Plant-based Beverages Market by Source (Almond, Soy, Coconut, and Rice), Type (Milk and Other Drinks), Function (Cardiovascular health, Cancer prevention, Lactose intolerance, and Bone health) and Region - Global Forecast to 2023

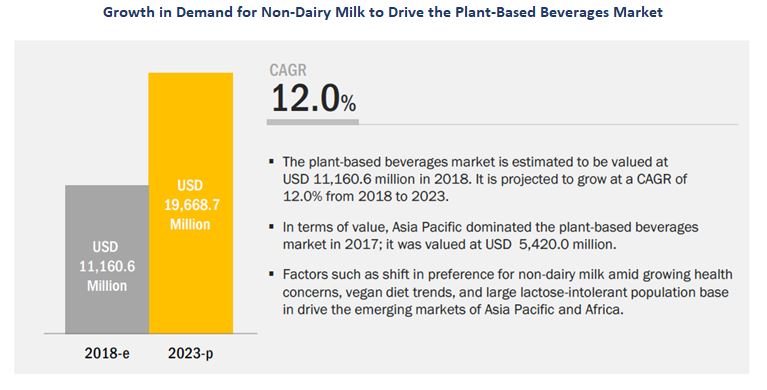

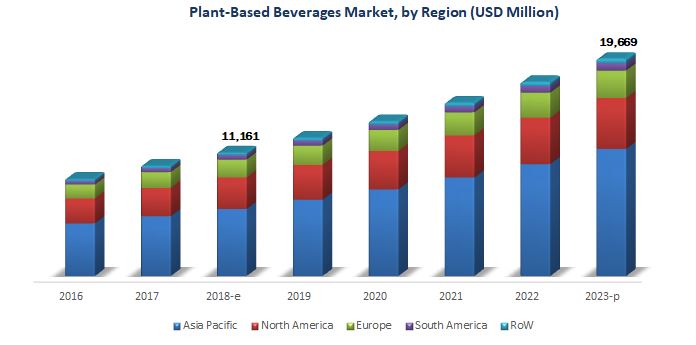

[131 Pages Report] The plant-based beverages market size is projected to reach USD 19.67 billion by 2023, at a CAGR of 12.0% during the forecast period. Plant-based beverages provide consumers with options that are low in cholesterol and calories. The growth of the plant-based beverages market is attributed to the shift in preference towards vegan diets among consumers at a global level. Apart from this, major food companies such as Danone (US) have been showing interest in plant-based beverages; this is expected to give the market a boost.

For more details on this research, Request Free Sample Report

Based on the source, the global market for plant-based beverages has been segmented into almond, soy, coconut, and rice. The almond segment dominated the market, in terms of value, in 2017. North America is one of the key markets for almond milk, owing to high almond production in this region. The Asia Pacific region is expected to be a major revenue-generating pocket for almond milk, owing to increased urbanization and the increasing number of high-income groups in the region. Consumers in this region are shifting toward natural and healthy food options to cope with their hectic lifestyles. This, in turn, has boosted the sales for plant-based beverages.

Based on type, the plant-based beverages market has been segmented into milk and other drinks. The milk segment is estimated to account for the larger share in the market for plant-based beverages in 2018. The increased demand for non-dairy milk, amidst the growing health concerns, has urged consumers to look out for alternate food options. Apart from this, the rising level of lactose intolerance, especially in the Asia Pacific population, is expected to be a major revenue pocket for plant-based beverage manufacturers in the coming years.

In 2018, Asia Pacific is estimated to occupy the largest share of the global plant-based beverages market, in terms of value and volume. The region consists of key revenue generating countries, China & Thailand, which have a large consumer base for plant-based beverages; with China having one of the largest lactose intolerant population.

The high price is one of the major challenges that manufacturers in the market face. Plant-based beverages can be easily purchased by consumers in developed countries; but in the developing countries, this remains a challenge.

The plant-based beverages market is dominated by key players such as United Technologies (US), Daikin Industries (Japan), Ingersoll-Rand (Ireland), China International Marine Containers (China), Utility Trailer (US). Other key players include Singamas Container (China), Hyundai (South Korea), Schmitz Cargobull (Germany), Fahrzeugwerk Bernard Krone (Germany), Lamberet (France), K๖gel Trailer (Germany), Great Dane (US), Webasto (Germany), and Wilhelm Schwarzmu๋ller (Austria). Innovative new product launches, strategic acquisitions, expansions, joint ventures, and partnerships were the key strategies adopted by these players to enhance their product offerings and to capture a larger market share, which has increased the demand for plant-based beverages.

The plant-based beverages market size was valued at USD 11.16 billion in 2018 and is projected to reach USD 19.67 billion by 2023, growing at a CAGR of 12.0% during the forecast period. The plant-based beverages market is driven by factors such as the increased demand for vegan food options, amidst the growing health concerns about the consumption of animal-based diets. Apart from this, consumers in emerging countries are adopting hectic lifestyles, which urge them to look out for low-calorie food options with high nutritional value. This has boosted the sale of plant-based beverage products.

For more details on this research, Request Free Sample Report

The years considered for the study are as follows:

- Base year: 2017

- Estimated year: 2018

- Projected year: 2023

- Forecast period: 2018-2023

Objectives of the study are as follows:

- To define, segment, and measure the plant-based beverages market concerning its source, type, function (qualitative), and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for the stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developmentsnew product developments, mergers & acquisitions, expansions, joint ventures, and partnershipsin the plant-based beverages market

- To profile the key plant-based beverage companies, based on business overview, recent financials, segmental revenue mix, geographic presence, and information about the products & services

- The market has been covered by mapping plant-based beverage products only. Yogurt has been excluded from the plant-based beverages market scope, as it falls under the food category.

Research Methodology:

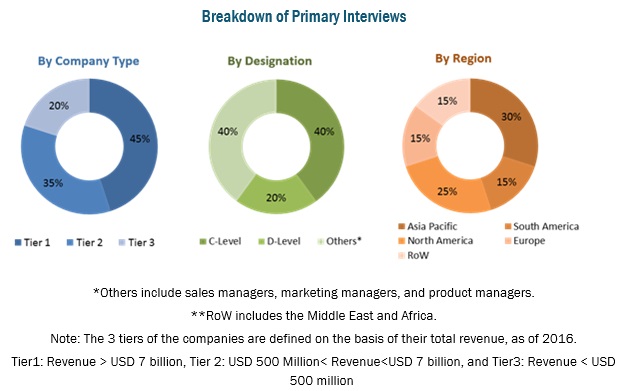

The research methodology used to estimate and forecast the plant-based beverages market begins with the capturing of data on the key players and their revenues through secondary sources such as the Plant Based Foods Association (PBFA), Food and Drug Administration (FDA), US Department of Agriculture (USDA), and European Food Safety Authority (EFSA). The overall market size was arrived after validating with primary interviews; and secondary research, which includes publications and statistics. Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the market size of various dependent submarkets in the overall plant-based beverages market. These submarkets were verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments.

The key players in the market include The WhiteWave Foods Company (US), Blue Diamond Growers (US), Pacific Foods (US), Hain Celestial (US), SunOpta (Canada), Want Want China Holdings Limited (China), Kikkoman (Japan), Califia Farms (US), The Coca-Cola Company (US), Ripple Foods (US), WildWood Organic (US), and Pureharvest (Australia).

Target Audience:

The report is targeted toward the existing players in the industry, which include:

- Manufacturers/suppliers

- Beverage manufacturers & processors

- Traders & retailers

- Regulatory bodies and associations, which include the following:

- Good Food Institute - Accelerate alternative protein innovation

- The Plant Based Foods Association (PBFA)

- The Food and Drug Administration (FDA)

- The United States Department of Agriculture (USDA)

- The European Food Safety Authority (EFSA)

- The Soyfoods Association of North America (SANA)

- The Specialty Food Association (SFA)

- The British Dietetic Association (BDA)

- The National Recreation and Park Association (NRPA)

- Dietitians of Canada (DC)

- National Milk Producers Federation (NMPF)

- Dietitians Association of Australia (DAA)

The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Plant-based Beverages Market Report:

On the basis of source, the market has been segmented into:

- Almond

- Soy

- Coconut

- Rice

- Others (cashew, oats, pea, and hemp)

On the basis of mode of type, the market has been segmented into:

- Milk

- Other drinks (smoothies, shakes, and nogs)

On the basis of function, the market has been segmented into:

- Cardiovascular health

- Cancer prevention

- Bone health

- Lactose-free alternative

- Qualitative segment

On the basis of region, the market has been segmented into:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Available Customization

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of the European market into Belgium, The Netherlands, Sweden, and Portugal.

- Further breakdown of the Rest of Asia Pacific market for plant-based beverages into South Korea, Taiwan, and the Philippines.

- Further breakdown of the RoW plant-based beverages market into the Middle East and Africa.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Frequently Asked Questions (FAQ):

What is the leading type in the plant-based beverages market?

The milk segment was the highest revenue contributor to the market, with USD 8,629.5 million in 2017, and is estimated to reach USD 17,072.5 million by 2023, with a CAGR of 12.1%.

What is the estimated industry size of plant-based beverages?

The global plant-based beverages market was valued at USD 9,964.8 million in 2017, and is projected to reach USD 19,668.7 million by 2023, registering a CAGR of 12.0% from 2018 to 2023.

What is the leading source of plant-based beverages market?

The almond segment was the highest revenue contributor to the market, with USD 4,860.0 million in 2017, and is estimated to reach USD 9,341.6 million by 2023, with a CAGR of 11.4%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in this Market

4.2 Plant-Based Beverages Market, By Region

4.3 Plant Based Beverages Market, By Type

4.4 Asia Pacific: Market, By Source and Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Regulatory Framework

5.2.1 Food and Drug Administration (FDA)

5.2.2 Food and Drug Regulations (FDR)

5.2.3 Food Standards Australia New Zealand (FSANZ)

5.2.4 European Court of Justice

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Consumer Trends Inclined Toward Replacing Dairy Milk With Plant-Based Beverages

5.3.1.2 Globally Increasing Cases of Lactose Intolerance and Milk Allergies

5.3.1.3 Increasing Number of Product Launches and Investments By Major Players

5.3.1.4 Nutritional Benefits Offered By Plant-Based Dairy Alternative Beverages

5.3.1.5 Growing Consumer Inclination Toward Veganism

5.3.1.6 Rapidly Growing Beverage Industry

5.3.2 Restraints

5.3.2.1 Relatively High Prices of Plant-Based Beverages as Compared to Dairy Milk

5.3.3 Opportunities

5.3.3.1 Plant-Based Milk Products for Coffee and Tea

5.3.3.2 Integration of Value-Added Ingredients and Flavor Innovations in Dairy Alternative Beverages

5.3.3.3 Favorable Marketing and Correct Positioning of Plant-Based Beverages

5.3.4 Challenges

5.3.4.1 Lack of Awareness Among Consumers

6 Plant-Based Beverages Market, By Source (Page No. - 43)

6.1 Introduction

6.2 Almond

6.2.1 Consumer Perception About Almond Milk as A Healthy Option to Drive the Demand During the Forecast Period

6.3 Soy

6.3.1 Soy Segment is Projected to Grow at the Highest CAGR During the Forecast Period

6.4 Coconut

6.4.1 Rising Awareness About the Health Benefits of Coconut-Based Products to Drive Growth During the Forecast Period

6.5 Rice

6.5.1 Improved Textural and Nutritional Properties Offered By Rice Projected to Drive the Rice Milk Segment During the Forecast Period

6.6 Others

6.6.1 Variety of Blends and Flavors of Cashew, Oat, Hemp, and Pea Milk Projected to Drive the Demand

7 Plant-Based Beverages Market, By Type (Page No. - 53)

7.1 Introduction

7.2 Milk

7.2.1 Milk is Projected to Be the Largest Segment During the Forecast Period

7.3 Other Drinks

7.3.1 Shakes, Smoothies, and Nogs are Gradually Gaining Popularity and are Projected to Witness Attractive Opportunities in Developing Economies

8 Plant-Based Beverages Market, By Function (Page No. - 59)

8.1 Introduction

8.2 Cardiovascular Health

8.3 Cancer Prevention

8.4 Lactose Intolerance

8.5 Bone Health

9 Plant-Based Beverages Market, By Region (Page No. - 61)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US is Projected to Be the Largest Market for Plant-Based Beverages in the North American Market

9.2.2 Canada

9.2.2.1 Canada is Projected to Be the Fastest-Growing Market During the Forecast Period in North America

9.2.3 Mexico

9.2.3.1 Rising Number of Health-Conscious Consumers in Mexico Leading to Increased Demand for Plant-Based Products

9.3 Europe

9.3.1 Germany

9.3.1.1 Shift of Consumer Preference Toward Plant-Based Milk From Dairy Milk to Drive the Growth of the Plant-Based Beverages Market

9.3.2 France

9.3.2.1 Factors Such as Lactose Intolerance and Calorie Concerns to Drive the Market Growth During the Forecast Period

9.3.3 UK

9.3.3.1 UK is Projected to Be the Largest and Fastest-Growing Market in Europe for Plant-Based Beverages

9.3.4 Italy

9.3.4.1 The Large Vegetarian Population and Growth in Adoption of Plant-Based Food to Drive the Growth of the Market

9.3.5 Spain

9.3.5.1 Rise in the Inclination of Consumers Toward Healthy and Low-Fat Beverages to Drive the Market

9.3.6 Rest of Europe

9.3.6.1 Rise in Health Concerns and the Growth of the Vegan Population to Drive the Market

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China is Projected to Be the Fastest-Growing Market During the Forecast Period

9.4.2 Thailand

9.4.2.1 Thailand is Projected to Be the Second-Largest Market During the Forecast Period

9.4.3 Japan

9.4.3.1 Increasing Health Concerns Among the Japanese Population Projected to Drive the Japanese Plant-Based Beverages Market

9.4.4 Vietnam

9.4.4.1 Rising Trend of Adopting Plant-Based Food & Beverage Products to Drive the Market Growth During the Forecast Period

9.4.5 Australia

9.4.5.1 Growing Inclination Toward Nutritional Beverages to Drive the Market During the Forecast Period

9.4.6 Rest of Asia Pacific

9.4.6.1 Increasing Demand for Nutrient-Rich Beverage Products to Drive the Market During the Forecast Period

9.5 South America

9.5.1 Brazil

9.5.1.1 Brazil Accounted for the Largest Share for Plant-Based Beverages in the South American Region

9.5.2 Argentina

9.5.2.1 Health Concerns as Well as Major Developments in the Argentinean Plant-Based Beverage Industry to Drive the Market During the Forecast Period

9.5.3 Rest of South America

9.5.3.1 The Market is Expected to Present High-Growth Prospects to Manufacturers in the Coming Years

9.6 RoW

9.6.1 Middle East

9.6.1.1 The Middle East is Projected to Be A Larger Market During the Forecast Period

9.6.2 Africa

9.6.2.1 Large Number of Lactose-Intolerant Population Along With Rising Health Concerns to Drive the Market During the Forecast Period

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Market Ranking

10.2.1 Key Market Strategies

10.3 Competitive Scenario

10.3.1 Joint Ventures & Partnerships

10.3.2 New Product Launches

10.3.3 Expansions

10.3.4 Acquisitions

11 Company Profiles (Page No. - 101)

11.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.2 The Whitewave Foods Company

11.3 Blue Diamond Growers

11.4 Pacific Foods of Oregon

11.5 The Hain Celestial Group

11.6 Sunopta

11.7 Califia Farms

11.8 Want Want China Holdings Limited

11.9 Kikkoman

11.10 The Coca-Cola Company

11.11 Ripple Foods

11.12 Wildwood Organic

11.13 Pureharvest

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 126)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (76 Tables)

Table 1 USD Exchange Rates Considered, 20122017

Table 2 Lactose Intolerance Rate, By Ethnicity

Table 3 Plant-Based Beverages Market Size, By Source, 20162023 (USD Million)

Table 4 Plant-Based Beverages Market Size, By Source, 20162023 (KT)

Table 5 Almond: Market Size, By Region, 20162023 (USD Million)

Table 6 Almond: Market Size, By Region, 20162023 (KT)

Table 7 Soy: Market Size, By Region, 20162023 (USD Million)

Table 8 Soy: Market Size, By Region, 20162023 (KT)

Table 9 Coconut: Market Size, By Region, 20162023 (USD Million)

Table 10 Coconut: Market Size, By Region, 20162023 (KT)

Table 11 Rice: Market Size, By Region, 20162023 (USD Million)

Table 12 Rice: Market Size, By Region, 20162023 (KT)

Table 13 Others: Market Size, By Region, 20162023 (USD Million)

Table 14 Others: Market Size, By Region, 20162023 (KT)

Table 15 Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 16 Market Size, By Type, 20162023 (KT)

Table 17 Milk: Market Size, By Region, 20162023 (USD Million)

Table 18 Milk: Market Size, By Region, 20162023 (KT)

Table 19 Other Drinks: Market Size, By Region, 20162023 (USD Million)

Table 20 Other Drinks: Market Size, By Region, 20162023 (KT)

Table 21 Plant-Based Beverages Market Size, By Region, 20162023 (USD Million)

Table 22 Market Size, By Region, 20162023 (KT)

Table 23 North America: Market Size, By Country, 20162023 (USD Million)

Table 24 North America: Market Size, By Country, 20162023 (KT)

Table 25 North America: Market Size, By Source, 20162023 (USD Million)

Table 26 North America: Market Size, By Source, 20162023 (KT)

Table 27 North America: Market Size, By Type, 20162023 (USD Million)

Table 28 North America: Market Size, By Type, 20162023 (KT)

Table 29 US: Market Size, By Type, 20162023 (USD Million)

Table 30 Canada: Market Size, By Type, 20162023 (USD Million)

Table 31 Mexico: Market Size, By Type, 20162023 (USD Million)

Table 32 Europe: Market Size, By Country, 20162023 (USD Million)

Table 33 Europe: Market Size, By Country, 20162023 (KT)

Table 34 Europe: Market Size, By Source, 20162023 (USD Million)

Table 35 Europe: Market Size, By Source, 20162023 (KT)

Table 36 Europe: Market Size, By Type, 20162023 (USD Million)

Table 37 Europe: Market Size, By Type, 20162023 (KT)

Table 38 Germany: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 39 France: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 40 UK: Plant Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 41 Italy: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 42 Spain: Plant Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 43 Rest of Europe: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 44 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 45 Asia Pacific: Market Size, By Country, 20162023 (KT)

Table 46 Asia Pacific: Market Size, By Source, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size, By Source, 20162023 (KT)

Table 48 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size, By Type, 20162023 (KT)

Table 50 China: Market Size, By Type, 20162023 (USD Million)

Table 51 Thailand: Market Size, By Type, 20162023 (USD Million)

Table 52 Japan: Market Size, By Type, 20162023 (USD Million)

Table 53 Vietnam: Market Size, By Type, 20162023 (USD Million)

Table 54 Australia: Market Size, By Type, 20162023 (USD Million)

Table 55 Rest of Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 56 South America: Market Size, By Country, 20162023 (USD Million)

Table 57 South America: Market Size, By Country, 20162023 (KT)

Table 58 South America: Market Size, By Source, 20162023 (USD Million)

Table 59 South America: Market Size, By Source, 20162023 (KT)

Table 60 South America: Market Size, By Type, 20162023 (USD Million)

Table 61 South America: Market Size, By Type, 20162023 (KT)

Table 62 Brazil: Plant Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 63 Argentina: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 64 Rest of South America: Plant Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 65 RoW: Plant Based Beverages Market Size, By Region, 20162023 (USD Million)

Table 66 RoW: Market Size, By Region, 20162023 (KT)

Table 67 RoW: Market Size, By Source, 20162023 (USD Million)

Table 68 RoW: Market Size, By Source, 20162023 (KT)

Table 69 RoW: Market Size, By Type, 20162023 (USD Million)

Table 70 RoW: Market Size, By Type, 20162023 (KT)

Table 71 Middle East: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 72 Africa: Plant-Based Beverages Market Size, By Type, 20162023 (USD Million)

Table 73 Joint Ventures & Partnerships, 2015-2016

Table 74 New Product Launches, 2016-2018

Table 75 Expansions, 2013-2018

Table 76 Acquisitions, 2014-2017

List of Figures (41 Figures)

Figure 1 Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Plant-Based Beverages Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Plant-Based Beverages Market Snapshot, By Source, 2018 vs 2023 (USD Million)

Figure 9 Plant Based Beverages Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 10 Plant-Based Beverages Market Size, By Region, 2017

Figure 11 Growth in Demand for Non-Dairy Milk to Drive the Plant Based Beverages Market

Figure 12 Asia Pacific to Dominate the Plant-Based Beverages Market From 2018 to 2023

Figure 13 Milk Segment Estimated to Hold A Larger Share of the Market in 2018

Figure 14 Soy Segment Estimated to Account for the Largest Share of the Asia Pacific Market in 2018

Figure 15 US Accounted for the Largest Share of the Global Plant Based Beverages Market, 2017

Figure 16 Plant-Based Beverages Market Dynamics

Figure 17 Fluid Milk (Dairy) Sales Quantity, 19902014 (Million Pounds)

Figure 18 US: Import of Beverage Products, 20092017 (USD Million)

Figure 19 Almond Segment to Dominate the Market From 2018 to 2023 (USD Million)

Figure 20 Milk Projected to Dominate the Market From 2018 to 2023 (USD Million)

Figure 21 Geographic Snapshot (20182023): China, UK, and Brazil are Emerging as New Hotspots, in Terms of Value

Figure 22 North America: Market Snapshot

Figure 23 Europe: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Plant Based Beverages Market From 2012 to 2018

Figure 26 Top 5 Players in the Global Plant-Based Beverages Market, 2017

Figure 27 Plant-Based Beverages Market Developments, By Growth Strategy, 20132018

Figure 28 The Whitewave Foods Company: Company Snapshot

Figure 29 The Whitewave Foods Company: SWOT Analysis

Figure 30 Blue Diamond Growers: Company Snapshot

Figure 31 Blue Diamond Growers: SWOT Analysis

Figure 32 Pacific Foods of Oregon: Company Snapshot

Figure 33 Pacific Foods of Oregon: SWOT Analysis

Figure 34 The Hain Celestial Group: Company Snapshot

Figure 35 The Hain Celestial Group: SWOT Analysis

Figure 36 Sunopta: Company Snapshot

Figure 37 Sunopta: SWOT Analysis

Figure 38 Want Want China Holdings Limited: Company Snapshot

Figure 39 Kikkoman: Company Snapshot

Figure 40 The Coca-Cola Company: Company Snapshot

Figure 41 Wildwood Organic: Company Snapshot

Growth opportunities and latent adjacency in Plant-based Beverages Market