Next-Generation Solar Cell Market by Material Type (Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon, Gallium-Arsenide, Others), Installation (On-Grid, Off-Grid), End User and Geography - Global Forecast to 2028

Updated on : October 22, 2024

Next-Generation Solar Cell Market Size

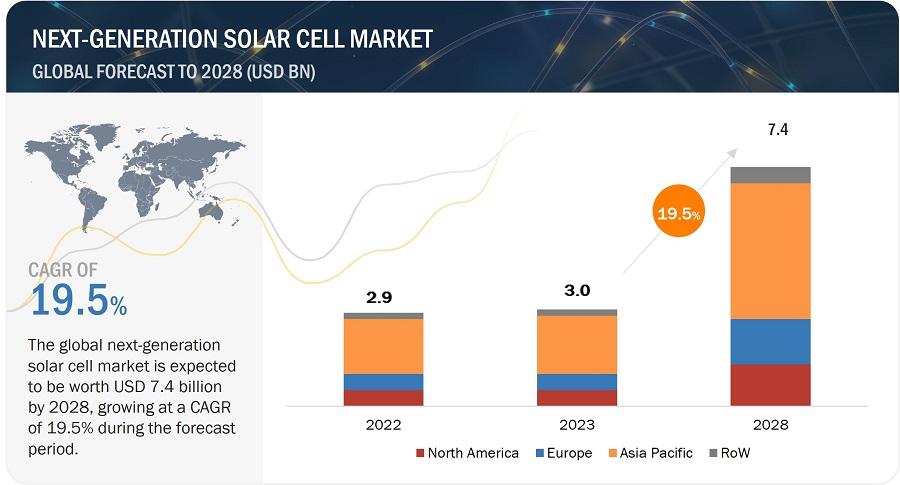

The next-generation solar cell market size is valued at USD 3.0 billion in 2023 and is projected to reach USD 7.4 billion by 2028, growing at a CAGR of 19.5% during the forecast period from 2023 to 2028.

High installation cost is a major restraint on the market's growth. One of the major challenges for the market is supply chain. The supply chain requires collaborating with industry stakeholders, material suppliers, manufacturers, and research institutes.

Next-Generation Solar Cell Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Next-Generation Solar Cell Market Trends and Dynamics:

Driver: Technological advancements in next-generation solar cells

The solar cell has different generations based on development. The first-generation solar cell includes solar cells based on crystalline silicon material. The second-generation solar cells are thin film solar cells which is the primary focus of this report. It includes materials cadmium telluride (CdTe), amorphous silicon (a-Si), copper indium gallium selenide (CIGS), and Gallium Arsenide (GaAs). The third generation of solar cells is new in the next-generation solar cell market; some are not yet commercialized. Third-generation solar cells in organic solar cells, dye-sensitized solar cells, and perovskite solar cells have been included in other sections. Technological advancements such as the development of Thin-Film technology are making it possible to create solar cells that are more efficient, cost-effective, and durable while using less material. For instance, In June 2022, researchers at Princeton University developed the first commercially viable perovskite solar cells, which can be manufactured at room temperature and requires less energy to produce than any other solar cell, such as silicon-based solar cells.

Overall, the empowerment and development of new and improved solar cell technologies are helping to make solar energy more cost-effective and practical for a broader range of applications. As solar power technologies continue to evolve and mature, they are expected to grow during the forecast period.

Restraint: High installation costs

Solar energy is cost competitive compared to traditional fossil fuels, but the installation costs of solar cells are relatively high, which is a significant barrier for homeowners and businesses, especially with limited financial resources. The permits and inspection costs from local authorities depend highly on locations and the installed system type. In some cases, additional equipment such as inverters, batteries, and monitoring systems costs can add up. Labor costs can also be a significant factor in solar installation costs. Highly skilled workers are often required to install solar panels and related equipment, and these workers may charge higher wages. Other factors, such as site preparation for solar installation, can also be costly, particularly in cases where the ground needs to be leveled or other site preparation is required.

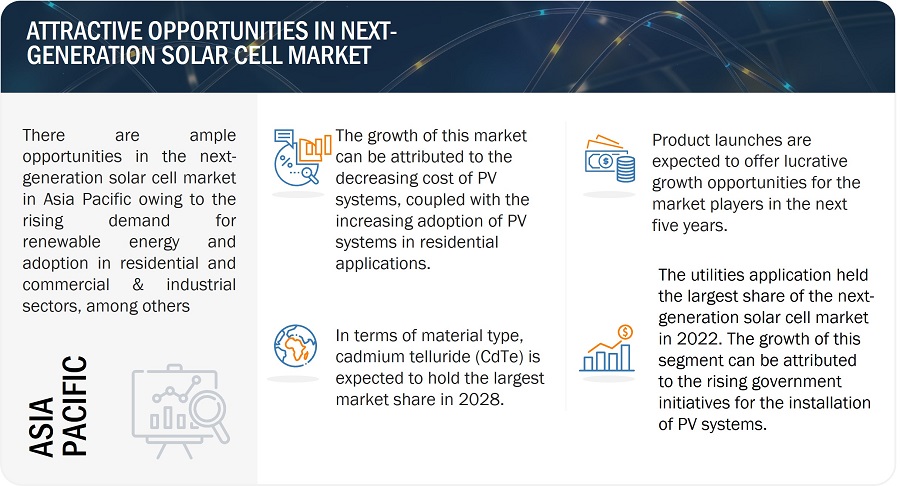

Opportunity: Surging demand for renewable energy

In the past few years, the demand for renewable energy has surged. With governments worldwide coming together for initiatives such as the Paris Climate Agreement, the demand for renewable energy, such as solar, is set to rise in the coming years. According to a 2018 report by the International Energy Agency, renewables will have the fastest growth in the electricity sector, catering to almost 30% of the power demand by 2023. During this period, renewables are forecast to account for more than 70% of global electricity generation, led by solar PV. Moreover, according to a March 2020 report by the International Renewable Energy Agency, solar and wind energy continued to dominate renewable capacity expansion, jointly accounting for 90% of all net renewable additions in 2019. Solar energy prices are already below retail electricity prices in major countries such as China. Besides, the cost of solar power is anticipated to decline by 15–35% by 2024, which is expected to spur the demand for solar cells and create growth opportunities for the next-generation solar cell market players.

Challenge: Supply chain issues in the next-generation solar cell market

Although there are many promising advantages of next-generation solar cells over traditional solar cells, some challenges need to be addressed before next-generation solar cells are widely adopted. Some of these challenges are the manufacturing costs of next-generation solar cells. The cost is generally higher than that of traditional solar cells. As the next-generation solar cells are not widely adopted, and their efficiency is still under research, they are manufactured in scale, so the cost is usually high. As the next-generation solar cells are still in the early stages of development, scaling up their production needs for large-scale energy systems will be challenging. New manufacturing techniques and supply chains will need to be developed to support their mass production.

Along with this, toxicity is one of the major concerns. Some next-generation solar cells, such as those based on cadmium, contain toxic materials that can pose health and environmental risks. Finding safe and sustainable materials for use in these cells will be an essential consideration for their widespread adoption. Thus, the harmful effects of these toxic materials are expected to hamper their demand and market growth challenges.

Next-Generation Solar Cell Market Ecosystem:

Next-Generation Solar Cell Market Segmentation

Perovskites solar cells, organic solar cells, and dye-sensitized solar cells materials to hold the highest CAGR during the forecast period

Other material includes perovskites solar cells, organic solar cell, and dye-sensitized solar cells. Perovskite-structured materials used in solar cells are generally hybrid organic-inorganic lead or tin-halide materials, such as methylammonium lead halide. The fabrication of these materials is simple and inexpensive as they are solution-processed. Hybrid metal halide perovskite solar cells (PSCs) have garnered great attention due to their low price, thinner design, low-temperature processing, and excellent light absorption properties (good performance under low and diffuse light).

Aerospace & defense and portable electronic devices end-user industries segment to dominate the market during the forecast period

Other end-user industries include aerospace & defense and portable electronic devices. In the aerospace & defense vertical, solar panels are used in drones and high-altitude pseudo satellites (HAPS). Aerospace & defense vertical companies are constantly developing solar energy-based products to meet the cost and energy demands while maximizing the aerodynamic efficiency to perform missions efficiently. Solar cell-powered aircraft fly at higher elevations for long periods but with relatively limited applications, such as a tiny wing loading for cargo.

Next-Generation Solar Cell Industry Regional Analysis

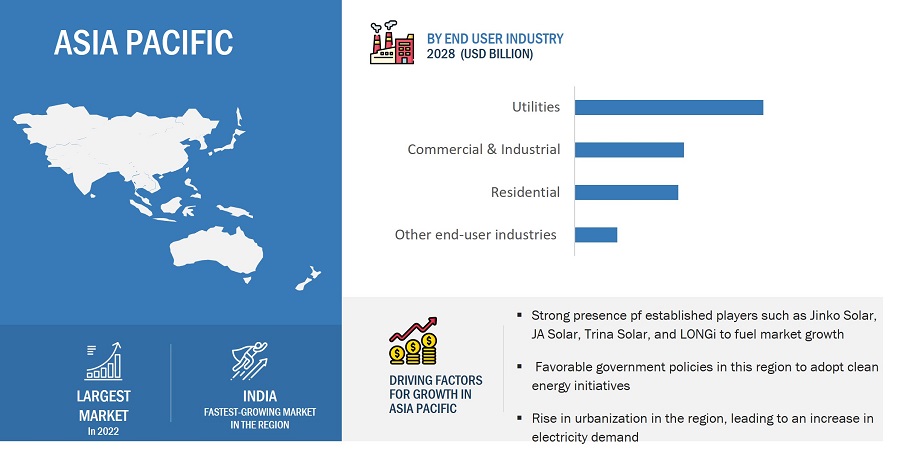

Asia Pacific region is expected to exhibit the highest CAGR during the forecast period

Asia Pacific is expected to continue to dominate the next-generation solar cell market from 2023 to 2028. The growing adoption of PV modules in countries such as China, Japan, and India is fueling the regional market's growth. Next-generation solar cells have higher efficiency and excellent natural and artificial light performance than silicon-based cells. The thickness of a next-generation solar cell is under one micron and can be manufactured at low temperatures using low-cost technologies, such as printing.

Next-Generation Solar Cell Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Next-Generation Solar Cell Companies - Key Market Players

- First Solar (US),

- Hanwha Q CELLS (South Korea),

- Ascent Solar Technologies (US),

- Oxford PV (UK),

- Kaneka Solar Energy (Japan),

- Flisom (Switzerland),

- Solactron (US),

- Mitsubishi Chemical Group (Japan),

- MiaSole (US),

- Hanergy thin film power group (China) are some key players operating in the Next-Generation Solar Cell Companies.

Next-Generation Solar Cell Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 3.0 billion in 2023 |

|

Expected Value |

USD 7.4 billion by 2028 |

|

Growth Rate |

CAGR of 19.5% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Market Leaders |

Hanwha Q CELLS (South Korea), Oxford PV (UK), Kaneka Solar Energy (Japan), Flisom (Switzerland), Mitsubishi Chemical Group (Japan), and Hanergy thin film power group (China), Heliatek (Germany), 3D-Micromac(Germany), Suntech Power Holdings (China), Sharp Corporation(Japan), Trina Solar (China), Panasonic Corporation(Japan), Sol Voltaics(Sweden), Geo Green Power(England), Jinko Solar (China), Canadian Solar(Canada), Yingli Solar(China), REC Group(Norway) |

|

Top Companies in North America |

First Solar (US), Ascent Solar Technologies (US), Solactron (US), MiaSole (US), Polysolar Technology (US), NanoPV technologies(US), Sunpower Corporation(US) |

|

Key Market Driver |

Technological advancements in next-generation solar cells |

|

Key Market Opportunity |

Surging demand for renewable energy |

|

Largest Growing Region |

Asia Pacific |

|

Highest CAGR |

Residential end-user industry |

Next-Generation Solar Cell Market Highlights

This research report categorizes the next-generation solar cell market based on material type, installation, end-user industry, and region.

|

Segment |

Subsegment |

|

By Material Type |

|

|

By Installation |

|

|

By End User Industry |

|

|

By Region |

|

Recent developments in Next-Generation Solar Cell Industry

- In July 2022, Hanwha Q CELLS acquired 66% of LYNQTECH GmbH, a subsidiary of enercity AG, to further its focus as a full-service provider of clean energy solutions for residential and commercial end-users.

- In April 2022, First Solar announced that its responsibly produced photovoltaic (PV) solar module technology would power 17% of the annual energy needs of Nevada Gold Mines (NGM), the single largest gold-producing complex in the world. NGM is a joint venture between Barrick Gold Corporation and Newmont Corporation operated by Barrick.

- In January 2022, Ascent Solar Technologies partnered with Momentus, a developer and manufacturer of novel 'last mile space solutions, to produce customized, flexible CIGS PV modules to provide power to a demonstration deployable PV array to fly on an upcoming Vigoride spacecraft—scheduled for flight in 2022.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the next-generation solar cell market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies adopted by the key players to grow in the next-generation solar cell market.

Which is the potential market for the end use application?

The Asia Pacific region will dominate the next-generation solar cell market.

What end-user industry dominates the next-generation solar cell market?

Utilities are expected to dominate the next-generation solar cell market.

Which material type dominates the next-generation solar cell market?

Cadmium Telluride (CdTe) is expected to have the largest market size during the forecast period.

Who are the major companies in the next-generation solar cell market?

First Solar (US), Hanwha Q CELLS (South Korea), Ascent Solar Technologies (US), Oxford PV (UK), Kaneka Solar Energy (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advancements in next-generation solar cell technology- Advantages of next-generation over traditional solar cells- Government initiatives in solar PV projects- Increasing demand for solar cells in residential and commercial sectorsRESTRAINTS- High installation costs and requirement for skilled workforce- Intense competition from players providing other renewable resources, including wind power and hydropowerOPPORTUNITIES- Surging demand for renewable energyCHALLENGES- Supply chain challenges in next-generation solar cell technologies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 CASE STUDY ANALYSISSUNPOWER MANUFACTURES HIGH-EFFICIENCY SOLAR PANELS FOR CUSTOMERS WITH LIMITED BUDGETSHANWHA Q CELLS HELPS COPENHAGEN ZOO IMPLEMENT C&I ROOFTOP SYSTEM TO MEET SUSTAINABILITY GOALSHARP HELPS BIG C SUPERMARKET (THAILAND) INSTALL ROOFTOP SOLAR PANELSSHARP INSTALLS ROOFTOP SOLAR PANELS FOR HEWLETT PACKARD (HP) TO MINIMIZE CARBON FOOTPRINTTATA POWER SOLAR COMMISSIONS 3 MW SOLAR PV POWER PLANT IN IRON ORE MINE AT NOAMUNDI

- 5.5 TECHNOLOGY ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 ECOSYSTEM/MARKET MAP

-

5.8 PATENT ANALYSIS

-

5.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.10 REGULATORY LANDSCAPE AND STANDARDSREGULATORY COMPLIANCE- Regulations- Standards

-

5.11 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERSREVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF PV MODULES OFFERED BY MARKET PLAYERSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ON-GRIDFOCUS ON REDUCING TRANSMISSION LOSSES AND STRAIN ON GRIDS TO INCREASE DEMAND FOR ON-GRID SOLAR CELLS

-

6.3 OFF-GRIDGROWING USE OF OFF-GRID SOLAR SYSTEMS IN REMOTE AREAS, CABINS, BOATS, AND RVS TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 AMORPHOUS SILICON (A-SI)BETTER PERFORMANCE OF A-SI IN LOW-LIGHT CONDITIONS TO BOOST ITS DEMANDCOPPER INDIUM GALLIUM SELENIDE (CIGS)- High demand for lightweight and flexible solar modules for rooftops and portable electronics to fuel segmental growthCADMIUM TELLURIDE (CDTE)- Low manufacturing cost of CdTe solar modules to propel marketGALLIUM ARSENIDE- High resistance, flexibility, and stability of GaAs PV cells at higher temperatures to fuel segmental growthOTHER MATERIALS- Perovskite- Dye-synthesized- Organic

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALGOVERNMENT SUBSIDIES TO BOOST ADOPTION OF SOLAR CELLS IN RESIDENTIAL APPLICATIONS

-

8.3 COMMERCIAL & INDUSTRIALENVIRONMENTAL, ECONOMIC, AND TAX BENEFITS TO SUPPORT MARKET GROWTH FOR COMMERCIAL & INDUSTRIAL APPLICATIONS

-

8.4 UTILITIESNEED FOR RELIABLE AND CONSISTENT SOURCE OF ELECTRICITY BY UTILITIES TO DRIVE MARKET

- 8.5 OTHER END-USER INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Rise in state and federal policies and programs to boost adoption of PV modulesCANADA- Abundance of solar energy resources and large areas for installations to drive marketMEXICO- Booming solar industry to boost demand for next-generation solar cellsIMPACT OF RECESSION ON MARKET IN NORTH AMERICA

-

9.3 EUROPEGERMANY- Growing adoption of PV systems to propel marketUK- Increasing installation of PV systems to harness solar resources to foster market growthFRANCE- Collaboration between solar technology providers and government to boost PV installation capacityITALY- Rising investments in R&D of solar energyREST OF EUROPEIMPACT OF RECESSION ON MARKET IN EUROPE

-

9.4 ASIA PACIFICCHINA- Rapid expansion of solar industry to boost demand for next-generation solar cellsJAPAN- Large presence of floating PV plants to fuel marketINDIA- Government-led developments in next-generation solar cells to accelerate market growthSOUTH KOREA- Focus on powering every public building with solar energy to boost demand for solar cellsREST OF ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

-

9.5 ROWSOUTH AMERICA- R&D on perovskite solar cells to contribute to market growthMIDDLE EAST & AFRICA- Increasing adoption of PV technology to support market growthIMPACT OF RECESSION ON MARKET IN ROW

- 10.1 INTRODUCTION

- 10.2 OVERVIEW

- 10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.4 NEXT-GENERATION SOLAR CELL MARKET SHARE ANALYSIS, 2022

- 10.5 THREE-YEAR COMPANY REVENUE ANALYSIS

-

10.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

10.7 NEXT-GENERATION SOLAR CELL STARTUPS/SMES QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

11.1 KEY COMPANIESFIRST SOLAR- Business overview- Recent developments- MnM viewHANWHA Q CELLS- Business overview- Recent developments- MnM viewASCENT SOLAR TECHNOLOGIES- Business overview- MnM viewOXFORD PHOTOVOLTAICS (PV)- Business overview- Products offered- Recent developments- MnM viewKANEKA SOLAR ENERGY- Business overview- Products offered- MnM viewFLISOM- Business overviewSOLACTRON- Business overviewMITSUBISHI CHEMICAL GROUP- Business overview- Products offeredMIASOLE- Business overview- Products offered- Recent developmentsHANERGY THIN FILM POWER GROUP- Business overview- Products offered

-

11.2 OTHER KEY PLAYERSHELIATEKPOLYSOLAR TECHNOLOGYNANOPV SOLAR3D-MICROMAC AGSUNTECH POWER HOLDINGS CO., LTD.SHARP CORPORATION LIMITEDTRINA SOLARPANASONIC CORPORATIONSOL VOLTAICSGEO GREEN POWERJINKO SOLARCANADIAN SOLAR INC.SUNPOWER CORPORATIONYINGLI SOLARREC GROUP

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 ANALYSIS OF RISK FACTORS

- TABLE 2 TECHNOLOGIES IN SOLAR CELL ECOSYSTEM

- TABLE 3 NEXT-GENERATION SOLAR CELL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 PLAYERS AND THEIR ROLE IN ECOSYSTEM

- TABLE 5 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 6 LIST OF PATENTS

- TABLE 7 IMPORT DATA, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 8 EXPORT DATA, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRY (%)

- TABLE 14 AVERAGE SELLING PRICE OF PHOTOVOLTAIC MODULES, 2022

- TABLE 15 AVERAGE SELLING PRICE OF PV SYSTEMS, BY END-USER INDUSTRY

- TABLE 16 AVERAGE SELLING PRICE OF PV MODULES OFFERED BY KEY PLAYERS, BY END-USER INDUSTRY (USD/WATT)

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 18 MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 19 MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 20 MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 21 AMORPHOUS SILICON (A-SI): MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 AMORPHOUS SILICON (A-SI): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 AMORPHOUS SILICON (A-SI): MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 24 AMORPHOUS SILICON (A-SI): MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 25 COPPER INDIUM GALLIUM SELENIDE (CIGS): MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 COPPER INDIUM GALLIUM SELENIDE (CIGS): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 COPPER INDIUM GALLIUM SELENIDE (CIGS): MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 28 COPPER INDIUM GALLIUM SELENIDE (CIGS): MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 29 CADMIUM TELLURIDE (CDTE): MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 CADMIUM TELLURIDE (CDTE): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 CADMIUM TELLURIDE (CDTE): MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 32 CADMIUM TELLURIDE (CDTE): MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 33 GALLIUM ARSENIDE (GAAS): MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 GALLIUM ARSENIDE (GAAS): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 GALLIUM ARSENIDE (GAAS): MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 GALLIUM ARSENIDE (GAAS): MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 OTHER MATERIALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 OTHER MATERIALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 OTHER MATERIALS: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 40 OTHER MATERIALS: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 42 MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 RESIDENTIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 RESIDENTIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 RESIDENTIAL: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 46 RESIDENTIAL: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 47 COMMERCIAL & INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 COMMERCIAL & INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 COMMERCIAL & INDUSTRIAL: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 50 COMMERCIAL & INDUSTRIAL: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 51 UTILITIES: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 52 UTILITIES: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 53 UTILITIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 OTHER END-USER INDUSTRIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 OTHER END-USER INDUSTRIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER END-USER INDUSTRIES: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 58 OTHER END-USER INDUSTRIES: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 US: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 68 US: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 69 CANADA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 70 CANADA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 MEXICO: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 72 MEXICO: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 80 GERMANY: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 UK: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 82 UK: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 FRANCE: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 84 FRANCE: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 85 ITALY: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 86 ITALY: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 CHINA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 96 CHINA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 97 JAPAN: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 98 JAPAN: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 INDIA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 100 INDIA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 105 ROW: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 106 ROW: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 ROW: MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 108 ROW: MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 109 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 115 OVERVIEW OF STRATEGIES DEPLOYED BY KEY NEXT-GENERATION SOLAR CELL MANUFACTURERS

- TABLE 116 DEGREE OF COMPETITION, 2022

- TABLE 117 NEXT-GENERATION SOLAR CELL MARKET: RANKING ANALYSIS

- TABLE 118 OVERALL COMPANY FOOTPRINT

- TABLE 119 COMPANY MATERIAL TYPE FOOTPRINT

- TABLE 120 COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 121 COMPANY REGION FOOTPRINT

- TABLE 122 MARKET: PRODUCT LAUNCHES, JANUARY 2019–MARCH 2023

- TABLE 123 MARKET: DEALS, JANUARY 2019–MARCH 2023

- TABLE 124 FIRST SOLAR: BUSINESS OVERVIEW

- TABLE 125 FIRST SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 FIRST SOLAR: DEALS

- TABLE 127 HANWHA Q CELLS: BUSINESS OVERVIEW

- TABLE 128 HANWHA Q CELLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HANWHA Q CELLS: PRODUCT LAUNCHES

- TABLE 130 HANWHA Q CELLS: DEALS

- TABLE 131 ASCENT SOLAR TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 132 ASCENT SOLAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED.

- TABLE 133 ASCENT SOLAR TECHNOLOGIES: DEALS

- TABLE 134 OXFORD PV: COMPANY OVERVIEW

- TABLE 135 OXFORD PV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 OXFORD PV: DEALS

- TABLE 137 OXFORD PV: OTHERS

- TABLE 138 KANEKA SOLAR ENERGY: COMPANY OVERVIEW

- TABLE 139 KANEKA SOLAR ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 FLISOM: BUSINESS OVERVIEW

- TABLE 141 FLISOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 FLISOM: OTHERS

- TABLE 143 SOLACTRON: BUSINESS OVERVIEW

- TABLE 144 SOLACTRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED.

- TABLE 145 MITSUBISHI CHEMICAL GROUP: COMPANY OVERVIEW

- TABLE 146 MITSUBISHI CHEMICAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 MIASOLE: COMPANY OVERVIEW

- TABLE 148 MIASOLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 MIASOLE: DEALS

- TABLE 150 MIASOLE: OTHERS

- TABLE 151 HANERGY THIN FILM POWER GROUP: COMPANY OVERVIEW

- TABLE 152 HANERGY THIN FILM POWER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 NEXT-GENERATION SOLAR CELL MARKET

- FIGURE 2 PROCESS FLOW: MARKET SIZE ESTIMATION

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- FIGURE 8 RECESSION IMPACT: GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 9 RECESSION IMPACT ON MARKET, 2019–2028 (USD MILLION)

- FIGURE 10 CADMIUM TELLURIDE SEGMENT TO HOLD LARGEST SHARE OF MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 UTILITIES SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC HELD LARGEST SIZE OF MARKET IN 2022

- FIGURE 13 MARKET TO GROW AT SIGNIFICANT RATE OWING TO INCREASING DEMAND FROM UTILITIES

- FIGURE 14 CADMIUM TELLURIDE TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY MATERIAL, IN 2028

- FIGURE 15 UTILITIES HELD LARGEST MARKET SHARE IN 2022

- FIGURE 16 MARKET IN MEXICO TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT OF DRIVERS ON MARKET

- FIGURE 19 IMPACT OF RESTRAINTS ON MARKET

- FIGURE 20 IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 21 IMPACT OF CHALLENGES ON MARKET

- FIGURE 22 SOLAR CELL VALUE CHAIN ANALYSIS

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 24 NUMBER OF PATENTS GRANTED EVERY YEAR, 2012–2022

- FIGURE 25 IMPORT DATA FOR HS CODE 854140, BY COUNTRY, 2018–2021

- FIGURE 26 EXPORT DATA FOR HS CODE 854140, BY COUNTRY, 2018–2021

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS IN NEXT-GENERATION SOLAR CELL MARKET

- FIGURE 28 AVERAGE SELLING PRICE OF PV MODULES OFFERED BY KEY PLAYERS, BY END-USER INDUSTRY

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRY

- FIGURE 30 INSTALLATION TYPES OF NEXT-GENERATION SOLAR CELLS

- FIGURE 31 MARKET, BY MATERIAL TYPE

- FIGURE 32 CADMIUM TELLURIDE-BASED SOLAR CELLS TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 33 MARKET, BY END-USER INDUSTRY

- FIGURE 34 RESIDENTIAL SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 35 OTHER MATERIALS SEGMENT TO WITNESS HIGHEST CAGR IN MARKET FOR UTILITIES DURING FORECAST PERIOD

- FIGURE 36 MARKET, BY REGION

- FIGURE 37 NORTH AMERICA: SNAPSHOT OF MARKET

- FIGURE 38 EUROPE: SNAPSHOT OF MARKET

- FIGURE 39 ASIA PACIFIC: SNAPSHOT OF NEXT-GENERATION SOLAR CELL MARKET

- FIGURE 40 MARKET SHARE ANALYSIS, 2022

- FIGURE 41 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

- FIGURE 42 MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 43 MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 44 FIRST SOLAR: COMPANY SNAPSHOT

- FIGURE 45 ASCENT SOLAR TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 46 MITSUBISHI CHEMICAL GROUP: COMPANY SNAPSHOT

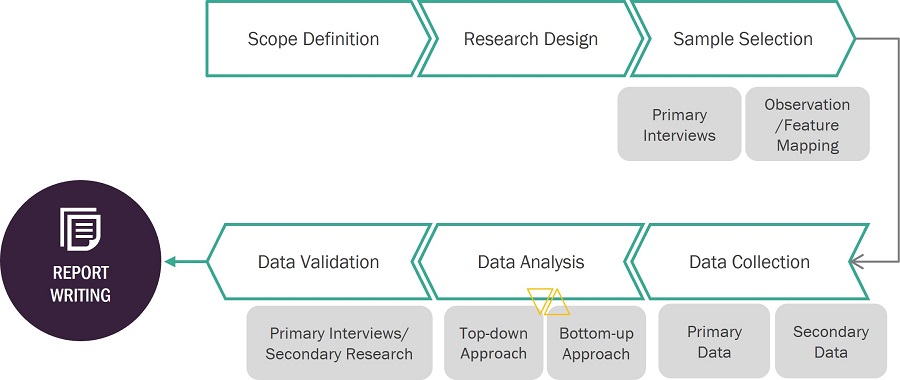

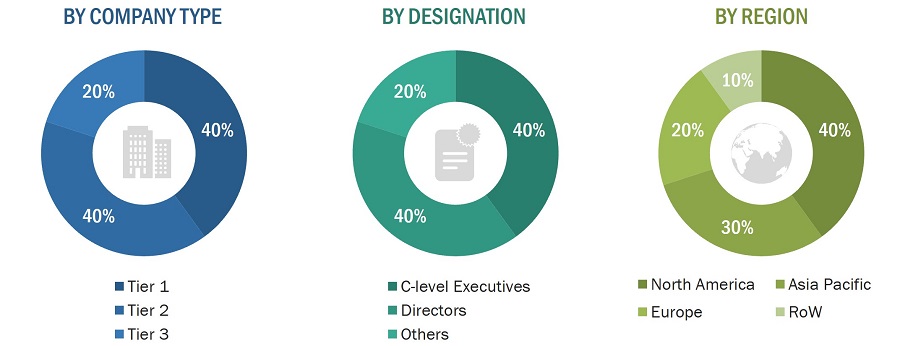

The study involved four major activities in estimating the current size of the next-generation solar cell market—exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include next-generation solar cell technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the next-generation solar cell market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

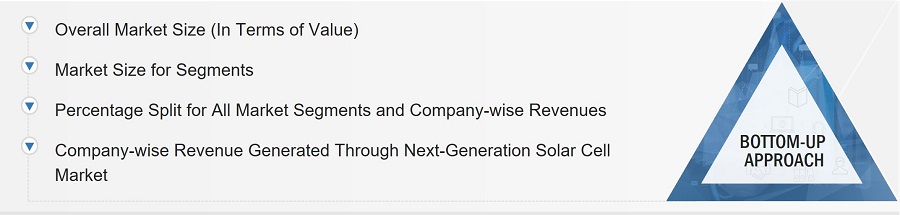

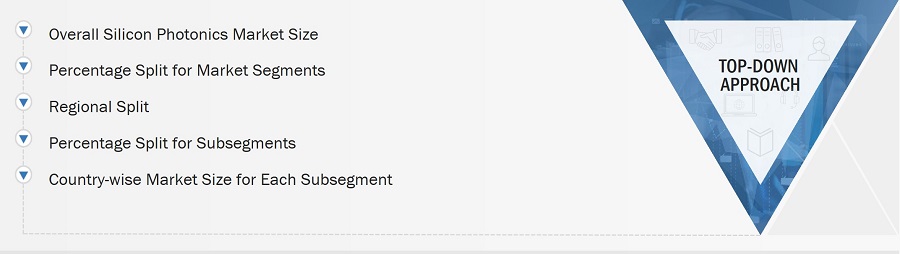

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the next-generation solar cell market and other dependent submarkets listed in this report.

- Extensive secondary research has identified key players in the industry and market.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Next-Generation Solar Cell Market: Bottom-Up Approach

Next-Generation Solar Cell Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends identified from both the demand and supply sides.

Market Definition

The Solar Energy Industries Association (SEIA) defines a solar cell as a device that converts light into electricity using the photoelectric effect. Specifically, a solar cell is made of semiconductor material, such as silicon, that absorbs photons of light and releases electrons. These electrons can then be captured as an electrical current, which can be used to power a wide variety of devices and applications, from small electronics to large power grids. Solar cells are often combined into modules or panels to create larger systems that can generate significant amounts of clean, renewable energy from the sun.The solar cell has different generations based on development. The first-generation solar cell includes solar cells based on crystalline silicon material. The second-generation solar cell solar cells are thin film solar cells which is the major focus of this report. It includes materials cadmium telluride (CdTe), amorphous silicon (a-Si), copper indium gallium selenide (CIGS), and Gallium Arsenide (GaAs). The third generation of solar cells is very new in the market; some are not yet commercialized. In other sections, third-generation solar cells that are in organic solar cells, dye-sensitized solar cells, and perovskite solar cells have been included.

Key Stakeholders

- Solar cell manufacturers

- Solar module manufacturers

- Energy Companies

- Raw materials and manufacturing equipment suppliers

- Solar market technical consultants

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and start-up companies

- Distributors

Report Objectives

The following are the primary objectives of the study.

- To describe, segment, and forecast the market based on type and end-user industry in terms of value.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the next-generation solar cell market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the market and the average selling price of PV modules.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 about individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market.

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the next-generation solar cell market

- To strategically profile the key players in the next-generation solar cell market and comprehensively analyze their market ranking and core competencies2.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Next-Generation Solar Cell Market