Digital Printing Market Size, Share & Industry Trends Growth Analysis Report by Ink (UV-cured, Aqueous, Solvent, Latex, and Dye Sublimation), Printheads (Inkjet and Laser), Substrate (Plastic Film or Foil, Release Liner, Glass, Textile, Paper, Ceramic), and Geography - Global Growth Driver and Industry Forecast

Updated on : Oct 23, 2024

Digital Printing Market Size & Growth

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Printing Market Segment Overview

The digital printing market for Inkjet printhead to grow at the highest CAGR during the forecast period.

The printers based on thermal inkjet technology provide low-cost printing at a fairly high speed and also have the added benefit of being able to print on a variety of surfaces such as specialty papers, plastics, metals, and so on.

The piezo-crystal-based inkjet printers create more precise and various droplet sizes and can use a wide variety of inks because of low operating temperature and also run longer.

The main advantage of MEMS-based printers is that because of the capability of producing mini devices, denser arrays of smaller ink orifices can be produced, which significantly improves the print resolution.

The digital printing market for textile substrate expected to grow at the highest CAGR during forecast period.

Textile printing is a technique of applying color to fabrics in a particular design and pattern. The increasing preference of consumers toward high-quality textile printing is a key factor that drives the market growth.

Direct-to-garment (DTG) printing or digital direct-to-garment printing involves the use of specialized inkjet technology for textile printing. This technology is mostly used for cotton garments.

The apparel industry is closely tied with the fashion industry, which is always evolving. Printed apparels are hugely popular among people, particularly millennials. In fact, many websites provide customized printed apparel on demand.

Solvent ink to hold the largest share of digital printing market during forecast period.

Solvent inks produce rich, vibrant colors comprising petroleum-based chemicals. These are flexible, waterproof, and durable, eliminating the need for over-coatings.

They contain pigments rather than dyes, unlike the aqueous version where the carrier is water. These are suitable for applications such as vehicle graphics, banners, and billboards. Solvent ink printers enable printing on flexible vinyl substrates. It is largely used in vehicle graphics, banners, and billboards.

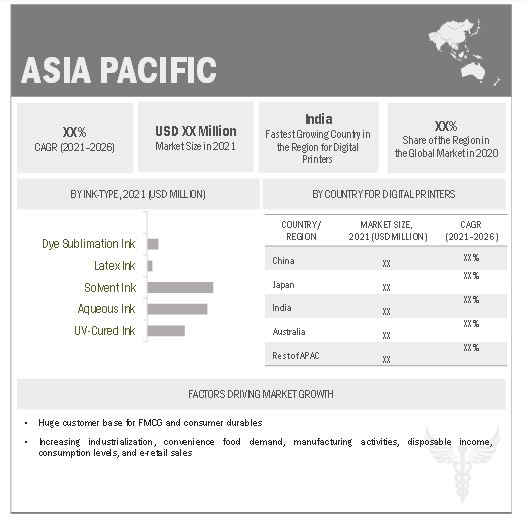

The digital printing market in APAC is expected to grow at the highest CAGR during forecast period.

The markets in India, Japan, and China are more likely to govern the APAC digital printing market in the years to come in terms of adaptability and market size.

Countries such as India and China are expected to witness high growth in the digital printing industry because of the growing developmental activities and rapid economic expansion. APAC is a market leader in the global textile printing industry. China and India are the biggest suppliers of textiles and comprise the maximum number of textile printing owners and marketers, and also hold the largest base of textile manufacturers.

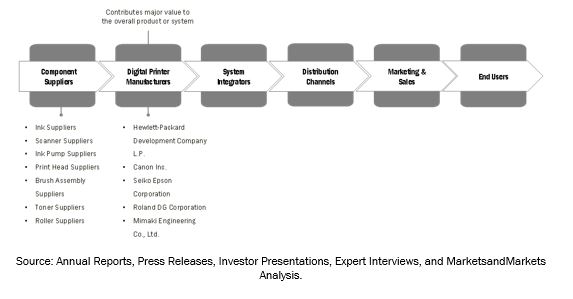

Digital Printing Industry Value Chain Analysis

To know about the assumptions considered for the study, download the pdf brochure

Top Digital Printing Companies - Key Market Players

- Hewlett-Packard Development Company, l.P. (US),

- Canon, Inc. (Japan),

- Ricoh Company, Ltd. (Japan),

- Mimaki Engineering Co., Ltd. (Japan),

- Roland DG Corporation (Japan),

- Xerox Corporation (US),

- Seiko Epson Corporation (Japan),

- Durst Phototechnik AG (Italy),

- Electronics for Imaging, Inc. (US),

- Inca Digital Printers Limited (UK),

- Printronix (US),

- Brother Industries, Ltd. (Japan),

- Oki Electric Industry (Japan),

- Kyocera Corporation (Japan),

- Toshiba (Japan),

- Samsung Electronics (South Korea),

- Konica Minolta (Japan),

- Sharp (Japan),

- Panasonic (Japan),

- GCC (Taiwan)are a few major companies dominating the digital printing market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Digital Printing Market Report Scope

|

Report Metric |

Details |

|

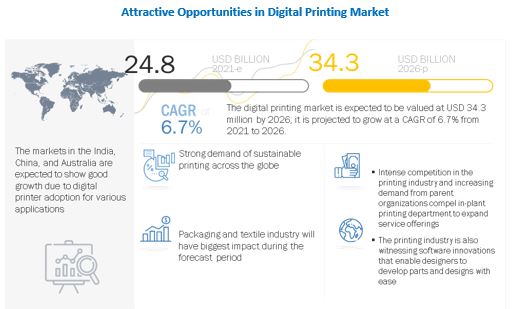

Estimated Market Size |

USD 24.8 billion in 2021 |

|

Projected Market Size |

USD 34.3 billion by 2026 |

|

Growth Rate |

CAGR of 6.7%. |

|

Market Size Available for Years |

2015-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Digital Printing Companies Covered |

|

| Key Market Driver | Developments in packaging and textile industries |

| Key Market Opportunity | Increasing demand from in-plant market |

| Largest Growing Region | APAC |

| Largest Digital Printing Market Share Segment | Solvent Ink |

| Highest CAGR Segment | Inkjet printhead |

Digital Printing Market Size Dynamics

Driver: Developments in packaging and textile industries

There are continuous developments in the textile industry. Earlier, digital printing companies used technologies for niche sections of the market. Nowadays, multinational brands incorporate new technologies for the overall market.

Manufacturers are producing dedicated textile-specific printing systems to cater to more orders. Increase in speed with new sustainable ink technologies is propelling digital printers toward the textile printing market.

The major demand is from the clothing market, which has two categories: fashion and sportswear. Digital printers are also used to print smaller designs on garments such as T-shirts, dresses, and promotional wear and print larger designs in textiles

Restraint: High initial investments

The initial investments and maintenance of digital printers incur higher costs. This is due to the complexity of design of digital printers. Different applications require different toners and inkjets. Moreover, the cost of ink used in the inkjet technology is very high.

Opportunity: Increasing demand from in-plant market

Intense competition in the printing industry and increasing demand from parent organizations compel the in-plant printing department to expand its service offerings.

Currently, the in-plant printing market offers value-added services, ranging from scanning and archiving to garment printing and others. The large-format digital printer is widely accepted for these new services.

Challenge: Rising demand for digital advertisements and e-books

The growing popularity of digital delivery of documents and data is expected to reduce the demand for printing certain products such as directories, financial documents, advertisements, and books.some websites serve as online sources of public domain material, offering e-books, novels, and documents for educational and recreational purposes.

The growth in demand for e-books is a major challenge for printing businesses. Furthermore, self-publishing e-books affect traditional publishing businesses as writers can instantly publish their books and make them accessible to all. Thus, the exponential growth of e-books in recent years acts as a challenge for the digital printing market.

Key Trends and opprtunuities for American Digital Printing in the Future

America's digital printing market is anticipated to expand as a result of rising consumer demand for customized goods, technological advancements, rising e-commerce adoption, and rising marketing and advertising expenditures. These elements will fuel the market's expansion for high-quality, reasonably priced digital printing services.

Digital Printing Market Size Categorization

This report categorizes the Digital printing market by end-user industry, applications, type, revenue, and geography.

Digital Printing Market By Digital Printing

- Digital Printers

- Ink

- Printhead

By Ink type

- UV-Cured Ink

- Aqueous Ink

- Solvent Ink

- Latex Ink

- Dye Sublimation Ink

By Printhead:

- Inkjet

- Laser

Digital Printing Market By Print head:

- Plastic Film or Foil

- Release Liner

- Glass

- Textile

- Paper

- Ceramic

- Others

Recent Developments in Digital Printing Industry

- In February 2021, , EFI announced a new reforestation initiative in coordination with new EFICretaprint ceramic printer sales. Under this new initiative, EFI will plant 17 trees for every new Cretaprint printer sold: a symbolic number that is equivalent to approximately three tons of CO2 emissions, according to 2019 greenhouse gas reporting.

- In January 2021,Roland DG Corporation launched the new VersaUV LEC2-640/330 64” and 30” wide-format UV printer/cutters.

- In December 2020, Ricoh unveiled a first look at the RICOH Pro Z75, its highly anticipated B2 sheet-fed inkjet system.

Frequently Asked Questions (FAQ):

How big digital printing market?

The digital printing market size is expected to grow from USD 24.8 billion in 2021 to USD 34.3 billion by 2026, at a CAGR of 6.7%.This growth can be attributed to sustainable printing and developments in packaging and textile industries and reduction in per unit cost of printing with digital printers.

Which are the recent industry trends that can be implemented to generate additional revenue streams?

Businesses are taking their printing efforts into their own hands, implementing digital label printers as part of their operations. Virtually every physical product needs a quality label, and digital label printers make it possible to print short-run packaging.

Who are the major players operating in the Digital printing detection market? Which companies are the front runners?

Roland DG Corporation (Japan), Xerox Corporation (US), Seiko Epson Corporation (Japan), Hewlett-Packard Development Company, l.P. (US), Canon, Inc. (Japan), Ricoh Company, Ltd. (Japan), Mimaki Engineering Co., Ltd. (Japan), Durst Phototechnik AG (Italy), Electronics for Imaging, Inc. (US), Inca Digital Printers Limited (UK),are some of the major vendors in the market

What are the major Ink types inDigital printing market?

UV-cured, Aqueous and solvent are major ink types of Digital printing market.

Which substrate type will have a major impact in the digital printing market?

Textile substrate is going to have a major impact on the digital printing market. Direct-to-garment (DTG) printing or digital direct-to-garment printing involves the use of specialized inkjet technology for textile printing. This technology is mostly used for cotton garments. However, in technology have made it possible to use the printers and give better results on cotton/polyester blends and light-colored polyester. Printing on dark-colored garments is also possible, provided the garments undergo a pre-treatment process.

How IoT will drive ITS Market?

As digital printing becomes more effective, affordable, and diverse, the market for it is anticipated to expand greatly in the future. The market is anticipated to increase as a result of rising consumer demand for customized goods and short-run printing.

What further developments in digital printing might we anticipate?

Future developments in digital printing technology should enable faster print times, better print quality, and higher levels of productivity.

How will the market for digital printing be affected by the drive towards sustainability?

As more businesses seek to lessen their environmental effect, the movement towards sustainability is anticipated to have a substantial impact on the digital printing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 INCLUSIONS AND EXCLUSIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 DIGITAL PRINTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market share by bottom-up analysis (demand side)

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share by top-down analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 5 GLOBAL DIGITAL PRINTING MARKET, 2015–2026 (USD MILLION)

FIGURE 6 INK MARKET FOR DIGITAL PRINTING IS EXPECTED TO HOLD THE LARGEST SHARE IN 2021

FIGURE 7 DIGITAL PRINTER MARKET FOR SOLVENT INK IS EXPECTED TO HOLD THE LARGEST SHARE IN 2021

FIGURE 8 INK MARKET FOR DIGITAL PRINTING FOR SOLVENT INK IS EXPECTED TO HOLD LARGEST SHARE IN 2021

FIGURE 9 INKJET PRINT HEAD MARKET FOR DIGITAL PRINTER IS EXPECTED TO HOLD A LARGER SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN DIGITAL PRINTING MARKET

FIGURE 10 PACKAGING AND TEXTILE INDUSTRY IS DRIVING MARKET

4.2 NORTH AMERICA DIGITAL PRINTING MARKET, BY INK TYPE & COUNTRY (2021)

FIGURE 11 UV-CURED INK AND US TO DOMINATE NORTH AMERICAN MARKET IN 2021

4.3 DIGITAL PRINTING MARKET

FIGURE 12 INK MARKET FOR DIGITAL PRINTER WILL HOLD LARGEST SHARE BY 2026

4.4 PRINT HEAD MARKET FOR DIGITAL PRINTERS

FIGURE 13 INKJET PRINTHEAD TO HOLD LARGEST SHARE BY 2026

4.5 INK MARKET FOR DIGITAL PRINTING

FIGURE 14 SOLVENT INK TO HOLD LARGEST DIGITAL PRINTING MARKET SHARE BY 2026

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DIGITAL PRINTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for sustainable printing

5.2.1.2 Developments in packaging and textile industries

5.2.1.3 Reduction in per unit cost of printing with digital printers

FIGURE 16 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High initial investments

FIGURE 17 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand from in-plant market

5.2.3.2 Investments in R&D

FIGURE 18 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Rising demand for digital advertisements and e-books

FIGURE 19 MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS (DIGITAL PRINTING MARKET)

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING PHASE

TABLE 1 DIGITAL PRINTERS MARKETS: VALUE CHAIN

6 DIGITAL PRINTING INDUSTRY TRENDS (Page No. - 53)

6.1 TECHNOLOGY ANALYSIS

6.1.1 FOCUS ON SUSTAINABILITY

6.1.2 DIGITAL LABEL PRINTERS

6.1.3 SPECIAL EFFECTS AND FINISHING

6.2 CASE STUDY

6.2.1 SOLENT DESIGN STUDIO

6.2.2 DIGIFORCE

6.2.3 USE OF PRINTERS IN AEROSPACE INDUSTRY

6.3 REGULATION OF PRINTERS

6.3.1 ISO STANDARDS

6.3.1.1 Papers per minute

6.3.1.2 Toner standards

6.3.1.3 Printing paper standards

6.3.1.4 Monochrome testing

6.3.1.5 Multicolor testing

6.3.1.6 Color richness testing

6.4 TRADE ANALYSIS

6.4.1 TRADE ANALYSIS FOR PRINTERS

TABLE 2 PRINTERS IMPORTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 3 PRINTERS EXPORTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

6.5 TARIFF ANALYSIS FOR PRINTERS

TABLE 4 MFN TARIFFS FOR PRINTERS EXPORTED BY PHILIPPINES

TABLE 5 MFN TARIFFS FOR PRINTERS EXPORTED BY THAILAND

6.6 PATENT ANALYSIS

TABLE 6 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS

6.7 AVERAGE SELLING PRICE AND UNIT SHIPMENTS OF DIGITAL PRINTERS

TABLE 7 GLOBAL DIGITAL PRINTER MARKET, ASP AND UNIT SHIPMENTS, 2015–2020

TABLE 8 GLOBAL DIGITAL PRINTER MARKET, ASP AND UNIT SHIPMENTS, 2021–2026

6.8 PORTER’S FIVE FORCES MODEL

TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT OF NEW ENTRANTS

6.8.2 THREAT OF SUBSTITUTES

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.4 BARGAINING POWER OF BUYERS

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.9 DIGITAL PRINTING ECOSYSTEM

FIGURE 22 ECOSYSTEM OF DIGITAL PRINTING MARKET

6.10 IMPACT OF COVID-19 ON MARKET

7 GLOBAL DIGITAL PRINTING MARKET (Page No. - 64)

7.1 INTRODUCTION

FIGURE 23 GLOBAL DIGITAL PRINTING

FIGURE 24 INK MARKET FOR DIGITAL PRINTING IS EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 10 GLOBAL DIGITAL PRINTING, 2015–2020 (USD MILLION)

TABLE 11 GLOBAL DIGITAL PRINTING, 2021–2026 (USD MILLION)

7.2 DIGITAL PRINTER MARKET

7.2.1 DIGITAL PRINTING ALLOWS ON-DEMAND PRINTING AND SHORT TURNAROUND TIME

TABLE 12 GLOBAL DIGITAL PRINTER MARKET, 2015–2020

TABLE 13 GLOBAL DIGITAL PRINTER MARKET, 2021–2026

TABLE 14 DIGITAL PRINTER MARKET, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 15 DIGITAL PRINTER MARKET, BY INK TYPE, 2021–2026 (USD MILLION)

TABLE 16 DIGITAL PRINTER MARKET, BY INK TYPE, 2015–2020 (THOUSAND UNITS)

TABLE 17 DIGITAL PRINTER MARKET, BY INK TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 18 DIGITAL PRINTER MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 19 DIGITAL PRINTER MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 20 DIGITAL PRINTER MARKET FOR UV-CURED INK, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 DIGITAL PRINTER MARKET FOR UV-CURED INK, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 DIGITAL PRINTER MARKET FOR AQUEOUS INK, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 DIGITAL PRINTER MARKET FOR AQUEOUS INK, BY REGION, 2021–2026 (USD MILLION)

TABLE 24 DIGITAL PRINTER MARKET FOR SOLVENT INK, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 DIGITAL PRINTER MARKET FOR SOLVENT INK, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 DIGITAL PRINTER MARKET FOR LATEX INK, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 DIGITAL PRINTER MARKET FOR LATEX INK, BY REGION, 2021–2026 (USD MILLION)

TABLE 28 DIGITAL PRINTER MARKET FOR DYE SUBLIMATION INK, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 DIGITAL PRINTER MARKET FOR DYE SUBLIMATION INK, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 DIGITAL PRINTER MARKET FOR UV-CURED INK, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 31 DIGITAL PRINTER MARKET FOR UV-CURED INK, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 32 DIGITAL PRINTER MARKET FOR AQUEOUS INK, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 33 DIGITAL PRINTER MARKET FOR AQUEOUS INK, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 34 DIGITAL PRINTER MARKET FOR SOLVENT INK, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 35 DIGITAL PRINTER MARKET FOR SOLVENT INK, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 36 DIGITAL PRINTER MARKET FOR LATEX INK, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 37 DIGITAL PRINTER MARKET FOR LATEX INK, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 38 DIGITAL PRINTER MARKET FOR DYE SUBLIMATION INK, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 39 DIGITAL PRINTER MARKET FOR DYE SUBLIMATION INK, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

7.3 INK MARKET FOR DIGITAL PRINTING

7.3.1 INK MARKET FOR DIGITAL PRINTING IS SEGMENTED INTO SOLVENT, UV-CURED, LATEX, AQUEOUS, AND DYE SUBLIMATION

TABLE 40 INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

7.4 PRINT HEAD MARKET FOR DIGITAL PRINTERS

7.4.1 INKJET PRINT HEADS ARE USED FOR INKJET PRINTING THAT RECREATES A DIGITAL IMAGE BY PROPELLING DROPLETS OF INK ON PAPER, PLASTIC, OR OTHER SUBSTRATES

TABLE 42 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2015–2020 (USD MILLION)

TABLE 43 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2021–2026 (USD MILLION)

8 INK MARKET FOR DIGITAL PRINTING, BY INK TYPE (Page No. - 79)

8.1 INTRODUCTION

FIGURE 25 INK MARKET FOR DIGITAL PRINTING, BY INK TYPE

FIGURE 26 THE INK MARKET FOR UV-CURED INK FOR DIGITAL PRINTING TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 44 INK MARKET FOR DIGITAL PRINTING, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 45 INK MARKET FOR DIGITAL PRINTING, BY INK TYPE, 2021–2026 (USD MILLION)

8.2 AQUEOUS INK

8.2.1 AQUEOUS INK IS USED IN TECHNICAL DOCUMENTS, DIGITAL GRAPHICS, PROFESSIONAL PHOTOGRAPHY, FINE ART, INDOOR SIGNAGE, SHORT-TERM OUTDOOR SIGNAGE AND BANNERS, TRADE SHOW PRINTING, AND PRE-PRESS PROOFING

TABLE 46 AQUEOUS INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 47 AQUEOUS INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 AQUEOUS INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 49 AQUEOUS INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

8.3 SOLVENT INK

8.3.1 SOLVENT INKS PRODUCE RICH, VIBRANT COLORS COMPRISING PETROLEUM-BASED CHEMICALS

TABLE 50 SOLVENT INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 51 SOLVENT INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 52 SOLVENT INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 53 SOLVENT INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

8.4 UV-CURED INK

8.4.1 UV-CURED INK PRIMARILY CONSISTS OF ACRYLIC MONOMERS WITH A PHOTOINITIATOR

TABLE 54 UV-CURED INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 UV-CURED INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 UV-CURED INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 57 UV-CURED INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

8.5 LATEX INK

8.5.1 LATEX INK IS A WATER-BASED INK WITH A POLYMER BONDED TO THE SUBSTRATE BY HEAT

TABLE 58 LATEX INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 59 LATEX INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 LATEX INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 61 LATEX INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

8.6 DYE SUBLIMATION INK

8.6.1 IN DYE SUBLIMATION PRINTING, IMAGES ARE PRINTED ON REVERSE SIDE OF THE PAPER

TABLE 62 DYE SUBLIMATION INK MARKET FOR DIGITAL PRINTING, BY REGION, 2015–2020 (USD MILLION)

TABLE 63 DYE SUBLIMATION INK MARKET FOR DIGITAL PRINTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 64 DYE SUBLIMATION INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 65 DYE SUBLIMATION INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

9 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY PRINT HEAD TYPE (Page No. - 91)

9.1 INTRODUCTION

FIGURE 27 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY INK TYPE

FIGURE 28 INKJET PRINT HEAD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE PRINT HEAD MARKET FOR DIGITAL PRINTERS DURING THE FORECAST PERIOD

TABLE 66 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY PRINT HEAD TYPE, 2015–2020 (USD MILLION)

TABLE 67 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY PRINT HEAD TYPE, 2021–2026 (USD MILLION)

9.2 INKJET

9.2.1 INKJET PRINT HEADS CAN EITHER BE OF CONTINUOUS INKJET TYPE OR DROP-ON-DEMAND INKJET PRINTERS

9.2.2 THERMAL INKJET

9.2.2.1 Thermal inkjet print heads use thermal energy to heat ink and apply it to a medium

9.2.3 PIEZO-CRYSTAL-BASED

9.2.3.1 Piezo-crystal-based inkjet printers create more precise and various droplet sizes

9.2.4 ELECTROSTATIC INKJET

9.2.4.1 In electrostatic inkjet technology, drops of inks are drawn from an orifice under the effect of an electrostatic field

9.2.5 MEMS (MICROELECTROMECHANICAL SYSTEM) INKJET

9.2.5.1 MEMS-based inkjet print heads are based on either piezo or thermal inkjet technology

TABLE 68 INKJET PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2015–2020 (USD MILLION)

TABLE 69 INKJET PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 INKJET PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 71 INKJET PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

9.3 LASER

9.3.1 LASER PRINT HEADS ARE IDEALLY SUITED FOR APPLICATIONS THAT REQUIRE HIGH-SPEED PRINTING

TABLE 72 LASER PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2015–2020 (USD MILLION)

TABLE 73 LASER PRINT HEAD MARKET FOR DIGITAL PRINTER, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 LASER PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 75 LASER PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

9.4 COMPETITIVE SCENARIO

TABLE 76 LIST OF MAJOR PRINT HEADS MANUFACTURERS

10 GLOBAL DIGITAL PRINTING MARKET, BY SUBSTRATE TYPE (Page No. - 99)

10.1 INTRODUCTION

FIGURE 29 MARKET, BY SUBSTRATE TYPE

FIGURE 30 INK MARKET FOR PLASTIC FILM OR FOIL SUBSTRATES IS EXPECTED TO HOLD THE LARGEST DIGITAL PRINTING MARKET SHARE DURING THE FORECAST PERIOD

TABLE 77 DIGITAL PRINTER MARKET, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 78 DIGITAL PRINTER MARKET, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 79 INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 80 INK MARKET FOR DIGITAL PRINTING, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

TABLE 81 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2015–2020 (USD MILLION)

TABLE 82 PRINT HEAD MARKET FOR DIGITAL PRINTER, BY SUBSTRATE TYPE, 2021–2026 (USD MILLION)

10.2 PLASTIC FILMS OR FOILS

10.2.1 INCREASING DEMAND FOR DIGITAL PRINTING IN THE PACKAGING INDUSTRY IS EXPECTED TO DRIVE DEMAND

10.3 RELEASE LINER

10.3.1 EMERGENCE OF DIGITAL LABEL PRINTING TECHNOLOGY TO DRIVE DEMAND

10.4 GLASS

10.4.1 DIGITAL PRINTING ON GLASS IS USED FOR PRINTING OF IMAGERY, PATTERN, OR TEXT ON SURFACE OF FLAT GLASS

10.5 TEXTILE

10.5.1 TEXTILE PRINTING IS A TECHNIQUE OF APPLYING COLOR TO FABRICS IN A PARTICULAR DESIGN AND PATTERN

10.6 PAPER

10.6.1 INCREASING DEMAND FOR DIGITAL PRINTING IN PACKAGING INDUSTRY TO DRIVE THE SEGMENT

10.7 CERAMIC

10.7.1 DIGITAL TECHNOLOGY HAS MADE RAPID INROADS IN CERAMIC PRINTING, ESPECIALLY IN THE TILES MARKET

10.8 OTHERS

11 GEOGRAPHIC ANALYSIS (Page No. - 106)

11.1 INTRODUCTION

FIGURE 31 DIGITAL PRINTING MARKET, BY GEOGRAPHY

FIGURE 32 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 83 MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 84 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: DIGITAL PRINTING MARKET SNAPSHOT

TABLE 85 DIGITAL PRINTER MARKET IN NORTH AMERICA, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 86 DIGITAL PRINTER MARKET IN NORTH AMERICA, BY INK TYPE, 2021–2026 (USD MILLION)

TABLE 87 DIGITAL PRINTER MARKET IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 88 DIGITAL PRINTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 INK MARKET FOR DIGITAL PRINTING IN NORTH AMERICA, 2015–2020 (USD MILLION)

TABLE 90 INK MARKET FOR DIGITAL PRINTING IN NORTH AMERICA, 2021–2026 (USD MILLION)

TABLE 91 INK MARKET FOR DIGITAL PRINTING IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 92 INK MARKET FOR DIGITAL PRINTING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 PRINT HEAD MARKET FOR DIGITAL PRINTER IN NORTH AMERICA, 2015–2020 (USD MILLION)

TABLE 94 PRINT HEAD MARKET FOR DIGITAL PRINTER IN NORTH AMERICA, 2021–2026 (USD MILLION)

TABLE 95 PRINT HEAD MARKET FOR DIGITAL PRINTER IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 96 PRINT HEAD MARKET FOR DIGITAL PRINTER IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing sales of consumer durables to drive the market

11.2.2 CANADA

11.2.2.1 Increasing demand for personalized printing materials to drive the market

11.2.3 MEXICO

11.2.3.1 Growing demand from packaging, textile, and glass industries to drive the market

11.3 EUROPE

TABLE 97 DIGITAL PRINTER MARKET IN EUROPE, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 98 DIGITAL PRINTER MARKET IN EUROPE, BY INK TYPE, 2021–2026 (USD MILLION)

TABLE 99 DIGITAL PRINTER MARKET IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 100 DIGITAL PRINTER MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 101 INK MARKET FOR DIGITAL PRINTING IN EUROPE, 2015–2020 (USD MILLION)

TABLE 102 INK MARKET FOR DIGITAL PRINTING IN EUROPE, 2021–2026 (USD MILLION)

TABLE 103 INK MARKET FOR DIGITAL PRINTING IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 104 INK MARKET FOR DIGITAL PRINTING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 PRINT HEAD MARKET FOR DIGITAL PRINTER IN EUROPE, 2015–2020 (USD MILLION)

TABLE 106 PRINT HEAD MARKET FOR DIGITAL PRINTER IN EUROPE, 2021–2026 (USD MILLION)

TABLE 107 PRINT HEAD MARKET FOR DIGITAL PRINTER IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 108 PRINT HEAD MARKET FOR DIGITAL PRINTER IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Expansion of businesses by digital printer manufacturers to drive the market

11.3.2 UK

11.3.2.1 High-quality and mass print production to drive the market

11.3.3 FRANCE

11.3.3.1 Increasing demand across end-user industries to drive the market

11.3.4 ITALY

11.3.4.1 Demand from retail, F&B, and healthcare industries to drive the market

11.3.5 REST OF EUROPE

11.4 APAC

FIGURE 34 APAC: DIGITAL PRINTING MARKET SNAPSHOT

TABLE 109 DIGITAL PRINTER MARKET IN APAC, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 110 DIGITAL PRINTER MARKET IN APAC, BY INK TYPE, 2021–2026 (USD MILLION)

TABLE 111 DIGITAL PRINTER MARKET IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 112 DIGITAL PRINTER MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 113 INK MARKET FOR DIGITAL PRINTING IN APAC, 2015–2020 (USD MILLION)

TABLE 114 INK MARKET FOR DIGITAL PRINTING IN APAC, 2021–2026 (USD MILLION)

TABLE 115 INK MARKET FOR DIGITAL PRINTING IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 116 INK MARKET FOR DIGITAL PRINTING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 117 PRINT HEAD MARKET FOR DIGITAL PRINTER IN APAC, 2015–2020 (USD MILLION)

TABLE 118 PRINT HEAD MARKET FOR DIGITAL PRINTER IN APAC, 2021–2026 (USD MILLION)

TABLE 119 PRINT HEAD MARKET FOR DIGITAL PRINTER IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 120 PRINT HEAD MARKET FOR DIGITAL PRINTER IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Rising demand for FMCG and F&B industries to drive the market

11.4.2 JAPAN

11.4.2.1 Increasing disposable income and urbanization to drive the market

11.4.3 INDIA

11.4.3.1 Growing advertising and digital marketing sectors to drive the market

11.4.4 AUSTRALIA

11.4.4.1 Growing demand for ready-to-eat and processed food to drive the market

11.4.5 REST OF APAC

11.5 ROW

TABLE 121 DIGITAL PRINTER MARKET IN ROW, BY INK TYPE, 2015–2020 (USD MILLION)

TABLE 122 DIGITAL PRINTER MARKET IN ROW, BY INK TYPE, 2021–2026 (USD MILLION)

TABLE 123 DIGITAL PRINTER MARKET IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 124 DIGITAL PRINTER MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 125 INK MARKET FOR DIGITAL PRINTING IN ROW, 2015–2020 (USD MILLION)

TABLE 126 INK MARKET FOR DIGITAL PRINTING IN ROW, 2021–2026 (USD MILLION)

TABLE 127 INK MARKET FOR DIGITAL PRINTING IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 128 INK MARKET FOR DIGITAL PRINTING IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 129 PRINT HEAD MARKET FOR DIGITAL PRINTER IN ROW, 2015–2020 (USD MILLION)

TABLE 130 PRINT HEAD MARKET FOR DIGITAL PRINTER IN ROW, 2021–2026 (USD MILLION)

TABLE 131 PRINT HEAD MARKET FOR DIGITAL PRINTER IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 132 PRINT HEAD MARKET FOR DIGITAL PRINTER IN ROW, BY REGION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (DIGITAL PRINTERS) (Page No. - 130)

12.1 OVERVIEW

FIGURE 35 KEY DEVELOPMENTS IN DIGITAL PRINTERS MARKET FROM 2017 TO 2020

12.2 MARKET SHARE ANALYSIS: DIGITAL PRINTERS MARKET

TABLE 133 MARKET SHARE OF KEY PLAYERS IN DIGITAL PRINTERS MARKET, 2020

12.3 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN DIGITAL PRINTERS MARKET

FIGURE 36 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN DIGITAL PRINTER MARKET, 2016–2020

12.4 MARKET EVALUATION FRAMEWORK

TABLE 134 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

12.4.1 PRODUCT PORTFOLIO

12.4.2 REGIONAL FOCUS

12.4.3 MANUFACTURING FOOTPRINT

12.4.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.5 COMPANY EVALUATION MATRIX

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 37 DIGITAL PRINTERS MARKET: COMPANY EVALUATION MATRIX, 2020

12.6 STARTUP/SME EVALUATION MATRIX, 2020

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 38 DIGITAL PRINTERS MARKET: STARTUP/SME EVALUATION MATRIX, 2020

12.7 COMPANY FOOTPRINT

TABLE 135 REGIONAL FOOTPRINT OF COMPANIES

TABLE 136 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 137 PRODUCT FOOTPRINT OF COMPANIES

TABLE 138 COMPANY FOOTPRINT

12.8 COMPETITIVE SITUATIONS AND TRENDS

12.8.1 PRODUCT LAUNCHES

12.8.2 DEALS

13 COMPANY PROFILES (Page No. - 145)

(Business Overview, Products Portfolio, Recent Developments, and MnM View)*

13.1 PRINTER MANUFACTURER

13.1.1 HEWLETT-PACKARD DEVELOPMENT COMPANY, L.P.

TABLE 139 HEWLETT-PACKARD DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT

FIGURE 39 HEWLETT-PACKARD DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT

13.1.2 CANON, INC.

TABLE 140 CANON, INC.: COMPANY SNAPSHOT

FIGURE 40 CANON, INC.: COMPANY SNAPSHOT

13.1.3 RICOH COMPANY, LTD.

TABLE 141 RICOH COMPANY, LTD.: COMPANY SNAPSHOT

FIGURE 41 RICOH COMPANY, LTD.: COMPANY SNAPSHOT

13.1.4 MIMAKI ENGINEERING CO., LTD.

TABLE 142 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

FIGURE 42 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

13.1.5 ROLAND DG CORPORATION

TABLE 143 ROLAND DG CORPORATION: COMPANY SNAPSHOT

FIGURE 43 ROLAND DG CORPORATION: COMPANY SNAPSHOT

13.1.6 XEROX CORPORATION

TABLE 144 XEROX CORPORATION: COMPANY SNAPSHOT

FIGURE 44 XEROX: COMPANY SNAPSHOT

13.1.7 SEIKO EPSON CORPORATION

TABLE 145 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

FIGURE 45 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

13.1.8 DURST PHOTOTECHNIK AG

TABLE 146 DURST PHOTOTECHNIK AG: COMPANY SNAPSHOT

13.1.9 ELECTRONICS FOR IMAGING, INC.

TABLE 147 ELECTRONICS FOR IMAGING, INC.: COMPANY SNAPSHOT

13.1.10 INCA DIGITAL PRINTERS LIMITED

TABLE 148 INCA DIGITAL PRINTERS LIMITED.: COMPANY SNAPSHOT

13.2 OTHER COMPANIES

13.2.1 PRINTRONIX

13.2.2 BROTHER INDUSTRIES, LTD.

13.2.3 OKI ELECTRIC INDUSTRY

13.2.4 KYOCERA CORPORATION

13.2.5 TOSHIBA

13.2.6 SAMSUNG ELECTRONICS

13.2.7 KONICA MINOLTA

13.2.8 SHARP

13.2.9 PANASONIC

13.2.10 GCC

13.2.11 ID TECHNOLOGY

13.2.12 NEURALABEL PRINTING SOLUTIONS

13.2.13 DALEMARK INDUSTRIES

13.2.14 INKCUPS

13.2.15 RENA SYSTEMS

13.3 INK MANUFACTURER

13.3.1 DIC CORPORATION

TABLE 149 DIC CORPORATION.: COMPANY SNAPSHOT

FIGURE 46 DIC CORPORATION: COMPANY SNAPSHOT

13.3.2 FLINT GROUP

TABLE 150 FLINT GROUP: COMPANY SNAPSHOT

13.3.3 TOYO INK SC HOLDINGS CO., LTD.

TABLE 151 TOYO INK SC HOLDINGS CO., LTD.: COMPANY SNAPSHOT

FIGURE 47 TOYO INK SC HOLDINGS CO., LTD.: COMPANY SNAPSHOT

13.3.4 SIEGWERK DRUCKFARBEN AG & CO. KGAA

TABLE 152 SIEGWERK DRUCKFARBEN AG & CO. KGAA: COMPANY SNAPSHOT

13.3.5 SAKATA INX CORPORATION

TABLE 153 SAKATA INX CORPORATION: COMPANY SNAPSHOT

FIGURE 48 SAKATA INX CORPORATION: COMPANY SNAPSHOT

13.3.6 T&K TOKA CO., LTD.

TABLE 154 T&K TOKA CO., LTD.: COMPANY SNAPSHOT

13.3.7 HUBERGROUP DEUTSCHLAND GMBH

TABLE 155 HUBERGROUP DEUTSCHLAND GMBH.: COMPANY SNAPSHOT

13.3.8 SICPA HOLDING SA

TABLE 156 SICPA HOLDING SA: COMPANY SNAPSHOT

13.3.9 ALTANA AG

TABLE 157 ALTANA AG: COMPANY SNAPSHOT

13.3.10 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.

TABLE 158 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY SNAPSHOT

FIGURE 49 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY SNAPSHOT

* Business Overview, Products Portfolio, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 206)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Printing Market

Hi, I am Looking for digital printing trends

Trying to understand the Digital Printing market better to see how technology services can be leveraged