Electric Construction Equipment Market

Electric Construction Equipment Market by Type (Excavator, Loader, Grader, Dump Truck, LHD, Self-propelled Sprayer, Tractor), Propulsion (Electric, Hybrid, Hydrogen), Battery Capacity & Chemistry, Power Output, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global electric construction equipment market is projected to reach USD 14.36 billion by 2032, growing from USD 4.51 billion in 2025, with a CAGR of 18.0%. The market for electric construction equipment is moving into a turning point as global regulations tighten. Stricter emission standards, such as EU Stage V, US Tier 4 Final, and China IV/V, along with more rigid noise control rules, are now shaping the buying decisions of contractors and fleet owners. In Europe, the Outdoor Noise Directive, which currently limits wheeled loader noise to 112 dB(A) and is set for even stricter limits with the 2024 revision, makes electric machines an obvious fit for city projects and noise-sensitive environments. Meanwhile, China has become the epicenter of this shift. Substantial government subsidies, the pace of urban development, and aggressive emission policies fuel the rapid adoption of electric loaders, establishing China as the largest market worldwide and a trendsetter for future growth. Buyers are further attracted by lifecycle cost savings from reduced fuel and maintenance. At the same time, stakeholders see clear value in future-proofing fleets against regulatory risks, ensuring eligibility for public projects, and strengthening ESG credentials. Also, the early adopters will secure compliance and gain a competitive edge in tenders, investor perception, and long-term operational efficiency.

KEY TAKEAWAYS

-

BY TYPEBattery-electric compact excavators, wheel loaders, and forklifts are outpacing hybrids due to duty cycles suited to current battery limits—short shifts, predictable loads, and depot charging. Ideal for urban and indoor use, they offer low noise, zero emissions, lower maintenance, and reduced lifecycle costs. Declining battery prices and diesel restrictions in cities further make pure battery-electric equipment a more attractive ROI than hybrids.

-

BY BATTERY CAPACITYElectric construction equipment is moving toward >100?kWh batteries, enabling longer runtimes for mid- and heavy-duty loaders, excavators, and dump trucks. Advances in lithium-ion and solid-state technologies, combined with fast charging, minimize downtime and reduce diesel dependency. Higher-capacity batteries boost productivity in continuous urban projects while ensuring compliance with EU Stage?V, US Tier?4 Final, and China IV/V regulations, positioning this segment as the key growth frontier.

-

BY POWER OUTPUTElectric construction equipment is advancing into the 150–300+ HP range, offering diesel-equivalent torque and duty cycles for heavy infrastructure and earthmoving. Higher battery energy density and advanced drivetrains cut fuel and maintenance costs while ensuring zero-emission compliance. The >150 HP segment is the fastest-growing, driven by contractor demand for high-performance machines suitable for both urban and large-scale projects without diesel backup.

-

BY PROPULSIONBattery-electric construction equipment (BECE) is outpacing hybrids as compact excavators, loaders, and forklifts now run full shifts on advanced lithium-ion batteries, avoiding the complexity of dual drivetrains. Urban zero-emission mandates in Europe and incentives in North America further boost adoption. Lower TCO through reduced fuel, maintenance, and downtime, plus enhanced sustainability credentials, gives contractors a competitive edge in securing city projects.

-

BY REGIONNorth America is expected to grow the fastest, with a CAGR of 18.9%, fueled by strong government incentives, stricter emission regulations, and rapid adoption of sustainability practices by contractors. High urbanization, infrastructure projects, and the push for lower TCO further accelerate BE equipment demand.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Hitachi and Volvo have entered into a number of agreements and partnerships to meet the growing demand for electric construction and mining application.

A key trend in electric construction equipment is the rapid shift toward larger, high-capacity electric excavators and loaders, moving beyond compact models. As battery technology advances and charging infrastructure expands, these heavy-duty machines will become viable for major projects, driving large-scale adoption. This evolution will accelerate fleet electrification, reduce lifecycle costs, and make zero-emission construction the industry standard in the future.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The electric construction equipment market’s revenue mix is evolving, shifting from ICE to electric and hydrogen-based vehicles, which is creating new growth opportunities due to niche limits, regulations in demand. EV adoption with advancement in battery technology and new investments for hydrogen construction equipment, driving the demand for electric construction equipment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High cost of ventilation in underground mining

-

Surge in demand for low-noise construction in residential areas

Level

-

Higher initial cost than conventional ICE equipment

-

Loss of productivity due to prolonged charging time

Level

-

Emergence of hydrogen-powered construction equipment

-

Development of long-range and fast-charging battery technology

Level

-

Technical complexities of shifting toward alternative power sources

-

Complex thermal management of batteries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High cost of ventilation in underground mining

The rising ventilation expenses in underground mining have become a key driver for adopting electric construction equipment. By eliminating on-site exhaust emissions, electric loaders, excavators, and dump trucks significantly cut the need for costly ventilation systems traditionally required to manage diesel fumes. This lowers operational costs and improves worker safety and environmental compliance. The transition is further reinforced by evolving regulations, such as India’s Automotive Industry Standards (AIS)-174, which set strict safety benchmarks for electric powertrain-based construction machinery, covering batteries, electrical systems, and charging infrastructure. Initially slated for implementation in October 2024, the enforcement has been pushed to January 2025, giving manufacturers additional time to align with the new requirements. These standards safeguard operators and communities while accelerating the shift toward cleaner, safer, and more sustainable construction practices.

Restraint: Higher initial cost than conventional ICE equipment

Electric construction machinery is steadily gaining traction due to its clear advantages: zero emissions, quieter operation, and lower maintenance needs. The main barrier, however, remains the higher upfront cost compared to traditional diesel-powered equipment, which continues to concern buyers in many regions. Despite this, hybrid and electric models prove their value through significant fuel and cost savings. For instance, Caterpillar’s 336E H Dozer delivers 20% greater fuel efficiency than the Caterpillar D7R and 33% more than the 330/336D. Komatsu’s hybrid excavator achieves up to 40% better fuel economy than conventional counterparts, reducing the payback period to 1–2 years. Similarly, Caterpillar’s D7E Dozer offers a return on investment within 2.5 years, whereas the 336E H achieves it in under a year. Beyond fuel efficiency, electric machines lower lifetime operating costs by cutting out many engine-related service requirements.

Opportunity: Emergence of hydrogen-powered construction equipment

Leading construction, mining, and agricultural equipment manufacturers are accelerating their shift toward hydrogen-powered propulsion systems, driven by tightening emissions regulations and the push for sustainable alternatives. Industry giants like JCB, Liebherr, Komatsu, and Caterpillar are investing heavily in both hydrogen combustion engines and fuel cell technologies. JCB, for example, has unveiled a 4.8-liter hydrogen engine designed for integration into its mainstream construction equipment, alongside mobile hydrogen refueling trailers to support customer adoption. Liebherr is gearing up for hydrogen engine production by 2025, while Komatsu is advancing hydrogen excavators and mining trucks through collaborations with Toyota and General Motors. Beyond the big players, smaller OEMs such as Escorts Kubota are also testing hydrogen solutions for tractors and construction equipment, citing superior torque delivery compared to battery-electric alternatives. Hence, these factors have created new opportunities for hydrogen-powered construction equipment.

Challenge: Technical complexities of shifting toward alternative power sources

Adopting alternative power sources in construction equipment, such as electric and hybrid models, demands substantial adjustments across dealerships, service operations, and end-user engagement. Dealers must upgrade their service capabilities by investing in technician training and certification programs tailored for electric and hybrid machinery. This includes expanding parts inventories and reconfiguring facilities to handle the specific requirements of these technologies. Technicians must gain expertise in electric drivetrains, high-voltage system management, and advanced diagnostic and repair procedures to ensure safe and reliable operations. On the customer side, winning the confidence of contractors and rental companies requires addressing concerns around performance, upfront investment, and unfamiliar technology. Manufacturers and dealers can accelerate acceptance through educational initiatives, live demonstrations, hands-on training, and flexible financing or incentive packages. By proactively addressing these challenges, the construction industry can pave the way for a smoother transition to cleaner power solutions while reducing its environmental footprint and advancing toward the future of sustainable construction practices.

electric construction equipment market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of electric compact excavators and wheel loaders in urban infrastructure projects | Zero local emissions, reduced noise for city sites, lower operating costs, and enhanced compliance with European zero-emission mandates |

|

Electric and hybrid machines for mining and heavy construction sites with high duty cycles | Significant fuel savings, reduced downtime, improved safety with advanced telematics, and support for sustainability targets in large-scale industrial projects |

|

Battery-electric mid-sized excavators for smart city and utility projects | Integration with digital platforms for predictive maintenance, quieter operations in residential zones, and alignment with Japan’s green infrastructure initiatives |

|

Electric excavators for tunneling and indoor construction where air quality is critical | Zero emissions in enclosed spaces, reduced ventilation costs, improved worker safety, and compliance with strict urban and indoor emission standards |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the electric construction equipment market is shaped by a network of battery suppliers, tier 1 component manufacturers, and global OEMs. At the tier 1 level, leading battery suppliers such as CATL, BYD, and Flash Batteries provide the advanced lithium-ion battery packs and energy management systems that serve as the foundation of electrified machinery. On the OEM side, industry leaders including Caterpillar, Volvo Construction Equipment, SANY, Hitachi, and Bobcat are spearheading the transition by integrating these technologies into excavators, loaders, and compact equipment, while expanding their electric portfolios to meet regulatory and customer demands.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Construction Equipment Market, By Type

Compact battery-electric machines such as excavators, wheel loaders, and forklifts are quickly gaining ground over hybrids. Their operating patterns, shorter shifts, steady workloads, and the ability to recharge at depots fit well within today’s battery capabilities. Contractors are turning to these machines for city projects, indoor work, and sustainability-driven sites where quiet operation and zero emissions make a big difference. Unlike hybrids, fully electric models do not need complex fuel systems, simplifying upkeep and lowering lifetime costs. With battery prices steadily declining and more cities restricting diesel use on construction sites, the financial case for going all-electric is becoming stronger than sticking with a hybrid “in-between."

Electric Construction Equipment Market, By Battery Capacity

The construction industry is entering a new phase as electric equipment adopts battery packs above 100 kWh. These larger capacities give machines enough runtime to move beyond small loaders and into demanding roles like mid- and heavy-duty excavators, loaders, and dump trucks. With improvements in lithium-ion technology and the promise of solid-state batteries combined with rapid charging, downtime is shrinking, and the need for diesel backup is fading. This translates to smoother operations on long, continuous projects in busy urban areas for contractors. At the same time, these high-capacity systems make it easier to stay aligned with strict emission standards such as EU Stage V, US Tier 4 Final, and China IV/V. Together, these factors position high-battery electric machines as the next significant growth opportunity in the sector.

Electric Construction Equipment Market, By Power Output

Electric construction machines are now moving into the powerful 150–300+ HP bracket, delivering the same muscle and endurance that diesel engines once dominated in heavy infrastructure and earthmoving. What makes this possible is the leap in battery energy density and smarter drivetrains, giving contractors equipment that cuts fuel and maintenance costs and keeps sites compliant with zero-emission rules. The strongest momentum is in the >150 HP category, where builders seek tough, regulation-ready machines that can seamlessly manage everything from congested city projects to massive earthworks without needing a diesel backup.

Electric Construction Equipment Market, By Propulsion

Battery-electric construction equipment is outpacing hybrids as contractors increasingly find that compact excavators, loaders, and forklifts can run an entire shift on advanced lithium-ion batteries. This removes the hassle of managing two drivetrains, which hybrids still require. At the same time, zero-emission rules in European cities and attractive incentive programs in North America are tipping the scales further toward fully electric machines. Beyond the regulatory push, higher fuel costs, fewer maintenance needs, and less downtime all contribute to a reduced total cost of ownership. For builders, adopting BE equipment is not just a cost decision; it is also a signal to clients and regulators that they are serious about sustainability, helping them stand out and secure more urban project contracts.

REGION

Asia Pacific to be the largest electric construction equipment market during the forecast period.

Asia Pacific dominates the electric construction equipment market because of the benefits from centralized policy frameworks, vertically integrated OEM-supplier ecosystems, and aggressive pilot programs in smart cities and mega-infrastructure projects. China, for instance, is deploying electric excavators on public projects and mandating local governments to allocate a share of their construction fleets to zero-emission equipment, creating demand pull for the adoption.

electric construction equipment market: COMPANY EVALUATION MATRIX

In the electric construction equipment market, Volvo CE (Star) leads with its broad EV lineup, large-scale production, and proven ability to drive mainstream fleet adoption in Europe and North America. Kobelco (Emerging Leader) is rapidly gaining traction with new battery-electric excavators and a clear roadmap that positions it for fast growth in urban and rental segments. While JCB has a well-established E-TECH compact electric range, making it a familiar and influential name across markets, particularly in compact equipment electrification, Bharat Earth Movers (BEML) is in the early stages of translating its strong domestic presence into a commercially scaled EV portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 4.51 BN |

| Revenue Forecast in 2030 | USD 14.36 BN |

| Growth Rate | 18.00% |

| Actual data | 2021–2032 |

| Base year | 2024 |

| Forecast period | 2032 |

| Units considered | Value (Units), Value (USD BN/MN) |

| Report Coverage | Revenue Forecast, Regional Market Shares, Competitive Landscape, Driving Factors, Trends |

| Segments Covered |

|

| Regions Covered | Americas, Asia Pacific, and Europe |

WHAT IS IN IT FOR YOU: electric construction equipment market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based electric construction equipment manufacturer |

|

|

| Supply chain & sourcing insights | Detailed analysis of key suppliers, components, and logistics for electric equipment | Helps clients mitigate risks and identify sourcing opportunities |

| Focus on regional market trends (e.g., North America, Europe, Asia Pacific) | Added region-specific sales, growth rates, regulations, and market drivers | Helps clients make targeted investment and marketing decisions per region |

| Lifecycle cost analysis | Added total cost of ownership, maintenance, charging, and operational costs | Assists clients in evaluating financial viability and cost savings |

RECENT DEVELOPMENTS

- February 2025 : In partnership with Dimaag, Komatsu introduced the Mobile Megawatt Charging System (MWCS) at Bauma 2025 in Munich. MWCS is a portable, modular charging platform for construction and mining sites. It provides scalable DC fast charging from 1 MW to 6 MW, powered by a 295-kWh energy storage system and advanced thermal management to ensure safety and durability.

- September 2024 : Caterpillar launched the Cat 793 XE, a battery-electric large mining truck, as part of its Early Learner program. The 793 XE has been deployed for testing and validation at select customer sites, including Newmont’s Cripple Creek and Victor mine, to evaluate its performance in real-world conditions.

- September 2024 : Komatsu launched the PC4000-11E, a large, electrically-powered hydraulic mining excavator designed to address the growing needs of mining operations. The PC4000-11E has an operating weight of 409 tons, a 22 m³ bucket capacity (for shovel or backhoe configurations), and is built to match 150–240 short-ton mining trucks.

- January 2024 : Hitachi unveiled the EH4000AC-5, its newest ultra-large rigid dump truck model. The EH4000AC-5 has a nominal payload of 242 tons, with some sources reporting a maximum payload of up to 266 tons under ideal conditions.

- January 2024 : Caterpillar entered a strategic partnership with CRH, North America’s top producer of aggregates, to speed up the deployment of Caterpillar’s 70–100-ton class battery electric off-highway trucks and integrated charging solutions.

Table of Contents

Methodology

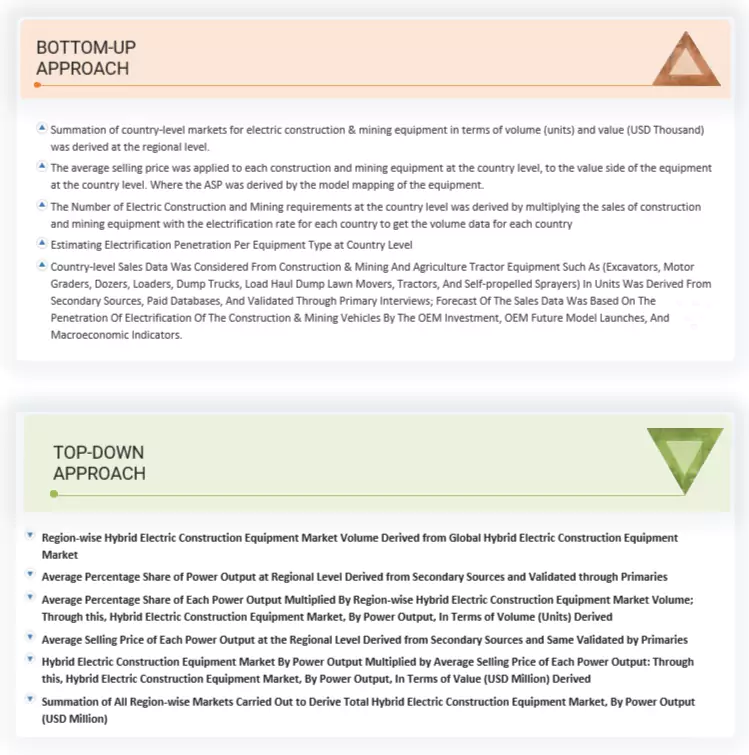

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study on the electric construction equipment market. The study involved four main activities in estimating the current market size: secondary research, validation through primary research, assumptions, and market analysis. Secondary research was carried out to collect information on the market, such as types of electric construction equipment with propulsion (battery electric, hybrid, and hydrogen) and upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; association [Construction & Mining Equipment Industry Group (CMEIG), Association of Equipment Manufacturers (AEM), Construction & Mining Equipment Industry Group (CMEIG), Association of Equipment Manufacturers (AEM), China Construction Machinery Association (CCMA), Japan Construction Equipment Manufacturers Association (CEMA), Korea Construction Equipment Manufacturers Association (KOCEMA), Construction Equipment Association (CEA), Indian Construction Equipment Manufacturers Association (iCEMA), Indonesia Construction Machinery Association (HAKI), Mining Industry Association of Canada (MIAC), and Earthmoving Equipment Manufacturers Association (EEMA)]; white papers and certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

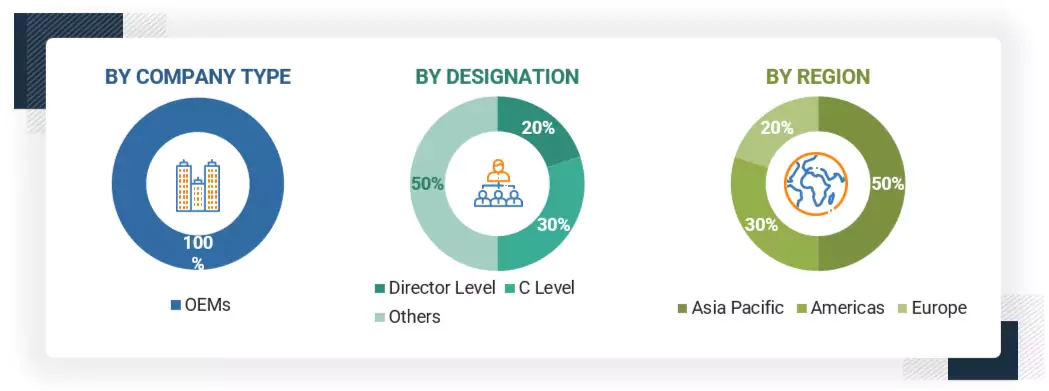

Primary Research

Extensive primary research was conducted after acquiring an understanding of the electric construction equipment market through secondary research. Primary interviews were conducted with market experts from the demand (electric construction equipment manufacturers) and supply (battery and drivetrain suppliers and others) sides across Asia Pacific, Europe, and the Americas. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were requested to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the rest of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the electric construction equipment market, as mentioned below:

- Key players in the electric construction equipment market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports and regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the electric trucks market were determined using secondary sources and model mapping and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The market data gathered was consolidated and added with detailed inputs, analyzed, and presented in this report.

Electric Construction Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

Electric construction equipment comprises both battery electric and hybrid electric construction equipment. Battery electric equipment is fully electric, where the combustion engine is replaced with batteries and an electric motor that powers the movement of the machine and its attachments. Meanwhile, hybrid electric equipment is powered by an internal combustion engine in combination with one or more electric motors that use energy stored in batteries to meet the additional auxiliary power needs of the equipment, electronic devices, and power tools.

- Construction Equipment: Construction equipment is manufactured with well-engineered structures, intelligent hydraulics, and powerful engines and is used in the most demanding applications, ranging from road construction and infrastructure projects to aggregate loading, irrigation, brickwork, and others.

- Mining Equipment: Mining equipment is a compact, robust machine engineered with smart features to ensure productivity. It is built for demanding surface and underground mining applications.

- Agriculture Equipment: Agriculture equipment is designed to match and efficiently handle all kinds of farming, agricultural, and operational needs.

- Lawn Mower: Lawn mowers are designed for cutting surfaces to get ultra-fine clippings for premium residential and commercial gardening applications, with the option of discharging the clippings straight back into the soil behind the mower..

Stakeholders

- Electric Construction Equipment Manufacturers

- Electric Mining Equipment Manufacturers

- Electric Tractor Manufacturers

- Lawn Mower Manufacturers

- Electric Off-Highway Equipment Component Suppliers

- Battery and Drivetrain Suppliers

- Electric Construction Equipment/Component Traders, Distributors, and Suppliers

- Automotive Industry Associations, Government Authorities, and Research Organizations

Report Objectives

- To define, describe, and forecast the size of the electric construction equipment market in terms of volume (units) and value (USD thousand/million)

-

Electric construction equipment market, by type (electric excavators, electric motor graders, electric dozers, electric loaders, electric dump trucks, and electric load haul dump loaders)

- Electric construction equipment market, by battery capacity (<50 kWh, 50–200 kWh, 200–500 kWh, and >500 kWh)

- Electric construction equipment market, by battery chemistry (lithium iron phosphate, lithium nickel manganese cobalt oxide, and others)

- Electric construction equipment market, by power output (<50 HP, 50–150 HP, 150–300 HP, and >300 HP)

- Electric construction equipment market, by propulsion (battery electric, hybrid electric, and hydrogen)

- Electric construction equipment market, by application (construction, mining, agriculture, and gardening)

- Electric agriculture equipment market, by type (electric lawnmowers, electric self-propelled sprayers, and electric tractors)

- Electric tractor market, by propulsion (battery electric, hybrid electric, and hydrogen)

- Electric tractor market, by battery capacity (<50 kWh, 50–200 kWh, 200–500 kWh, and >500 kWh)

- Electric tractor market, by battery chemistry (lithium iron phosphate, lithium nickel manganese cobalt oxide, and others)

- Electric construction equipment market, by region (Asia Pacific, Europe, Americas)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the electric construction equipment market

- To analyze the competitive landscape and company profiles of global players operating in the market, which includes business overview, products offered, and recent developments

- To strategically analyze key player strategies, competitive benchmarking, market share analysis, and revenue analysis

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants according to the strength of their product portfolio and business strategies

- To study the market with supply chain analysis, ecosystem analysis, trade analysis, case studies, pricing analysis, patent analysis, trends and disruptions impacting customer business, technology analysis, total cost of ownership, bill of materials, key stakeholders and buying criteria, OEM analysis, regulatory landscape, and investment scenario

- To analyze and understand the customer buying behavior in the market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, product launches, and other activities carried out by key industry participants in the electric construction equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION

- Construction

- Mining

- Agriculture

- Gardening

ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION

- Electric

- Hybrid

- Hydrogen

ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY AND CHEMISTRY

- <50 kWh

- 50–200 kWh

- 200–500 kWh

- >500 kWh

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt Oxide

- Others

ELECTRIC MINING MACHINERY MARKET, BY BATTERY CAPACITY AND CHEMISTRY

- <50 kWh

- 50–200 kWh

- 200–500 kWh

- >500 kWh

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt Oxide

ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY BATTERY CAPACITY AND CHEMISTRY

- <50 kWh

- 50–200 kWh

- 200–500 kWh

- >500 kWh

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt Oxide

- Others

ELECTRIC CONSTRUCTION EQUIPMENT MARKET FOR ADDITIONAL COUNTRIES

- Australia

- Scandinavian Countries

ADDITIONAL COMPANY PROFILES

Key Questions Addressed by the Report

What is the current size of the electric construction equipment market?

The electric construction equipment market is estimated at USD 4.51 billion in 2025.

Which application is currently leading the electric construction equipment market?

Mining applications are leading the electric construction equipment market.

Many companies are operating in the global electric construction equipment market. Do you know who the front leaders are and what strategies they have adopted?

Hitachi Construction Machinery (Japan), Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), and JCB (UK) are the top five players.

How does the demand for the electric construction equipment market vary by region?

The demand varies due to the high electrification trend in developed countries and increased demand for construction and mining equipment.

What are the growth opportunities for electric construction equipment suppliers?

Hydrogen-powered construction equipment will likely offer lucrative opportunities for electric construction equipment suppliers.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Construction Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Electric Construction Equipment Market

Ghed22

Sep, 2022

Beyond the big names there are many smaller or new comers in the electric equipment market, does this report map them?.

User

Aug, 2019

Hi, I am a graduate student researching the EV market and I came across your report. I would greatly appreciate if I can get a free sample of the report as this will greatly enhance the quality of my research. .

User

Jun, 2019

I write in my blog in the Spanish Financial Newspaper Expansion., about climate change and solutions, like renewable energy and electric mobility..

User

Jun, 2019

Electric vehicle markets Evolution of electrification in mobility (road transport, maritime, aviation).

Akshit

Jun, 2019

Hello. I am looking to gain some statistics on commercial market and consumer market market share. In addition to this, how much of the commercial market is already electric? Thank you in advance..