Plasma Fractionation Market by Product (Immunoglobulins, Albumin, Protease Inhibitors, von Willebrand Factor, PCC), Application (Neurology, Immunology, Hematology, Rheumatology), End User (Clinical Research, Hospitals & Clinics) - Global Forecast to 2028

Plasma Fractionation Market Size, Growth Drivers & Restraints

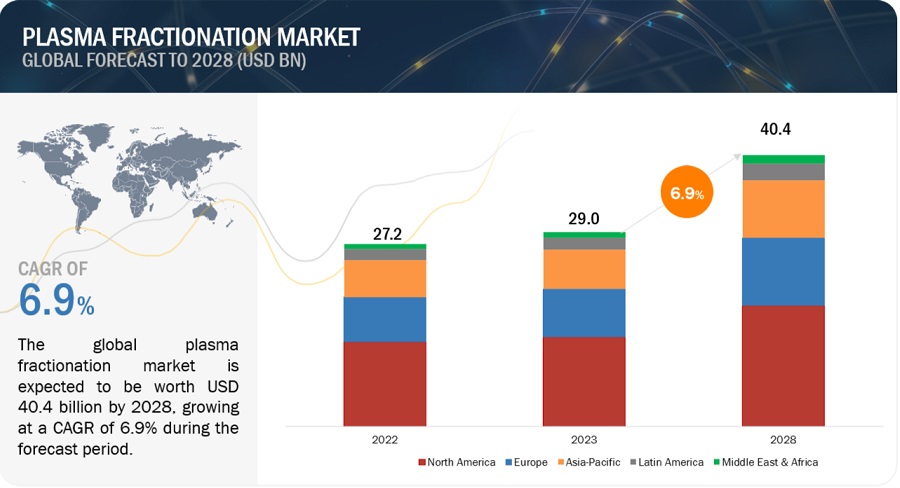

The global plasma fractionation market, valued at US$27.2 billion in 2022, stood at US$29.0 billion in 2023 and is projected to advance at a resilient CAGR of 6.9% from 2025 to 2028, culminating in a forecasted valuation of US$40.4 billion by the end of the period. Market growth is driven mainly by factors such as the growing use of immunoglobulins in various therapeutic areas, strategic expansion of plasma collection centers/inventories by market players, and the growing prevalence of respiratory diseases and AATD. However, high costs, limited reimbursements for plasma products, and market disruption caused by recombinant alternatives are expected to restrain the growth of this market to a certain extent during the forecast period.

Plasma Fractionation Market - Global Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Plasma Fractionation Market

Global Plasma Fractionation Market Dynamics

DRIVER: Growing prevalence of respiratory diseases and AATD

In recent years, the use of protease inhibitors such as alpha-1-antitrypsin has increased significantly for the treatment of lung diseases (such as emphysema) and hepatic diseases (such as hepatic inflammation, fibrosis, and cirrhosis). Alpha-1-antitrypsin deficiency (AATD) is a chronic, unrecognized metabolic genetic disorder. It is responsible for 2–3% of emphysema cases in the US. The deficiency of alpha-1-antitrypsin leads to the early onset of pan-lobular emphysema in both smokers and non-smokers, and the abnormal accumulation of alpha-1-antitrypsin in the liver leads to liver diseases. AATD occurs worldwide, but its prevalence varies by geography. Emphysema, along with chronic bronchitis, is collectively known as chronic obstructive pulmonary disease (COPD). Severe AATD is associated with a significant number of cases of COPD. According to a publication by Elsevier B.V. in July 2023, an estimated worldwide prevalence of the PI*ZZ Alpha-1 Antitrypsin genotype in subjects with COPD was around 50% in Europe, 37% in America, 9% in Asia, 3% in Australasia, and 1% in Africa. The estimated crude prevalence of COPD in adults older than 40 years was 13.51% in America, 12.45% in Europe, 13.22% in Africa, 11.70% in Asia, and 11.86% in Australasia. Prevalence was significantly higher, especially in Europe, the USA, Canada, New Zealand, and Australia, while it was found to be lower, especially in regions of Asia and Africa.

The growing prevalence of AATD and emphysema and improvements in diagnostic techniques such as CT scanning are expected to increase the number of people undergoing therapies for these diseases. This, in turn, will lead to a greater demand for protease inhibitors such as alpha-1-antitrypsin and contribute to the overall growth of the plasma fractionation market.

RESTRAINT: Market disruption caused by recombinant alternatives

Recent approvals for recombinant factors such as AFSTYLA (CSL), VONVENDI (Takeda/Shire), and Kovaltry (Bayer) are expected to offer lucrative opportunities for companies operating in this market space. At present, two different classes of recombinant factor products are available—standard half-life products and extended half-life products. The former class of recombinant factors last in the body for the same amount of time as the natural factor VIII or factor IX. Whereas extended half-life products are modified to last longer in the body than standard half-life products.

In developed countries, recombinant factors VIII and IX have already gained traction as alternatives to plasma-derived factors VIII and IX in bleeding disorders, as reported by the Annual Global Survey conducted by the World Federation of Hemophilia (WFH) in 2020. On the other hand, the use of recombinant factors has also increased in countries such as Brazil, India, and Russia. This trend is expected to impose certain limitations on the expansion of plasma-derived coagulation factors, thereby affecting the overall market growth.

OPPORTUNITY: Government strategies increasing regional self-sufficiency

The implementation of government strategies aimed at increasing regional self-sufficiency in plasma fractionation acts as a significant driver for the plasma fractionation market. These strategies are designed to strengthen the domestic production and availability of plasma-derived products within a specific region.

The United States is the world's leading provider of plasma and plasma-derived medicinal products, with plasma received entirely from US donors. The majority of other nations that produce therapies using plasma rely on importing US plasma, plasma fractions, and plasma pharmacological products. The nations have long aimed to stop depending on US plasma by reviewing outdated policies that restrict plasma collection. The UK removed the ban on domestic blood plasma for clinical use in 2021, which was imposed two decades ago in reaction to mad cow disease (BSE, or bovine spongiform encephalopathy). The UK's annual plasma collection rate increased as a result of the policy change, which increased the potential for manufacturing plasma-derived products to meet local patient demands. For the rest of Europe, 40% of plasma is collected in Germany, Austria, Hungary, and the Czech Republic. The EU Blood, Tissues, and Cells (BTC) regulation is currently being revised, which may lead to other countries increasing plasma collection and fractionation.

CHALLENGE: Stringent government regulations for maintaining the safety and quality of plasma-derived products

Plasma fractionation is one of the most heavily regulated sectors in the pharmaceutical industry. The risk of transmission of blood-borne pathogens and other diseases associated with transfusion has compelled regulatory authorities to focus on the safety and quality of fractionated plasma products. According to WHO guidelines, national regulatory authorities should inspect the quality of sourced plasma and plasma-derived products regularly. The WHO has also mentioned the characteristics of plasma for the fractionation process. The stringent regulations in the market act as a barrier to the entrance of new players, besides posing as a restraint for small local players to expand in the international market. Multinational companies also face challenges while investing in local/regional markets such as China. The import of plasma products, except albumin, has been banned in China since 1986. These factors are hampering the growth of the market in China, which is the second-largest market for plasma fractionation products.

Global Plasma Fractionation Market Ecosystem Analysis

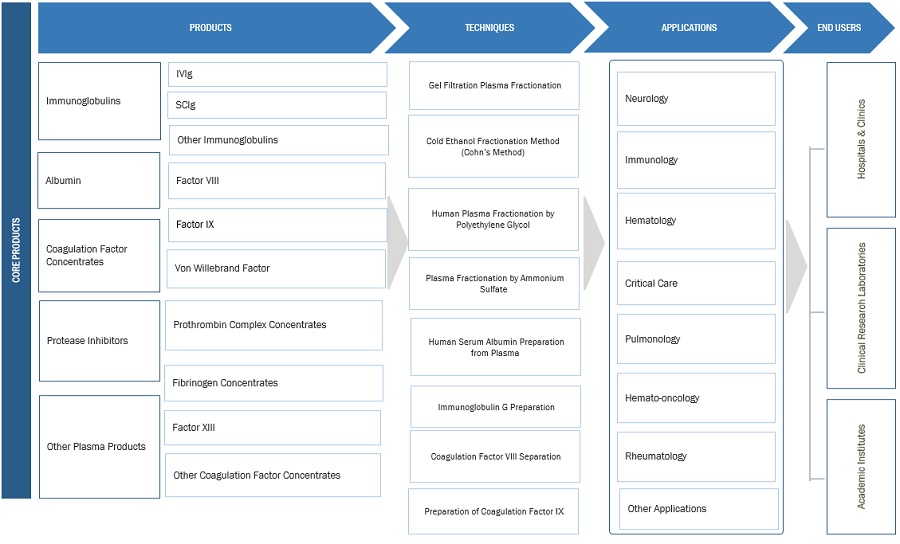

The plasma fractionation market ecosystem comprises raw material suppliers such as blood donation & plasma donation centers, plasma fractionation product manufacturers, and end users such as hospitals & clinics, biopharmaceutical manufacturers, R&D institutes, CROs, CDMOs, and academic institutes. Plasma fractionation manufacturers provide various types of plasma products, such as immunoglobulins, albumin, protease inhibitors, coagulation factor concentrates, and other plasma products.

The immunoglobins segment of the plasma fractionation industry will witness the highest growth during the forecast period.

Based on product, the plasma fractionation market is segmented into albumins, protease inhibitors, immunoglobulins, coagulation factor concentrates, and other products. The immunoglobulins segment has accounted for the largest share of the plasma fractionation market in 2022. The large share of the segment is due to several off-label immunoglobulin indications and applications of these medicines. Additionally, Immunoglobulins are also used as a defense against immunosenescence and other aging-related immune system problems. In coming years, it is anticipated that the use of immunoglobulins will expand due to the rising prevalence of infectious diseases. Furthermore, this segment is also expected to register the highest CAGR during the forecast period, based on volume, owing to the high demand for intravenous immunoglobulin (IVIg) for a wide range of indications including primary immunodeficiency disorders, autoimmune diseases, neurological disorders, among others.

The neurology segment dominated the plasma fractionation industry in 2022.

Based on application, the plasma fractionation market is segmented into hemato-oncology, rheumatology, neurology, immunology, hematology, critical care, pulmonology, and other applications. In 2022, the neurology segment accounted for the largest share of the plasma fractionation market. This is primarily due to the fact that IVIg produces a faster response than steroids or oral immunosuppressants. IVIg is effective for a range of disorders with the peripheral and central nervous systems. Additionally, IVIg is being investigated for additional neurological indications like Alzheimer's disease. If these indications demonstrated encouraging results, there would be a surge in the demand for IVIg in neurological applications.

To know about the assumptions considered for the study, download the pdf brochure

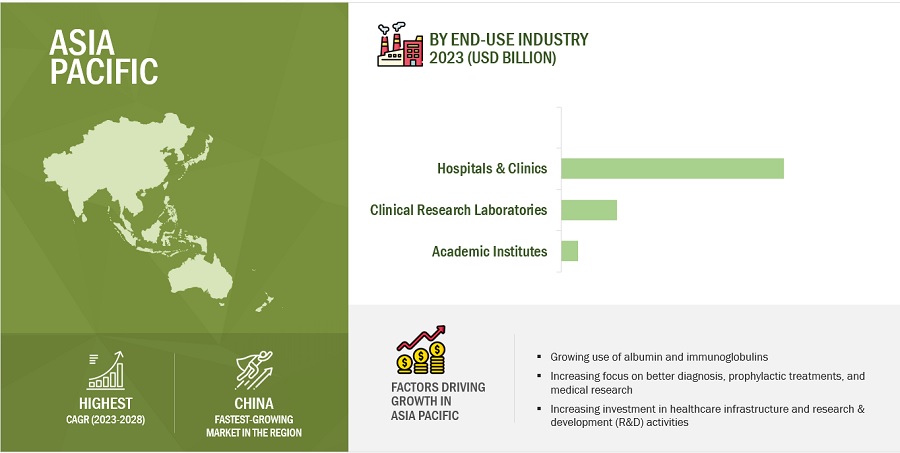

Asia Pacific was the fastest-growing regional market for plasma fractionation industry during the forecast period.

Geographically, the plasma fractionation market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In the forecast period 2023-2028, the Asia Pacific accounted for the highest CAGR of the plasma fractionation market. This is attributed to the growing use of albumin and immunoglobulins. The increasing focus on better diagnosis, prophylactic treatments, and medical research will increase the adoption of plasma-derived products, which, in turn, will drive the market for plasma fractionation in Asia Pacific.

Key players in the global plasma fractionation market include CSL (Australia), Takeda Pharmaceutical company limited (Japan), Grifols, S.A. (Spain), Octapharma AG (Switzerland), Kedrion S.P.A (Italy), LFB (France), ADMA Biologics (US), Sanquin (Netherlands), China Biologic Products Holdings Inc. (China), GC Pharma (Korea), Hualan Bioengineering Co., Ltd. (China), Japan Blood Products Organization (Japan), Emergent BioSolutions (US), Shanghai Raas Blood Products Co., Ltd. (China), Intas Pharmaceuticals Ltd. (India), Bharat Serum Vaccines Limited (India), SK Plasma (Korea), Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd. (China), Kamada (Israel), Centurion Pharma (Istanbul), Prothya Biosolutions (Netherlands), PlasmaGen BioSciences Pvt. Ltd. (India), Virchow Biotech Private Limited (India), Fusion Healthcare (India), and Hemarus Therapeutics Limited (India).

Scope of the Plasma Fractionation Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$29.0 billion |

|

Estimated Value by 2028 |

$40.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.9% |

|

Market Driver |

Growing prevalence of respiratory diseases and AATD |

|

Market Opportunity |

Government strategies increasing regional self-sufficiency |

This report categorizes the plasma fractionation market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Immunoglobulins

- Intravenous Immunoglobulins

- Subcutaneous Immunoglobulins

- Other Immunoglobulins

-

Coagulation Factor Concentrates

- Factor VIII

- Factor IX

- Von Willebrand Factor

- Prothrombin Complex Concentrate

- Fibrinogen Concentrates

- Factor XIII

- Other Coagulation Factor Concentrates

- Albumin

- Protease Inhibitors

- Other Plasma Products

By Application

- Neurology

- Immunology

- Hematology

- Critical care

- Pulmonology

- Hemato-Oncology

- Rheumatology

- Other Applications

By End User

- Hospitals and Clinics

- Clinical Research Laboratories

- Academic institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- Australia

- India

- Vietnam

- Indonesia

- Malaysia

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- RoLATAM

-

Middle East and Africa (MEA)

- Turkey

- Saudi Arabia

- Egypt

- UAE

- Rest of Middle East and Africa

Recent Developments of Plasma Fractionation Industry

- In April 2023, CSL (Australia) received Food and Drug Administration (FDA) approval for the 50mL/10gm prefilled syringe for Hizentra (Immune Globulin Subcutaneous [Human] 20% Liquid for patients suffering from PI and CIPD.

- In March 2022, Grifols (Spain) received European approvals for XEMBIFY, a 20% subcutaneous immunoglobulin (SCIG)

- In January 2022, Permira, a global investment firm, announced that it would be acquiring Kedrion and merging the company with BPL.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global plasma fractionation market?

The global plasma fractionation market boasts a total revenue value of $40.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global plasma fractionation market?

The global plasma fractionation market has an estimated compound annual growth rate (CAGR) of 6.9% and a revenue size in the region of $29.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing use of immunoglobulins in various therapeutic areas- Strategic expansion of plasma collection centers/inventories by market players- Growing prevalence of respiratory diseases and Alpha-1-antitrypsin deficiencyRESTRAINTS- High costs and limited reimbursements for plasma-derived products- Market disruption caused by recombinant alternativesOPPORTUNITIES- Government strategies for increasing regional self-sufficiency in plasma fractionationCHALLENGES- Stringent government regulations for maintaining safety and quality of plasma-derived products

- 5.3 PRICING ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM MARKET MAP

-

5.8 PATENT ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.10 REGULATORY ANALYSISREGULATORY SCENARIO IN DIFFERENT COUNTRIES/REGIONS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 TECHNOLOGY ANALYSISCOHN’S COLD ETHANOL PLASMA FRACTIONATIONGEL FILTRATION PLASMA FRACTIONATIONHUMAN PLASMA FRACTIONATION BY POLYETHYLENE GLYCOLPLASMA FRACTIONATION BY AMMONIUM SULFATEPLASMA FRACTIONATION BY CENTRIFUGATIONDEPTH FILTRATION PLASMA FRACTIONATIONPLASMA FRACTIONATION BY CHROMATOGRAPHY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14 KEY BUYING CRITERIA, BY END USER

-

5.15 PLASMA COLLECTION, BY VOLUMEUSCANADAUKJAPANINDIABRAZIL

- 5.16 PLASMA COLLECTION CENTERS

- 6.1 INTRODUCTION

-

6.2 IMMUNOGLOBULINSIVIG- Intravenous immunoglobulins segment to dominate plasma fractionation immunoglobulins market during study periodSCIG- Ease of self-administration and lower incidence of non-serious systemic adverse reactions to drive segmentOTHER IMMUNOGLOBULINS

-

6.3 COAGULATION FACTOR CONCENTRATESFACTOR VIII- Factor VIII held largest share of coagulation factor concentrates market in 2022FACTOR IX- Routine use of human plasma-derived factor IX concentrates in hemophilia treatment to drive segmentVON WILLEBRAND FACTOR- Increasing prevalence and early diagnosis of hemophilia to drive segmentPROTHROMBIN COMPLEX CONCENTRATES- Advantages of prothrombin complex concentrate over fresh frozen plasma to drive segmentFIBRINOGEN CONCENTRATES- Better safety profile, greater accuracy, and higher speed of administration to drive segmentFACTOR XIII- Applications in treating rare bleeding disorders and preventing surgical bleeding to drive segmentOTHER COAGULATION FACTOR CONCENTRATES

-

6.4 ALBUMINRISING DEMAND IN MAINTAINING ONCOTIC PRESSURE AND CONDUCTING MEDICAL TREATMENTS TO DRIVE MARKET

-

6.5 PROTEASE INHIBITORSRISING PREVALENCE OF COPD AND OTHER RESPIRATORY DISEASES GLOBALLY TO DRIVE MARKET

- 6.6 OTHER PLASMA PRODUCTS

- 7.1 INTRODUCTION

-

7.2 NEUROLOGYRISING PREVALENCE OF AGE-RELATED NEUROLOGICAL DISORDERS TO DRIVE MARKET

-

7.3 IMMUNOLOGYADVANCEMENTS IN GENETICS RESEARCH AND NOVEL THERAPEUTIC STRATEGIES TO DRIVE MARKET

-

7.4 HEMATOLOGYGROWING NUMBER OF HEMOPHILIA PATIENTS TO DRIVE DEMAND FOR COAGULATION FACTORS

-

7.5 CRITICAL CAREINCREASING OFF-LABEL USE OF ALBUMIN TO DRIVE DEMAND FOR PLASMA-DERIVED CRITICAL CARE PRODUCTS

-

7.6 PULMONOLOGYRISING PREVALENCE OF ALPHA-1-ANTITRYPSIN DEFICIENCY AND COPD TO DRIVE MARKET

-

7.7 HEMATO-ONCOLOGYRISING NUMBER OF BLOOD CANCER PATIENTS TO DRIVE MARKET

-

7.8 RHEUMATOLOGYINCREASING PREVALENCE OF RHEUMATIC ARTHRITIS IN DEVELOPED COUNTRIES TO DRIVE MARKET

- 7.9 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS AND CLINICSGROWING NUMBER OF SURGERIES AND INCREASING OFF-LABEL USE OF IMMUNOGLOBULINS TO DRIVE MARKET

-

8.3 CLINICAL RESEARCH LABORATORIESINCREASING CLINICAL STUDIES ON NEW INDICATIONS FOR PLASMA-DERIVED PRODUCTS TO DRIVE MARKET

-

8.4 ACADEMIC INSTITUTESGROWING STUDIES ON SAFETY AND EFFICACY OF PLASMA-DERIVED PRODUCTS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- US to dominate market for plasma fractionation products during forecast periodCANADA- High per capita usage of immunoglobulins and increased number of blood-related diseases to drive market

-

9.3 EUROPEGERMANY- Largest plasma fractionation capacity and highest number of plasma collection centers in Europe to drive marketUK- Increased incidence of hemophilia and lift on ban of plasma donation to drive marketFRANCE- High prevalence of bleeding disorders to drive marketITALY- Growth in geriatric population to drive demand for plasma fractionation productsSPAIN- Growing demand for plasma products for treatment of chronic diseases in geriatric population to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Rising incidence of chronic diseases and growing geriatric population to drive marketJAPAN- Rising prevalence of neurological disorders and hematological diseases to drive marketAUSTRALIA- Growing demand for plasma products and rising geriatric population to drive marketINDIA- Growing healthcare awareness, increasing availability of better diagnostic tools, and rising geriatric population to drive marketVIETNAM- Increasing number of patients suffering from COPD, PID, and bleeding disorders to drive marketINDONESIA- Rising number of government initiatives and growing geriatric population to boost marketMALAYSIA- Increasing prevalence of bleeding disorders to drive marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICABRAZIL- Growing incidence of immunodeficiency diseases and rising number of hemophilic patients to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICATURKEY- Turkey to dominate plasma fractionation market in Middle East & Africa during study periodSAUDI ARABIA- Developments in healthcare infrastructure to drive marketEGYPT- Increasing research on plasma and plasma derivatives by government organizations to drive marketUAE- Growing government initiatives for healthcare infrastructure development to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PLASMA FRACTIONATION MARKET

-

10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS IN PLASMA FRACTIONATION MARKETSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

-

10.7 COMPANY EVALUATION MATRIX FOR START-UPS/SMES IN PLASMA FRACTIONATION MARKETPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.8 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

-

11.1 KEY PLAYERSCSL- Business overview- Products offered- Recent developments- MnM viewTAKEDA PHARMACEUTICAL COMPANY LIMITED- Business overview- Products offered- Recent developments- MnM viewGRIFOLS, S.A.- Business overview- Products offered- Recent developments- MnM viewOCTAPHARMA AG- Business overview- Products offered- Recent developmentsKEDRION S.P.A- Business overview- Products offered- Recent developmentsLFB- Business overview- Products offered- Recent developmentsADMA BIOLOGICS, INC.- Business overview- Products offered- Recent developmentsSANQUIN- Business overview- Products offered- Recent developmentsCHINA BIOLOGIC PRODUCTS HOLDINGS, INC.- Business overview- Products offered- Recent developmentsGC PHARMA- Business overview- Products offered- Recent developmentsHUALAN BIOENGINEERING CO., LTD.- Business overview- Products offeredJAPAN BLOOD PRODUCTS ORGANIZATION- Business overview- Products offeredEMERGENT- Business overview- Products offered- Recent developmentsSHANGHAI RAAS BLOOD PRODUCTS CO., LTD.- Business overview- Products offered- Recent developmentsINTAS PHARMACEUTICALS LTD.- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSBHARAT SERUMS AND VACCINES LIMITEDSK PLASMASICHUAN YUANDA SHUYANG PHARMACEUTICAL CO., LTD.KAMADA PHARMACEUTICALSCENTURION PHARMAPROTHYA BIOSOLUTIONS B.V.PLASMAGEN BIOSCIENCES PVT. LTD.VIRCHOW BIOTECHFUSION HEALTHCAREHEMARUS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2021–2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 PLASMA FRACTIONATION MARKET: IMPACT ANALYSIS

- TABLE 5 OFF-LABEL INDICATIONS OF INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- TABLE 6 ON-LABEL INDICATIONS OF INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- TABLE 7 NUMBER OF CLINICAL STUDIES ON IMMUNOGLOBULINS, BY COUNTRY/REGION (2020–2021)

- TABLE 8 NUMBER OF PATIENTS TREATED FOR TOP 15 TARGET CONDITIONS IN UK

- TABLE 9 AVERAGE SELLING PRICE OF PLASMA FRACTIONATION PRODUCTS, BY KEY PLAYER, 2022 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF PLASMA FRACTIONATION PRODUCTS, BY REGION, 2021 (USD)

- TABLE 11 ROLE IN ECOSYSTEM (SUPPLY SIDE/DEMAND SIDE): PLASMA FRACTIONATION MARKET

- TABLE 12 PLASMA FRACTIONATION MARKET: LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 PORTER’S FIVE FORCES ANALYSIS: PLASMA FRACTIONATION MARKET

- TABLE 19 NUMBER OF PLASMA COLLECTION CENTERS, BY COMPANY, 2021–2022

- TABLE 20 PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 21 INTRAVENOUS IMMUNOGLOBULINS (IVIG) VS. SUBCUTANEOUS IMMUNOGLOBULINS (SCIG) THERAPY

- TABLE 22 PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 29 IVIG OFFERED BY KEY PLAYERS

- TABLE 30 IVIG MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 IVIG MARKET, BY REGION, 2021–2028 (METRIC TONS)

- TABLE 32 NORTH AMERICA: IVIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: IVIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 34 EUROPE: IVIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 EUROPE: IVIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 36 ASIA PACIFIC: IVIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: IVIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 38 LATIN AMERICA: IVIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 LATIN AMERICA: IVIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 40 MIDDLE EAST & AFRICA: IVIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 MIDDLE EAST & AFRICA: IVIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 42 SCIG OFFERED BY KEY PLAYERS

- TABLE 43 SCIG MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 SCIG MARKET, BY REGION, 2021–2028 (METRIC TONS)

- TABLE 45 NORTH AMERICA: SCIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: SCIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 47 EUROPE: SCIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: SCIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 49 ASIA PACIFIC: SCIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SCIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 51 LATIN AMERICA: SCIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 LATIN AMERICA: SCIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 53 MIDDLE EAST & AFRICA: SCIG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 MIDDLE EAST & AFRICA: SCIG MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 55 OTHER IMMUNOGLOBULINS OFFERED BY KEY PLAYERS

- TABLE 56 OTHER IMMUNOGLOBULINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 OTHER IMMUNOGLOBULINS MARKET, BY REGION, 2021–2028 (METRIC TONS)

- TABLE 58 NORTH AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 60 EUROPE: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 62 ASIA PACIFIC: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 64 LATIN AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 LATIN AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 66 MIDDLE EAST & AFRICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 68 PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 FACTOR VIII OFFERED BY KEY PLAYERS

- TABLE 76 FACTOR VIII MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 FACTOR VIII MARKET, BY REGION, 2021–2028 (MILLION IU)

- TABLE 78 NORTH AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 80 EUROPE: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 82 ASIA PACIFIC: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 84 LATIN AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 LATIN AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 86 MIDDLE EAST & AFRICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: FACTOR VIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 88 FACTOR IX OFFERED BY KEY PLAYERS

- TABLE 89 FACTOR IX MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 FACTOR IX MARKET, BY REGION, 2021–2028 (MILLION IU)

- TABLE 91 NORTH AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 93 EUROPE: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 95 ASIA PACIFIC: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 97 LATIN AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 99 MIDDLE EAST & AFRICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: FACTOR IX MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 101 VON WILLEBRAND FACTOR OFFERED BY KEY PLAYERS

- TABLE 102 VON WILLEBRAND FACTOR MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 VON WILLEBRAND FACTOR MARKET, BY REGION, 2021–2028 (MILLION LITER)

- TABLE 104 NORTH AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 106 EUROPE: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 108 ASIA PACIFIC: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 110 LATIN AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 112 MIDDLE EAST & AFRICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 114 PROTHROMBIN COMPLEX CONCENTRATES OFFERED BY KEY PLAYERS

- TABLE 115 PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 116 PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY REGION, 2021–2028 (MILLION LITER)

- TABLE 117 NORTH AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 119 EUROPE: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 EUROPE: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 121 ASIA PACIFIC: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 123 LATIN AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 125 MIDDLE EAST & AFRICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 127 FIBRINOGEN CONCENTRATES OFFERED BY KEY PLAYERS

- TABLE 128 FIBRINOGEN CONCENTRATES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 129 FIBRINOGEN CONCENTRATES MARKET, BY REGION, 2021–2028 (METRIC TONS)

- TABLE 130 NORTH AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 132 EUROPE: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 EUROPE: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 134 ASIA PACIFIC: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 136 LATIN AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 138 MIDDLE EAST & AFRICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 140 FACTOR XIII OFFERED BY KEY PLAYERS

- TABLE 141 FACTOR XIII MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 142 FACTOR XIII, BY REGION, 2021–2028 (MILLION IU)

- TABLE 143 NORTH AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 145 EUROPE: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 EUROPE FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 147 ASIA PACIFIC: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 149 LATIN AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 151 MIDDLE EAST & AFRICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: FACTOR XIII MARKET, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 153 OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 155 EUROPE: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 159 ALBUMIN OFFERED BY KEY PLAYERS

- TABLE 160 PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY REGION, 2021–2028 (USD MILLION)

- TABLE 161 PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY REGION, 2021–2028 (MILLION LITER)

- TABLE 162 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 164 EUROPE: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 165 EUROPE: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 166 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 168 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 170 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021–2028 (METRIC TONS)

- TABLE 172 PROTEASE INHIBITORS OFFERED BY KEY PLAYERS

- TABLE 173 PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 174 PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY REGION, 2021–2028 (MILLION IU)

- TABLE 175 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 176 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 177 EUROPE: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 178 EUROPE: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 179 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 181 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 183 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021–2028 (MILLION IU)

- TABLE 185 PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 187 EUROPE: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 191 PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 DISABILITY-ADJUSTED LIFE YEARS (DALYS) FOR NEUROLOGICAL DISORDERS AND PROJECTED PERCENTAGE (2005 VS. 2015 VS. 2030)

- TABLE 193 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN NEUROLOGY

- TABLE 194 PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 195 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 196 EUROPE: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, 2021–2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 200 PHYSICIAN-REPORTED PREVALENCE OF PRIMARY IMMUNODEFICIENCY DISEASES AMONG PATIENTS, BY REGION, 2013–2021

- TABLE 201 LIST OF FDA-APPROVED INDICATIONS FOR IMMUNOGLOBULINS IN IMMUNOLOGY

- TABLE 202 DIAGNOSIS DISTRIBUTION OF DIFFERENT CATEGORIES OF PRIMARY IMMUNODEFICIENCY DISEASES

- TABLE 203 PLASMA-DERIVED PRODUCTS AND THEIR APPLICATIONS IN IMMUNOLOGY

- TABLE 204 PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 205 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 206 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, 2021–2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 210 NUMBER OF IDENTIFIED PATIENTS, BY INDICATION, 2021

- TABLE 211 PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 212 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 213 EUROPE: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, 2021–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 217 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN CRITICAL CARE

- TABLE 218 PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 219 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 220 EUROPE: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, 2021–2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 224 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN PULMONOLOGY

- TABLE 225 PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 227 EUROPE: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, 2021–2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 231 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN HEMATO-ONCOLOGY

- TABLE 232 PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 233 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 234 EUROPE: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, 2021–2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 238 PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 239 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 240 EUROPE: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, 2021–2028 (USD MILLION)

- TABLE 241 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 242 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 244 PLASMA-DERIVED PRODUCTS FOR OTHER APPLICATIONS

- TABLE 245 PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 246 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 247 EUROPE: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, 2021–2028 (USD MILLION)

- TABLE 248 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 251 PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 252 PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 253 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 254 EUROPE: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, 2021–2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 258 PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 259 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 260 EUROPE: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 261 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, 2021–2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 264 PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 265 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 266 EUROPE: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 267 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, 2021–2028 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 270 PLASMA FRACTIONATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 271 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 272 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 273 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 275 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 276 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 277 US: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 278 US: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 US: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 280 US: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 281 US: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 282 CANADA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 283 CANADA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 284 CANADA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 285 CANADA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 286 CANADA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 287 EUROPE: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 288 EUROPE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 289 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 290 EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 291 EUROPE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 292 EUROPE: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 293 GERMANY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 294 GERMANY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 295 GERMANY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 296 GERMANY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 297 GERMANY: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 298 UK: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 299 UK: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 300 UK: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 301 UK: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 302 UK: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 303 NUMBER OF PEOPLE WITH BLEEDING DISORDERS IN FRANCE, 2012–2021

- TABLE 304 FRANCE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 305 FRANCE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 306 FRANCE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 307 FRANCE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 308 FRANCE: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 309 PRODUCTION OF PLASMA PRODUCTS IN ITALY (2013, 2018, AND 2023)

- TABLE 310 ITALY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 311 ITALY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 312 ITALY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 313 ITALY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 314 ITALY: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 315 SPAIN: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 316 SPAIN: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 317 SPAIN: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 318 SPAIN: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 319 SPAIN: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 320 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 321 REST OF EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 322 REST OF EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 323 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 324 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 325 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 326 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 327 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 328 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 329 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 330 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 331 CHINA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 332 CHINA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 333 CHINA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 334 CHINA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 335 CHINA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 336 MEAN PER CAPITA FACTOR VIII AND IX USE IN JAPAN, 2014 VS. 2018 (IN IU/TOTAL POPULATION)

- TABLE 337 PATIENTS WITH BLEEDING DISORDERS IN JAPAN, 2014 VS. 2021

- TABLE 338 JAPAN: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 339 JAPAN: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 340 JAPAN: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 341 JAPAN: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 342 JAPAN: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 343 TOTAL IG (GRAMS) USED IN AUSTRALIA, 2008/09–2017/18

- TABLE 344 AUSTRALIA: BLOOD SECTOR OVERVIEW (2017–2018)

- TABLE 345 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 346 AUSTRALIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 347 AUSTRALIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 348 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 349 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 350 INDIA: NUMBER OF PATIENTS WITH BLEEDING DISORDERS, 2012–2021

- TABLE 351 INDIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 352 INDIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 353 INDIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 354 INDIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 355 INDIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 356 VIETNAM: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 357 VIETNAM: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 358 VIETNAM: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 359 VIETNAM: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 360 VIETNAM: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 361 INDONESIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 362 INDONESIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 363 INDONESIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 364 INDONESIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 365 INDONESIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 366 MALAYSIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 367 MALAYSIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 368 MALAYSIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 369 MALAYSIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 370 MALAYSIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 371 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 372 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 373 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 374 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 375 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 376 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 377 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 378 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 379 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 380 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 381 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 382 BRAZIL: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 383 BRAZIL: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 384 BRAZIL: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 385 BRAZIL: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 386 BRAZIL: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 387 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 388 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 389 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 390 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 391 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 392 HEMOPHILIA PATIENTS IN MIDDLE EAST & AFRICA, BY COUNTRY, 2012–2020

- TABLE 393 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 394 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 395 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 399 TURKEY: DEMOGRAPHIC INDICATORS

- TABLE 400 TURKEY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 401 TURKEY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 402 TURKEY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 403 TURKEY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 404 TURKEY: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 405 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 406 SAUDI ARABIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 407 SAUDI ARABIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 408 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 409 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 410 EGYPT: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 411 EGYPT: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 412 EGYPT: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 413 EGYPT: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 414 EGYPT: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 415 UAE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 416 UAE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 417 UAE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 418 UAE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 419 UAE: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 420 HEMOPHILIA PATIENTS IN REST OF MIDDLE EAST & AFRICA, 2012 VS. 2017 VS. 2018

- TABLE 421 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 422 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 423 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 424 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 425 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 426 PLASMA FRACTIONATION MARKET: DEGREE OF COMPETITION

- TABLE 427 END USER FOOTPRINT ANALYSIS (KEY PLAYERS)

- TABLE 428 PRODUCT FOOTPRINT ANALYSIS (KEY PLAYERS)

- TABLE 429 REGIONAL FOOTPRINT ANALYSIS (KEY PLAYERS)

- TABLE 430 DETAILED LIST OF KEY START-UPS/SMES: PLASMA FRACTIONATION MARKET

- TABLE 431 COMPETITIVE BENCHMARKING OF START-UPS/SMES: PLASMA FRACTIONATION MARKET

- TABLE 432 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021–JULY 2023

- TABLE 433 KEY DEALS, JANUARY 2021–JULY 2023

- TABLE 434 OTHER KEY DEVELOPMENTS, JANUARY 2021–JULY 2023

- TABLE 435 CSL: COMPANY OVERVIEW

- TABLE 436 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 437 GRIFOLS, S.A.: COMPANY OVERVIEW

- TABLE 438 OCTAPHARMA AG: COMPANY OVERVIEW

- TABLE 439 KEDRION S.P.A: COMPANY OVERVIEW

- TABLE 440 LFB: COMPANY OVERVIEW

- TABLE 441 ADMA BIOLOGICS, INC.: COMPANY OVERVIEW

- TABLE 442 SANQUIN: COMPANY OVERVIEW

- TABLE 443 CHINA BIOLOGIC PRODUCTS HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 444 GC PHARMA: COMPANY OVERVIEW

- TABLE 445 HUALAN BIOENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 446 JAPAN BLOOD PRODUCTS ORGANIZATION: COMPANY OVERVIEW

- TABLE 447 EMERGENT: COMPANY OVERVIEW

- TABLE 448 SHANGHAI RAAS BLOOD PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 449 INTAS PHARMACEUTICALS LTD.: COMPANY OVERVIEW

- FIGURE 1 PLASMA FRACTIONATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PLASMA FRACTIONATION MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY SIDE ANALYSIS, 2022

- FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2022

- FIGURE 6 ILLUSTRATIVE EXAMPLE OF CSL: REVENUE SHARE ANALYSIS, 2022

- FIGURE 7 MARKET GROWTH FACTORS VALIDATION FROM PRIMARY EXPERTS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 PLASMA FRACTIONATION MARKET: CAGR PROJECTIONS, 2023–2028

- FIGURE 10 PLASMA FRACTIONATION MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 PLASMA FRACTIONATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 PLASMA FRACTIONATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PLASMA FRACTIONATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 REGIONAL SNAPSHOT: PLASMA FRACTIONATION MARKET

- FIGURE 16 GROWING USE OF IMMUNOGLOBULINS IN VARIOUS THERAPEUTIC AREAS TO DRIVE MARKET

- FIGURE 17 IMMUNOGLOBULINS AND US DOMINATED NORTH AMERICAN PLASMA FRACTIONATION MARKET IN 2022

- FIGURE 18 IMMUNOGLOBULINS SEGMENT TO DOMINATE PLASMA FRACTIONATION MARKET DURING FORECAST PERIOD

- FIGURE 19 HOSPITALS AND CLINICS SEGMENT COMMANDED LARGEST MARKET SHARE IN PLASMA FRACTIONATION MARKET IN 2022

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN PLASMA FRACTIONATION MARKET FROM 2023 TO 2028

- FIGURE 21 PLASMA FRACTIONATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 REVENUE SHIFT AND NEW POCKETS FOR PLASMA FRACTIONATION PRODUCT PROVIDERS

- FIGURE 23 PROCEDURE OF PLASMA FRACTIONATION

- FIGURE 24 VALUE CHAIN ANALYSIS: PLASMA FRACTIONATION MARKET

- FIGURE 25 SUPPLY CHAIN ANALYSIS: PLASMA FRACTIONATION MARKET

- FIGURE 26 ECOSYSTEM MARKET MAP: PLASMA FRACTIONATION MARKET

- FIGURE 27 PATENT APPLICATIONS FOR PLASMA FRACTIONATION MARKET, JANUARY 2013–JULY 2023

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PLASMA FRACTIONATION PRODUCTS

- FIGURE 29 KEY BUYING CRITERIA OF END USERS IN PLASMA FRACTIONATION MARKET

- FIGURE 30 PLASMA COLLECTION CENTERS IN NORTH AMERICA, 2010–2021

- FIGURE 31 DISTRIBUTION OF HEMOPHILIA PATIENTS, BY REGION, 2022

- FIGURE 32 NORTH AMERICA: PLASMA FRACTIONATION MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: PLASMA FRACTIONATION MARKET SNAPSHOT

- FIGURE 34 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN PLASMA FRACTIONATION MARKET, 2020–2023

- FIGURE 35 PLASMA FRACTIONATION MARKET: MARKET SHARE ANALYSIS, 2022 (TOP 5 PLAYERS)

- FIGURE 36 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN PLASMA FRACTIONATION MARKET (TOP 5)

- FIGURE 37 COMPANY EVALUATION MATRIX FOR KEY PLAYERS IN PLASMA FRACTIONATION MARKET, 2022

- FIGURE 38 COMPANY EVALUATION MATRIX FOR START-UPS/SMES IN PLASMA FRACTIONATION MARKET, 2022

- FIGURE 39 CSL: COMPANY SNAPSHOT (2022)

- FIGURE 40 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 41 GRIFOLS, S.A.: COMPANY SNAPSHOT (2022)

- FIGURE 42 OCTAPHARMA AG: COMPANY SNAPSHOT (2022)

- FIGURE 43 KEDRION S.P.A: COMPANY SNAPSHOT (2022)

- FIGURE 44 ADMA BIOLOGICS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 SANQUIN: COMPANY SNAPSHOT (2022)

- FIGURE 46 GC PHARMA: COMPANY SNAPSHOT (2021)

- FIGURE 47 EMERGENT: COMPANY SNAPSHOT (2022)

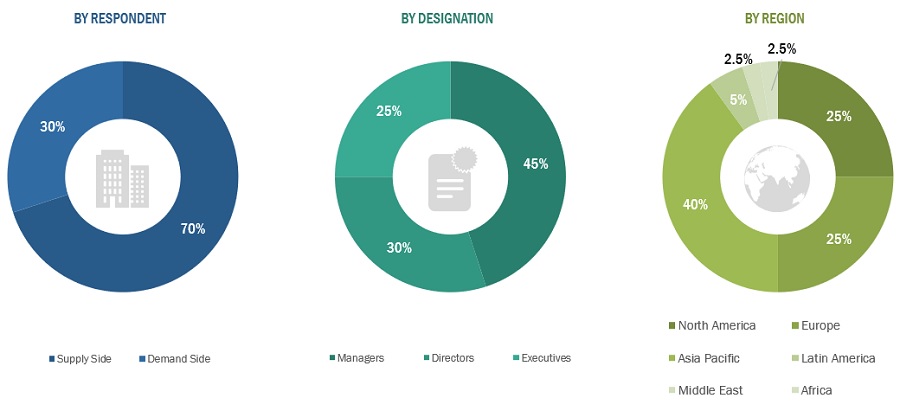

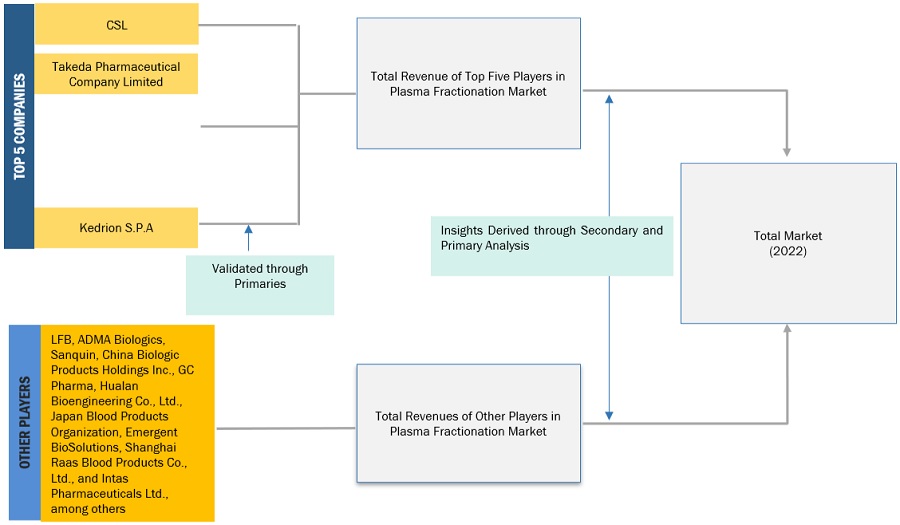

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global plasma fractionation market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as International Plasma Fractionation Association (IPFA), Plasma Protein Therapeutics Association (PPTA), International Plasma Products Industry Association (IPPIA), European Association of the Plasma Products Industry (EAPPI), World Health Organization (WHO). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global plasma fractionation market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global plasma fractionation market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as hospitals, clinics, clinical research laboratories, and academic institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across five major regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Approximately 80% and 20% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the plasma fractionation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the plasma fractionation business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Plasma fractionation is the process of separating plasma proteins from blood samples and sourced plasma materials based on their molecular size, charge, and other properties. The resulting individual components are then purified, concentrated and can be used for various medical purposes. Plasma-derived products obtained from the plasma fractionation process include albumin, immunoglobulins, coagulation factor concentrates, and protease inhibitors. These proteins are crucial for maintaining blood viscosity, regulating immunological responses, and promoting clotting, among other functions in the body.

Stakeholders

- Plasma fractionation product manufacturers and distributors

- Pharmaceutical and biotechnology companies

- Healthcare service providers (including hospitals and clinics)

- Research and development (R&D) companies

- Academic institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the global plasma fractionation market based on the product, application, end-user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contributions to the overall plasma fractionation market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the plasma fractionation market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plasma Fractionation Market

Informative; however, the study requires more details.