Nickel Alloys Market by Function (Corrosion Resistant, Heat Resistant, High Performance, Electronic Alloys), End-Use Industry (Aerospace & Defense, Oil & Gas, Chemical, Energy & Power), and Region - Global Forecast to 2022

The nickel alloys market is projected to grow from an estimated USD 12.14 billion in 2017 to USD 14.68 billion by 2022, at a CAGR of 3.9% from 2017 to 2022. The major factors that are contributing to the growth of the nickel alloys market include the growing demand from aerospace & defense industry. Nickel alloys are used by end-use industries such as aerospace & defense, chemical, electrical & electronics, oil & gas, energy & power, and automotive among others for functions such as high performance alloys, corrosion resistant alloys, electronic alloys, and heat resistant alloys. In this study, 2016 has been considered the base year and 2017-2022 as the forecast period to estimate the nickel alloys market size.

Market Dynamics

Drivers

- Growing demand from aerospace & defense industry

Restraints

- Rising cost of raw materials

Opportunities

- Increase in offshore spending and potential of new oilfield discovery

Challenges

- Reducing greenhouse gas emissions

See how this study impacted revenues for other players in Nickel Alloys Market

Clients Problem Statement

Our client, a leading European stainless and speciality steel manufacturer, was interested to understand merger and acquisition (M&A) opportunities in nickel and cobalt alloys market in China and India. This understanding was crucial for senior management to take array of critical strategic decisions- which company to acquire, which product to focus on, which region within China and India to focus on, which customer segments to target and what value proposition to build for target customers.

MnM Approach

MNM has identified potential nickel and cobalt alloy manufacturers in China and India who can be acquired or partnered with by the client. Then, we ranked these players in terms of strength of their product portfolio and business strategy excellence. MNM also helped the client to identify customers of these target cobalt alloy manufacturers in China and India. MNM also provided detailed analysis to client on competitive landscape, business models & strategies, and latest strategic developments of these target players. These insights have helped them to prioritize acquisition targets and finalize the 1-2 companies for future M&A activities. We had conducted interviews with potential customers from different end-use industries to understand their unmet needs, criteria they use to select nickel and cobalt alloy suppliers, and expectation from product suppliers. These insights helped our client to adjust its metal alloy portfolio and value proposition for local customers in India and China and create revenue earning opportunities.

Revenue Impact (RI)

Our findings helped the client to realize growth opportunity in $4 Bn market, with a projected revenue of $150 million in 5 years. The client was able to identify its M&A target and expand its nickel and cobalt alloys business in China and India.

Growing demand from aerospace & defense industry

Nickel alloys are metals that have excellent corrosion resistance, strength, toughness, metallurgical stability, fabric ability, and weldability. These properties make these alloys to be used across various end-use industries, such as aerospace & defense, chemical, power & energy, electronics, and automotive. Nickel alloys are used to manufacture various components in these industries. The growth of the end-use industries in the emerging countries, such as China, India, Indonesia, and Thailand drive the market for nickel alloys. Aerospace & defense is one of the major end-use industries of nickel alloys. Nickel alloys are used to manufacture various components of aircraft engines, due to its superior properties compared to other materials like steel and stainless steel. The global aerospace industry is growing at a significant pace, due to increase in the passenger air travel. Travelers are opting for air travel often in the Middle East & Africa and Asia Pacific, due to low cost. The airline companies are expanding its businesses by introducing new aircraft. The number of people using air transport is increasing, in turn driving the demand for new airplanes. This demand is anticipated to fuel the growth of the companies supplying aerospace components to the aircraft manufacturing industry. This increase will directly influence the growth of the nickel alloys market, as nickel alloys are used to manufacture airplane engine components, turbine blades, and others.

The main objectives of this market study are:

- To define and segment the nickel alloys market on the basis of function, end-use industry, and region

- To estimate and forecast the nickel alloys market in terms of value and volume

- To estimate and forecast the nickel alloys market based on end-use industry at country level in each region

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the market

- To analyze significant region-specific trends in North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To analyze recent market developments such as joint ventures, mergers & acquisitions, and new product launches in the nickel alloys market

- To identify and profile key market players and analyze their core competencies1 in each type of nickel alloys

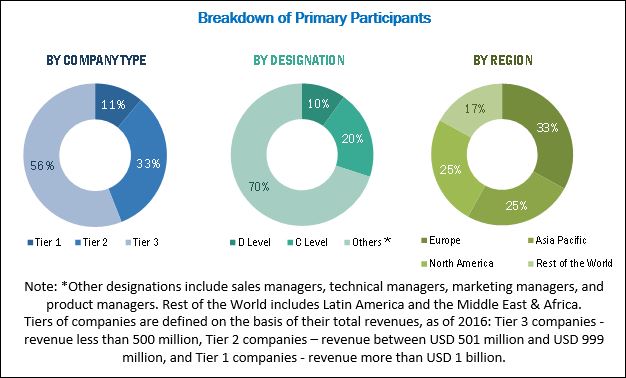

Secondary sources such as company websites, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites have been used to identify and collect information that is useful for this extensive commercial study of the nickel alloys market. Primary sources, which include experts from related industries, have been interviewed to verify and collect critical information as well as to assess the prospects of the market. The top-down approach has been implemented to validate the market size. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study. The breakdown of primaries conducted is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The nickel alloys ecosystem includes nickel alloy manufacturers and nickel alloy based product manufacturers such as VDM Metals (Germany), Aperam S.A. (Luxembourg), Sandvik Materials Technology AB (Sweden), Allegheny Technologies Incorporated (US), Carpenter Technology Corporation (US), ThyssenKrupp AG (Germany), Haynes International Inc. (US), Precision Castparts Corporation (US), Voestalpine AG (Austria), and Rolled Alloys Inc. (US), among others. The demand side users include companies from the aerospace & defense, chemical, electrical & electronics, oil & gas, energy & power, and automotive, and others industries, which use nickel alloys as various functions such as high performance alloys, corrosion resistant alloys, electronic alloys, and heat resistant alloys.

Target Audience of the Report:

- Nickel Alloys Manufacturers

- Nickel Alloys Traders, Distributors, and Suppliers

- End-use Industries

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report:

This research report categorizes the nickel alloys market based on function, end-use industry, and region, and forecasts revenue growth and provides an analysis of trends in each of the submarkets.

By Function:

- Corrosion Resistant Alloys

- High Performance Alloys

- Electronic Alloys

- Heat Resistant Alloys

Each function is further described in detail in the report with value forecasts until 2022.

By End-use Industry:

- Aerospace & Defense

- Electrical & Electronics

- Chemical

- Oil & Gas

- Energy & Power

- Automotive

- Others

Each end-use industry is further described in detail in the report with value forecasts until 2022.

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Each region is further segmented by key countries, such as China, India, Japan, South Korea, Indonesia, the US, Mexico, Canada, Germany, the UK, Italy, France, Netherlands, Belgium, Saudi Arabia, UAE, South Africa, Argentina, and Brazil.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

New Product Analysis

Product matrix, which gives a detailed comparison of new products and market trends in each industry

Geographic Analysis

Further breakdown of a region with respect to a particular country and end-use industry

Company Information

Detailed analysis and profiles of additional market players (up to five)

The nickel alloys market is projected to grow from an estimated USD 12.14 billion in 2017 to USD 14.68 billion by 2022, at a CAGR of 3.9% from 2017 to 2022. Increase in offshore spending and potential of new oilfield discovery is expected to drive the nickel alloys market. Growing demand from end-use industries such as aerospace & defense is also expected to fuel the demand for nickel alloys.

The nickel alloys market has been segmented on the basis of function, end-use industry, and region. Based on function, the high performance alloys segment led the nickel alloys market in 2016 owing to their excellent mechanical and physical properties, which makes them highly suitable for applications such as engine turbine, blades, and exhausts systems, among others. Based on end-use industry, the aerospace & defense segment led the nickel alloys market in 2016, due to increased demand for alloys in the aircraft building industry. The key applications of nickel alloys include manufacturing of aircraft engine blades and other parts requiring corrosion resistance and performance at extremely high temperatures.

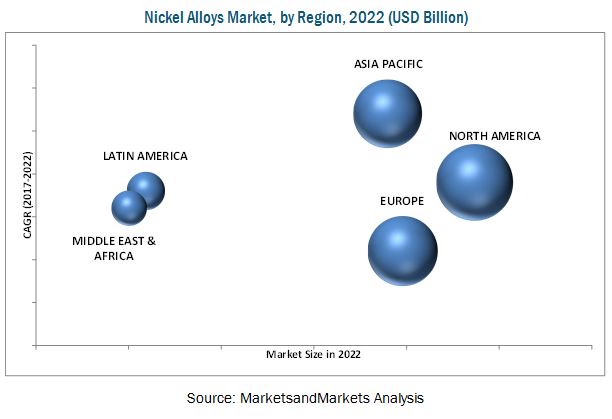

The North America region led the nickel alloys market in 2016, and is expected to grow at the significant rate during the forecast period, owing to the increasing demand for nickel alloys from countries such as the US, Canada, and Mexico. The growth of the North America nickel alloys market is mainly driven by product development and capacity expansions of various leading players in this region.

Application in the aerospace & defense, chemical, electrical & electronics, oil & gas, energy & power, and automotive drive the growth of nickel alloys market

Aerospace & Defense Industry

The aerospace & defense industry is a major market for nickel alloys wherein they are majorly used for high-temperature applications. The demand for alloys increased in the aircraft building industry due to its properties such as excellent mechanical strength and creep resistance at high temperatures; surface stability; and corrosion and oxidation resistance. The growth of the aerospace industry is due to the increasing air traffic in the emerging economies and demand for new-generation fuel-efficient aircraft. This growth in the aerospace industry is expected to increase the demand for nickel alloys and fuel its market, globally.

Chemical Industry

The use of nickel alloys in the chemical process industry has increased over the years. Manufacturing of chemicals often exposes the processing equipment to highly corrosive fluids. In these applications, aggressive fluids come into contact with interior surfaces of the equipment used. Nickel alloys based equipment provides excellent corrosion resistant properties to the corrosive fluids. The mechanical strength of nickel alloys allows for lighter fabrication and greater design flexibility. Nickel alloys are used to manufacture chemical reactors, heat exchangers, pressure vessels, storage tanks, water heaters. The nickel alloys market is growing with the demand from the chemical industry.

Oil & Gas Industry

Oil & gas companies are using nickel alloy-based equipment and components, owing to their high corrosion resistance and superior mechanical and physical properties compared to other types of materials such as stainless steel and iron. Various grades of nickel alloys are used in oil & gas industry for their improved corrosion and stress resistance. Nickel alloys are used in process piping systems, separators, scrubbers, pumps, manifolds, Christmas tree components, and flowlines and pipelines transporting corrosive oils and gas. Growth in oil & gas exploration activities around the globe is driving the market for nickel alloys and its various grades.

Electrical & Electronics Industry

Nickel alloy based wire and strips have been extensively used in electrical and electronic devices because of their high strength at high and low temperatures, toughness, corrosion resistance, controlled thermal expansion, workability, and excellent spring properties. The electronic & electrical industry requires alloys that can be utilized at elevated operating temperatures. Nickel alloys are also used to manufacture anode plates, hydrogen thyratron components, passive cathodes, cathode shanks, plater bars, and transistor enclosures because nickel provides corrosion resistance, stability, workability, and strength at high and low temperatures.

Energy & Power Industry

In the power industry, nickel alloys are used in boiler applications because of their creep strength and hot corrosion resistance in elevated temperature environments. Depending on the presence of chlorine, nickel alloys are commonly used for coal nozzles as well as other internal boiler parts like tube supports, tube shields, and temperature probes. Excellent mechanical properties at extremely low and high temperature, outstanding resistance to pitting and corrosion are some of the properties because of which nickel-based alloys are most widely used in the power generation industry.

Automotive Industry

Nickel alloys are used in the automotive industry depending on the vehicle type and application. The material selection depends on the area of application and its operational requirements. Nickel alloys are also used in brake fluid lines, actuators and connectors, pistons and cylinder inserts, ignition systems, sensors, safety devices, and electrical and electronic switchgear. Environmental legislations and demand for more fuel-efficient engines have driven major car manufacturers and exhaust system designers to add nickel alloys based engine components in modern vehicles.

Critical questions the report answers:

- Where will all the major developments take the industry in the mid to long term?

- What are the upcoming industry applications for nickel alloys?

Rising cost of raw materials, which required for the manufacturing nickel alloys are expected to hinder the growth of the nickel alloys market during the forecast period. Key companies in the nickel alloys market include VDM Metals (Germany), Aperam S.A. (Luxembourg), Sandvik Materials Technology AB (Sweden), Allegheny Technologies Incorporated (US), Carpenter Technology Corporation (US), ThyssenKrupp AG (Germany), Haynes International Inc. (US), Precision Castparts Corporation (US), Voestalpine AG (Austria), and Rolled Alloys Inc. (US) among others. These players have a wide market reach and established distribution networks, and are investing increasingly in research & development activities. These companies also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Nickel Alloys Market

4.2 Nickel Alloys Market, By Region

4.3 Nickel Alloys Market, By Function & End-Use Industry

4.4 Nickel Alloys Market, By Country

4.5 Nickel Alloys Market, By End-Use Industry

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand From Aerospace & Defense Industry

5.2.2 Restraints

5.2.2.1 Rising Cost of Raw Materials

5.2.3 Opportunities

5.2.3.1 Increase in Offshore Spending and Potential of New Oilfield Discovery

5.2.4 Challenges

5.2.4.1 Reducing Greenhouse Gas Emissions

5.3 Economic Indicators

5.3.1 Trends and Forecast of GDP

5.4 Industry Outlook

5.4.1 Oil & Gas Industry

5.4.2 Chemical & Petrochemical

5.4.3 Power Generation

5.4.4 Automotive

5.4.5 Aerospace

6 Nickel Alloys Market, By Function (Page No. - 44)

6.1 Introduction

6.2 High Performance Alloys

6.3 Corrosion Resistant Alloys

6.4 Electronic Alloys

6.5 Heat Resistant Alloys

7 Nickel Alloys Market, By End-Use Industry (Page No. - 48)

7.1 Introduction

7.2 Aerospace & Defense

7.2.1 Aircraft Engines

7.2.2 Defense Equipment

7.3 Chemical

7.3.1 Chemical Reactors

7.3.2 Heat Exchangers

7.3.3 Pressure Vessels

7.3.4 Others

7.4 Oil & Gas

7.4.1 Pipeline

7.4.2 Separators

7.4.3 Scrubbers

7.4.4 Pumps

7.4.5 Others

7.5 Electrical & Electronics

7.5.1 Precision Measurement Instruments

7.5.2 Electrical & Electronic Device and Components

7.6 Energy & Power

7.6.1 Nuclear Power Plant Components

7.6.2 Power Plants Components

7.7 Automotive

7.7.1 Exhaust Valves

7.7.2 Turbocharger

7.7.3 Other Parts and Components

7.8 Others

8 Regional Analysis (Page No. - 63)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 Italy

8.3.3 France

8.3.4 The Netherlands

8.3.5 Belgium

8.3.6 UK

8.3.7 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 India

8.4.5 Indonesia

8.4.6 Rest of Asia Pacific

8.5 Latin America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of Latin America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 South Africa

8.6.4 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 104)

9.1 Introduction

9.1.1 Visionary Leaders

9.1.2 Innovators

9.1.3 Dynamic Differentiators

9.1.4 Emerging Companies

9.2 Competitive Benchmarking

9.2.1 Strength of Product Portfolio

9.2.2 Business Strategy Excellence

9.3 Market Ranking

10 Company Profiles (Page No. - 109)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

10.1 Precision Castparts Corporation

10.2 VDM Metals GmbH

10.3 Aperam S.A.

10.4 Allegheny Technologies Incorporated

10.5 Carpenter Technology Corporation

10.6 Sandvik Materials Technology Ab

10.7 Haynes International Inc.

10.8 Thyssenkrupp AG

10.9 Voestalpine AG

10.10 Kennametal Inc.

10.11 Ametek Inc.

10.12 Other Key Players in the Nickel Alloys Market

10.12.1 Alloy Wire International

10.12.2 Rolled Alloys Inc.

10.12.3 Valbruna Stainless Inc.

10.12.4 Cogne Acciai Speciali S.P.A.

10.12.5 Aerospace Alloys Inc.

10.12.6 Foroni S.P.A.

10.12.7 Erasteel

10.12.8 Columbia Metals Ltd.

10.12.9 Neonickel

10.12.10 Sanyo Special Steel Co., Ltd.

10.12.11 JLC Electromet Pvt. Ltd.

10.12.12 WaLLColmonoy Corporation

10.12.13 Universal Stainless & Alloy Products Inc.

10.12.14 Multi Alloys Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 153)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (91 Tables)

Table 1 Nickel Alloys Market Snapshot

Table 2 Trends and Forecast of GDP, USD Billion (20152022)

Table 3 World Nickel Production and Proven Reserves, 2017 (Tons)

Table 4 Production of Automobiles, By Country, 2016

Table 5 Aircraft Deliveries, By Airplane Size &Region

Table 6 Nickel Alloys Market, By Function, 20152022 (Kilotons)

Table 7 Nickel Alloys Market, By Function, 20152022 (USD Million)

Table 8 Nickel Alloys Market, By End-Use Industry, 20152022 (Kilotons)

Table 9 Nickel Alloys Market, By End-Use Industry, 20152022 (USD Million)

Table 10 Nickel Alloys Market for Aerospace & Defense, By Region, 20152022 (Tons)

Table 11 Market for Aerospace & Defense, By Region, 20152022 (USD Million)

Table 12 Nickel Alloys Market for Chemical, By Region, 20152022 (Tons)

Table 13 Market for Chemical, By Region, 20152022 (USD Million)

Table 14 Nickel Alloys Market for Oil & Gas, By Region, 20152022 (Tons)

Table 15 Market for Oil & Gas, By Region, 20152022 (USD Million)

Table 16 Nickel Alloys Market for Electrical & Electronic, By Region, 20152022 (Tons)

Table 17 Market for Electrical & Electronic, By Region, 20152022 (USD Million)

Table 18 Nickel Alloys Market for Energy & Power, By Region, 20152022 (Tons)

Table 19 Market for Energy & Power, By Region, 20152022 (USD Million)

Table 20 Nickel Alloys Market for Automotive, By Region, 20152022 (Tons)

Table 21 Market for Automotive, By Region, 20152022 (USD Million)

Table 22 Nickel Alloys Market in Others, By Region, 20152022 (Tons)

Table 23 Market in Others, By Region, 20152022 (USD Million)

Table 24 Nickel Alloys Market, By Region, 20152022 (Kilotons)

Table 25 Market, By Region, 20152022 (USD Million)

Table 26 North America Nickel Alloys Market, By Country, 2015-2022 (Kilotons)

Table 27 North America Market, By Country, 2015-2022 (USD Million)

Table 28 North America Market, By End-Use Industry, 2015-2022 (Kilotons)

Table 29 North America Market, By End-Use Industry, 2015-2022 (USD Million)

Table 30 US: Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 31 US: Market, By End-Use Industry, 20152022 (USD Million)

Table 32 Canada Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 33 Canada Market, By End-Use Industry, 20152022 (USD Million)

Table 34 Mexico Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 35 Mexico Market, By End-Use Industry, 20152022 (USD Million)

Table 36 Europe Nickel Alloys Market, By Country, 2015-2022 (Kilotons)

Table 37 Europe Market, By Country, 2015-2022 (USD Million)

Table 38 Europe Market, By End-Use Industry, 2015-2022 (Kilotons)

Table 39 Europe Market, By End-Use Industry, 2015-2022 (USD Million)

Table 40 Germany Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 41 Germany Market, By End-Use Industry, 20152022 (USD Million)

Table 42 Italy Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 43 Italy Market, By End-Use Industry, 20152022 (USD Million)

Table 44 France Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 45 France Market, By End-Use Industry, 20152022 (USD Million)

Table 46 The Netherlands Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 47 The Netherlands Market, By End-Use Industry, 20152022 (USD Million)

Table 48 Belgium Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 49 Belgium Market, By End-Use Industry, 20152022 (USD Million)

Table 50 UK Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 51 U.K. Market, By End-Use Industry, 20152022 (USD Million)

Table 52 Rest of Europe Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 53 Rest of Europe Market, By End-Use Industry, 20152022 (USD Million)

Table 54 Asia Pacific Nickel Alloys Market, By Country, 2015-2022 (Kilotons)

Table 55 Asia Pacific Market, By Country, 2015-2022 (USD Million)

Table 56 Asia Pacific Market, By End-Use Industry, 2015-2022 (Kilotons)

Table 57 Asia Pacific Market, By End-Use Industry, 2015-2022 (USD Million)

Table 58 China Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 59 China Market, By End-Use Industry, 20152022 (USD Million)

Table 60 Japan Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 61 Japan Market, By End-Use Industry, 20152022 (USD Million)

Table 62 South Korea Nickel Alloys Market, By End-Use Industry, 20152022 (Kilotons)

Table 63 South Korea Market, By End-Use Industry, 20152022 (USD Million)

Table 64 India Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 65 India Market, By End-Use Industry, 20152022 (USD Million)

Table 66 Indonesia Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 67 Indonesia Market, By End-Use Industry, 20152022 (USD Million)

Table 68 Rest of Asia Pacific Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 69 Rest of Asia Pacific Market, By End-Use Industry, 20152022 (USD Million)

Table 70 Latin America Nickel Alloys Market, By Country, 2015-2022 (Kilotons)

Table 71 Latin America Market, By Country, 2015-2022 (USD Million)

Table 72 Latin America Market, By End-Use Industry, 2015-2022 (Tons)

Table 73 Latin America Market, By End-Use Industry, 2015-2022 (USD Million)

Table 74 Brazil Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 75 Brazil Market, By End-Use Industry, 20152022 (USD Million)

Table 76 Argentina Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 77 Argentina Market, By End-Use Industry, 20152022 (USD Million)

Table 78 Rest of Latin America Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 79 Rest of Latin America Market, By End-Use Industry, 20142021 (USD Million)

Table 80 Middle East & Africa Nickel Alloys Market, By Country, 2015-2022 (Tons)

Table 81 Middle East & Africa Market, By Country, 2015-2022 (USD Million)

Table 82 Middle East & Africa Market, By End-Use Industry, 2015-2022 (Tons)

Table 83 Middle East & Africa Market, By End-Use Industry, 2014-2021 (USD Million)

Table 84 Saudi Arabia Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 85 Saudi Arabia Market, By End-Use Industry, 20152022 (USD Million)

Table 86 UAE Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 87 UAE Market, By End-Use Industry, 20142021 (USD Million)

Table 88 South Africa Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 89 South Africa Market, By End-Use Industry, 20152022 (USD Million)

Table 90 Rest of Middle East & Africa Nickel Alloys Market, By End-Use Industry, 20152022 (Tons)

Table 91 Rest of Middle East & Africa Market, By End-Use Industry, 20152022 (USD Million)

List of Figures (43 Figures)

Figure 1 Nickel Alloys Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 High Performance Alloys Segment is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 7 Aerospace & Defense is Estimated to Be the Largest Segment During the Forecast Period

Figure 8 Nickel Alloy Market in Asia Pacific is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 9 Increasing Demand From Various End-Use Industries is Projected to Fuel the Growth of the Nickel Alloy Market From 2017 to 2022

Figure 10 Nickel Alloy Market in Asia Pacific is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 High Performance Alloys and Aerospace & Defense Segments Estimated to Account for the Largest Share of the Nickel Alloy Market in 2017

Figure 12 Nickel Alloy Market in China is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 13 North America Expected to Have Largest Share Across All End-Use Industry

Figure 14 Drivers, Restraints, Opportunities, and Challenges for the Nickel Alloy Market

Figure 15 Oil Production, By Region, 2014-2015

Figure 16 World Energy Consumption, 2011-2015

Figure 17 High Performance Alloys is Estimated to Be the Largest Segment of the Nickel Alloy Market From 2017 to 2022

Figure 18 Aerospace & Defense is Estimated to Be the Largest Segment of the Nickel Alloy Market During the Forecast Period

Figure 19 Asia Pacific is Estimated to Be the Fastest-Growing Market for Aerospace & Defense Industry Segment From 2017 to 2022

Figure 20 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Chemical Segment

Figure 21 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Oil & Gas Segment

Figure 22 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Electrical & Electronic Segment

Figure 23 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Energy & Power Segment

Figure 24 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Automotive Segment

Figure 25 Asia Pacific to Be the Fastest Growing Market for Nickel Alloys in Others End-Use Industry Segment

Figure 26 Nickel Alloy Market Share, By Region, 2017

Figure 27 North America Nickel Alloy Market Snapshot

Figure 28 Europe Nickel Alloy Market Snapshot

Figure 29 Asia Pacific Nickel Alloy Market Snapshot

Figure 30 Latin America Nickel Alloy Market Snapshot

Figure 31 Middle East & Africa Nickel Alloy Market Snapshot

Figure 32 Competitive Leadership Mapping, 2016

Figure 33 Precision Castparts Corporation (U.S.) is the Leading Player in the Nickel Alloy Market

Figure 34 Precision Castparts Corporation: Company Snapshot

Figure 35 Aperam S.A.: Company Snapshot

Figure 36 Allegheny Technologies Incorporated: Company Snapshot

Figure 37 Carpenter Technology Corporation: Company Snapshot

Figure 38 Sandvik Materials Technology AB: Company Snapshot

Figure 39 Haynes International Inc.: Company Snapshot

Figure 40 Thyssenkrupp AG: Company Snapshot

Figure 41 Voestalpine AG: Company Snapshot

Figure 42 Kennametal Inc.: Company Snapshot

Figure 43 Ametek Inc.: Company Snapshot

Growth opportunities and latent adjacency in Nickel Alloys Market