Oilseeds Market by Type (Soybean, Rapeseed, Sunflower, Cottonseed, Groundnut, Copra, Palm Kernel), Category (Conventional and Genetically Modified), Application (Oilseed Meal and Vegetable Oils), and Region-Global Forecast to 2025

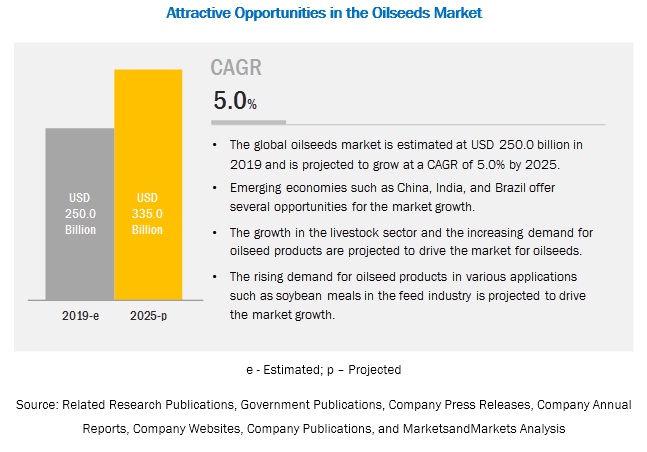

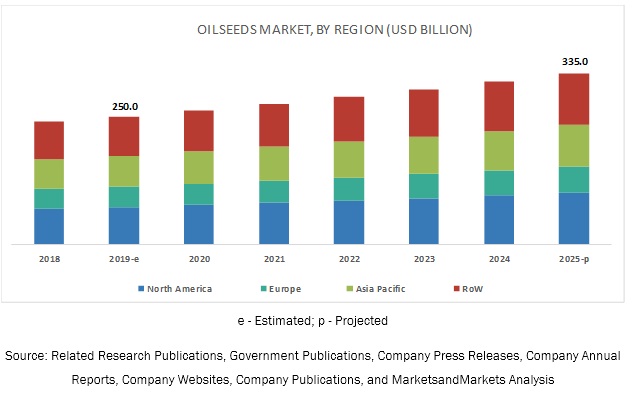

[182 Pages Report] The oilseeds market is estimated to account for a value of USD 250.0 billion in 2019 and is projected to grow at a CAGR of 5.0% from 2019, to reach a value of USD 335.0 billion by 2025. The demand for healthy and organic oilseed-processed products, public-private partnerships in varietal development, and molecular breeding in oilseeds are some of the factors driving the growth of the oilseeds market.

By type, the sunflower segment is projected to be the fastest-growing segment in the oilseeds market during the forecast period.

The sunflower segment in this market is projected to be the fastest-growing segment as it is a rich source of oil, protein, calcium, carbohydrate, and ash. The seeds of sunflower are being used widely in the feed industry in the form of sunflower meal, which is increasingly used as a substitute to soybean meal as it is offered at higher prices.

By category, the conventional segment is projected to dominate the market during the forecast period.

The conventional segment is projected to hold the largest market share in the market during the forecast period as it is relatively cheaper. It is also eco-friendly as it enhances the soil quality and nitrogen restoration, and lowers the levels of contamination in soil, air, and other water resources. The increasing demand for healthy and organic products from consumers has also led to an increase in demand for conventional oilseeds.

By application, the vegetable oil segment is projected to dominate the market during the forecast period.

The vegetable oil segment dominates the oilseeds market due to the high demand for fats & oils from the bakery & confectionery industry and increasing applications in sauces, spreads, & dressings, meat products, RTE, and snacks & savory products. The demand for vegetable oil also remains high in the industrial sector due to the increasing application in the production of adhesive, antiknock additives, disinfectants, inks & paints, plastics & resins, glycerols, and fatty acids.

The increasing demand for oilseeds in the North American and European regions is driving the growth of the market.

The North American and European countries are witnessing increasing demand for oilseeds for use mainly in the food and feed industries. Favorable trade and price support systems have encouraged trade in oilseeds in the US. However, countries in Europe witness high demand for organic products, due to which the demand for conventional oilseeds remains high.

Key Market Players

Key players in this market include Archer Daniels Midland (US), Cargill (US), Wilmar International (Singapore), and Bunge Limited (US). Major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) and Volume (MMT) |

|

Segments covered |

Type, Category, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, RoW |

|

Companies covered |

Cargill (US), Archer Daniels Midland (US), Bühler Group (Switzerland), Bunge Limited (Netherlands), AGT Food and Ingredients (Canada), Louis Dreyfus Company (Netherlands), Mountain States Oilseeds (US), Soni Soya Products Limited (India), Kanematsu Corporation (Japan), CHS Inc. (US), Oilseeds International (US), Wilmar International (Singapore), Cootamundra Oilseeds (Australia), Bora Agro Foods (India), and ETG Agro Private Ltd (Africa) |

This research report categorizes the oilseeds market based on type, category, application, and region.

On the basis of type, the market has been segmented as follows:

- Soybean

- Sunflower

- Cottonseed

- Palm kernel

- Groundnut

- Rapeseed

- Copra

- Others include safflower, linseed/flaxseed, and grapeseed

On the basis of category, the market has been segmented as follows:

- Conventional

- Genetically modified

On the basis of application, the market has been segmented as follows:

-

Oilseed meal

-

Food products

- Bakery & confectionery products

- Sauces, spreads, and dressings

- Meat products

- Others include

- Feed

- Industrial products

-

Food products

-

Vegetable oil

-

Food products

- Bakery & confectionery products

- Sauces, spreads, and dressings

- Meat products

- R.T.E., snacks, and savory products

- Industrial products

-

Food products

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes South America and the Middle East & Africa

Key questions addressed by the report:

- What are the new application areas for the oilseeds market that companies are exploring?

- Who are some of the key players operating in the oilseeds market and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the oilseeds market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders, due to the benefits offered by oilseeds market, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers?

Frequently Asked Questions (FAQ):

What is the leading type in the oilseeds market?

The soybean segment was the highest revenue contributor to the market, with USD 102.0 billion in 2018, and is estimated to reach USD 144.3 billion by 2025, with a CAGR of 5.2%.

What is the estimated industry size of oilseeds?

The global oilseeds market was valued at USD 240.2 billion in 2018, and is projected to reach USD 335 billion by 2025, registering a CAGR of 5.0% from 2019 to 2025.

What is the leading application in the oilseeds market?

The vegetable oils segment was the highest revenue contributor to the market, with USD 139.3 billion in 2018, and is estimated to reach USD 197.7 billion by 2025, with a CAGR of 5.3%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

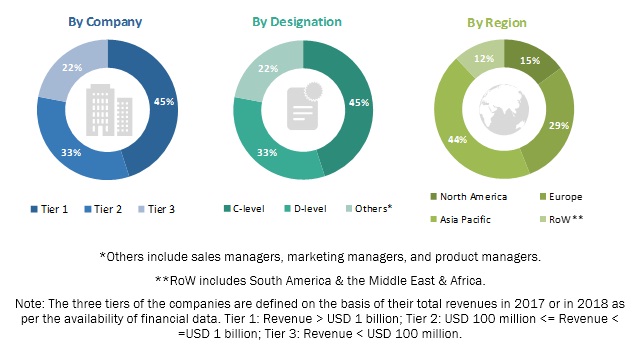

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Market

4.2 Market For Oilseeds, By Region, 2019 vs. 2025

4.3 Market For Oilseeds, By Type, 2019 vs. 2025

4.4 Oilseeds Market, By Category, 2019 vs. 2025 (USD Billion)

4.5 North America: Oilseeds Market, By Type and Country, 2018

4.6 Oilseeds Market Share, By Application, 2019 vs. 2025

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Usage of Oilseeds in Animal Feed

5.2.1.2 Increasing Demand From the Biodiesel Sector

5.2.1.3 Growing Demand for Protein Meals

5.2.1.4 Increasing Demand for Non-Gmo Oilseeds

5.2.2 Restraints

5.2.2.1 Uncertainty in Climatic Conditions

5.2.2.2 Price Fluctuations in Oilseeds

5.2.2.3 Low Yield of Oilseed Crops in Under-Irrigated Areas

5.2.3 Opportunities

5.2.3.1 Demand for Healthy and Organic Oilseed-Processed Products

5.2.3.2 Public-Private Partnerships in Varietal Development

5.2.3.2.1 Molecular Breeding in Oilseeds

5.2.4 Challenges

5.2.4.1 New Entrants in the Market

5.2.4.2 Post-Harvest Management in Developing Countries

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porter’s Five Forces

6.4 Patent Analysis

7 Regulatory Framework (Page No. - 50)

7.1 Introduction

7.2 International Body for Food Safety Standards and Regulations

7.2.1 US Food and Drug Administration (FDA)

7.2.2 Codex Alimentarius Commission Committee on Fats and Oils (CCFO)

7.2.3 European Commission

7.2.4 Indian Oilseed and Produce Export Promotion Council (IOPEPC)

8 Oilseeds Market, By Type (Page No. - 53)

8.1 Introduction

8.2 Soybean

8.2.1 Genetically Modified Soybean Increasingly Finds Application in the Feed Industry Due to Its Cost-Effectiveness Features

8.3 Palm Kernel

8.3.1 Palm Kernel Oil is Replacing Coconut Oil in Various Applications Due to Its Low Production Costs

8.4 Rapeseed

8.4.1 Increasing Demand for High-Oleic Canola Oil is Projected to Drive the Market for Rapeseed

8.5 Sunflower

8.5.1 Sunflower Husk is Witnesses Increasing Demand in the Packaging Industry

8.6 Cottonseed

8.6.1 Extensive Research is Being Conducted on Commercializing the Biotech Version of the Cotton Plant

8.7 Groundnut

8.7.1 The Adoption of A Casein-Free Diet is Projected to Drive the Demand for Groundnut Milk

8.8 Copra

8.8.1 Companies are Conducting Research to Make Use of Copra Meal Flour to Treat Colon Cancer

8.9 Others

8.9.1 Grapeseed is Increasingly Used as an Ingredient to Meet the Increasing Demand for Inexpensive Dietary Supplements

9 Oilseeds Market, By Category (Page No. - 70)

9.1 Introduction

9.2 Conventional

9.2.1 Conventional Soybean Seeds Have A Positive Environmental Impact Due to Which the Demand is Still Prevalent

9.3 Genetically Modified

9.3.1 Growth in Demand for Genetically Modified Oilseeds in the Indian Vegetable Oil Industry

10 Oilseeds Market, By Application (Page No. - 77)

10.1 Introduction

10.2 Oilseed Meal

10.2.1 Food Products

10.2.1.1 in The Food Industry, Oilseed Meal is Used for Making Chunks and Granules, Which Finds Application in Several Prepared Food Products

10.2.2 Feed

10.2.2.1 Soybean Meal is an Important Protein Source Fed to Farm Animals

10.2.3 Industrial

10.2.3.1 Soybean Meal is A Natural Bio-Fertilizer, Which Provides A Slow-Release, Plant-Based Source of Nitrogen, Along With the Other Key Macro- and Micronutrients to Support Overall Plant Growth

10.3 Vegetable Oil

10.3.1 Food Products

10.3.1.1 Vegetable Oil is Formulated to Suit Specific Applications Such as Salad and Cooking Oils, as Well as in the Production of Margarine

10.3.2 Industrial

10.3.2.1 Vegetable Oils are Widely Used in the Lubricant Sector Due to Monounsaturated Oils, Which Combine Good Stability to Oxidation and thermal Degradation With Liquidity

11 Oilseeds Market, By Region (Page No. - 98)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 A Favorable Price Support System in the Country Aids the Growth of the Market in the US

11.2.2 Canada

11.2.2.1 High Domestic Demand for Soybean Oil is Catered to By the US

11.2.3 Mexico

11.2.3.1 Shift Toward A Healthy Diet has Pushed the Demand for Sunflower and Palm Oil in Mexico

11.3 Europe

11.3.1 Germany

11.3.1.1 Rising Demand for High Protein Sunflower Meals to Drive the Market in Germany

11.3.2 UK

11.3.2.1 Increasing Demand for Rapeseed in the Biodiesel Industry to Drive the Growth in the Country

11.3.3 France

11.3.3.1 Growing Demand for Palm Oil in the Food Industry Due to Relatively Affordable Prices and Non-Genetically Engineered Content

11.3.4 Spain

11.3.4.1 The High Demand for Hydrotreated Vegetable Oil (HVO) Fuels to Drive the Demand for Palm Oil in the Country

11.3.5 Russia

11.3.5.1 The Country Faces A High Domestic Demand for Oil Extracted From Sunflower and Cottonseed

11.3.6 Rest of Europe

11.3.6.1 Belgium Witnesses A High Demand for Full Fat Soybean Meal in the Feed Industry

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Cost-Effectiveness of Rapeseed Drives Its Demand in China’s Vegetable Oil Industry

11.4.2 India

11.4.2.1 High Demand for Vegetable Oil in the Country is Driving the Market for Oilseeds

11.4.3 Japan

11.4.3.1 The High Cost Associated With Soybean has Led to an Increase in the Consumption of Rapeseed and Palm Kernel to Prepare Feed

11.4.4 Australia & New Zealand

11.4.4.1 Canola Seeds Offered at Affordable Prices are Replacing Wheat and Barley in Australia

11.4.5 Rest of Asia Pacific

11.4.5.1 The Rapid Modernization of the Animal Husbandry Sector in Pakistan is Driving the Growth of the Market

11.5 Rest of the World

11.5.1 South America

11.5.1.1 Favorable Trade Policies Have Made Argentina A Conducive Market for Soybean and Its Products

11.5.2 Middle East & Africa

11.5.2.1 South Africa Experiences High Demand for Vegetable Oil Sourced From Palm Kernel

12 Competitive Landscape (Page No. - 138)

12.1 Overview

12.2 Competitive Leadership Mapping (Overall Market)

12.2.1 Terminology/Nomenclature

12.2.1.1 Visionary Leaders

12.2.1.2 Innovators

12.2.1.3 Dynamic Differentiators

12.2.1.4 Emerging Companies

12.2.2 Strength of Product Portfolio

12.2.3 Business Strategy Excellence

12.3 Ranking of Key Players, 2018

12.4 Competitive Scenario

12.4.1 New Product Launches

12.4.2 Expansions & Investments

12.4.3 Mergers & Acquisitions

12.4.4 Agreements, Joint Ventures, and Partnerships

13 Company Profiles (Page No. - 148)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Cargill

13.2 Archer Daniels Midland

13.3 Bühler Group

13.4 Bunge Limited

13.5 Wilmar International

13.6 Loius Dreyfus Company

13.7 AGT Food and Ingredients

13.8 CHS Inc.

13.9 Cootamundra Oilseeds

13.10 Oilseeds International

13.11 Mountain States Oilseeds

13.12 Kanematsu Corporation

13.13 Soni Soya Products Limited

13.14 Bora Agro Foods

13.15 ETG Agro Private Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 175)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (127 Tables)

Table 1 USD Exchange Rates Considered, 2014–2018

Table 2 Protein Sources Used in Animal Feed

Table 3 Oilseeds Used in the Production of Biodiesel

Table 4 Weather Conditions vs Disease in Groundnut

Table 5 Food Losses in Low-Income Sub-Saharan African Countries

Table 6 Oilseeds Market Size, By Type, 2017–2025 (USD Billion)

Table 7 Market Size, By Type, 2017–2025 (Mmt)

Table 8 Application Areas of Soybean Seed

Table 9 Soybean Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 10 Soybean Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 11 Palm Kernel Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 12 Palm Kernel Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 13 Rapeseed Oilseed Market Size, By Region, 2017–2025 (USD Billion)

Table 14 Rapeseed Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 15 Nutrient Composition of Whole Sunflower Seeds

Table 16 Sunflower Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 17 Sunflower Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 18 Cottonseed Oilseed Market Size, By Region, 2017–2025 (USD Billion)

Table 19 Cottonseed Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 20 Functionality and Chemical Composition of Groundnut By-Products

Table 21 Groundnut Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 22 Groundnut Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 23 Copra Oilseeds Market Size, By Region, 2017–2025 (USD Million)

Table 24 Copra Oilseed Market Size, By Region, 2017–2025 (Mmt)

Table 25 Others Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 26 Others Oilseeds Market Size, By Region, 2017–2025 (Mmt)

Table 27 Market Size, By Category, 2017–2025 (USD Billion)

Table 28 Market Size, By Category, 2017–2025 (Mmt)

Table 29 Environmental Impact of Conventional Soybean

Table 30 Conventional Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 31 Conventional Oilseeds Market Size, By Region, 2017–2025 (Mmt)

Table 32 Genetically Modified Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 33 Genetically Modified Oilseeds Market Size, By Region, 2017–2025 (Mmt)

Table 34 Oilseeds Market, By Application, 2017–2025 (USD Billion)

Table 35 Market, By Application, 2017–2025 (Mmt)

Table 36 Comparison of Nutrient Composition for Different Sources of Oilseed Meal

Table 37 Oilseed Meal Oilseeds Market, By Region, 2017–2025 (USD Billion)

Table 38 Oilseed Meal Oilseeds Market, By Region, 2017–2025 (Mmt)

Table 39 Oilseed Meal Oilseed Market, By Application, 2017–2025 (USD Billion)

Table 40 Oilseed Meal Oilseed Market, By Application, 2017-2025 (Mmt)

Table 41 Food Products Oilseed Meal Market, By Region, 2017-2025 (USD Billion)

Table 42 Food Products Oilseed Meal Market, By Region, 2017–2025 (Mmt)

Table 43 Oilseed Meal Market, By Food Products, 2017–2025 (USD Billion)

Table 44 Bakery & Confectionery: Oilseed Meal Applications Market, By Region, 2017–2025 (USD Billion)

Table 45 Sauces, Spreads, and Dressings: Oilseed Meal Applications Market, By Region, 2017–2025 (USD Billion)

Table 46 Meat Products: Oilseed Meal Applications Market, By Region, 2017–2025 (USD Billion)

Table 47 Others: Oilseed Meal Applications Market, By Region, 2017–2025 (USD Billion)

Table 48 Feed Oilseed Meal Market, By Region, 2017–2025 (USD Billion)

Table 49 Feed Oilseed Meal Market, By Region, 2017–2025 (Mmt)

Table 50 Industrial Oilseed Meal Market, By Region, 2017–2025 (USD Billion)

Table 51 Industrial Oilseed Meal Market, By Region, 2017–2025 (Mmt)

Table 52 Vegetable Oil Oilseeds Market, By Region, 2017–2025 (USD Billion)

Table 53 Vegetable Oil Oilseeds Market, By Region, 2017–2025 (Mmt)

Table 54 Vegetable Oil Market, By Application, 2017–2025 (USD Billion)

Table 55 Vegetable Oil Market, By Application, 2017–2025 (Mmt)

Table 56 Food Vegetable Oil Market, By Region, 2017–2025 (USD Billion)

Table 57 Food Vegetable Oil Market, By Region, 2017–2025 (Mmt)

Table 58 Vegetable Oil Market, By Food Product Application, 2017–2025 (USD Billion)

Table 59 Bakery & Confectionery Food Products Vegetable Oil Applications Market, By Region, 2017–2025 (USD Billion)

Table 60 Comparison of Nutrient Composition of Oilseeds Meal

Table 61 Sauces, Spreads, & Dressings Food Vegetable Oil Applications Market, By Region, 2017–2025 (USD Billion)

Table 62 Meat Products Food Vegetable Oil Applications Market, By Region, 2017–2025 (USD Billion)

Table 63 RTE, Snacks & Savoury Products Food Vegetable Oil Applications Market, By Region, 2017–2025 (USD Billion)

Table 64 Industrial Vegetable Oil Market, By Region, 2017–2025 (USD Billion)

Table 65 Industrial Vegetable Oil Market, By Region, 2017–2025 (Mmt)

Table 66 Global Oilseeds Market Size, By Region, 2017–2025 (USD Billion)

Table 67 Global Market Size, By Region, 2017–2025 (Mmt)

Table 68 North America: Oilseeds Market Size, By Country, 2017–2025 (USD Billion)

Table 69 North America: Market Size, By Country, 2017–2025 (Mmt)

Table 70 North America: Market Size, By Type, 2017–2025 (USD Billion)

Table 71 North America: Market Size, By Type, 2017–2025 (Mmt)

Table 72 North America: Market Size, By Category, 2017–2025 (USD Billion)

Table 73 North America: Market Size, By Category, 2017–2025 (Mmt)

Table 74 North America: Market Size, By Application, 2017–2025 (USD Billion)

Table 75 North America: Market Size, By Application, 2017–2025 (Mmt)

Table 76 North America: Market Size, By Vegetable Oil Application, 2017–2025 (USD Billion)

Table 77 North America: Market Size, By Vegetable Oil Application, 2017–2025 (Mmt)

Table 78 North America: Vegetable Oil Oilseeds Market Size, By Food Product Application, 2017–2025 (USD Billion)

Table 79 North America: Oilseeds Market Size, By Oilseed Meal Application, 2017–2025 (USD Billion)

Table 80 North America: Market Size, By Oilseed Meal Application, 2017–2025 (Mmt)

Table 81 North America: Oilseed Meal Oilseeds Market Size, By Food Product Application, 2017–2025 (USD Billion)

Table 82 Europe: Oilseeds Market Size, By Country, 2017–2025 (USD Billion)

Table 83 Europe: Market Size, By Country, 2017–2025 (Mmt)

Table 84 Europe: Market Size, By Type, 2017–2025 (USD Billion)

Table 85 Europe: Market Size, By Type, 2017–2025 (Mmt)

Table 86 Europe: Market Size, By Category, 2017–2025 (USD Billion)

Table 87 Europe: Market Size, By Category, 2017–2025 (Mmt)

Table 88 Europe: Market Size, By Application, 2017–2025 (USD Billion)

Table 89 Europe: Market Size, By Application, 2017–2025 (Mmt)

Table 90 Europe: Market Size, By Vegetable Oil Application, 2017–2025 (USD Billion)

Table 91 Europe: Market Size, By Vegetable Oil Application, 2017–2025 (Mmt)

Table 92 Europe: Vegetable Oil Oilseeds Market Size, By Food Products Application, 2017–2025 (USD Billion)

Table 93 Europe: Oilseeds Market Size, By Oilseed Meal Application, 2017–2025 (USD Billion)

Table 94 Europe: Market Size, By Oilseed Meal Application, 2017–2025 (Mmt)

Table 95 Europe: Oilseed Meal Market Size, By Food Products Application, 2017–2025 (USD Billion)

Table 96 Asia Pacific: Oilseeds Market Size, By Country, 2017–2025 (USD Billion)

Table 97 Asia Pacific: Market Size, By Country, 2017–2025 (Mmt)

Table 98 Asia Pacific: Market Size, By Type, 2017–2025 (USD Billion)

Table 99 Asia Pacific: Market Size, By Type, 2017–2025 (Mmt)

Table 100 Asia Pacific: Market Size, By Category, 2017–2025 (USD Billion)

Table 101 Asia Pacific: Market Size, By Category, 2017–2025 (Mmt)

Table 102 Asia Pacific: Market Size, By Application, 2017–2025 (USD Billion)

Table 103 Asia Pacific: Market Size, By Application, 2017–2025 (Mmt)

Table 104 Asia Pacific: Market Size, By Vegetable Oil Application, 2017–2025 (USD Billion)

Table 105 Asia Pacific: Market Size, By Vegetable Oil Application, 2017–2025 (Mmt)

Table 106 Asia Pacific: Vegetable Oil Market Size, By Food Products Application, 2017–2025 (USD Billion)

Table 107 Asia Pacific: Market Size, By Oilseed Meal Application, 2017–2025 (USD Billion)

Table 108 Asia Pacific: Market Size, By Oilseed Meal Application, 2017–2025 (Mmt)

Table 109 Asia Pacific: Oilseed Meal Market Size, By Food Products Application, 2017–2025 (USD Billion)

Table 110 RoW: Oilseeds Market Size, By Country/Region, 2017–2025 (USD Billion)

Table 111 RoW: Market Size, By Country/Region, 2017–2025 (Mmt)

Table 112 RoW: Market Size, By Type, 2017–2025 (USD Billion)

Table 113 RoW: Market Size, By Type, 2017–2025 (Mmt)

Table 114 RoW: Market Size, By Category, 2017–2025 (USD Billion)

Table 115 RoW: Market Size, By Category, 2017–2025 (Mmt)

Table 116 RoW: Market Size, By Application, 2017–2025 (USD Billion)

Table 117 RoW: Market Size, By Application, 2017–2025 (Mmt)

Table 118 RoW: Market Size, By Vegetable Oil Application, 2017–2025 (USD Billion)

Table 119 RoW: Market Size, By Vegetable Oil Application, 2017–2025 (Mmt)

Table 120 RoW: Vegetable Oil Oilseeds Market Size, By Food Product Application, 2017–2025 (USD Billion)

Table 121 RoW: Oilseeds Market Size, By Oilseed Meal Application, 2017–2025 (USD Billion)

Table 122 RoW: Market Size, By Oilseed Meal Application, 2017–2025 (Mmt)

Table 123 RoW: Oilseed Meal Oilseeds Market Size, By Food Product Application, 2017–2025 (USD Billion)

Table 124 New Product Launches

Table 125 Expansions & Investments

Table 126 Mergers & Acquisitions

Table 127 Agreements, Joint Ventures, and Partnerships

List of Figures (66 Figures)

Figure 1 Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Oilseeds Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Research Methodology Steps

Figure 8 Data Triangulation Methodology

Figure 9 Soybean Segment, By Type, to Dominate the Oilseeds Market Throughout 2025

Figure 10 Conventional Segment, By Category, to Dominate the Oilseeds Market During the Forecast Period

Figure 11 Vegetable Oil Segment, By Application, to Dominate the Market

Figure 12 North America to Be the Fastest-Growing Region in the Market During the Forecast Period

Figure 13 Oilseeds: an Emerging Market With Promising Growth Potential

Figure 14 RoW to Dominate the Oilseeds Market From 2019 to 2025

Figure 15 The Soybean Segment is Projected to Hold the Largest Share in the Oilseeds Market From 2019 to 2025

Figure 16 The Conventional Segment is Projected to Hold A Larger Share in the Oilseeds Market From 2019 to 2025

Figure 17 The Soybean Segment, By Type, Accounted for the Largest Share of the North America Oilseeds Market

Figure 18 Vegetable Oils Segment Estimated to Dominate the Market in 2019

Figure 19 Us, China, and India Projected to Grow at Higher CAGRs During the Forecast Period (By Value)

Figure 20 Oil Seeds Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Use of Protein Material By the European Animal Feed Sector (2016 – 2017)

Figure 22 US Market Share of Commercial Vehicle Registrations, 2016–2020

Figure 23 US Biodiesel Production, 2017 vs. 2018

Figure 24 Global Production and Consumption of Protein Meals, 2018–2025

Figure 25 Oilseed Prices (2007–2017)

Figure 26 Growth of Organic Agriculture Land and Organic Share, 2005–2015

Figure 27 Oilseed Processing Phases Play A Vital Role in the Supply Chain

Figure 28 Porter’s Five Forces: Market Fragmentation and Launch of Several New Products Have Intensified Competitive Rivalry

Figure 29 Oilseeds Market, By Type, 2019 vs. 2025 (Mmt)

Figure 30 Market, By Type, 2019 vs. 2025 (USD Billion)

Figure 31 Soybean: Oilseed Market, By Region, 2019 vs. 2025 (Mmt)

Figure 32 Soybean: Oilseed Market, By Region, 2019 vs. 2025 (USD Billion)

Figure 33 Production of Rapeseed (Mmt)

Figure 34 Major Copra Producing Countries, 2017

Figure 35 Oilseeds Market Size, By Category, 2019 vs. 2025 (USD Billion)

Figure 36 Oilseeds Market Size, By Category, 2019 vs. 2025 (Mmt)

Figure 37 Oilseeds Market Size, By Application, 2019 vs. 2025 (USD Billion)

Figure 38 Oilseeds Market Size, By Application, 2019 vs. 2025 (Mmt)

Figure 39 Use of Protein Material By the European Union Feed Sector in 2017

Figure 40 South America Held the Largest Market Share in the Oilseeds Market During the Forecast Period

Figure 41 North America: Oilseeds Market Snapshot, 2018

Figure 42 Share of Soybean Oil Production in the Us, 2010

Figure 43 Share of Soybean Meal Production in the Us, 2010

Figure 44 Europe: Oilseeds Market Snapshot, 2018

Figure 45 Asia Pacific: Oilseed Market Snapshot, 2018

Figure 46 Soybean Consumption in China, 2018

Figure 47 Oilseed Production in India (In Thousand Metric Tons)

Figure 48 Consumption of Soybean in Japan, 2018

Figure 49 Australian Export of Canola (Thousand Metric Tons)

Figure 50 Oilseeds Produced in the Middle East, 2018

Figure 51 Key Developments of the Leading Players in the Oilseeds Market, 2014–2019

Figure 52 Global Oilseeds Market Competitive Leadership Mapping, 2018

Figure 53 Archer Daniels Midland Led the Oilseeds Market in 2018

Figure 54 Market Evaluation Framework, 2016–2018

Figure 55 Cargill: Company Snapshot

Figure 56 Cargill: SWOT Analysis

Figure 57 Archer Daniels Midland: Company Snapshot

Figure 58 Archer Daniels Midland: SWOT Analysis

Figure 59 Bühler Group: Company Snapshot

Figure 60 Bühler Group: SWOT Analysis

Figure 61 Bunge Limited: Company Snapshot

Figure 62 Bunge Limited: SWOT Analysis

Figure 63 Wilmar International: Company Snapshot

Figure 64 Wilmar International: SWOT Analysis

Figure 65 Louis Dreyfus Company: Company Snapshot

Figure 66 CHS Inc: Company Snapshot

The study involves four major activities to estimate the current size of the oilseeds market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders such as manufacturers, importers and exporters, traders, distributors, and suppliers of oilseeds, feed processors & manufacturers, government & research organizations. It also includes manufacturers of pharmaceuticals and nutraceutical companies. The demand-side of this market is characterized by the rising demand for oilseeds in the feed and biofuel industries. The supply-side is characterized by the supply of non-GMO oilseeds from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the oilseed market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oilseeds market.

Report Objectives

- To define, segment, and project the global size of the oilseeds market.

- To understand the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe oilseeds market into Italy, Denmark, Belgium, and the Netherlands

- Further breakdown of the Rest of Asia Pacific oilseeds market into Indonesia, Thailand, Vietnam, Singapore, Malaysia, Pakistan, the Philippines, and South Korea

- Further breakdown of the RoW oilseeds market into Brazil, Argentina, Peru, the UAE, and South Africa

Company Information

- · Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Oilseeds Market