The study encompassed four primary tasks to determine the present scope of the low-speed vehicle market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. Employing both bottom-up and top-down methodologies, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to for the study of the low-speed vehicle market are directly dependent on end-use industry growth. Low-speed vehicle sales and end-use industry demand are derived through secondary sources such as the International Light Transportation Vehicle Association, Inc., the National Mobility Equipment Dealers Association (NMEDA), the National Motorists Association, the Electrical Apparatus Service Association, Inc., the European Golf Association, the Japan Golf Association, the Indian Golf Union, the South African Golf Association (SAGA), the Organization for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat, corporate filings such as annual reports, investor presentations, and financial statements, and paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have gathered insights such as low-speed vehicle market sizing estimation and forecast, future technology trends, and upcoming technologies. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

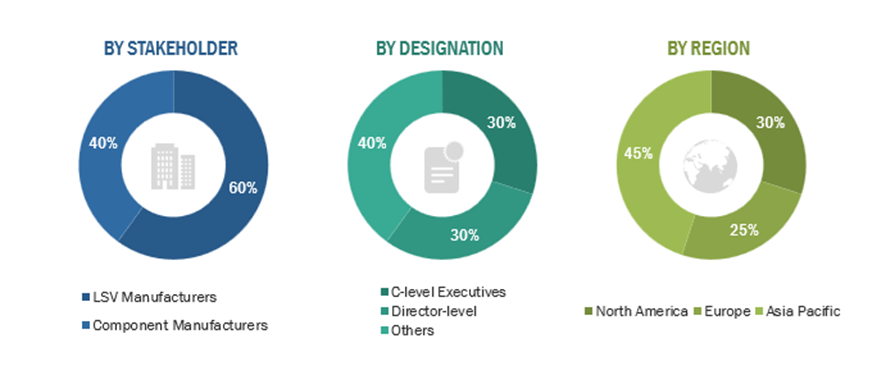

Primary interviews have been conducted with market experts from the demand-side (end-use industries) and supply-side (low-speed vehicle providers) across four regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 60% and 40% of the primary interviews were conducted on the OEMs and component manufacturer sides. Primary data has been collected through questionnaires, emails, and telephonic interviews. After communicating with primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value of the low-speed vehicle market and other dependent submarkets.

-

Secondary research identified key players in the low-speed vehicle market and determined their global market ranking.

-

The research methodology included a study of annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

-

All vehicle level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

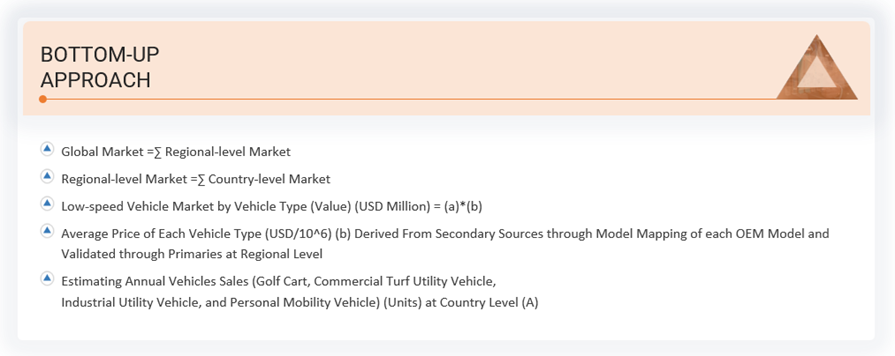

Global Low Speed Vehicle Market Size: Bottom-Up Approach, By Vehicle Type and Country

To know about the assumptions considered for the study, Request for Free Sample Report

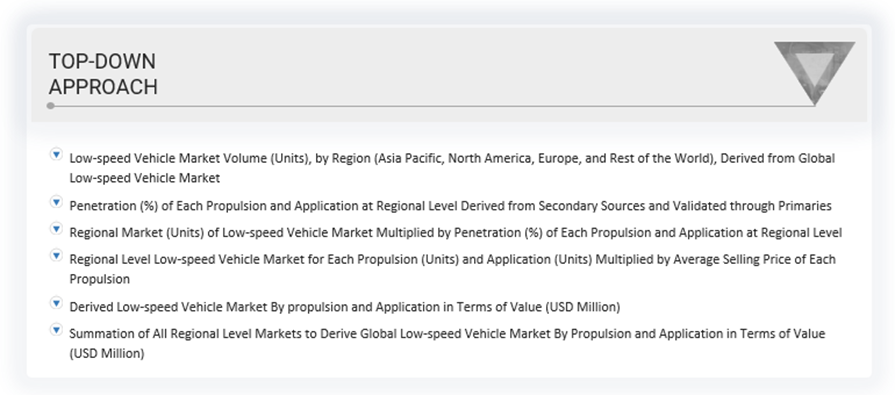

Global Low Speed Vehicle Market Size: Top-down Approach, By Vehicle Type and Country

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

According to the US Department of Energy, a low-speed vehicle is a four-wheeled motor vehicle capable of reaching speeds of more than 20 miles per hour (mph) but not more than 25 mph. It may not operate on a highway with a posted speed limit of more than 35 mph. A city or county may adopt ordinances that allow the operation of low-speed vehicles or medium-speed EVs on city streets or county roads with posted speed limits greater than 35 mph and 45 mph, respectively. Low-speed vehicles and medium-speed EVs must comply with specific standards in Title 49 of the US Code of Federal Regulations, section 571.500.

Key Stakeholders

-

Senior Management

-

End User Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, and forecast the size of the low-speed vehicle market in terms of value (USD million) and volume (units) between 2024 and 2030 based on the following segments:

-

By Application (Golf Course, Hotel & Resort, Airport, Industrial Facility, and Other Applications)

-

By Vehicle Type (Golf Cart, Commercial Turf Utility Vehicle, Industrial Utility Vehicle, and Personal Mobility Vehicle)

-

By Propulsion (Electric, Gasoline, and Diesel)

-

By Power Output (<5 kW, 6–15 kW, and >15 kW)

-

By Battery Type (Lithium-ion Battery and Lead-acid Battery)

-

By Category (L6 Vehicle and L7 Vehicle)

-

By Voltage (<60 V, 61–99 V, and >100 V)

-

By Motor Configuration (Hub-mounted, Mid-mounted, and Other Motor Configurations)

-

By Motor Type (AC Motor and DC Motor)

-

By Region (Asia Pacific, Europe, North America, and Rest of the World)

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market.

-

To analyze the market share of leading players in the low-speed vehicle market and evaluate competitive leadership mapping.

-

To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

-

Trends and Disruptions Impacting Customers’ Businesses

-

Market Ecosystem

-

Technology Analysis

-

Supply Chain Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Case Study Analysis

-

Key Stakeholders and Buying Criteria

-

Key Conferences and Events

-

Trade Analysis

-

Investment and Funding Scenario

-

Pricing Analysis

-

To analyze recent developments, including product launches, partnerships, acquisitions, expansions, and other developments undertaken by key industry participants in the market

-

To give a brief understanding of the low-speed vehicle market in the recommendations chapter

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

Global low-speed vehicle market by propulsion type, at the country level (North America, Europe, Asia Pacific, and the Rest of the World)

Global low-speed vehicle market, by power output, at country level (North America, Europe, Asia Pacific, and Rest of the World)

Global low-speed vehicle market by seating capacity

-

Small (2-4 seater)

-

Medium (6-8 seater)

-

Large (Above 8 seater)

Growth opportunities and latent adjacency in Low-Speed Vehicle Market