Photoresist & Photoresist Ancillaries Market by Photoresist Type (ArF Immersion, ArF Dry Film, KrF, G-line & I-line), Ancillary Type (Anti-reflective Coating, Remover, Developer), Application (Semiconductor & IC, LCD, ), Region - Global Forecast to 2028

Photoresist Market

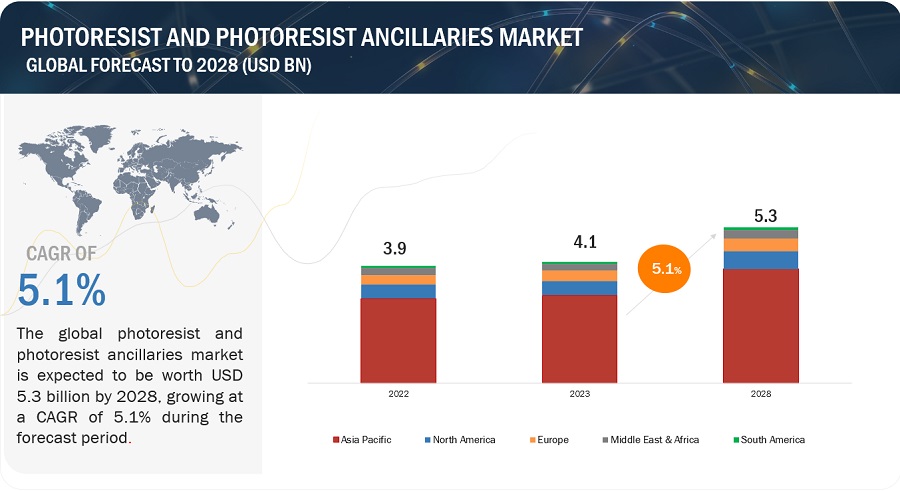

The global photoresist market is valued at USD 4.1 billion in 2023 and is projected to reach USD 5.3 billion by 2028, growing at a cagr 5.1% from 2023 to 2028. A photoresist is a light sensitive material composed of adhesive agents, sensitizers, and solvents. Adhesives are used to control the thermal property of the resist. The sensitizers define the photosensitivity of the resist, and solvents define the viscosity of the resist. A photoresist is mainly used in designing circuits. The process of using photoresist in designing circuits is known as photolithography, which is one of the patterning methods of semiconductor fabrication. The applications of photoresist and photoresist ancillaries are semiconductors & ICs, LCDs, PCBs, MEMs, and sensors. There are five main types of photoresists: ArF immersion, ArF dry, KrF, I-line, and G-line.

Attractive Opportunities in the Photoresist and Photoresist Ancillaries Market

To know about the assumptions considered for the study, Request for Free Sample Report

Photoresist and Photoresist Ancillaries Market Dynamics

Driver: Rapidly growing consumer electronics industry to boost growth.

The consumer electronics industry is one of the major application areas of printed circuit boards (PCB)s. The printed circuit board (PCB) is used to mechanically support and interconnect electrical and electronic components using conductive pathways, tracks, or track signals from copper sheets onto non-conductive substrates. The photoresist material is a key material used in the fabrication of PCBs. PCBs are used across various applications including medical devices, LEDs, consumer electronics, industrial equipment, aerospace components, safety and security equipment, telecom equipment, and others.

Restraint: Regulations associated with the environment

Photoresists decompose into low-molecular weight compounds after being exposed to light, including the carrier solvents and phenol, cresol, benzene, toluene, xylene, and other benzene-based aromatic chemicals. Benzene is recognized to have harmful impacts on human health and the environment. The environmental concern about negative impact further leads to imposition of rules and regulations established by bodies such as the EPA and REACH. This environmental concern acts as a major market restraint.

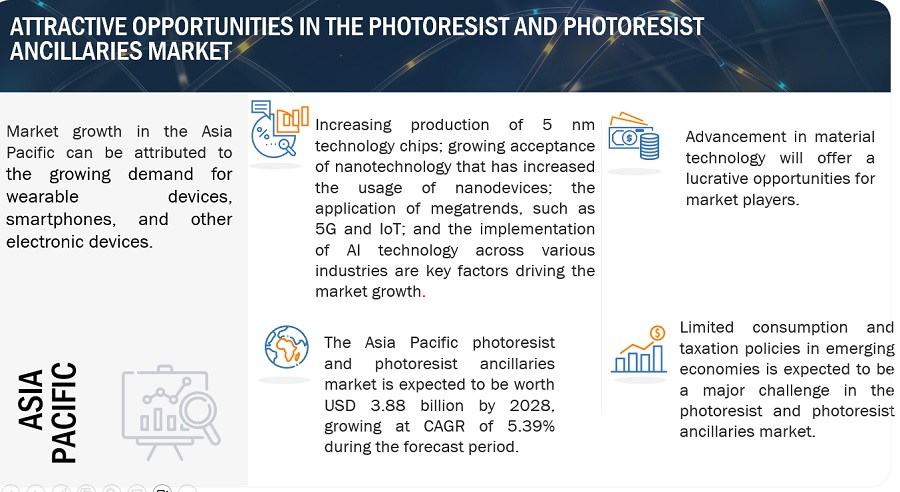

Opportunities: Upcoming technologies such as AI and IoT

The advent of new technologies such as IoT (Internet of Things) and AI (Artificial Intelligence) have created a new product subcategory of intelligent home devices. The use of AI-related technology has opened a myriad of opportunities for electronic materials manufacturers. Technology transitions such as AI and IoT are driving the fast adoption of electronic devices. All these technological advancements require compact PCB designs and hence aid in driving the growth of the photoresist and photoresist ancillaries market.

Challenges : High Cost

The major factor challenging the photoresist and photoresist ancillaries market growth is the cost associated with the photoresist materials in the lithography process. The cost varies as per the complexity of logic in ICs, and the cost depends on the layout along with edge placement error. The layout and edge positioning accuracy affect the pricing. The cost of photoresist is higher since it requires more technology and is harder to use. In certain countries, increasing tax rates also raise the price of photoresist.

Ecosystem

By Photoresist Type, the Arf immersion segment accounted for the largest share during the forecast period

The ArF immersion segment accounted for the largest share in 2022. ArF immersion has the smallest wavelength among all the photoresist types due to which they are suitable for designing small circuits. ArF immersion is used for designing small and more complex circuits. The demand for wearable and small devices is increasing, which is acting as a key driver for the consumption of this type of photoresist. The ArF dry segment is projected to register a CAGR of 5.40% between 2023 and 2028, in terms of value.

By Photoresist Ancillaries Type, the anti-reflective coatings segment accounted for the largest share during the forecast period

Anti-reflective coatings are utilized in the lithography process to improve the photoresist profile and reduce the line width variation caused by scattering and reflecting light. The use of anti-reflective coatings helps improve process operating windows and leads to increased yields while providing cost-effective solutions for advanced semiconductors.

By Application, the semiconductors & ICS segment accounted for the largest share during the forecast period

Semiconductor & ICs is the largest application of photoresist and photoresist ancillaries. Due to the upcoming megatrends, such as 5G, IoT, and AI, the demand for more advance and cutting-edge chips or ICs has increased. This has driven the consumption of photoresist for pattern etching that has led this application segment to acquire a significant share in the photoresist and photoresist ancillaries market.

To know about the assumptions considered for the study, download the pdf brochure

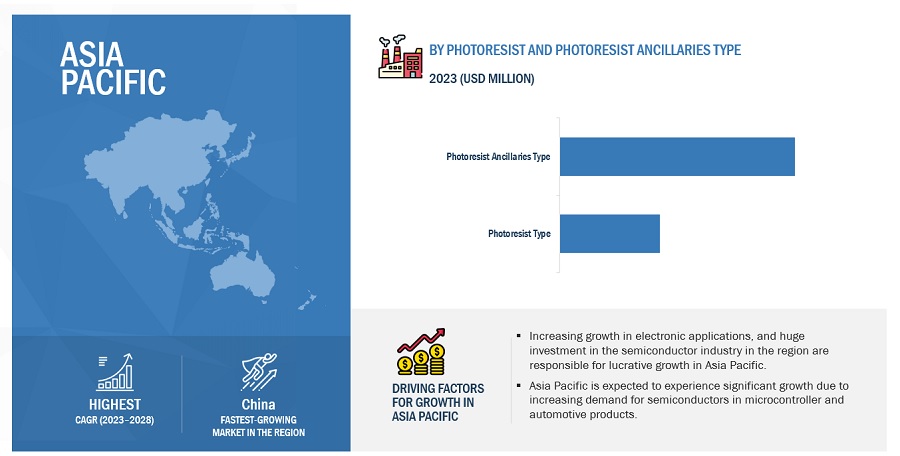

China is projected to account for the highest CAGR in Asia Pacific region in the photoresist and photoresist ancillaries market during the forecast period

The Chinese semiconductors market is growing at a higher rate than that of the global market. China is the largest market for semiconductors & ICs globally. It holds a market share of approximately 45% of the demand for silicon chips worldwide. The major application of these chips is in the manufacturing of ICs. Investments from companies, such as Qualcomm and Intel, which are the world’s leading mobile chip and modem manufacturers, will further drive the market in the country.

Key Market Players

Photoresist and photoresist ancillaries comprise of major manufacturers such as JSR Corporation (Japan), Tokyo Ohka Kogyo Co., Ltd. (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Fujifilm Corporation (Japan), and Sumitomo Chemical Co., Ltd. (Japan) were the leading players in the photoresist and photoresist ancillaries market.

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion), and Volume (Ton) |

|

Segments |

Photoresist Market By Type, Photoresist Ancillaries Market By Type, By Application, and Region |

|

Regions |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

The major players are Tokyo Ohka Kogyo Co., Ltd (Japan), JSR Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Shin-Etsu Chemical Co., Ltd (Japan), Fujifilm Corporation (Japan), and others are covered in the photoresist and photoresist ancillaries market. |

This research report categorizes the global photoresist and photoresist ancillaries market on the basis of Material, End-use industry, and Region.

Photoresist Market, By Type

- ArF Immersion Photoresist

- ArF Dry Photoresist

- KrF Photoresist

- G-line & I-line Photoresist

Photoresist Ancillaries Market: By Type

- Anti-reflective Coatings

- Remover

- Developer

- Others (Primers or Adhesion Promoters and Thinners)

Photoresist and photoresist ancillaries Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In August 2022, JSR Corporation signed an investment agreement for the establishment of a subsidiary in the area of Shanghai. This is done to strengthen JSR Group's business operations in the Chinese market regarding semiconductor materials.

- In September 2021, JSR Corporation launched a subsidiary in Singapore called "JSR Electronic Materials Singapore Pte. Ltd." in order to boost the sales and marketing efforts of the semiconductor materials business in Singapore and Southeast Asia. With the creation of the subsidiary, the company will improve its regional marketing and customer service skills in Southeast Asia, which will result in an increase in the client and product base.

- In October 2020, The Tokyo-based Shin-Etsu Chemical Co., Ltd., announced plans to invest 30 billion yen (USD 280 million) in new facilities at its manufacturing facilities for photoresists in Taiwan and Japan. Shin-Etsu will keep investing in facilities to keep up with the rising demand for photoresists, which are crucial in the production of cutting-edge semiconductors.

- In July 2020, TOK advanced materials have started the production of extreme ultraviolet (EUV) in its facility at Songdo, Incheon, South Korea. The step has been taken to serve Samsung electronics as it has increased the use of EUV-based lithography for chip production.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Photoresist and photoresist ancillaries Market?

The major drivers influencing the growth of the Photoresist and photoresist ancillaries market are the rapidly growing consumer electronics industry, growth of automotive industries, and the growth in 5G infrastructure

What are the major challenges in the photoresist and photoresist ancillaries Market?

The major challenge in the photoresist and photoresist ancillaries market are the high cost and the constantly changing market dynamics.

What are the restraining factors in the photoresist and photoresist ancillaries Market?

The major restraining factor faced by the photoresist and photoresist ancillaries market is the regulations associated with the environment.

What is the key opportunity in the Photoresist and photoresist ancillaries Market?

Upcoming technologies such as AI and IoT and advancements in technology are the key opportunity for the Photoresist and photoresist ancillaries market.

What are the different photoresist and ancillaries materials used in the Photoresist and photoresist ancillaries?

Arf immersion, Krf, Arf dry, I-Line, G-Line, anti-reflective coatings, removers, developers etc. are some of the materials used in photoresist and photoresist ancillaries market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapidly growing consumer electronics industry- Increasing demand for nanodevices and miniaturization of electronic devices- Growth of automotive sector- Development of 5G infrastructureRESTRAINTS- Implementation of stringent environmental regulations- Limited consumption in emerging economiesOPPORTUNITIES- Adoption of upcoming technologies such as AI and IoT- Advancements in material technology- Growing applications in healthcare sectorCHALLENGES- High cost associated with photoresist materials- Limited availability of skilled professionals- Changing market dynamics

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.5 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECAST

-

6.6 ECOSYSTEM MAPPING

-

6.7 CASE STUDY ANALYSISUSE OF OLEOPHOBIC PHOTORESIST IN PHOTOLITHOGRAPHY PROCESSUSE OF PHOTORESISTS IN MINIATURIZED ELECTROMECHANICAL APPLICATIONS

-

6.8 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSTOP APPLICANTS

-

6.9 TECHNOLOGY ANALYSISQUANTUM DOTSPHOTOLITHOGRAPHYEXTREME ULTRAVIOLET LITHOGRAPHYELECTRON BEAM LITHOGRAPHY

-

6.10 REGULATORY LANDSCAPEOCCUPATIONAL SAFETY AND HEALTH ADMINISTRATIONEUROPEAN COMMITTEE FOR STANDARDIZATIONREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY PHOTORESIST TYPE

- 6.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

- 7.2 ANTIREFLECTIVE COATINGS

- 7.3 REMOVERS

- 7.4 DEVELOPERS

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

- 8.2 ARF IMMERSION

- 8.3 ARF DRY

- 8.4 KRF

- 8.5 G-LINE AND I-LINE

- 9.1 INTRODUCTION

-

9.2 SEMICONDUCTORS & ICSGROWING DEMAND FOR CONSUMER ELECTRONICS TO DRIVE MARKET

-

9.3 LCDSUSE OF PHOTORESISTS FOR COLOR FILTERING AND PATTERNING TO DRIVE MARKET

-

9.4 PRINTED CIRCUIT BOARDSTREND OF COMPACT DEVICES AND EV AUTOMOBILES TO FUEL DEMAND FOR SMALLER PCBS

- 9.5 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICTAIWAN- Increased production and presence of major end users to drive marketCHINA- Government initiatives for domestic semiconductor production to drive marketJAPAN- Presence of leading photoresist manufacturing companies to drive marketSOUTH KOREA- Steady growth of semiconductor and electronics industries to drive marketSINGAPORE- High investment in electronic industry to drive demand for photoresist ancillariesTHAILAND- Growth of electronics sector to drive marketMALAYSIA- High demand for semiconductors in electronics and electrical companies to fuel marketREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Growth of semiconductor industry to drive marketCANADA- Innovation in telecommunication industry to drive marketMEXICO- High demand for printed circuit boards to drive market

-

10.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- Growth of electronics and automotive sectors to boost marketFRANCE- Investments in electronics sector to fuel marketUK- Growth of power electronics companies to drive marketIRELAND- Foreign investments in electronics sector to fuel marketREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAISRAEL- Presence of local and international chip manufacturers to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Growth of semiconductor and electronics sector to drive marketARGENTINA- Increasing penetration of 4G and use of smartphone to drive marketREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

11.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.6 SME/STARTUP MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSJSR CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOKYO OHKA KOGYO CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewSHIN-ETSU CHEMICAL CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJIFILM CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUMITOMO CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUPONT DE NEMOURS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALLRESIST- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 OTHER PLAYERSMICRO RESIST TECHNOLOGY GMBHDJ MICROLAMINATESLG CHEMKEMLAB INC.ETERNAL MATERIALS CO., LTD.EVERLIGHT CHEMICAL INDUSTRIAL CO.IKONICSLAM RESEARCH CORP. ?HONSHU CHEMICAL INDUSTRY CO., LTD.PHICHEM AMERICASHENZHEN RONGDA PHOTOSENSITIVE SCIENCE & TECHNOLOGY CO., LTD.KLA CORPORATIONAGC INC.APPLIED MATERIALS, INC.JIANGSU NANDA OPTOELECTRONIC MATERIALS CO., LTD.HTP HITECH PHOTOPOLYMERE AGKOLON INDUSTRIES, INC.

- 13.1 INTRODUCTION

- 13.2 METHODOLOGY LIMITATIONS

-

13.3 ELECTRONIC CHEMICALS AND MATERIALS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 13.4 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY TYPE

- 13.5 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY APPLICATION

- 13.6 ELECTRONIC CHEMICALS AND MATERIALS, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EXPOSURE REGULATIONS

- TABLE 6 AVERAGE SELLING PRICE, BY PHOTORESIST TYPE (USD/KG)

- TABLE 7 PHOTORESISTS AND PHOTORESIST ANCILLARIES MARKET: KEY CONFERENCES AND EVENTS

- TABLE 8 KEY STAKEHOLDERS

- TABLE 9 KEY BUYING CRITERIA

- TABLE 10 PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 13 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 14 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY REGION, 2021–2028 (TON)

- TABLE 16 ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 18 ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 21 ASIA PACIFIC: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 23 TAIWAN: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 24 TAIWAN: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 TAIWAN: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 26 TAIWAN: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 27 TAIWAN: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 28 CHINA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 29 CHINA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 30 CHINA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 31 CHINA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 32 CHINA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 33 JAPAN: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 34 JAPAN: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 35 JAPAN: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 36 JAPAN: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 JAPAN: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 38 SOUTH KOREA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 39 SOUTH KOREA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 SOUTH KOREA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 41 SOUTH KOREA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 SOUTH KOREA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 SINGAPORE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 44 SINGAPORE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 SINGAPORE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 46 SINGAPORE: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 SINGAPORE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 THAILAND: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 49 THAILAND: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 THAILAND: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 51 THAILAND: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 THAILAND: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 MALAYSIA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 54 MALAYSIA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 MALAYSIA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 56 MALAYSIA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 MALAYSIA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 61 REST OF ASIA PACIFIC: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 65 NORTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 68 NORTH AMERICA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 US: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 71 US: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 US: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 73 US: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 US: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 CANADA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 76 CANADA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 CANADA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 78 CANADA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 CANADA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 MEXICO: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 81 MEXICO: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 MEXICO: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 83 MEXICO: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 MEXICO: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 87 EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 EUROPE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 EUROPE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 90 EUROPE: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 92 GERMANY: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 GERMANY: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 GERMANY: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 95 GERMANY: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 GERMANY: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 97 FRANCE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 FRANCE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 FRANCE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 100 FRANCE: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 FRANCE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 UK: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 UK: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 UK: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 105 UK: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 UK: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 IRELAND: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 IRELAND: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 IRELAND: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 110 IRELAND: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 IRELAND: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 115 REST OF EUROPE: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 119 MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 122 MIDDLE EAST & AFRICA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 ISRAEL: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 125 ISRAEL: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 ISRAEL: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 127 ISRAEL: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 ISRAEL: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2021–2028 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 136 SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 SOUTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 139 SOUTH AMERICA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 141 BRAZIL: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 BRAZIL: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 BRAZIL: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 144 BRAZIL: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 BRAZIL: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 146 ARGENTINA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 ARGENTINA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 ARGENTINA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 149 ARGENTINA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 ARGENTINA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 REST OF SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: PHOTORESIST MARKET, BY TYPE, 2021–2028 (TON)

- TABLE 154 REST OF SOUTH AMERICA: PHOTORESIST ANCILLARIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 156 KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN 2020 AND 2023

- TABLE 157 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 158 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: KEY PLAYERS

- TABLE 159 DEALS, 2020–2023

- TABLE 160 PRODUCT LAUNCHES, 2020–2023

- TABLE 161 OTHER DEVELOPMENTS, 2020–2023

- TABLE 162 JSR CORPORATION: BUSINESS OVERVIEW

- TABLE 163 JSR CORPORATION: DEALS

- TABLE 164 JSR CORPORATION: OTHERS

- TABLE 165 TOKYO OHKA KOGYO CO., LTD.: BUSINESS OVERVIEW

- TABLE 166 TOKYO OHKA KOGYO CO., LTD.: OTHERS

- TABLE 167 SHIN-ETSU CHEMICAL CO. LTD.: BUSINESS OVERVIEW

- TABLE 168 SHIN-ETSU CHEMICAL CO. LTD.: OTHERS

- TABLE 169 FUJIFILM CORPORATION: BUSINESS OVERVIEW

- TABLE 170 FUJIFILM CORPORATION: DEALS

- TABLE 171 FUJIFILM CORPORATION: OTHERS

- TABLE 172 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 173 SUMITOMO CHEMICAL CO., LTD: OTHERS

- TABLE 174 MERCK GROUP: BUSINESS OVERVIEW

- TABLE 175 MERCK GROUP: PRODUCT LAUNCH

- TABLE 176 DUPONT DE NEMOURS, INC.: BUSINESS OVERVIEW

- TABLE 177 DUPONT DE NEMOURS, INC.: PRODUCT LAUNCH

- TABLE 178 DUPONT DE NEMOURS, INC.: OTHERS

- TABLE 179 ALLRESIST: BUSINESS OVERVIEW

- TABLE 180 MICRO RESIST TECHNOLOGY GMBH: COMPANY OVERVIEW

- TABLE 181 DJ MICROLAMINATES: COMPANY OVERVIEW

- TABLE 182 LG CHEM: COMPANY OVERVIEW

- TABLE 183 KEMLAB INC.: COMPANY OVERVIEW

- TABLE 184 ETERNAL MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 185 EVERLIGHT CHEMICAL INDUSTRIAL CO.: COMPANY OVERVIEW

- TABLE 186 IKONICS: COMPANY OVERVIEW

- TABLE 187 LAM RESEARCH CORP. ?: COMPANY OVERVIEW

- TABLE 188 HONSHU CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 189 PHICHEM AMERICA: COMPANY OVERVIEW

- TABLE 190 SHENZHEN RONGDA PHOTOSENSITIVE SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 191 KLA CORPORATION: COMPANY OVERVIEW

- TABLE 192 AGC INC.: COMPANY OVERVIEW

- TABLE 193 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 194 JIANGSU NANDA OPTOELECTRONIC MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 195 HTP HITECH PHOTOPOLYMERE AG: COMPANY OVERVIEW

- TABLE 196 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 197 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

- TABLE 198 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

- TABLE 199 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET SEGMENTATION

- FIGURE 2 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, BY REGION

- FIGURE 3 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: DATA TRIANGULATION

- FIGURE 7 ARF IMMERSION TO BE LARGEST TYPE OF PHOTORESIST DURING FORECAST PERIOD

- FIGURE 8 ANTIREFLECTIVE COATINGS TO BE LARGEST MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 9 SEMICONDUCTOR & ICS TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 GROWING DEMAND FOR SEMICONDUCTORS & ICS TO DRIVE MARKET

- FIGURE 12 SEMICONDUCTORS & ICS APPLICATION AND CHINA ACCOUNTED FOR LARGEST SHARES IN TERMS OF VOLUME

- FIGURE 13 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 GLOBAL AUTOMOBILE PRODUCTION (UNITS)

- FIGURE 16 VALUE CHAIN ANALYSIS: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET

- FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET

- FIGURE 18 REVENUE SHIFT FOR PHOTORESIST AND PHOTORESIST ANCILLARIES MANUFACTURERS

- FIGURE 19 KEY STAKEHOLDERS IN PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET

- FIGURE 20 GRANTED PATENTS, 2018 TO 2022

- FIGURE 21 PUBLICATION TRENDS, 2018-2022

- FIGURE 22 JURISDICTION ANALYSIS

- FIGURE 23 TOP 10 APPLICANTS WITH HIGHEST PATENT COUNT

- FIGURE 24 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 26 KEY BUYING CRITERIA FOR PHOTORESISTS AND PHOTORESIST ANCILLARIES

- FIGURE 27 ANTIREFLECTIVE COATINGS TO LEAD PHOTORESIST ANCILLARIES MARKET DURING FORECAST PERIOD

- FIGURE 28 ARF IMMERSION TO BE LARGEST MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 29 SEMICONDUCTORS & ICS APPLICATION TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 30 CHINA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET SNAPSHOT

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 35 FOUR-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 36 COMPANY EVALUATION MATRIX: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2022

- FIGURE 37 SME/STARTUP MATRIX: PHOTORESIST AND PHOTORESIST ANCILLARIES MARKET, 2022

- FIGURE 38 JSR CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 TOKYO OHKA KOGYO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 40 SHIN-ETSU CHEMICAL CO. LTD.: COMPANY SNAPSHOT

- FIGURE 41 FUJIFILM CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 MERCK GROUP: COMPANY SNAPSHOT

- FIGURE 44 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the photoresist and photoresist ancillaries market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The photoresist and photoresist ancillaries market comprise of several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the photoresist and photoresist ancillaries market. Primary sources from the supply side include associations and institutions involved in the photoresist and photoresist ancillaries industry, key opinion leaders, and processing players.

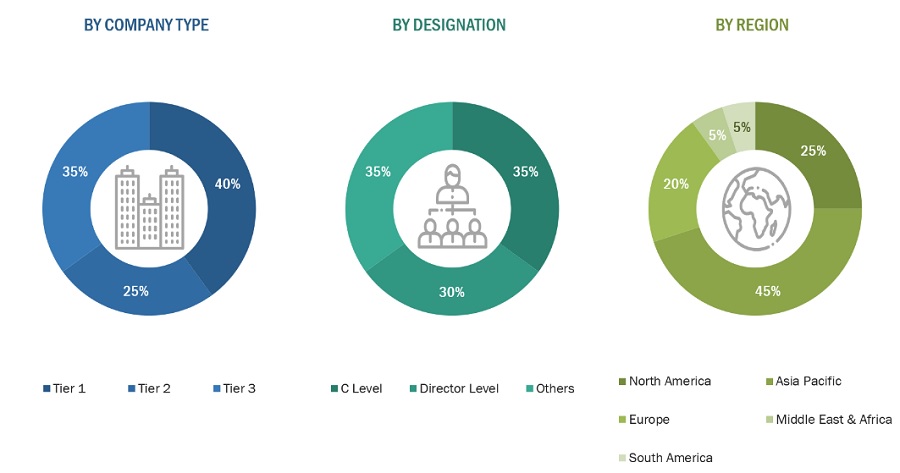

Following is the breakdown of primary respondents—

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global photoresist and photoresist ancillaries market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The Photoresist and photoresist ancillaries market refers to the industry that produces and supplies photoresist and photoresist ancillaries materials and products. In order to properly print and etch substrates during the production of integrated circuits and electronic devices, photoresists, which are light-sensitive materials, are utilized in the semiconductor and microelectronics industries. When these materials are exposed to light, a chemical transformation occurs that allows precise pattern transfer. In order to improve the lithographic process, photoresist ancillaries are complimentary materials and chemicals utilized with photoresists. Primer, anti-reflective coatings (ARCs), developers, adhesion promoters, solvents, strippers, and post-processing chemicals are just a few examples of the numerous items available on the market for photoresist ancillaries.

Key Stakeholders

- Raw material suppliers

- Photoresist and photoresist ancillaries material manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, describe, and forecast the global photoresist and photoresist ancillaries market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based photoresist market by type, photoresist ancillaries by type, and application.

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the Asia Pacific photoresist and photoresist ancillaries market

- Further breakdown of the Rest of Europe's photoresist and photoresist ancillaries market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Photoresist & Photoresist Ancillaries Market