Aircraft Mounts Market by Application (Vibration/Shock Isolation, Suspension, Engine Mounts), Material (Nickel-based Alloys, Aluminum, Steel Alloys, Polyamide), Mount Type (Interior, Exterior), End Use, Aircraft Type, and Region - Global Forecast to 2035

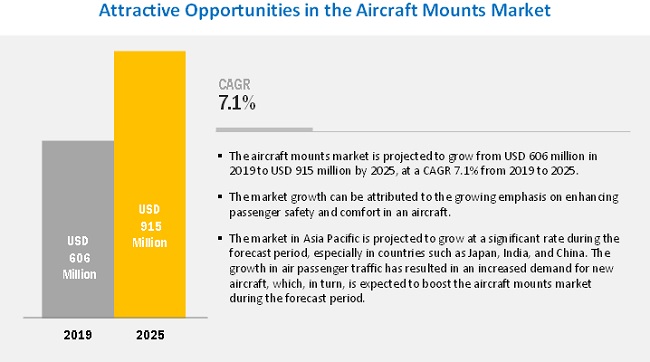

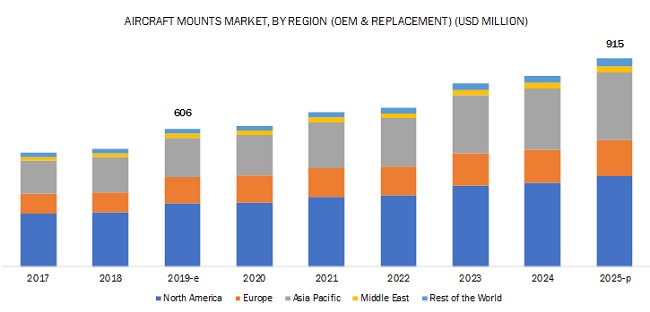

[171 Pages Report] The global aircraft mounts market size is estimated to be USD 606 million in 2019 and is projected to reach USD 915 million by 2025, at a CAGR of 7.1% from 2019 to 2025.

The aircraft mounts industry has been growing at a significant rate since the past few years and is expected to continue during the forecast period. The demand for mounts in aviation applications is growing, due to increasing emphasis to enhance safety and comfort in aircraft.

The replacement segment is projected to grow at a higher CAGR during the forecast period as compared to the OEM segment

The timely inspection of aircraft mounts is essential to ensure the effective functioning of aircraft to avert chances of engineering equipment getting damaged. This, in turn, is increasing the demand for replacement of aircraft mounts.

The engine mounts segment is projected to lead the aircraft mounts market during the forecast period

Engine mounts are commonly known as flexible, elastic, or shock mounts. If the engine is subjected to abnormal shocks or loads, engine mounts limit the excessive movement of the engine. The demand for engine mounts is expected to increase during the forecast period, due to the growing efforts of manufacturers to protect engineering equipment in aircraft and enhance operational capabilities.

North America is expected to lead the aircraft mounts market (OEM and replacement) from 2019 to 2025

The North America aircraft mounts industry is projected to contribute significantly during the forecast period. The US is considered to be the largest manufacturer, operator, and exporter of aircraft mounts, globally. The aviation industry is one of the most profitable industries in North America. According to the International Air Transport Association (IATA), the commercial airline industry witnessed a net profit of USD 14.5 billion in 2018. The growing commercial air traffic is expected to drive the demand for aircraft mounts.

Key Market Players

Key players in the aircraft mounts market are LORD Corporation (US), GMT Rubber-Metal-Technic Ltd. (UK), Trelleborg AB (Sweden), Cadence Aerospace (US), MAYDAY Manufacturing (US), Shock Tech, Inc. (US), AirLoc Ltd. (US), VMC Group (US), and VibraSystems Inc. (US), among others.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2025 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

End Use, Aircraft Type, Application, Mount Type, Material and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Rest of the World |

|

Companies Covered |

LORD Corporation (US), GMT Rubber-Metal-Technic Ltd. (UK), Trelleborg AB (Sweden), Cadence Aerospace (US), MAYDAY Manufacturing (US), Shock Tech, Inc. (US), AirLoc Ltd. (US), VMC Group (US), and VibraSystems Inc. (US), among others. |

This research report categorizes the aircraft mounts market based on application, vertical, and solution, forecast type, and region.

On the basis of End Use:

- OEM

- Replacement

On the basis of Aircraft Type:

-

Commercial Aircraft

- Narrow Body Aircraft

- Wide Body Aircraft

- Large Aircraft

- Regional Transport Aircraft

- Commercial Helicopters

-

General Aviation Aircraft

- Business Jet

- Ultralight Aircraft

-

Military Aircraft

- Fighter Jets

- Transport Aircraft

- Military Helicopters

On the basis of Mount Types:

-

Exterior Mounts

-

Multiplane Mounts

- Machine Feet

- Auxiliary Power Unit (APU) Mounts

- Cup Mounts

- Wire Rope Mounts

- Rubber Bobbins

-

Pedestal Mounts

- Device Mounts

- Miniature Mounts

- Electronic Flight Bag (EFB) Mounts

-

Platform Mounts

- Elastomeric Mounts

- High Deflection Mounts

- Compactor Mounts

- Sandwich Mounts

-

Shock Mounts

- Cone Mounts

- Rubber Mounts

- Low Profile Mounts

-

Multiplane Mounts

-

Interior Mounts

- Galley Mounts

- Panel Mounts

- Floor Mounts

- Headliner Mounts

- Bulkhead Mounts

On the basis of Application:

- Vibration/Shock Isolation

- Suspension

- Engine Mounts

On the basis of Material:

- Nickel-based alloys

- Aluminium Alloys

- Steel Alloys

- Rubber

- Polyamide

- Others

On the basis of Region:

OEM-

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

Replacement-

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Key Questions Addressed by the Report

- What is the growth perspective of the aircraft mounts market?

- What are the key dynamics and trends governing the market?

- What are the key sustainability strategies adopted by the leading players in the aircraft mounts industry?

- What are the new and emerging technologies disrupting the aircraft mounts market?

- What are the most promising aircraft mounts procured by various industries?

Frequently Asked Questions (FAQ):

Which are the major applications of aircraft mounts? How huge is the opportunity for their growth in the next five years?

The major applications of aircraft mounts include vibration/shock isolation, suspension, and engine mounting. With growing efforts to protect engineering equipment in aircraft to enhance the operational capabilities, aircraft mounts are expected to witness a rapid demand during the forecast period.

Which are the major companies in the aircraft mounts market? What are their major strategies to strengthen their market presence?

The major companies in the aircraft mounts market include LORD Corporation (US), GMT Rubber-Metal-Technic (UK), Trelleborg AB (Sweden), Cadence Aerospace (US) and MAYDAY Manufacturing (US), among others. The major strategies adopted by these players include new product launches and contracts with end-users to increase their foothold in the global aircraft mounts market.

Why is there an increasing need for mounts for aircraft? Which material segment for the mounts is expected to grow with the highest growth rate in the next five years?

The demand for mounts in aviation applications is growing, due to the increasing emphasis to enhance safety and comfort in aircraft. The aluminum alloys segment is estimated to grow at a higher growth rate during the forecast period. The aim of aircraft manufacturers to improve durability and reduce weight, increased the demand for aluminum alloys that provide improved combinations of durability, strength, and damage tolerance.

What are the drivers and opportunities for the aircraft mounts market?

Factors such as growing emphasis on enhancing safety and comfort in aircraft, stringent regulations pertaining to noise pollution, and penetration of internal mounts with widening application areas of smart devices in aircraft operation are driving the growth of the aircraft mounts market. Moreover, the development of aircraft mounts with 3D printing technology is expected to stimulate market growth.

Which end-use is expected to drive the growth of the aircraft mounts market in the next five years?

The replacement segment is projected to lead the aircraft mounts market across the forecast period. Timely maintenance and replacement of aircraft mounts are necessary to ensure the effective functioning of aircraft mounts to avert the chances of engineering equipment getting damaged. This, in turn, is leading to an increased demand for aircraft mounts.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONAL SCOPE

1.3.1.1 OEM Regional Scope

1.3.1.2 Replacement Regional Scope

1.3.2 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES,2017—2019

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 MARKET DEFINITION & SCOPE

2.1.4 SEGMENT DEFINITIONS & SCOPE

2.1.4.1 By end use

2.1.4.2 By mount type

2.1.4.3 By application

2.1.4.4 By material

2.1.4.5 By aircraft type

2.2 RESEARCH APPROACH & METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.2 OEM MARKET APPROACH

2.2.3 REPLACEMENT APPROACH

2.2.3.1 Replacement of mounts in commercial (NBA,WBA,RTA,commercial helicopters) and military aircraft (fighter aircraft,transport aircraft,military helicopters)

2.2.3.2 Replacement of mounts in general aviation aircraft (business jets aircraft and ultralight aircraft) and very large aircraft

2.2.4 TOP-DOWN APPROACH

2.3 TRIANGULATION & VALIDATION

2.3.1 TRIANGULATION THROUGH SECONDARY RESEARCH

2.3.2 TRIANGULATION THROUGH PRIMARIES

2.4 RESEARCH ASSUMPTIONS

2.4.1 MARKET SIZING AND MARKET FORECASTING

2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AIRCRAFT MOUNTS MARKET

4.2 AIRCRAFT MOUNTS MARKET,BY MOUNT TYPE

4.3 AIRCRAFT MOUNTS MARKET,BY MATERIAL

4.4 EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY APPLICATION & COUNTRY

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing emphasis on enhancing safety and comfort in aircraft

5.2.1.2 Stringent regulations pertaining to noise pollution

5.2.1.3 Increase in manufacturing of commercial and military aviation fleets

5.2.1.4 Growing penetration of internal mounts with widening application area of smart devices in aircraft operations

5.2.2 OPPORTUNITIES

5.2.2.1 Development of aircraft mounts with 3D printing technology

5.2.2.2 Emergence of aircraft manufacturers in Asia Pacific and Latin America

5.2.3 CHALLENGES

5.2.3.1 High material cost of mounts

5.2.3.2 Developing a robust and agile supply chain

6 INDUSTRY TRENDS (Page No. - 47)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ADVANCED MATERIALS

6.2.1.1 Capabilities of advanced materials

6.2.2 ADDITIVE MANUFACTURING

6.2.3 PIEZOSTACK-BASED ACTIVE MOUNTS

7 AIRCRAFT MOUNTS MARKET,BY END USE (Page No. - 50)

7.1 INTRODUCTION

7.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

7.2.1 INCREASING AIRCRAFT DELIVERIES DRIVE THE OEM SEGMENT

7.2.1.1 OEM aircraft mounts market size,by aircraft type

7.2.1.2 OEM aircraft mounts market size,by application

7.2.1.3 OEM aircraft mounts market size,by mount type

7.3 REPLACEMENT

7.3.1 THE GROWING EMPHASIS ON THE REPLACEMENT OF AGING EQUIPMENT FOR GREATER OPERATIONAL EFFICIENCY DRIVE THE REPLACEMENT SEGMENT

7.3.1.1 Aircraft mounts replacement market size,by aircraft type

7.3.1.2 Aircraft mounts replacement market size,by application

7.3.1.3 Aircraft mounts replacement market size,by mount type

8 AIRCRAFT MOUNTS MARKET,BY APPLICATION (Page No. - 55)

8.1 INTRODUCTION

8.2 VIBRATION/SHOCK ISOLATION

8.2.1 INCREASING EMPHASIS ON REDUCING THE NOISE OF AIRCRAFT COMPONENTS DRIVE THE VIBRATION/SHOCK ISOLATION SEGMENT

8.3 SUSPENSION

8.3.1 CRITICAL WORKING ENVIRONMENT DRIVES THE DEMAND FOR MOUNTS IN SUSPENSION IN AN AIRCRAFT

8.4 ENGINE MOUNTS

8.4.1 THE GROWING EMPHASIS ON REPLACEMENT OF AGING EQUIPMENT FOR GREATER OPERATIONAL EFFICIENCY TO DRIVE THE DEMAND FOR AIRCRAFT MOUNTS REPLACEMENT

9 AIRCRAFT MOUNTS MARKET,BY MOUNT TYPE (Page No. - 58)

9.1 INTRODUCTION

9.2 INTERIOR MOUNTS

9.2.1 GROWING EMPHASIS TO DEVELOP COMFORTABLE AIRCRAFT INTERIORS IS DRIVING THE INTERIOR MOUNTS SEGMENT

9.2.2 GALLEY MOUNTS

9.2.3 PANEL MOUNTS

9.2.4 FLOOR MOUNTS

9.2.5 HEADLINER MOUNTS

9.2.6 BULKHEAD MOUNTS

9.3 EXTERIOR MOUNTS

9.3.1 GROWING FOCUS ON INCREASING OPERATIONAL LIFE OF EQUIPMENT DRIVES THE DEMAND FOR EXTERIOR MOUNTS

9.3.2 MULTIPLANE MOUNTS

9.3.2.1 Machine feet

9.3.2.2 Auxiliary Power Unit (APU) mounts

9.3.2.3 Cup mounts

9.3.2.4 Wire rope mounts

9.3.2.5 Rubber bobbins

9.3.3 PEDESTAL MOUNTS

9.3.3.1 Device mounts

9.3.3.2 Miniature mounts

9.3.3.3 Electronic Flight Bag (EFB) mounts

9.3.4 PLATFORM MOUNTS

9.3.4.1 Elastomeric mounts

9.3.4.2 High deflection mounts

9.3.4.3 Compactor mounts

9.3.5 SANDWICH MOUNTS

9.3.6 SHOCK MOUNTS

9.3.6.1 Cone mounts

9.3.6.2 Low profile mounts

9.3.6.3 Rubber mounts

10 AIRCRAFT MOUNTS MARKET,BY AIRCRAFT TYPE (Page No. - 65)

10.1 INTRODUCTION

10.2 COMMERCIAL AIRCRAFT

10.2.1 NARROW BODY AIRCRAFT

10.2.1.1 Growing domestic travel expected to drive the market for narrow body aircraft

10.2.2 WIDE BODY AIRCRAFT

10.2.2.1 Growing passenger and cargo-carrying capacity expected to drive the market for wide body aircraft

10.2.3 VERY LARGE AIRCRAFT

10.2.3.1 Growing preference for long-haul journeys expected to drive the market for very large aircraft

10.2.4 COMMERCIAL HELICOPTERS

10.2.4.1 Growing application area of commercial helicopters projected to stimulate its market

10.2.5 REGIONAL TRANSPORT AIRCRAFT

10.2.5.1 The growing presence of domestic airlines drive the market for regional transport aircraft

10.3 GENERAL AVIATION AIRCRAFT

10.3.1 BUSINESS JETS

10.3.1.1 Growing affordability of travelers drive the business jets market

10.3.2 ULTRALIGHT AIRCRAFT

10.3.2.1 Frequent demand for aircraft replacement expected to fuel the market for ultralight aircraft

10.4 MILITARY AIRCRAFT

10.4.1 FIGHTER JETS

10.4.1.1 Increasing emphasis on strengthening combat capabilities to drive the market growth

10.4.2 TRANSPORT AIRCRAFT

10.4.2.1 Growing aftermarket demand drive the transport aircraft segment

10.4.3 MILITARY HELICOPTERS

10.4.3.1 New procurement plans in emerging economies drive the military helicopters segment

11 AIRCRAFT MOUNTS MARKET,BY MATERIAL (Page No. - 72)

11.1 INTRODUCTION

11.2 NICKEL-BASED ALLOYS

11.2.1 HIGH RESISTANCE TO TEMPERATURE AND STRESS DRIVE THE DEMAND FOR NICKEL-BASED ALLOYS

11.3 ALUMINUM ALLOYS

11.3.1 HIGH STRENGTH-TO-WEIGHT RATIO STIMULATES THE DEMAND FOR ALUMINUM ALLOYS FOR THE PRODUCTION OF AIRCRAFT MOUNTS

11.4 STEEL ALLOYS

11.4.1 THE HIGH STRENGTH OF STEEL ALLOYS MAKES THEM PREFERABLE FOR THE PRODUCTION OF AIRCRAFT MOUNTS

11.5 RUBBER

11.5.1 HIGH VISCOELASTIC PROPERTY OF RUBBER STIMULATE ITS DEMAND IN THE PRODUCTION OF AIRCRAFT MOUNTS

11.6 POLYAMIDE

11.6.1 FAVORABLE PROPERTIES OF POLYAMIDE TO DRIVE ITS DEMAND IN PRODUCTION OF AIRCRAFT MOUNTS

11.7 OTHERS

11.7.1 GROWING DEVELOPMENT IN MATERIAL TECHNOLOGIES DRIVE THE PENETRATION OF OTHER MATERIALS IN AIRCRAFT MOUNTS

12 AIRCRAFT MOUNTS OEM MARKET REGIONAL ANALYSIS (Page No. - 76)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 US

12.2.1.1 Presence of leading aircraft mount manufacturers drive the growth of aircraft mounts market in the US

12.2.2 CANADA

12.2.2.1 Growth of the aerospace industry in Canada fueling the adoption of aircraft mounts in general aviation and commercial aircraft

12.3 EUROPE

12.3.1 FRANCE

12.3.1.1 Increasing aircraft demand from airlines to drive the market in France

12.3.2 UK

12.3.2.1 Presence of military aircraft OEMs,as well as aircraft mounts manufacturers,are responsible for the aircraft mounts market in the country

12.3.3 SWITZERLAND

12.3.3.1 Growing demand for general aviation aircraft is fueling the market for aircraft mounts in Switzerland

12.3.4 SWEDEN

12.3.4.1 Supportive regulatory environment to be responsible for the aircraft mounts market in Sweden

12.3.5 RUSSIA

12.3.5.1 Presence of OEMs expected to drive the market for aircraft mounts in Russia

12.3.6 ITALY

12.3.6.1 Demand for aircraft mounts from aircraft manufacturers in Italy are constantly supporting the market growth

12.3.7 GERMANY

12.3.7.1 Growing investment to enhance air travel experience is responsible for the presence of aircraft mounts market in Germany

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.1.1 Increase in demand for aircraft fueling the market for aircraft mounts in China

12.4.2 JAPAN

12.4.2.1 Increasing orders for new aircraft projected to fuel the demand for aircraft mounts in Japan

12.4.3 INDIA

12.4.3.1 Growth of military and general aviation aircraft market projected to increase the adoption of aircraft mounts in India

12.4.4 NEW ZEALAND

12.4.4.1 Presence of OEMs to drive the aircraft mounts market in New Zealand

12.5 MIDDLE EAST

12.6 LATIN AMERICA

13 AIRCRAFT MOUNTS REPLACEMENT MARKET REGIONAL ANALYSIS (Page No. - 100)

13.1 INTRODUCTION

13.2 NORTH AMERICA

13.2.1 US

13.2.1.1 Upgradation of engineering components in aircraft by airlines is driving the growth of the market for aircraft mounts replacement in the US

13.2.2 CANADA

13.2.2.1 Aircraft modernization programs drive the aircraft mounts replacement market in Canada

13.3 EUROPE

13.3.1 UK

13.3.1.1 Presence of MROs in the UK boost the demand for aircraft mounts replacement

13.3.2 GERMANY

13.3.2.1 Growing government initiatives to replace aging aircraft equipment drive the demand for aircraft mounts replacement

13.3.3 FRANCE

13.3.3.1 Presence of MROs is driving the growth of the aircraft mounts replacement market in France

13.3.4 ITALY

13.3.4.1 Changing dynamics of aftermarket ecosystem is driving the demand for aircraft mounts replacement in Italy

13.3.5 REST OF EUROPE

13.3.5.1 Growing emphasis on timely maintenance and replacement of aircraft parts to drive the market in Rest of Europe

13.4 ASIA PACIFIC

13.4.1 CHINA

13.4.1.1 Growing demand for aerospace products from the US drive the aircraft mounts replacement market in China

13.4.2 JAPAN

13.4.2.1 Growing air traffic and foreign investments are driving the market for aircraft mounts replacement in Japan

13.4.3 INDIA

13.4.3.1 Improving domestic capabilities of aerospace industry drive the Indian market for aircraft mounts

13.4.4 AUSTRALIA

13.4.4.1 Growth in international as well as domestic air traffic is driving the market for aircraft mounts replacement in Australia

13.4.5 REST OF ASIA PACIFIC

13.4.5.1 Aging aircraft expected to drive the demand for aircraft mounts replacement in Rest of Asia Pacific

13.5 MIDDLE EAST

13.5.1 UAE

13.5.1.1 Growing export of aircraft components drive the market for aircraft mounts replacement in the UAE

13.5.2 SAUDI ARABIA

13.5.2.1 Significant growth of airlines drive the demand for aircraft mounts in Saudi Arabia

13.5.3 REST OF MIDDLE EAST

13.5.3.1 Growing aircraft repair stations to drive the demand for aircraft mounts in the Rest of Middle East

13.6 REST OF THE WORLD

13.6.1 BRAZIL

13.6.1.1 Emphasis on domestic production drive the market for aircraft mounts replacement in Brazil

13.6.2 SOUTH AFRICA

13.6.2.1 Demand for replacement of aircraft components will boost the market in South Africa

13.6.3 REST OF LATIN AMERICA & AFRICA

13.6.3.1 Availability of low-cost raw materials drive the market for replacement of aircraft mounts in Rest of Latin America & Africa

14 COMPETITIVE LANDSCAPE (Page No. - 129)

14.1 INTRODUCTION

14.2 COMPETITIVE LEADERSHIP MAPPING

14.2.1 VISIONARY LEADERS

14.2.2 INNOVATORS

14.2.3 DYNAMIC DIFFERENTIATORS

14.2.4 EMERGING COMPANIES

14.3 RANKING OF KEY PLAYERS,2018

14.4 COMPETITIVE SCENARIO

14.4.1 NEW PRODUCT LAUNCHES

14.4.2 CONTRACTS

14.4.3 OTHER STRATEGIES

15 COMPANY PROFILES (Page No. - 135)

(Business Overview,Products Offered,Recent Developments,SWOT Analysis,MnM View)*

15.1 LORD CORPORATION

15.2 TRELLEBORG GROUP

15.3 GMT RUBBER-METAL-TECHNIC LTD.

15.4 CADENCE AEROSPACE

15.5 MAYDAY MANUFACTURING

15.6 SHOCK TECH,INC.

15.7 AIRLOC LTD.

15.8 ANGEROLE MOUNTS,LLC

15.9 RAM MOUNTS

15.10 THE VMC GROUP

15.11 MEEKER AVIATION

15.12 VIBRASYSTEMS INC.

15.13 HUTCHINSON AEROSPACE GMBH

15.14 BUTSER RUBBER

15.15 ARKON RESOURCES,INC.

15.16 SINGAPORE AEROSPACE MANUFACTURING PTE LTD

15.17 ANTI VIBRATION METHODS (RUBBER) CO. LTD.

15.18 AVIONICS SUPPORT GROUP,INC.

15.19 GUARDIAN AVIONICS

15.20 MYGOFLIGHT

*Details on Business Overview,Products Offered,Recent Developments,SWOT Analysis,MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 164)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

LIST OF TABLES (154 Tables)

TABLE 1 MAXIMUM TAKE-OFF MASS (MTOM) STANDARDS

TABLE 2 DELIVERIES AND GROWTH OF COMMERCIAL AIRCRAFT,BY REGION,2017—2036

TABLE 3 MILITARY AIRCRAFT ACTIVE FLEET,BY COUNTRY,2019

TABLE 4 CAPABILITIES AND CHARACTERISTICS OF ADVANCED MATERIALS

TABLE 5 AIRCRAFT MOUNTS MARKET SIZE,BY END USE,2017—2025 (USD MILLION)

TABLE 6 OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 7 OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 8 OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 9 AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 10 AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 11 AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 12 AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 13 AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 14 INTERIOR AIRCRAFT MOUNTS MARKET SIZE,BY TYPE,2017—2025 (USD MILLION)

TABLE 15 EXTERIOR AIRCRAFT MOUNTS MARKET SIZE,BY TYPE,2017—2025 (USD MILLION)

TABLE 16 AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 17 COMMERCIAL AIRCRAFT MOUNTS MARKET SIZE,BY TYPE,2017—2025 (USD MILLION)

TABLE 18 GENERAL AVIATION AIRCRAFT MOUNTS MARKET SIZE,BY TYPE,2017—2025 (USD MILLION)

TABLE 19 MILITARY AIRCRAFT MOUNTS MARKET SIZE,BY TYPE,2017—2025 (USD MILLION)

TABLE 20 AIRCRAFT MOUNTS MARKET SIZE,BY MATERIAL,2017—2025 (USD MILLION)

TABLE 21 NORTH AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 22 NORTH AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 23 NORTH AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 24 NORTH AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 25 US: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 26 US: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 27 US: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 28 CANADA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 29 CANADA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 30 CANADA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 31 EUROPE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 32 EUROPE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 33 EUROPE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 34 EUROPE: AIRCRAFT MOUNTS MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 35 FRANCE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 36 FRANCE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 37 FRANCE: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 38 UK: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 39 UK: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 40 UK: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 41 SWITZERLAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 42 SWITZERLAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 43 SWITZERLAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 44 SWEDEN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 45 SWEDEN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 46 SWEDEN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 47 RUSSIA: OEM AIRCRAFT MOUNTS MARKET,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 48 RUSSIA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 49 RUSSIA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 50 ITALY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 51 ITALY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 52 ITALY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 53 GERMANY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 54 GERMANY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 55 GERMANY: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 57 ASIA PACIFIC: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 58 ASIA PACIFIC: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: OEM AIRCRAFT MOUNTS MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 60 CHINA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 61 CHINA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 62 CHINA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 63 JAPAN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 64 JAPAN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 65 JAPAN: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 66 INDIA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 67 INDIA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 68 INDIA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 69 NEW ZEALAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017–2025 (USD MILLION)

TABLE 70 NEW ZEALAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 71 NEW ZEALAND: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 72 MIDDLE EAST: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 73 MIDDLE EAST: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 74 MIDDLE EAST: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 75 LATIN AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 76 LATIN AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 77 LATIN AMERICA: OEM AIRCRAFT MOUNTS MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 78 NORTH AMERICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY AIRCRAFT TYPE,2017–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 80 NORTH AMERICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 81 NORTH AMERICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 82 US: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 83 US: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 84 US: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 85 CANADA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 86 CANADA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 87 CANADA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 88 EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 89 EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 90 EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 91 EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 92 UK: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 93 UK: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 94 UK: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 95 GERMANY: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 96 GERMANY: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 97 GERMANY: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 98 FRANCE: REPLACEMENT AIRCRAFT MOUNTS MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 99 FRANCE: REPLACEMENT AIRCRAFT MOUNTS MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 100 FRANCE: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNTS TYPE,2017—2025 (USD MILLION)

TABLE 101 ITALY: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 102 ITALY: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 103 ITALY: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 104 REST OF EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 105 REST OF EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 106 REST OF EUROPE: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 107 ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 109 ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 111 CHINA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 112 CHINA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 113 CHINA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 114 JAPAN: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 115 JAPAN: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 116 JAPAN: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 117 INDIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 118 INDIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 119 INDIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 120 AUSTRALIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 121 AUSTRALIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 122 AUSTRALIA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017–2025 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 126 MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 127 MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 128 MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 129 MIDDLE EAST: AIRCRAFT MOUNTS MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 130 UAE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 131 UAE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 132 UAE: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 133 SAUDI ARABIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 134 SAUDI ARABIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 135 SAUDI ARABIA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 137 REST OF MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 139 REST OF THE WORLD: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 140 REST OF THE WORLD: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 141 REST OF THE WORLD: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 142 REST OF THE WORLD: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY COUNTRY,2017—2025 (USD MILLION)

TABLE 143 BRAZIL: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 144 BRAZIL: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 145 BRAZIL: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 146 SOUTH AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 147 SOUTH AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 148 SOUTH AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET,BY MOUNTS TYPE,2017—2025 (USD MILLION)

TABLE 149 REST OF LATIN AMERICA & AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY AIRCRAFT TYPE,2017—2025 (USD MILLION)

TABLE 150 REST OF LATIN AMERICA & AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY APPLICATION,2017—2025 (USD MILLION)

TABLE 151 REST OF LATIN AMERICA & AFRICA: AIRCRAFT MOUNTS REPLACEMENT MARKET SIZE,BY MOUNT TYPE,2017—2025 (USD MILLION)

TABLE 152 NEW PRODUCT LAUNCHES,2015—2019

TABLE 153 CONTRACTS,2015—2019

TABLE 154 OTHER STRATEGIES,2015—2019

LIST OF FIGURES (35 Figures)

FIGURE 1 AIRCRAFT MOUNTS MARKET SEGMENTATION

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE,DESIGNATION,AND REGION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (OEM AND REPLACEMENT)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY ON THE AIRCRAFT MOUNTS MARKET

FIGURE 9 COMMERCIAL AIRCRAFT SEGMENT PROJECTED TO LEAD AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 10 REPLACEMENT SEGMENT PROJECTED TO DOMINATE AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 11 ENGINE MOUNTS SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF AIRCRAFT MOUNTS MARKET IN 2019

FIGURE 12 AIRCRAFT MOUNTS MARKET IN ASIA PACIFIC PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 GROWING EMPHASIS ON ENHANCING SAFETY AND COMFORT IN AIRCRAFT PROJECTED TO DRIVE THE AIRCRAFT MOUNTS MARKET

FIGURE 14 EXTERIOR MOUNTS SEGMENT PROJECTED TO ACCOUNT FOR THE LARGEST SHARE OF AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 15 ALUMINUM ALLOYS SEGMENT IS ESTIMATED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 16 COMMERCIAL AIRCRAFT SEGMENT AND THE UK ARE ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF AIRCRAFT MOUNTS REPLACEMENT MARKET IN EUROPE IN 2019

FIGURE 17 AIRCRAFT MOUNTS MARKET DYNAMICS: DRIVERS,OPPORTUNITIES & CHALLENGES

FIGURE 18 REPLACEMENT SEGMENT TO LEAD AIRCRAFT MOUNTS MARKET IN 2019

FIGURE 19 ENGINE MOUNTS SEGMENT TO LEAD AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 20 EXTERIOR MOUNTS SEGMENT TO LEAD AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 21 COMMERCIAL AIRCRAFT SEGMENT PROJECTED TO LEAD AIRCRAFT MOUNTS MARKET DURING FORECAST PERIOD

FIGURE 22 STEEL ALLOYS SEGMENT ESTIMATED TO LEAD AIRCRAFT MOUNTS MARKET IN 2019

FIGURE 23 NORTH AMERICA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF OEM AIRCRAFT MOUNTS MARKET IN 2019

FIGURE 24 NORTH AMERICA OEM AIRCRAFT MOUNTS MARKET SNAPSHOT

FIGURE 25 EUROPE OEM AIRCRAFT MOUNTS MARKET SNAPSHOT

FIGURE 26 ASIA PACIFIC OEM AIRCRAFT MOUNTS MARKET SNAPSHOT

FIGURE 27 NORTH AMERICA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF AIRCRAFT MOUNTS REPLACEMENT MARKET IN 2019

FIGURE 28 NORTH AMERICA AIRCRAFT MOUNTS REPLACEMENT MARKET SNAPSHOT

FIGURE 29 EUROPE AIRCRAFT MOUNTS REPLACEMENT MARKET SNAPSHOT

FIGURE 30 ASIA PACIFIC AIRCRAFT MOUNTS REPLACEMENT MARKET SNAPSHOT

FIGURE 31 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT MOUNTS MARKET BETWEEN 2015 AND 2019

FIGURE 32 AIRCRAFT MOUNTS MARKET COMPETITIVE LEADERSHIP MAPPING,2018

FIGURE 33 MARKET RANKING OF TOP PLAYERS IN THE AIRCRAFT MOUNTS MARKET,2018

FIGURE 34 TRELLEBORG GROUP: COMPANY SNAPSHOT

FIGURE 35 TRELLEBORG GROUP: SWOT ANALYSIS

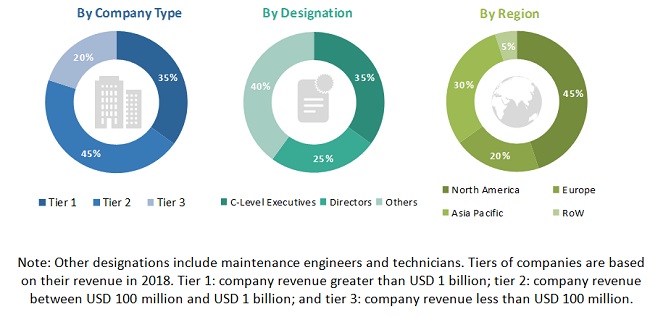

The study involved four major activities in estimating the current size of the aircraft mounts market. Exhaustive secondary research was undertaken to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources included annual reports, press releases & investor presentations of companies, certified publications and articles by recognized authors.

Primary Research

The demand side of this market includes industries, such as aviation, military as well as MROs and OEMs. The supply side includes aircraft mounts providers. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft mounts market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the aircraft mounts market.

Report Objectives

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft mounts market

- To forecast the market size of various segments of the aircraft mounts market with respect to the following regions (OEM—North America, Europe, Asia Pacific, Latin America, and the Middle East; Replacement—North America, Europe, Asia Pacific, the Middle East, and Rest of the World) along with key countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, acquisitions, and new product developments

- To identify detailed financial positions, key products, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Aircraft Mounts Market