Plastic Antioxidants Market by Antioxidants Type (Phenolic, Phosphite & Phosphonite, Antioxidant Blends), Polymer Resin (Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Acrylonitrile Butadiene Styrene), and Region - Global Forecast to 2025

Updated on : June 18, 2024

Plastic Antioxidants Market

The plastic antioxidants market was valued at USD 2.0 billion in 2020 and is projected to reach USD 2.6 billion by 2025, growing at 5.3% cagr from 2020 to 2025. The market is mainly driven by the rising demand for plastic antioxidants for polymer resins such as PE, PP, PVC, PS, ABS, and others for industries such as automotive, consumer goods, building & construction, and medical & healthcare. Factors such as plastics replacing conventional materials, increasing demand in the medical industry, and rapid urbanization in developing countries will drive the plastic antioxidants market. Asia Pacific is the key market for plastic antioxidants, globally, followed by Europe and North America, in terms of volume and value.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Plastic Antioxidants Market

In 2020, the outbreak of COVID-19 resulted in a downfall for many industries across the globe. The decrease in demand for plastics from end-use industries such as automotive, building & construction, consumer goods, and packaging has resulted in a decrease in demand for additives, including plastic antioxidants, used to process plastics. After Q3 2020, industries opened up, but with a limited workforce and expected to be fully functional by the end of 2020. Considering the above factors, the plastic antioxidants market is expected to witness negative growth in 2020 and is expected to rebound with positive growth during the forecast period.

Plastic Antioxidants Market Dynamics

Driver: Plastics gaining preference over conventional materials

Antioxidants are used in a wide range of polymers such as PE, PP, and PVC. These plastics are used in industries such as packaging, building & construction, and automotive. Plastics have superior mechanical and electrical properties, enhanced abrasion resistance, and superior chemical resistance than conventional materials such as metals, glass, paper, and ceramic. Continuous innovation and the need for more lightweight materials in several industries have led to the replacement of metals, glass, paper, and ceramic with plastics in packaging, building & construction, and automotive industries. This is expected to drive the market for plastic antioxidants.

In the automotive industry, particularly in automobile designing, plastics have contributed to several innovations in safety, fuel efficiency, and performance. For instance, airbags made from high-strength polymer fabric can reduce the risk of fatal injury in a direct, frontal car crash. Other advancements include child safety seats, roof linings, steering wheel, dashboard, fenders, as well as fuel system, headlamp covers, and other exterior parts that are directly exposed to heat and light.

Restraints: Health Effects of Synthetic Plastic Antioxidants

Antioxidants are added to plastics to protect their structure and make them thermally stable. However, synthetic antioxidants, such as 2,6 di-tert-butyl-p-cresol (BHT), which is commonly used for polymers such as PP and HDPE, affect human health. According to a study, BHT causes mutations, tumors, and endocrine effects in test animals. It also causes allergic responses in humans. Studies have also shown that LDPE, HDPE, and PP bottles release measurable BHT levels, Chimassorb 81, Irganox PS 800, Irganox 1076, and Irganox 1010 into the food contents. The health effects caused by these antioxidants include endocrine disruption that can lead to cancer, developmental problems in children, congenital defects, and immune system suppression. Various household appliances, car parts, food packaging, and building materials are made of plastics containing these antioxidants. These harmful components migrate out of the plastic and enter into the human body. The demand for phenolic antioxidants is decreasing due to its ill effects on health.

Opportunities: Untapped Opportunities in the Agricultural Sector of developing countries

Plastics are used in mulch films, greenhouse film covers, shades, netting, and silage strap wrap in the agricultural sector. The plastics used in the agriculture sector provide high light transmission to promote the growth of plants. Agricultural plastics need to be able to withstand high solar radiation and mechanical stress. Therefore, antioxidants are used to provide processing and thermal stability and discoloration resistance to agricultural plastics. Countries such as India have not explored the benefits of plastics in the agricultural industry. According to the Federation of Indian Chambers of Commerce & Industry, in 2013, the global average demand for plastics in the agricultural industry was 8%, and in India, it was 2%. Thus, there is a strong growth opportunity for stakeholders in the plastic antioxidants market in India.

Phenolic antioxidant is estimated to be the largest type in 2019.

Antioxidants are classified on the basis of their ability to interrupt the overall oxidation process. Chain breaking and preventive mechanisms are the two major antioxidant mechanisms that interfere with polymer oxidation cycles. The two classes of antioxidants identified are chain-breaking or primary antioxidants and preventive or secondary antioxidants. Primary antioxidants react rapidly and are, therefore, referred to as radical scavengers. Phenolic antioxidants are primary antioxidants, which interfere with chain propagation by terminating the free radical. They are used for plastics or polymer systems that are sensitive to thermal and oxidative degradation due to the formation of peroxides and free radicals. Phenolic antioxidants protect plastics or other polymers against degradation and oxidation at high processing temperatures.

The PP resin is projected to account for the largest share, in terms of volume and value, of the overall plastic antioxidants market between 2020 and 2025.

PP is a thermoplastic polymer with the presence of tertiary carbon atoms. The presence of tertiary carbon atoms makes it susceptible to oxidation and thermal degradation at high temperatures. Polypropylene is processed at temperatures between 428°F and 536°F, and under these conditions, it degrades to form low molecular weight products. Thus, antioxidants are added to PP to stabilize it. Antioxidants are added during the manufacturing process and palletizing. The commonly used antioxidant for PP is butylated hydroxyl-toluene (BHT), which is used as a primary antioxidant, and phosphite & phosphonite, used as secondary antioxidants.

Asia Pacific is expected to be the largest plastic antioxidants market during the forecast period, in terms of value and volume.

Asia Pacific dominated the plastic antioxidants market in 2019, It is also projected to witness the highest CAGR between 2020 and 2025. The growing population and increasing disposable income in countries such as China and India are fueling the growth of the building & construction, packaging, automotive, and other industries in Asia Pacific, thereby driving the plastics and consequently plastic antioxidants market. The region is characterized by a growing population and economic developments. The increasing population in the region, accompanied by increasing construction spending in the developing markets of China, India, and Indonesia, is projected to make this region an ideal destination for the plastic industry. This, in turn, is expected to drive the plastic antioxidants industry in the near future.

Europe is estimated to be the second largest plastic antioxidants market during the forecast period.

Europe is estimated to be the second-largest plastic antioxidants market. The European plastic antioxidants market is segmented into Germany, France, the UK, Italy, Spain, Russia, Poland, and Rest of Europe. Germany is the largest market for plastic antioxidants in Europe. The rising demand for plastics from various industries such as packaging, building & construction, automotive, electronic & electrical, agriculture, consumer & household goods, and furniture fuel the growth of the plastic antioxidants market in the region. There are many untapped opportunities in the packaging industry of Eastern Europe, which shows growth prospects for the plastic antioxidants market in the region.

Plastic Antioxidants Market Players

The key market players profiled in the report include BASF SE (Germany), Songwon (South Korea), Adeka Corporation (Japan), Solvay (Belgium), SK Capital (US), Clariant (Switzerland), Sumitomo Chemical (Japan), 3V Sigma S.p.A (Italy), and Dover Chemical Corporation (US).

In December 2019, BASF opened the second phase of the new antioxidant manufacturing plant in Shanghai, China, to support the fast-growing antioxidants market in the country.

Plastic Antioxidants Market Report Scope

|

Report Metric |

Details |

| Years considered for the study | 2018-2025 |

| Base Year | 2019 |

| Forecast period | 2020–2025 |

| Units considered | Volume (Kilotons); Value (USD Million) |

| Segments | Type, Polymer Resin, and Region |

| Regions | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies | BASF SE (Germany), Songwon (South Korea), Adeka Corporation (Japan), Solvay (Belgium), SK Capital (US), Clariant (Switzerland), Sumitomo Chemical (Japan), 3V Sigma S.p.A (Italy), and Dover Chemical Corporation (US). |

This report categorizes the global plastic antioxidants market based on type, polymer resin, and region.

On the basis of Type, the plastic antioxidants market has been segmented as follows:

- Phenolic

- Phosphite & Phosphonite

- Antioxidants

- Other

On the basis of polymer resin, the plastic antioxidants market has been segmented as follows:

- PE

- PP

- PVC

- PS

- ABS

- Others

On the basis of region, the plastic antioxidants market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Key questions addressed by the report

- What are the factors Influencing the growth of plastic antioxidants?

Light weight and fuel efficiency in automotive industry to replace metals with plastics

- What are phenolic and phpsphite & phophonite antioxidants?

Phenolic antioxidants are primary antioxidants, which interfere with chain propagation by terminating the free radical. Phosphites & phosphonites are phosphorus-based secondary antioxidants. Secondary antioxidants are known as hydroperoxide decomposers as they react with hydroperoxides to produce non-radical products.

- What is the biggest Restraint for plastic antioxidants?

Health effects of synthetic plastic antioxidants

- How many types of plastic antioxidants are available in the market?

Plastic antioxidants are segmented as phenolic, phosphite & phosphonite, antioxidants blends, and others. Phenolic is amongst the most widely used plastic antioxidants.

Frequently Asked Questions (FAQ):

How big is the Plastic Antioxidants Market?

Plastic Antioxidants Market worth $2.6 billion by 2025.

What is the growth rate of Plastic Antioxidants Market?

Plastic Antioxidants Market grows at a CAGR of 5.3% during the forecast period.

What are the factors Influencing the growth of plastic antioxidants?

Light weight and fuel efficiency in automotive industry to replace metals with plastics

What are phenolic and phpsphite & phophonite antioxidants?

Phenolic antioxidants are primary antioxidants, which interfere with chain propagation by terminating the free radical. Phosphites & phosphonites are phosphorus-based secondary antioxidants. Secondary antioxidants are known as hydroperoxide decomposers as they react with hydroperoxides to produce non-radical products.

What is the biggest Restraint for plastic antioxidants?

Health effects of synthetic plastic antioxidants

How many types of plastic antioxidants are available in the market?

Plastic antioxidants are segmented as phenolic, phosphite & phosphonite, antioxidants blends, and others. Phenolic is amongst the most widely used plastic antioxidants. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 PLASTIC ANTIOXIDANTS MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 PLASTIC ANTIOXIDANTS: MARKET DEFINITION AMD INCLUSIONS, BY ANTIOXIDANT TYPE

1.2.3 PLASTIC ANTIOXIDANTS: MARKET DEFINITION AMD INCLUSIONS, BY POLYMER RESIN

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 PLASTIC ANTIOXIDANTS MARKET: STUDY APPROACH

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.1.3 PARENT MARKET APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

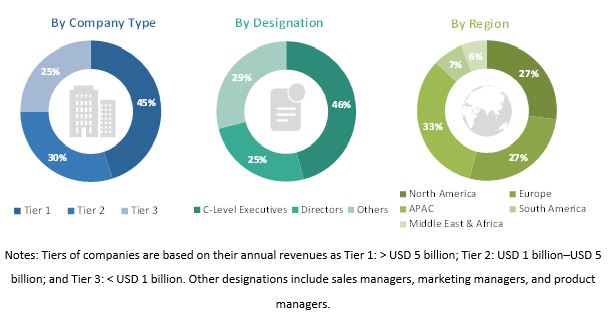

2.3.2.1 Primary interviews: Demand and Supply Sides

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 1 PLASTIC ANTIOXIDANTS MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 2 PLASTIC ANTIOXIDANTS MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 3 PLASTIC ANTIOXIDANTS MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH PLASTIC ANTIOXIDANTS MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 4 PHOSPHITE & PHOSPHONITE TO BE THE FASTEST-GROWING ANTIOXIDANT TYPE IN THE OVERALL PLASTIC ANTIOXIDANTS MARKET

FIGURE 5 PP TO BE THE LARGEST POLYMER RESIN SEGMENT IN THE PLASTIC ANTIOXIDANTS MARKET

FIGURE 6 APAC ACCOUNTED FOR THE LARGEST MARKET FOR PLASTIC ANTIOXIDANTS IN 2019

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 OVERVIEW OF THE PLASTIC ANTIOXIDANTS MARKET

FIGURE 7 PLASTIC ANTIOXIDANTS MARKET TO REGISTER MODERATE GROWTH DURING THE FORECAST PERIOD

4.2 APAC: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN AND COUNTRY

FIGURE 8 CHINA LED THE APAC PLASTIC ANTIOXIDANTS MARKET IN 2019

4.3 PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

FIGURE 9 PHENOLIC ANTIOXIDANTS TO DOMINATE THE MARKET BETWEEN 2020 AND 2025

4.4 PLASTIC ANTIOXIDANTS MARKET, BY REGION

FIGURE 10 APAC PROJECTED TO BE THE FASTEST-GROWING MARKET BETWEEN 2020 AND 2025

4.5 PLASTIC ANTIOXIDANTS MARKET, REGION VS. POLYMER RESIN

4.6 PLASTIC ANTIOXIDANTS MARKET ATTRACTIVENESS

FIGURE 11 INDIA IS PROJECTED TO BE THE FASTEST-GROWING MARKET BETWEEN 2020 AND 2025

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 OVERVIEW OF FACTORS GOVERNING THE PLASTIC ANTIOXIDANTS MARKET

5.2.1 DRIVERS

5.2.1.1 Plastics gaining preference over conventional materials

TABLE 1 ENERGY CONSUMPTION IN THE PROCESSING OF PLASTICS AND OTHER CONVENTIONAL MATERIALS

5.2.1.2 Rise in demand for medical plastics in the healthcare industry

5.2.1.3 Increase in disposable income and rapid urbanization in developing countries

5.2.2 RESTRAINTS

5.2.2.1 Health effects of synthetic plastic antioxidants

5.2.2.2 Compliance with stringent regulatory standards

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand from packaging and consumer goods

5.2.3.2 Untapped opportunities in the agricultural sector of developing countries

5.2.4 CHALLENGES

5.2.4.1 Development of new products for use in polymers other than commodity plastics

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PLASTIC ANTIOXIDANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 14 PLASTIC ANTIOXIDANTS MARKET: SUPPLY CHAIN ANALYSIS

5.5 PRICE ANALYSIS OF PLASTIC ANTIOXIDANTS

FIGURE 15 PRICE ANALYSIS OF PLASTIC ANTIOXIDANTS

5.6 PLASTIC ANTIOXIDANTS MARKET SCENARIOS, 2018-2025

FIGURE 16 PRICE ANALYSIS OF PLASTIC ANTIOXIDANTS

5.7 PATENT ANALYSIS

5.8 PLASTIC ANTIOXIDANTS: ECOSYSTEM

FIGURE 17 PLASTIC ANTIOXIDANTS ECOSYSTEM

5.9 CHANGE IN INDUSTRY SHIFT IMPACTING THE FUTURE REVENUE MIX

5.1 MACROECONOMIC INDICATORS

5.10.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 2 TRENDS AND FORECAST OF REAL GDP, BY MAJOR ECONOMY, ANNUAL PERCENTAGE CHANGE, 2019–2021

5.11 CASE STUDIES

FIGURE 18 CASE STUDY 1: ASSESSMENT OF THE PLASTIC ADDITIVES MARKET IN NORTH AMERICA

FIGURE 19 CASE STUDY 2: ASSESSMENT OF THE FLAME RETARDANT ADDITIVES MARKET

5.12 COVID-19 IMPACT

5.12.1 INTRODUCTION

5.12.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COUNTRY-WISE SPREAD OF COVID-19

5.12.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.12.3.1 Impact of COVID-19 on the Economy: Scenario Assessment

FIGURE 22 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 23 SCENARIOS OF COVID-19 IMPACT

6 PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 24 PHENOLIC ANTIOXIDANTS TO ACCOUNT FOR THE LARGEST SHARE IN THE PLASTIC ANTIOXIDANTS MARKET BETWEEN 2020 AND 2025

TABLE 3 PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 4 PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 5 PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 6 PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

6.2 PHENOLIC ANTIOXIDANTS

6.2.1 WIDE DEMAND IN PREVENTING PLASTICS FROM DEGRADATION AND OXIDATION

FIGURE 25 APAC TO DOMINATE THE PHENOLIC ANTIOXIDANTS MARKET BETWEEN 2020 AND 2025

TABLE 7 PHENOLIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 PHENOLIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 9 PHENOLIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 10 PHENOLIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

6.3 PHOSPHITE & PHOSPHONITE ANTIOXIDANTS

6.3.1 EFFECTIVE AS STABILIZERS IN PLASTIC PROCESSING

FIGURE 26 APAC TO BE THE FASTEST-GROWING PHOSPHITE & PHOSPHONITE ANTIOXIDANTS MARKET DURING THE FORECAST PERIOD

TABLE 11 PHOSPHITE & PHOSPHONITE ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 PHOSPHITE & PHOSPHONITE ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 13 PHOSPHITE & PHOSPHONITE ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 14 PHOSPHITE & PHOSPHONITE ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

6.4 ANTIOXIDANT BLENDS

6.4.1 INCREASE IN DEMAND FOR HIGH-TEMPERATURE PROCESSING OF POLYMERS

FIGURE 27 EUROPE TO BE THE SECOND-LARGEST PLASTIC ANTIOXIDANT BLENDS MARKET DURING THE FORECAST PERIOD

TABLE 15 PLASTIC ANTIOXIDANT BLENDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 PLASTIC ANTIOXIDANT BLENDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 17 PLASTIC ANTIOXIDANT BLENDS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 18 PLASTIC ANTIOXIDANT BLENDS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

6.5 OTHER ANTIOXIDANTS

FIGURE 28 MIDDLE EAST & AFRICA TO BE SECOND-FASTEST-GROWING MARKET FOR OTHER PLASTIC ANTIOXIDANTS DURING THE FORECAST PERIOD

TABLE 19 OTHER PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 OTHER PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 OTHER PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 22 OTHER PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

6.5.1 THIOETHERS

6.5.2 THIOESTERS

7 PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN (Page No. - 86)

7.1 INTRODUCTION

FIGURE 29 PP TO DOMINATE THE PLASTIC ANTIOXIDANTS MARKET BETWEEN 2020 & 2025

TABLE 23 PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 24 PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 25 PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN,2016–2019 (KILOTON)

TABLE 26 PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

7.2 POLYPROPYLENE (PP)

7.2.1 RISE IN DEMAND FOR PP IN AUTOMOTIVE COMPONENTS

FIGURE 30 APAC TO DOMINATE THE PLASTIC ANTIOXIDANTS MARKET IN POLYPROPYLENE RESIN DURING THE FORECAST PERIOD

TABLE 27 PLASTIC ANTIOXIDANTS MARKET SIZE IN PP, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 PLASTIC ANTIOXIDANTS MARKET SIZE IN PP, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 PLASTIC ANTIOXIDANTS MARKET SIZE IN PP, BY REGION, 2016–2019 (KILOTON)

TABLE 30 PLASTIC ANTIOXIDANTS MARKET SIZE IN PP, BY REGION, 2020–2025 (KILOTON)

7.3 POLYETHYLENE (PE)

7.3.1 INCREASE IN DEMAND FOR PE IN PACKAGING, AGRICULTURAL FILMS, AND CABLE FILMS

FIGURE 31 NORTH AMERICA TO BE THE SECOND-LARGEST PLASTIC ANTIOXIDANTS MARKET FOR PE DURING THE FORECAST PERIOD

TABLE 31 PLASTIC ANTIOXIDANTS MARKET SIZE IN PE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 PLASTIC ANTIOXIDANTS MARKET SIZE IN PE, BY REGION, 2020–2025 (USD MILLION)

TABLE 33 PLASTIC ANTIOXIDANTS MARKET SIZE IN PE, BY REGION, 2016–2019 (KILOTON)

TABLE 34 PLASTIC ANTIOXIDANTS MARKET SIZE IN PE, BY REGION, 2020–2025 (KILOTON)

7.4 POLYVINYL CHLORIDE (PVC)

7.4.1 USED IN PVC TO PREVENT DEGRADATION OF ITS MECHANICAL PROPERTIES DURING PROCESSING

FIGURE 32 EUROPE TO BE THE SECOND LARGEST PLASTIC ANTIOXIDANTS MARKET FOR PVC DURING THE FORECAST PERIOD

TABLE 35 PLASTIC ANTIOXIDANTS MARKET SIZE IN PVC, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 PLASTIC ANTIOXIDANTS MARKET SIZE IN PVC, BY REGION, 2020–2025 (USD MILLION)

TABLE 37 PLASTIC ANTIOXIDANTS MARKET SIZE IN PVC, BY REGION, 2016–2019 (KILOTON)

TABLE 38 PLASTIC ANTIOXIDANTS MARKET SIZE IN PVC, BY REGION, 2020–2025 (KILOTON)

7.5 POLYSTYRENE (PS)

7.5.1 RISE IN DEMAND FOR PS IN PACKAGING AND CONSUMER GOODS

FIGURE 33 MIDDLE EAST & AFRICA TO BE SECOND FASTEST GROWING PLASTIC ANTIOXIDANT MARKET FOR POLYSTYRENE DURING THE FORECAST PERIOD

TABLE 39 PLASTIC ANTIOXIDANTS MARKET SIZE IN PS, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 PLASTIC ANTIOXIDANTS MARKET SIZE IN PS, BY REGION, 2020–2025 (USD MILLION)

TABLE 41 PLASTIC ANTIOXIDANTS MARKET SIZE IN PS, BY REGION, 2016–2019 (KILOTON)

TABLE 42 PLASTIC ANTIOXIDANTS MARKET SIZE IN PS, BY REGION, 2020–2025 (KILOTON)

7.6 ACRYLONITRILE BUTADIENE STYRENE (ABS)

7.6.1 ANTIOXIDANTS IN ABS DUE TO ITS SENSITIVITY TO DEGRADATION AND OXIDATION

FIGURE 34 APAC TO BE LARGEST PLASTIC ANTIOXIDANTS MARKET FOR ABS RESIN DURING THE FORECAST PERIOD

TABLE 43 PLASTIC ANTIOXIDANTS MARKET SIZE IN ABS, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 PLASTIC ANTIOXIDANTS MARKET SIZE IN ABS, BY REGION, 2020–2025 (USD MILLION)

TABLE 45 PLASTIC ANTIOXIDANTS MARKET SIZE IN ABS, BY REGION, 2016–2019 (KILOTON)

TABLE 46 PLASTIC ANTIOXIDANTS MARKET SIZE IN ABS, BY REGION, 2020–2025 (KILOTON)

7.7 OTHER POLYMER RESINS

7.7.1 POLYCARBONATE (PC)

7.7.2 POLYAMIDE (PA)

7.7.3 POLYETHYLENE TEREPHTHALATE (PET)

7.7.4 POLYURETHANE (PUR)

FIGURE 35 EUROPE TO BE SECOND-LARGEST PLASTIC ANTIOXIDANTS MARKET FOR OTHER RESINS DURING THE FORECAST PERIOD

TABLE 47 PLASTIC ANTIOXIDANTS MARKET SIZE IN OTHER POLYMER RESINS, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 PLASTIC ANTIOXIDANTS MARKET SIZE IN OTHER POLYMER RESINS, BY REGION, 2020–2025 (USD MILLION)

TABLE 49 PLASTIC ANTIOXIDANTS MARKET SIZE IN OTHER POLYMER RESINS, BY REGION, 2016–2019 (KILOTON)

TABLE 50 PLASTIC ANTIOXIDANTS MARKET SIZE IN OTHER POLYMER RESINS, BY REGION, 2020–2025 (KILOTON)

8 PLASTIC ANTIOXIDANTS MARKET, BY REGION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 36 APAC TO BE THE FASTEST-GROWING PLASTIC ANTIOXIDANTS MARKET

TABLE 51 PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 54 PLASTIC ANTIOXIDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

8.2 APAC

FIGURE 37 APAC: PLASTIC ANTIOXIDANTS MARKET SNAPSHOT

8.2.1 APAC: PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

TABLE 55 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 56 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 57 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 58 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

8.2.2 APAC: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN

TABLE 59 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 60 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 61 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (KILOTON)

TABLE 62 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

8.2.3 APAC: PLASTIC ANTIOXIDANTS MARKET, BY COUNTRY

TABLE 63 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 65 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 66 APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY,2020–2025 (KILOTON)

8.2.3.1 China

8.2.3.1.1 Growth in production and domestic demand for PP in packaging and automotive components in China

TABLE 67 CHINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 68 CHINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 69 CHINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 70 CHINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.2 Japan

8.2.3.2.1 Increase in demand for polymer resins in packaging and lightweight material in automobiles in Japan

TABLE 71 JAPAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 72 JAPAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 73 JAPAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 74 JAPAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.3 INDIA

8.2.3.3.1 Rise in demand for plastics from the Indian packaging and agriculture sectors

TABLE 75 INDIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 76 INDIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 77 INDIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 78 INDIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.4 Singapore

8.2.3.4.1 Growth in demand for PE in the country

TABLE 79 SINGAPORE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 80 SINGAPORE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 81 SINGAPORE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 82 SINGAPORE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.5 Malaysia

8.2.3.5.1 Increase in industrialization and growth in the Malaysian service sector

TABLE 83 MALAYSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 84 MALAYSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 85 MALAYSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 86 MALAYSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.6 South Korea

8.2.3.6.1 Growth of the construction industry in South Korea

TABLE 87 SOUTH KOREA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 88 SOUTH KOREA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 89 SOUTH KOREA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 90 SOUTH KOREA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.2.3.7 Rest of APAC

8.2.3.7.1 Plastic antioxidants market to witness the fastest growth in the PE segment in Rest of APAC

TABLE 91 REST OF APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 92 REST OF APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 93 REST OF APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 94 REST OF APAC: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3 EUROPE

FIGURE 38 EUROPE: PLASTIC ANTIOXIDANTS MARKET SNAPSHOT

8.3.1 EUROPE: PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

TABLE 95 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 96 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 97 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 98 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

8.3.2 EUROPE: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN

TABLE 99 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 101 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (KILOTON)

TABLE 102 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

8.3.3 EUROPE: PLASTIC ANTIOXIDANTS MARKET, BY COUNTRY

TABLE 103 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 105 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 106 EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

8.3.3.1 Germany

8.3.3.1.1 Plastic antioxidants in ABS to witness the highest growth in Germany

TABLE 107 GERMANY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 108 GERMANY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 109 GERMANY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 110 GERMANY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.2 Italy

8.3.3.2.1 Growth in the packaging and automotive industries

TABLE 111 ITALY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 112 ITALY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 113 ITALY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 114 ITALY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.3 France

8.3.3.3.1 France witnesses a rise in the production of PE and PP

TABLE 115 FRANCE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 116 FRANCE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 117 FRANCE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 118 FRANCE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.4 Spain

8.3.3.4.1 Use of plastics in industries such as construction and packaging in Spain

TABLE 119 SPAIN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 120 SPAIN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 121 SPAIN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 122 SPAIN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.5 UK

8.3.3.5.1 Strong packaging industry is a major consumer of plastic antioxidants in the UK

TABLE 123 UK: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 124 UK: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 125 UK: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 126 UK: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.6 Poland

8.3.3.6.1 Growth in demand for plastics from the Polish packaging industry

TABLE 127 POLAND: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 128 POLAND: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 129 POLAND: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 130 POLAND: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.7 Russia

8.3.3.7.1 Developing automotive industry drives the consumption of plastic antioxidants in Russia

TABLE 131 RUSSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 132 RUSSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 133 RUSSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 134 RUSSIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.3.3.8 Rest of Europe

8.3.3.8.1 Polyethylene is dominant in the overall plastic antioxidants market in Rest of Europe

TABLE 135 REST OF EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 136 REST OF EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 137 REST OF EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 138 REST OF EUROPE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.4 NORTH AMERICA

FIGURE 39 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SNAPSHOT

8.4.1 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

TABLE 139 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 140 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 142 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

8.4.2 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN

TABLE 143 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 144 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 145 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (KILOTON)

TABLE 146 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

8.4.3 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY COUNTRY

TABLE 147 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 148 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 150 NORTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

8.4.3.1 US

8.4.3.1.1 Growth in manufacturing and construction industries in the US

TABLE 151 US: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 152 US: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 153 US: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 154 US: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.4.3.2 Mexico

8.4.3.2.1 Growth of the automotive industry fuels the consumption of plastics in Mexico

TABLE 155 MEXICO: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 156 MEXICO: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 157 MEXICO: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 158 MEXICO: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.4.3.3 Canada

8.4.3.3.1 Plastic antioxidants in PVC to witness high growth in Canada

TABLE 159 CANADA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 160 CANADA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 161 CANADA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 162 CANADA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

TABLE 163 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 166 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE,BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

8.5.2 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN

TABLE 167 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (KILOTON)

TABLE 170 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

8.5.3 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET, BY COUNTRY

TABLE 171 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 174 MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

8.5.3.1 Turkey

8.5.3.1.1 Rise in disposable income of the middle-class population to support the growth of the packaging industry in Turkey

TABLE 175 TURKEY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 176 TURKEY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 177 TURKEY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 178 TURKEY: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.5.3.2 Saudi Arabia

8.5.3.2.1 Higher penetration of premium products among the high-income population in Saudi Arabia

TABLE 179 SAUDI ARABIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 180 SAUDI ARABIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 181 SAUDI ARABIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 182 SAUDI ARABIA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.5.3.3 Iran

8.5.3.3.1 Iran witnesses increasing demand for plastics in the automotive industry

TABLE 183 IRAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 184 IRAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 185 IRAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 186 IRAN: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.5.3.4 UAE

8.5.3.4.1 Building & construction witnessing growth with rapid urbanization in the UAE

TABLE 187 UAE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 188 UAE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 189 UAE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 190 UAE: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.5.3.5 Rest of the Middle East & Africa

8.5.3.5.1 Rising infrastructure spending and growth in the industrial sector in the Rest of the Middle East & Africa

TABLE 191 REST OF THE MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 192 REST OF THE MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 193 REST OF THE MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 194 REST OF THE MIDDLE EAST & AFRICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY ANTIOXIDANT TYPE

TABLE 195 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (USD MILLION)

TABLE 196 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (USD MILLION)

TABLE 197 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2016–2019 (KILOTON)

TABLE 198 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY ANTIOXIDANT TYPE, 2020–2025 (KILOTON)

8.6.2 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY POLYMER RESIN

TABLE 199 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD MILLION)

TABLE 200 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD MILLION)

TABLE 201 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (KILOTON)

TABLE 202 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (KILOTON)

8.6.3 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET, BY COUNTRY

TABLE 203 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 204 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 205 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 206 SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

8.6.3.1 Brazil

8.6.3.1.1 Consumption of plastics increasing in the country

TABLE 207 BRAZIL: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 208 BRAZIL: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 209 BRAZIL: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 210 BRAZIL: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.6.3.2 Argentina

8.6.3.2.1 Rise in demand for plastics in packaging and agricultural films in Argentina

TABLE 211 ARGENTINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 212 ARGENTINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 213 ARGENTINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 214 ARGENTINA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

8.6.3.3 Rest of South America

8.6.3.3.1 Rise in GDP and disposable income of the middle-class population in Rest of South America

TABLE 215 REST OF SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (USD THOUSAND)

TABLE 216 REST OF SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (USD THOUSAND)

TABLE 217 REST OF SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2016–2019 (TON)

TABLE 218 REST OF SOUTH AMERICA: PLASTIC ANTIOXIDANTS MARKET SIZE, BY POLYMER RESIN, 2020–2025 (TON)

9 COMPETITIVE LANDSCAPE (Page No. - 178)

9.1 OVERVIEW

FIGURE 40 EXPANSION WAS THE KEY GROWTH STRATEGY ADOPTED BY THE MARKET PLAYERS BETWEEN 2016 AND 2020

9.2 MARKET SHARE OF KEY PLAYERS

FIGURE 41 MARKET SHARE ANALYSIS, 2019

9.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 42 RANKING ANALYSIS OF TOP FIVE PLAYERS IN THE PLASTIC ANTIOXIDANTS MARKET, 2019

9.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019

9.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

9.5.1 STARS

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE PLAYERS

9.5.4 PARTICIPANTS

FIGURE 43 PLASTIC ANTIOXIDANTS MARKET: COMPANY EVALUATION MATRIX, 2019

9.6 SMALL AND MEDIUM SIZE ENTERPRISES (SMES) MATRIX, 2019

FIGURE 44 PLASTIC ANTIOXIDANTS MARKET: SMES MATRIX, 2019

9.7 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE PLASTIC ANTIOXIDANTS MARKET, 2019

FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE PLASTIC ANTIOXIDANTS MARKET

9.8 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE PLASTIC ANTIOXIDANTS MARKET, 2019

FIGURE 46 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE PLASTIC ANTIOXIDANTS MARKET

9.9 COMPETITIVE SITUATION & TRENDS

9.9.1 EXPANSION

TABLE 219 EXPANSION, 2016–2019

9.9.2 NEW PRODUCT LAUNCH

TABLE 220 NEW PRODUCT LAUNCH, 2016–2019

9.9.3 MERGER & ACQUISITION

TABLE 221 MERGER & ACQUISITION, 2016–2019

9.9.4 PARTNERSHIP & AGREEMENT

TABLE 222 PARTNERSHIP & AGREEMENT, 2016–2019

10 COMPANY PROFILES (Page No. - 190)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 BASF SE

FIGURE 47 BASF SE: COMPANY SNAPSHOT

FIGURE 48 BASF SE: WINNING IMPERATIVES

10.2 SONGWON

FIGURE 49 SONGWON: COMPANY SNAPSHOT

FIGURE 50 SONGWON: WINNING IMPERATIVES

10.3 ADEKA CORPORATION

FIGURE 51 ADEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 52 ADEKA CORPORATION: WINNING IMPERATIVES

10.4 SOLVAY

FIGURE 53 SOLVAY: COMPANY SNAPSHOT

FIGURE 54 SOLVAY: WINNING IMPERATIVES

10.5 SK CAPITAL (SI GROUP)

FIGURE 55 SK CAPITAL (SI GROUP): WINNING IMPERATIVES

10.6 CLARIANT

FIGURE 56 CLARIANT: COMPANY SNAPSHOT

10.7 SUMITOMO CHEMICAL

FIGURE 57 SUMITOMO CHEMICAL: COMPANY SNAPSHOT

10.8 3V SIGMA S.P.A

10.9 DOVER CHEMICAL CORPORATION

10.10 EVERSPRING CHEMICAL CO., LTD.

10.11 AMPACET CORPORATION

10.12 EVONIK INDUSTRIES

FIGURE 58 EVONIK INDUSTRIES: COMPANY SNAPSHOT

10.13 LYONDELLBASELL (A. SCHULMAN)

10.14 ASTRA POLYMERS COMPOUNDING CO. LTD.

10.15 EMERALD PERFORMANCE MATERIALS

10.16 KRISHNA ANTIOXIDANTS PVT. LTD.

10.17 LANXESS

10.18 MILLIKEN & COMPANY

10.19 OMNOVA SOLUTIONS INC.

10.20 OXIRIS CHEMICALS S.A.

10.21 RIFRA MASTERBATCHES S.P.A

10.22 WELLS PLASTICS LTD.

10.23 SAKAI CHEMICAL INDUSTRY CO., LTD.

10.24 SHANDONG LINYI SUNNY WEALTH CHEMICALS CO., LTD.

10.25 TRIGON ANTIOXIDANTS PVT. LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 218)

11.1 INTRODUCTION

11.2 LIMITATION

11.3 IMPACT MODIFIER MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.4 IMPACT MODIFIER MARKET, BY REGION

TABLE 223 IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 224 IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

11.4.1 APAC

11.4.1.1 By Country

TABLE 225 APAC: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 226 APAC: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

11.4.1.2 By End-use Industry

TABLE 227 APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 228 APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11.4.2 EUROPE

11.4.2.1 By Country

TABLE 229 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 230 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

11.4.2.2 By End-use Industry

TABLE 231 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 232 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11.4.3 NORTH AMERICA

11.4.3.1 By Country

TABLE 233 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 234 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

11.4.3.2 By End-use Industry

TABLE 235 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 236 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11.4.4 MIDDLE EAST & AFRICA

11.4.4.1 By Country

TABLE 237 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

11.4.4.2 By End-use Industry

TABLE 239 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 240 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11.4.5 SOUTH AMERICA

11.4.5.1 By Country

TABLE 241 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 242 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

11.4.5.2 By End-use Industry

TABLE 243 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 244 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

12 APPENDIX (Page No. - 228)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size for plastic antioxidants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The plastic antioxidants market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development and usage of PE, PP, PVC, PS, ABS, and other polymer resins to be used in end-use industries such as automotive, construction, packaging, and consumer goods. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the plastic antioxidants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the plastic antioxidants market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the plastic antioxidants market on the basis of type and polymer resin

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger & acquisition, and agreement in the plastic antioxidants market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Plastic Antioxidants Market