON-PREMISES DEPLOYMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 59 MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 60 PRE-COVID-19: MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 61 POST-COVID-19: MARKET SIZE, BY DEPLOYMENT, 20202025 (USD MILLION)

10.2 ON-PREMISES

10.2.1 INCREASING DEMAND FOR OFFLINE DATA ANALYTICS AND PACKAGE FILTERING TO DRIVE THE ON-PREMISES SEGMENT

10.2.2 ON-PREMISES: COVID-19 IMPACT

FIGURE 31 BY SIZE, NORTH AMERICA TO DOMINATE THE ON-PREMISES DEPLOYMENT SPACE DURING THE FORECAST PERIOD

TABLE 62 ON-PREMISES MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 63 PRE-COVID-19: ON-PREMISES MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 64 POST-COVID-19: ON-PREMISES MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10.3 CLOUD

10.3.1 GROWING DEMAND FOR REAL-TIME DATA FILTERING AND STORAGE TO FURTHER FUEL THE GROWTH OF CLOUD SEGMENT

10.3.2 CLOUD: COVID-19 IMPACT

FIGURE 32 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE CLOUD SEGMENT DURING THE FORECAST PERIOD

TABLE 65 CLOUD MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 66 PRE-COVID-19: CLOUD MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 67 POST-COVID-19: CLOUD MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10.4 NETWORK FUNCTION VIRTUALIZATION

10.4.1 INCREASING NEED FOR VIRTUALIZED AND COST-EFFECTIVE ENVIRONMENT ACROSS TELECOM NETWORKS TO BOOST THE DEMAND FOR NETWORK FUNCTION VIRTUALIZATION

10.4.2 NETWORK FUNCTION VIRTUALIZATION: COVID-19 IMPACT

FIGURE 33 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE NETWORK FUNCTION VIRTUALIZATION SEGMENT DURING THE FORECAST PERIOD

TABLE 68 NETWORK FUNCTION VIRTUALIZATION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 69 PRE-COVID-19: NETWORK FUNCTION VIRTUALIZATION MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 70 POST-COVID-19: NETWORK FUNCTION VIRTUALIZATION MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11 NETWORK SECURITY FIREWALL MARKET, BY REGION (Page No. - 131)

11.1 INTRODUCTION

11.1.1 NORTH AMERICA: COVID-19 DRIVERS IMPACTING MARKET

FIGURE 34 ASIA PACIFIC TO EXHIBIT THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 35 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST, 20202025

TABLE 71 MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 72 PRE-COVID-19: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 73 POST-COVID-19: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: NETWORK SECURITY FIREWALL MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 75 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 76 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY COMPONENT, 20202025 (USD MILLION)

TABLE 77 POST-COVID-19: SERVICES MARKET SIZE, FOR NORTH AMERICA, 20192025 (USD MILLION)

TABLE 78 POST-COVID-19: SOLUTION MARKET SIZE, FOR NORTH AMERICA, 20192025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 80 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 81 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY SOLUTION, 20202025 (USD MILLION)

TABLE 82 POST-COVID-19: SMS FIREWALL MARKET SIZE, FOR NORTH AMERICA, 20202025 (USD MILLION)

TABLE 83 POST-COVID-19: SIGNALING FIREWALL MARKET SIZE, FOR NORTH AMERICA, 20192025 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SMS FIREWALL, 20142019 (USD MILLION)

TABLE 85 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 86 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY SMS FIREWALL, 20202025 (USD MILLION)

FIGURE 37 SS7 SEGMENT TO GROW AT THE HIGHEST CAGR IN THE SIGNALING FIREWALL SEGMENT IN NORTH AMERICA DURING THE FORECAST PERIOD

TABLE 87 NORTH AMERICA: MARKET SIZE, BY SIGNALING FIREWALL, 20142019 (USD MILLION)

TABLE 88 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 89 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY SIGNALING FIREWALL, 20202025 (USD MILLION)

TABLE 90 NORTH AMERICA: NETWORK SECURITY FIREWALL MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 91 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 92 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY SERVICE, 20202025 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 20142019 (USD MILLION)

TABLE 94 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 95 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20202025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 97 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 98 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY DEPLOYMENT, 20202025 (USD MILLION)

TABLE 99 POST-COVID-19: ON-PREMISES MARKET SIZE, FOR NORTH AMERICA, 20192025 (USD MILLION)

TABLE 100 POST-COVID-19: CLOUD MARKET SIZE, FOR NORTH AMERICA, 20192025 (USD MILLION)

TABLE 101 POST-COVID-19: MARKET, BY NETWORK FUNCTION VIRTUALIZATION DEPLOYMENT, 20192025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 103 PRE- COVID-19: NORTH AMERICA MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 104 POST- COVID-19: NORTH AMERICA MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 105 POST-COVID-19: NETWORK SECURITY FIREWALL MARKET, BY US, 20192025 (USD MILLION)

TABLE 106 POST-COVID-19: MARKET, BY CANADA, 20192025 (USD MILLION)

11.2.1 UNITED STATES

11.2.1.1 Growing demand for secure network and protection against fraud to drive network firewall security market in the US

11.2.2 CANADA

11.2.2.1 Government initiatives set to fuel the growth of market

11.3 EUROPE

11.3.1 EUROPE: COVID-19 DRIVERS IMPACTING MARKET

TABLE 107 EUROPE: NETWORK SECURITY FIREWALL MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 108 PRE-COVID-19: EUROPE MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 109 POST-COVID-19: EUROPE MARKET SIZE, BY COMPONENT, 20202025 (USD MILLION)

TABLE 110 POST-COVID-19: SERVICE MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 111 POST-COVID-19: SOLUTION MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 113 PRE-COVID-19: EUROPE MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 114 POST-COVID-19: EUROPE MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 115 POST-COVID-19: SMS FIREWALL MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 116 POST-COVID-19: SIGNALING FIREWALL MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SMS FIREWALL, 20142019 (USD MILLION)

TABLE 118 PRE- COVID-19: EUROPE MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 119 POST- COVID-19: EUROPE MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

FIGURE 38 SS7 SEGMENT TO RECORD GROWTH AT THE HIGHEST CAGR IN THE SIGNALING FIREWALL SEGMENT IN EUROPE DURING THE FORECAST PERIOD

TABLE 120 EUROPE: MARKET SIZE, BY SIGNALING FIREWALL, 20142019 (USD MILLION)

TABLE 121 PRE- COVID-19: EUROPE MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 122 POST-COVID-19: EUROPE MARKET SIZE, BY SIGNALING FIREWALL, 20202025 (USD MILLION)

TABLE 123 EUROPE: NETWORK SECURITY FIREWALL MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 124 PRE- COVID-19: EUROPE MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 125 POST- COVID-19: EUROPE MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 20142019 (USD MILLION)

TABLE 127 PRE-COVID-19: EUROPE MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 128 POST-COVID-19: EUROPE MARKET SIZE, BY PROFESSIONAL SERVICE, 20192025 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 130 PRE-COVID-19: EUROPE MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 131 POST-COVID-19: EUROPE MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 132 POST-COVID-19: ON-PREMISES MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 133 POST-COVID-19: CLOUD MARKET SIZE, FOR EUROPE, 20192025 (USD MILLION)

TABLE 134 POST-COVID-19: NETWORK FUNCTION VIRTUALIZATION, FOR EUROPE, 20192025 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 136 PRE-COVID-19: EUROPE MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 137 POST-COVID-19: EUROPE MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 138 POST-COVID-19: NETWORK SECURITY FIREWALL MARKET, BY UK, 20192025 (USD MILLION)

TABLE 139 POST-COVID-19: MARKET, BY FRANCE, 20192025 (USD MILLION)

TABLE 140 POST-COVID-19: MARKET, BY REST OF EUROPE, 20192025 (USD MILLION)

11.3.2 UNITED KINGDOM

11.3.2.1 Focus on enhancing protection against telecom fraud to fuel the growth of market

11.3.3 FRANCE

11.3.3.1 Presence of large telecommunication service providers to spur demand for network security firewall

11.3.4 REST OF EUROPE

11.3.4.1 Increasing level of frauds to trigger significant adoption of network security firewall solutions

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: COVID-19 DRIVERS IMPACTING NETWORK SECURITY FIREWALL MARKET

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 142 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 143 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 144 POST-COVID-19: SERVICE MARKET SIZE, FOR ASIA PACIFIC, 20192025 (USD MILLION)

TABLE 145 POST-COVID-19: SOLUTION MARKET SIZE, FOR ASIA PACIFIC, 20192025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 147 PRE- COVID-19: ASIA PACIFIC MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 148 POST- COVID-19: ASIA PACIFIC MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 149 POST-COVID-19: SMS FIREWALL MARKET SIZE, FOR ASIA PACIFIC MARKET, 20192025 (USD MILLION)

TABLE 150 POST-COVID-19: SIGNALING FIREWALL MARKET SIZE, FOR ASIA PACIFIC MARKET, 20192025 (USD MILLION)

FIGURE 40 A2P MESSAGING SEGMENT TO EXHIBIT A HIGHER CAGR IN THE SIGNALING FIREWALL SEGMENT IN ASIA PACIFIC DURING THE FORECAST PERIOD

TABLE 151 ASIA PACIFIC: NETWORK SECURITY FIREWALL MARKET SIZE, BY SMS FIREWALL, 20142019 (USD MILLION)

TABLE 152 PRE-COVID-19: ASIA PACIFIC MARKET, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 153 POST-COVID-19: ASIA PACIFIC MARKET, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY SIGNALING FIREWALL, 20142019 (USD MILLION)

TABLE 155 PRE-COVID-19: ASIA PACIFIC MARKET, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 156 POST-COVID-19: ASIA PACIFIC MARKET, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 158 PRE-COVID-19: ASIA PACIFIC MARKET, BY SERVICE, 20192025 (USD MILLION)

TABLE 159 POST-COVID-19: ASIA PACIFIC MARKET, BY SERVICE, 20192025 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 20142019 (USD MILLION)

TABLE 161 PRE-COVID-19: MARKET, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 162 POST-COVID-19: MARKET, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 163 ASIA PACIFIC: NETWORK SECURITY FIREWALL MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 164 PRE-COVID-19: ASIA PACIFIC MARKET, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 165 POST-COVID-19: ASIA PACIFIC MARKET, BY DEPLOYMENT, 20202025 (USD MILLION)

TABLE 166 POST-COVID-19: ON-PREMISES MARKET SIZE, FOR ASIA PACIFIC, 20192025 (USD MILLION)

TABLE 167 POST-COVID-19: CLOUD MARKET SIZE, FOR ASIA PACIFIC, 20192025 (USD MILLION)

TABLE 168 POST-COVID-19: NETWORK FUNCTION VIRTUALIZATION, FOR ASIA PACIFIC, 20192025 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 170 PRE-COVID-19: ASIA PACIFIC MARKET, BY COUNTRY, 20192025 (USD MILLION)

TABLE 171 POST-COVID-19: ASIA PACIFIC MARKET, BY COUNTRY, 20192025 (USD MILLION)

TABLE 172 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY CHINA, 20192025 (USD MILLION)

TABLE 173 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY JAPAN, 20192025 (USD MILLION)

TABLE 174 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY REST OF ASIA PACIFIC, 20192025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Adoption of new regulations related to network security to drive the market in China

11.4.3 JAPAN

11.4.3.1 Strong telecommunications industry and government policies to boost the growth of the market in Japan

11.4.4 REST OF ASIA PACIFIC

11.4.4.1 Adoption of network security firewall solutions to drive the market in the region

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: COVID-19 DRIVERS IMPACTING NETWORK SECURITY FIREWALL MARKET

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 176 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 177 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 178 POST-COVID-19: SERVICE MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 179 POST-COVID-19: SOLUTION MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 181 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 182 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 183 POST-COVID-19: SMS FIREWALL MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 184 POST-COVID-19: SIGNALING FIREWALL MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SMS FIREWALL, 20142019 (USD MILLION)

TABLE 186 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 187 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

FIGURE 41 SS7 FIREWALL SEGMENT TO EXHIBIT THE LARGEST MARKET SHARE IN SIGNALING FIREWALLS IN MEA MARKET DURING THE FORECAST PERIOD

TABLE 188 MIDDLE EAST AND AFRICA: NETWORK SECURITY FIREWALL MARKET SIZE, BY SIGNALING FIREWALL, 20142019 (USD MILLION)

TABLE 189 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 190 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 192 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 193 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 20142019 (USD MILLION)

TABLE 195 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 196 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 197 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 198 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 199 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 200 POST-COVID-19: ON-PREMISES MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 201 POST-COVID-19: CLOUD MARKET SIZE, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 202 POST-COVID-19: NETWORK FUNCTION VIRTUALIZATION, FOR MIDDLE EAST AND AFRICA, 20192025 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: NETWORK SECURITY FIREWALL MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 204 PRE- COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 205 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 206 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY MIDDLE EAST, 20192025 (USD MILLION)

TABLE 207 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY AFRICA, 20192025 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Government regulations on cybersecurity to drive the market in the Middle East

11.5.3 AFRICA

11.5.3.1 Focus on controlling telecom cyberattacks to drive the adoption of network security firewall technology in Africa

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 DRIVERS IMPACTING NETWORK SECURITY FIREWALL MARKET

TABLE 208 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 209 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 210 POST- COVID-19: LATIN AMERICA MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 211 POST-COVID-19: SERVICES MARKET SIZE, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 212 POST-COVID-19: SOLUTION MARKET SIZE, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 214 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 215 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 216 POST-COVID-19: SMS FIREWALL, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 217 POST-COVID-19: SIGNALING FIREWALL, FOR LATIN AMERICA, 20192025 (USD MILLION)

FIGURE 42 A2P MESSAGING TO EXHIBIT A HIGHER CAGR IN THE SIGNALING FIREWALL SEGMENT IN LATIN AMERICA DURING THE FORECAST PERIOD

TABLE 218 LATIN AMERICA: MARKET SIZE, BY SMS FIREWALL, 20142019 (USD MILLION)

TABLE 219 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 220 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY SMS FIREWALL, 20192025 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET SIZE, BY SIGNALING FIREWALL, 20142019 (USD MILLION)

TABLE 222 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 223 POST- COVID-19: LATIN AMERICA MARKET SIZE, BY SIGNALING FIREWALL, 20192025 (USD MILLION)

TABLE 224 LATIN AMERICA: NETWORK SECURITY FIREWALL MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 225 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 226 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 20142019 (USD MILLION)

TABLE 228 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 229 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY PROFESSIONAL SERVICES, 20192025 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 20142019 (USD MILLION)

TABLE 231 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 232 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY DEPLOYMENT, 20192025 (USD MILLION)

TABLE 233 POST-COVID-19: ON-PREMISES MARKET SIZE, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 234 POST-COVID-19: CLOUD MARKET SIZE, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 235 POST-COVID-19: NETWORK FUNCTION VIRTUALIZATION, FOR LATIN AMERICA, 20192025 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 237 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 238 POST- COVID-19: LATIN AMERICA MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

TABLE 239 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY BRAZIL, 20192025 (USD MILLION)

TABLE 240 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY MEXICO MARKET SIZE, 20192025 (USD MILLION)

TABLE 241 POST-COVID-19: NETWORK FIREWALL MARKET SIZE, BY REST OF LATIN AMERICA MARKET SIZE, 20192025 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Improvements in telecom network security to drive the adoption of network security firewall technology in Brazil

11.6.3 MEXICO

11.6.3.1 Business expansion plans by telecommunication industry to fuel market growth in Mexico

11.6.4 REST OF LATIN AMERICA

11.6.4.1 Expanding telecommunications industry to spur the demand for network security firewall technology

12 COMPETITIVE LANDSCAPE (Page No. - 197)

12.1 COMPETITIVE LANDSCAPE OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 INNOVATORS

12.2.4 EMERGING COMPANIES

FIGURE 43 NETWORK SECURITY FIREWALL MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2018

12.3 COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

12.3.1 PROGRESSIVE

12.3.2 RESPONSIVE

12.3.3 DYNAMIC COMPANIES

12.3.4 STARTING BLOCKS

FIGURE 44 MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2018

12.4 RANKING OF KEY PLAYERS

TABLE 242 RANKING OF KEY PLAYERS IN THE MARKET (OVERALL MARKET)

12.5 COMPETITIVE SCENARIO

FIGURE 45 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE NETWORK SECURITY FIREWALL MARKET DURING 20162018

12.5.1 NEW PRODUCT/SERVICE LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 243 NEW PRODUCT/SERVICE LAUNCHES AND PRODUCT ENHANCEMENTS, 20162018

12.5.2 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 244 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS, 20162019

12.5.3 MERGERS AND ACQUISITIONS

TABLE 245 MERGERS AND ACQUISITIONS, 20152018

13 COMPANY PROFILES (Page No. - 205)

(Business Overview, products and Solutions offered, Recent Developments, COVID-19 strategy, SWOT Analysis, and MnM View)*

13.1 ADAPTIVEMOBILE

FIGURE 46 SWOT ANALYSIS: ADAPTIVEMOBILE

13.2 AMD TELECOM

13.3 ANAM

FIGURE 47 SWOT ANALYSIS: ANAM

13.4 CELLUSYS

FIGURE 48 SWOT ANALYSIS: CELLUSYS

13.5 MOBILEUM

FIGURE 49 SWOT ANALYSIS: MOBILEUM

13.6 NETNUMBER

13.7 ORANGE

FIGURE 50 ORANGE: COMPANY SNAPSHOT

13.8 OPENMIND NETWORKS

13.9 SAP SE

FIGURE 51 SAP SE: COMPANY SNAPSHOT

13.10 SINCH

FIGURE 52 SINCH: COMPANY SNAPSHOT

FIGURE 53 SWOT ANALYSIS: SINCH

13.11 TATA COMMUNICATIONS

FIGURE 54 TATA COMMUNICATIONS: COMPANY SNAPSHOT

13.12 OMOBIO

13.13 PROTEI

13.14 ROUTE MOBILE

13.15 BICS

13.16 TWILIO

13.17 TELECOM ITALIA SPARKLE

13.18 SOPHOS

13.19 HPE

13.20 NOKIA

13.21 ENGHOUSE NETWORK

13.22 FORTINET

13.23 CHECK POINT

13.24 MAVENIR

13.25 SONICWALL

13.26 INFOBIP

13.27 GLOBAL WAVENET

13.28 JUNIPER

13.29 PALO ALTO NETWORKS

13.30 BARRACUDA NETWORKS

*Details on Business Overview, products and Solutions offered, Recent Developments, COVID-19 strategy, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 250)

14.1 INTRODUCTION TO ADJACENT MARKETS

14.2 ADJACENT MARKETS AND FORECASTS

14.3 LIMITATIONS

14.4 NETWORK SECURITY FIREWALL ECOSYSTEM AND ADJACENT MARKETS

14.5 INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET

TABLE 246 INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 247 NORTH AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 248 NORTH AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 249 NORTH AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 250 EUROPE: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 251 EUROPE: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 252 EUROPE: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT TYPE, 20172024 (USD MILLION)

TABLE 253 EUROPE: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 254 ASIA PACIFIC: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 255 ASIA PACIFIC: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 256 ASIA PACIFIC: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT TYPE, 20172024 (USD MILLION)

TABLE 257 ASIA PACIFIC: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 260 MIDDLE EAST AND AFRICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT, 20172024 (USD MILLION)

TABLE 261 MIDDLE EAST AND AFRICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 262 LATIN AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 263 LATIN AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 264 LATIN AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT, 20172024 (USD MILLION)

TABLE 265 LATIN AMERICA: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

14.6 SECURE WEB GATEWAY MARKET

TABLE 266 SECURE WEB GATEWAY MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 267 NORTH AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 268 NORTH AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 269 NORTH AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 270 NORTH AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 271 EUROPE: SECURE WEB GATEWAY MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 272 EUROPE: SECURE WEB GATEWAY MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 273 EUROPE: SECURE WEB GATEWAY MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 274 EUROPE: SECURE WEB GATEWAY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 275 ASIA PACIFIC: SECURE WEB GATEWAY MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 276 ASIA PACIFIC: SECURE WEB GATEWAY MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 277 ASIA PACIFIC: SECURE WEB GATEWAY MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 278 ASIA PACIFIC: SECURE WEB GATEWAY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 279 MIDDLE EAST AND AFRICA: SECURE WEB GATEWAY MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 280 MIDDLE EAST AND AFRICA: SECURE WEB GATEWAY MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 281 MIDDLE EAST AND AFRICA: SECURE WEB GATEWAY MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 282 LATIN AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 283 LATIN AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 284 LATIN AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 285 LATIN AMERICA: SECURE WEB GATEWAY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

14.7 DEEP PACKET INSPECTION AND PROCESSING MARKET

TABLE 286 NORTH AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 287 NORTH AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 288 NORTH AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 20172024 (USD MILLION)

TABLE 289 NORTH AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 290 EUROPE: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 291 EUROPE: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 292 EUROPE: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 293 ASIA PACIFIC: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 294 ASIA PACIFIC: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 295 ASIA PACIFIC: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 299 LATIN AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 20172024 (USD MILLION)

TABLE 300 LATIN AMERICA: DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 20172024 (USD MILLION)

15 APPENDIX (Page No. - 269)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved 4 major steps to estimate the current market size for the network security firewall market. The exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, technology journals and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

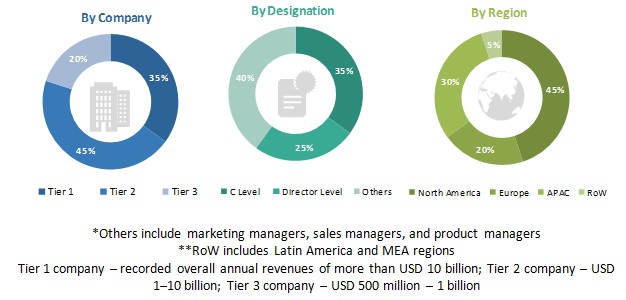

The network security firewall market comprises several stakeholders, such as solution and service providers, support and maintenance service providers, manufacturing enterprises, technology consultants, system design and development vendors, and logistics and supply chain management providers. The extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakup of primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the network security firewall market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through the extensive secondary research.

- The network security firewall market expenditures across regions, along with the geographic split in various segments have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the network security firewall industry.

Report Objectives:

- To define, describe, and forecast the network security firewall market by component, deployment, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to 5 main regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies1

- To analyze competitive developments, such as new partnerships, new contracts, and new product developments, in the network security firewall market

1Core competencies of the companies have been captured in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, France, and Rest of Europe

- Further breakup of the APAC market into the China, Japan, and Rest of APAC

- Further breakup of the MEA market into the Africa and Middle East

- Further breakup of the Latin American market into the Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Network Security Firewall Market