SMS Firewall Market by Component (SMS Firewall Platform and Services (Professional and Managed)), SMS Type (A2P and P2A Messages), SMS Traffic (National and International), Deployment Mode (On-premises and Cloud), and Region - Global Forecast to 2025

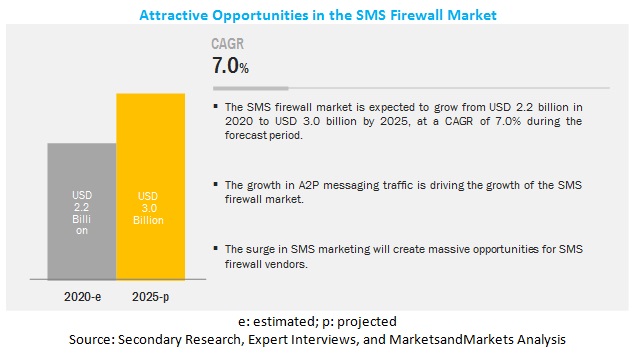

The SMS Firewall Market is projected to expand at a CAGR of 7.0% during the forecast period to reach USD 3.0 billion by 2025, size was valued USD 2.2 billion in 2020. The major factors driving the growth of the SMS firewall include combating SMS fraudulent activities such as SMS phishing, SMS spoofing, and SMS spamming, stringent government regulations and policies, and increasing adoption of Application-to-Person (A2P) SMS in the businesses.

Services segment to grow at a higher CAGR during the forecast period

The services segment includes professional and managed services. It plays an important role in keeping telecom infrastructure functioning effectively. The professional services segment includes education, training and certification, consulting, planning, and implementation. The overall services segment has a major influence on the SMS firewall market. These services help reduce costs, increase overall revenues, and improve performance. With the help of services, Mobile Network Operators (MNOs) can track, evaluate, and analyze the requirement of the business, so that they can make informed decisions.

The on-premises segment to hold a higher market share during the forecast period

The on-premises deployment mode is one of the most favorable modes for the deployment of an SMS firewall by telecom operators. This mode offers more security and privacy to telecom operators for protecting and blocking unwanted SMS traffic. With the on-premises SMS firewall, MNOs have better control over controlling malicious SMS traffic. The spam text messages harm both the customer as well as the telecom operator’s revenue. Telecom operators use SMS firewall solutions to combat against such spam SMS traffic. This SMS firewall solution comprises rules-based filtering, content-based filtering, and reporting tools. Nowadays, most of the telecom operators still prefer on-premises deployment mode due to a range of features and functionalities.

China to record the highest market share in the APAC region

China is one of the world’s most developed markets with operators such as China Telecom, China Unicom, and China Mobile moving ahead in the development of 5G services, while 4G remains the dominant mobile technology accounting for more than 80% of total connections. In 2019, mobile technologies and services generated USD 759 billion contributing around 5.4% of GDP across China. The country has one of the largest subscriber bases with 1.2 billion mobile subscribers and 1.7 billion SIM connections, which accounts for 82% of the region’s population. However, the country is one of the biggest hotspots for scammer with a 54% Y-o-Y growth on mobile payment attacks and second highest cases of account takeover at 17%, as per a report from Threat Matrix.

Key Market Players

Key SMS Firewall Market players profiled in this report include Comviva (India), Mobileum (US), AdaptiveMobile Security (Ireland), BICS (Belgium), Monty Mobile (UK), ANAM Technologies (Ireland), Infobip Ltd (UK), Route Mobile Limited (India), Proofpoint, Inc (US), Sinch (Sweden), TeleOSS (India), NetNumber Inc (US), Enghouse Networks (Canada), Global Wavenet (Singapore), HAUD (Malta), Tango Telecom Limited (Ireland), Eastwind (Russia), SAP SE (Germany), Tata Communications (India), AMD Telecom S.A. (Greece), Omobio (Sri Lanka), Syniverse Technologies LLC (US), Mavenir (US), Cellusys (Ireland), BroadNet Technologies (Lebanon), Mylinex International (Pvt) Ltd (Sri Lanka), TWILIO INC (US), NewNet (US), Openmind Networks (Ireland), Mitto (Switzerland), Tanla (India), and 6d Technologies (India). These players have adopted various growth strategies, such as partnerships and new service launches, to expand their presence further in the SMS firewall market and broaden their customer base.

Comviva has a wide range of product portfolio, including mobile financial solutions, digital lifestyle solutions, converged mobile solutions, messaging solutions, business solutions, customer value management, and mobile data. The company offers a wide range of messaging solutions for enterprise customers and telecom operators, including the A2P monetization solution, the Ngage messaging platform, the Uno messaging platform, SMS hub, and SMS firewall solution to control the SMS spam traffic. Managed services offered to the telecom operators and enterprises by the company includes a set of cloud and financial services, rapid detection and auto-recovery, service performance insights suite, and robust automated perceptive intelligent testing solution.

Scope of Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 2.2 billion |

|

Revenue forecast for 2025 |

USD 3.0 billion |

|

Growth Rate |

7.0% CAGR |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, SMS types, SMS traffic, deployment mode, and region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Comviva (India), Mobileum (US), AdaptiveMobile Security (Ireland), BICS (Belgium), Monty Mobile (UK), ANAM Technologies (Ireland), Infobip Ltd (UK), Route Mobile Limited (India), Proofpoint, Inc (US), Sinch (Sweden), TeleOSS (India), NetNumber Inc (US), Enghouse Networks (Canada), Global Wavenet (Singapore), HAUD (Malta), Tango Telecom Limited (Ireland), Eastwind (Russia), SAP SE (Germany), Tata Communications (India), AMD Telecom S.A. (Greece), Omobio (Sri Lanka), Syniverse Technologies LLC (US), Mavenir (US), Cellusys (Ireland), BroadNet Technologies (Lebanon), Mylinex International (Pvt) Ltd (Sri Lanka), TWILIO INC (US), NewNet (US), Openmind Networks (Ireland), Mitto (Switzerland), Tanla (India), and 6d Technologies (India) |

This research report categorizes the SMS firewall market to forecast revenue and analyze trends in each of the following submarkets:

Based on components:

- SMS firewall platform

- Services

Based on Services:

- Professional Services

- Managed Services

Based on SMS types:

- Application-to-Person (A2P) messages

- Person-to-Application (P2A) messages

Based on SMS traffic:

- National SMS traffic

- International SMS traffic

Based on the deployment modes:

- On-premises

- Cloud

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In March 2020, Mobileum collaborated with STC. STC has chosen the Active Intelligence platform of Mobileum for fraud and risk detection in 5G networks. The platform will enable STC to secure its network and subscribers from fraud and security threats.

- In October 2019, Sinch acquired TWW do Brasil S.A. The acquisition of TWW do Brasil S.A enabled Sinch to expand its network and entail domestic presence in Latin America. TWW is the 3rd largest SMS connectivity provider in Brazil. The acquisition has equipped Sinch with a wide range of customer base.

- In October 2019, BICS expanded the market of its European network connectivity. The company launched five new points-of-presence and a new fiber route between Italy and Switzerland to enable low latency voice, data, and IP services in North-Eastern Europe.

- In February 2019, Monty Mobile partnered with Glo Ghana. Glo Ghana’s partnership with Monty Mobile is aimed to monitor and analyze any kind of leakage using its International A2P SMS hub.

- In October 2018, AdaptiveMobile launched Commercial Traffic Management (CTM), which is launched to capitalize on A2P traffic for managing the revenue leakage through grey routes. The platform will enable aggregators and operators with advanced capabilities, such as identifying, analyzing, and managing the A2P traffic.

Key questions addressed by the report

- What are the growth opportunities in the SMS firewall market?

- What is the competitive landscape scenario in the market?

- What are the regulations that are expected to have an impact on the market?

- What are the market dynamics of the SMS firewall market?

Frequently Asked Questions (FAQ):

What is the SMS Firewall market?

The SMS firewall market refers to an in-house and cloud-based SMS firewall platform/solution that helps Mobile Network Operators (MNOs) to safeguard Application-to-Person (A2P) and Person-to-Application (P2A) messaging traffic against all malicious attacks and provides end-to-end protection to text messages over the telecom network. The SMS firewall solution proactively detects, filters, and secures illicit national and international SMS traffic. It is a preemptive measure taken by MNOs to improve customer experience, reduce grey route traffic, and drive business revenue.

What is the forecast of the SMS firewall market in the next five years?

The global SMS firewall market size is expected to grow from USD 2.2 billion in 2020 to USD 3.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period.

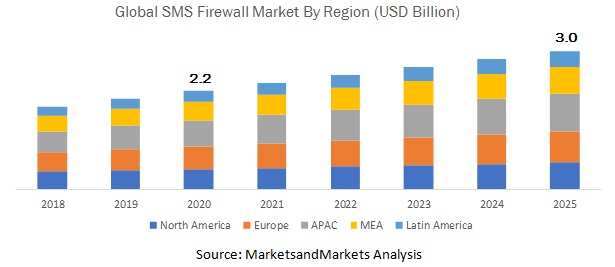

Which regions have the highest market shares in the SMS firewall market?

The APAC and Europe region have the highest market shares in the SMS firewall market, where these two regions together contribute approximately 45-50% to the global SMS firewall market in 2020.

What are the major factors that are anticipated to drive the SMS firewall market?

The telecom sector has been experiencing a massive change in terms of competition, technology advancements (5G), mergers and acquisitions, and the entrance of OTT players. Therefore, they are looking for an alternative source of revenue, which will help them regain the lost revenue from enterprises and individual customers. With growing RCS, A2P, and P2A messaging traffic, which is influenced by a range of services that enterprises are offering to their customers, such as banking and transaction details, insurance claim processing, location confirmation, and medical and appointment reminders. Moreover, this traffic is affected by spams, malicious attacks, and fraudulent activities. Therefore, telecom operators are willingly adopting SMS firewall solution to protect their networks and detect illegal SMS traffic that helps telecom operators scale up their business operations and enhance the customer experience. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

1.3 COVID-19 ECONOMIC ASSESSMENT

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 STAKEHOLDERS

1.8 CHANGE IN MARKET OUTLOOK

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key Industry Insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS FOR THE STUDY

2.6.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SMS FIREWALL MARKET

4.2 MARKET, BY DEPLOYMENT MODE

4.3 MARKET IN NORTH AMERICA, BY SMS TYPE AND SMS TRAFFIC

4.4 MARKET IN EUROPE, BY SMS TYPE AND SMS TRAFFIC

4.5 SMS FIREWALL MARKET IN ASIA PACIFIC, BY SMS TYPE AND SMS TRAFFIC

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 To combat against SMS fraudulent activities such as SMS phishing, SMS spoofing, and SMS spamming

5.2.1.2 Stringent government regulations and policies spurring the demand for SMS firewall globally

5.2.1.3 Increasing adoption of A2P SMS in the business such as BFSI, retail and eCommerce, and travel and hospitality

5.2.1.4 Safeguarding network from grey route traffic that causes significant revenue loss

5.2.2 RESTRAINTS

5.2.2.1 Entrance of OTT players into messaging businesses limiting the growth of A2P messages

5.2.3 OPPORTUNITIES

5.2.3.1 Growing trend of mobile marketing via SMS

5.2.3.2 Strong appeal for next-generation SMS firewall from mobile network operators

5.2.4 CHALLENGES

5.2.4.1 Vulnerabilities in existing signaling and firewall systems

5.2.4.2 SIM farm/box bypassing SMS firewall rules and policies

5.3 REGULATORY LANDSCAPE

5.3.1 UNITED STATES FEDERAL LAW CTIA COMMON SHORT CODE

5.3.2 AUSTRALIAN COMMUNICATIONS AND MEDIA AUTHORITY SPAM ACT 2003

5.3.3 UNITED KINGDOM CODE COMPLIANCE (PHONEPAYPLUS)

5.3.4 CANADA CWTA AND MMA CODE OF CONDUCT

5.3.5 SINGAPORE PERSONAL DATA PROTECTION COMMISSION

5.3.6 NEW ZEALAND MOBILE MESSAGING SERVICES CODE

5.3.7 IRELAND COMMISSION FOR COMMUNICATIONS REGULATION

5.3.8 TELECOM REGULATORY AUTHORITY OF INDIA

5.3.9 BRAZILIAN REGULATION BODY (ANATEL)

5.3.10 FRANCE COUNCIL FOR SERVICE APPLICATIONS

5.3.11 NETHERLANDS SMS SERVICE PROVISION CODE OF CONDUCT

5.3.12 SWEDEN CODE OF CONDUCT

5.3.13 RUSSIAN MINISTRY OF TELECOMMUNICATION

5.3.14 GERMANY YOUTH MEDIA PROTECTION TREATY

5.3.15 BAHRAIN REGULATION ON COMMERCIAL BULK MESSAGES

5.3.16 SOUTH AFRICA WIRELESS APPLICATION SERVICE PROVIDERS ASSOCIATION

5.3.17 CHINA PENALTY FOR SENDING SPAM

5.3.18 HONG KONG OFFICE OF THE TELECOMMUNICATIONS AUTHORITY

5.4 VALUE CHAIN ANALYSIS

5.5 CASE STUDY ANALYSIS

5.6 APPLICATION AREAS

5.6.1 BANKING, FINANCIAL SERVICES AND INSURANCE

5.6.2 IT AND TELECOM

5.6.3 MEDIA AND ENTERTAINMENT

5.6.4 TRAVEL AND HOSPITALITY

5.6.5 RETAIL AND ECOMMERCE

5.6.6 HEALTHCARE

5.6.7 GOVERNMENT

5.6.8 UTILITIES AND LOGISTICS

5.7 TECHNOLOGICAL IMPACT

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 ANALYTICS

6 COVID-19 IMPACT ON SMS FIREWALL MARKET (Page No. - 69)

6.1 SMS FIREWALL MARKET SCENARIO DURING COVID–19

6.1.1 SUPPLY SIDE

6.1.2 DEMAND SIDE

7 SMS FIREWALL MARKET, BY COMPONENT (Page No. - 74)

7.1 INTRODUCTION

7.2 SMS FIREWALL PLATFORM

7.2.1 SMS FIREWALL PLATFORM: MARKET DRIVERS

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.1.1 Professional services: market drivers

7.3.2 MANAGED SERVICES

7.3.2.1 Managed services: market drivers

8 SMS FIREWALL MARKET ANALYSIS, BY SMS TYPE (Page No. - 84)

8.1 INTRODUCTION

8.2 A2P MESSAGES

8.2.1 A2P MESSAGES: MARKET DRIVERS

8.3 P2A MESSAGES

8.3.1 P2A MESSAGES: MARKET DRIVERS

9 SMS FIREWALL MARKET, BY SMS TRAFFIC (Page No. - 91)

9.1 INTRODUCTION

9.2 NATIONAL SMS TRAFFIC

9.2.1 NATIONAL SMS TRAFFIC: MARKET DRIVERS

9.3 INTERNATIONAL SMS TRAFFIC

9.3.1 INTERNATIONAL SMS TRAFFIC: MARKET DRIVERS

10 SMS FIREWALL MARKET, BY DEPLOYMENT MODE (Page No. - 95)

10.1 INTRODUCTION

10.2 ON-PREMISES

10.2.1 ON-PREMISES: MARKET DRIVERS

10.3 CLOUD

10.3.1 CLOUD: MARKET DRIVERS

11 SMS FIREWALL MARKET, BY REGION (Page No. - 100)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 UNITED STATES

11.2.1.1 United States: market drivers

11.2.2 CANADA

11.2.2.1 Canada: market drivers

11.3 EUROPE

11.3.1 UNITED KINGDOM

11.3.1.1 United Kingdom: market drivers

11.3.2 GERMANY

11.3.2.1 Germany: SMS firewall market drivers

11.3.3 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 CHINA

11.4.1.1 China: market drivers

11.4.2 JAPAN

11.4.2.1 Japan: market drivers

11.4.3 INDIA

11.4.3.1 India: market drivers

11.4.4 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 KINGDOM OF SAUDI ARABIA

11.5.1.1 Kingdom of Saudi Arabia: SMS firewall market drivers

11.5.2 SOUTH AFRICA

11.5.2.1 South Africa: market drivers

11.5.3 REST OF MIDDLE EAST AFRICA

11.6 LATIN AMERICA

11.6.1 BRAZIL

11.6.1.1 Brazil: market drivers

11.6.2 MEXICO

11.6.2.1 Mexico: SMS firewall market drivers

11.6.3 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 155)

12.1 OVERVIEW

12.2 COMPETITIVE SITUATION AND TRENDS

12.2.1 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

12.2.2 NEW PRODUCT/SERVICE DEVELOPMENTS

12.2.3 MERGERS AND ACQUISITIONS

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 VISIONARY LEADERS

12.3.2 INNOVATORS

12.3.3 DYNAMIC DIFFERENTIATORS

12.3.4 EMERGING COMPANIES

12.4 STRENGTH OF PRODUCT PORTFOLIO

12.5 BUSINESS STRATEGY EXCELLENCE

12.6 VENDOR RANKING ANALYSIS

13 COMPANY PROFILES (Page No. - 164)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, RightToWin)*

13.1 ANAM

13.2 COMVIVA

13.3 INFOBIP

13.4 MOBILEUM

13.5 SINCH

13.6 ADAPTIVEMOBILE

13.7 BICS

13.8 MONTY MOBILE

13.9 PROOFPOINT

13.10 ROUTE MOBILE

13.11 6D TECHNOLOGIES

13.12 AMD TELECOM

13.13 BROADNET TECHNOLOGIES

13.14 CELLUSYS

13.15 EASTWIND

13.16 ENGHOUSE NETWORKS

13.17 GLOBAL WAVENET

13.18 HAUD

13.19 MAVENIR

13.20 MITTO

13.21 MYLINEX

13.22 NETNUMBER

13.23 NEWNET

13.24 OMOBIO

13.25 OPENMIND NETWORKS

13.26 SAP

13.27 SYNIVERSE

13.28 TANGO TELECOM

13.29 TANLA

13.30 TATA COMMUNICATIONS

13.31 TELEOSS

13.32 TWILIO

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, RightToWin might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 216)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (114 Tables)

TABLE 1 FACTOR ANALYSIS

TABLE 2 COMMON SMS ATTACKS ON MOBILE PHONES

TABLE 3 GOVERNMENT REGULATIONS/POLICIES/INITIATIVES: TO SAFEGUARD SMS FROM ATTACKERS

TABLE 4 CASE STUDY: INDOSAT OOREDOO, INDONESIA

TABLE 5 CASE STUDY: VIETNAMOBILE, VIETNAM

TABLE 6 CASE STUDY: AFRICA’S LEADING MOBILE NETWORK OPERATOR

TABLE 7 CASE STUDY: ETISALAT, SRI LANKA

TABLE 8 CASE STUDY: IDEA CELLULAR, INDIA

TABLE 9 CASE STUDY: LARGE MOBILE NETWORK OPERATOR, ASIA PACIFIC

TABLE 10 SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 11 SMS FIREWALL PLATFORM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 13 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 MANAGED SERVICES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 16 A2P MESSAGES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 P2A MESSAGES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 SMS FIREWALL MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 19 NATIONAL SMS TRAFFIC: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 INTERNATIONAL SMS TRAFFIC: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 22 ON-PREMISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 SMS FIREWALL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 NORTH AMERICA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 UNITED STATES: KEY MOBILE TRENDS, 2018

TABLE 32 UNITED STATES: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 33 UNITED STATES: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 34 UNITED STATES: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 35 UNITED STATES: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 36 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 37 CANADA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 38 CANADA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 39 CANADA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 40 CANADA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: SMS FIREWALL MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 UNITED KINGDOM: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 49 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 50 UNITED KINGDOM: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 51 UNITED KINGDOM: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 52 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 53 GERMANY: EXTERNAL REVENUE FROM MOBILE SERVICES (EURO BILLIONS)

TABLE 54 GERMANY: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 55 GERMANY: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 56 GERMANY: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 58 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 CHINA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 66 CHINA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 67 CHINA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 68 CHINA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 70 JAPAN: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 71 JAPAN: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 72 JAPAN: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 73 JAPAN: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 74 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 75 INDIA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 76 INDIA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 77 INDIA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 78 INDIA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 79 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 86 KINGDOM OF SAUDI ARABIA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 87 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 88 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 89 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 90 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AFRICA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 93 SOUTH AFRICA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 94 SOUTH AFRICA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 96 LATIN AMERICA: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 102 BRAZIL: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 103 BRAZIL: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 104 BRAZIL: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 105 BRAZIL: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 106 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 107 MEXICO: SMS FIREWALL MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 108 MEXICO: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 109 MEXICO: MARKET SIZE, BY SMS TYPE, 2018–2025 (USD MILLION)

TABLE 110 MEXICO: MARKET SIZE, BY SMS TRAFFIC, 2018–2025 (USD MILLION)

TABLE 111 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 112 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS, 2018–2020

TABLE 113 NEW PRODUCT/SERVICE DEVELOPMENTS, 2018

TABLE 114 MERGERS AND ACQUISITIONS, 2019

LIST OF FIGURES (81 Figures)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 6 SMS FIREWALL MARKET: RESEARCH DESIGN

FIGURE 7 DATA TRIANGULATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): SMS FIREWALL MARKET

FIGURE 11 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

FIGURE 12 MARKET HOLISTIC VIEW

FIGURE 13 MARKET: GROWTH TREND

FIGURE 14 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 15 GROWTH IN A2P MESSAGING TRAFFIC TO DRIVE THE SMS FIREWALL MARKET GROWTH DURING THE FORECAST PERIOD

FIGURE 16 ON-PREMISES SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 17 APPLICATION TO PERSON AND NATIONAL SMS TRAFFIC SEGMENTS TO ACCOUNT FOR HIGH MARKET SHARES IN NORTH AMERICA IN 2020

FIGURE 18 APPLICATION TO PERSON AND NATIONAL SMS TRAFFIC SEGMENTS TO ACCOUNT FOR HIGH MARKET SHARES IN EUROPE IN 2020

FIGURE 19 APPLICATION TO PERSON AND NATIONAL SMS TRAFFIC SEGMENT TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

FIGURE 20 SMS FIREWALL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 21 TYPES OF FRAUDS AND THEIR IMPACT ON A2P MONETIZATION

FIGURE 22 IMPACT OF SUCCESSFUL PHISHING ATTACKS

FIGURE 23 USAGE OF MESSAGING SERVICE BY ENTERPRISE

FIGURE 24 A2P MESSAGE TRAFFIC, BY INDUSTRY VERTICAL

FIGURE 25 EMERGENCE OF GREY ROUTE SMS

FIGURE 26 KEY CHALLENGES FACED BY MOBILE NETWORK OPERATOR

FIGURE 27 UNITED STATES: SMS USAGE

FIGURE 28 SMS FARM ECOSYSTEM

FIGURE 29 SMS FIREWALL MARKET: VALUE CHAIN ANALYSIS

FIGURE 30 SMS FIREWALL MARKET: PRE- AND POST-COVID-19 MARKET SIZE (USD MILLION)

FIGURE 31 TECHNOLOGY IMPACT

FIGURE 32 COVID-19-RELATED SMS COMPLAINTS

FIGURE 33 COVID-19: CROSS-SECTOR IMPACT

FIGURE 34 SERVICES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 35 TELECOMMUNICATION FRAUD (USD BILLION)

FIGURE 36 UNITED STATES: SMS SMISHING ATTACKS

FIGURE 37 MANAGED SERVICES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 38 APPLICATION-TO-PERSON MESSAGES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 39 MOBILE SUBSCRIPTION PENETRATION (% OF POPULATION)

FIGURE 40 MOBILE SUBSCRIPTION (MILLION)

FIGURE 41 INTERNATIONAL SMS TRAFFIC SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 42 CLOUD SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 43 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 44 ASIA PACIFIC TO EXHIBIT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 45 NORTH AMERICA: NUMBER OF MOBILE SUBSCRIBERS, 2018

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 47 UNITED STATES: COVID-19-RELATED SCAM MESSAGES/CALLS, 2020

FIGURE 48 UNITED STATES: WIRELESS DATA TRAFFIC, 2018

FIGURE 49 UNITED STATES: TOTAL AMERICANS WHO LOST MONEY DUE TO SCAM CALLS, 2020

FIGURE 50 UNITED STATES: PERCENTAGE OF SCAM CALLS OVER VARIOUS DEVICES, 2020

FIGURE 51 CANADA: MOBILE SUBSCRIBERS, 2019

FIGURE 52 CANADA: FREQUENCY OF COMMUNICATION VIA SMS, 2018

FIGURE 53 EUROPE: TOTAL TELECOMMUNICATIONS REVENUE, 2015–2019

FIGURE 54 EUROPE: TELECOMMUNICATIONS REVENUE BY SEGMENT, 2018

FIGURE 55 UNITED KINGDOM: TELECOM REVENUES (EURO BILLIONS)

FIGURE 56 UNITED KINGDOM: MOBILE SUBSCRIPTIONS, BY SUBSCRIPTION TYPE (MILLIONS)

FIGURE 57 UNITED KINGDOM: AVERAGE MONTHLY MESSAGES, BY SUBSCRIPTION TYPE (MILLIONS)

FIGURE 58 GERMANY: SMS MESSAGES SENT (BILLIONS)

FIGURE 59 ASIA PACIFIC: NETWORK TRANSFORMATION STRATEGY

FIGURE 60 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 61 JAPAN: SHARE OF MOBILE COMMUNICATION SUBSCRIBERS, 2019

FIGURE 62 INDIA: TOP SPAMMERS, 2019

FIGURE 63 INDIA: PERCENTAGE OF SPAM TEXTS OVER A DURATION, 2019

FIGURE 64 SOUTH AFRICA: NUMBER OF MOBILE SUBSCRIBERS, 2019 (MILLIONS)

FIGURE 65 SOUTH AFRICA: AVERAGE NUMBER OF SPAM MESSAGES/USER/ MONTH

FIGURE 66 SOUTH AFRICA: TOP SPAMMERS, 2019

FIGURE 67 BRAZIL: TOP SPAMMERS IN 2019

FIGURE 68 COMPANIES ADOPTED PARTNERSHIP, COLLABORATION, AND AGREEMENT AS THE KEY GROWTH STRATEGY DURING THE PERIOD 2019–2020

FIGURE 69 MARKET EVALUATION FRAMEWORK, 2018–2020

FIGURE 70 PARTNERSHIP, AGREEMENT, AND COLLABORATION HAS BEEN ADOPTED AS A KEY STRATEGY FOR COMPANY GROWTH

FIGURE 71 GLOBAL SMS FIREWALL MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 72 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SMS FIREWALL MARKET

FIGURE 73 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SMS FIREWALL MARKET

FIGURE 74 RANKING OF KEY PLAYERS, 2020

FIGURE 75 ANAM: SWOT ANALYSIS

FIGURE 76 COMVIVA: SWOT ANALYSIS

FIGURE 77 INFOBIP: SWOT ANALYSIS

FIGURE 78 MOBILEUM: SWOT ANALYSIS

FIGURE 79 SINCH: COMPANY SNAPSHOT

FIGURE 80 SINCH: SWOT ANALYSIS

FIGURE 81 PROOFPOINT: COMPANY SNAPSHOT

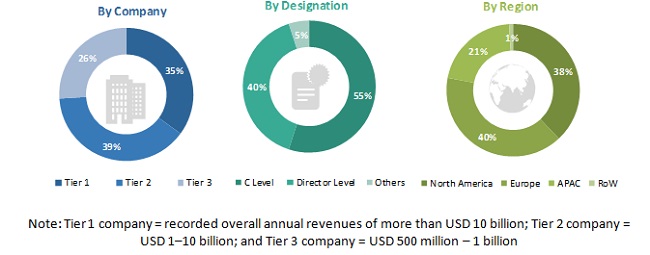

The study involved four major activities in estimating the current market size for the Short Message Service (SMS) firewall market. Exhaustive secondary research was done to collect information on the SMS firewall market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the SMS firewall market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS) and Scientific.Net; and various associations, including the European Association of Next Generation Telecommunications Innovators (EANGTI) and International Telecommunication Union (ITU) were referred to, for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market’s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the SMS firewall market. The primary sources from the demand side included telecom operators, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from telecom and government associations.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

SMS Firewall Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the SMS firewall market. The first approach involves the estimation of the market size by summing up companies’ revenue generated through the sale of solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the SMS firewall market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer solutions and services in the SMS firewall market was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solution and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global SMS firewall market based on components, services, SMS types, SMS traffic, deployment mode, and region from 2020 to 2025, and analyze various macro and microeconomic factors affecting the market growth

- To forecast the size of the market segments for five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the SMS firewall market

- To analyze each submarket for individual growth trends, prospects, and contributions to the global market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the global market

- To profile the key market players, such as top vendors and startups; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations, in the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the SMS firewall market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in SMS Firewall Market