Oral Care Market Size, Growth, Share & Trends Analysis

Oral Care Market by Product (Toothbrush (Manual, Electric, Battery), Toothpaste (Paste, Gel), Mouthwash, Dental Accessory), Application (Dental Clinic), Distribution Channel (Consumer Store, Pharmacy, eCommerce), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The oral care market is valued at an estimated USD 37.21 billion in 2024. The size is projected to reach USD 53.29 billion by 2030, at a CAGR of 6.4%. Oral care products are used to diagnose, treat, and prevent dental & gum diseases; maintenance of oral hygiene; or provide postoperative care. These products include toothpastes, toothbrushes, mouthwashes/rinses, dental accessories/ancillaries, denture products, and prosthesis cleaning solutions.The oral care market is primarily driven by the rising global prevalence of dental diseases such as dental caries and periodontal issues, which heightens consumer demand for effective treatments and prevention products. This demand is further amplified by increasing public awareness of oral hygiene and continuous technological innovation that brings advanced products, such as electric toothbrushes and specialized toothpaste, to the market

KEY TAKEAWAYS

-

BY PRODUCTBased on the product type, the oral care market is segmented into Toothpaste, toothbrush, mouthwashes/rinses, dental accessories, denture products. In 2024, the toothpaste segment accounted for the largest market share of the oral care market. Growth in this market segment can be attributed to the large scale use of the toothpaste on daily basis. Also, the availability and affordability of the product has increased its demand. The advancements in the product such as the teeth whitening toothpaste turn out to be an attractive feature for those who have aesthetics as their primary concern. Also, other varieties such as cavity prevention which avoids the plaque buildup, sensitivity relief are responsible for the growth of the market. The various options available help the consumers to switch to different brands.

-

BY APPLICATIONBased on applications, homecare holds the largest share of the oral care market. All the daily essentials such as the toothpaste, toothbrush, mouthwashes/rinses, dental floss are included in the homecare segment which are used by the consumers on daily basis for multiple times. The various options available in these products include the breath fresheners in different flavors, various toothpaste which cater to the need of various dental problems such as the tooth sensitivity, gum problems, cavity prevention. The availability of these oral care products on a large scale at retail stores and pharmacies has increased the consumption of these products.

-

BY DISTRIBUTION CHANNELBased on distribution channel, consumer stores hold the largest share of the oral care market. The consumer stores are widely available which makes it more convenient for the consumers to buy the products. The consumer gets to compare all the brands and get the best out of it. The availability of all the products enables the consumer to get the products whenever in need without any delay. The satisfaction of buying the product in person gives immense satisfaction to the consumer. Loyalty with the seller helps the consumer gain various benefits on buying of the products.

-

BY REGIONThe oral care market is segmented by region into North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa. Asia Pacific is expected to grow fastest with a CAGR of 7.8%, driven by the increasing prevalence of dental caries and other oral diseases, in large countries like China and India that create a greater demand for oral care products.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and collaborations. For instance, Colgate-Palmolive announced a strategic collaboration with IMPAct4Nutrition, a platform supported by UNICEF India, to promote greater awareness of oral health and nutrition among children.

The oral care market is driven by rising awareness of oral hygiene, growing prevalence of dental disorders such as cavities and gum disease, and increasing demand for preventive and aesthetic solutions. Additionally, innovations in smart oral care devices, natural and herbal formulations, and convenient product formats are further boosting market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oral care market is advancing rapidly due to innovations in technology. A key shift is the growing demand for AI-enabled connected devices, which is fueling a transition from traditional oral care products to advanced, tech-driven solutions. Online distribution channels are gaining momentum, supported by the convenience of product accessibility and rising digital engagement. Smart toothbrushes with sensors, AI-powered feedback, and app integration are leading this shift, reflecting consumer preference for innovation, personalization, and preventive care. Beyond hygiene, innovations such as whitening kits, intraoral cameras, and nanotechnology-based remineralizing toothpastes are broadening the scope of oral care, driving higher margins for manufacturers and redefining the competitive landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of dental diseases

-

Rising number of practicing dentists on a global scale

Level

-

Product Recalls

Level

-

Rising trend of online purchasing e-commerce

-

Growing awareness about oral hygiene

Level

-

Adverse effects of teeth whitening products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of dental diseases

The persistent high prevalence of oral diseases is a crucial factor propelling the growth of the oral care products market globally. According to the WHO Global Oral Health Status Report (2022), approximately 3.5 billion people are affected by oral health issues, with a disproportionate 75% residing in middle-income countries, underscoring a significant public health challenge. In the United States, data from the American Association of Oral and Maxillofacial Surgeons (AAOMS) reveals that nearly 69% of adults aged 35 to 44 lose one or more permanent teeth annually due to factors such as dental caries, periodontal disease, or trauma. This alarming incidence necessitates an increased emphasis on preventative oral care solutions. As public awareness of oral health evolves and integrates with preventive healthcare paradigms, the oral care market is positioned for sustained growth.

Restraint:Product recall

Product recalls act as a major restring factor for oral care market. Oftenly recalls are due to safety concern which are a result of contamination of the product which causes harm to the oral tissue, manufacturing defect such as defective batteries of the electric toothbrushes which may cause burns due to overheating of the product, or any defect in the electric toothbrush. Various tooth whitening products can cause tooth sensitivity or harm to the oral tissues. Such incidents make the consumers more cautious about trying new products which eventually leads to a decline in market growth.

Opportunity: Growing awareness about oral hygiene

Increasing use of social media by patients and dental professionals helps to increase awareness about the importance of oral hygiene. As the consumer gains more knowledge about the link between oral health and overall being, it leads to an increase in the demand for preventive and specialized oral care products. Various public health campaigns, recommendations of the dental professionals and social media play an important role in having an impact on the oral hygiene practices. This encourages the consumers to maintain oral hygiene to avoid oral diseases or gum issues by use of antibacterial mouthwashes, fluoride toothpaste. The regular use of dental floss, mouthwashes, breath fresheners have led to an increase in the oral care market.

Challenge: Adverse effects of teeth whitening products

The teeth whitening products are famous and used for aesthetic reasons, but their improper use can lead to tooth sensitivity erosion of enamel, irritation of the oral tissues and gums. These side effects discourage the consumers to use the whitening products and distrust in the brand. Also, the increase in the consumer awareness has led to an increase in the scrutiny of the products which increases the regulations for the product development and approval.

Oral Care Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Wide portfolio of toothpastes, mouthwashes, and toothbrushes, including herbal and natural formulations | Cavity protection, gum health, fresh breath, whitening solutions, and affordability |

|

Oral-B toothbrushes (manual & electric), toothpastes, and whitening systems | Advanced cleaning, plaque removal, gum protection, smart connectivity in electric toothbrushes |

|

Affordable toothpastes, herbal rinses, and whitening oral care products targeting emerging markets | Daily oral hygiene, cavity prevention, accessible pricing, and herbal-based solutions |

|

Sensodyne and Parodontax toothpastes, therapeutic mouthwashes, and specialized oral care products | Relief for sensitivity, enamel repair, gum disease prevention, dentist-recommended solutions |

|

Listerine antiseptic mouthwashes, whitening kits, and oral rinses | Clinically proven plaque and gingivitis reduction, 24-hour germ protection, alcohol-free options |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oral care market functions as a broad ecosystem where global manufacturers like P&G, Unilever, and LION develop and produce a wide range of products, including toothpaste, mouthwashes, and accessories. This inventory is brought to consumers through key distributors such as McKesson and Henry Schein, who utilize retail pharmacies, consumer stores, and online platforms to ensure widespread availability. Regulatory bodies, including the US FDA and PMDA, establish stringent safety and compliance standards that govern market entry. Meanwhile, the demand for these products is driven by patients and caregivers seeking to prevent dental diseases and maintain hygiene, a demand that is heavily influenced by dentists and healthcare providers (like those at Johns Hopkins Medicine) through their clinical recommendations and by advocacy organizations such as the American Dental Association (ADA), which set industry guidelines and promote awareness. Dental professionals, including general dentists and hygienists, act as key influencers by recommending oral care products based on patient needs. Additionally, professional bodies, academic institutions, and public health organizations contribute by issuing guidelines on safe and effective oral care products use, supporting patient education, and promoting best practices in oral hygiene management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oral Care Market, By Product

Based on the product type, the oral care market is segmented into Toothpaste, toothbrush, mouthwashes/rinses, dental accessories, denture products. In 2024, the toothpaste segment accounted for the largest market share of the oral care market. Growth in this market segment can be attributed to the large-scale use of toothpaste on daily basis. Also the availability and affordability of the product has increased its demand. The advancements in the product such as the teeth whitening toothpaste turn out to be an attractive feature for those who have aesthetics as their primary concern. Also, other varieties such as the cavity prevention which avoids the plaque buildup, and sensitivity relief are responsible for the growth of the market. The various options available help the consumers to switch to different brands.

Oral Care Market, By Application

Based on application ,homecare holds the largest share of the oral care market. All the daily essentials such as the toothpaste, toothbrush, mouthwashes/rinses, dental floss are included in the homecare segment which are used by the consumer on daily basis for a multiple time. The various options available in these products include the breath freshener in different flavors, various toothpaste which cater the need of various dental problems such as the tooth sensitivity, gum problems, cavity prevention. The availability of these oral care products on a large scale at retail stores, pharmacies has increased the consumption of these products.

Oral Care Market, By Distribution Channel

Based on distribution channel, consumer stores hold the largest share of the oral care market. The consumer stores are widely available which makes it more convenient for the consumers to buy the products. The consumer gets to compare all the brands and get the best out of it. The availability of all the products enables the consumer to get the products whenever in need without any delay. The satisfaction of buying the product in person gives immense satisfaction to the consumer. The loyalty with the seller helps the consumer gain various benefits on buying products.

REGION

Asia Pacific to be fastest-growing region in global oral rinses market during forecast period

The Asia-Pacific region is expected to record the highest CAGR globally during the forecast period, driven by multiple factors. The increasing prevalence of dental caries and other oral diseases is a key growth driver, supported by rising awareness of oral health and preventive care. Expanding middle-class incomes and shifting lifestyles, which contribute to greater oral health concerns, are further boosting demand. In addition, strong participation from both local and global players introducing herbal and region-specific products, along with the rapid growth of e-commerce and supportive government initiatives, is making oral care products more accessible and accelerating adoption across the region.

Oral Care Market: COMPANY EVALUATION MATRIX

In the oral rinses market matrix, Colgate-Palmolive Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Church & Dwight Co, Inc (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Colgate-Palmolive Company dominates through reach, Church & Dwight Co, Inc’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 37.21 Billion |

| Revenue Forecast in 2030 | USD 53.29 Billion |

| Growth Rate | CAGR of 6.4% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product: Toothpaste, Toothbrush & Accessories, Mouthwashes/ Rinses, Dental Accessories/ Ancillaries, Denture Products By Application: Homecare, Dental Clinics & Hospitals By Distribution Channel: Consumer Stores, Retail Pharmacies & Dental dispensaries, Online Distribution |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Oral Care Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- April 2025 : Kenvue announced a strategic scientific collaboration with the Indian Dental Association (IDA) in India to advance scientific literature around the use of mouthwashes in oral care.

- April 2024 : Church & Dwight Co., Inc.’s TheraBreath brand announced the launch of TheraBreath Deep Clean Oral Rinse in the US.

- In February 2024 : Colgate-Palmolive announced a strategic collaboration with IMPAct4Nutrition, a platform supported by UNICEF India, to promote greater awareness of oral health and nutrition among children.

- June 2023 : Procter & Gamble launched its new concentrated mouthwash called Crest Scope Squeez Mouthwash. This marks P&G’s first concentrated mouthwash product. The innovative packaging of Crest Scope Squeez offers significant advantages in terms of reduced packaging and customisable product strength, making it a convenient option for consumers

Table of Contents

Methodology

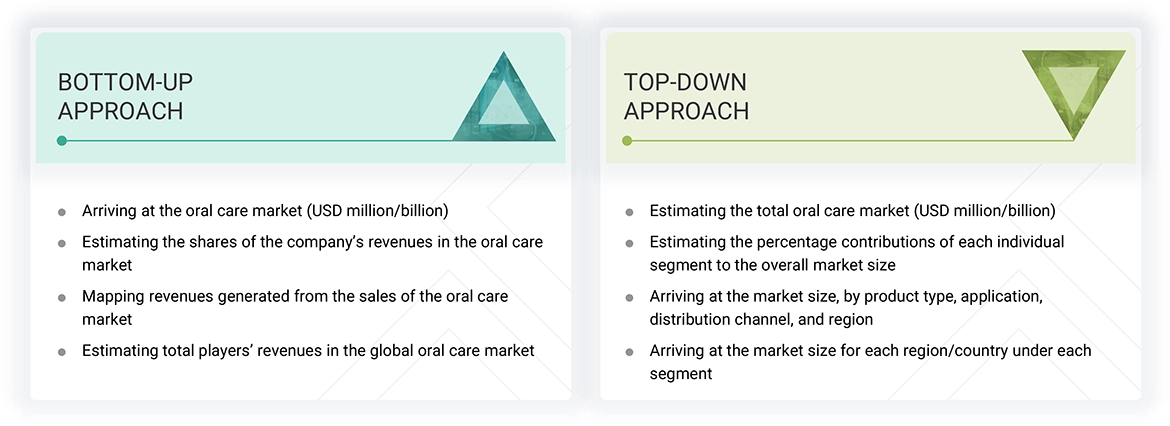

The study involved major activities in estimating the current market size for the oral care market. Exhaustive secondary research was done to collect information on the oral care industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the oral care market.

The study involved four major activities to estimate the current size of the oral care market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to to identify and collect information for the study of oral care market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after obtaining information regarding oral care market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from manufacturers; distributors operating in oral care market; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped me understand the various trends related to product type, application, distribution channel, and region. Stakeholders from the demand side, customers/end users who are using infection control products, were interviewed to understand the buyer’s perspective on the suppliers, products, current usage, and future outlook of their business, which will affect the overall market.

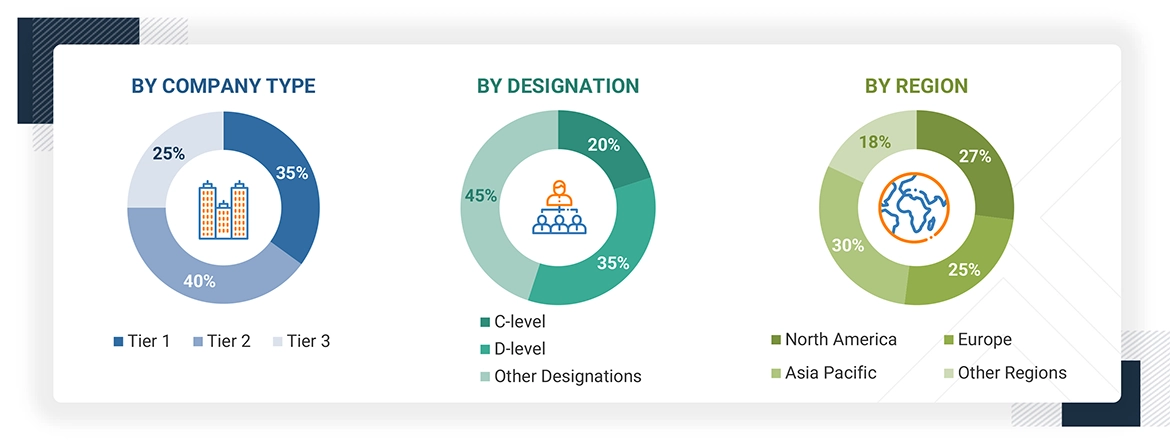

The following is a breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the oral care market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the oral care market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall orthodontic supplies market was obtained from secondary data and validated by primary participants to arrive at the total oral care market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual devices & consumables segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall oral care market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Oral Care Market Size: Bottom-up & Top-down approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oral care market.

Market Definition

Oral care products are specialized dentistry products that help maintain oral hygiene and avoid oral diseases. These include toothbrushes, toothpaste, dental floss, mouthwash, rinses, and teeth-whitening products. There has been an increase in the availability of the best-quality oral care products with successful clinical outcomes in the market, which has widened the opportunity to use them.

Stakeholders

- Oral Care and Support Product Manufacturing Companies

- Product Distributors and Channel Partners

- Dental Professionals

- Contract Manufacturers and Third-party Suppliers

- Research Laboratories and Academic Institutes

- Clinical Research Organizations (CROs)

- Government and Non-governmental Regulatory Authorities

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the oral care market, by product type, application, distribution channel, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall oral care market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments concerning five main regions: North America (the US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Mexico, Brazil, Argentina, and the Rest of Latin America), Middle East & Africa, and GCC Countries

- To profile the key players in the oral care market and comprehensively analyze their global revenue shares and core competencies

- To benchmark players within the market using a proprietary company evaluation matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To track and analyze competitive developments, such as product launches & approvals, partnerships, agreements, collaborations, and acquisitions, in the oral care market

Key Questions Addressed by the Report

What is the expected addressable market value of the oral care market over the next five years?

The oral care market is projected to reach USD 53.28 billion by 2030 from USD 37.29 billion in 2024, at a CAGR of 6.4% from 2025 to 2030.

What are the key drivers for the oral care market?

Several phenomena drive the oral care market. These include the increase in dental and gum diseases, the increase in dental professionals worldwide, and the advancement in technologies.

Which oral care market types have been included in this report?

This report contains the following main segments:

-

Toothpaste

- Pastes

- Gels

- Powders

- Polishes

-

Toothbrushes & Accessories

-

Toothbrushes

- Manual Toothbrushes

- Electric Toothbrushes

- Battery-powered Toothbrushes

- Replacement Toothbrush Heads

-

Toothbrushes

-

Mouthwashes/Rinses

- Non-medicated Mouthwashes

- Medicated Mouthwashes

-

Dental Accessories/Ancillaries

- Dental Flosses

- Breath Fresheners

- Cosmetic Dental Whitening Products

- Other Dental Accessories/Ancillaries

-

Denture Products

- Denture Fixatives

- Denture Prosthesis Cleaning Solutions

What are the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansions, distribution agreements, product launches, and product approvals as important growth tactics.

Who are the main players in this market?

The main vendors in the market are Colgate-Palmolive (US), Procter & Gamble (US), Haleon (UK), Koninklijke Philips (Netherlands), and Johnson & Johnson (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oral Care Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Oral Care Market

MnM Analyst

Jul, 2023

Key players in the North American Oral Care Market include:

- Colgate-Palmolive: Colgate-Palmolive is a leading player in the oral care market, offering a wide range of oral care products including toothpastes, toothbrushes, mouthwashes, and more.

- Procter & Gamble: Procter & Gamble is another major player in the oral care market, offering popular brands such as Crest, Oral-B, and Scope.

- Johnson & Johnson: Johnson & Johnson is a diversified healthcare company with a strong presence in the oral care market, offering products such as Listerine mouthwash and Reach toothbrushes.

- GlaxoSmithKline: GlaxoSmithKline is a leading pharmaceutical company that also offers a range of oral care products, including Aquafresh toothpaste and Sensodyne toothpaste for sensitive teeth.

- Church & Dwight: Church & Dwight is a leading producer of personal care and household products, with a strong presence in the oral care market through its Arm & Hammer brand of toothpastes and other oral care products.

.Robert

Jul, 2023

Who are the top key players in oral care market in North America?.

Austin

Mar, 2022

Can you share the detailed information on technological advancements in the Oral Care Market?.

Carl

Mar, 2022

In what way COVID19 is Impacting the global growth of the Oral Care Market?.

Arthur

Mar, 2022

Can you enlighten us about the key players operating in the global Oral Care Market?.