Almond Ingredients Market by Type (Whole Almonds, Almond Pieces, Almond Flour, Almond Paste, and Almond Milk), Application (Snacks, Bars, Bakery, Confectionery, Milk Substitutes & Ice Creams, Nut & Seed Buttres, RTE Cereals), Region - Global Forecast to 2025

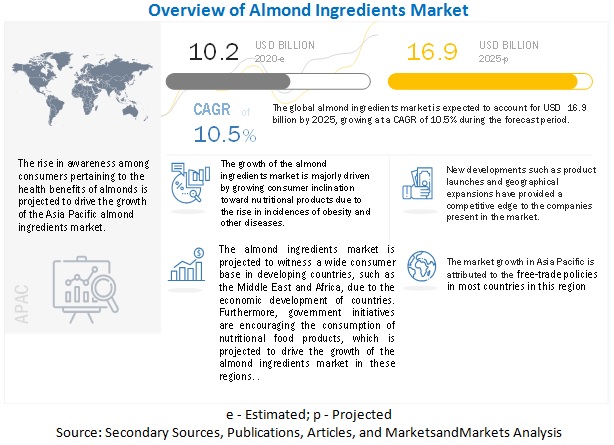

[222 Pages Report] The almond ingredients market size is projected to reach USD 16.9 billion by 2025, recording a CAGR of 10.5%. The increasing almond-based product launches by key players in the food & beverage market drives the growth of market. Other factors driving the demand for the almond ingredients include growing inclination of consumers toward plant-based and gluten-free products and associations and organizations promoting the nut ingredient industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rapid increase in almond-based product launches by key players in the food & beverage market

The increasing demand for nutritional and health-based products plays an important role in the continuous increase in the number of almond-based products. The growing obese and geriatric population demand food products with nut ingredients, especially almonds, in developed nations such as the US, Germany, and the UK. Consumers are increasingly adopting healthy eating habits to prevent diseases. The growing health awareness, increasing risk of chronic diseases, and changing lifestyles are some of the major factors driving the demand for healthier products.

The launch of new products through product line extensions, innovative formulations, and novel packaging are various marketing strategies adopted by food & beverage manufacturers for meeting consumer demand. Manufacturers are developing new products for health-conscious consumers with less-desirable nutrients such as fats and sugars. Moreover, products positioned as natural on labels are the leading trend in product launches in the past years. Product launches based on claims of the absence of additives and the presence of clean-label ingredients also attract consumers.

Foods (US), Hain Celestial (US), Califia Farms (US), and Blue Diamond Growers (US) offer a broad range of nut-based products. These players emphasize on developing innovative products and continuously introduce new products in the global market. For instance, in February 2018, So Delicious Dairy Free, a subsidiary of WhiteWave Foods (US), expanded its nut milks product line by launching So Delicious Organic Almondmilks in three new flavors: vanilla, unsweetened, and original. In September 2018, the company also launched a new range of almond milk yogurt, which is 100% plant-based and dairy-free. Similarly, Godiva Chocolatier (US) launched Almond Butter Bark in October 2018. In January 2019, Blue Diamond (US) launched almond milk blended with bananas in the US to expand its almond breeze product range. Snickers, a Mars Corporation (US) brand, launched the All New Almond Variant in India in February 2019.

Restraints: Unstable prices of raw material

Seasonal variations in production and the increasing global demand for almonds from emerging countries such as China and India are causing almond prices to rise and fall. The major reasons that are causing price fluctuations are variation in demand, production level, and changes in tariff policies. The drought in southern California, which is the main production center for almonds, makes the local government impose restrictions on water intake from rivers and aquifers. Owing to the lack of water for almond trees, growers are being forced to harvest smaller nuts, resulting in the shortage of supply of large almonds.

The continuous rise and fall in the global demand for almonds have affected the prices of almonds, especially in countries such as China and India. The shortage of almond and unstable prices are further affecting distributors and food manufacturers. The changing raw material costs affect the profit growth of companies manufacturing food & beverage products.

Opportunities: Increasing demand for almond ingredients in developing markets, such as Asia Pacific region

Numerous opportunities for the almond ingredients market are present in developing economies such as India, China, and Latin American countries. The factor driving the demand for almond ingredients is the growing demand for premium food products, which are positioned as healthy and are becoming popular with all generations in emerging economies. The increasing spending power, rapid urbanization, and changing lifestyles have fueled the demand for almond-based food & beverage products. Consumers in Asia Pacific are increasingly inclining toward purchasing clean-label products. Furthermore, there is a rising awareness of the ill effects of harmful ingredients on ones health. Numerous organizations and associations focus on promoting the health benefits of almond ingredients to create a potential market where food & beverage manufacturers expand their businesses in these emerging markets. The inclination of consumers toward vegan products is also rising, as marketing campaigns highlight their use and the health benefits offered by them. Owing to the increase in consumer preference for vegan diets, countries such as Australia, China, and India are expected to experience a significant surge in demand for almond ingredients during the forecast period.

Challenges: Food safety issues along the supply chain of almond trading

The supply chain of almond consists of procurement, pre-export processing, packing, transportation, post-export processing, and storage. Processed or unprocessed almonds are prone to contamination throughout the supply chain. Owing to the various stages of growing, processing, packaging, transport, or storage, contaminants may be present in the chain. Generally, the different forms of contamination for almonds are as follows:

- Heavy metals: There are restrictions for lead and cadmium.

- Aflatoxin: Limits have been set for aflatoxins B1, B2, G1, and G2 in most edible nuts and dried fruits.

Preventing contamination throughout the supply chain becomes very challenging and requires a high level of investment. Product packaging also plays a vital role during the supply and export of products. Packaging is beneficial for product storage and avoiding contamination or spoilage, as well as for easy transportation. However, the packaging of almonds has to be as per packaging standards, which creates challenges for manufacturers

By type, the bars segment is projected to experience the fastest growth in the almond ingredients market during the forecast period

The bars segment is expected to experience the fastest growth in the global market, on the basis of type, in 2019. The majority of consumers are inclining toward the bar category as a convenience health befitting food product. The bars segment has experienced a significant amount of growth in the past few years. According to the Almond Board of California, snack and cereal bar launches have witnessed a growth of more than 80% over the last five years. There is more scope for innovation, as bars are currently consumed by 53% of adults, and breakfast bars or granola bars alone are eaten by 46% of consumers. Moreover, consumers consider almonds as the most desired ingredient, as almonds make a bar crunchier in texture and provide numerous nutrients, and improves taste.

By application, the whole almonds segment is projected to account for the largest share in the almond ingredients market during the forecast period

The whole almond segment accounted for a major share in the global market, in 2019, in terms of value. Whole almonds are used in two different forms, which are blanched and natural. Blanched whole almonds are majorly used in various confectionery and bakery applications, as well as for garnishing various desserts. Natural whole almonds have numerous applications such as confectionery, snacks, and bakery. Whole natural almonds are consumed as snacks in flavored and roasted forms. Whole natural or blanched almonds also find applications in confectioneries for producing embedded or enrobed chocolates. In some countries, whole almonds are given as gifts on various occasions. The major factors impacting the growth of the almonds market in recent years include the constantly evolving economic standards across the world and the increase in the inclination of consumers toward healthier food products. Due to the numerous health benefits, almonds are often considered as a healthy snack. Roasting whole almonds at low temperatures allow the heat to penetrate without scorching, which provides more crispiness and increased intense flavor. Frying almonds decrease the vitamin B count in them and eliminate the harmful acrylamide.

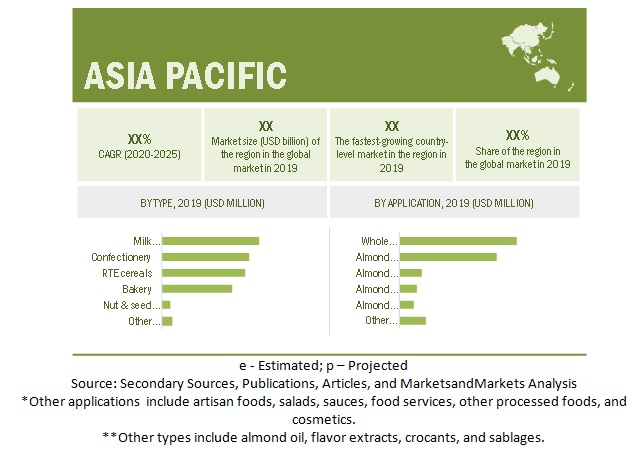

Asia Pacific is projected to grow at the highest growth rate during the forecast period

The Asia Pacific region is projected to record a higher growth rate during the forecast period. The almond ingredients industry in the Asia Pacific region is growing due to the change in the lifestyle of customers and the increase in disposable income. According to the World Bank, it is the fastest-growing economy in the world. The market in this region is witnessing a dramatic transformation regarding diet diversification, rapid urbanization, and liberal trade policies in the food sector. Furthermore, a rise in consumer awareness about health issues, an increase in inclination of consumers toward health-benefiting food products, a surge in income and purchasing power, and rapid growth of the middle-class population are the major factors offering growth opportunities for almond ingredient manufacturers in the market in the region.

Key Market Players:

ADM (US), Olam International Limited (Singapore), Barry Callebaut (Switzerland), Blue Diamond Growers (US), John B. Sanfilippo & Son (US) , Kanegrade (UK), Borges Agricultural & Industrial Nuts (Netherlands), Savencia SA (France), The Wonderful Company (US), Harris Woolf California Almonds (US), Treehouse California Almonds (US), Dφhler GmbH (Germany), Royal Nut Company (Australia), Repute Foods Pvt. Ltd (India), Deep Nuts N Flavors LLP (India), Shivam Cashew Industry (India), Modern Ingredients (India), ConnOils LLC (Wisconsin),Valley Harvest Nut Company (US), and ETChem (Jiangsu).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

20182025 |

|

Base year considered |

2019 |

|

Forecast period considered |

20202025 |

|

Units considered |

Value (USD) and Volume (KT) |

|

Segments covered |

Type, Application, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and RoW |

|

Companies studied |

|

Target Audience:

- Suppliers

- Almond growers/farmers

- Agriculture institutes

- R&D institutes

- Equipment manufacturers/suppliers

- Almond/Nut processors/manufacturers

- Regulatory bodies

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Government agencies and NGOs

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- Food & beverage manufacturers/suppliers

Report Scope:

This research report categorizes the almond ingredients market based on type, application and region.

By Type

- Whole Almonds

- Almond Pieces

- Almond Flour

- Almond Milk

- Other types

- Sablages

- Almond oil

- Crocants

- Flavor extracts

By Application

- Snacks

- Bars

- Bakery

- Confectionery

- Milk substitutes & ice creams

- Nut & Seed butters

- RTE Cereals

- Other applications

- Salads

- Sauces

- Artisan foods

- Food services

- Other processed foods

- Cosmetic applications

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In December 2019, Olam International Limited (Singapore) acquired Hughson Nut (California). This helped the company in expanding its almond ingredients capacity and meeting the growing demand from customers in and outside the US.

- In February 2019, Blue Diamond Growers signed a multi‐year licensing partnership agreement with Grupo LAlA (Mexico), a leading healthy and nutritious food company. This agreement would help the company sell and distribute its almond milk/beverage, Almond Breeze, in Mexico.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 ALMOND INGREDIENTS MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 20152018

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 ALMOND INGREDIENTS MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.2.3 MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 2 ALMOND INGREDIENTS MARKET SNAPSHOT, 2020 VS. 2020

FIGURE 4 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 5 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 6 ALMOND INGREDIENTS MARKET SHARE, BY REGION

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 BRIEF OVERVIEW OF THE ALMOND INGREDIENTS MARKET

FIGURE 7 ALMOND INGREDIENTS: AN EMERGING MARKET WITH IMMENSE GROWTH POTENTIAL

4.2 MARKET FOR ALMOND INGREDIENTS, BY REGION

FIGURE 8 ASIA PACIFIC TO GROW AT THE HIGHEST RATE IN THE ALMOND INGREDIENTS MARKET FROM 2020 TO 2025

4.3 MARKET FOR ALMOND INGREDIENTS, BY APPLICATION

FIGURE 9 SNACKS SEGMENT, BY APPLICATION, IS ESTIMATED TO DOMINATE THE MARKET IN 2020 (VALUE)

4.4 MARKET FOR ALMOND INGREDIENTS, BY TYPE

FIGURE 10 WHOLE SEGMENT IS PROJECTED TO DOMINATE THE MARKET FROM 2020 TO 2025 (USD MILLION)

4.5 EUROPE: MARKET FOR ALMOND INGREDIENTS, BY APPLICATION AND COUNTRY

FIGURE 11 SNACKS SEGMENT, BY APPLICATION, ACCOUNTED FOR THE LARGEST SHARE IN THE EUROPEAN ALMOND INGREDIENTS MARKET IN 2019

FIGURE 12 THE US, FOLLOWED BY GERMANY, OCCUPIED A MAJOR SHARE IN THE GLOBAL MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 PATENT ANALYSIS

FIGURE 13 NUMBER OF PATENTS FILED FOR ALMOND AND ALMOND INGREDIENTS, 20142018

TABLE 3 SOME OF THE GRANTED PATENTS PERTAINING TO ALMOND AND ALMOND INGREDIENTS, 20162018

5.3 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Numerous nutritional benefits offered by almond and almond ingredients

TABLE 4 NUTRITIONAL CONTENT OF ALMONDS (IN 100 GRAMS)

5.3.1.2 Rapid increase in almond-based product launches by key players in the food & beverage market

FIGURE 15 INCREASE IN ALMOND FLOUR- AND SHELL-CONTAINING NEW PRODUCT LAUNCHES

FIGURE 16 ALMONDS WERE THE MOST-USED NUTS IN TERMS OF NEW PRODUCTS LAUNCHED BETWEEN 2007 AND 2017

5.3.1.3 Growing inclination of consumers toward plant-based and gluten-free products

5.3.1.4 Associations and organizations promoting the nut ingredient industry

5.3.2 RESTRAINTS

5.3.2.1 Growing incidences of almond allergy among consumers

TABLE 5 ALMOND ALLERGENS

5.3.2.2 Unstable prices of raw materials

FIGURE 17 CALIFORNIA ALMOND VALUE: PRICE PER POUND FOR 2015-2019

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing demand for almond ingredients in developing markets, such as the Asia Pacific region

5.3.3.2 Expansions by key players and resources present in the region

5.3.3.3 Potential for diversification into other application sectors

5.3.4 CHALLENGES

5.3.4.1 Food safety issues along the supply chain of almond trading

5.3.4.2 Impact of COVID-19 on the supply chain of almond ingredients

5.4 PRICING ANALYSIS

5.5 TRADE ANALYSIS

5.6 ECOSYSTEM

FIGURE 18 MARKET ECOSYSTEM FOR ALMOND INGREDIENTS

5.7 YC-YCC SHIFT

FIGURE 19 YC-YCC SHIFT: ALMOND INGREDIENTS MARKET

6 KEY REGULATIONS (Page No. - 62)

6.1 INTRODUCTION

6.2 REGULATIONS FOR ALMOND INGREDIENTS

6.2.1 FOOD AND DRUG ADMINISTRATION

6.2.2 ELECTRONIC CODE OF FEDERAL REGULATIONS

6.2.3 EU REGULATIONS

7 CASE STUDY ANALYSIS (Page No. - 65)

7.1 CASE STUDIES ON TOP INDUSTRY INNOVATIONS AND BEST PRACTICES

7.1.1 ALMONDS AND ALMOND INGREDIENTS TO ENCOURAGE SNACKING INNOVATIONS IN THE COMING YEARS

7.1.2 INCREASE IN APPLICATION OF ALMOND FLOUR IN THE FOOD INDUSTRY OTHER THAN BAKERY PRODUCTS

8 ALMOND INGREDIENTS MARKET, BY TYPE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 20 ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 6 MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 7 MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

8.2 COVID-19 IMPACT ANALYSIS

TABLE 8 ALMOND INGREDIENTS COVID-19 IMPACT, OPTIMISTIC SCENARIO, BY TYPE, 20182021 (USD MILLION)

TABLE 9 ALMOND INGREDIENTS COVID-19 IMPACT, REALISTIC SCENARIO, BY TYPE, 20182021 (USD MILLION)

TABLE 10 ALMOND INGREDIENTS COVID-19 IMPACT, PESSIMISTIC SCENARIO, BY TYPE, 20182021 (USD MILLION)

8.3 WHOLE ALMONDS

8.3.1 INCREASE IN INCLINATION OF CONSUMERS TOWARD HEALTHY FOOD TO DRIVE THE MARKET GROWTH

TABLE 11 WHOLE ALMONDS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 12 WHOLE ALMONDS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 WHOLE ALMONDS MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 14 WHOLE ALMONDS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

8.4 ALMOND PIECES

8.4.1 AVAILABILITY OF A WIDE RANGE ALMOND PIECES FOR VARIOUS APPLICATIONS

TABLE 15 ALMOND PIECES MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 16 ALMOND PIECES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.5 ALMOND FLOUR

8.5.1 INCREASE IN DEMAND FOR GLUTEN-FREE FOOD PRODUCTS TO CREATE GROWTH OPPORTUNITIES FOR MANUFACTURERS

TABLE 17 ALMONDS FLOUR MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 18 ALMONDS FLOUR MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.6 ALMOND PASTE

8.6.1 APPLICATION IN TRADITIONAL RECIPES AND ALMOND MILK PROVIDES GROWTH OPPORTUNITIES FOR MANUFACTURERS

TABLE 19 ALMOND PASTE MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 20 ALMOND PASTE MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.7 ALMOND MILK

8.7.1 INCREASING CASES OF LACTOSE INTOLERANCE AND MILK ALLERGIES TO CREATE GROWTH OPPORTUNITIES FOR ALMOND MILK MANUFACTURERS

TABLE 21 ALMOND MILK MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 22 ALMOND MILK MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.8 OTHERS

8.8.1 ALMOND OIL AND EXTRACTS TO CONTRIBUTE TO THE GROWTH OF THE MARKET

TABLE 23 OTHER ALMOND INGREDIENTS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 24 OTHER ALMOND INGREDIENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9 ALMOND INGREDIENTS MARKET, BY APPLICATION (Page No. - 79)

9.1 INTRODUCTION

FIGURE 21 ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 25 ALMOND INGREDIENT MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 26 MILK SUBSTITUTES AND ICE CREAM MARKET SIZE, 20182025 (KT)

TABLE 27 ALMOND INGREDIENT MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 28 MILK SUBSTITUTES AND ICE CREAM MARKET SIZE, 20182025 (USD MILLION)

9.2 COVID-19 IMPACT ANALYSIS

TABLE 29 ALMOND INGREDIENTS COVID-19 IMPACT, OPTIMISTIC SCENARIO, BY APPLICATION, 20182021 (USD MILLION)

TABLE 30 ALMOND INGREDIENTS COVID-19 IMPACT, REALISTIC SCENARIO, BY APPLICATION, 20182021 (USD MILLION)

TABLE 31 ALMOND INGREDIENTS COVID-19 IMPACT, PESSIMISTIC SCENARIO, BY APPLICATION, 20182021 (USD MILLION)

9.3 SNACKS

9.3.1 RISING DEMAND FOR HEALTH-BASED SNACKS CREATING GROWTH OPPORTUNITIES

TABLE 32 SNACKS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 33 SNACKS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.4 BARS

9.4.1 INCREASING PRODUCT LAUNCHES OF ALMOND BARS ARE CREATING GROWTH OPPORTUNITIES

TABLE 34 BARS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 35 BARS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.5 BAKERY

9.5.1 INCREASED USAGE OF ALMOND FLAVOR IN CONFECTIONERY AND BAKED FOODS TO DRIVE THE MARKET

TABLE 36 BAKERY MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 37 BAKERY MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.6 CONFECTIONERY

9.6.1 INCREASING DEMAND FOR CHOCOLATE CONFECTIONS WITH ALMOND INCLUSIONS DRIVES THE MARKET

TABLE 38 CONFECTIONERY MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 39 CONFECTIONERY MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.7 MILK SUBSTITUTES & ICE CREAMS

9.7.1 MILK SUBSTITUTES

9.7.1.1 Growing demand for dairy alternatives driving the milk substitutes market

9.7.2 ICE CREAMS

9.7.2.1 Premium range of almond-based low-fat ice creams driving the market

TABLE 40 MILK SUBSTITUTES & ICE CREAMS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 41 MILK SUBSTITUTES & ICE CREAMS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.8 NUT & SEED BUTTERS

9.8.1 RISING NUMBER OF PRODUCT INNOVATIONS TO DRIVE THE MARKET

TABLE 42 NUT & SEED BUTTERS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 43 NUT & SEED BUTTERS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.9 RTE CEREALS

9.9.1 INCREASING TREND FOR HEALTHY BREAKFAST CEREALS AND MUESLI TO CREATE GROWTH OPPORTUNITIES FOR THE MARKET

TABLE 44 RTE CEREALS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 45 RTE CEREALS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.10 OTHER APPLICATIONS

9.10.1 ALMOND OIL AND ARTISAN FOODS AT A TRENDING STAGE

TABLE 46 OTHER APPLICATIONS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 47 OTHER APPLICATIONS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10 ALMOND INGREDIENTS MARKET, BY BRAND (Page No. - 94)

10.1 INTRODUCTION

10.2 LA MORELLA NUTS

10.3 MARIANI NUT COMPANY

10.4 TERRASOUL SUPERFOODS

10.5 BLUE DIAMOND GROWERS

10.6 WONDERFUL PISTACHIOS & ALMONDS LLC

10.7 SUNBEST NATURAL

10.8 OLAM INTERNATIONAL

10.9 SQUIRREL BRAND

10.10 BORGES AGRICULTURAL & INDUSTRIAL NUTS

10.11 WE GOT NUTS

11 ALMOND INGREDIENTS MARKET, BY REGION (Page No. - 97)

11.1 INTRODUCTION

FIGURE 22 REGIONAL SNAPSHOT: CHINA LEADS THE GLOBAL ALMOND INGREDIENTS MARKET, IN TERMS OF VALUE, RECORDING THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 48 ALMOND INGREDIENTS MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 49 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

11.2 COVID-19 IMPACT ANALYSIS

TABLE 50 ALMOND INGREDIENTS COVID-19 IMPACT, OPTIMISTIC SCENARIO, BY REGION, 20182021 (USD MILLION)

TABLE 51 ALMOND INGREDIENTS COVID-19 IMPACT, REALISTIC SCENARIO, BY REGION, 20182021 (USD MILLION)

TABLE 52 ALMOND INGREDIENTS COVID-19 IMPACT, PESSIMISTIC SCENARIO, BY REGION, 20182021 (USD MILLION)

11.3 NORTH AMERICA

TABLE 53 NORTH AMERICA: ALMOND INGREDIENTS MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 58 NORTH AMERICA: WHOLE ALMONDS MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 59 NORTH AMERICA: ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 60 NORTH AMERICA: WHOLE ALMONDS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.3.1 US

11.3.1.1 Increase in demand for healthy snacking products to drive the growth of the market in the US

TABLE 61 US: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 62 US: MARKET SIZE, BY TYPE, 20172025 (KT)

TABLE 63 US: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 64 US: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Canadian food safety regulations to encourage the consumption of natural and health-promoting ingredients

TABLE 65 CANADA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 66 CANADA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 68 CANADA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 NAFTA modernization to provide profitable trade opportunities for manufacturers in the US and Mexico

TABLE 69 MEXICO: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 70 MEXICO: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 71 MEXICO: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 72 MEXICO: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4 EUROPE

FIGURE 23 EUROPE: ALMOND INGREDIENTS MARKET

TABLE 73 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 74 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 76 EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 78 EUROPE: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 79 EUROPE: ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 80 EUROPE: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Demand for gluten-free, vegan, and natural foods to create growth opportunities for manufacturers in the market

TABLE 81 GERMANY: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 82 GERMANY: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 83 GERMANY: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 84 GERMANY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.2 SPAIN

11.4.2.1 Largest importer and consumer of almond ingredients

TABLE 85 SPAIN: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 86 SPAIN: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 87 SPAIN: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 88 SPAIN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 Investor-friendly policies and free-trade agreements to drive the market growth

TABLE 89 FRANCE: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 90 FRANCE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 91 FRANCE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 92 FRANCE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Increase in demand for proteins and multivitamin-rich food ingredients to drive the market growth

TABLE 93 ITALY: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 94 ITALY: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 95 ITALY: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 96 ITALY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.5 UK

11.4.5.1 Largest per capita retail snacking market to drive the demand for almond ingredients

TABLE 97 UK: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 98 UK: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 99 UK: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 100 UK: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.6 RUSSIA

11.4.6.1 Large consumer base and evolving food processing sector to create growth opportunities for manufacturers

TABLE 101 RUSSIA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 102 RUSSIA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 103 RUSSIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 104 RUSSIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.4.7 REST OF EUROPE

11.4.7.1 Rise in health concerns and an increase in vegan population to drive the growth of the market

TABLE 105 REST OF EUROPE: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 108 REST OF EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: ALMOND INGREDIENTS MARKET

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 114 ASIA PACIFIC: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 115 ASIA PACIFIC: ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 116 ASIA PACIFIC: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Increase in the number of new product launches to create growth opportunities for manufacturers in the market

TABLE 117 CHINA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 118 CHINA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 120 CHINA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.2 INDIA

11.5.2.1 Increase in the use of almonds in artisan food products and cuisines prepared during festivals to drive the market

TABLE 121 INDIA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 122 INDIA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 123 INDIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 124 INDIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.3 JAPAN

11.5.3.1 Increase in consumption of nut-based food products to drive the market growth

TABLE 125 JAPAN: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 126 JAPAN: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 127 JAPAN: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 128 JAPAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.4 AUSTRALIA

11.5.4.1 Growth of the bakery & confectionery industry to drive the demand for almond ingredients

TABLE 129 AUSTRALIA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 130 AUSTRALIA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 131 AUSTRALIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 132 AUSTRALIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.5 NEW ZEALAND

11.5.5.1 Increase in popularity of innovative almond products among consumers to drive the growth of the market

TABLE 133 NEW ZEALAND: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 134 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 135 NEW ZEALAND: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 136 NEW ZEALAND: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.5.6 REST OF ASIA PACIFIC

11.5.6.1 Free-trade policies to drive the growth of the market

TABLE 137 REST OF ASIA PACIFIC: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 138 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 140 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.6 LATIN AMERICA

TABLE 141 LATIN AMERICA: ALMOND INGREDIENTS MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 142 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 144 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 146 LATIN AMERICA: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 147 LATIN AMERICA: ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 148 LATIN AMERICA: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Increase in the number of health-conscious consumers to create growth opportunities for the market

TABLE 149 BRAZIL: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 150 BRAZIL: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 151 BRAZIL: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 152 BRAZIL: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Increase in the expenditure on healthcare services and products is projected to drive the market growth

FIGURE 25 ARGENTINEAN HEALTH EXPENDITURE (% OF GDP), 2012-2017

TABLE 153 ARGENTINA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 154 ARGENTINA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 155 ARGENTINA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 156 ARGENTINA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.6.3 REST OF LATIN AMERICA

11.6.3.1 Increase in the trend of maintaining health and wellness levels is projected to drive the market growth

TABLE 157 REST OF LATIN AMERICA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 158 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 159 REST OF LATIN AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 160 REST OF LATIN AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.7 REST OF THE WORLD

TABLE 161 REST OF THE WORLD: ALMOND INGREDIENTS MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 162 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 163 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 164 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 165 REST OF THE WORLD: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 166 REST OF THE WORLD: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 167 REST OF THE WORLD: ALMOND INGREDIENTS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 168 REST OF THE WORLD: WHOLE ALMOND MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.7.1 AFRICA

11.7.1.1 Increase in focus of key players to cater to the consumer demands is a key factor driving the growth of the market in Africa

TABLE 169 AFRICA: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 170 AFRICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 171 AFRICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 172 AFRICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11.7.2 MIDDLE EAST

11.7.2.1 High consumption of Persian food products to drive the demand for almond ingredients in the region

TABLE 173 MIDDLE EAST: ALMOND INGREDIENTS MARKET SIZE, BY APPLICATION, 20182025 (KT)

TABLE 174 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 175 MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 176 MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 166)

12.1 OVERVIEW

FIGURE 26 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE ALMOND INGREDIENT MARKET, 2017-2020

12.2 COMPETITIVE SCENARIO

12.2.1 NEW PRODUCT LAUNCHES

TABLE 177 NEW PRODUCT LAUNCHES

12.2.2 EXPANSIONS & INVESTMENTS

TABLE 178 EXPANSIONS & INVESTMENTS

12.2.3 JOINT VENTURES, INVESTMENTS, AND PARTNERSHIPS

TABLE 179 JOINT VENTURES, INVESTMENTS, AND PARTNERSHIPS

12.2.4 MERGERS AND ACQUISITIONS

TABLE 180 MERGERS AND ACQUISITIONS

12.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ALMOND INGREDIENT MARKET

12.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 28 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ALMOND INGREDIENT MARKET

12.5 MARKET SHARE OF MAJOR PLAYERS

12.6 COVID-19 IMPACT ANALYSIS, BY KEY PLAYER

12.6.1 ADM

12.6.2 OLAM INTERNATIONAL

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 175)

13.1 COMPETITIVE LEADERSHIP MAPPING- ESTABLISHED PLAYER MICROQUADRANTS

13.1.1 STARS

13.1.2 EMERGING LEADERS

13.1.3 PERVASIVE

13.1.4 EMERGING COMPANIES

FIGURE 29 GLOBAL ALMOND INGREDIENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

13.2 START-UP MICROQUADRANTS

13.2.1 PROGRESSIVE COMPANIES

13.2.2 RESPONSIVE COMPANIES

13.2.3 DYNAMIC COMPANIES

13.2.4 STARTING BLOCKS

FIGURE 30 GLOBAL ALMOND INGREDIENT MARKET: COMPETITIVE LEADERSHIP MAPPING OF SMES/START-UPS, 2020

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.3 ARCHER DANIELS MIDLAND COMPANY (ADM)

FIGURE 31 ARCHER DANIELS MIDLAND COMPANY (ADM): COMPANY SNAPSHOT

FIGURE 32 ARCHER DANIELS MIDLAND COMPANY (ADM): SWOT ANALYSIS

13.4 OLAM INTERNATIONAL LIMITED

FIGURE 33 OLAM INTERNATIONAL LIMITED: COMPANY SNAPSHOT

FIGURE 34 OLAM INTERNATIONAL LIMITED: SWOT ANALYSIS

13.5 BARRY CALLEBAUT GROUP

FIGURE 35 BARRY CALLEBAUT GROUP: COMPANY SNAPSHOT

FIGURE 36 BARRY CALLEBAUT GROUP: SWOT ANALYSIS

13.6 BLUE DIAMOND GROWERS

FIGURE 37 BLUE DIAMOND GROWERS: SWOT ANALYSIS

13.7 JOHN B. SANFILIPPO & SON

FIGURE 38 JOHN B. SANFILIPPO & SON: COMPANY SNAPSHOT

FIGURE 39 JOHN B. SANFILIPPO & SON: SWOT ANALYSIS

13.8 BORGES AGRICULTURAL & INDUSTRIAL NUTS (BAIN)

FIGURE 40 BORGES AGRICULTURAL & INDUSTRIAL NUTS (BAIN): COMPANY SNAPSHOT

FIGURE 41 BORGES AGRICULTURAL & INDUSTRIAL NUTS (BAIN): SWOT ANALYSIS

13.9 SAVENCIA SA

FIGURE 42 SAVENCIA SA: COMPANY SNAPSHOT

FIGURE 43 SAVENCIA SA: SWOT ANALYSIS

13.10 KANEGRADE LIMITED

13.11 THE WONDERFUL COMPANY

13.12 HARRIS WOOLF CALIFORNIA ALMONDS

13.13 TREEHOUSE CALIFORNIA ALMONDS

13.14 DΦHLER GMBH

13.15 ROYAL NUT COMPANY

13.16 REPUTE FOODS PVT. LTD.

13.17 DEEP NUTS N FLAVORS LLP

13.18 SHIVAM CASHEW INDUSTRY

13.19 MODERN INGREDIENTS

13.20 CONNOILS LLC

13.21 VALLEY HARVEST NUT COMPANY

13.22 ETCHEM

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 214)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

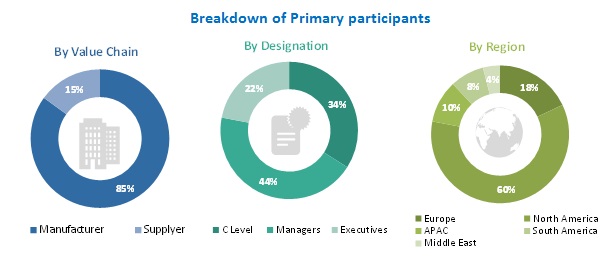

This research study involved the extensive use of secondary sourcesdirectories and databases, such as Bloomberg Businessweek and Factivato identify and collect information useful for a technical, market-oriented, and commercial study of the almond ingredients market. In-depth interviews were conducted with various primary respondentssuch as key industry participants, subject matter experts (SMEs), and C-level executives of key market players and industry consultantsto obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources, such as the AFND (Association of Health Food Nutrition and Dietetics), USDA (United States Department of Agriculture), FDA (US Food and Drug Administration), ANA (American Nutrition Association), and American Society for Nutrition, were referred to identify and collect information for this study. The secondary sources also include clinical studies and journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain key information about the industrys supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary sources from the demand-side include distributors, importers, exporters, and end consumers.

Given below is the breakdown of the primary respondents.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major almond ingredients players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall almond ingredients market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the almond ingredient market with respect to type, application, brand, and region over five years ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Addition of key players present in the market.

- Detailed and separate quadrant for the established players and start-up.

- Market share analysis updated keeping the product portfolio and revenue of the major players in the market.

- Value and volume of all the segments are updated in the report.

- Brand analysis have been provided for key players present in the market.

- Identifying and profiling the key market players in the almond ingredients market

- Determining the market share of key players operating in the almond ingredient market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Providing insights on the trade scenario

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World almond ingredients market into Middle East & Africa.

- Further breakdown of the Rest of European almond ingredients market into Poland, the Netherlands, Switzerland, Belgium, and Eastern European countries

- Further breakdown of the Rest of Asia Pacific into Thailand, Malaysia, Indonesia, South Korea, Pakistan, and Vietnam.

- Further breakdown of the Rest of Latin America into Colombia, Peru, Chile, and Venezuela.

Segment Analysis

- Further breakdown of the type segment into almond oil, flavor extracts, crocants, and sablages.

- Further breakdown of the application segment into artisan foods, salads, sauces, food services, other processed foods, and cosmetics.

Growth opportunities and latent adjacency in Almond Ingredients Market