NLP in Healthcare & Life Sciences Market

NLP in Healthcare & Life Sciences Market by NLP Technique (OCR, NER, Sentiment Analysis), Application (Genomics & Precision Medicine, Patient Care & Engagement, Clinical Operations & Decision Support, Biomedical Research) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The NLP in Healthcare & Life Sciences market is projected to grow significantly, from USD 5.18 billion in 2025 to USD 16.01 billion by 2030 (a 25.3% CAGR), driven by the need to unlock value from unstructured clinical data, improve decision-making, and support AI-powered healthcare transformation. Leading vendors like Microsoft (Nuance DAX Copilot), Google Cloud (MedLLM), AWS (Comprehend Medical), and IQVIA (Linguamatics) are leveraging NLP as a core enabler for Ambient Clinical Intelligence (ACI), Medical Large Language Models (LLMs), Social Determinants of Health (SDOH) analytics, and FHIR-native APIs. Real-world deployments, such as the U.S. Veterans Health Administration's hybrid NLP system, demonstrate measurable impact, achieving high precision in dementia detection and suicide risk identification (F1-score of 0.87). As healthcare focuses on value-based care and personalized medicine, NLP is becoming essential for workflow optimization and regulatory compliance, leading vendors to prioritize explainable AI, cloud-native scalability, and multilingual NLP solutions.

KEY TAKEAWAYS

- By Region, North America is estimated for largest market share of 31.73% in 2025.

- By Software, the integrated NLP software segment is projected to grow at the highest CAGR of 25.7% during the forecast period..

- By NLP type, the market for the NLG segment is expected to register the highest CAGR of 28.3% during the forecast period.

- By NLP technique, the named entity recognition segment is estimated to hold largest market share.

- The market for genomics & precision medicine segment is expected to register the highest CAGR during the forecast period.

- By End User, Healthcare Researchers segment is expected to dominate the market.

- The major market players like IBM, Google, Microsoft, and Amazon Web Services have adopted both organic and inorganic strategies, including partnerships and investments.

- Companies like Biofourmis (US), Veritis (US), and KMS Healthcare (US) among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The NLP in healthcare and life sciences market is poised for steady expansion, driven by the increasing need to extract insights from vast volumes of unstructured clinical data comprising approximately 80% of healthcare information and the growing demand for automated medical documentation. NLP systems are becoming critical for interpreting clinical notes, processing electronic health records, and enhancing documentation accuracy across healthcare organizations. With the ongoing digital transformation and evolving healthcare delivery models, the industry is enhancing integration of intelligent automation into clinical and operational workflows. The adoption of sophisticated large language models and voice-activated technologies represents a significant advancement stage. A growing focus on predictive analytics to improve health outcomes and enhance care delivery positions NLP technology as a vital backbone for modern healthcare systems seeking operational efficiency gains

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The NLP in healthcare and life sciences market is rapidly evolving, driven by the growing need for intelligent, context-aware solutions that enhance clinical decision-making, streamline administrative workflows, and improve patient outcomes. This transformation is being accelerated by the adoption of AI-powered platforms, cloud-native architectures, and integration with electronic health records (EHRs), wearables, and telemedicine systems. Key trends include real-time language translation, voice-enabled virtual assistants, and the use of NLP for drug discovery and population health analytics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Surging Volume of Unstructured Clinical Data

-

•Demand for Enhanced Clinical Decision Support (CDS) & Efficiency

Level

-

•Clinical accuracy and reliability concerns

-

•Linguistic and Contextual Ambiguity in Medical Terminology

Level

-

•Emergence of advanced AI technology for generating valuable insights for healthcare

-

•Rise of Personalized Medicine and Genomic Interpretation

Level

-

•Lack of Model Interpretability (Explainable AI - XAI)

-

•High cost of implementation and maintenance of NLP technology

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Demand for Enhanced Clinical Decision Support (CDS) & Efficiency

Healthcare providers are adopting NLP-powered CDS systems to reduce diagnostic errors, streamline treatment pathways, and improve care quality. Real-time analysis of electronic health records (EHRs) using advanced NLP algorithms enables evidence-based medicine and workflow optimization, while reducing clinician burnout.

Clinical accuracy and reliability concerns

Providers remain cautious about NLP’s ability to interpret complex medical language, abbreviations, and contextual nuances. Ensuring clinical-grade accuracy, algorithmic transparency, and validation against medical standards is essential for broader adoption.

Rise of Personalized Medicine and Genomic Interpretation

NLP is unlocking new frontiers in precision medicine by analyzing genomic data, pharmacogenomic reports, and biomedical literature. These capabilities support targeted therapies, drug discovery acceleration, and data-driven treatment planning tailored to individual patient profiles.

Lack of Model Interpretability (Explainable AI - XAI)

The black-box nature of NLP models limits clinical trust and regulatory acceptance. There is a growing need for explainable AI (XAI) frameworks that offer transparent, interpretable insights without compromising accuracy, critical for clinical accountability and compliance.

NLP in Healthcare and Life Sciences Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

CSL Behring partnered with IQVIA (Linguamatics) to apply NLP for automated medical coding in pharmacovigilance. The challenge was manually converting high volumes of unstructured AE reports into MedDRA. The solution automated AE and indication extraction | The NLP implementation doubled the auto-coding rate from 30% to 60%. This sharply reduced manual workload and improved coding consistency, leading to reduced risk in case processing and medical safety evaluation |

|

Humana partnered with IBM Watson to deploy a conversational voice agent for healthcare providers. The goal was to automate routine, pre-service inquiries that were previously handled by an inefficient IVR system | The AI agent handles inquiries at roughly one-third the cost of the old system and has nearly double the response rate. This improved efficiency and reduced call completion time to about two minutes |

|

Philips adopted Amazon EC2/AWS to attain secure, resizable computing capacity for its HealthSuite PaaS solution. The challenge was the industry difficulties in gathering and analyzing vital AI data while complying with various data protection and geographical laws | The AWS foundation supports Philips HealthSuite for medical professionals, enabling secure connection, storage, and analysis of vast clinical data. Benefits include increased AI/ML accuracy, better diagnostics, and a reduction in human errors. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The NLP in healthcare and life sciences ecosystem comprises leading technology giants like Google, Microsoft, IBM, and Amazon Web Services alongside specialized healthcare AI providers including Oncocra Medical, Biofourmis, and Enlitic. These stakeholders collaborate across patient care, clinical operations, biomedical research, administrative management, genomics, and medical education applications, leveraging advanced natural language processing to transform healthcare delivery and improve patient outcomes

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oilfield Communications Market, By Offering

Managed services represent the fastest growing segment as healthcare organizations increasingly outsource NLP implementation, maintenance, and optimization to specialized providers. This model eliminates the need for in-house AI expertise, reduces operational costs, ensures continuous system updates with latest algorithms, and provides scalable support for complex clinical workflows. Managed NLP services enable healthcare facilities to focus on core patient care while leveraging expert-managed natural language processing capabilities

Oilfield Communications Market, By NLP Type

Natural language generation emerges as the fastest growing NLP type, enabling automated creation of clinical narratives, patient summaries, and medical reports from structured data. This technology streamlines documentation workflows by generating comprehensive discharge summaries, radiology reports, and clinical notes, reducing physician documentation time while maintaining accuracy. Natural language generation transforms data into human-readable text, enhancing communication between healthcare providers and improving patient engagement through personalized health communications

Oilfield Communications Market, By NLP Technique

Text summarization demonstrates the fastest growth as healthcare professionals face information overload from vast clinical documentation, research literature, and patient records. This technique condenses lengthy medical texts into concise, actionable summaries, enabling rapid review of patient histories, accelerated literature reviews for clinical research, and efficient knowledge extraction from electronic health records. Text summarization enhances clinical decision-making speed while improving healthcare productivity and reducing cognitive burden on medical practitioners

Oilfield Communications Market, By Application

Genomics and precision medicine applications experience the fastest growth as NLP technologies unlock insights from complex genetic data, biomedical literature, and clinical trial information. Advanced algorithms interpret genomic sequences, extract pharmacogenomic relationships, and analyze patient-specific molecular profiles to support targeted therapy selection. NLP accelerates precision oncology research, enables personalized treatment protocols based on genetic markers, and facilitates integration of multi-omics data for breakthrough discoveries in regenerative medicine

Oilfield Communications Market, By End User

Pharmaceutical and biotech companies represent the fastest growing end-user segment, leveraging NLP for drug discovery, clinical trial optimization, pharmacovigilance, and regulatory compliance. These organizations implement natural language processing to analyze scientific literature, extract adverse event reports, accelerate candidate molecule identification, and streamline regulatory submission processes. NLP technologies reduce drug development timelines, enhance safety monitoring capabilities, and improve competitive intelligence gathering across pharmaceutical research and development operations

REGION

Asia Pacific to be fastest-growing region in global Oilfield Communications Market during forecast period

Asia Pacific emerges as the fastest-growing region, driven by rapid healthcare digitization, expanding telemedicine infrastructure, government initiatives promoting AI adoption, and increasing investments in digital health technologies. Countries including China, India, Japan, and South Korea are accelerating NLP implementation across hospitals, research institutions, and pharmaceutical companies. Growing patient populations, rising healthcare expenditure, technological innovation hubs, and supportive regulatory frameworks position the Asia Pacific as a key growth driver for NLP healthcare solutions

NLP in Healthcare and Life Sciences Market: COMPANY EVALUATION MATRIX

In the NLP in healthcare and life sciences market matrix, Google (Star) leads with a strong market share and extensive product footprint, driven by its advanced natural language understanding models, cloud-based healthcare AI platforms, and integrated solutions widely adopted across clinical documentation and medical research applications. NVIDIA (Emerging Leader) is gaining visibility with its specialized AI computing infrastructure and tailored GPU-accelerated NLP frameworks for healthcare services, strengthening its position through innovation and niche technology offerings in medical imaging analysis and genomic data processing. While major technology providers dominate through scale and diverse healthcare AI portfolios, NVIDIA shows significant potential to move toward the leaders' quadrant as demand for high-performance computing, real-time clinical decision support, and AI-powered precision medicine solutions continues to rise

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.13 Billion |

| Market Forecast in 2030 (value) | USD 16.01 Billion |

| Growth Rate | 25.30% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | USD Million |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: NLP in Healthcare and Life Sciences Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading AI solution provider (US) | In-depth competitive profiling of NLP vendors in the healthcare and life sciences domain. Product benchmarking across key performance parameters, Ecosystem mapping of NLP solution providers, End-user adoption analysis to assess market traction. | Identified competitive dynamics between tech giants and specialized healthcare AI vendors, Uncovered enterprise adoption barriers, informing go-to-market and product positioning strategies. |

| Leading NLP solution provider (US) | Region-specific market sizing and forecasting for NLP adoption in drug discovery and clinical trials. Market opportunity analysis by NLP technique (e.g., Named Entity Recognition, Text Summarization, Sentiment Analysis), Application-specific insights for pharmacovigilance and clinical development. | Identified rising demand for AI-powered clinical trial optimization, Highlighted regional growth in real-world evidence (RWE) analytics and precision medicine enablement. |

RECENT DEVELOPMENTS

- April 2025 : KPJ Healthcare, Malaysia’s largest private hospital network, partnered with IBM Malaysia and GlobeOSS to deploy an AI-powered patient engagement chatbot using IBM watsonx and Watson Discovery. This solution enables 24/7 automated responses for patient inquiries, specialist information, and appointment scheduling across 30 hospitals. The initiative reflects the growing demand for conversational AI in healthcare, particularly in emerging markets, and highlights IBM’s strategy to scale AI-driven patient experience platforms in collaboration with regional partners.

- March 2025 : Microsoft introduced Dragon Copilot, the healthcare industry’s first unified voice AI assistant, combining Dragon Medical One and DAX Copilot. This innovation streamlines clinical documentation, surfaces relevant medical information, and automates administrative tasks. The launch underscores Microsoft’s leadership in ambient clinical intelligence (ACI) and its commitment to reducing clinician burnout through real-time, voice-enabled NLP solutions integrated directly into EHR workflows.

- January 2025 : AWS and General Catalyst announced a strategic collaboration to co-develop generative AI solutions for healthcare transformation. By merging AWS’s cloud and AI capabilities with General Catalyst’s healthcare expertise, the partnership aims to deliver innovations in personalized care, diagnostics, and operational efficiency. This move reinforces AWS’s positioning as a foundational cloud-native AI enabler for healthcare ecosystems and signals a broader shift toward co-innovation models between tech giants and healthcare investors.

- January 2025 : IQVIA and NVIDIA formed a strategic alliance to advance agentic AI in healthcare and life sciences. Leveraging IQVIA’s Connected Intelligence and NVIDIA’s AI Foundry, the partnership focuses on automating complex workflows, enhancing data extraction, and improving patient outcomes. This collaboration highlights the convergence of healthcare-grade AI and high-performance computing, positioning both companies at the forefront of autonomous clinical systems and AI-driven research acceleration.

- November 2024 : Google Cloud partnered with DeliverHealth to enhance AI-powered clinical documentation using Gemini 1.5 Pro multimodal models. The solution enables clinicians to document care through voice, reducing administrative burden while ensuring accurate, billable records. This partnership reflects Google’s strategy to embed multimodal AI into healthcare workflows, combining human-curated medical data with advanced language models to drive precision documentation and revenue cycle optimization.

Table of Contents

Methodology

This research study on the NLP in healthcare & life sciences market involved extensive secondary sources, directories, IEEE Communication-efficient Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred NLP in healthcare & life sciences providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the NLP in healthcare & life sciences spending of various countries was extracted from the respective sources.

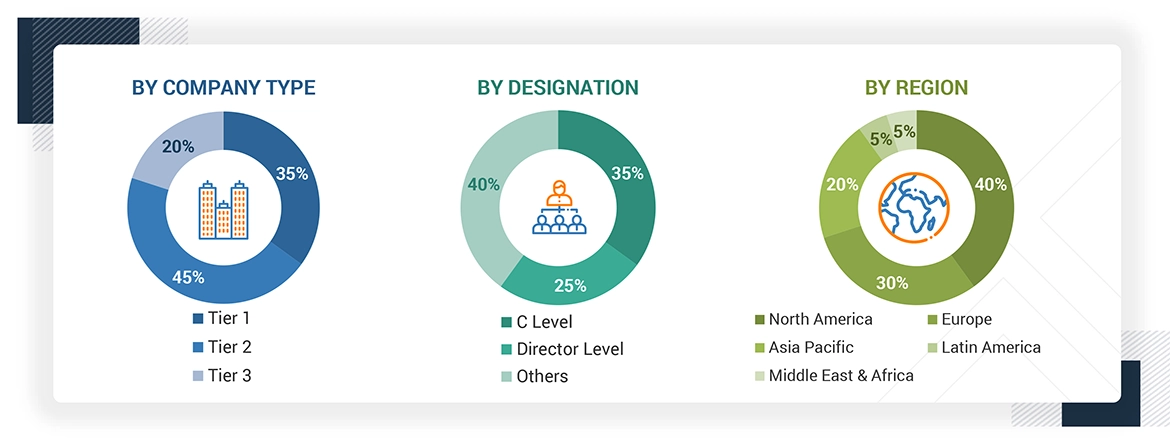

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and NLP in healthcare & life sciences providers. It also included key executives from NLP in healthcare & life sciences solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD

1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion. Other designations include sales managers,

marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the NLP in healthcare & life sciences market. The first approach involved estimating the market size by companies’ revenue generated through the sale of NLP in healthcare & life sciences products.

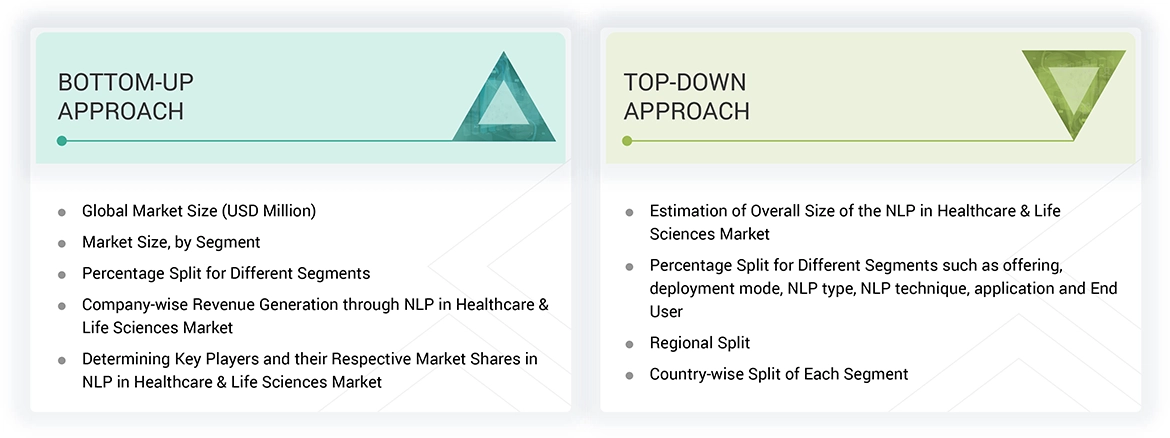

Market Size Estimation Methodology: Top-down Approach

In the top-down approach, an exhaustive list of all the vendors offering products in the NLP in the healthcare & life sciences market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology: Bottom-up Approach

In the bottom-up approach, the adoption rate of NLP in healthcare & life sciences products among different verticals in key countries concerning their regions contributing the most to the market share was identified. Cross-validation revealed the adoption of NLP in healthcare and life sciences products among enterprises, along with various use cases by region. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included analyzing the NLP in the healthcare & life sciences market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major NLP in healthcare & life sciences providers, and organic and inorganic business development activities of regional and global players were estimated.

NLP in Healthcare & Life Sciences Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

NLP is the ability of computers to understand the latest human speech and text. It is used in current technology to support spam email privacy, personal voice assistants, and language translation applications. The adoption of NLP in healthcare & life sciences is rising due to its recognized potential to search, analyze, and interpret a mammoth amount of patient datasets. Using advanced NLP-based algorithms, healthcare & life sciences firms harness the relevant insights and concepts from the clinical data previously hidden in the text form.

Stakeholders

- NLP in healthcare & life sciences solution providers

- NLP in healthcare & life sciences service providers

- Independent software vendors (ISVs)

- NLP service providers

- Managed service providers

- Hospitals and clinics

- Government councils

- Health information exchanges

- Health information service providers (HISPs)

- Pharmaceutical companies

Report Objectives

- To define, describe, and predict the NLP in the healthcare & life sciences market by offering, deployment mode, NLP type, NLP technique, application, end user, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the NLP in the healthcare & life sciences market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American NLP in healthcare & life sciences market

- Further breakup of the European NLP in healthcare & life sciences market

- Further breakup of the Asia Pacific NLP in healthcare & life sciences market

- Further breakup of the Middle East & Africa NLP in healthcare & life sciences market

- Further breakup of the Latin American NLP in healthcare & life sciences market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is NLP in Healthcare & Life Sciences?

According to ForeSee Medical, NLP is the ability of computers to understand the latest human speech terms and text. It is used in current technology to support spam email privacy, personal voice assistants, and language translation applications. The adoption of NLP in Healthcare & Life sciences is rising due to its recognized potential to search, analyze, and interpret many patient datasets. Using advanced NLP-based algorithms, Healthcare & Life sciences firms harness the relevant insights and concepts from the clinical data previously considered buried in the text form.

What is the projected market size of the NLP in Healthcare & Life Sciences market by 2030?

According to MarketsandMarkets, the market is anticipated to rise from about USD 5.18 billion in 2025 to USD 16.01 billion by 2030.

What is the expected CAGR for the NLP in Healthcare & Life Sciences market from 2025 to 2030?

The market is projected to grow at a CAGR of 25.3% from 2025 to 2030.

Which segments are positively impacting the NLP in Healthcare & Life Sciences market?

Key segments include offering and application, with software solutions like clinical documentation and text mining being widely adopted.

Which region is expected to witness the highest growth rate in the NLP in Healthcare & Life Sciences market?

According to MarketsandMarkets, Asia Pacific is projected to experience the highest growth rate due to rising healthcare digitization, increasing patient data volumes, growing investments in AI, and expanding adoption of EHRs.

What factors are driving NLP integration in the Asia Pacific region?

Government initiatives, improving healthcare infrastructure, and a surge in AI startups are further driving NLP integration across clinical documentation, drug discovery, and patient care.

How does NLP enhance clinical operations and decision support?

NLP streamlines data extraction from medical records, enabling faster, more accurate diagnoses and treatment plans, reducing clinician workload, enhancing patient safety, and improving care quality.

What are some use cases of NLP in healthcare and life sciences?

Use cases include clinical documentation, drug discovery, patient monitoring, and genomics, driving innovation, operational efficiency, and improved patient outcomes.

How does Named Entity Recognition (NER) contribute to NLP applications?

NER enables precise extraction of key medical terms, such as diseases, drugs, and procedures, from unstructured data, enhancing clinical decision-making, patient record management, drug discovery, and biomedical research efficiency.

What global trends are driving the adoption of NLP in healthcare and life sciences?

According to MarketsandMarkets, the surge in unstructured clinical data, widespread use of EHRs, demand for predictive analytics, need for enhanced clinical decision support, and rising focus on personalized medicine are contributing to improved patient outcomes and operational efficiency.

Why is there a rising demand for predictive analytics in healthcare and life sciences?

Predictive analytics enables healthcare providers and researchers to anticipate significant health concerns, enhance patient outcomes, and optimize resource utilization.

How does NLP facilitate predictive analytics in healthcare?

NLP is crucial in extracting meaningful insights from vast amounts of unstructured clinical data, such as electronic health records (EHRs), clinical notes, research articles, and patient interactions.

What is the significance of data-driven approaches in healthcare?

Data-driven approaches are essential for identifying at-risk patients, enabling proactive interventions, and improving overall healthcare delivery.

How does the integration of AI advancements impact the NLP market?

According to MarketsandMarkets, Rapid advancements in AI contribute to the development of more sophisticated NLP solutions, enhancing their effectiveness and adoption in healthcare settings.

What role do software solutions play in the NLP in Healthcare & Life Sciences market?

Software solutions, such as clinical documentation and text mining, are widely adopted, facilitating efficient data management and analysis.

How do services complement software solutions in the NLP market?

Services ensure seamless implementation and maintenance of NLP solutions, supporting their effective deployment in healthcare environments.

Which are the key end users adopting NLP in Healthcare & Life Sciences market solutions and services?

Key end users adopting NLP in Healthcare & Life sciences solutions and services include clinical practitioners, healthcare researchers, healthcare administrators, health insurance & payer professionals, pharmaceutical & biotech companies, and other end users (medical educators & researchers, data privacy & ethics consultants).

Who are the key vendors in NLP in healthcare & life sciences market?

The key vendors in the global NLP in Healthcare & Life sciences market include as IBM (US), Microsoft (US), Google (US), AWS (US), IQVIA (US), Oracle Corporation (US), Inovalon(US), Dolbey Systems (US), Averbis (Germany), SAS Institute (US), Solventum (US), Press Ganey (US), Ellipsis Health (US), NVIDIA (US), Lexalytics (US), GE Healthcare (US), Clinithink (US), Hewlett Packard Enterprise (US), Oncora Medical (US), Flatiron Health (US), Datavant (US), Edifecs (US), John Snow Labs (US), ITRex Group (US), Forsee Medical (US), Gnani.ai (India), Notable (US), Biofourmis (US), Suki (US), Wave Health Technologies (US), Corti (Denmark), CloudMedx (US), Emtelligent (Canada), and Deep 6 AI (US).

What challenges are hindering the widespread adoption of NLP in this domain?

Despite its potential, NLP adoption in healthcare and life sciences faces several challenges. Data privacy and security remain critical concerns due to the sensitive nature of patient information. The complexity of medical language, filled with abbreviations, synonyms, and context-specific terms, makes it difficult to achieve high NLP accuracy. Additionally, integrating NLP with legacy systems and EHRs is technically demanding.

What are the major factors driving the growth of the NLP in healthcare & life sciences industry?

The key drivers supporting the market growth for NLP in Healthcare & Life Sciences market include a focus on enhancing clinical decision support, the need for predictive analytics to improve significant health concerns, rising demand to enhance care delivery and patient engagement.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the NLP in Healthcare & Life Sciences Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in NLP in Healthcare & Life Sciences Market

Kerri

Nov, 2018

Understand the application of NLP in Healthcare..

Andres

Jul, 2017

Detailed understanding of the Artificial Intelligence (Data Scientist, Machine Learning, NLP, Sentiment Analysis, Recommender Systems)..