Phycocyanin Market Form (Dry and Liquid), Grade (Phycocyanin E18, Phycocyanin E25, and Phycocyanin E3.0) Application (Food, Beverages, Nutraceuticals, Cosmetics & Personal Care, and Animal Feed), Nature (Organic and Conventional) and Key Region - Forecasted to 2027

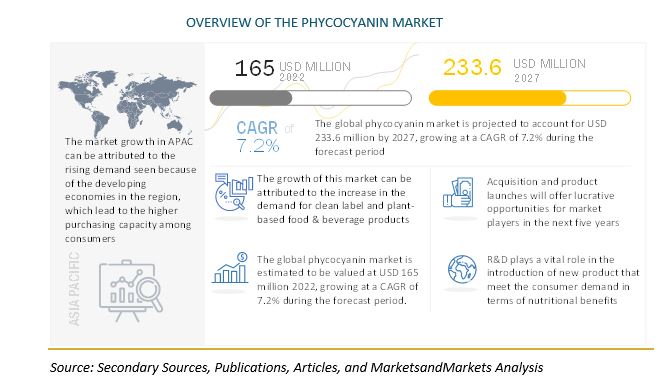

According to MarketsandMarkets, the global phycocyanin market is estimated to be valued at USD 165.0 million in 2022. It is projected to reach USD 233.6 million by 2027, with a CAGR of 7.2%, in terms of value between 2022 and 2027. The growth in this market is attributed to increase in usage of phycocyanin in nutritional products, rise in investment by the key players in the food colors segment, rising demand for natural blue colorant, and consumer inclination towards natural and clean-label ingredients over synthetic ingredients.

Phycocyanin Market Dynamics

Drivers: Growing demand for natural and clean-label products

The demand for food with natural ingredients and clean labels is increasing in almost all regions, owing to the increasing health awareness, increasing spending power of consumers, and increasing food adulteration instances. Hence, manufacturers are focusing on expanding their natural food & beverage portfolio.

Restraints: High cost and limited raw material availability

Many natural food ingredients are sourced from crops. Limited availability of such raw materials is a key factor causing an increase in the prices of ingredients sourced from them. Farmers are adopting new practices such as precision farming to increase the production of crops to source ingredients. The availability of raw materials for natural food ingredients is subject to seasonal changes.

Opportunities: Multifunctional properties

The food colors segment growth has further scope for development by inducing multifunctionality in the products. Besides imparting only color to food products, food colors with health benefits or flavor infusions are expected to be the future trends in the market. The demand for sugar-free products is rising across the globe due to growing concerns about diabetes and obesity. The Nutrition Facts labeling mandate imposed by the FDA for packaged food requires declaring of added sugar on the product. Some natural food colors that are derived from fruit or vegetable sources contain some amount of sugar. Infusing such colors into food products is considered as added sugar. Hence, the launch of natural food colors with no sugar content offers opportunities for market growth.

Challenges: Lack of consistency in regulations pretending to various ingredients

The natural food colors industry faces a legal obligation to abide by the norms and standards of various regulatory standards. International bodies such as the National Food Safety and Quality Service (SENASA), Argentina; Canadian Food Inspection Agency (CFIA), Canada; Food and Drug Administration (FDA); World Health Organization (WHO); and Committee on the Environment; Public Health and Food Safety (EU) are associated with food safety and quality regulations. These organizations have control over the usage of different ingredients and chemicals, including bitterness, used in food processing, directly or indirectly.

By application, food & beverage segment accounted for the largest share in the forecast period.

Based on application, the market is segmented into food, beverages, nutraceuticals, cosmetics & personal care, and animal feed. The food & beverage segment dominates the global phycocyanin market. Increasing awareness towards substitute of artificial colors with natural ingredients, consumer inclination towards ready-to-drink beverages, and considering phycocyanin as a super food owing to its rich protein content are expected to drive the demand in food & beverage application.

The dry segment dominates the phycocyanin market

Based on form, the dry segment dominates the market in the forecasted period. The dry segment is the most widely used as it can be easily incorporated into various kinds of products, such as beverages, cosmetics, beauty, and personal care. The dry form is easy to handle for manufacturers and thus expected to dominate the market.

The European market accounted for a significant share in the phycocyanin market. With the increasing consumer demand, food manufacturers have moved toward increased usage of approved natural colors. The technological leadership of the region in several applications of food colors has helped Europe become a dominant market. The drive today is for more authenticity and naturalness, so there is more innovation on natural ‘named’ clean label products.

The development of various food industries such as bakery & confectionery, meat processing, and functional food over the decades and the increasing demand for innovative food colors by food manufacturers drive the market in the European region. The UK, Germany, France, Italy, and Spain, which also have some of the largest food industries in the region, are the leading markets for natural food colors.

Key Market Players:

Key players in this market Chr. Hansen, Cyanotech Corporation, DDW The Color House, GNT Group, Sensient Technologies, Parry Nutraceuticals, Döhler, Naturex (Givaudan), Fraken Biochem, among others.

FAQs:

- Which are the major types considered in this study and which segments are projected to have promising growth rates in the future?

- I am interested in the European market for phycocyanin. Is the customization available for the same? What all information would be included in the same?

- What are some of the opportunities in the phycocyanin market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the company profile section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 PHYCOCYANIN MARKET, BY GRADE

7.1 INTRODUCTION

7.2 PHYCOCYANIN E18

7.3 PHYCOCYANIN E25

7.4 PHYCOCYANIN E3.0

8 PHYCOCYANIN MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 FOOD

8.3 BEVERAGES

8.4 NUTRACEUTICALS

8.5 COSMETICS & PERSONAL CARE

8.6 ANIMAL FEED

9 PHYCOCYANIN MARKET, BY FORM

9.1 INTRODUCTION

9.2 DRY

9.3 LIQUID

10 PHYCOCYANIN MARKET, BY NATURE

10.1 INTRODUCTION

10.2 CONVENTIONAL

10.3 ORGANIC

10 PHYCOCYANIN MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS*

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

12 COMPANY PROFILES

12.1 CHR. HANSEN

12.2 CYANOTECH CORP

12.3 DDW THE COLOUR HOUSE

12.4 GNT GROUP

12.5 SENSIENT TECHNOLOGIES

12.6 PARRY NUTRACEUTICALS

12.7 DOLHER

12.8 NATUREX (GIVAUDAN)

12.9 FRAKEN BIOCHEM

Note: Currently, list of only 9 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Phycocyanin Market