Weigh-In-Motion System Market by Weighing Technology (Bending Plate, Piezoelectric Sensor), End-use Industry, Component (Hardware, Software), Application, Installation Method, Vehicle Speed (Low, High), Sensors and Region - Global Forecast to 2027

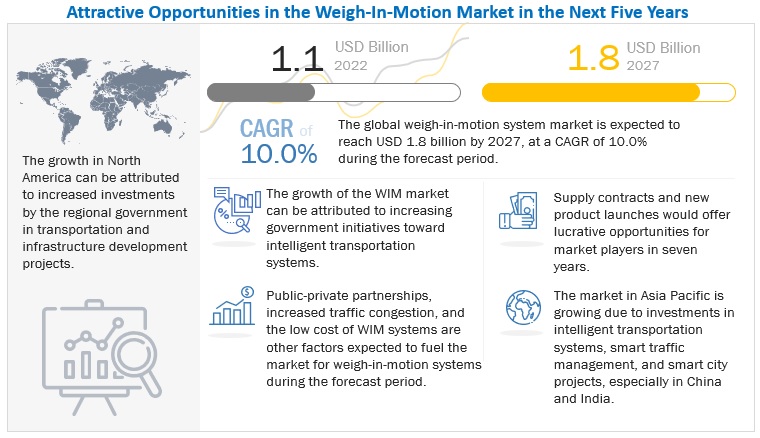

[267 Pages Report] The weigh-in-motion system market is projected to reach USD 1.8 billion by 2027 from USD 1.1 billion in 2022, at a CAGR of 10.0% during the forecast period. A weigh-in-motion (WIM) system records information on the weight, speed, length, and class of the moving vehicle. Weigh-in-motion scales provide a number of benefits over conventional static weight scales. By weighing moving vehicles, it facilitates a smooth flow of traffic while reducing operating time, maintenance requirements, and costs. For intelligent transportation systems (ITS), weigh-in-motion has become a useful technology. It creates records for each vehicle containing the vehicle type, speed, axle load, and spacing. This detailed traffic information is utilized for pavement analysis and design, overweight enforcement, real-time traffic data analysis, and reporting, freight estimation, and virtual traffic monitoring applications. The market for weigh-in-motion is fueled by increasing government initiatives for intelligent transportation systems, public-private partnerships, and traffic congestion.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Government initiatives toward intelligent transportation systems & increased public-private partnerships

To make transportation safe, more efficient, and sustainable, the governments of various countries, such as the US, China, Japan, and many European countries, have defined a roadmap for intelligent transportation infrastructure which includes the installation of Weigh-in motion systems on highways and other roads for vehicle data collection, weight enforcement ad weight-based tolling. For instance, ITS Strategic Plan 2022–2026, started by the US Department of Transportation (USDOT), focuses on intelligent vehicles, intelligent infrastructure, and the creation of intelligent transportation systems (ITS). Further, the Indian Government stated in February 2022 that 467 of 692 toll plazas were equipped with weigh-In-motion systems, and a need for rapid installation of WIM systems in the rest of the toll plazas was raised in the Rajya Sabha, along with a need to equip the new toll plazas with high-speed weigh in motion systems only enabling uninterrupted traffic flow. Public private partnerships are being considered for the faster implementation of the same. For instance, in September 2022, the Union ministry of road transport and highways in India invited US-based firms for PPPs to develop national highways, which bought USD 720 million in FDIs. ITS applications offer the benefits of combining information, data processing, communication, and sensor technology and apply them to vehicles, traffic infrastructure, and management software to provide a more efficient transport network. A WIM system enables intelligent use of the available transportation infrastructure and vehicles by allowing real-time information and data flow. The system collects data from sensors located in or above the infrastructure. It helps smooth traffic flow, increases road safety by identifying overweight vehicles, and reduces road wear. Therefore, the growing demand for ITS worldwide is expected to drive the WIM market during the forecast period.

Restraint: Lack of standardized and uniform technologies

Solutions for traffic management, like the weigh-in-motion system, lack uniformity and standardization. The weigh-in-motion system uses a variety of hardware and software elements from different vendors. In addition, different businesses' requirements for sensors, CPUs, and other hardware are not compatible with every underlying hardware. Additionally, different nations and regions have various communication network standards and protocols, which prevents solution providers from offering their services globally. For instance, the laws governing the gathering and analysis of traffic data in the European Union member states are inconsistent or even null and void in certain other European regions. The lack of standardization also affects the aftermarket component replacement of weigh-in-motion systems, which further complicates the maintenance of a WIM system. As a result, a common protocol for communication and workflow for weigh-in-motion systems is required for widespread adoption throughout the world. Therefore, the absence of regulations, guidelines, and requirements for the use of weigh-in-motion systems might limit market growth.

Opportunity: Investments in smart city projects

The transformation of traditional cities into smart cities by deploying state-of-the-art technologies in the industrial, transport, and healthcare sectors significantly influences the weigh-in-motion market. The development of smart cities has accentuated the need for effective, low-cost, and energy-efficient transport services. Developed and developing countries are making huge investments in smart city projects. The global spending on smart city initiatives is estimated to total nearly USD 511.6 billion in 2022 according to smart energy international. WIM systems are essential components of intelligent traffic systems as they offer real-time vehicle information, increase road safety by identifying overweight vehicles, and reduce road wear, which further plays a major role in the development of smart cities. Hence, the increasing investment in smart cities will likely accelerate the deployment of WIM systems during the forecast period.

Challenge: Data fusion from onboard WIM into centralised ITS/TMS systems

Data fusion synthesizes the data generated from touchpoints and sensors used in weigh-in-motion systems. It reduces the blind spot and complexities in a measuring system. A WIM system comprises many sensors, such as piezoelectric, infrared, image, radar, LiDAR, pedestrian, inductive loops, ultrasonic wave detectors, and cameras, which generate huge volumes of data. Synthesizing and integrating the raw data generated from these touchpoints to derive valuable traffic information, such as vehicle weight, vehicle class, number of axles, vehicle length, speed, travel times, and congestion, is complex and leads to system failure. Companies such as Transcore (US) have developed Infinity Digital Lane System, which avoids data fusion with its robust module design. Therefore, deploying a multi-sensor data fusion technology, which collates recorded signals to create an informed traffic control environment, poses a major challenge.

The Highway Toll and Road Safety segment is estimated to be the largest during the forecast period

According to end-use industries, the Highway Toll and Road Safety segment commands the weigh-in-motion system market. To alleviate traffic congestion and identify overweight vehicles, especially freight carriers, weigh-in-motion devices are mostly employed for highway toll reasons. To minimize overloading, overspeeding, accidents, and unanticipated damage to roads and related infrastructure, key technological advancements in ITS/TMS systems and stronger laws set for road usage for freight trucks are required. Key consumers of WIM systems for the highway toll and road safety market are countries investing in ITS/TMS while developing new roads and repairing aging infrastructure.

The onboard weigh-in-motion systems segment is projected to register the highest growth rate during the forecast period

Onboard weigh-in-motion systems have numerous advantages over the other two types such as low cost, less maintenance required, no infrastructure required, and can work at any vehicle speed. For instance, an in-road low-speed weigh-in-motion system costs about USD 25,000–60,000 depending on the accuracy, whereas the hardware of the onboard weigh-in-motion system costs approximately USD 1,100–1,300 per truck. If such systems are made mandatory in the coming years, the hardware costs may even come down to about USD 550–600. The accuracy recorded from onboard weigh-in-motion systems is also higher compared to a low-speed, in-road WIM system. The typical measurement inaccuracy is between ±1% and ±2% depending on the sensing technology, whereas, the same for in-road WIM system is ±3% to ±5%

The onboard segment is expected to be the fastest-growing segment during the forecast period. The C-ITS/V2X technologies for wireless data exchange between Onboard WIM systems and TMS/ITS are expected to boost the demand for Onboard WIM systems combined with the lower cost incurred by authorities and governments to build a TMS ecosystem around Onboard WIM systems.

Asia Pacific to be the fastest growing market by value during the forecast period

The increasing number of megacities and the population growth in developed and developing countries have increased the use of various traffic sensors and weigh-in-motion systems in the Asia Pacific region. Various countries in the region have started recognizing traffic solutions using weigh-in-motion systems and traffic sensors for curbing traffic congestion, automated toll, vehicle detection, traffic control, and traffic management. The number of underway traffic management projects across the Asia Pacific is vast, owing to the growing need for replacing and upgrading existing conventional transportation systems. The weigh-in-motion system market in the Asia Pacific is growing rapidly because of the demand in countries such as China, Japan, and India. The local and regional government bodies have implemented several traffic management projects. These include Gateway WA Perth Airport and Freight Access Project, Australia; Secondary National Roads Development Project (SNRDP), Philippines; Chenani-Nashri Tunnel (Patnitop Tunnel), India; Smart City Kochi, India; Rohtang Tunnel at Lahaul, Spiti Valley, India; Hong Kong Intelligent Transport System (ITS), China; and Beijing Real-Time Traffic Information System, China. All these initiatives are expected to boost the traffic management market in the Asia Pacific. The demand for weigh-in-motion systems in the Asia Pacific is significantly driven by the growth of road infrastructure and the implementation of ITS. Hence, Asia Pacific is estimated to be the fastest-growing market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The weigh-in-motion system market is dominated by established players such as Avery Weigh-Tronix (US), Mettler Toledo (US), Kistler Instruments AG (Switzerland), International Road Dynamics Inc. (Canada), and Q-Free ASA (Norway). These companies adopted various strategies, such as new product developments, deals, and others to gain traction in the weigh-in-motion system market.

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2017–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million/USD Billion) |

| Segments covered | End-Use Industry, Component, Weighing Technology, Application, Installation Method, and Vehicle Speed. |

| Geographies covered | Asia Pacific, Europe, North America, and RoW |

| Companies covered | Avery Weigh-Tronix (US), Mettler Toledo (US), Kistler Instruments AG (Switzerland), International Road Dynamics Inc. (Canada), and Q-Free ASA (Norway). |

The study categorizes the weigh-in-motion system market based on type, vehicle speed, component, end-use industry, function, and region

Weigh-in-motion system Market, By Vehicle Speed

- Low-speed (<15 km/h)

- High-speed (>15 km/h)

Weigh-in-motion system Market, By Installation Method

- In-road Weigh-in-Motion System

- Bridge Weigh-in-Motion System

- Onboard Weigh-in-Motion System

Weigh-in-motion system Market, By End-Use Industry

- Highway Toll & Road Safety

- Oil & Refinery

- Logistics

- Other End-use Industries

Weigh-in-motion system Market, By Component

- Hardware

- Software & Services

Weigh-in-motion system Market, By Technology

- Load Cell Technology

- Bending Plate Technology

- Piezoelectric Sensor Technology

- Other Technologies

Weigh-in-motion system Market, By Application

- Vehicle Profiling

- Axle Counting

- Weight Enforcement

- Weight-based Toll Collection

- Bridge Protection

- Traffic Data Collection

Weigh-in-motion system Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In May 2022, International Road Dynamics Inc. announced that the company had been awarded two contracts totaling around USD 900 thousand for weigh-in-motion (WIM) system upgrades for the Illinois State Toll Highway Authority.

- In April 2022, Mettler Toledo launched a single-draft weigh-in-motion scale, TruckPass, which enables legal-for-trade levels of accuracy, previously unavailable to in-motion solutions. Companies in the US can now benefit from this technology, boosting efficiency, reducing emissions, and improving operations with the integration of DataBridge Transaction Management Software due to the updates in Specifications, Tolerances, and Other Technical Requirements for Weighing and Measuring Devices’ standards in the US.

- In September 2021, International Road Dynamics Inc. got an award to supply and install a mainline Weigh-In Motion and electronic pre-clearance system for the Idaho Transportation Department (ITD) with a contract size of approximately USD 1.6 million.

- In September 2021, Quarterhill Inc (Parent company of. International Road Dynamics Inc.) acquired Electronic Transaction Consultants, LLC. (US) a company focused on tolling and mobility systems for cash consideration of approximately USD 120 million.

- In April 2021, Quarterhill Inc (Parent company of. International Road Dynamics Inc.) acquired VDS Verkehrstechnik GmbH (VDS), a German-based Intelligent Transportation Systems (“ITS”) provider of high precision traffic monitoring devices, for cash consideration of approximately USD 2.07 million.

- In March 2021, Q-Free ASA launched HI-TRAC TMU4X, an advanced multimodal, high-speed weigh-in-motion (WIM) data collection solution that includes automatic vehicle classification (AVC) and pedestrian and cyclist data counts, all in a single unit.

Frequently Asked Questions (FAQ):

What is the current size of the global weigh-in-motion system market?

The global weigh-in-motion system market is estimated to be USD 1.1 billion in 2022, with Europe dominating the market.

Which type is currently leading the weigh-in-motion system market?

Low-speed WIM system is leading the weigh-in-motion system market.

Many companies are operating globally in the weigh-in-motion system market space. Do you know who are the front leaders, and what strategies have been adopted by them?

Avery Weigh-Tronix (US), Mettler Toledo (US), Kistler Instruments AG (Switzerland), International Road Dynamics Inc. (Canada), and Q-Free ASA (Norway). These companies adopted various strategies, such as new product developments, deals, and others to gain traction in the weigh-in-motion system market.

How is the demand for weigh-in motion systems varies by region?

Europe with higher adoption of high-speed weigh-in motion systems for reducing traffic congestion, weight enforcement measures, reducing wear and tear of roads, and keeping the roads safe is expected to drive the high-speed WIM system demand. However, in North America and Asia Pacific region, the low-speed weigh-in motion systems with factors like higher accuracy and low price respectively are expected to dominate the market.

What drivers and opportunities for the weigh-in-motion system supplier?

Increasing investment in smart cities, free trade agreements, and onboard WIM systems are expected to offer promising future growth in the market for weigh-in-motion systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

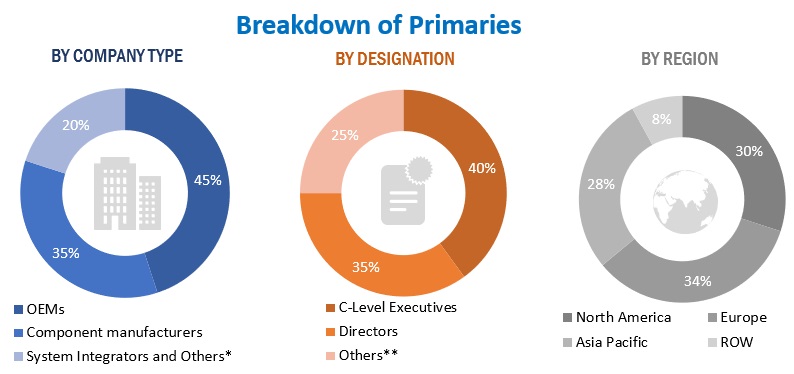

The study involved four major activities in estimating the current size of the weigh-in-motion system market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate segments and subsegments' market size.

Secondary Research

Secondary sources referred for this research study include the International Society for Weigh in Motion (ISWIM), investor presentations, and financial statements, the International Bridge Tunnel and Turnpike Association (IBTTA), The Oil & Gas Journal, European Logistics Association (ELA), International Warehouse Logistics Association (IWLA), American Trucking Associations, State Departments of Transportation, and American Association of State Highway and Transportation Officials (AASHTO), Databases such as Factiva and Bloomberg, and corporate filings (such as annual reports, investor presentations, and financial statements). Secondary data was collected and analyzed to arrive at the overall market size, validated further through primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the weigh-in-motion system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (end-user- toll manufacturer, ITS supplier) and supply-side (weigh-in-motion system manufacturer) across major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand- and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the weigh-in-motion market and other dependent submarkets, as mentioned below:

- Key players in the weigh-in-motion market were identified through secondary research, and their market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

- All major penetration rates, percentage shares, splits, and breakdowns for the weigh-in-motion market were determined using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Report Objectives

- To define, describe, and forecast the size of the weigh-in-motion system market, in terms of value (USD million)

-

To forecast the market size based on

- End-use Industry (Highway Toll & Road Safety, Oil & Refinery, Logistics, and Other End-use Industries)

- Component (Hardware and Software & Services)

- Weighing Technology (Load Cell Technology, Bending Plate Technology, Piezoelectric Sensor Technology, and Other Technologies)

- Application (Vehicle Profiling, Axle Counting, Weight Enforcement, Weight-based Toll Collection, Bridge Protection, and Traffic Data Collection)

- Installation Method (In-road, Weigh Bridge, and Onboard)

- Vehicle Speed [Low-speed (<15 km/h) and High-speed (>15 km/h)]

- Sensors (Image Sensors, Piezoelectric Sensors, Bending Plates, Inductive Loops, Magnetic Sensors, Acoustic Sensors, Infrared Sensors, Radar Sensors, LiDAR Sensors, and Thermal Sensors)

- Region [North America, Europe, Asia Pacific, and the Rest of the World (RoW)]

- To analyze technological developments impacting the weigh-in-motion system market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders in the weigh-in-motion system market

- To provide detailed information on the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market ranking and their core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Weigh-in-motion market, by application, by country

- Profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Weigh-In-Motion System Market