Operating Room Integration Market by Component (Software, Services), Application (General, Orthopedic, Cardiovascular & Neurosurgery), Device (Audio & Video Systems, Display, Document Management), End User (Hospital, ASC) & Region - Global Forecast to 2028

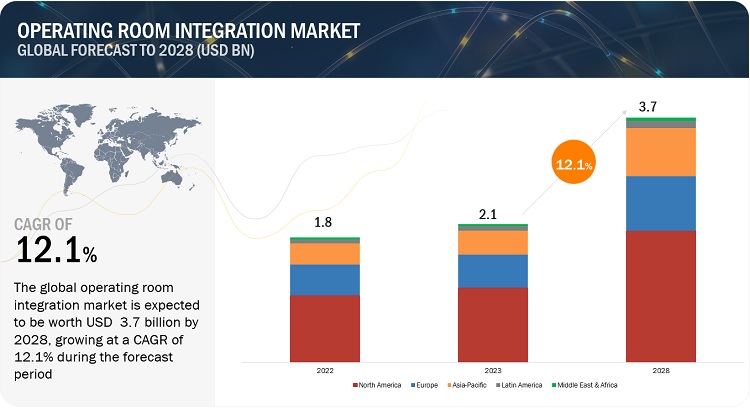

The global operating room integration market, valued at US$1.8 billion in 2022, stood at US$2.1 billion in 2023 and is projected to advance at a resilient CAGR of 12.1% from 2023 to 2028, culminating in a forecasted valuation of US$3.7 billion by the end of the period. The gradual shift towards predictable outcomes and care quality has supported the greater implementation of various IT systems in healthcare organizations. OR integration provides a range of benefits, which includes streamlined workflow, improved communication, real-time data visualization, device control and automation, structured documentation, multimedia capture and storage, EHR integration, patient safety, education and research support, and cost savings. These advanatges contribute to improved surgical practices, patient care, and overall efficiency in the operating room environment.

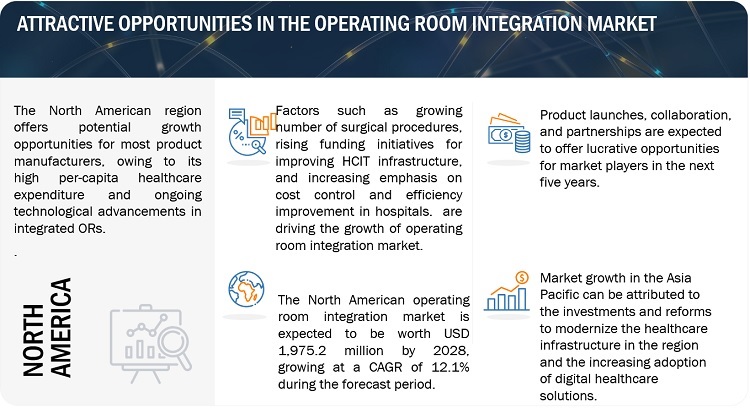

Other factors driving market growth include the rising demand for technologically advanced solutions, a growing number of surgical procedures, rising funding initiatives for improving HCIT infrastructure, and increasing emphasis on cost control and efficiency improvement in hospitals. However, high setup and operational costs, interoperability issues, and a shortage of skilled surgeons in OR integration are expected to restrain market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Operating Room Integration Market Dynamics

Driver: Rising demand for technologically advanced solutions

In minimally invasive surgeries, the wide use of advanced technologies, such as image guidance techniques and endoscopy equipment, makes it an ideal application area for OR integration solutions. In these procedures, OR integration helps streamline surgical workflows by enabling seamless communication between different systems and ensuring the effective and more accessible operation of these systems, preferably from a single source. For instance, ENDOALPHA by Olympus Corporation (Japan) provides solutions for the simultaneous control of multiple device settings. The use of such solutions helps reduce surgical times, encourages coordination between healthcare providers, and improves patient safety. This ultimately ensures faster recovery of patients and shorter hospital stays, which are the significant benefits of minimally invasive surgeries.

The rising complexity of advanced surgeries has driven hospitals to opt for technological advancements in the OR. The adoption of integrated ORs equipped with surgical instruments and technologies, such as integrated digital imaging diagnostics and surgical instruments with robotic 3D imaging, surgical robots, and virtual reality, is also rising. New surgical technology allows doctors to increase efficiency and safety by guiding their movements and offering unprecedented access to information in the operating room. This trend is expected to continue in the coming years, with an increasing number of hospitals focusing on integrated ORs—supplementing the growth of the operating room integration market.

As integrated ORs consolidate patient information, streamline workflows, and centralize data from multiple platforms, several routine activities of surgical staff are dispersed. These activities include examining and listing patient information, controlling OR lighting, and stepping into the surgical field to display or change the video. The time and energy saved by these time-consuming activities can be utilized to attend to a patient & a specific procedure. The integration of ORs often extends beyond the operating room, connecting and supporting teams, and processing information across the operative workflow. For instance, through real-time surgical video streaming, surgical teams can coordinate or provide supervision with remote specialists or demonstrate a surgical procedure to train and educate students and colleagues virtually. Clinicians can show and share high-definition images of the procedure on a tablet or cellphone during a post-operative consultation with the patient and family. These images and videos automatically associate with the patient record for documentation. These solutions offer ease of implementation, low costs, and low infrastructural requirements will also drive the demand for integrated OR software.

Restraint: Interoperability issues

The heterogeneity of health information systems is one of the critical challenges in successfully implementing and utilizing integrated OR solutions. Many countries lack specific IT data storage and exchange standards, leading to interoperability issues. Although various data storage, transportation, and safety standards exist, implementing these interoperability standards is a major challenge for healthcare providers and HCIT solution vendors. Due to the absence of a single health information system that helps address large healthcare providers' administrative, clinical, technical, and laboratory requirements, interoperability standards have become critical.

Vendors also follow different data formats and standards due to the lack of defined standards, making it difficult to share real-time data with partner systems, thereby increasing the cost of integrated OR solutions. Data quality and integrity, the lack of compliance with standards, the absence of skilled professionals, and operational time differences between hospitals and other healthcare providers are major obstacles that hinder implementing an efficient integrated OR solution.

Opportunity: Technological advancements in hospitals

The rising complexity of advanced surgeries has driven hospitals to opt for technological advancements in the OR. The adoption of hybrid ORs equipped with a combination of surgical instruments and technologies, such as integrated digital imaging diagnostics and surgical instruments with robotic 3D imaging, is also on the rise. This trend is expected to continue in the coming years, with an increasing number of hospitals focusing on hybrid ORs—which will also supplement the growth of the market.

The increasing preference for cloud-based solutions will work towards increasing market growth. The ease of implementation, low cost, and low infrastructural requirements of cloud-based solutions will drive the demand for cloud-based ORM software.

Challenge: Shortage of skilled surgeons in integrated operating rooms

Major countries worldwide witness limited availability of skilled healthcare professionals who can provide the requisite expertise in integrated operating rooms. For instance, the surgical treatment of cardiac diseases in an integrated OR setup involves an interdisciplinary approach that could require a team of specialized surgeons, interventional cardiologists, anesthesiologists, and well-trained support staff.

According to the AAMC (Association of American Medical Colleges), the US healthcare industry is expected to witness a shortage of ~46,000 surgeons by 2025. Similarly, emerging and less-developed countries (such as India, South Africa, and Brazil) have reported limited availability of trained healthcare professionals. In 20216, According to the WFSA study, India, with a population of 1.3 billion, has 883,812 physicians, while the number of physician anesthesia providers is only 16,500. This means the density of physician anesthesia providers per 100,000 population in India is just 1.27. Similarly, in December 2019, on the HPCSA register, there were 6329 specialists in the surgical workforce in South Africa, including 3191 surgeons (50.4%), 1292 (20.4%) OBGYN, and 1846 (29.2%) anesthesiologists. (Source: Department of Surgery, College of Medicine, US). South Africa falls short of the minimum specialist workforce density of 20 per 100,000 needed to provide adequate essential and emergency surgical care. In order to address the current and future burden of diseases treatable by surgical care, South Africa needs a robust surgical healthcare system with adequate human resources to translate healthcare services into improved health outcomes.

The limited availability of skilled and well-trained physicians, surgeons, nurses, and other healthcare professionals is expected to limit the adoption of integrated operating rooms in several countries worldwide in the coming years.

Operating Room Integration Market Ecosystem

The rising adoption of advanced operating room solutions and services in the healthcare industry pertaining to the growing number of surgeries is driving the growth of the market globally. The industry is leveraging advanced technologies to modify business models and enhance operational efficiency. This has also led to the development of smart supply chains, improved manufacturing processes, and an efficient end-to-end ecosystem.

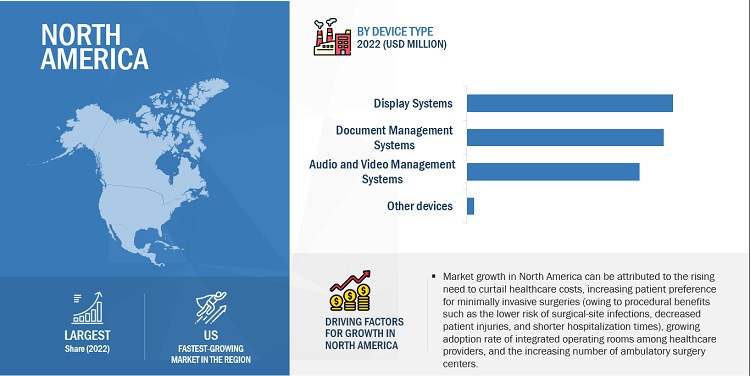

Document management system segment was the largest segment in the device type of operating room integration market in 2022.

On the basis of device type, the document management system segment accounted for the largest share. The large share of this segment can be attributed to the benefits of document management systems, such as data management with minimal errors in operating rooms. Additionally with the help of documentation systems, surgical teams streamline their workflow, enhance communication, and ensure accurate and complete documentation of surgical procedures. These systems helps in efficient and safe operating room practices while supporting quality improvement, research, and patient care.

General Surgery is the largest application segment in the operating room integration market in 2022.

Based on application, the market is segmented into general, orthopedic, cardiovascular, neurosurgery, thoracic, and other applications (gynecological, urological, ophthalmic, dental, ENT, and pediatric surgeries). In 2022, the general surgery segment accounted for the largest share in the market. Factors such as the increasing incidence of breast cancer, colorectal cancer, liver cancer, GI disorders, and endocrine disorders and the rising number of general surgical procedures performed worldwide are driving the growth of this market segment.

APAC region of operating room integration market to witness the highest growth rate during the forecast period.

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors such as the procedural benefits of integrated ORs, the growing prevalence of chronic diseases, and the rising adoption of advanced surgical treatment methodologies in the region. The other factors augmenting market growth in this region are the ongoing expansion of the healthcare infrastructure and the growing market availability of advanced surgical technologies.

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such as include Stryker Corporation (US) , STERIS Plc (US), Karl Storz SE & Co. KG (Germany), Olympus Corporation (Japan), Getinge AB (Sweden).

Operating Room Integration Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.1 billion |

|

Projected Revenue by 2028 |

$3.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 12.1% |

|

Market Driver |

Rising demand for technologically advanced solutions |

|

Market Opportunity |

Technological advancements in hospitals |

The study categorizes the operating room integration market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Introduction

- Software

- Services

By Device Type

- Introduction

- Display systems

- Document Management systems

- Audio & Video Management systems

- Other OR Integration devices

By Application

- Introduction

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Neurosurgery

- Thoracic Surgery

- Other Applications

By End User

- Introduction

- Hospitals

- Ambulatory Surgical Centers and Clinics

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest Of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East & Africa

Recent Developments

- In February 2023, KARL STORZ collaborated with Asensu Surgical (US), Through this collaboration, the company developed next-generation equipment and also aimed to sell Asensus' Intelligent Surgical Unit (ISU) as a standalone device.

- In February 2022, Stryker acquired Vocera Communications (US). This acquisition offers Stryker's Medical division an innovative portfolio that boosts the company's Advanced Digital Healthcare services and advance Stryker's focus on preventing adverse occurrences throughout the continuum of care.

- In December 2022, Olympus Corporation (US) collaborated with Sony Corporation (Japan) for the development of a surgical endoscopy system with surgical visualization features such as 4K, 3D, infrared (IR) imaging, and NBI (Narrow Band Imaging).

- In November 2021, Barco (Belgium) partnered with Getinge (Sweden) in which Getinge will utilize Barco’s Nexxis video-over-IP platform to launch its renewed Tegris operating room integration system.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global operating room integration market?

The global operating room integration market boasts a total revenue value of $3.7 billion by 2028.

What is the estimated growth rate (CAGR) of the global operating room integration market?

The global operating room integration market has an estimated compound annual growth rate (CAGR) of 12.1% and a revenue size in the region of $2.1 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for technologically advanced solutions- Growing number of surgical procedures- Rising funding initiatives for improvement of HCIT infrastructure- Increasing emphasis on curtailing healthcare costsRESTRAINTS- High setup and operational costs- Interoperability issuesOPPORTUNITIES- Emerging marketsCHALLENGES- Shortage of skilled surgeons in OR rooms

- 6.1 INTRODUCTION

-

6.2 INDUSTRY TRENDSINTERACTIVE COMMUNICATION AND EDUCATION IN ORSINNOVATIVE TECHNOLOGIES

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 ECOSYSTEM ANALYSIS

-

6.5 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 TECHNOLOGY ANALYSISMACHINE LEARNINGARTIFICIAL INTELLIGENCE

- 6.7 VALUE CHAIN ANALYSIS

-

6.8 ADJACENT MARKET ANALYSISHEALTHCARE IT INTEGRATION MARKET

-

6.9 PATENT ANALYSISOPERATING ROOM INTEGRATION MARKET: PATENT APPLICATION TRENDSJURISDICTION AND TOP APPLICANT ANALYSIS

-

6.10 CASE STUDY ANALYSISCASE STUDY 1: AUGMENTED REALITY FOR SURGERYCASE STUDY 2: VIRTUAL HOSPITALS AND CLINICS

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.12 KEY CONFERENCES AND EVENTS

-

6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.14 PRICING ANALYSIS

- 7.1 INTRODUCTION

-

7.2 SOFTWAREABILITY TO EXPEDITE SURGICAL PROCEDURES TO DRIVE MARKET

-

7.3 SERVICESRISING NEED FOR SUPPORT AND MAINTENANCE OF ORS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 DISPLAY SYSTEMSRISING TECHNOLOGICAL INNOVATIONS FOR IMAGE ENHANCEMENT TO DRIVE MARKET

-

8.3 DOCUMENT MANAGEMENT SYSTEMSPOTENTIAL TO REDUCE ERRORS TO PROPEL MARKET

-

8.4 AUDIO & VIDEO MANAGEMENT SYSTEMSABILITY TO REDUCE BURDEN ON STAFF AND DECREASE DOWNTIME TO DRIVE MARKET

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 GENERAL SURGERYGROWING PREFERENCE FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO DRIVE MARKET

-

9.3 ORTHOPEDIC SURGERYRISING CASES OF OSTEOPOROSIS DISORDERS TO DRIVE MARKET

-

9.4 CARDIOVASCULAR SURGERYRISING NEED FOR IMAGE PROCESSING PLATFORMS FOR CVD MANAGEMENT TO DRIVE MARKET

-

9.5 NEUROSURGERYTECHNOLOGICAL ADVANCEMENTS IN MEDICAL ROBOTICS TO SUPPORT MARKET GROWTH

-

9.6 THORACIC SURGERYRISING CASES OF THORACIC SURGERIES TO SUPPORT MARKET GROWTH

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 HOSPITALSHIGH VOLUME OF SURGICAL PROCEDURES TO SUPPORT MARKET GROWTH

-

10.3 AMBULATORY SURGERY CENTERS AND CLINICSCOST-EFFECTIVE BENEFITS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Rising healthcare expenditure to drive marketCANADA- Rising government initiatives for adoption of integrated OR solutions to drive marketNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Increasing establishment of hybrid ORs to drive marketUK- Growing patient volume in hospitals to drive marketFRANCE- Favorable government initiatives to propel demand for OR solutionsITALY- Advancements in medical technologies to support market growthSPAIN- Increasing establishment of hospitals to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICJAPAN- Increasing government initiatives for adoption of HCIT solutions to drive marketCHINA- Improvements in healthcare infrastructure to support market growthINDIA- Adoption of connected healthcare system and rising healthcare expenditure to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 LATIN AMERICABRAZIL- Developments in healthcare infrastructure to support market growthMEXICO- Government expenditure toward healthcare digitization to drive marketREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EAST AND AFRICAHOSPITAL INVESTMENTS IN ADVANCED TECHNOLOGIES FOR OR INTEGRATION TO DRIVE MARKETMIDDLE EAST AND AFRICA: RECESSION IMPACT

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE SHARE ANALYSIS OF LEADING MARKET PLAYERS (2022)

- 12.4 MARKET SHARE ANALYSIS (2022)

- 12.5 COMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.7 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSSTRYKER CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewSTERIS PLC- Business overview- Products/Services offered- Recent developments- MnM viewKARL STORZ SE & CO. KG- Business overview- Products/Services offered- Recent developments- MnM viewOLYMPUS CORPORATION- Business overview- Products/Services offered- Recent developmentsGETINGE AB- Business overview- Products/Services offered- Recent developmentsALVO MEDICAL- Business overview- Products/Services offered- Recent developmentsSKYTRON, LLC- Business overview- Products/Services offered- Recent developmentsMERIVAARA- Business overview- Products/Services offeredBRAINLAB AG- Business overview- Products/Services offered- Recent developmentsTRILUX GMBH & CO. KG (A SUBSIDIARY OF MIZUHO OSI)- Business overview- Products/Services offeredCARESYNTAX- Business overview- Products/Services offered- Recent developmentsSONY GROUP CORPORATION- Business overview- Products/Services offered- Recent developmentsBARCO- Business overview- Products/Services offered- Recent developmentsARTHREX, INC.- Business overview- Products/Services offered- Recent developmentsRICHARD WOLF GMBH- Business overview- Products/Services offered- Recent developmentsFUJIFILM HOLDINGS CORPORATION- Business overview- Products/Services offered- Recent developmentsZIMMER BIOMET- Business overview- Products/Services offered- Recent developmentsDRÄGERWERK AG & CO. KGAA- Business overview- Products/Services offeredHILL-ROM HOLDINGS, INC. (A SUBSIDIARY OF BAXTER INTERNATIONAL)- Business overview- Products/Services offered- Recent developmentsEIZO GMBH- Business overview- Products/Services offered- Recent developments

-

13.2 OTHER PLAYERSOPEXPARK INC.- Products/Services offeredISIS-SURGIMEDIA- Products/Services offeredMEDITEK- Products/Services offeredDITEC MEDICAL- Products/Services offeredDORICON MEDICAL SYSTEMS- Products/Services offered

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT ANALYSIS

- TABLE 3 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 US: INCREASE IN NUMBER OF SURGERIES PERFORMED (%) (2010 VS. 2020)

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 KEY REGULATIONS AND STANDARDS GOVERNING HEALTHCARE IT INTEGRATION TECHNOLOGIES

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 9 KEY BUYING CRITERIA FOR OPERATING ROOM INTEGRATION COMPONENTS

- TABLE 10 DETAILED LIST OF CONFERENCES AND EVENTS (2023−2024)

- TABLE 11 OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 12 OPERATING ROOM INTEGRATION MARKET FOR SOFTWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 OPERATING ROOM INTEGRATION MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 15 OPERATING ROOM INTEGRATION MARKET FOR DISPLAY SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 OPERATING ROOM INTEGRATION MARKET FOR DOCUMENT MANAGEMENT SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 OPERATING ROOM INTEGRATION MARKET FOR AUDIO & VIDEO MANAGEMENT SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 OPERATING ROOM INTEGRATION MARKET FOR OTHERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 20 OPERATING ROOM INTEGRATION MARKET FOR GENERAL SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 OPERATING ROOM INTEGRATION MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2021–2028 (USD MILLION

- TABLE 22 OPERATING ROOM INTEGRATION MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 OPERATING ROOM INTEGRATION MARKET FOR NEUROSURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 OPERATING ROOM INTEGRATION MARKET FOR THORACIC SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 OPERATING ROOM INTEGRATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 27 US: INCREASE IN SURGICAL PROCEDURES PERFORMED (%) (2010 VS. 2020)

- TABLE 28 OPERATING ROOM INTEGRATION MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 OPERATING ROOM INTEGRATION MARKET FOR ASCS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 OPERATING ROOM INTEGRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 US: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 37 US: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 38 US: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 39 US: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 CANADA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 41 CANADA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 CANADA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: OPERATING ROOM INTEGRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 GERMANY: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 50 GERMANY: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 GERMANY: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 UK: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 54 UK: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 55 UK: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 UK: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 FRANCE: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 58 FRANCE: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 59 FRANCE: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 FRANCE: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 ITALY: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 ITALY: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 SPAIN: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 SPAIN: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 JAPAN: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 79 JAPAN: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 80 JAPAN: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 81 JAPAN: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 83 CHINA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 84 CHINA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 CHINA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 INDIA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 87 INDIA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 88 INDIA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 INDIA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 97 LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 BRAZIL: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 100 BRAZIL: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 101 BRAZIL: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 BRAZIL: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 MEXICO: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 104 MEXICO: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 105 MEXICO: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 MEXICO: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 REST OF LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 108 REST OF LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 REST OF LATIN AMERICA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST AND AFRICA: OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST AND AFRICA: OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST AND AFRICA: OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST AND AFRICA: OPERATING ROOM INTEGRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 COMPANY FOOTPRINT ANALYSIS

- TABLE 116 COMPONENT FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 117 DEVICE FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 118 REGIONAL FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 119 OPERATING ROOM INTEGRATION MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS (2020–2023)

- TABLE 120 OPERATING ROOM INTEGRATION MARKET: DEALS (2020–2023)

- TABLE 121 OPERATING ROOM INTEGRATION MARKET: OTHER DEVELOPMENTS (2020–2023)

- TABLE 122 STRYKER CORPORATION: BUSINESS OVERVIEW

- TABLE 123 STERIS PLC: BUSINESS OVERVIEW

- TABLE 124 KARL STORZ SE & CO. KG: BUSINESS OVERVIEW

- TABLE 125 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- TABLE 126 GETINGE AB: BUSINESS OVERVIEW

- TABLE 127 ALVO MEDICAL: BUSINESS OVERVIEW

- TABLE 128 SKYTRON, LLC: BUSINESS OVERVIEW

- TABLE 129 MERIVAARA: BUSINESS OVERVIEW

- TABLE 130 BRAINLAB AG: BUSINESS OVERVIEW

- TABLE 131 TRILUX GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 132 CARESYNTAX: BUSINESS OVERVIEW

- TABLE 133 SONY GROUP CORPORATION: BUSINESS OVERVIEW

- TABLE 134 BARCO: BUSINESS OVERVIEW

- TABLE 135 ARTHREX, INC.: BUSINESS OVERVIEW

- TABLE 136 RICHARD WOLF GMBH: BUSINESS OVERVIEW

- TABLE 137 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 138 ZIMMER BIOMET: BUSINESS OVERVIEW

- TABLE 139 DRÄGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 140 HILL-ROM HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 141 EIZO GMBH: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 OPERATING ROOM INTEGRATION MARKET: CAGR PROJECTIONS

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 OPERATING ROOM INTEGRATION MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 OPERATING ROOM INTEGRATION MARKET, BY DEVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 OPERATING ROOM INTEGRATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 OPERATING ROOM INTEGRATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 GEOGRAPHICAL SNAPSHOT

- FIGURE 12 INCREASING ADOPTION OF TECHNOLOGICALLY ADVANCED SOLUTIONS TO DRIVE MARKET

- FIGURE 13 SOFTWARE SEGMENT IN JAPAN TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 14 CHINA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 OPERATING ROOM INTEGRATION: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 OPERATING ROOM INTEGRATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 19 VALUE-CHAIN ANALYSIS (2022)

- FIGURE 20 PATENT PUBLICATION TRENDS (JANUARY 2013–APRIL 2023)

- FIGURE 21 TOP APPLICANTS FOR OPERATING ROOM INTEGRATION PATENTS (JANUARY 2013 TO APRIL 2023)

- FIGURE 22 TOP APPLICANTS FOR OPERATING ROOM INTEGRATION PATENTS, BY REGION/COUNTRY (JANUARY 2013 TO APRIL 2023)

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR OPERATING ROOM INTEGRATION COMPONENTS

- FIGURE 25 OPERATING ROOM INTEGRATION MARKET: TRENDS/DISRUPTIONS IMPACTING BUSINESSES

- FIGURE 26 NORTH AMERICA: OPERATING ROOM INTEGRATION MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: OPERATING ROOM INTEGRATION MARKET SNAPSHOT

- FIGURE 28 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2020 AND APRIL 2023

- FIGURE 29 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 30 OPERATING ROOM INTEGRATION MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 31 OPERATING ROOM INTEGRATION MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 32 OPERATING ROOM INTEGRATION MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2022)

- FIGURE 33 STRYKER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 34 STERIS PLC: COMPANY SNAPSHOT (2021)

- FIGURE 35 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 36 GETINGE AB: COMPANY SNAPSHOT (2022)

- FIGURE 37 SONY GROUP CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 38 BARCO: COMPANY SNAPSHOT (2022)

- FIGURE 39 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 40 ZIMMER BIOMET: COMPANY SNAPSHOT (2022)

- FIGURE 41 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 42 HILL-ROM HOLDINGS, INC. (BAXTER INTERNATIONAL): COMPANY SNAPSHOT (2022)

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, annual reports, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the operating room integration market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the OR Integration market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), ambulatory surgical centers.

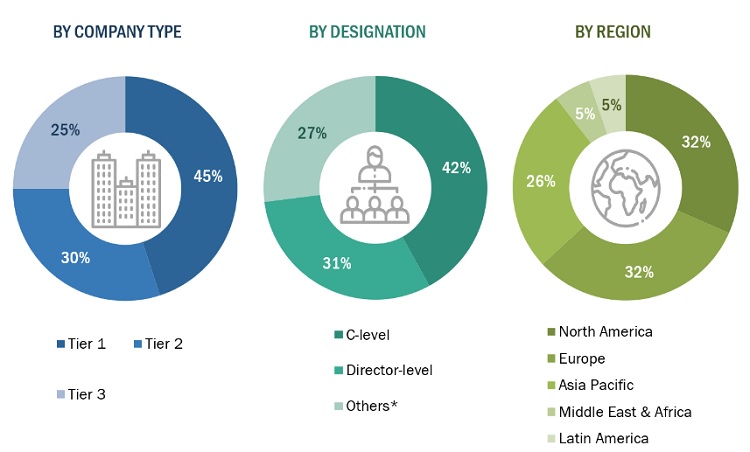

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the operating room integration market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

The size of the operating room integration market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the operating room integration market were gathered from secondary sources to the extent available. In certain cases, shares of operating room integration businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the operating room integration market was determined by extrapolating the Market share data of major companies.

Market Definition

An OR integration system is designed to simplify & streamline the operating room by consolidating data, providing access to video, and giving control to all devices at a central command station. An OR integration system allows the surgical staff to perform their tasks more efficiently.

This report provides a close look at operating room integration market. It offers applications in general surgery, orthopedic, thoracic, neuro, and other surgeries

Key Stakeholders

- OR integration software and service providers

- Hospital construction companies

- Medical device manufacturers

- Hospitals and healthcare service providers (hospitals, specialty clinics, and ambulatory surgery centers)

- Market research and consulting firms

- Academic and research institutes

- Venture capitalists and investors

To know about the assumptions considered for the study, Request for Free Sample Report

Global operating room integration market Size: Top-Down Approach

Objectives of the Study

- To define, describe, and forecast the operating room integration market based on component, device, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall operating room (OR) integration market

- To analyze the market opportunities for key stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments with respect to five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as product/service launches, agreements, expansions, partnerships, and collaborations, in the operating room integration market

- To benchmark players within the operating room integration market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters in business and product strategies

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific operating room integration market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe's operating room integration market into Belgium, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Operating Room Integration Market

Are there any changing variables which would affect the business landscape of Operating Room/OR Integration Market?

What are the major tailwinds and headwinds for the Operating Room Integration Market?

How do you anticipate technological advancement to impact the future of the Operating Room Integration Market?