Oilseed Processing Market by Oilseed Type (Soybean, Rapeseed, Sunflower, and Cottonseed), Process (Mechanical and Chemical), Application (Food, Feed, and Industrial), and Region - Global Forecast to 2022

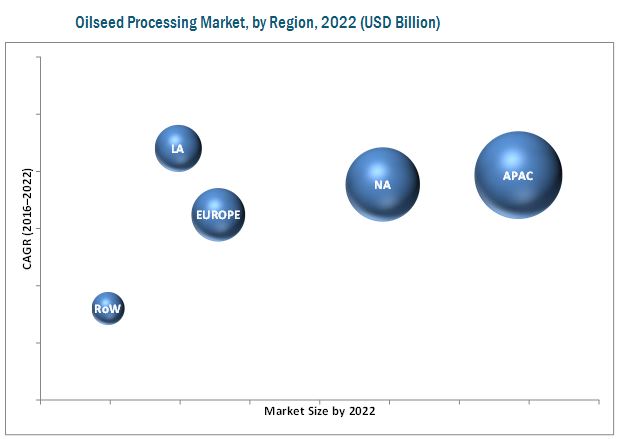

[119 Pages Report] Oilseed Processing Market categorizes the Global Market by Oilseed Type (Soybean, Rapeseed, Sunflower, and Cottonseed), Process (Mechanical and Chemical), Application (Food, Feed, and Industrial), and Region. The oilseed processing market is projected to grow at a CAGR of 7.37% from 2016 to 2022, to reach USD 344.37 Billion by 2022. The base year considered for the study is 2015, and the forecast period is from 2016 to 2022. The basic objective of the report is to define, segment, and project the global market size for oilseed processing on the basis of oilseed type, process, application, and region. It also helps to understand the structure of the market by identifying its various sub segments. The other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro and micro indicators of this market to provide factor analysis and to project the size of the market and its submarkets, in terms of value.

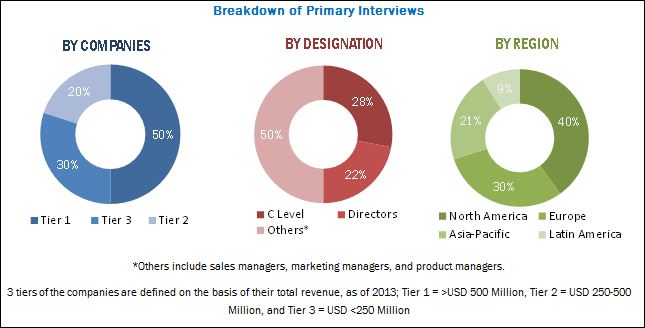

This report includes estimations of the market size in terms of value (USD billion). Both top-down and bottom-up approaches have been used to estimate and validate the size of the global oilseed processing market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the supply chain of the oilseed processing market are the product manufacturers, end use industries, and raw material suppliers. The key players that are profiled in the report include Archer Daniels Midland Company (U.S.), Bunge Limited (U.S.), Cargill (U.S.), Wilmar International Ltd. (Singapore), Richardson International Limited (Canada), Louis Dreyfus Company B.V. (Netherlands), CHS Inc. (U.S.), Ag Processing Inc. (U.S.), ITOCHU Corporation (Japan), and EFKO GROUP ( Austria)

This report is targeted at the existing players in the industry, which include the following:

- Manufacturers, importers & exporters, traders, distributors, and suppliers of oilseeds

- Raw material suppliers

- Agricultural producers

- Government authorities

The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments.

Scope of the Report

On the basis of oilseed Type, the market has been segmented into:

- Soybean

- Rapeseed

- Sunflower

- Cottonseed

- Others (linseed and sesame)

On the basis of Process , the market has been segmented into:

- Mechanical

- Chemical

On the basis of Application, the market has been segmented into:

- Food

- Feed

- Industrial

On the basis of Region, the market has been segmented into:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Regional Analysis

- Further country specific data and its market analysis

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The oilseed processing market is projected to grow at a CAGR of 7.37% from 2016 to 2022, to reach a projected value of USD 344.37 Billion by 2022. The market has become more diversified in recent years due to the increase in number of health conscious consumers that prefer to consume food products with less trans-fat content and is also expected to fuel the market growth of the market.

On the basis of oilseed type, the global market was led by soybean and was followed by rapeseed and sunflower in 2015. Soybean is the leading segment owing to the high demand for animal feed, especially from Asia-Pacific countries, such as India and China, where the livestock population is increasing steadily. The soybean type segment is expected to register the highest growth rate due to the growth in demand for biodiesel derived from soybean feedstock, which in turn results in high growth of the market for processed oilseed products.

The oilseed processing market, on the basis of process, is segmented into chemical and mechanical. The chemical process segment accounted for the largest market share in 2015. This process ensures maximum extraction of oil content from the seed with minimal residue in meals.

The global market, on the basis of application, is segmented into food, feed, and industrial. The food segment accounted for the largest market share in 2015. Oilseed processed products such as edible oil are used to a large extent in various food products across the globe. Some of the common products derived from oilseeds are protein concentrates, flour, and lecithin.

Asia-Pacific accounted for the largest market share for market in 2015, owing to the increase in demand for various oilseed products such as soybean meal in countries such as India and China. However, Latin America is projected to be the fastest-growing market during the forecast period, due to the high adoption of the upgraded seed technologies in comparison to other regions in order to cater the growing demand for the oilseed processed products.

The major restraining factor for this market is price instability due to the seasonal nature of various crops is the major factor that hampers the market growth of the oilseed processing products. Moreover, limited availability of the oilseeds is expected to restraint the growth of the oilseed processing market globally during the forecast period.

Archer Daniels Midland Company (U.S.), one of the prominent players in the oilseeds processing market, focuses on expanding its oilseed processing capacity in order to cater to the huge customer base to develop new products. Its core competencies are diverse product portfolios that include biodiesel and industrial oil. In October 2015, the company invested in order to expand the 2.5 million bushels of soybean capacity at the companys processing plant in Deerfield, Missouri.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in this Market

4.2 Oilseed Processing Market, By Oilseed Type

4.3 Oilseed Processing Market in the Asia-Pacific Region

4.4 Brazil is Projected to Be the Fastest-Growing Market

4.5 Oilseed Processing Market, By Application

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Oilseed Type

5.2.2 By Process

5.2.3 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Growth in Livestock and Dairy Sectors

5.3.1.2 Increased Consumption of Oilseed-Processed Products

5.3.2 Restraints

5.3.2.1 Price Instability

5.3.2.2 Low Yield of Oilseed Crops in Under-Irrigated Areas

5.3.3 Opportunities

5.3.3.1 Demand for Healthy Oilseed-Processed Products

5.3.3.2 Increasing Demand for Biofuel in the Asia-Pacific Region

5.3.4 Challenges

5.3.4.1 Stringent Mandates for Trans-Fat Content

5.3.4.2 Lack of Advanced Technology

6 Oilseed Processing Market, By Oilseed Type (Page No. - 41)

6.1 Introduction

6.2 Soybean

6.3 Rapeseed

6.4 Sunflower

6.5 Cottonseed

6.6 Others

7 Oilseed Processing Market, By Process (Page No. - 48)

7.1 Introduction

7.2 Chemical

7.3 Mechanical

8 Oilseed Processing Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Food

8.3 Feed

8.4 Industrial

9 Oilseed Processing Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Netherlands

9.3.4 U.K.

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Indonesia

9.4.5 Malaysia

9.4.6 Rest of Asia-Pacific

9.5 Latin America

9.5.1 Brazil

9.5.2 Argentina

9.6 Rest of the World (RoW)

9.6.1 Africa

9.6.2 Middle East

10 Competitive Landscape (Page No. - 84)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation & Trends

10.3.1 Expansions

10.3.2 Agreements & Joint Ventures

10.3.3 Acquisitions

10.3.4 New Product Launches

11 Company Profiles (Page No. - 90)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Archer Daniels Midland Company

11.2 Bunge Limited

11.3 Wilmar International Ltd.

11.4 CHS Inc.

11.5 Itochu Corporation

11.6 Richardson International Limited

11.7 Cargill

11.8 Louis Dreyfus Company B.V.

11.9 AG Processing Inc

11.10 Efko Group

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 111)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (64 Tables)

Table 1 Oilseed Processing Market Size, By Oilseed Type, 20142022 (USD Billion)

Table 2 Market Size, By Oilseed Type, 20142022 (Million Tons)

Table 3 Soybean Market Size, By Region, 20142022 (USD Billion)

Table 4 Rapeseed Market Size, By Region, 20142022 (USD Billion)

Table 5 Sunflower Market Size, By Region, 20142022(USD Billion)

Table 6 Cottonseed Market Size, By Region, 20142022(USD Billion)

Table 7 Others Market Size, By Region, 20142022 (USD Billion)

Table 8 Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 9 Market Size, By Process, 20142022 (Million Tons)

Table 10 Chemical Market Size, By Region, 20142022 (USD Billion)

Table 11 Mechanical Market Size, By Region, 20142022 (USD Billion)

Table 12 Oilseed Processing Market Size, By Application, 2014-2022 (USD Billion)

Table 13 Market Size, By Application, 2014-2022 (Million Tons)

Table 14 Food Market Size, By Region, 2014-2022 (USD Billion)

Table 15 Food Market Size, By Type, 2014-2022 (USD Billion)

Table 16 Feed Market Size, By Region, 2014-2022 (USD Billion)

Table 17 Feed Market Size, By Type, 2014-2022 (USD Billion)

Table 18 Industrial Market Size, By Region, 2014-2022 (USD Billion)

Table 19 Industrial Market Size, By Type, 2014-2022 (USD Billion)

Table 20 Oilseed Processing Market Size, By Region, 20142022 (USD Billion)

Table 21 Market Size, By Region, 20142022 (Million Tons)

Table 22 North America: Oilseed Processing Market Size, By Country, 20142022 (USD Billion)

Table 23 North America: Market Size, By Oilseed Type, 20142022 (USD Billion)

Table 24 North America: Market Size, By Process, 20142022 (USD Billion)

Table 25 North America: Market Size, By Application, 20142022 (USD Billion)

Table 26 U.S.: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 27 Canada: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 28 Mexico: Oilseeds Processing Market Size, By Process, 20142022 (USD Billion)

Table 29 Europe: Oilseeds Processing Market Size, By Country, 2014-2022 (USD Billion)

Table 30 Europe: Market Size, By Oilseed Type, 2014-2022 (USD Billion)

Table 31 Europe: Market Size, By Process, 2014-2022 (USD Billion)

Table 32 Europe: Market Size, By Application, 2014-2022 (USD Billion)

Table 33 Germany: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 34 France: Market Size, By Process, 2014-2022 (USD Billion)

Table 35 Netherlands: Market Size, By Process, 2014-2022 (USD Billion)

Table 36 U.K.: Market Size, By Process, 2014-2022 (USD Billion)

Table 37 Spain: Market Size, By Process, 2014-2022 (USD Billion)

Table 38 Rest of Europe: Market Size, By Process, 2014-2022 (USD Billion)

Table 39 Asia-Pacific: Market Size, By Country, 2014-2022 (USD Billion)

Table 40 Asia-Pacific: Market Size, By Oilseed Type, 2014-2022 (USD Billion)

Table 41 Asia-Pacific: Market Size, By Process, 2014-2022 (USD Billion)

Table 42 Asia-Pacific: Market Size, By Application, 2014-2022 (USD Billion)

Table 43 China: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 44 India: Market Size, By Process, 2014-2022 (USD Billion)

Table 45 Japan: Market Size, By Process, 2014-2022 (USD Billion)

Table 46 Indonesia: Market Size, By Process, 2014-2022 (USD Billion)

Table 47 Malaysia: Market Size, By Process, 2014-2022 (USD Billion)

Table 48 Rest of Asia-Pacific: Market Size, By Process, 2014-2022 (USD Billion)

Table 49 Latin America: Oilseed Processing Market Size, By Country, 20142022 (USD Billion)

Table 50 Latin America: Market Size, By Oilseed Type, 20142022 (USD Billion)

Table 51 Latin America: Market Size, By Process, 20142022 (USD Billion)

Table 52 Latin America: Market Size, By Application, 20142022 (USD Billion)

Table 53 Brazil: Oilseeds Processing Market Size, By Process, 20142022 (USD Billion)

Table 54 Argentina: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 55 RoW: Oilseed Processing Market Size, By Country/Region, 20142022 (USD Billion)

Table 56 RoW: Market Size, By Oilseed Type, 20142022 (USD Billion)

Table 57 RoW: Market Size, By Process, 20142022 (USD Billion)

Table 58 RoW: Market Size, By Application, 20142022 (USD Billion)

Table 59 Africa: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 60 Middle East: Oilseed Processing Market Size, By Process, 20142022 (USD Billion)

Table 61 Expansions, 20102015

Table 62 Agreements & Joint Ventures, 20102015

Table 63 Acquisitions, 20102015

Table 64 New Product Launch, 20102015

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Asia-Pacific is Expected to Dominate this Market in 2016

Figure 8 Oilseed Processing Market Size, By Oilseed Type, 2016 vs 2022

Figure 9 Food Segment is Projected to Hold the Largest Market Share By 2022

Figure 10 Chemical Process is Projected to Hold the Largest Market Share By 2022

Figure 11 Rising Applicability of Oilseed Processing Provides Opportunities for This Market

Figure 12 Soybean Segment to Grow at the Highest Rate

Figure 13 Asia-Pacific Region Was the Largest Market for Oilseed Processing in 2015

Figure 14 Brazil is Projected to Be the Fastest-Growing Country-Level Market for Oilseed Processing From 2016 to 2022

Figure 15 Asia-Pacific Dominated the Feed Segment in 2015

Figure 16 Oilseed Processing Market Segmentation, By Oilseed Type

Figure 17 Market Segmentation, By Process

Figure 18 Market Segmentation, By Application

Figure 19 High Growth in the Livestock and Dairy Sectors Drives the Market Growth

Figure 20 World Oilseed Consumption 2012 to 2016

Figure 21 Oilseed Processing Market: Soybean is the Largest Segment, 2016 vs 2022 (USD Billion)

Figure 22 Soybean Market Size, By Region, 2016 vs 2022 (USD Billion)

Figure 23 Sunflower Market Size, By Region, 2016 vs 2022 (USD Billion)

Figure 24 Chemical Segment is Expected to Dominate for the Next Few Years, 2016-2022 (USD Billion)

Figure 25 Asia-Pacific Expected to Dominate the Market, 2016-2022 (USD Billion)

Figure 26 Oilseed Processing Market: Food is the Largest Segment, 2016 vs 2022 (USD Billion)

Figure 27 Food Market Size, By Region, 2016 vs 2022 (USD Billion)

Figure 28 Industrial Market Size, By Region, 2016 vs 2022 (USD Billion)

Figure 29 Regional Snapshot: Markets in Latin America are Emerging as Hotspots

Figure 30 North American Oilseed Processing Market Snapshot: U.S. is Projected to Be the Leader Between 2016 & 2022

Figure 31 Key Companies Preferred Strategies Such as Expansions & Agreements, From 2011 to 2016

Figure 32 Market Share Analysis (2015) : Oilseed Processing Market

Figure 33 Key Players Adopted Expansions to Accelerate Growth in the Market, From 2011 to 2016

Figure 34 Archer Daniels Midland Company: Company Snapshot

Figure 35 Archer Daniels Midland Company: SWOT Analysis

Figure 36 Bunge Limited: Company Snapshot

Figure 37 Bunge Limited : SWOT Analysis

Figure 38 Wilmar International Ltd.: Company Snapshot

Figure 39 Wilmar International Ltd.: SWOT Analysis

Figure 40 CHS Inc.: Company Snapshot

Figure 41 CHS Inc.: SWOT Analysis

Figure 42 Itochu Corporation: Company Snapshot

Figure 43 Itochu Corporation: SWOT Analysis

Figure 44 Cargill: Company Snapshot

Figure 45 Louis Dreyfus Company B.V. : Company Snapshot

Figure 46 AG Processing Inc: Company Snapshot

Growth opportunities and latent adjacency in Oilseed Processing Market