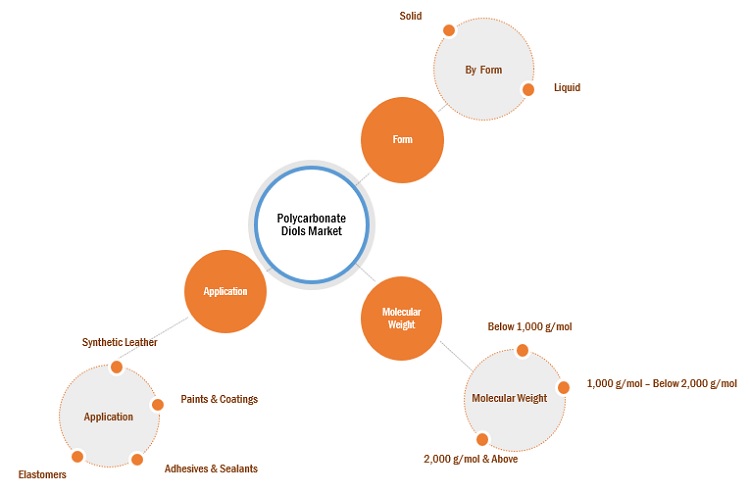

Polycarbonate Diols Market by Form (Solid, Liquid), Molecular Weight (g/mol) (<1,000, 1,000 – below 2,000, 2,000 & Above), Application (Synthetic Leather, Paints & Coatings, Adhesives & Sealants, Elastomers) and Region - Global Forecast to 2027

Updated on : August 28, 2025

Polycarbonate Diols Market

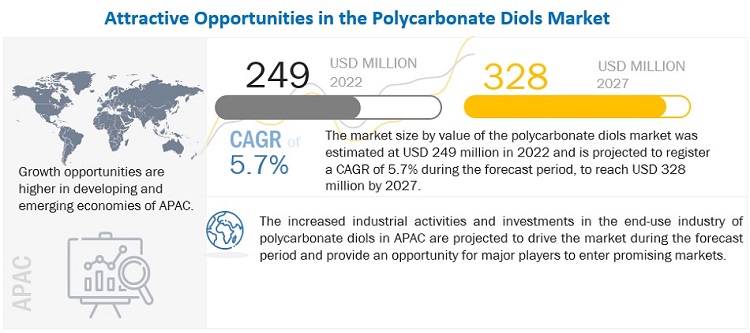

The global polycarbonate diols market was valued at USD 249 million in 2022 and is projected to reach USD 328 million by 2027, growing at 5.7% cagr from 2022 to 2027. With increasing environmental consciousness and the imposition of strict regulations across the globe, there has been a drastic shift from solvent-based to water-based polyurethane materials over the past few years.

However, in the case of water-based polyurethane, the water-resistant property of the material gets affected because it is made from traditional polyols which contain a hydrophilic group, directly affecting water-bases polyurethane. To reduce this, instead of conventional polyols, polycarbonate can be used to enhance hydrolysis resistance of polyurethane materials. Thus, the polycarbonate diols can be used extensively in the production of waterborne polyurethane materials.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19

The outbreak of COVID-19 has affected end-use industries of the polycarbonate diols market across the globe. The impact can be felt over the economy with lockdowns and suspension of production operations due to social distancing norms. The decline in demand from end-use industries impacted the polycarbonate diols market across the globe.

Polycarbonate Diols Market Dynamics

Driver: Growth in demand for water-based polyurethane systems

The demand for water-based polyurethane systems is increasing due to the increasing consumer awareness of the harmful effects of hazardous air pollutants (HAPs). Nowadays, polyurethane dispersions are offered with very low or zero VOCs and are available in a wide range of hardness and solid content. Several industries prefer water-based over solvent-based polyurethane systems, owing to their versatility and superior properties. In several countries, including the US, China, and European countries, governments have stringent rules pertaining to the use of solvent-based polyurethane systems. Thus, growing environmental consciousness and regulations developed by governments in developed as well as developing economies keep VOCs below 350 g/l are expected to drive the solvent-free polyurethane dispersions market anytime soon.

Restraint: Costlier than conventional polyols

The cost of polycarbonate diols is greater than convention polyether and polyester polyols. The higher price is mainly due to higher costs of production of polycarbonate diols. Polycarbonate diols are used to impart several properties in polyurethane, such as high hydrolysis resistance, heat resistance, and wear resistance, among others, which is not possible with the use of conventional polyols. Except if the polyurethane manufacturers do not receive demand for high-performance PU products, they are not using these polyols. Hence, high cost is a big restraining factor for the polycarbonate diols market.

Opportunity: Government regulation encouraging the use of eco-friendly chemicals

Recently, China's Ministry of Ecology and Environment imposed stringent regulations similar to REACH on the specialty chemical industry. Owing to this, there has been a drastic rise in the demand for eco-friendly

chemicals in China. Along with this, European and North American countries have banned the consumption of solvent-based polyurethane systems and paved the way for the use of water-based polyurethane systems.

Governmental organizations, such as REACH and Environmental Protection Agency (EPA), are continuously assessing the amount of VOCs released from paints & coatings, leather, and textile industries. Additionally, VOC regulations are also strictly followed by major manufacturers present in North America and Europe. Thus, the imposition of those regulations expands the market spectrum by providing new opportunities for the growth of eco-friendly chemicals. This is a great opportunity for the players in the polycarbonate diols market.

Challenges: Controlling prices to ensure affordability

In a competitive environment, the major challenge faced by polyurethane manufacturers is to offer high-performance polyurethane at affordable prices to end users. However, the cost of polycarbonate diols is two to three times higher than conventional polyols, which leads to an increase in the value of the final

product. To mitigate the cost constraints, several polyurethane manufacturers are blending polycarbonate diols with polyester polyols to produce tailor-made polyurethane for specific applications

Polycarbonate Diols Market Ecosystem

Solid form is projected to be the fastest-growing during the forecast period.

Solid polycarbonate diols impart high resistance to hydrolysis, oxidation, stain, and wear in polyurethane products compared to the polyether and polyester polyols. The increasing demand for solid polycarbonate is being attributed primarily to the growing demand for high-performance synthetic leathers. Accessibility of a wide range of solid products with different molecular weights and its fitness for several end-use applications helps preserve its dominance over the forecast period.

Synthetic leather is the biggest and fastest-growing application in the polycarbonate diols market.

Developing of the synthetic leather industry has been affected by the supply of raw materials, growing environmental concerns, animal protection, and changes in consumer demand. Thereby, a major shift in the market from natural to synthetic leather is being seen across the globe. The manufacturing of synthetic leather-based products has led to the growing demand for high-quality, functional polyurethane from artificial leather manufacturers that are constantly growing across the globe.

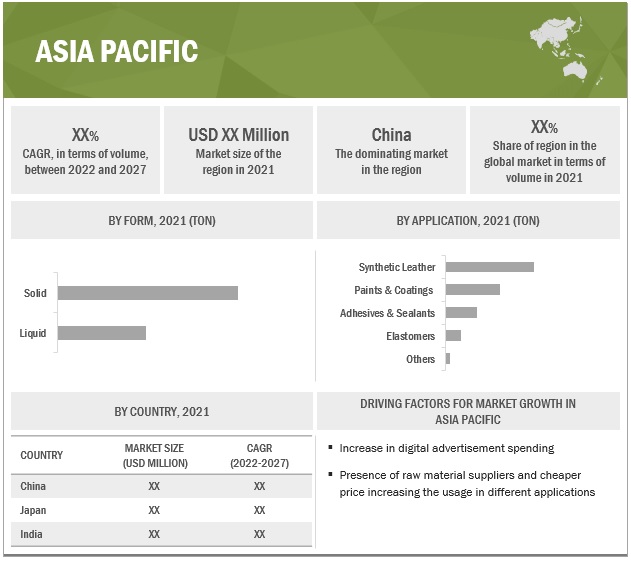

The Asia Pacific is estimated to account for the biggest polycarbonate diols market share during the forecast period.

There has been a shift of the manufacturing bases from the developed economies to the developing regions, post the global recession in 2008. Owing to the low cost of production and lenient regulation, APAC seemed like a profitable market for the worldwide industry shift. Since then, the APAC industrial sector had recorded healthy growth in terms of production. This industrial sector's growth is helping to drive the demand for the Polyurethane market, which in turn also supports growth of the polycarbonate diols market.

To know about the assumptions considered for the study, download the pdf brochure

Polycarbonate Diols Market Players

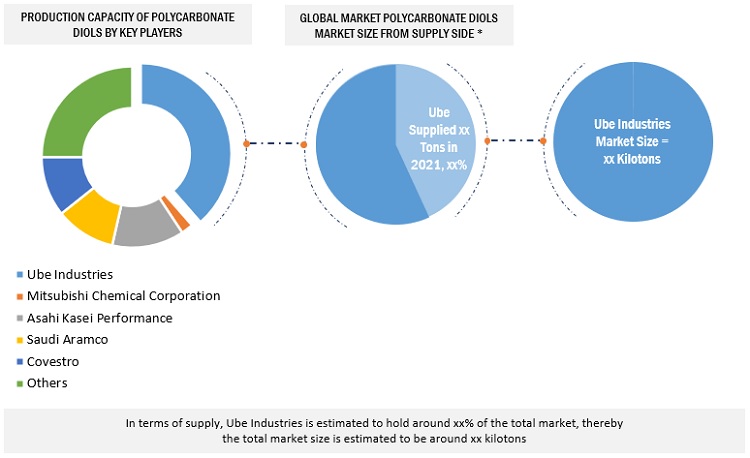

The major players in the polycarbonate diols industry are Ube Industries Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), Asahi Kasei Corporation (Japan), Covestro Ag (Germany), Tosoh Corporation (Japan), Daicel Corporation (Japan), Perstorp Group (Sweden), Saudi Arabian Oil Co. (Saudi Arabia), GRR Fine Chem Pvt. Ltd. (India), and Chemwill Asia Co. Ltd. (China), among others.

Polycarbonate Diols Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million), Volume (Tons) |

|

Segments |

Form, Molecular Weight, Application, and Region |

|

Regions |

North America, Europe, Asia-Pacific, and Rest of World |

|

Companies |

UBE Industries Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), Asahi Kasei Corporation (Japan), Covestro Ag (Germany), Tosoh Corporation (Japan), Daicel Corporation (Japan), Perstorp Group (Sweden), Saudi Arabian Oil Co. (Saudi Arabia), GRR Fine Chem Pvt. Ltd.(India), and Chemwill Asia Co. Ltd. (China), among others are covered in the Polycarbonate Diols market. |

This research report categorizes the global Polycarbonate Diols market on the basis of Form, Molecular Weight, Application, and Region.

Polycarbonate Diols Market, By Form

- Solid

- Liquid

Polycarbonate Diols Market, By Molecular Weight

- Below 1,000 g/mol

- 1000 g/mol – Below 2,000 g/mol

- 2000 g/mol & Above

Polycarbonate Diols Market, By Application

- Synthetic Leather

- Paints & Coatings

- Adhesives & Sealants

- Elastomers

- Others

Polycarbonate Diols Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In 2019, Covestro Ag has a strong polyurethane production capacity and is ranked 2nd in terms of production across the globe. Along with this, the company has a significant share in the global polyol market

- In 2019, Saudi Aramco started producing polycarbonate diols based on Converge technology by the conversion of CO2 into high end-products such as a polyol, and binder compounds, among others.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of Polycarbonate Diols?

Yes the report covers the new applications of Polycarbonate Diols.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the Polycarbonate Diols market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

China, Japan, and India are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 1 POLYCARBONATE DIOLS MARKET: INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 POLYCARBONATE DIOLS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 POLYCARBONATE DIOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH: BASED ON GLOBAL PRODUCTION OF POLYCARBONATE DIOLS

FIGURE 3 TOP-DOWN APPROACH: BASED ON PRODUCTION OF POLYCARBONATE DIOLS

2.2.2 SUPPLY-SIDE ESTIMATION: BASED ON PRODUCTION CAPACITY

FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.3 DEMAND-SIDE ESTIMATION: BASED ON POLYOL MARKET

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 6 POLYCARBONATE DIOLS MARKET: DATA TRIANGULATION

2.3.1 RESEARCH ASSUMPTIONS

2.3.2 RESEARCH LIMITATIONS

2.3.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 SOLID FORM HOLDS MAJOR SHARE OF POLYCARBONATE DIOLS MARKET

FIGURE 8 2,000 G/MOL & ABOVE SEGMENT ACCOUNTS FOR LARGEST SHARE OF POLYCARBONATE DIOLS MARKET

FIGURE 9 SYNTHETIC LEATHER IS LARGEST APPLICATION OF POLYCARBONATE DIOLS

FIGURE 10 ASIA PACIFIC LED POLYCARBONATE DIOLS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 BRIEF OVERVIEW OF POLYCARBONATE DIOLS MARKET

FIGURE 11 RISING DEMAND IN SYNTHETIC LEATHER APPLICATION TO DRIVE MARKET

4.2 ASIA PACIFIC POLYCARBONATE DIOLS MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 12 CHINA AND SYNTHETIC LEATHER SEGMENT ACCOUNTED FOR LARGEST SHARES

4.3 POLYCARBONATE DIOLS MARKET, BY FORM

FIGURE 13 SOLID SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.4 POLYCARBONATE DIOLS MARKET, BY MOLECULAR WEIGHT

FIGURE 14 1,000 G/MOL-BELOW 2,000 G/MOL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 POLYCARBONATE DIOLS MARKET, BY APPLICATION

FIGURE 15 SYNTHETIC LEATHER SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 POLYCARBONATE DIOLS MARKET, BY MAJOR COUNTRIES

FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYCARBONATE DIOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for synthetic leather

5.2.1.2 Growing demand for high-performance PU products in automotive industry

5.2.1.3 Rising demand for water-based polyurethane systems

5.2.2 RESTRAINTS

5.2.2.1 Costlier than conventional polyols

5.2.3 OPPORTUNITIES

5.2.3.1 Government regulations encouraging use of eco-friendly chemicals

5.2.4 CHALLENGES

5.2.4.1 Controlling prices to ensure affordability

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 POLYCARBONATE DIOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 POLYCARBONATE DIOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

FIGURE 19 REVENUE SHIFT FOR POLYCARBONATE DIOLS MARKET

5.5 SUPPLY CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 CONVENTIONAL PHOSGENE METHOD

5.6.2 TRANSESTERIFICATION METHOD

5.6.3 RING-OPENING POLYMERIZATION METHOD

5.6.4 CARBON DIOXIDE (CO2) METHOD

5.7 INDUSTRY TRENDS

5.7.1 CONSOLIDATION AND EXPANSION OF PRODUCTION FACILITIES

5.7.2 DEVELOPMENT OF ADVANCED MANUFACTURING PROCESSES

5.8 PRICING ANALYSIS

TABLE 3 POLYCARBONATE DIOLS MARKET: PRICING ANALYSIS, BY REGION

TABLE 4 POLYCARBONATE DIOLS MARKET: AVERAGE PRICE, BY REGION

5.9 ECOSYSTEM

FIGURE 20 POLYCARBONATE DIOLS MARKET: ECOSYSTEM

5.10 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 5 POLYCARBONATE DIOLS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO APPLICATIONS (%)

5.11.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR POLYCARBONATE DIOLS IN TOP 2 APPLICATIONS

5.12 TRADE ANALYSIS

5.12.1 IMPORT SCENARIO

TABLE 8 IMPORT SCENARIO FOR HS CODE 390950, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.12.2 EXPORT SCENARIO

TABLE 9 EXPORT SCENARIO FOR HS CODE: 390950, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.13 REGULATION LANDSCAPE

5.13.1 LEED STANDARDS

TABLE 10 LEED STANDARDS FOR ADHESIVES AND SEALANTS IN ARCHITECTURAL APPLICATIONS

TABLE 11 REGULATIONS RELATED TO LEATHER AND ARTIFICIAL LEATHER

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 12 TOTAL NUMBER OF GRANTED PATENTS IN LAST 10 YEARS

FIGURE 23 NUMBER OF PATENTS PUBLISHED (2011–2021)

FIGURE 24 NUMBER OF PATENTS PUBLISHED YEAR-WISE (2011–2021)

5.14.4 INSIGHTS

5.14.5 JURISDICTION ANALYSIS

FIGURE 25 PATENT ANALYSIS: BY TOP JURISDICTION

5.14.6 TOP APPLICANTS

FIGURE 26 TOP 10 PATENT APPLICANTS

TABLE 13 LIST OF PATENTS BY MITSUBISHI CHEM CORP.

TABLE 14 LIST OF PATENTS BY ASAHI CHEMICAL IND.

TABLE 15 LIST OF PATENTS BY BASF COATINGS GMBH

TABLE 16 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 POLYCARBONATE DIOLS MARKET, BY MOLECULAR WEIGHT (Page No. - 82)

6.1 INTRODUCTION

FIGURE 27 POLYCARBONATE DIOLS MARKET SHARE, BY MOLECULAR WEIGHT, IN TERMS OF VOLUME (2021)

TABLE 17 POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 18 POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 19 POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 20 POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

6.2 BELOW 1,000 G/MOL

6.2.1 STEADY GROWTH IN DEMAND FROM PAINTS & COATINGS INDUSTRY

TABLE 21 POLYCARBONATE DIOLS MARKET SIZE IN BELOW 1,000 G/MOL SEGMENT, BY REGION, 2017–2020 (TON)

TABLE 22 POLYCARBONATE DIOLS MARKET SIZE IN BELOW 1,000 G/MOL SEGMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 POLYCARBONATE DIOLS MARKET SIZE IN BELOW 1,000 G/MOL SEGMENT, BY REGION, 2021–2027 (TON)

TABLE 24 POLYCARBONATE DIOLS MARKET SIZE IN BELOW 1,000 G/MOL SEGMENT, BY REGION, 2021–2027 (USD MILLION)

6.3 1,000–BELOW 2,000 G/MOL

6.3.1 RISING DEMAND IN SYNTHETIC LEATHER APPLICATION

TABLE 25 POLYCARBONATE DIOLS MARKET SIZE IN 1,000–BELOW 2,000 G/MOL SEGMENT, BY REGION, 2017–2020 (TON)

TABLE 26 POLYCARBONATE DIOLS MARKET SIZE IN 1,000–BELOW 2,000 G/MOL SEGMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 POLYCARBONATE DIOLS MARKET SIZE IN 1,000–BELOW 2,000 G/MOL SEGMENT, BY REGION, 2021–2027 (TON)

TABLE 28 POLYCARBONATE DIOLS MARKET SIZE IN 1,000–BELOW 2,000 G/MOL SEGMENT, BY REGION, 2021–2027 (USD MILLION)

6.4 2,000 G/MOL & ABOVE

6.4.1 CHARACTERIZED BY BETTER CHEMICAL STABILITY THAN OTHERS

TABLE 29 POLYCARBONATE DIOLS MARKET SIZE IN 2,000 G/MOL & ABOVE SEGMENT, BY REGION, 2017–2020 (TON)

TABLE 30 POLYCARBONATE DIOLS MARKET SIZE IN 2,000 G/MOL & ABOVE SEGMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 POLYCARBONATE DIOLS MARKET SIZE IN 2,000 G/MOL & ABOVE SEGMENT, BY REGION, 2021–2027 (TON)

TABLE 32 POLYCARBONATE DIOLS MARKET SIZE IN 2,000 G/MOL & ABOVE SEGMENT, BY REGION, 2021–2027 (USD MILLION)

7 POLYCARBONATE DIOLS MARKET, BY FORM (Page No. - 89)

7.1 INTRODUCTION

FIGURE 28 POLYCARBONATE DIOLS MARKET SHARE, BY FORM, IN TERMS OF VOLUME (2021)

TABLE 33 POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 34 POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 35 POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 36 POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

7.2 SOLID

7.2.1 ROBUST GROWTH IN DEMAND FROM SYNTHETIC LEATHER APPLICATION

TABLE 37 POLYCARBONATE DIOLS MARKET SIZE IN SOLID FORM, BY REGION, 2017–2020 (TON)

TABLE 38 POLYCARBONATE DIOLS MARKET SIZE IN SOLID FORM, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 POLYCARBONATE DIOLS MARKET SIZE IN SOLID FORM, BY REGION, 2021–2027 (TON)

TABLE 40 POLYCARBONATE DIOLS MARKET SIZE IN SOLID FORM, BY REGION, 2021–2027 (USD MILLION)

7.3 LIQUID

7.3.1 INCREASING DEMAND FOR WATERBORNE PAINTS & COATINGS

TABLE 41 POLYCARBONATE DIOLS MARKET SIZE IN LIQUID FORM, BY REGION, 2017–2020 (TON)

TABLE 42 POLYCARBONATE DIOLS MARKET SIZE IN LIQUID FORM, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 POLYCARBONATE DIOLS MARKET SIZE IN LIQUID FORM, BY REGION, 2021–2027 (TON)

TABLE 44 POLYCARBONATE DIOLS MARKET SIZE IN LIQUID FORM, BY REGION, 2021–2027 (USD MILLION)

8 POLYCARBONATE DIOLS MARKET, BY APPLICATION (Page No. - 95)

8.1 INTRODUCTION

FIGURE 29 POLYCARBONATE DIOLS MARKET SHARE, BY APPLICATION, IN TERMS OF VOLUME (2021)

TABLE 45 POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 46 POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 47 POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 48 POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

8.2 SYNTHETIC LEATHER

8.2.1 GROWING ADOPTION OF HIGH-PERFORMANCE SYNTHETIC LEATHER ACROSS INDUSTRIES

TABLE 49 POLYCARBONATE DIOLS MARKET SIZE IN SYNTHETIC LEATHER APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 50 POLYCARBONATE DIOLS MARKET SIZE IN SYNTHETIC LEATHER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 POLYCARBONATE DIOLS MARKET SIZE IN SYNTHETIC LEATHER APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 52 POLYCARBONATE DIOLS MARKET SIZE IN SYNTHETIC LEATHER APPLICATION, BY REGION, 2021–2027 (USD MILLION)

8.3 PAINTS & COATINGS

8.3.1 INCREASING DEMAND FOR WATERBORNE PAINTS & COATINGS TO

TABLE 53 POLYCARBONATE DIOLS MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 54 POLYCARBONATE DIOLS MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 POLYCARBONATE DIOLS MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 56 POLYCARBONATE DIOLS MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2021–2027 (USD MILLION)

8.4 ADHESIVES & SEALANTS

8.4.1 GROWTH IN DEMAND FOR HIGH-PERFORMANCE ADHESIVES

TABLE 57 POLYCARBONATE DIOLS MARKET SIZE IN ADHESIVES & SEALANTS APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 58 POLYCARBONATE DIOLS MARKET SIZE IN ADHESIVES & SEALANTS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 POLYCARBONATE DIOLS MARKET SIZE IN ADHESIVES & SEALANTS APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 60 POLYCARBONATE DIOLS MARKET SIZE IN ADHESIVES & SEALANTS APPLICATION, BY REGION, 2021–2027 (USD MILLION)

8.5 ELASTOMERS

8.5.1 DEMAND FOR PU ELASTOMERS TO DRIVE MARKET

TABLE 61 POLYCARBONATE DIOLS MARKET SIZE IN ELASTOMERS APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 62 POLYCARBONATE DIOLS MARKET SIZE IN ELASTOMERS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 POLYCARBONATE DIOLS MARKET SIZE IN ELASTOMERS APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 64 POLYCARBONATE DIOLS MARKET SIZE IN ELASTOMERS APPLICATION, BY REGION, 2021–2027 (USD MILLION)

8.6 OTHERS

TABLE 65 POLYCARBONATE DIOLS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (TON)

TABLE 66 POLYCARBONATE DIOLS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 POLYCARBONATE DIOLS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (TON)

TABLE 68 POLYCARBONATE DIOLS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

9 POLYCARBONATE DIOLS MARKET, BY REGION (Page No. - 107)

9.1 INTRODUCTION

FIGURE 30 INDIA TO BE FASTEST-GROWING POLYCARBONATE DIOLS MARKET

TABLE 69 POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 70 POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 72 POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SNAPSHOT

TABLE 73 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 74 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 75 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 76 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 78 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 79 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 80 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 82 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 83 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 84 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 86 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 87 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 88 ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Growth of manufacturing sector to support market growth

TABLE 89 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 90 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 91 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 92 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 93 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 94 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 95 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 96 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 97 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 98 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 99 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 100 CHINA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Strong production capacity and huge automobile manufacturing base

TABLE 101 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 102 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 103 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 104 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 105 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 106 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 107 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 108 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 109 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 110 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 112 JAPAN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Significant growth in FDI investment and change in policies for industrial sector growth

TABLE 113 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 114 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 115 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 116 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 117 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 118 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 119 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 120 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 121 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 122 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 123 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 124 INDIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Steady growth of end-use industries to drive market

TABLE 125 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 126 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 127 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 128 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 129 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 130 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 131 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 132 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 133 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 134 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 135 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 136 SOUTH KOREA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

TABLE 137 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 138 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 140 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 142 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 144 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 146 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 148 REST OF ASIA PACIFIC: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.3 NORTH AMERICA

TABLE 149 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 150 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 151 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 152 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 153 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 154 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 155 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 156 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 157 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 158 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 159 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 160 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 161 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 162 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 163 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 164 NORTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.3.1 US

9.3.1.1 Growing demand for polyurethane to drive market

FIGURE 32 POLYURETHANE DEMAND IN US, IN TERMS OF VOLUME, BY END-USE INDUSTRY (2021)

TABLE 165 US: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 166 US: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 167 US: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 168 US: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 169 US: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 170 US: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 171 US: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)U

TABLE 172 US: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 173 US: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 174 US: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 175 US: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 176 US: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Slow economic growth to hamper market growth

TABLE 177 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 178 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 179 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 180 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 181 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 182 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 183 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 184 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 185 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 186 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 187 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 188 CANADA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Growing manufacturing sector to boost market

TABLE 189 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 190 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 191 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 192 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 193 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 194 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 195 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 196 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 197 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 198 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 199 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 200 MEXICO: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4 EUROPE

TABLE 201 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 202 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 203 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 204 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 205 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 206 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 207 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 208 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 209 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 210 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 211 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 212 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 213 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 214 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 215 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 216 EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Proactive implementation of green economy to drive market

TABLE 217 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 218 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 219 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 220 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 221 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 222 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 223 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 224 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 225 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 226 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 227 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 228 GERMANY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.2 UK

9.4.2.1 Manufacturing sector growth to boost market

TABLE 229 UK: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 230 UK: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 231 UK: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 232 UK: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 233 UK: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 234 UK: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 235 UK: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 236 UK: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 237 UK: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 238 UK: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 239 UK: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 240 UK: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Steady growth of automotive industry to spur market growth

TABLE 241 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 242 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 243 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 244 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 245 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 246 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 247 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 248 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 249 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 250 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 251 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 252 FRANCE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.4 RUSSIA

9.4.4.1 Large footwear industry to propel demand for synthetic leather

TABLE 253 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 254 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 255 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 256 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 257 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 258 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 259 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 260 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 261 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 262 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 263 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 264 RUSSIA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.5 ITALY

9.4.5.1 Synthetic leather and paints & coating applications to drive market

TABLE 265 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 266 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 267 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 268 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 269 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 270 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 271 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 272 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 273 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 274 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 275 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 276 ITALY: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.6 SPAIN

9.4.6.1 Leather finishing application to drive market

TABLE 277 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 278 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 279 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 280 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 281 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 282 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 283 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 284 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 285 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 286 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 287 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 288 SPAIN: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 289 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 290 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 291 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 292 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 293 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 294 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 295 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 296 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 297 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 298 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 299 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 300 REST OF EUROPE: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.5 ROW

TABLE 301 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 302 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 303 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 304 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 305 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 306 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 307 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 308 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 309 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 310 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 311 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 312 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 313 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 314 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 315 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 316 ROW: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

TABLE 317 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 318 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 319 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 320 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 321 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 322 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 323 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 324 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 325 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 326 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 327 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 328 SOUTH AMERICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

TABLE 329 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (TON)

TABLE 330 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 331 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (TON)

TABLE 332 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 333 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (TON)

TABLE 334 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2017–2020 (USD MILLION)

TABLE 335 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (TON)

TABLE 336 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY MOLECULAR WEIGHT, 2021–2027 (USD MILLION)

TABLE 337 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 338 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 339 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 340 MIDDLE EAST & AFRICA: POLYCARBONATE DIOLS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 194)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 341 OVERVIEW OF STRATEGIES ADOPTED BY POLYCARBONATE DIOL MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 33 RANKING OF TOP FIVE PLAYERS IN POLYCARBONATE DIOLS MARKET (2021)

10.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 342 SHARE OF KEY PLAYERS IN POLYCARBONATE DIOLS MARKET

FIGURE 34 POLYCARBONATE DIOLS MARKET SHARE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 35 POLYCARBONATE DIOLS MARKET: COMPANY EVALUATION QUADRANT (2021)

10.5 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 36 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX (2021)

10.6 COMPETITIVE BENCHMARKING

TABLE 343 POLYCARBONATE DIOLS MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 344 POLYCARBONATE DIOLS MARKET: COMPANY APPLICATION FOOTPRINT

10.7 COMPETITIVE SITUATION & TRENDS

10.7.1 EXPANSIONS

TABLE 345 EXPANSIONS, 2018–2021

10.7.2 NEW PRODUCT LAUNCHES

TABLE 346 NEW PRODUCT LAUNCHES, 2018–2021

11 COMPANY PROFILES (Page No. - 201)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 UBE INDUSTRIES, LTD.

TABLE 347 UBE INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 37 UBE INDUSTRIES: COMPANY SNAPSHOT

11.2 MITSUBISHI CHEMICAL CORPORATION

TABLE 348 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

FIGURE 38 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

11.3 ASAHI KASEI CORPORATION

TABLE 349 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

FIGURE 39 ASAHI KASEI: COMPANY SNAPSHOT

11.4 COVESTRO AG

TABLE 350 COVESTRO AG: COMPANY OVERVIEW

FIGURE 40 COVESTRO AG: COMPANY SNAPSHOT

11.5 TOSOH CORPORATION

TABLE 351 TOSOH CORPORATION: COMPANY OVERVIEW

FIGURE 41 TOSOH CORPORATION: COMPANY SNAPSHOT

11.6 DAICEL CORPORATION

TABLE 352 DAICEL CORPORATION: COMPANY OVERVIEW

FIGURE 42 DAICEL CORPORATION: COMPANY SNAPSHOT

11.7 PERSTORP GROUP

TABLE 353 PERSTORP GROUP: COMPANY OVERVIEW

FIGURE 43 PERSTORP GROUP: COMPANY SNAPSHOT

11.8 SAUDI ARABIAN OIL COMPANY

TABLE 354 SAUDI ARABIAN OIL COMPANY: COMPANY OVERVIEW

FIGURE 44 SAUDI ARABIAN OIL COMPANY: COMPANY SNAPSHOT

11.9 ADDITIONAL PLAYERS

11.9.1 GRR FINE CHEM PVT. LTD.

TABLE 355 GRR FINE CHEM PVT. LTD.: COMPANY OVERVIEW

11.9.2 CHEMWILL ASIA CO. LTD.

TABLE 356 CHEMWILL ASIA CO. LTD.: COMPANY OVERVIEW

11.9.3 CAFFARO INDUSTRIE SPA

TABLE 357 CAFFARO INDUSTRIE SPA: COMPANY OVERVIEW

11.9.4 CROMOGENIA UNITS S. A.

TABLE 358 CROMOGENIA UNITS S. A.: COMPANY OVERVIEW

11.9.5 GUANGDONG DAZHI ENVIRONMENTAL PROTECTION TECHNOLOGY INCORPORATED COMPANY

TABLE 359 GUANGDONG DAZHI ENVIRONMENTAL PROTECTION TECHNOLOGY INCORPORATED COMPANY:COMPANY OVERVIEW

11.9.6 HUBEI JUSHENG TECHNOLOGY CO., LTD.

TABLE 360 HUBEI JUSHENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

11.9.7 KURARAY CO., LTD.

TABLE 361 KURARAY CO., LTD.: COMPANY OVERVIEW

11.9.8 JIANGSU CHEMICAL INDUSTRY RESEARCH INSTITUTES CO. LTD.

TABLE 362 JIANGSU CHEMICAL INDUSTRY RESEARCH INSTITUTES CO. LTD.: COMPANY OVERVIEW

11.9.9 SUMITOMO BAKELITE CO., LTD.

TABLE 363 SUMITOMO BAKELITE CO., LTD.: COMPANY OVERVIEW

11.9.10 QINGDAO HUAYUAN POLYMER CO., LTD.

TABLE 364 QINGDAO HUAYUAN POLYMER CO., LTD.: COMPANY OVERVIEW

11.9.11 ERCA ADVANCED POLYMER SOLUTIONS SRL

TABLE 365 ERCA ADVANCED POLYMER SOLUTIONS SRL: COMPANY OVERVIEW

11.9.12 MERCK KGAA

TABLE 366 MERCK KGAA: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 226)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the polycarbonate diols market. The primary sources include industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with different primary respondents, such as key industry participants, subject matter experts (SMEs), C-Level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

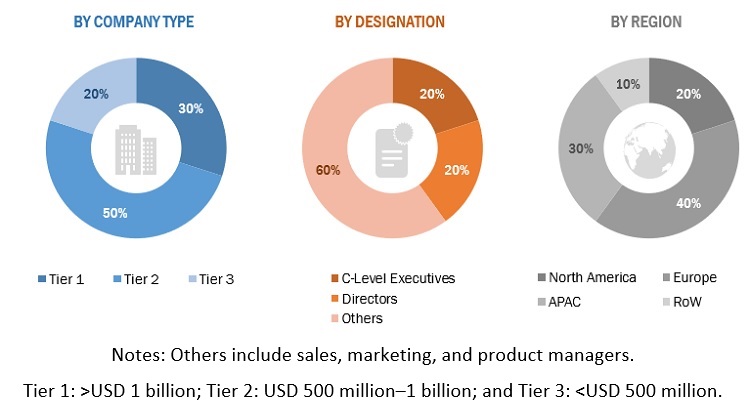

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, Porter’s Five Forces Analysis, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the polycarbonate diols market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market size estimation process, both the top-down and bottom-up approaches have been used, along with several data triangulation methods to carry out estimations and projections for the overall market and its sub-segments listed in this report. Extensive qualitative and quantitative analyses have been carried out on the complete process to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Supply side estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the process explained above, the total market has been split into several segments and sub-segments. To complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the polycarbonate diols market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on form, molecular weight, application

- To analyze and forecast the market size in terms of value and volume, with respect to four main regions: , North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch, and expansion, in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Polycarbonate Diols market

- Further breakdown of Rest of Europe Polycarbonate Diols market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polycarbonate Diols Market