NLP in Finance Market by Offering (Software, Services), Application (Customer Service and Support, Risk Management and Fraud Detection, Sentiment Analysis), Technology (Machine Learning, Deep Learning), Vertical and Region - Global Forecast to 2028

Natural Language Processing (NLP) in Finance Market - Size, Growth, Report & Analysis

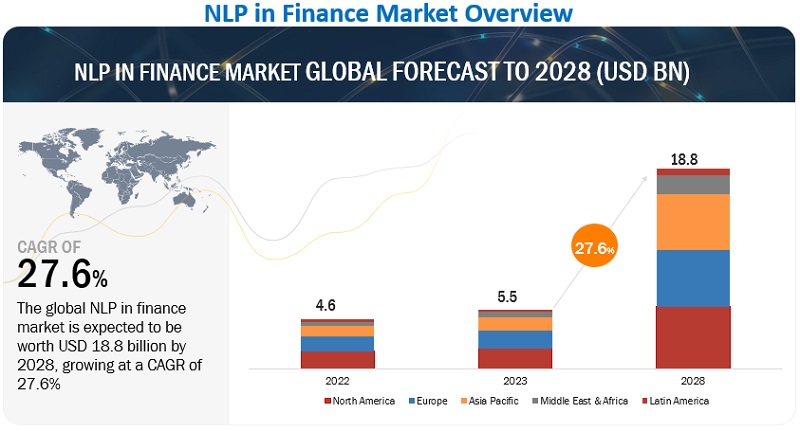

[376 Pages Report] The global NLP in Finance Market size was surpassed $5.5 billion in 2023 and is anticipated to rise over $18.8 billion by the end of 2028, projecting a CAGR of 27.6% during the forecast period(2023-2028). The base year for estimation is 2022 and the market size available for the years 2023 to 2028.

The NLP in finance market is estimated to witness significant growth during the forecast period, attributed to the increasing demand for automated and efficient financial services. The rising need for accurate and real-time analysis of complex financial data and the emergence of AI and ML models that enable enhanced NLP capabilities in finance are also major growth drivers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

NLP in Finance Market Growth Dynamics

Driver: Increasing demand for automated and efficient financial services across the globe

The adoption of NLP in the finance industry has been driven by the increasing demand for automated and efficient financial services worldwide. The use of NLP technology has become increasingly popular among financial institutions as they strive to provide personalized financial solutions that are cost-effective, efficient, and easily accessible to customers.

One of the key areas of delivering enhanced financial services is to improve customer service. Financial institutions are using NLP-powered chatbots to provide instant assistance to their customers, which has led to significant cost savings and improved customer satisfaction levels. These chatbots can answer frequently asked questions, provide information on account balances, and assist with money transfers. For example, Bank of America’s chatbot, Erica, has assisted over 15 million customers with their banking needs, resulting in a 19% reduction in customer service costs.

Restraints: Difficulty in managing large volumes of unstructured data

One of the primary reasons for the difficulty in managing large volumes of unstructured data is the lack of standardization. Unstructured data comes in different formats and types, such as text, images, and videos, making extracting meaningful insights challenging. Financial institutions often rely on manual processing, which can be time-consuming, expensive, and prone to errors.

Another factor contributing to the same is the lack of sophisticated tools to handle the complexities of unstructured data. Traditional data analysis tools were designed to handle structured data and are often ill-equipped to handle unstructured data. As a result, financial institutions are turning to advanced technologies such as natural language processing (NLP) to help them manage and analyze their data effectively.

Opportunity: Development of customized NLP solutions for specific financial services and use cases

The finance industry is witnessing rapid growth in the adoption of Natural Language Processing (NLP) techniques. NLP is used to analyze unstructured data, such as news articles, social media posts, and earnings call transcripts, to extract valuable insights and drive informed decision-making. However, the lack of standardization in NLP-based financial applications and services, difficulty in managing large volumes of unstructured data, and the complexity in developing and training sophisticated NLP models are major restraints that hinder the market growth.

Despite these challenges, the market opportunity for NLP in the finance industry remains significant. The development of customized NLP solutions & services for specific financial use cases is a major market opportunity. For instance, banks can use NLP to extract valuable insights from customer feedback to improve their products and services. Similarly, investment firms can use NLP to analyze market sentiments and news articles to make informed investment decisions.

Challenge: High implementation costs associated with NLP

The high cost of implementation can be a significant barrier to entry for smaller financial institutions, which may not have the resources or expertise to effectively implement NLP solutions. Hence, this factor can lead to a widening gap between larger and smaller financial institutions, with the former being better equipped to leverage the benefits of NLP in their operations. For example, a financial institution implementing an NLP-powered chatbot may need to invest in additional hardware and software to support the application, as well as hire specialized developers and data scientists to build and maintain the underlying NLP model. The costs of training employees on how to use the chatbot and monitor its performance may also add to the total cost of ownership.

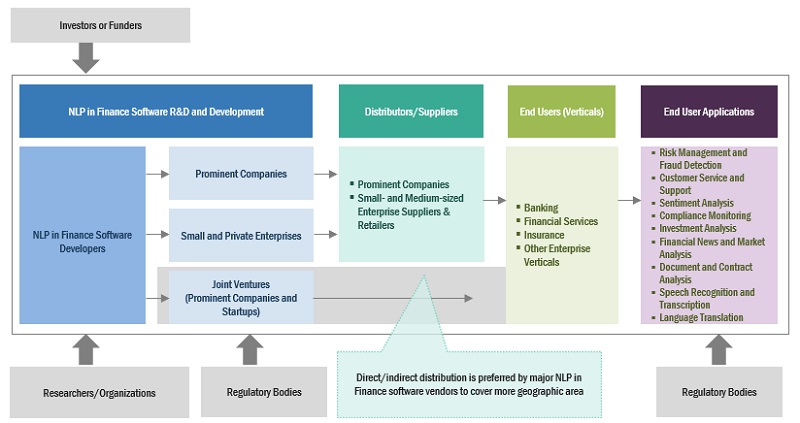

NLP in Finance Market Ecosystem

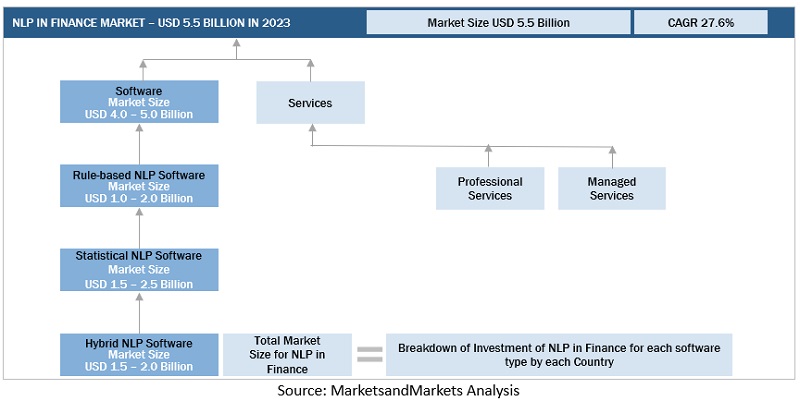

Software segment to account for larger market size during forecast period

The market is expected to continue growing at a rapid pace due to the increasing demand for NLP tools in the finance industry. The adoption of machine learning algorithms for NLP has significantly improved the accuracy and efficiency of NLP solutions in the finance industry. Machine learning-based NLP tools are capable of processing large volumes of data and providing more accurate and personalized insights. The use of chatbots and virtual assistants powered by NLP is gaining popularity among financial institutions. These tools provide customers personalized financial advice and support, improving customer engagement and satisfaction.

Deep Learning to register highest CAGR during forecast period

The deep learning segment is projected to witness a higher growth rate during the forecast period. Deep Learning has played a critical role in advancing NLP developments in the finance sector. One of the main advantages of deep Learning is its ability to learn from large and complex datasets, which is particularly important in finance, where a vast amount of data is available. This has led to the development of more accurate and sophisticated NLP models for various applications. For example, deep learning algorithms have been shown to outperform traditional machine learning algorithms in sentiment analysis, resulting in more accurate predictions of market trends and behaviors.

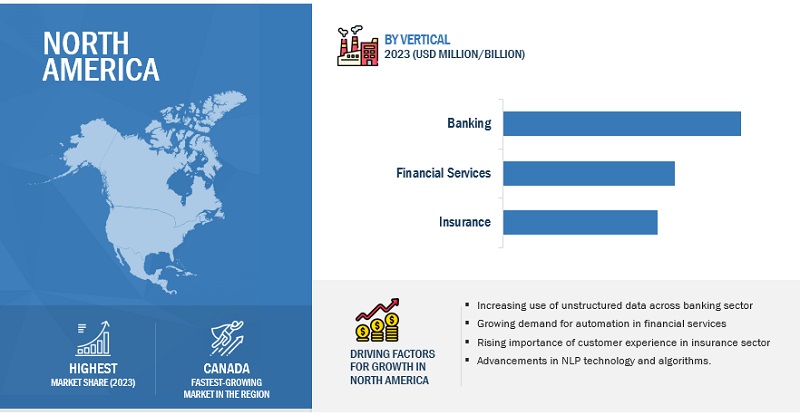

North America to have largest market size during forecast period

North America is expected to have the largest NLP in finance market share. The region has a lot of technological research centers, human capital, and strong infrastructure. Moreover, the rise in technical support and the developed R&D sector in the region fuels the growth of the market. NLP has been widely adopted in the finance industry in North America for various applications, including sentiment analysis, fraud detection, risk management, and customer service. NLP technology has proven useful for analyzing large volumes of unstructured data, such as news articles, social media posts, and customer feedback, to extract valuable insights.

NLP in Finance Comapnies

The NLP in finance solutions and service providers have implemented various types of organic and inorganic growth strategies, such as product launches, product upgradations, partnerships, agreements, business expansions, and mergers and acquisitions to strengthen their offerings. Some major players in the NLP in finance market include Microsoft (US), IBM (US), Google (US), AWS (US), Oracle (US), SAS Institute (US), Qualtrics (US), Baidu (China), Inbenta (US), Basis Technology (US), Nuance Communications (US) and Expert.ai (Italy).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Offering, Technology, Application, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

List of Companies in NLP in Finance |

Microsoft (US), IBM (US), Google (US), AWS (US), Oracle (US), SAS Institute (US), Qualtrics (US), Baidu (China), Inbenta (US), Basis Technology (US), Nuance Communications (US), expert.ai (Italy), LivePerson (US), Veritone (US), Automated Insights (US), Bitext (US), Conversica (US), Accern (US), Kasisto (US), Kensho (US), ABBYY (US), Mosaic (US), Uniphore (US), Observe.AI (US), Lilt (US), Cognigy (Germany), Addepto (Poland), Skit.ai (US), MindTitan (Estonia), Supertext.ai (India), Narrativa (US), and Cresta (US). |

NLP in Finance Market Highlights

This research report categorizes the NLP in Finance Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Technology: |

|

|

By Application: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments:

- In December 2022, AWS announced that Stability AI, a community-driven, open-source artificial intelligence (AI) company, has selected AWS as its preferred cloud provider to build and scale its AI models for image, language, audio, video, and 3D content generation.

- In March 2022, Microsoft announced its acquisition of Nuance Communications, a leader in conversational AI and ambient intelligence across industries, including healthcare, financial services, retail, and telecommunications. Driven by a shared vision to build outcomes-based AI, Microsoft, and Nuance will enable organizations across industries to accelerate their business goals.

- In February 2022, Google Cloud, KeyBank, and Deloitte announced an expanded, multi-year strategic partnership to accelerate KeyBank’s commitment to a cloud-first approach to banking.

- In November 2021, IBM launched its latest version of Watson Discovery, a cloud-based platform that uses natural language processing to extract insights from unstructured data in documents.

Frequently Asked Questions (FAQ):

What is Natural Language Processing (NLP) in Finance?

NLP is a machine learning technology that gives computers the ability to interpret, manipulate, and comprehend human language. Financial organizations today have large volumes of voice and text data from various communication channels like emails, text messages, social media newsfeeds, video, audio, and more. They use NLP software to automatically process this data, analyze the intent or sentiment in the message, and respond in real time to human communication.

What is the Natural Language Processing (NLP) in Finance Market Size?

The global Natural Language Processing (NLP) in Finance Market size was surpassed $5.5 billion in 2023 and is anticipated to rise over $18.8 billion by the end of 2028, projecting a CAGR of 27.6% during the forecast period

Which are the key drivers supporting the NLP in finance market growth?

Some factors driving the NLP in finance market growth include the rise in content creation and creative applications, evolution in AI and Deep Learning, innovation of cloud storage enabling easy access to data, and acceleration in the deployment of Large Language Models (LLMs).

Which are the key technology trends prevailing in the NLP in Finance market?

The three key technologies gaining a foothold in the NLP in Finance market are machine learning, deep Learning, and natural language generation. Apart from these three, other prominent technologies include text classification, topic modeling, emotion detection, named entity recognition, and event extraction.

Who are the key vendors in the NLP in Finance market?

Some major players in the NLP in Finance market include Microsoft (US), IBM (US), Google (US), AWS (US), Oracle (US), SAS Institute (US), Qualtrics (US), Baidu (China), Inbenta (US), Basis Technology (US), Nuance Communications (US), Expert.ai (Italy), LivePerson (US), Veritone (US), Automated Insights (US), Bitext (US), Conversica (US), Accern (US), Kasisto (US), Kensho (US), ABBYY (US), Mosaic (US), Uniphore (US), Observe.AI (US), Lilt (US), Cognigy (Germany), Addepto (Poland), Skit.ai (US), MindTitan (Estonia), Supertext.ai (India), Narrativa (US), and Cresta (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for automated and efficient financial services worldwide- Rising need for accurate and real-time analysis of complex financial data- Emergence of AI and ML modelsRESTRAINTS- Lack of standardization in NLP-based financial applications and services- Difficulty in managing large volumes of unstructured data- Complexity in developing and training sophisticated NLP modelsOPPORTUNITIES- Development of customized NLP solutions for specific financial services and use cases- Integration of NLP with blockchain and big data to enhance accuracy and efficiency of financial operations- Growing adoption of NLP-powered chatbots and virtual assistantsCHALLENGES- High implementation costs associated with NLP- Limited availability of skilled professionals- Data privacy concerns associated with use of NLP

-

5.3 ETHICS AND IMPLICATIONS OF NLP IN FINANCEBIAS AND FAIRNESSPRIVACY AND SECURITYINTELLECTUAL PROPERTYACCOUNTABILITY AND RESPONSIBILITYSOCIETAL AND ECONOMIC IMPACT

- 5.4 BRIEF HISTORY OF NLP IN FINANCE

-

5.5 ECOSYSTEM ANALYSISNLP IN FINANCE TECHNOLOGY PROVIDERSNLP IN FINANCE CLOUD PLATFORM PROVIDERSNLP IN FINANCE API AND AS-A-SERVICE PROVIDERSNLP IN FINANCE HARDWARE PROVIDERSNLP IN FINANCE END USERSNLP IN FINANCE REGULATORS

-

5.6 NLP IN FINANCE TOOLS AND FRAMEWORKTENSORFLOWPYTORCHKERASNLTKAPACHE OPENNLPSPACYGENSIMALLENNLPFLAIRSTANFORD CORENLP

-

5.7 CASE STUDY ANALYSISCASE STUDY 1: NATWEST IMPROVED SPEED AND ACCURACY OF COMPLAINT-HANDLING PROCESS THROUGH IBMCASE STUDY 2: AYASDI’S NLP PLATFORM HELPED J.P. MORGAN CHASE RAMP UP RISK ASSESSMENT TECHNIQUESCASE STUDY 3: CAPITAL ONE ELIMINATED INEFFICIENCIES IN CUSTOMER QUERY RESOLUTION THROUGH NLPCASE STUDY 4: BLACKROCK IDENTIFIED NEW INVESTMENT AVENUES BY ANALYZING LARGE VOLUMES OF UNSTRUCTURED DATACASE STUDY 5: YSEOP ASSISTED TD AMERITRADE IN DISCOVERING NEW CUSTOMER INSIGHTSCASE STUDY 6: ALLIANZ WITNESSED SUBSTANTIAL IMPROVEMENT IN INSURANCE CLAIMS PROCESSING THROUGH NLPCASE STUDY 7: UBS TRAINED DATASETS THROUGH NLP TO AUGMENT RISK MANAGEMENT PROCESSESCASE STUDY 8: CITI ADDED PERSONALIZED TOUCH TO CUSTOMER RECOMMENDATIONS VIA NLP-BASED QUERY ANALYSISCASE STUDY 9: BARCLAYS SCALED ITS TRADING AND INVESTMENT ANALYSIS PROCESSES VIA AYASDI’S NLP TOOLCASE STUDY 10: GOLDMAN SACHS AUGMENTED ITS FINANCIAL R&D PROWESSCASE STUDY 11: NLP EMPOWERED KABBAGE WITH SMARTER DECISION-MAKING FOR LOAN DISBURSALCASE STUDY 12: CHAINALYSIS DEPLOYED NLP FOR FRAUD PREVENTION IN CRYPTO TRADING

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- Fair Credit Reporting Act (FCRA)- Consumer Financial Protection Act (CFPA)- Gramm-Leach-Bliley Act (GLBA)- Sarbanes-Oxley Act (SOX)- Dodd-Frank Wall Street Reform and Consumer Protection ActEUROPE- Markets in Financial Instruments Directive II (MiFID II)- General Data Protection Regulation (GDPR)- Payment Services Directive 2 (PSD2)- Markets in Financial Instruments Regulation (MiFIR)- Anti-Money Laundering (AML) DirectiveASIA PACIFIC- Personal Information Protection Act (PIPA) – Japan- Personal Data Protection Act (PDPA) – Singapore- Information Technology Act (ITA) – India- Personal Information Protection Law (PIPL) – China- Privacy Act – AustraliaLATIN AMERICA- General Data Protection Law (LGPD) – Brazil- Data Protection Law (Ley de Proteccion de Datos Personales) – Mexico- Financial Institutions Law (Ley de Instituciones de Credito) – Mexico- Anti-Money Laundering (AML) Law – Colombia- Financial Sector Law (Ley del Sector Financiero) – ColombiaMIDDLE EAST AND AFRICA- Dubai Financial Services Authority (DFSA) Regulations- Financial Sector Regulation (FSR) – South Africa- Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Regulations – Saudi Arabia- Data Protection and Privacy Regulations – Egypt- Financial Services Authority (FSA) Regulations – Morocco

-

5.10 PATENT ANALYSISMETHODOLOGYPATENTS FILED, BY DOCUMENT TYPE, 2019–2022INNOVATION AND PATENT APPLICATIONSTOP APPLICANTS

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.12 PRICING ANALYSIS

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.15 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF NLP IN FINANCE MARKET

-

5.16 BEST PRACTICES IN NLP IN FINANCE MARKETDOMAIN-SPECIFIC DATA SELECTION AND DATA CLEANINGFEATURE ENGINEERINGMODEL SELECTIONEVALUATION METRICSCROSS-VALIDATIONREGULARIZATIONHYPERPARAMETER TUNINGTRANSFER LEARNINGINTERPRETABILITYREGULATORY COMPLIANCEBACKTESTING AND DEPLOYMENT

-

5.17 TECHNOLOGY ROADMAP OF NLP IN FINANCENLP IN FINANCE ROADMAP TILL 2030- Pre-2020- 2020-2022- Short-term (2023-2025)- Mid-term (2026-2028)- Long-term (2029-2030)

-

5.18 CURRENT AND EMERGING BUSINESS MODELSSAAS MODELCONSULTING SERVICES MODELPARTNER PROGRAMS (REVENUE SHARING MODEL)PAY-PER-USE MODEL

-

5.19 NLP IN FINANCE’S IMPACT ON ADJACENT NICHE TECHNOLOGIESHIGH-FREQUENCY TRADING AND ELECTRONIC TRADING PLATFORMSFINANCIAL CYBERSECURITYREGULATORY TECHNOLOGY (REGTECH)

-

6.1 INTRODUCTIONOFFERING: NLP IN FINANCE MARKET DRIVERS

-

6.2 SOFTWARENLP IN FINANCE SOFTWARE, BY SOFTWARE TYPE- Rule-based NLP Software- Statistical NLP Software- Hybrid NLP Software

-

6.3 SERVICESPROFESSIONAL SERVICES- Professional services to offer specialized expertise in NLP in financeMANAGED SERVICES- Managed services to provide end-to-end management to help businesses focus on core competencies

-

7.1 INTRODUCTIONAPPLICATION: NLP IN FINANCE MARKET DRIVERS

-

7.2 SENTIMENT ANALYSISSENTIMENT ANALYSIS TO IDENTIFY AND MITIGATE POTENTIAL FINANCIAL RISKS- Brand reputation management- Market sentiment analysis- Customer feedback analysis- Product review analysis- Social media monitoring

-

7.3 RISK MANAGEMENT AND FRAUD DETECTIONNLP TO IMPROVE SPEED AND ACCURACY OF RISK IDENTIFICATION AND FRAUD DETECTION- Credit risk assessment- Fraud Detection and Prevention- Anti-money laundering (AML)- Compliance monitoring- Cybersecurity threat detection

-

7.4 COMPLIANCE MONITORINGNLP TO ANALYZE FINANCIAL TRANSACTIONS AND IDENTIFY POTENTIAL NON-COMPLIANCE ISSUES- Regulatory compliance monitoring- KYC/AML compliance monitoring- Legal and policy compliance monitoring- Audit trail monitoring- Trade surveillance

-

7.5 INVESTMENT ANALYSISFINANCIAL INSTITUTIONS INVESTING IN NLP TECHNOLOGY TO HAVE COMPETITIVE EDGE- Asset allocation and portfolio optimization- Equity research and analysis- Quantitative analysis and modeling- Investment recommendations and planning- Risk management and prediction- Investment opportunity identification

-

7.6 FINANCIAL NEWS AND MARKET ANALYSISNLP ALGORITHMS TO PREDICT HOW MARKETS REACT AND HELP INVESTORS MAKE INFORMED INVESTMENT DECISIONS- Financial news analysis- Stock market prediction- Macroeconomic analysis

-

7.7 CUSTOMER SERVICE AND SUPPORTADOPTION OF INTELLIGENT CHATBOTS AND CUSTOMER SUPPORT SYSTEMS TO DRIVE GROWTH- Chatbots and virtual assistants- Personalized support and service- Compliant resolution- Query resolution and escalation management- Self-service options- Multilingual customer service and support

-

7.8 DOCUMENT AND CONTRACT ANALYSISDOCUMENT AND CONTRACT ANALYSIS TO STREAMLINE DATA PROCESSING WORKFLOWS- Contract management- Legal document analysis- Due diligence analysis- Data extraction and normalization

-

7.9 SPEECH RECOGNITION AND TRANSCRIPTIONPOWERFUL TOOL TO CAPTURE AND ANALYZE VOICE DATA AND ENSURE COMPLIANCE- Voice-enabled search and navigation- Speech-to-text conversion- Call transcription and analysis- Voice biometrics and authentication- Speech-enabled virtual assistants

-

7.10 LANGUAGE TRANSLATIONAUTOMATING REPORT WRITING AND PERSONALIZED FINANCIAL ADVICE TO DRIVE UPTAKE OF LANGUAGE TRANSLATION TOOLS- Financial document translation- Investment research translation- Cross-border business communication- Localization and internationalization

- 7.11 OTHER APPLICATIONS

-

8.1 INTRODUCTIONTECHNOLOGY: NLP IN FINANCE MARKET DRIVERS

-

8.2 MACHINE LEARNINGMACHINE LEARNING TO BE EXTENSIVELY DEPLOYED TO PREDICT FINANCIAL MARKET INSIGHTS- Supervised learning- Unsupervised learning- Reinforcement learning

-

8.3 DEEP LEARNINGDEEP LEARNING TO PLAY CRITICAL ROLE IN ADVANCING NLP DEVELOPMENTS- Convolutional neural networks (CNN)- Recurrent neural networks (RNN)- Transformer models (BERT, GPT-3, etc.)

-

8.4 NATURAL LANGUAGE GENERATIONFINANCIAL INSTITUTIONS TO INCREASINGLY ADOPT NLG TO IMPROVE EFFICIENCY AND REDUCE COSTS- Automated report writing- Customer communication- Financial document generation

-

8.5 TEXT CLASSIFICATIONTEXT CLASSIFICATION TO ANALYZE MARKET SENTIMENTS IN FINANCE- Sentiment classification- Intent classification

-

8.6 TOPIC MODELINGTOPIC MODELING TO EXTRACT INSIGHTS FROM FINANCIAL NEWS ARTICLES- Topic identification- Topic clustering- Topic visualization

-

8.7 EMOTION DETECTIONEMOTION DETECTION TO IMPROVE SENTIMENT ANALYSIS IN FINANCIAL DISCOURSE- Emotion recognition- Emotion classification

-

8.8 OTHER TECHNOLOGIESNER AND EVENT EXTRACTION TO FACE SPIKE IN HANDLING UNSTRUCTURED FINANCIAL DATA

-

9.1 INTRODUCTIONVERTICAL: NLP IN FINANCE MARKET DRIVERS

-

9.2 BANKINGNLP TO IMPROVE EFFICIENCY, ACCURACY, AND CUSTOMER EXPERIENCENLP IN FINANCE: BANKING USE CASES- Retail banking- Corporate banking- Investment banking- Wealth management

-

9.3 INSURANCEINSURANCE COMPANIES TO ANALYZE LARGE AMOUNTS OF DATA USING NLPNLP IN FINANCE: INSURANCE USE CASES- Life insurance- Property and casualty insurance- Health insurance

-

9.4 FINANCIAL SERVICESUSE OF NLP TO GROW IN FINTECHNLP IN FINANCE: FINANCIAL SERVICES USE CASES- Credit rating- Payment processing and remitting- Accounting and auditing- Personal finance management- Robo-advisory- Cryptocurrencies and blockchain- Stock movement prediction- Others

-

9.5 OTHER ENTERPRISE VERTICALSNLP IN FINANCE TO MAKE INROADS ACROSS FINANCIAL OPERATIONS- Healthcare and life sciences- Manufacturing- Retail and eCommerce- Energy & utilities- Transportation and logistics- Others

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: NLP IN FINANCE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- US to implement NLP for real-time data analysisCANADA- Canadian banks to use NLP-powered chatbots to interact with customers

-

10.3 EUROPEEUROPE: NLP IN FINANCE MARKET DRIVERSEUROPE: RECESSION IMPACTUK- UK companies to leverage NLP to improve operations and gain competitive edgeGERMANY- Adoption of NLP to be driven by regulatory compliance, cost reduction, and better customer experienceFRANCE- France to witness emergence of AI-based chatbots using NLPITALY- NLP to help financial institutions analyze large volumes of data efficiently and accuratelySPAIN- NLP to significantly improve customer service and reduce operating costs in bankingSWITZERLAND- Swiss banks and financial institutions to invest in NLP to gain competitive advantageREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: NLP IN FINANCE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- NLP solutions to develop as demand for digital transformation increasesINDIA- Adoption of NLP in banking to be influenced by startups and Digital India movementJAPAN- NLP potential to be unlocked in Japan's finance marketsSOUTH KOREA- NLP to change financial sector by improving consumer experienceSINGAPORE- Singapore to improve its financial services and stay competitive using NLPANZ- NLP solutions to gain more prominence due to technology developmentREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: NLP IN FINANCE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Saudi Arabia to embrace NLP to drive economic growthUAE- Several UAE startups to leverage NLP to drive innovationSOUTH AFRICA- South Africa to witness several developments in NLPISRAEL- Adoption of NLP to position country as leader in technological advancementsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: NLP IN FINANCE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACT- Brazil- Mexico- Argentina- Rest of Latin America

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

-

11.3 REVENUE ANALYSISHISTORIC REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 STARTUP/SME COMPETITIVE BENCHMARKING

-

11.9 NLP IN FINANCE PRODUCT LANDSCAPEPROMINENT NAMED SENTIMENT ANALYSIS PRODUCTS- Lexalytics- Aylien- Google Cloud- IBM Watson- Amazon ComprehendPROMINENT NAMED ENTITY RECOGNITION PRODUCTS- Rosette- Spacy- Basis Tech- Expert.AI- MeaningCloudPROMINENT TOPIC MODELING PRODUCTS- Gensim- Mallet- LDAvis- bigARTM- Stanford NLPPROMINENT TEXT CLASSIFICATION PRODUCTS- MonkeyLearn- Datumbox- OpenAI- Hugging Face- TensorFlowPROMINENT DOCUMENT CLASSIFICATION PRODUCTS- Azure Cognitive Services Text Analytics- OpenText Magellan- RapidMiner- Prodigy By Explosion AI- KNIME Analytics Platform

- 11.10 VALUATION AND FINANCIAL METRICS OF KEY NLP IN FINANCE VENDORS

-

11.11 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSMICROSOFT- Business overview- Software/Services offered- Recent developments- MnM viewIBM- Business overview- Software/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Software/Services offered- Recent developments- MnM viewAWS- Business overview- Software/Services offered- Recent developments- MnM viewORACLE- Business overview- Software/Services offered- Recent developments- MnM viewSAS INSTITUTE- Business overview- Software/Services offered- Recent developmentsQUALTRICS- Business overview- Software/Services offered- Recent developmentsBAIDU- Business overview- Software/Services offered- Recent developmentsINBENTA- Business overview- Software/Services offered- Recent developmentsBASIS TECHNOLOGY- Business overview- Software/Services offered- Recent developmentsNUANCE COMMUNICATIONS- Business overview- Software/Services offered- Recent developmentsEXPERT.AI- Business overview- Software/Services offered- Recent developmentsLIVEPERSONVERITONEAUTOMATED INSIGHTSBITEXTCONVERSICAACCERNKASISTOKENSHOABBYYMOSAICUNIPHORE

-

12.3 STARTUP/SME PROFILESOBSERVE.AILILTCOGNIGYADDEPTOSKIT.AIMINDTITANSUPERTEXT.AINARRATIVACRESTA

-

13.1 NLP IN HEALTHCARE & LIFE SCIENCESMARKET DEFINITIONMARKET OVERVIEW- NLP in healthcare & life sciences market, by component- NLP in healthcare & life sciences market, by type- NLP in healthcare & life sciences market, by application- NLP in healthcare & life sciences market, by size- NLP in healthcare & life sciences market, by deployment mode- NLP in healthcare & life sciences market, by technique- NLP in healthcare & life sciences market, by end user- NLP in healthcare & life sciences market, by region

-

13.2 SPEECH ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEW- Speech analytics market, by component- Speech analytics market, by business function- Speech analytics market, by organization size- Speech analytics market, by deployment mode- Speech analytics market, by application- Speech analytics market, by vertical- Speech analytics market, by region

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATE, 2019–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 NLP IN FINANCE MARKET SIZE AND GROWTH RATE, 2019–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL NLP IN FINANCE MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 NLP IN FINANCE MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2019–2022

- TABLE 12 TOP 20 PATENT OWNERS IN NLP IN FINANCE MARKET, 2013–2022

- TABLE 13 LIST OF PATENTS IN NLP IN FINANCE MARKET, 2021–2023

- TABLE 14 NLP IN FINANCE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 AVERAGE SELLING PRICING ANALYSIS OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD)

- TABLE 16 IMPACT OF EACH FORCE ON NLP IN FINANCE MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 NLP IN FINANCE ROADMAP TILL 2030

- TABLE 20 NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 21 NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 22 SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 SOFTWARE: NLP IN FINANCE MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 25 SOFTWARE: NLP IN FINANCE MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 26 RULE-BASED NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 RULE-BASED NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 STATISTICAL NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 STATISTICAL NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 HYBRID NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 HYBRID NLP SOFTWARE: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 33 NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 34 SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SERVICES: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 37 SERVICES: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 TRAINING AND CONSULTING SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 TRAINING AND CONSULTING SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SUPPORT AND MAINTENANCE SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 SUPPORT AND MAINTENANCE SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MANAGED SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 SENTIMENT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 SENTIMENT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 RISK MANAGEMENT AND FRAUD DETECTION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 RISK MANAGEMENT AND FRAUD DETECTION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 COMPLIANCE MONITORING: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 COMPLIANCE MONITORING: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 INVESTMENT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 INVESTMENT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 FINANCIAL NEWS AND MARKET ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 FINANCIAL NEWS AND MARKET ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 CUSTOMER SERVICE AND SUPPORT: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 CUSTOMER SERVICE AND SUPPORT: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 DOCUMENT AND CONTRACT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 DOCUMENT AND CONTRACT ANALYSIS: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 SPEECH RECOGNITION AND TRANSCRIPTION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 SPEECH RECOGNITION AND TRANSCRIPTION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 LANGUAGE TRANSLATION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 LANGUAGE TRANSLATION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 OTHER APPLICATIONS: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 71 NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 72 MACHINE LEARNING: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 MACHINE LEARNING: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 DEEP LEARNING: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 DEEP LEARNING: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NATURAL LANGUAGE GENERATION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 NATURAL LANGUAGE GENERATION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 TEXT CLASSIFICATION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 TEXT CLASSIFICATION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 TOPIC MODELING: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 TOPIC MODELING: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 EMOTION DETECTION: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 EMOTION DETECTION: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 OTHER TECHNOLOGIES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 OTHER TECHNOLOGIES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 87 NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 BANKING: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 BANKING: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 INSURANCE: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 INSURANCE: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 FINANCIAL SERVICES: NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 FINANCIAL SERVICES: NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 NLP IN FINANCE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 NLP IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: NLP IN FINANCE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: NLP IN FINANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 US: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 113 US: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 115 CANADA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 117 EUROPE: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: NLP IN FINANCE MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 119 EUROPE: NLP IN FINANCE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 123 EUROPE: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 125 EUROPE: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 127 EUROPE: NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 129 EUROPE: NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: NLP IN FINANCE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 EUROPE: NLP IN FINANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 UK: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 133 UK: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 134 GERMANY: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 135 GERMANY: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 136 FRANCE: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 137 FRANCE: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 138 ITALY: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 139 ITALY: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 140 SPAIN: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 141 SPAIN: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 SWITZERLAND: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 143 SWITZERLAND: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 145 REST OF EUROPE: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: NLP IN FINANCE MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: NLP IN FINANCE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: NLP IN FINANCE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: NLP IN FINANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 CHINA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 163 CHINA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 164 INDIA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 165 INDIA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 166 JAPAN: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 167 JAPAN: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 SOUTH KOREA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 169 SOUTH KOREA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 170 SINGAPORE: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 171 SINGAPORE: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 172 ANZ: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 173 ANZ: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 192 SAUDI ARABIA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 193 SAUDI ARABIA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 194 UAE: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 195 UAE: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 198 ISRAEL: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 199 ISRAEL: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: NLP IN FINANCE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: NLP IN FINANCE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 207 LATIN AMERICA: NLP IN FINANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 209 LATIN AMERICA: NLP IN FINANCE MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 211 LATIN AMERICA: NLP IN FINANCE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: NLP IN FINANCE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: NLP IN FINANCE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: NLP IN FINANCE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: NLP IN FINANCE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: NLP IN FINANCE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: NLP IN FINANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 218 BRAZIL: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 219 BRAZIL: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 220 MEXICO: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 221 MEXICO: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 222 ARGENTINA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 223 ARGENTINA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 224 REST OF LATIN AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: NLP IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 226 OVERVIEW OF STRATEGIES ADOPTED BY KEY NLP IN FINANCE VENDORS

- TABLE 227 NLP IN FINANCE MARKET: DEGREE OF COMPETITION

- TABLE 228 NLP IN FINANCE MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 229 NLP IN FINANCE MARKET: PRODUCT FOOTPRINT ANALYSIS OF OTHER KEY PLAYERS, 2022

- TABLE 230 NLP IN FINANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 231 NLP IN FINANCE MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/ SMES, 2022

- TABLE 232 COMPARATIVE ANALYSIS OF PROMINENT NAMED SENTIMENT ANALYSIS PRODUCTS

- TABLE 233 COMPARATIVE ANALYSIS OF PROMINENT NAMED ENTITY RECOGNITION PRODUCTS

- TABLE 234 COMPARATIVE ANALYSIS OF PROMINENT TOPIC MODELING PRODUCTS

- TABLE 235 COMPARATIVE ANALYSIS OF PROMINENT TEXT CLASSIFICATION PRODUCTS

- TABLE 236 COMPARATIVE ANALYSIS OF PROMINENT DOCUMENT CLASSIFICATION PRODUCTS

- TABLE 237 SERVICE/PRODUCT LAUNCHES, 2020–2023

- TABLE 238 DEALS, 2021–2023

- TABLE 239 MICROSOFT: BUSINESS OVERVIEW

- TABLE 240 MICROSOFT: SOFTWARE/SERVICES OFFERED

- TABLE 241 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 MICROSOFT: DEALS

- TABLE 243 IBM: BUSINESS OVERVIEW

- TABLE 244 IBM: SOFTWARE/SERVICES OFFERED

- TABLE 245 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 IBM: DEALS

- TABLE 247 GOOGLE: BUSINESS OVERVIEW

- TABLE 248 GOOGLE: SOFTWARE/SERVICES OFFERED

- TABLE 249 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 GOOGLE: DEALS

- TABLE 251 AWS: BUSINESS OVERVIEW

- TABLE 252 AWS: SOFTWARE/SERVICES OFFERED

- TABLE 253 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 254 AWS: DEALS

- TABLE 255 ORACLE: BUSINESS OVERVIEW

- TABLE 256 ORACLE: SOFTWARE/SERVICES OFFERED

- TABLE 257 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 258 ORACLE: DEALS

- TABLE 259 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 260 SAS INSTITUTE: SOFTWARE/SERVICES OFFERED

- TABLE 261 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 SAS INSTITUTE: DEALS

- TABLE 263 QUALTRICS: BUSINESS OVERVIEW

- TABLE 264 QUALTRICS: SOFTWARE/SERVICES OFFERED

- TABLE 265 QUALTRICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 266 QUALTRICS: DEALS

- TABLE 267 BAIDU: BUSINESS OVERVIEW

- TABLE 268 BAIDU: SOFTWARE/SERVICES OFFERED

- TABLE 269 BAIDU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 INBENTA: BUSINESS OVERVIEW

- TABLE 271 INBENTA: SOFTWARE/SERVICES OFFERED

- TABLE 272 INBENTA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 INBENTA: DEALS

- TABLE 274 BASIS TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 275 BASIS TECHNOLOGY: SOFTWARE/SERVICES OFFERED

- TABLE 276 BASIS TECHNOLOGY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 BASIS TECHNOLOGY: DEALS

- TABLE 278 NUANCE COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 279 NUANCE COMMUNICATIONS: SOFTWARE/SERVICES OFFERED

- TABLE 280 NUANCE COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 281 NUANCE COMMUNICATIONS: DEALS

- TABLE 282 EXPERT.AI: BUSINESS OVERVIEW

- TABLE 283 EXPERT.AI: SOFTWARE/SERVICES OFFERED

- TABLE 284 EXPERT.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 285 EXPERT.AI: DEALS

- TABLE 286 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 287 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 288 SOLUTIONS: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 289 SOLUTIONS: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 290 NLP IN HEALTHCARE & LIFE SCIENCES SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 291 NLP IN HEALTHCARE & LIFE SCIENCES SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 292 SERVICES: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 293 SERVICES: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 294 SERVICES: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 295 SERVICES: NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 296 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 297 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 298 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 299 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 300 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY SIZE, 2017–2021 (USD MILLION)

- TABLE 301 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY SIZE, 2022–2027 (USD MILLION)

- TABLE 302 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 303 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 304 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 305 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

- TABLE 306 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 307 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 308 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 309 NLP IN HEALTHCARE & LIFE SCIENCES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 310 SPEECH ANALYTICS MARKET, BY COMPONENT, 2018–2021(USD MILLION)

- TABLE 311 SPEECH ANALYTICS MARKET, BY COMPONENT, 2022–2027(USD MILLION)

- TABLE 312 SOLUTIONS: SPEECH ANALYTICS MARKET, BY REGION, 2018–2021(USD MILLION)

- TABLE 313 SOLUTIONS: SPEECH ANALYTICS MARKET, BY REGION, 2022–2027(USD MILLION)

- TABLE 314 SPEECH ANALYTICS MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 315 SPEECH ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 316 SERVICES: SPEECH ANALYTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 317 SERVICES: SPEECH ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 318 SPEECH ANALYTICS MARKET, BY BUSINESS FUNCTION, 2018–2021(USD MILLION)

- TABLE 319 SPEECH ANALYTICS MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

- TABLE 320 SPEECH ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 321 SPEECH ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 322 SPEECH ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2021(USD MILLION)

- TABLE 323 SPEECH ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

- TABLE 324 SPEECH ANALYTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 325 SPEECH ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 326 SPEECH ANALYTICS MARKET BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 327 SPEECH ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 328 SPEECH ANALYTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 329 SPEECH ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 NLP IN FINANCE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 NLP IN FINANCE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF NLP IN FINANCE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF NLP IN FINANCE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF NLP IN FINANCE MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF NLP IN FINANCE THROUGH OVERALL SPENDING

- FIGURE 8 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 9 STATISTICAL NLP SOFTWARE TO ACCOUNT FOR MAJOR MARKET SHARE IN 2023

- FIGURE 10 PROFESSIONAL SERVICES TO DOMINATE MARKET IN 2023

- FIGURE 11 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES TO DOMINATE MARKET IN 2023

- FIGURE 12 RISK MANAGEMENT AND FRAUD DETECTION TO BE LEADING APPLICATION IN 2023

- FIGURE 13 MACHINE LEARNING TO BE MOST DEPLOYED TECHNOLOGY IN 2023

- FIGURE 14 INSURANCE VERTICAL SET TO WITNESS FASTEST GROWTH RATE

- FIGURE 15 NORTH AMERICA TO HOLD LARGEST MARKET SHARE

- FIGURE 16 INCREASING POPULARITY OF CHATBOTS ACROSS FINANCE AND IMPROVING PERFORMANCE OF NLP MODELS TO DRIVE MARKET GROWTH

- FIGURE 17 CUSTOMER SERVICE AND SUPPORT APPLICATION SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE

- FIGURE 18 SOFTWARE AND BANKING TO BE LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2023

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 20 NLP IN FINANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 BRIEF HISTORY OF NLP IN FINANCE

- FIGURE 22 KEY PLAYERS IN NLP IN FINANCE MARKET ECOSYSTEM

- FIGURE 23 NLP IN FINANCE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013–2022

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR NLP IN FINANCE MARKET, 2013-2022

- FIGURE 27 INDICATIVE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS

- FIGURE 28 NLP IN FINANCE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 NLP IN FINANCE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 32 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 STATISTICAL NLP SOFTWARE TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 34 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR IN NLP IN FINANCE MARKET FOR SERVICES DURING FORECAST PERIOD

- FIGURE 35 TRAINING AND CONSULTING SERVICES SUB-SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NATURAL LANGUAGE GENERATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 37 DEEP LEARNING SEGMENT TO GROW AT HIGHER CAGR

- FIGURE 38 INSURANCE SEGMENT TO GROW AT HIGHEST CAGR

- FIGURE 39 ASIA PACIFIC NLP IN FINANCE MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INDIA TO REGISTER HIGHEST CAGR IN NLP IN FINANCE

- FIGURE 41 NORTH AMERICA: SNAPSHOT OF NLP IN FINANCE MARKET

- FIGURE 42 ASIA PACIFIC: SNAPSHOT OF NLP IN FINANCE MARKET

- FIGURE 43 HISTORIC REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 44 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN 2022

- FIGURE 45 NLP IN FINANCE MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 STARTUPS/SMES: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 47 VALUATION AND FINANCIAL METRICS OF KEY NLP IN FINANCE VENDORS

- FIGURE 48 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 GOOGLE: COMPANY SNAPSHOT

- FIGURE 51 AWS: COMPANY SNAPSHOT

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- FIGURE 53 QUALTRICS: COMPANY SNAPSHOT

- FIGURE 54 BAIDU: COMPANY SNAPSHOT

- FIGURE 55 NUANCE COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 56 EXPERT.AI: COMPANY SNAPSHOT

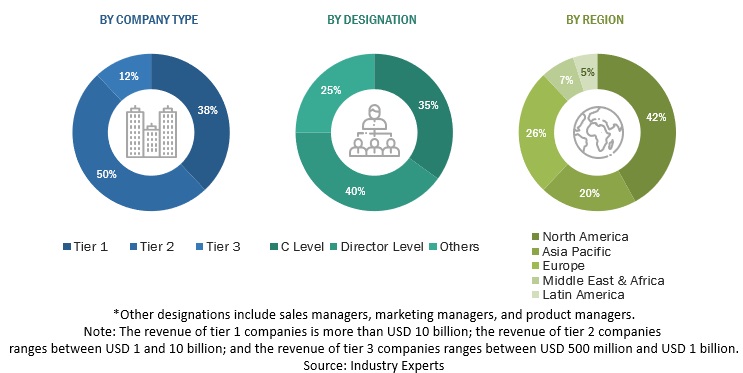

The research study for the NLP in finance market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred NLP in finance providers, third-party service providers, consulting service providers, end-users, and other commercial enterprises. In-depth interviews were conducted with primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative & quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, the spending of various countries on NLP in finance was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation. This was done in accordance with the offerings of the major players, industry trends related to solutions, services, technologies, applications, verticals, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative & quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, and NLP in finance expertise; related key executives from NLP in finance solution vendors, SIs, professional service providers, and industry associations; and the key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions & services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end-users using NLP in finance solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of NLP.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Skit.ai |

Senior Conversational User Experience Designer |

|

Expert.ai |

Senior Project Manager |

|

Uniphore |

Senior Solutions Consultant |

|

|

Senior NLP Researcher |

Market Size Estimation

In the bottom-up approach, For cross-validation, the adoption of NLP in finance solutions & services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the NLP in finance market’s regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major NLP in finance providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall NLP in finance market size and segments’ size were determined and confirmed.

Global NLP in Finance Market Size: Bottom-Up Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Global NLP in Finance Market Size: Top-down Approach

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the NLP in finance market’s regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major NLP in finance providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall NLP in finance market size and segments’ size were determined and confirmed.

Market Definition

NLP uses machine learning to reveal the structure and meaning of the text. With natural language processing applications, organizations can analyze text and extract information about people, places, and events to better understand social media sentiment and customer conversations. NLP technology for the finance sector is built on advanced algorithms trained on vast amounts of financial data to improve the accuracy and performance of financial models–such as credit risk assessment, market sentiment analysis, and asset management.

Stakeholders

- NLP in finance software vendors

- NLP in finance service providers

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/migration service providers

- Value-added resellers (VARs) and distributors

- Independent software vendors (ISVs)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the NLP in finance market by offering (software and services), application, technology, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the NLP in finance market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the NLP in finance market

- To analyze the impact of recession in the NLP in finance market across all the regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American NLP in finance market

- Further breakup of the European NLP in finance market

- Further breakup of the Asia Pacific NLP in finance market

- Further breakup of the Middle Eastern & African NLP in finance market

- Further breakup of the Latin America NLP in finance market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NLP in Finance Market