Phase Transfer Catalyst Market by Type (Ammonium Salts, Phosphonium Salts), End-use Industry (Pharmaceuticals, Agrochemicals), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Global Forecast to 2023

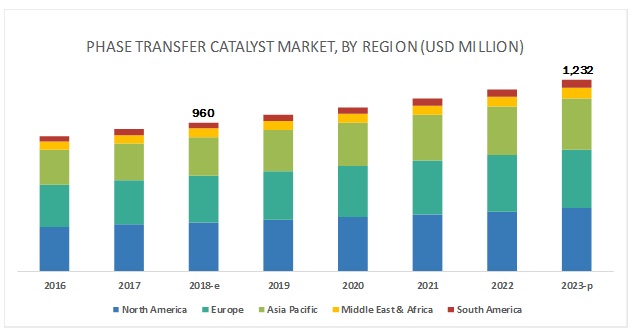

[98 Pages Report] The phase transfer catalyst market is projected to grow from USD 960 million in 2018 to USD 1,232 million by 2023, at a Compound Annual Growth Rate (CAGR) of 5.1% during the forecast period from 2018 to 2023. Rising demand and adoption of green chemistry in organic synthesis is the major factor driving the growth of the phase transfer catalyst market across the globe.

Based on type, the phosphonium salts segment is projected to be one of the largest contributors to the phase transfer catalyst market during the forecast period.

Phosphonium salts are a major type of quaternary onium salts. The phosphonium salts segment is projected to be second-largest type segment of the phase transfer catalyst market from 2018 to 2023. These salts are ionic compounds with the formula (R)4P+, where R is an organic group. Phosphonium salts are capable of tolerating high temperatures fluctuations. Methyl triphenyl phosphonium bromide, methyl triphenyl phosphonium chloride, ethyl triphenyl phosphonium bromide, ethyl triphenyl phosphonium chloride, and benzyl triphenyl phosphonium chloride are some of the phosphonium salts used as phase transfer catalysts. Phosphonium salts are expensive as compared to ammonium salts.

Based on end-use industry, the pharmaceuticals segment of the phase transfer catalyst market is projected to grow at the highest CAGR from 2018 to 2023.

In the pharmaceuticals industry, compounds used for drugs are generally complex multifunctional molecules, which are built up by a sequence of chemical reactions. Phase transfer catalysts are used in the pharmaceuticals industry in synthesis, R&D, drug formulation, and laboratory applications. Moreover, the imposition of stringent regulations in the western regions on the use of harmful compounds in the pharmaceuticals industry is also leading to the increased consumption of phase transfer catalysts in the pharmaceuticals industry as they eliminate the requirement of using organic solvents and dangerous, inconvenient, and expensive reactants. These catalysts also reduce the generation of industrial wastes. The pharmaceuticals segment of the phase transfer catalyst market is projected to witness significant growth in the Asia Pacific region during the forecast period due to increased demand for these catalysts from emerging economies of the region.

The Asia Pacific phase transfer catalyst market is projected to grow at the highest CAGR during the forecast period.

The growth of the Asia Pacific phase transfer catalyst market is driven by the increased demand for these catalysts from countries such as China, Japan, Australia, South Korea, and India. Ongoing industrialization and flourishing end-use industries such as pharmaceuticals and agrochemicals in emerging economies such as China and India are also driving the growth of the phase transfer catalyst market in the Asia Pacific region.

Key Market Players

SACHEM Inc. (US), Tokyo Chemical Industry Co., Ltd. (Japan), Nippon Chemical Industrial Co., Ltd. (Japan), Dishman Group (India), PAT IMPEX (India), Tatva Chintan Pharma Chem Pvt. Ltd. (India), Central Drug House (P) Ltd. (India), Pacific Organics Private Limited (India), Otto Chemie Pvt. Ltd. (India), and Volant-Chem Corp. (China) are the key players operating in the phase transfer catalyst market.

Scope of the Report:

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD million) |

|

Segments covered |

Type, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

SACHEM Inc. (US), Tokyo Chemical Industry Co., Ltd. (Japan), Nippon Chemical Industrial Co., Ltd. (Japan), Dishman Group (India), PAT IMPEX (India), Tatva Chintan Pharma Chem Pvt. Ltd. (India), Central Drug House (P) Ltd. (India), Pacific Organics Private Limited (India), Otto Chemie Pvt. Ltd. (India), and Volant-Chem Corp. (China) |

This research report categorizes the phase transfer catalyst market based on type, end-use industry, and region.

On the basis of type, the phase transfer catalyst market has been segmented as follows:

- Ammonium Salts

- Phosphonium Salts

- Others (Crown Ethers and Cryptands)

On the basis of end-use Industry, the phase transfer catalyst market has been segmented as follows:

- Pharmaceuticals

- Agrochemicals

- Others (Chemical and Cosmetics)

On the basis of region, the phase transfer catalyst market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

In 2012, SACHEM, Inc. introduced Salego BASE 1000 series, which are used as phase transfer catalysts in the pharmaceuticals industry. This launch helped the company in meeting the increased demand for organic synthesis manufacturing techniques in the pharmaceuticals industry.

Key Questions Addressed by the Report

- What are the future revenue pockets for the phase transfer catalyst market?

- What will be the future product mix of the phase transfer catalyst market?

- What are the prime strategies adopted by leaders in the phase transfer catalyst market?

- Which key developments are expected to have a long-term impact on the phase transfer catalyst market?

- How is the current regulatory framework expected to impact the growth of the phase transfer catalyst market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations of the Study

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Phase Transfer Catalyst Market

4.2 Market, By Region

4.3 North America Phase Transfer Catalyst Market, By Type and Country

4.4 Market: Major Countries

4.5 Phase Transfer Catalyst Market, By End-Use Industry and Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand and Adoption of Green Chemistry in Organic Synthesis

5.2.2 Restraints

5.2.2.1 Availability of Low-Cost Industrial Catalysts

5.2.3 Opportunities

5.2.3.1 Scope for Vertical and Backward Integration in the Market

5.2.4 Challenges

5.2.4.1 Technological Advancements in Chemical Synthesis to Reduce Catalyst Consumption

5.3 Value Chain Analysis

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 Pharmaceuticals

6 Phase Transfer Catalyst Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Ammonium Salts

6.3 Phosphonium Salts

6.4 Others

6.4.1 Crown Ethers

6.4.2 Cryptands

7 Phase Transfer Catalyst Market, By End-Use Industry (Page No. - 43)

7.1 Introduction

7.2 Pharmaceuticals

7.2.1 Active Pharmaceutical Ingredient (API)

7.2.2 Drug Formulation

7.3 Agrochemicals

7.4 Others

8 Regional Analysis (Page No. - 49)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 Italy

8.3.3 UK

8.3.4 Switzerland

8.3.5 France

8.3.6 Spain

8.3.7 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.2 China

8.4.3 India

8.4.4 Australia

8.4.5 South Korea

8.4.6 Rest of Asia Pacific

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 75)

9.1 Overview

9.2 Competitive Leadership Mapping

9.2.1 Progressive Companies

9.2.2 Responsive Companies

9.2.3 Dynamic Companies

9.2.4 Starting Blocks

9.3 Ranking of Key Players, 2018

9.4 Competitive Scenario

9.4.1 New Product Launches

10 Company Profiles (Page No. - 78)

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.1 Sachem Inc.

10.2 Tokyo Chemical Industry Co., Ltd.

10.3 Nippon Chemical Industrial Co., Ltd.

10.4 Dishman Group

10.5 PAT IMPEX

10.6 Tatva Chintan Pharma Chem Pvt. Ltd.

10.7 Central Drug House (P) Ltd.

10.8 Volant-Chem Corp.

10.9 Pacific Organics Private Limited

10.10 Otto Chemie Pvt. Ltd.

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 88)

11.1 Excerpts From Expert Interviews

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (49 Tables)

Table 1 Phase Transfer Catalyst Market Snapshot

Table 2 Market, By Type, 20162023 (USD Million)

Table 3 Ammonium Salts Phase Transfer Catalyst Market, By Region, 20162023 (USD Million)

Table 4 Phosphonium Salts Phase Transfer Catalyst Market, By Region, 20162023 (USD Million)

Table 5 Others Phase Transfer Catalyst Market, By Region, 20162023 (USD Million)

Table 6 Market, By End-Use Industry, 20162023 (USD Million)

Table 7 Phase Transfer Catalyst Market in Pharmaceuticals, By Region, 20162023 (USD Million)

Table 8 Market in Agrochemicals, By Region, 20162023 (USD Million)

Table 9 Phase Transfer Catalyst Market in Others, By Region, 20162023 (USD Million)

Table 10 Market Size, By Region, 20162023 (USD Million)

Table 11 North America By Market Size, By Country, 20162023 (USD Million)

Table 12 North America By Crown Ether Phase Transfer Catalyst Market Size, By Type, 20162023 (USD Million)

Table 13 North America By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 14 US By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 15 Canada By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 16 Mexico By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 17 Europe By Market Size, By Country, 20162023 (USD Million)

Table 18 Europe By Crown Ether Phase Transfer Catalyst Market Size, By Type, 20162023 (USD Million)

Table 19 Europe By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 20 Germany By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 21 Italy By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 22 UK By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 23 Switzerland By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 24 France By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 25 Spain By Crown Ether Phase Transfer Catalyst Market Size, By End-Use Industry, 20162023 (USD Million)

Table 26 Rest of Europe By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 27 Asia Pacific By Market Size, By Country, 20162023 (USD Million)

Table 28 Asia Pacific By Market Size, By Type, 20162023 (USD Million)

Table 29 Asia Pacific By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 30 Japan By Quaternary Ammonium Salts PTC Market Size, By End-Use Industry, 20162023 (USD Million)

Table 31 China By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 32 India By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 33 Australia By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 34 South Korea By Quaternary Ammonium Salts PTC Market Size, By End-Use Industry, 20162023 (USD Million)

Table 35 Rest of Asia Pacific By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 36 Middle East & Africa By Market Size, By Country, 20162023 (USD Million)

Table 37 Middle East & Africa By Quaternary Ammonium Salts PTC Market Size, By Type, 20162023 (USD Million)

Table 38 Middle East & Africa By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 39 Saudi Arabia By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 40 UAE By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 41 South Africa By Market Size, By End-Use Industry, 20162023 (USD Thousand)

Table 42 Rest of the Middle East & Africa By Market Size, By End-Use Industry, 20162023 (USD Thousand)

Table 43 South America By Market Size, By Country, 20162023 (USD Million)

Table 44 South America By Quaternary Ammonium Salts PTC Market Size, By Type, 20162023 (USD Million)

Table 45 South America By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 46 Brazil By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 47 Argentina By Market Size, By End-Use Industry, 20162023 (USD Thousand)

Table 48 Rest of South America By Market Size, By End-Use Industry, 20162023 (USD Thousand)

Table 49 New Product Launches, 2012-2018

List of Figures (33 Figures)

Figure 1 Phase Transfer Catalyst Market: Research Design

Figure 2 Market: Top-Down Approach

Figure 3 Phase Transfer Catalyst Market: Bottom-Up Approach

Figure 4 Market: Data Triangulation

Figure 5 Phase Transfer Catalyst Market, By Type, 2018 & 2023 (USD Million)

Figure 6 Market, By End-Use Industry, 2018 & 2023 (USD Million)

Figure 7 North America Accounted for the Largest Share of the Phase Transfer Catalyst Market in 2017

Figure 8 Increasing Demand for Phase Transfer Catalysts From Various End-Use Industries Projected to Fuel the Growth of the Market

Figure 9 Asia Pacific Phase Transfer Catalyst Market Projected to Grow at the Highest Cagr From 2018 to 2023

Figure 10 Ammonium Salts Segment and the Us Accounted for the Largest Shares of the North America Phase Transfer Catalyst Market in 2017

Figure 11 India Phase Transfer Catalyst Market Projected to Grow at the Highest Cagr From 2018 to 2023

Figure 12 North America to Lead Pharmaceuticals and Agrochemicals Segments of the Market in 2018

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Phase Transfer Catalyst Market

Figure 14 Phase Transfer Catalyst Market Witnesses Oligopoly Competition

Figure 15 Ammonium Salts Projected to Be Largest Type Segment of Phase Transfer Catalyst Market During Forecast Period

Figure 16 Asia Pacific Projected to Lead Ammonium Salts Type Segment From 2018 to 2023

Figure 17 Phosphonium Salts Type Segment Projected to Grow at Highest Cagr in North America During Forecast Period

Figure 18 North America Expected to Lead Others Segment From 2018 to 2023

Figure 19 Pharmaceuticals Projected to Be Largest End-Use Industry Segment During Forecast Period

Figure 20 Pharmaceuticals End-Use Industry Segment in Asia Pacific Expected to Grow at Highest Cagr During Forecast Period

Figure 21 North America Projected to Lead Agrochemicals End-Use Industry Segment During Forecast Period

Figure 22 Others Segment Projected to Grow at Highest Cagr in Europe During Forecast Period

Figure 23 Phase Transfer Catalyst Market in India Expected to Grow at the Highest Rate During the Forecast Period

Figure 24 North America Expected to Lead the Phase Transfer Catalyst Market During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Middle East & Africa: Market Snapshot

Figure 29 South America: Market Snapshot

Figure 30 Phase Transfer Catalyst Market, Competitive Leadership Mapping, 2018

Figure 31 Sachem Inc., Led the Phase Transfer Catalyst Market in 2018

Figure 32 Nippon Chemical Industrial Co., Ltd.: Company Snapshot

Figure 33 Dishman Group: Company Snapshot

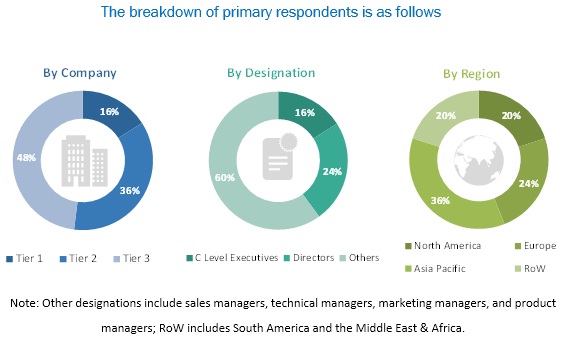

The study involved 4 major activities to estimate the size of the phase transfer catalyst market across the globe. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, market breakdown and data triangulation were used to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to so as to identify and collect information for this study on the phase transfer catalyst market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The phase transfer catalyst market comprised several stakeholders such as raw material suppliers, processors, and end product manufacturers. The demand side of this market was characterized by the development of the pharmaceuticals and agrochemicals industries. The supply side was characterized by the market consolidation activities undertaken by the manufacturers to offer phase transfer catalysts. Various primary sources from both, supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, top-down and bottom-up approaches were used to estimate and validate the overall size of the phase transfer catalyst market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the market were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size-using the market size estimation process explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, demand and supply sides.Report Objectives:

- To estimate and forecast the size of the phase transfer catalyst market in terms of value

- To define, describe, and forecast the phase transfer catalyst market based on type, end-use industry, and region

- To estimate and forecast the size of the phase transfer catalyst market in 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA)

- To identify and analyze the drivers, restraints, challenges, and opportunities influencing the growth of the phase transfer catalyst market

- To profile key players in the phase transfer catalyst market and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the phase transfer catalyst market, along with an analysis of business and corporate strategies such as new product launches, mergers, agreements, partnerships, and collaborations adopted by key market players

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Europe phase transfer catalyst market into Russia and the Netherlands

- Further breakdown of the Asia Pacific phase transfer catalyst market into Indonesia and Malaysia

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Phase Transfer Catalyst Market