Non-woven - Industrial Membrane Market by Module Type (Spiral Wound, Hollow Fiber, Tubular, Plate & Frame), Application (Water & Wastewater Treatment, Pharmaceutical & Medical, Food & Beverage, Chemical, Industrial Gas), and Region - Forecast to 2025

Updated on : March 21, 2024

Nonwoven Industrial Membrane Market

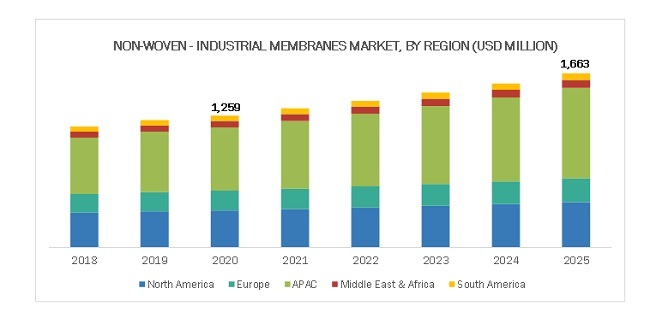

The Nonwoven Industrial Membrane Market was valued at USD 1,259 million in 2020 and is projected to reach USD 1,663 million by 2025, growing at 5.72% cagr from 2020 to 2025. Factors, such as the increasing number of end-use applications and rapid industrialization, coupled with increasing importance of water and wastewater treatment are driving the nonwoven - industrial membrane market. The nonwoven textiles sector is undergoing significant changes with the increasing significance of new applications in industrial membranes, which are further used in food & beverage, pharmaceutical, geotextiles, water treatment, and other industries.

To know about the assumptions considered Request for Free Sample Report

In terms of both value and volume, spiral wound segment to lead the nonwoven - industrial membranes market by 2025.

Spiral wound, by module type, accounted for the largest market share in the nonwoven - industrial membranes market. Spiral-wound membranes are produced by winding consecutive layers of feed spacer, membrane, permeate collection channel, and a membrane around perforated center tube for permeate collection. Majority of the reverse osmosis membranes are spiral wound. They offer similar advantages as the others at lower energy costs due to their reduced pumping requirements and higher packing density.

The pharmaceutical & medical segment is projected to be the fastest-growing application in the nonwoven - industrial membranes market from 2020 to 2025.

The pharmaceutical & medical segment is projected to be the fastest-growing application in the nonwoven - industrial membranes market. The pharmaceutical sector is vast with high inflow of leading chemical companies. It is the second-largest application segment of the global market for nonwoven—industrial membranes. As many pharmaceutical processes use toxic chemicals, the need for a clean workspace is a priority that has created a good market for air filters, where industrial membranes have a key role to play. The pharmaceutical industry involves a wide range of production processes, ranging from simple chemical synthesis to complex drug production that requires separation equipment. Nonwoven—industrial membranes find widespread applications in the biopharmaceutical industry as its products and their intermediates are susceptible to degradation due to heat and chemical treatment, making it difficult to separate those using alternate technologies. The harvesting of cells or recuperation of biomass is an important step in the process of fermentation, especially when manufacturing products, such as antibiotics. Filtration improves production as well as reduces the operator’s workload and maintenance costs. Membranes are also a standard part of industrial production lines for enzymes. They are used for concentrating enzymes prior to their use in other processes according to the requirements.

To know about the assumptions considered for the study, download the pdf brochure

In terms of both value and volume, the Asia Pacific nonwoven - industrial membranes market is projected to grow at the highest CAGR during the forecast period.

In terms of value and volume, the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2025. According to the World Bank, APAC was the fastest-growing region, in terms of both population and economy. Countries such as India and China are expected to post high growth in the nonwoven - industrial membranes market due to the increasing developmental activities and rapid economic expansion.

According to the World Bank, the two economic giants of the APAC region, China and Japan, are the world’s second- and third-largest economies in 2019. In addition to this, the growing population in these countries presents a huge customer base which is resulting in the growth of end-use secftors like water & wastewater treatment, food & beverages, and pharmaceuticals, which will in turn propel the market for non-woven – industrial membranes.

Key Market Players in Non-Woven–Industrial Membranes Market

Key players, such as Ahlstrom-Munksjo (Finland), Berry Global Inc. (US), Glatfelter Company (US), Toray Industries (Japan), Freudenberg (Germany), 3M Company (US), Lydall Inc. (US), and TWE Group (Germany) have adopted various growth strategies, such as acquisitions, investments, and expansions, to increase their market shares and enhance their product portfolios.

Glatfelter is a global supplier of engineered materials. Their solutions are found in tea and single-serve coffee filtration, personal hygiene, as well as in many diverse packaging, home improvement, and industrial applications. In 2010, the company acquired Concert Industries Corporation (US), a global supplier of cellulose-based air-laid nonwoven materials. This helped the company to generate higher revenue and became one of the world’s largest manufacturers of nonwoven products. In 2013, the company acquired Dresden Papier GmbH (Germany), a leading manufacturer of nonwoven wall cover materials. This acquisition helped the company to further increase its market share and expand its business of nonwoven products. The company operates through two reporting segments: Composite Fibers and Airlaid Materials. It has partnered with leading consumer product companies and other market leaders to provide innovative solutions delivering outstanding performance to meet market requirements. The company is committed to grow in its key markets and has made appropriate investments to support its customers and satisfy market demands.

Non-Woven–Industrial Membranes Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018 - 2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020 - 2025 |

|

Forecast units |

Value (USD) and Volume (Kiloton) |

|

Segments covered |

Module Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Ahlstrom-Munksjo (Finland), Glatfelter Company (US), E.I. DuPont (US), Lydall Inc. (US), Fitesa (Brazil), TWE Group (Germany), Freudenberg Group (Germany), Asahi Kasei (Japan), Toray Industries (Japan), Fitesa (Brazil), Johns Manvilles (US) |

This research report categorizes the nonwoven - industrial membranes based on module type, application, and region.

Based on module type:

- Spiral Wound

- Hollow Fiber

- Tubular

- Plate & Frame

Based on the application:

- Water & Wastewater Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Chemical Processing

- Industrial Gas Processing

- Others

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments in Non-Woven–Industrial Membranes Market

- In May 2020, Freudenberg acquired 100% shares of Low & Bonar PLC, London, United Kingdom. Freudenberg submitted an offer in September 2019. The Low & Bonar shareholders approved the sale in November 2019, and the European Commission authorized the merger on April 17. Low & Bonar PLC was delisted from the London Stock Exchange on May 13 at 8 AM local London time. Low & Bonar is a global manufacturer of technical textiles. The company will be integrated into the Freudenberg Performance Materials Business Group and strengthen its nonwoven business.

- In June 2019, Fitesa invested USD 70 million in a new spunbond line at its joint venture company—CNCFitesa, based in Rayong, Thailand. The company acquired a 51% stake in CNC International in 2018, marking its first entry into the fast-growing Southeast Asian market.

- In September 2018, Lydall expanded its portfolio with the introduction of new, innovative LydAir GP gas phase filter media. Layered in pleatable substrates, LydAir GP media consists of highly uniform and efficient specialty sorbent particles that aid in the adsorption of acid and base contaminants, as well as other volatile organic compounds.

Key Questions Addressed by the Report:

- What are the global trends in the non-woven – industrial membranes market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different applications of non-woven – industrial membranes?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for non-woven – industrial membranes?

- Who are the major players in the non-woven – industrial membranes market globally?

Frequently Asked Questions (FAQ):

What is the current size of the global Rain gutter market?

The global Rain gutter market is estimated to be USD 7.0 billion in 2020 and projected to reach USD 7.9 billion by 2025, at a CAGR of 2.5%.

Who are the winners in the global rain gutter market?

Companies such as Lindab, Gibraltar industries, KMW fall under the winner’s category. These companies cater to the requirements of their customers by providing customized products and services. Moreover, these companies have multiple supply contracts with regional contractors and effective supply chain strategies. Such advantages give these companies an edge over other companies that are component providers.

What is the COVID-19 impact on rain gutter manufacturers?

Industry experts believe that COVID-19 could affect construction industry by 20-30% globally in 2020. This also translates into a snowballing effect on the rain gutter market. For instance, since in March 2020, the Indian construction work has come to standstill due to workforce unavailability and supply chain disruptions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.3.2 REGIONS COVERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.4.1 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 26)

3.1 INTRODUCTION

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 ATTRACTIVE OPPORTUNITIES IN NONWOVEN - INDUSTRIAL MEMBRANE MARKET

4.2 NONWOVEN - INDUSTRIAL MEMBRANE MARKET, BY MODULE TYPE AND COUNTRY, 2019

4.3 NONWOVEN - INDUSTRIAL MEMBRANE MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 31)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing use in filtration applications

5.2.1.2 Growing adoption of non-woven fabric products

5.2.1.3 Increasing importance of water and wastewater treatment

5.2.2 RESTRAINTS

5.2.2.1 Availability of raw materials and high energy costs

5.2.3 OPPORTUNITIES

5.2.3.1 Proliferation of new technologies

5.2.3.2 Growing demand for membranes in emerging economies

5.2.3.3 Increasing awareness of waste management in pharmaceutical industry

5.2.4 CHALLENGES

5.2.4.1 Performance-to-cost balancing concern for small manufacturers

5.2.4.2 Lifespan of membranes

5.2.4.3 Volatility in raw material prices

5.3 YC, YCC SHIFT

6 INDUSTRY TRENDS (Page No. - 38)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.2 PROMINENT COMPANIES

6.2.3 SMALL & MEDIUM ENTERPRISES

6.3 PORTER'S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 SEPARATION TECHNIQUES (FILTRATION TECHNOLOGIES)

6.4.1 INTRODUCTION

6.4.2 REVERSE OSMOSIS

6.4.3 ULTRAFILTRATION (UF)

6.4.4 MICROFILTRATION

6.4.5 NANOFILTRATION(NF)

6.4.6 GAS SEPARATION

6.4.7 DIALYSIS

6.4.8 PERVAPORATION

6.4.9 OTHERS

7 IMPACT OF COVID-19 ON NON-WOVEN - INDUSTRIAL MEMBRANE MARKET (Page No. - 48)

8 NON-WOVEN-INDUSTRIAL MEMBRANE MARKET, BY MODULE TYPE (Page No. - 49)

8.1 INTRODUCTION

8.2 TUBULAR MEMBRANES

8.3 SPIRAL-WOUND MEMBRANES

8.4 PLATE & FRAME (PF)

8.5 HOLLOW FIBER MEMBRANES

9 NONWOVEN-INDUSTRIAL MEMBRANE MARKET, BY APPLICATION (Page No. - 53)

9.1 INTRODUCTION

9.2 WATER & WASTEWATER TREATMENT

9.3 PHARMACEUTICAL & MEDICAL

9.4 FOOD & BEVERAGE PROCESSING

9.5 CHEMICAL PROCESSING

9.6 INDUSTRIAL GAS PROCESSING

9.7 OTHERS

10 NON-WOVEN-INDUSTRIAL MEMBRANES MARKET, BY REGION (Page No. - 59)

10.1 INTRODUCTION

10.2 APAC

10.2.1 CHINA

10.2.1.1 China to be the largest market in APAC

10.2.2 JAPAN

10.2.2.1 Government investments to propel the market in Japan

10.2.3 SOUTH KOREA

10.2.3.1 Market growth supported by government's investments for smart water management

10.2.4 INDIA

10.2.4.1 India to be the fastest-growing market in APAC

10.2.5 AUSTRALIA

10.2.5.1 Investments in wastewater treatment infrastructure to propel the market

10.2.6 REST OF APAC

10.3 NORTH AMERICA

10.3.1 US

10.3.1.1 The largest market for nonwoven - industrial membrane in North America

10.3.2 CANADA

10.3.2.1 Growing end-use industries, such as pharmaceutical, chemical, and food & beverage driving the market

10.3.3 MEXICO

10.3.3.1 Growing need for wastewater treatment propelling the demand for nonwoven industrial membranes

10.4 EUROPE

10.4.1 GERMANY

10.4.1.1 Pharmaceutical and food & beverage segments propelling the demand for nonwoven - industrial membranes

10.4.2 UK

10.4.2.1 Market growth supported by the increase in expenditure on packaged food & beverage products

10.4.3 RUSSIA

10.4.3.1 Government investments in infrastructural development boosting market growth

10.4.4 FRANCE

10.4.4.1 France to be the fastest-growing market in Europe

10.4.5 SPAIN

10.4.5.1 Increasing food & beverage exports propelling market growth

10.4.6 ITALY

10.4.6.1 Market growth supported by vast pharmaceutical industry

10.4.7 REST OF EUROPE

10.5 MIDDLE EAST & AFRICA

10.5.1 UAE

10.5.1.1 UAE to be the fastest growing country in the Middle East & African nonwoven - industrial membrane

10.5.2 SAUDI ARABIA

10.5.2.1 Chemical processing industry providing opportunities for market growth

10.5.3 SOUTH AFRICA

10.5.3.1 Growing need for fresh water to support market growth

10.5.4 TURKEY

10.5.4.1 Turkey to dominate non-woven - industrial membrane market in Middle East & Africa

10.5.5 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.1.1 Brazil to lead the market in South America

10.6.2 ARGENTINA

10.6.2.1 Government regulations for wastewater treatment driving demand for non-woven - industrial membranes

10.6.3 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 124)

11.1 OVERVIEW

11.1 COMPETITIVE SCENARIO

11.1.1 MERGER & ACQUISITION

11.1.2 EXPANSION & INVESTMENT

11.1.3 NEW PRODUCT DEVELOPMENT

11.1.4 JOINT VENTURES & PARTNERSHIPS

11.2 COMPETITIVE EVALUATION MATRIX

11.2.1 OVERVIEW

11.2.1.1 STAR

11.2.1.2 EMERGING LEADERS

11.2.1.3 PERVASIVE

11.2.1.4 EMERGING COMPANIES

11.2.2 STRENGTH OF PRODUCT PORTFOLIO

11.2.3 BUSINESS STRATEGY EXCELLENCE

12 COMPANY PROFILES (Page No. - 135)

12.1 AHLSTROM-MUNKSJO

12.1.1 BUSINESS OVERVIEW

12.1.2 FINANCIAL ASSESSMENT

12.1.3 FILTRATION AND PERFORMANCE SEGMENT - FINANCIAL DATA (USD MILLION)

12.1.4 OPERATIONAL ASSESSMENT

12.1.5 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.6 RECENT DEVELOPMENTS

12.1.7 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.1.8 SWOT ANALYSIS

12.1.9 WINNING IMPERATIVES

12.1.10 CURRENT FOCUS AND STRATEGIES

12.1.11 THREAT FROM COMPETITION

12.1.12 RIGHT TO WIN

12.2 BERRY GLOBAL INC.

12.2.1 BUSINESS OVERVIEW

12.2.2 FINANCIAL ASSESSMENT

12.2.3 OPERATIONAL ASSESSMENT

12.2.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.5 RECENT DEVELOPMENTS

12.2.6 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.2.7 SWOT ANALYSIS

12.2.8 WINNING IMPERATIVES: BERRY GLOBAL INC.

12.2.9 CURRENT FOCUS AND STRATEGIES

12.2.10 THREAT FROM COMPETITION

12.2.11 RIGHT TO WIN

12.3 GLATFELTER

12.3.1 BUSINESS OVERVIEW

12.3.2 FINANCIAL ASSESSMENT

12.3.3 GLATFELTER'S DIVISION OF SEGMENTAL REVENUE (USD MILLION)

12.3.4 OPERATIONAL ASSESSMENT

12.3.5 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.3.6 RECENT DEVELOPMENTS

12.3.7 SWOT ANALYSIS

12.3.8 WINNING IMPERATIVES

12.3.9 CURRENT FOCUS AND STRATEGIES

12.3.10 THREAT FROM COMPETITION

12.3.11 RIGHT TO WIN

12.4 DUPONT

12.4.1 BUSINESS OVERVIEW

12.4.2 FINANCIAL ASSESSMENT

12.4.3 OPERATIONAL ASSESSMENT

12.4.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.4.5 RECENT DEVELOPMENTS

12.4.6 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.4.7 SWOT ANALYSIS

12.4.8 WINNING IMPERATIVES

12.4.9 CURRENT FOCUS AND STRATEGIES

12.4.10 THREAT FROM COMPETITION

12.4.11 RIGHT TO WIN

12.5 TORAY INDUSTRIES INC.

12.5.1 BUSINESS OVERVIEW

12.5.2 FINANCIAL ASSESSMENT

12.5.3 OPERATIONAL ASSESSMENT

12.5.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.5.5 RECENT DEVELOPMENTS

12.5.6 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.5.7 RIGHT TO WIN

12.6 LYDALL, INC.

12.6.1 BUSINESS OVERVIEW

12.6.2 FINANCIAL ASSESSMENT

12.6.3 OPERATIONAL ASSESSMENT

12.6.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.6.5 RECENT DEVELOPMENTS

12.6.6 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.6.7 RIGHT TO WIN

12.7 FITESA

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.7.3 RECENT DEVELOPMENTS

12.7.4 RIGHT TO WIN

12.8 JOHNS MANVILLE

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.8.3 RECENT DEVELOPMENTS

12.8.4 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.8.5 RIGHT TO WIN

12.9 TWE GROUP

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.9.3 RECENT DEVELOPMENTS

12.9.4 RIGHT TO WIN

12.1 FREUDENBERG GROUP

12.10.1 BUSINESS OVERVIEW

12.10.2 FINANCIAL ASSESSMENT

12.10.3 OPERATIONAL ASSESSMENT

12.10.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.10.5 RECENT DEVELOPMENTS

12.10.6 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.10.7 RIGHT TO WIN

12.11 3M COMPANY

12.11.1 BUSINESS OVERVIEW

12.11.2 FINANCIAL ASSESSMENT

12.11.3 OPERATIONAL ASSESSMENT

12.11.4 PRODUCTS OFFERED

12.11.5 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.11.6 RIGHT TO WIN

12.12 ASAHI KASEI CORPORATION

12.12.1 BUSINESS OVERVIEW

12.12.2 FINANCIAL ASSESSMENT

12.12.3 OPERATIONAL ASSESSMENT

12.12.4 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.12.5 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.12.6 RIGHT TO WIN

12.13 FIBERWEB (INDIA) LTD.

12.13.1 BUSINESS OVERVIEW

12.13.2 OPERATIONAL ASSESSMENT

12.13.3 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.13.4 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

12.13.5 RIGHT TO WIN

12.14 OTHER PLAYERS

12.14.1 EXXONMOBIL

12.14.2 HOLLINGSWORTH & VOSE

12.14.3 BONDEX, INC.

12.14.4 GREAT LAKES FILTERS

12.14.5 FIBERTEX NONWOVENS A/S

12.14.6 HYDROWEB GMBH

12.14.7 AUTOTECH NONWOVENS PVT. LTD.

13 APPENDIX (Page No. - 184)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (141 Tables)

TABLE 1 NONWOVEN - INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 2 NON-WOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILO TON)

TABLE 3 NONWOVEN - INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 4 NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (KILO TON)

TABLE 5 NONWOVEN - INDUSTRIAL MEMBRANES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 6 NON-WOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 7 NONWOVEN - INDUSTRIAL MEMBRANE MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 8 NON-WOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILO TON)

TABLE 9 NONWOVEN - INDUSTRIAL MEMBRANES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 10 NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 11 APAC: NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 12 APAC: MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 13 APAC: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 14 APAC: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 15 APAC: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 16 APAC: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 17 CHINA: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 18 CHINA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 19 CHINA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 20 CHINA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 21 JAPAN: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 22 JAPAN: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 23 JAPAN: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 24 JAPAN: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 25 SOUTH KOREA: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 26 SOUTH KOREA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 27 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 28 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 29 INDIA: NONWOVEN - INDUSTRIAL MEMBRANE MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 30 INDIA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 31 INDIA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 32 INDIA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 33 AUSTRALIA: NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 34 AUSTRALIA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 35 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 36 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 37 REST OF APAC: NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 38 REST OF APAC: NONWOVEN - INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 39 REST OF APAC: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 40 REST OF APAC: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 41 NORTH AMERICA: NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 47 US: NONWOVEN-INDUSTRIAL MEMBRANE MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 49 US: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 51 CANADA: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 53 CANADA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 55 MEXICO: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 56 MEXICO: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 57 MEXICO: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 58 MEXICO: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 59 EUROPE: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 61 EUROPE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 63 EUROPE: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 65 GERMANY: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 66 GERMANY: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 67 GERMANY: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 68 GERMANY: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 69 UK: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 70 UK: NONWOVEN - INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 71 UK: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 72 UK: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 73 RUSSIA: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 74 RUSSIA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 75 RUSSIA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 76 RUSSIA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 77 FRANCE: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 78 FRANCE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 79 FRANCE: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 80 FRANCE: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 81 SPAIN: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 82 SPAIN: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 83 SPAIN: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 84 SPAIN: NON-WOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 85 ITALY: NONWOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 86 ITALY: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 87 ITALY: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 88 ITALY: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 89 REST OF EUROPE: NON-WOVEN-INDUSTRIAL MEMBRANES MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 90 REST OF EUROPE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 91 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 93 MIDDLE EAST & AFRICA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: NONWOVEN - INDUSTRIAL MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 95 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 99 UAE: NON-WOVEN INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 UAE: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 101 UAE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 102 UAE: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 103 SAUDI ARABIA: NON-WOVEN INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 104 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 105 SAUDI ARABIA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 106 SAUDI ARABIA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 107 SOUTH AFRICA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 108 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 109 SOUTH AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 110 SOUTH AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 111 TURKEY: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 112 TURKEY: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 113 TURKEY: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 114 TURKEY: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 115 REST OF MIDDLE EAST & AFRICA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 116 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 117 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 118 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 119 SOUTH AMERICA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 120 SOUTH AMERICA: SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 125 BRAZIL: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 126 BRAZIL: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 127 BRAZIL: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 128 BRAZIL: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 129 ARGENTINA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 130 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 131 ARGENTINA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 132 ARGENTINA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 133 REST OF SOUTH AMERICA: NONWOVEN- INDUSTRIAL MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 134 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 135 REST OF SOUTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (USD MILLION)

TABLE 136 REST OF SOUTH AMERICA: MARKET SIZE, BY MODULE TYPE, 2018-2025 (KILOTON)

TABLE 137 MERGER & ACQUISITION

TABLE 138 EXPANSION & INVESTMENT

TABLE 139 NEW PRODUCT DEVELOPMENT

TABLE 140 JOINT VENTURES & PARTNERSHIPS

TABLE 141 FREUDENBERG'S TECHNICAL TEXTILES AND FILTRATION SEGMENT

LIST OF FIGURES (44 Figures)

FIGURE 1 NON-WOVEN - INDUSTRIAL MEMBRANE MARKET SEGMENTATION

FIGURE 2 APPROACH 1 (BASED ON COUNTRY-LEVEL PARENT MARKET)

FIGURE 3 APPROACH 2 (TOP-DOWN, BASED ON REGIONAL MARKET SHARE INFORMATION)

FIGURE 4 NONWOVEN -INDUSTRIAL MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 5 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 7 SPIRAL WOUND SEGMENT TO ACCOUNT FOR LARGEST SHARE

FIGURE 8 PHARMACEUTICAL & MEDICAL TO REGISTER THE HIGHEST CAGR

FIGURE 9 APAC LED THE NON-WOVEN INDUSTRIAL MEMBRANE MARKET IN 2019

FIGURE 10 WATER & WASTEWATER TREATMENT TO GENERATE HIGH DEMAND FOR NONWOVEN - INDUSTRIAL MEMBRANE

FIGURE 11 CHINA AND SPIRAL WOUND SEGMENT ACCOUNTED FOR LARGEST SHARES

FIGURE 12 INDIA TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN NON-WOVEN - INDUSTRIAL MEMBRANE MARKET

FIGURE 14 CRUDE OIL PRICES

FIGURE 15 YC-YCC DRIVERS

FIGURE 16 VALUE CHAIN ANALYSIS

FIGURE 17 PORTER'S FIVE FORCES ANALYSIS OF NON-WOVEN - INDUSTRIAL MEMBRANE MARKET

FIGURE 18 SPIRAL WOUND TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

FIGURE 19 NONWOVEN-INDUSTRIAL MEMBRANES MARKET, BY APPLICATION, 2020 VS 2025

FIGURE 20 GEOGRAPHICAL SNAPSHOT: NONWOVEN-INDUSTRIAL MEMBRANES MARKET GROWTH RATE, BY KEY COUNTRIES, 2020-2025

FIGURE 21 APAC: NONWOVEN - INDUSTRIAL MEMBRANE MARKET SNAPSHOT

FIGURE 22 COMPANIES ADOPTED JOINT VENTURE & PARTNERSHIP AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

FIGURE 23 NON-WOVEN - INDUSTRIAL MEMBRANE MARKET: COMPETITIVE EVALUATION MATRIX, 2020

FIGURE 24 AHLSTROM-MUNKSJO: COMPANY SNAPSHOT

FIGURE 25 AHLSTROM-MUNKSJO: SWOT ANALYSIS

FIGURE 26 WINNING IMPERATIVES: AHLSTROM-MUNKSJO

FIGURE 27 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 28 BERRY GLOBAL INC.: SWOT ANALYSIS

FIGURE 29 WINNING IMPERATIVES: BERRY GLOBAL INC.

FIGURE 30 GLATFELTER: COMPANY SNAPSHOT

FIGURE 31 GLATFELTER: SWOT ANALYSIS

FIGURE 32 WINNING IMPERATIVES: GLATFELTER

FIGURE 33 DUPONT: COMPANY SNAPSHOT

FIGURE 34 DUPONT: SWOT ANALYSIS

FIGURE 35 WINNING IMPERATIVES: DUPONT

FIGURE 36 TORAY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 37 LYDALL INC.: COMPANY SNAPSHOT

FIGURE 38 FITESA: COMPANY SNAPSHOT

FIGURE 39 JOHNS MANVILLE: COMPANY SNAPSHOT

FIGURE 40 TWE GROUP: COMPANY SNAPSHOT

FIGURE 41 FREUDENBERG GROUP: COMPANY SNAPSHOT

FIGURE 42 3M: COMPANY SNAPSHOT

FIGURE 43 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

FIGURE 44 FIBERWEB (INDIA) LTD: COMPANY SNAPSHOT

The study involved four major activities for estimating the current global size of the nonwoven - industrial membranes market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of nonwoven - industrial membranes through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the nonwoven - industrial membranes market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the nonwoven - industrial membrane market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

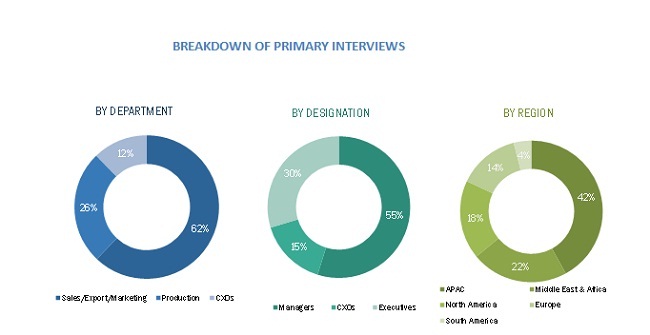

Various primary sources from both the supply and demand sides of the nonwoven - industrial membranes market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the nonwoven - industrial membranes industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

BREAKDOWN OF PRIMARY INTERVIEWS

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the nonwoven - industrial membranes market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the nonwoven - industrial membranes market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To estimate and forecast the non-woven – industrial membrane market, in terms of value and volume

- To elaborate drivers, restraints, opportunities, and challenges in the market

- To define, describe, and forecast the market size, on the basis of module type, application, and region

- To forecast the market size, along with segments and submarkets, in key regions: North America, Europe, APAC, the Middle East & Africa, and South America with their key countries

- To strategically analyze micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To analyze competitive developments, such as merger & acquisition, expansion & investment, joint venture, partnership & agreement, and new product development in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the nonwoven - industrial membranes report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the nonwoven - industrial membranes market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Non-woven - Industrial Membrane Market