Nut Products Market by Product Type (Nut Butter, Nut Paste/Marzipan Paste/Persipan Paste, Nut Fillings with Cocoa, Nut Fillings without Cocoa, Caramelized Nuts, and Nut Flour), Nut Type, Application, Quality, Category and Region - Global Forecast to 2027

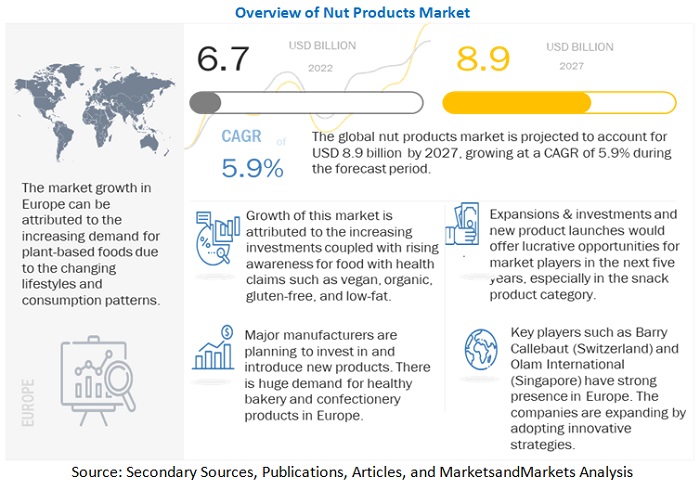

[246 Pages Report] According to MarketsandMarkets, the global nut products market size is estimated to be valued at USD 6.7 billion in 2022. It is projected to reach USD 8.9 billion by 2027, recording a CAGR of 5.9% in terms of value. The market growth is attributed to the growing snack food industry, the inclusion of health-based ingredients, and awareness related to health claims. There is a global increase in the popularity of nut products with low-calorie, low-sugar, plant-based, and low-fat properties; this increase is due to most of the global population adopting a healthy and high-nutrient diet. Globally, the health benefits of nut products have led to their large-scale adoption in numerous applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rising health awareness leading to evolving dietary patterns

The increasing awareness of nutrition over and above regular dietary habits and an inclination toward healthy lifestyles is projected to drive the global nut market. The changing consumer preferences for convenience products with health and wellness claims have led to high demand for nut products. The increasing health concerns and awareness have led to an evolving consumption pattern. Further, consumers’ nutrition choices are changing to support better well-being. Almonds, walnuts, macadamia nuts, hazelnuts, and pecans have significant omega-3 fatty acids that are required for the upkeep of joints and bone, along with cognitive health.

Restraints: Availability and fluctuating costs for nuts as raw material

The raw materials for nut products are agri-commodities that witness high uncertainties in their prices and availability. Exotic and uncommon nuts are harder to obtain, given their fluctuating yields. Ingredient manufacturers utilizing nuts as a raw material require a carefully planned inventory management system, which is usually not the case, especially for small and medium-scale manufacturers. Hence, converting nuts into value-added products, such as butter, pastes, and fillings, becomes cost-intensive. This high cost trickles down to processed food & beverage manufacturers that ultimately pass it on to end consumers. It is one of the primary restraining factors for the growth of the market.

Opportunities: Expanding application spectrum for nuts and derivatives

The robust growth and promising potential in plant-based dairy alternatives and meat analogs have created significant opportunities for nut product manufacturers. Key players such as Olam International and Barry Callebaut have already intensified their efforts in catering to these attractive end-use avenues for gaining a cutting-edge advantage in the foreseeable future. Apart from the food industry, non-food application sectors can also act as a potential revenue stream for companies - nut ingredients have applications in various industries such as cosmetics and pharmaceuticals. The cosmetics market comprises a diversified population, among which the aging population forms a significant segment.

Challenges: Supply chain management intricacies and quality of nut products

One of the crucial challenges in the growth of the nut products market is the quality and safety issues as the product travels through different junctures in the supply chain. Lacunae on the part of handling, distribution, transportation, and intermediate storage can cause severe implications on the overall quality of nut products. The supply chain of nuts consists of procurement, processing, packing, and storage. Throughout the supply chain, nuts (processed or unprocessed) are prone to contamination.

By product type, the nut pastes/marzipan pastes/persipan pastes segment is projected to dominate the market during the forecast period

Nut paste is a rich energy source, manufactured with either raw or roasted natural or blanched nuts. It is manufactured utilizing a significant amount of sugar and vegetable fats to form a thick paste-like consistency. Nut paste is made from various nuts, catering to different food industries. Marzipan (almond paste) and Persipan (apricot or peach kernels) are used mainly by the food industry in various traditional recipes, including croissants and Danish pastry confectionery products.

By nut types, the hazelnuts segment is anticipated to acquire the largest market share in the market during the study period

Hazelnuts are the top-most ingredients used in the confectionery industry in the preparation of chocolates and also as hazelnut spread, paste, and meals. These are the highest quality nuts that command the highest prices and are sold unshelled or in processed form. Diced, ground, and pastes are used in baked goods and ice creams. Turkey is the key producer of the global hazelnut crop with a 70% approximate share, and Europe consumes 80-85% of the Turkish hazelnut produced as an ingredient in the confectionery industry.

By application, the industrial food manufacturers segment is forecasted to dominate the nut products market during the forecast period

Nuts are used in the chocolate confectionery industry as they provide a crunchy texture, taste, and health benefits. Around one-third of confectioneries contain nut products such as almond flakes, walnut halves, or pecan pieces. Chocolate confections are working harder to innovate chocolates using nuts to enhance the sensory experience. Hazelnuts, walnuts, and almonds are the most popular nut inclusions. Almonds are popularly used in North America in the confectionery industry, while hazelnuts are popular in the European chocolate industry. Also, to meet specific consumer needs, such as gluten- or dairy-free, profiles by addition of flavored nut paste or butter to various formulations are being tapped by manufacturers.

By category, the conventional segment is anticipated to acquire the largest market share in the market.

Conventional nuts farming includes synthetic chemical fertilizers, pesticides, herbicides, and other continual inputs. Thus, conventional nuts agriculture is typically highly resource-demanding and energy-intensive, increasing the total production cost. However, at the same time, conventional farming has high productivity compared to organic farming.

By quality, the standard quality segment is forecasted to dominate the market during the forecast period.

Edible nuts are increasingly being recognized for their health benefits. Therefore, the provision of safe, high-quality nuts is a major concern. To market nut products, manufacturers ensure that they meet the ideal standards associated with nut products. There are requirements for sustainable products to appeal to consumers, particularly when edible nuts come from developing countries. The standards from the United Nations Economic Commission for Europe (UNECE) and Working Party on Agricultural Quality Standards describe the products and the quality requirements at the export control stage that concern the appearance, moisture content, sizing, presence of defects, infestations, and blemishes along with packaging requirements.

To know about the assumptions considered for the study, download the pdf brochure

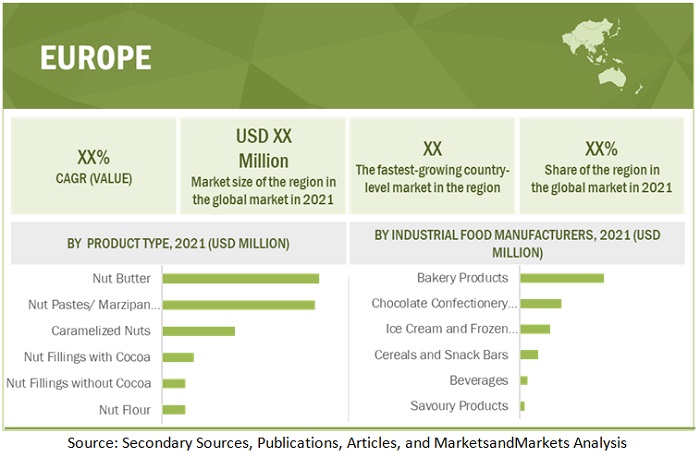

Europe accounted for the highest share in the global market by volume in 2021. Demand for healthy yet indulgent snacks that can satisfy consumer's taste buds without compromising on nutritional values is the biggest trend that drives manufacturers to innovate nut products. Consumers in this region are witnessing a high demand for natural and low-sugar ingredients and food products, resulting in a surge in nut product consumption.

Key Market Players:

Key players in this market include Olam International (Singapore), Barry Callebaut (Switzerland), Blue Diamond Growers (US), Kerry Group (Ireland), Zentis GmbH & Co. KG. (Germany), Mount Franklin Foods (US), Mandelin, Inc (US), Besana (Italy), Bazzini (US), and Lubeca (Denmark).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2019–2027 |

|

Units considered |

Value (USD) and Volume (KT) |

|

Segments covered |

Product type, Nut type, Application, Quality, Category, and region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Rest of the World |

|

Companies studied |

|

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Nut products ingredient distributors

- Marketing directors

- Key executives from various key companies and organizations in nut products market

Report Scope:

This research report categorizes nut products market based on product types, nut types, application, category, quality, and region.

By Product Type

- Nut Butter

- Nut Pastes/ Marzipan Paste/ Persipan Paste

- Nut Fillings with Cocoa

- Nut Fillings without Cocoa

- Caramelized Nuts

- Nut Flour

By Nut Type

- Almonds

- Hazelnuts

- Walnuts

- Cashews

- Peanuts

- Pistachios

- Macadamias

- Pecans

- Pine Nuts

- Brazil Nuts

By Application

- Industrial Food Manufacturers

- Chocolate Confectionery Products

- Bakery Products

- Ice Cream and Frozen Desserts

- Cereals and Snack Bars

- Beverages

- Savoury Products

- Foodservice & Bakeries

- Bakery Shops (Including Artisanal Bakeries)

- Foodservice (restaurants, cafes and hotels)

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the world

Recent Developments

- In June 2022, Blue Diamond Growers launched new flavors – Elote – Mexican-style street Corn Almonds, Korean BBQ Almonds, Mash-Ups Cinnamon and Maple Almonds, and Mash-Ups Dark chocolate and chili pepper almonds.

- In May 2022, Puratos acquired Danish fruit filling and jam manufacturer, Konfekture. This acquisition will complement the company’s position in the global nut products market to develop nut-based jams and fillings.

- In March 2022, Mount Franklin Foods announced the expansion of a state-of-the-art manufacturing facility to meet the current demand for the company’s core products.

Frequently Asked Questions (FAQ):

Which are the major product types considered in this study, and which segments are projected to have promising growth rates in the future?

All the major product applications such as nut butter, nut pastes/ marzipan pastes/ persipan pastes, nut fillings with cocoa, nut fillings without cocoa, caramelized nuts, and nut flour. Nut pastes/ marzipan pastes/ persipan pastes currently account for the dominant share in the nut products market, followed by nut butter.

I am interested in the Asia Pacific market for nut pastes/ marzipan pastes/ persipan pastes and nut butter segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects, including market size, forecast, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific (Thailand, Malaysia, and Vietnam)

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the nut products market?

Global nut products market is characterized by the following drivers:

- Rising health awareness leading to evolving dietary patterns

The increasing consumer health awareness and the rising disposable income across regions are factors that have encouraged people to opt for high-quality nut products. Consumers are increasingly seeking nut products in their daily diet. The health and wellness trend is becoming a preferred marketing strategy within the food industry. The emergence of private labels provides a dynamic market and a fresher health perspective to categories, such as snacks and bars, confectionery, dairy products, and beverages, which are innovated, keeping the health concern at the center stage.

- Robust growth projections for the bakery and confectionery sectors

Globally, the bakery and confectionery sectors are among the leading end users of nut products. The promising growth potential of the application sectors acts as a growth impetus to the nut products market. The growth of confectionery and bakeries is attributed to the rising demand for convenience - there has been a significant change in the food consumption pattern of consumers. Ready-to-eat or convenience food products are preferred mainly over home-cooked foods.

The growth rates for bakery and confectionery sectors are expected to witness greater traction in the Asia Pacific and Latin America's developing markets, which are highly inclined toward the western dietary habits of enhanced convenience amidst hectic lifestyles.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call. It will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market, including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market include Mount Franklin Foods (US), Mandelin, Inc (US), Besana (Italy), Bazzini (US), Lubeca (Denmark), include Olam International (Singapore), Barry Callebaut (Switzerland), Blue Diamond Growers (US), Kerry Group (Ireland), and Zentis GmbH & Co. KG. (Germany). .

How is the nut market impacted by global economic conditions?

The nut industry is intricately linked to global economic conditions. Consumer purchasing power plays a pivotal role, with economic downturns potentially leading to decreased demand for premium nut products. International trade dynamics, influenced by tariffs and geopolitical factors, can impact the cost and availability of nuts. Currency exchange rates fluctuations also play a role, affecting the competitiveness of nut-exporting countries. Supply chain disruptions resulting from economic instability or natural disasters can lead to shortages. Economic conditions influence investment availability, impacting the industry's capacity for expansion and innovation. Moreover, health and wellness trends, government policies, and climate change can further shape the landscape, affecting consumer preferences, regulations, and crop yields. Keeping a close eye on these economic factors is vital for stakeholders to navigate challenges and capitalize on opportunities in the dynamic nut market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 MARKET FOR NUT PRODUCTS: RESEARCH DESIGN CHART

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 EXPERT INSIGHTS

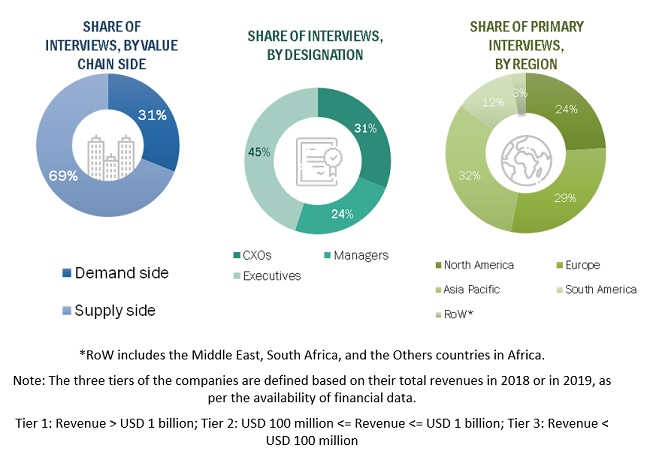

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 2 NUT PRODUCTS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET FOR NUT PRODUCTS, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET FOR NUT PRODUCTS, BY QUALITY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET FOR NUT PRODUCTS, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

FIGURE 13 NUT PRODUCTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING DEMAND FOR PLANT-BASED FOOD TO DRIVE MARKET FOR NUT PRODUCTS

4.2 EUROPE: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE AND COUNTRY

FIGURE 15 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT AND GERMANY TO ACCOUNT FOR LARGEST SHARES IN EUROPE IN 2022

4.3 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE

FIGURE 16 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT TO DOMINATE DURING FORECAST PERIOD

4.4 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE AND REGION

FIGURE 17 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT AND EUROPE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET FOR NUT PRODUCTS, BY NUT TYPE

FIGURE 18 HAZELNUTS TO DOMINATE DURING FORECAST PERIOD

4.6 MARKET FOR NUT PRODUCTS, BY QUALITY

FIGURE 19 STANDARD QUALITY TO DOMINATE DURING FORECAST PERIOD

4.7 MARKET FOR NUT PRODUCTS, BY CATEGORY

FIGURE 20 CONVENTIONAL SEGMENT TO DOMINATE DURING FORECAST PERIOD

4.8 MARKET FOR NUT PRODUCTS, BY APPLICATION

FIGURE 21 INDUSTRIAL FOOD MANUFACTURERS TO DOMINATE DURING FORECAST PERIOD

FIGURE 22 US ACCOUNTED FOR LARGEST SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 NUT PRODUCTS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising health awareness leading to evolving dietary patterns

TABLE 3 AMINO ACID PROFILE OF WALNUTS

TABLE 4 NUTRITIONAL PROFILE OF DIFFERENT NUTS PER 100 GRAMS

5.2.1.2 Robust growth projections for bakery and confectionery sectors

FIGURE 24 ESTIMATED CONFECTIONERY SALES, BY REGION, 2018–2020 (USD BILLION)

5.2.1.3 Preventive healthcare – emerging dietary approach to address lifestyle diseases

TABLE 5 SCIENTIFIC EVIDENCE HIGHLIGHTING DISEASE PREVENTION ABILITIES OF NUTS

5.2.1.4 Nuts as major ingredients in new product development

FIGURE 25 NEW PRODUCT LAUNCHES WITH NUTS AS KEY INGREDIENT, 2015–2020

5.2.1.5 Vegan food products – nuts as key ingredient – their strategic positioning

5.2.2 RESTRAINTS

5.2.2.1 Availability and fluctuating costs for nuts as raw material

5.2.2.2 Allergy concerns for nut-based ingredients

5.2.3 OPPORTUNITIES

5.2.3.1 Expanding application spectrum for nuts and derivatives

5.2.3.2 Emerging economies as global hotspots for investments

5.2.4 CHALLENGES

5.2.4.1 Supply chain management intricacies and quality of nut products

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 26 NUT PRODUCTS: VALUE CHAIN ANALYSIS

6.2.1 GROWERS & SMALL-SCALE PRODUCERS

6.2.2 SUPPLIERS/TRADERS

6.2.3 PROCESSORS & PACKERS

6.2.4 BRANDING, MARKETING & SALES

6.2.5 LOGISTICS & DISTRIBUTION

6.2.6 END USERS

6.3 PRICING ANALYSIS: MARKET FOR NUT PRODUCTS, BY TYPE

TABLE 6 GLOBAL ASP: PRICING ANALYSIS OF NUT PRODUCT TYPES, 2020 (‘000 USD/TONNES)

FIGURE 27 GLOBAL PRICING TREND OF NUT-BASED SEMI-FINISHED PRODUCTS, BY KEY NUT TYPE, 2019-2021 (‘000 USD/TONNES)

6.4 ECOSYSTEM MAP

6.4.1 MARKET FOR NUT PRODUCTS: ECOSYSTEM VIEW

TABLE 7 NUT PRODUCTS MARKET: ECOSYSTEM

6.4.2 NUT PRODUCTS MARKET MAP

6.4.2.1 Upstream

6.4.2.1.1 Raw material suppliers

6.4.2.1.2 Ingredient manufacturers

6.4.2.2 Downstream

6.4.2.2.1 Testing, Inspection & Certification (TIC) Service Providers and Regulatory bodies

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 28 REVENUE SHIFT FOR NUT PRODUCTS MARKET

6.6 TECHNOLOGY ANALYSIS

6.7 PATENT ANALYSIS

FIGURE 29 PATENTS GRANTED FOR NUT PRODUCTS MARKET, 2011–2021

FIGURE 30 REGIONAL ANALYSIS OF PATENT GRANTED, 2011–2021

TABLE 8 KEY PATENTS PERTAINING TO NUT PRODUCTS MARKET, 2020–2021

6.8 TRADE ANALYSIS

TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF NUTS, 2021 (KT)

TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF EDIBLE NUTS, 2021 (KT)

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MARKET FOR NUT PRODUCTS: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 IMPROVISING TEXTURAL ATTRIBUTES OF NUT BUTTERS AND FACILITATING THEIR INCORPORATION

6.10.2 CRUNCHY ATTRIBUTE OF NUTS AMONG END-USE INDUSTRIES

6.10.3 NUT-BASED DERIVATIVE PRODUCTS – COMPOSITION AND KEY REQUISITES

6.10.4 IMPROVISING COMPOSITION AND NUTRITIONAL PROFILE OF NUT-BASED CONFECTIONS

6.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 12 NUT PRODUCTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING DIFFERENT QUALITY NUTS

6.12.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR NUT PRODUCTS IN INDUSTRIAL FOOD APPLICATIONS

TABLE 14 KEY BUYING CRITERIA FOR NUT PRODUCTS IN INDUSTRIAL FOOD APPLICATIONS

7 KEY REGULATIONS FOR NUT PRODUCTS (Page No. - 82)

7.1 US

7.1.1 US FOOD AND DRUG ADMINISTRATION

7.1.2 ELECTRONIC CODE OF FEDERAL REGULATIONS

7.1.3 EUROPEAN UNION REGULATIONS

7.2 TARIFF AND REGULATORY LANDSCAPE

7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 NUT PRODUCTS MARKET, BY PRODUCT TYPE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 32 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 19 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 20 MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

8.1.1 NUT BUTTER

8.1.1.1 Snacking to be potential growth market for nut spreads

TABLE 21 NUT BUTTER: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 22 NUT BUTTER: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

8.1.2 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES

8.1.2.1 Rising consumption of healthy bakery products to boost nut pastes segment

TABLE 23 NUT PASTES: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 24 NUT PASTES: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

8.1.3 NUT FILLINGS WITH COCOA

8.1.3.1 Increased usage of almond flavor in confectionery and baked foods to drive market

TABLE 25 NUT FILLINGS WITH COCOA: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 26 NUT FILLINGS WITH COCOA: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

8.1.4 NUT FILLINGS WITHOUT COCOA

8.1.4.1 Application of pralines in various foods to drive market

TABLE 27 NUT FILLINGS WITHOUT COCOA: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 28 NUT FILLINGS WITHOUT COCOA: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

8.1.5 CARAMELIZED NUTS

8.1.5.1 Companies to invest in product innovations in this segment

TABLE 29 CARAMELIZED NUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 30 CARAMELIZED NUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

8.1.6 NUT FLOUR

8.1.6.1 Premium range of almond flour to drive this segment

TABLE 31 NUT FLOUR: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 32 NUT FLOUR: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9 NUT PRODUCTS MARKET, BY NUT TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 33 WORLD TREE NUT PRODUCTION, KERNEL BASIS, 2021-2022

FIGURE 34 NUT PRODUCTS MARKET, BY NUT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 34 MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

9.2 ALMONDS

9.2.1 ALMONDS RANK HIGHEST IN TERMS OF USAGE IN FOOD INDUSTRY

FIGURE 35 CALIFORNIAN ALMOND PRODUCTION, 2015-2019 (MILLION POUNDS)

TABLE 35 ALMONDS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 36 ALMONDS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.3 HAZELNUTS

9.3.1 HAZELNUTS LARGELY PREFERRED IN NORTH AMERICAN AND EUROPEAN CONFECTIONERY INDUSTRIES

FIGURE 36 WORLD HAZELNUT PRODUCTION, KERNEL BASIS, 2016-2021 (METRIC TONS)

TABLE 37 HAZELNUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 38 HAZELNUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.4 WALNUTS

9.4.1 CHINESE WALNUTS TO HAVE GREAT DEMAND WORLDWIDE

FIGURE 37 WALNUT PRODUCTION, KERNEL BASIS, 2020-2021

TABLE 39 WALNUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 40 WALNUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.5 CASHEWS

9.5.1 ASIA PACIFIC TO CONTINUE TO BE LARGE CONSUMER OF CASHEWS

TABLE 41 CASHEWS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 42 CASHEWS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.6 PISTACHIOS

9.6.1 PISTACHIOS TO BE INCREASINGLY POPULAR IN CHINA

FIGURE 38 PISTACHIO PRODUCTION, IN-SHELL BASIS, 2021-2022

TABLE 43 PISTACHIOS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 44 PISTACHIOS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.7 PEANUTS

9.7.1 PEANUT BUTTER TO BE MAJORLY CONSUMED NUT BUTTER WORLDWIDE

FIGURE 39 ESTIMATED PEANUT PRODUCTION, IN-SHELL BASIS, 2021-2022

TABLE 45 PEANUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 46 PEANUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.8 MACADAMIAS

9.8.1 MACADAMIA NUTS TO BE INCLUDED IN CEREALS, PROTEIN BARS, AND ICE-CREAM TOPPINGS

FIGURE 40 MACADAMIA PRODUCTION, KERNEL BASIS, 2021

TABLE 47 MACADAMIAS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 48 MACADAMIAS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.9 PECANS

9.9.1 PECANS EXPORTED FROM US AND MEXICO ACCOUNTED FOR 98% OF GLOBAL SHARE

FIGURE 41 PECAN PRODUCTION, KERNEL BASIS, 2021-2022

TABLE 49 PECANS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 50 PECANS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.10 PINE NUTS

9.10.1 INCREASE IN MEDITERRANEAN COOKING TO DRIVE MARKET

TABLE 51 PINE NUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 52 PINE NUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

9.11 BRAZIL NUTS

9.11.1 BOLIVIA TO BE LARGEST PRODUCER OF BRAZIL NUTS

TABLE 53 BRAZIL NUTS: NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 54 BRAZIL NUTS: MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

10 NUT PRODUCTS MARKET, BY APPLICATION (Page No. - 113)

10.1 INTRODUCTION

FIGURE 42 MARKET FOR NUT PRODUCTS, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 55 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 56 FOODSERVICE & BAKERIES: MARKET FOR NUT PRODUCTS, BY APPLICATION, 2019–2027 (USD MILLION)

10.2 INDUSTRIAL FOOD MANUFACTURERS

10.2.1 CHOCOLATE CONFECTIONERY PRODUCTS

10.2.1.1 Increasing demand for chocolate confections with almond inclusions to drive market

TABLE 57 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR CHOCOLATE CONFECTIONERY PRODUCTS, BY REGION, 2019–2027 (USD MILLION)

10.2.2 BAKERY PRODUCTS

10.2.2.1 Almond flour widely used in bakery sector

TABLE 58 INDUSTRIAL FOOD MANUFACTURERS: MARKET FOR BAKERY PRODUCTS, BY REGION, 2019–2027 (USD MILLION)

10.2.3 ICE CREAM & FROZEN DESSERTS

10.2.3.1 Premium ice creams with nut inclusions to drive market

TABLE 59 INDUSTRIAL FOOD MANUFACTURERS: MARKET FOR ICE CREAM & FROZEN DESSERTS, BY REGION, 2019–2027 (USD MILLION)

10.2.4 CEREALS & SNACK BARS

10.2.4.1 Nut snack bars to gain popularity in US

TABLE 60 INDUSTRIAL FOOD MANUFACTURERS: MARKET FOR CEREALS & SNACK BARS, BY REGION, 2019–2027 (USD MILLION)

10.2.5 BEVERAGES

10.2.5.1 Demand for milk substitutes to create demand for nut-based beverages

TABLE 61 INDUSTRY FOOD MANUFACTURERS: MARKET FOR BEVERAGES, BY REGION, 2019–2027 (USD MILLION)

10.2.6 SAVORY PRODUCTS

10.2.6.1 Nut inclusions in savory products building slowly with increasing demand for protein-rich foods

TABLE 62 INDUSTRIAL FOOD MANUFACTURERS: MARKET FOR SAVORY PRODUCTS, BY REGION, 2019–2027 (USD MILLION)

10.3 FOODSERVICE AND BAKERIES

10.3.1 BAKERY SHOPS

10.3.1.1 Traditional delicacies require more nut products

TABLE 63 FOODSERVICE AND BAKERIES: NUT PRODUCTS MARKET FOR BAKERY SHOPS (INCLUDING ARTISANAL BAKERIES), BY REGION, 2019–2027 (USD MILLION)

10.3.2 FOODSERVICE

10.3.2.1 Demand for natural ingredients to drive market

TABLE 64 FOODSERVICE AND BAKERIES: MARKET FOR FOODSERVICE (RESTAURANTS, CAFES, AND HOTELS), BY REGION, 2019–2027 (USD MILLION)

11 NUT PRODUCTS MARKET, BY QUALITY (Page No. - 122)

11.1 INTRODUCTION

FIGURE 43 MARKET FOR NUT PRODUCTS, BY QUALITY, 2022 VS. 2027 (USD MILLION)

TABLE 65 MARKET FOR NUT PRODUCTS, BY QUALITY, 2019–2027 (USD MILLION)

11.2 STANDARD QUALITY

TABLE 66 STANDARD QUALITY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

11.3 PREMIUM/SPECIALTY PRODUCTS

TABLE 67 PREMIUM/SPECIALTY PRODUCTS: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

12 NUT PRODUCTS MARKET, BY CATEGORY (Page No. - 127)

12.1 INTRODUCTION

FIGURE 44 MARKET FOR NUT PRODUCTS, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

TABLE 68 MARKET FOR NUT PRODUCTS, BY CATEGORY, 2019–2027 (USD MILLION)

12.2 CONVENTIONAL

TABLE 69 CONVENTIONAL: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

12.3 ORGANIC

TABLE 70 ORGANIC: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

13 NUT PRODUCTS MARKET, BY REGION (Page No. - 130)

13.1 INTRODUCTION

FIGURE 45 ITALY TO RECORD HIGHEST CAGR FROM 2022 TO 2027

TABLE 71 NUT PRODUCTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 72 MARKET FOR NUT PRODUCTS, BY REGION, 2019–2027 (KT)

13.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: NUT PRODUCTS MARKET SNAPSHOT

FIGURE 47 NORTH AMERICA: PECAN IMPORTS, 2020 (SHELLED BASIS)

TABLE 73 NORTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR NUT PRODUCTS, BY COUNTRY, 2019–2027 (KT)

TABLE 75 NORTH AMERICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 77 NORTH AMERICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

TABLE 79 NORTH AMERICA: MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Almonds to lead tree nut consumption in US

FIGURE 48 ALMOND CONSUMPTION IN US, 2016-2020 (METRIC TONS)

TABLE 81 US: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 82 US: MARKET SIZE FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Growing interest in low-calorie snacks to drive market in Canada

TABLE 83 CANADA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 84 CANADA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Foodservice industry to dominate nut products in Mexico

TABLE 85 MEXICO: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 86 MEXICO: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3 EUROPE

FIGURE 49 TREE NUT PRODUCTION IN EUROPE, 2019–2020 (METRIC TONS)

FIGURE 50 EUROPE: NUT PRODUCTS MARKET SNAPSHOT

TABLE 87 EUROPE: MARKET FOR NUT PRODUCTS, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET FOR NUT PRODUCTS, BY COUNTRY, 2019–2027 (KT)

TABLE 89 EUROPE: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 91 EUROPE: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

TABLE 93 EUROPE: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 94 EUROPE: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Inclination toward healthy foods to increase demand for snacks

FIGURE 51 ALMOND IMPORTS IN GERMANY, 2016-2020 (METRIC TONS)

TABLE 95 GERMANY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 96 GERMANY: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.2 SPAIN

13.3.2.1 Spanish confectionery and snack industries use various nut products

TABLE 97 SPAIN: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 98 SPAIN: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Investor-friendly policies and free-trade agreements to drive market

TABLE 99 FRANCE: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 100 FRANCE: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Rising demand for Italian cuisines to drive market

TABLE 101 ITALY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 102 ITALY: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.5 BELGIUM

13.3.5.1 Huge demand from consumers for chocolates creates growth opportunities for nut product manufacturers

TABLE 103 BELGIUM: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 104 BELGIUM: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.6 UK

13.3.6.1 Increasing preference for functional foods to boost market

TABLE 105 UK: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 106 UK: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.7 TURKEY

13.3.7.1 Increase in hazelnut exports to cater to different food industries

FIGURE 52 WORLD HAZELNUT EXPORTS, 2020 (SHELLED)

TABLE 107 TURKEY: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 108 TURKEY: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.3.8 REST OF EUROPE

13.3.8.1 Rising health concerns and increase in vegan population to drive market

TABLE 109 REST OF EUROPE: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 110 REST OF EUROPE: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4 ASIA PACIFIC

TABLE 111 ASIA PACIFIC: NUT PRODUCTS MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY COUNTRY, 2019–2027 (KT)

TABLE 113 ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 115 ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

TABLE 117 ASIA PACIFIC: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Increasing shift to premium food products to boost market

TABLE 119 CHINA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 120 CHINA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4.2 INDIA

13.4.2.1 Increasing demand for plant-based foods leading to nut products market growth

TABLE 121 INDIA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 122 INDIA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Growth in “guilt-free” food to pave way for nut products

TABLE 123 JAPAN: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 124 JAPAN: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4.4 SOUTH KOREA

13.4.4.1 Imported nuts account for over 90% of tree nut consumption

FIGURE 53 MARKET SHARE OF NUT TYPES IN SOUTH KOREA, 2019

TABLE 125 SOUTH KOREA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 126 SOUTH KOREA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4.5 AUSTRALIA & NEW ZEALAND

13.4.5.1 Urge to consume healthy food products to drive market

TABLE 127 AUSTRALIA & NEW ZEALAND: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 128 AUSTRALIA & NEW ZEALAND: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.4.6 REST OF ASIA PACIFIC

13.4.6.1 Increasing demand for high-value products to lead to market growth

TABLE 129 REST OF ASIA PACIFIC: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 130 REST OF ASIA PACIFIC: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.5 SOUTH AMERICA

FIGURE 54 BRAZIL NUT PRODUCTION, 2021-2022 (KERNEL BASIS)

TABLE 131 SOUTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 132 SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY COUNTRY, 2019–2027 (KT)

TABLE 133 SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 134 SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 135 SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 136 SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

TABLE 137 SOUTH AMERICA: MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 138 SOUTH AMERICA: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Brazil nuts have high demand due to their nutritional content

TABLE 139 BRAZIL: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 140 BRAZIL: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.5.2 ARGENTINA

13.5.2.1 Rising health-related problems to drive market growth

TABLE 141 ARGENTINA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 142 ARGENTINA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.5.3 REST OF SOUTH AMERICA

13.5.3.1 Entry of new market players to boost market growth

TABLE 143 REST OF SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 144 REST OF SOUTH AMERICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.6 REST OF THE WORLD

TABLE 145 REST OF THE WORLD: NUT PRODUCTS MARKET, BY COUNTRY/REGION, 2019–2027 (USD MILLION)

TABLE 146 REST OF THE WORLD: MARKET FOR NUT PRODUCTS, BY COUNTRY/REGION, 2019–2027 (KT)

TABLE 147 REST OF THE WORLD: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (USD MILLION)

TABLE 148 REST OF THE WORLD: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 149 REST OF THE WORLD: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

TABLE 150 REST OF THE WORLD: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (KT)

TABLE 151 REST OF THE WORLD: MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 152 REST OF THE WORLD: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019–2027 (USD MILLION)

13.6.1 SOUTH AFRICA

13.6.1.1 Key players expanding their business in South Africa

TABLE 153 SOUTH AFRICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 154 SOUTH AFRICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.6.2 MIDDLE EAST

13.6.2.1 High consumption of traditional flavors to drive demand for nut products

TABLE 155 MIDDLE EAST: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 156 MIDDLE EAST: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

13.6.3 OTHER COUNTRIES IN AFRICA

13.6.3.1 Commodities are grown in line with ongoing trend of healthy food consumption

TABLE 157 OTHER COUNTRIES IN AFRICA: MARKET FOR NUT PRODUCTS, BY PRODUCT TYPE, 2019–2027 (KT)

TABLE 158 OTHER COUNTRIES IN AFRICA: MARKET FOR NUT PRODUCTS, BY NUT TYPE, 2019–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 188)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2021

TABLE 159 MARKET FOR NUT PRODUCTS: DEGREE OF COMPETITION

14.3 KEY PLAYER STRATEGIES

14.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 55 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2019–2021 (USD BILLION)

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STARS

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE PLAYERS

14.5.4 PARTICIPANTS

FIGURE 56 MARKET FOR NUT PRODUCTS: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

14.6 PRODUCT TYPE FOOTPRINT

TABLE 160 COMPANY, BY PRODUCT TYPE FOOTPRINT

TABLE 161 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

TABLE 162 COMPANY, BY REGIONAL FOOTPRINT

TABLE 163 COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

14.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

14.7.1 PROGRESSIVE COMPANIES

14.7.2 STARTING BLOCKS

14.7.3 RESPONSIVE COMPANIES

14.7.4 DYNAMIC COMPANIES

TABLE 164 NUT PRODUCTS: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

FIGURE 57 MARKET FOR NUT PRODUCTS: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

14.8 COMPETITIVE SCENARIO

14.8.1 NEW PRODUCT LAUNCHES

TABLE 165 MARKET FOR NUT PRODUCTS: NEW PRODUCT LAUNCHES, 2018–2022

14.8.2 DEALS

TABLE 166 MARKET FOR NUT PRODUCTS: DEALS, 2018–2022

14.8.3 OTHERS

TABLE 167 MARKET FOR NUT PRODUCTS: EXPANSIONS, 2019 - 2022

15 COMPANY PROFILES (Page No. - 201)

15.1 KEY PLAYERS

(Business Overview, Products offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1.1 OLAM INTERNATIONAL

TABLE 168 OLAM INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 58 OLAM INTERNATIONAL: COMPANY SNAPSHOT

TABLE 169 OLAM INTERNATIONAL: PRODUCTS OFFERED

15.1.2 BARRY CALLEBAUT

TABLE 170 BARRY CALLEBAUT: BUSINESS OVERVIEW

FIGURE 59 BARRY CALLEBAUT: COMPANY SNAPSHOT

TABLE 171 BARRY CALLEBAUT: PRODUCTS OFFERED

15.1.3 BLUE DIAMOND GROWERS

TABLE 172 BLUE DIAMOND GROWERS: BUSINESS OVERVIEW

FIGURE 60 BLUE DIAMOND GROWERS: COMPANY SNAPSHOT

TABLE 173 BLUE DIAMOND GROWERS: PRODUCTS OFFERED

15.1.4 SUCREST GMBH (SUBSIDIARY OF KERRY GROUP)

TABLE 174 SUCREST GMBH: BUSINESS OVERVIEW

FIGURE 61 KERRY GROUP: COMPANY SNAPSHOT

TABLE 175 KERRY GROUP: PRODUCTS OFFERED

15.1.5 ZENTIS GMBH & CO. KG

TABLE 176 ZENTIS GMBH & CO. KG: BUSINESS OVERVIEW

FIGURE 62 ZENTIS GMBH & CO. KG: COMPANY SNAPSHOT

TABLE 177 ZENTIS GMBH & CO. KG: PRODUCTS OFFERED

15.1.6 MOUNT FRANKLIN FOODS

TABLE 178 MOUNT FRANKLIN FOODS: BUSINESS OVERVIEW

TABLE 179 MOUNT FRANKLIN FOODS: PRODUCTS OFFERED

15.1.7 MANDELIN, INC

TABLE 180 MANDELIN, INC: BUSINESS OVERVIEW

TABLE 181 MANDELIN, INC: PRODUCTS OFFERED

15.1.8 BAZZINI

TABLE 182 BAZZINI: BUSINESS OVERVIEW

TABLE 183 BAZZINI: PRODUCTS OFFERED

15.1.9 BESANA

TABLE 184 BESANA: BUSINESS OVERVIEW

TABLE 185 BESANA: PRODUCTS OFFERED

15.1.10 LUBECA

TABLE 186 LUBECA: BUSINESS OVERVIEW

TABLE 187 LUBECA: PRODUCTS OFFERED

15.1.11 PURATOS

TABLE 188 PURATOS: BUSINESS OVERVIEW

TABLE 189 PURATOS: PRODUCTS OFFERED

15.1.12 GEORG LEMKE GMBH & CO. KG

TABLE 190 GEORG LEMKE GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 191 GEORG LEMKE GMBH & CO. KG: PRODUCTS OFFERED

15.1.13 ALMENDRAS LLOPIS S.A.U.

TABLE 192 ALMENDRAS LLOPIS S.A.U.: BUSINESS OVERVIEW

TABLE 193 ALMENDRAS LLOPIS S.A.U.: PRODUCTS OFFERED

15.1.14 KANEGRADE

TABLE 194 KANEGRADE: BUSINESS OVERVIEW

TABLE 195 KANEGRADE: PRODUCTS OFFERED

15.1.15 MOLL MARZIPAN GMBH

TABLE 196 MOLL MARZIPAN GMBH: BUSINESS OVERVIEW

TABLE 197 MOLL MARZIPAN GMBH: PRODUCTS OFFERED

15.1.16 KONDIMA

15.1.17 CSM

15.1.18 TREEHOUSE ALMONDS

15.1.19 ROYAL NUT COMPANY

TABLE 198 ROYAL NUT COMPANY: BUSINESS OVERVIEW

15.1.20 STELLIFERI & ITAVEX S.P.A (ACQUIRER: FERRERO INTERNATIONAL SA)

*Details on Business Overview, Products offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 234)

16.1 INTRODUCTION

TABLE 199 ADJACENT MARKETS

16.2 LIMITATIONS

16.3 ALMOND INGREDIENTS MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

TABLE 200 ALMOND INGREDIENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

16.4 BAKING INGREDIENTS MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

TABLE 201 BAKING INGREDIENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

16.5 NUT INGREDIENTS MARKET

16.5.1 MARKET DEFINITION

16.5.2 MARKET OVERVIEW

TABLE 202 NUT INGREDIENTS MARKET, BY FORM, 2012–2019 (MILLION)

17 APPENDIX (Page No. - 238)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating nut products market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, growers and suppliers, importers and exporters, and intermediary suppliers such as traders and distributors of nut products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include nut products manufacturers, exporters, and importers. The primary sources from the demand-side include reatilers, wholesellers, health food stores, and other distribution partners.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the nut product market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the nut product market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points, match the data assumed to be correct.

Report Objectives

- To describe and forecast the nut product market in terms of product types, nut types, application, category, quality, and region

- To describe and forecast the nut product market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the nut product market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the nut product market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in nut product market

The nut flour market plays a significant role in driving the growth of the nut products market.

Nut flours are produced by grinding nuts into a fine powder, which can be used as a substitute for wheat flour in baking and cooking. Nut flours are high in protein, healthy fats, and other nutrients, making them a popular choice among health-conscious consumers. As demand for healthy and gluten-free alternatives to wheat flour has grown, so has the demand for nut flours. This has led to an increase in the production of nut flours and a corresponding increase in the availability of nut-based products in the market.

Nut-based products, such as nut butters, snack bars, and baked goods made with nut flours, have become increasingly popular in recent years, driven in part by the rise of health-conscious and plant-based diets. The growth of the nut flour market has helped to fuel this trend by providing manufacturers with a versatile and nutritious ingredient to use in the production of these products. The nut flour market has also helped to drive innovation in the nut products market. Manufacturers have developed new and unique products, such as almond flour pizza crusts and cashew flour pasta, that offer consumers healthy and flavorful alternatives to traditional wheat-based products.

Overall, the nut flour market plays a critical role in driving the growth of the nut products market by providing manufacturers with a versatile and nutritious ingredient to use in the production of a wide range of products. As demand for healthy and gluten-free alternatives continues to grow, we can expect to see continued growth in both the nut flour and nut products markets.

The nut flour market is expected to have a significant impact on several industries in the future. Here are a few examples:

- Baking Industry: The baking industry is one of the industries that has already been impacted by the growth of the nut flour market. As consumers increasingly seek out gluten-free and healthy alternatives to wheat flour, nut flours have emerged as a popular ingredient in baked goods such as cookies, cakes, and bread.

- Snack Industry: The snack industry is another industry that is likely to be impacted by the growth of the nut flour market. As consumers look for healthier snacking options, manufacturers are developing new and innovative snack products made with nut flours. Examples include nut-based snack bars, crackers, and chips.

- Gluten-Free Industry: The gluten-free industry is expected to continue to grow in the coming years, driven in part by the rise of gluten-free and health-conscious diets. Nut flours are a popular ingredient in gluten-free products, as they can be used to create baked goods and other products that are free from gluten.

- Health and Wellness Industry: The health and wellness industry is expected to be impacted by the growth of the nut flour market, as consumers increasingly seek out healthier food options. Nut flours are a rich source of protein, healthy fats, and other nutrients, making them a popular choice among health-conscious consumers.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific nut products market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nut Products Market