Polyurethane Dispersions Market

Polyurethane Dispersions Market By Type (Solvent-Free Polyurethane Dispersions, Low-Solvent Polyurethane Dispersions), By Chemistry (Anionic Polyurethane Dispersions, Cationic Polyurethane Dispersions, Nonionic Polyurethane Dispersions, Self-Crosslinking Polyurethane Dispersions, Hybrid Polyurethane Dispersions), By Functionality [One-Component (1k) Systems, Two-Component (2k) Systems], By Application (Paints & Coatings, Adhesives & Sealants, Leather Manufacturing & Finishing, Textile Finishing), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

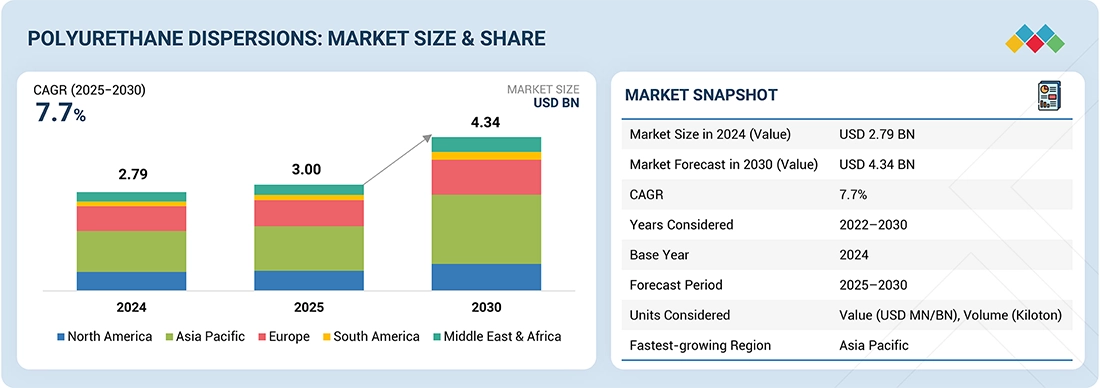

The polyurethane dispersions (PUD) market is projected to grow from USD 3.00 billion in 2025 to USD 4.34 billion by 2030, registering a CAGR of around 7.7% during the forecast period. The market is witnessing strong growth driven by rising demand for low-VOC, environmentally compliant coating and adhesive technologies across key industries, including automotive, textiles, leather, wood coatings, and construction. Polyurethane dispersions serve as essential high-performance binders and film-forming materials, offering superior durability, chemical resistance, and flexibility compared to conventional solvent-borne systems. Their expanding adoption in waterborne coatings, adhesives, and sealants enhances process efficiency, regulatory compliance, and end-product quality. Advancements in anionic, cationic, self-crosslinking, and hybrid PUD chemistries are further broadening application potential, supporting innovation in sustainable materials, and strengthening the overall growth trajectory of the global PUD market.

KEY TAKEAWAYS

-

By RegionIn 2024, the Asia Pacific accounted for the largest share of the PUD market (41.4%).

-

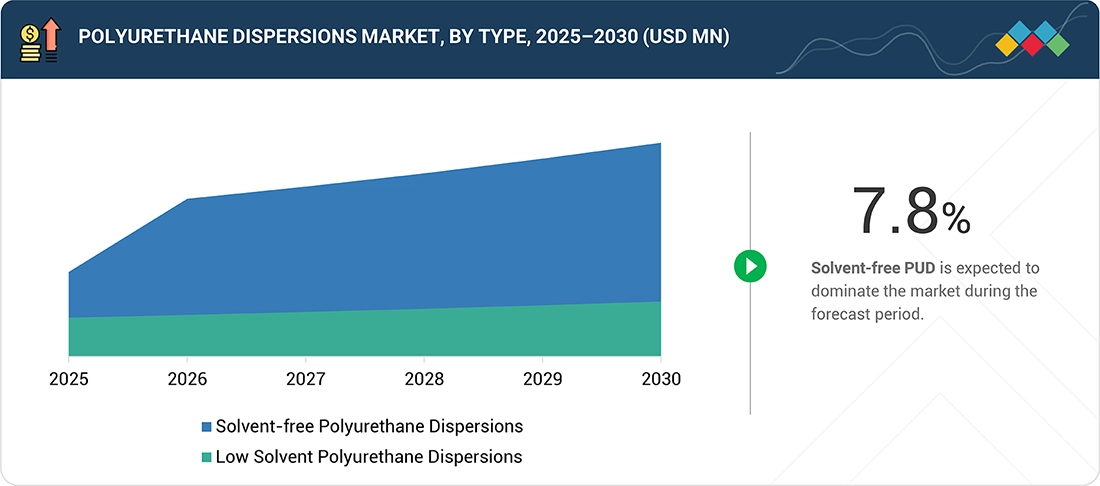

By TypeBy type, the solvent-free polyurethane dispersion segment is expected to register the highest CAGR of 7.8%.

-

By ChemistryBy chemistry, the hybrid polyurethane dispersions segment is expected to grow at the highest CAGR of 9.1%.

-

By FunctionalityBy functionality, the two-component (2K) systems segment is expected to dominate the market.

-

By ApplicationBy application, the paints & coatings segment is projected to grow at the fastest rate from 2025 to 2030.

-

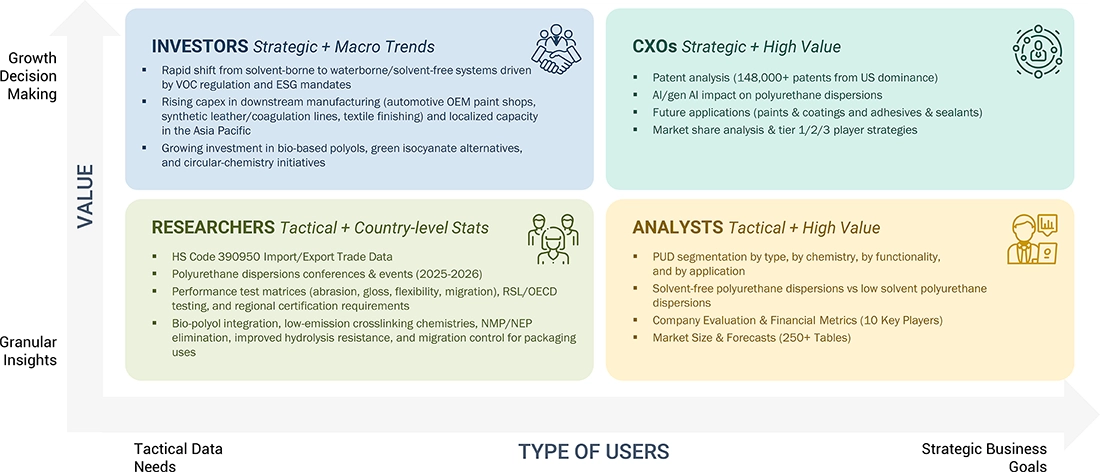

Competitive Landscape - Key PlayersCovestro, BASF, Wanhua, and Lubrizol were identified as Star players in the market, as they have focused on innovation, have broad industry coverage, and possess strong operational & financial strength.

-

Competitive Landscape - StartupsRUDOLF Holding, Lamberti, and SNP have distinguished themselves among startups and SMEs due to their strong product portfolios and business strategies.

Polyurethane dispersions (PUDs) play a critical role as environmentally friendly binders and film-forming agents in a wide range of coating, adhesive, sealant, and elastomer applications across industries such as automotive, textiles, leather finishing, wood coatings, and construction. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are increasingly enforcing stringent VOC emissions and chemical safety standards, accelerating the shift from solvent-borne to water-borne polyurethane technologies. This regulatory pressure is encouraging manufacturers to adopt greener production methods, non-toxic raw materials, and energy-efficient dispersion processes.

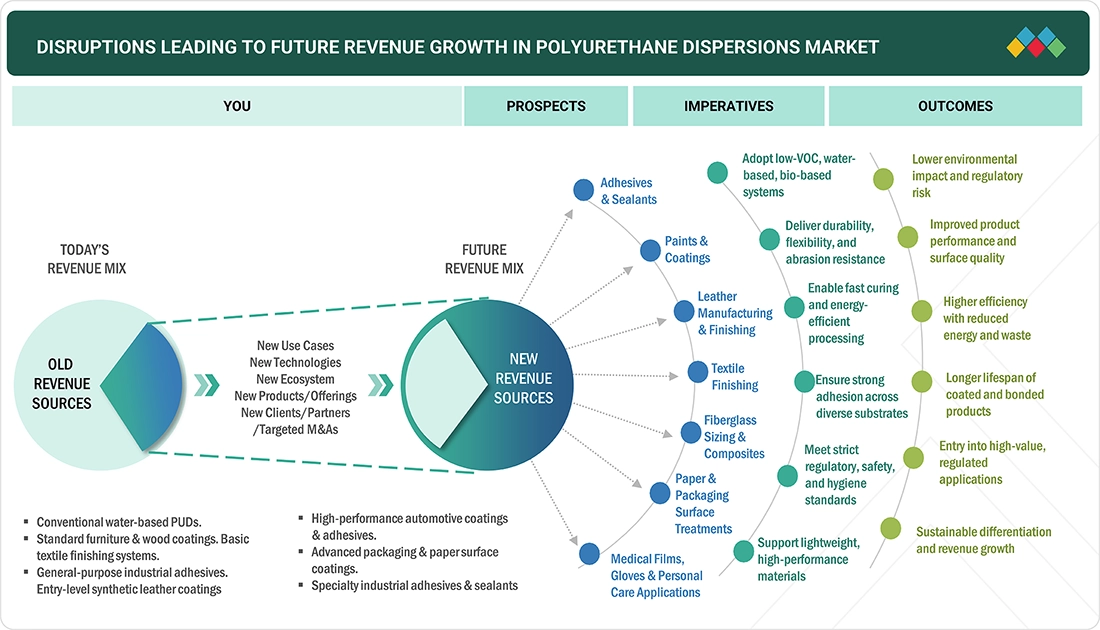

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effects on consumer-oriented industries in the market are shaped by evolving customer preferences, regulatory pressures, and rapid shifts in manufacturing technologies. Hotbets include automotive OEMs, textile and leather processors, wood and furniture manufacturers, packaging converters, and construction chemical companies, while target sectors encompass high-performance coatings, adhesives, sealants, inks, synthetic leather finishing, and specialty elastomers. Transformations such as stringent VOC and hazardous substance regulations, rising demand for waterborne and bio-based polymers, and the push for low-emission, energy-efficient production processes directly impact the purchasing behavior and revenue streams of these end users. These changes in application-level requirements, in turn, influence the revenues of hotbets that rely heavily on polyurethane dispersions to deliver durability, flexibility, and environmental compliance. Consequently, PUD manufacturers must continuously adapt their product portfolios, production technologies, and supply chain models to meet evolving sustainability standards, performance expectations, and industry-specific regulatory frameworks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Accelerating adoption of low-VOC and environmentally compliant coatings

-

Growing demand from automotive, construction, and industrial applications

Level

-

Higher production costs limiting wider adoption

-

Limited solvent and chemical resistance in certain grades

Level

-

Expanding the bio-based & circular PUDs market through sustainable innovation

-

High-performance industrial & specialty applications

Level

-

Sustaining performance while complying with environmental norms

-

Competition from low-cost regional producers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Accelerating Adoption of Low-VOC and Environmentally Compliant Coatings

The polyurethane dispersions market has grown due to increasing demand for low-VOC, environmentally friendly coatings amid strict regulations in Europe and North America. These regulations, similar to the European Paints Directive and U.S. standards, have prompted manufacturers to transition from solvent-based systems to waterborne polyurethane dispersions, which offer similar properties while reducing emissions. Consumer demand in construction, automotive, and residential sectors, along with corporate sustainability goals, further promotes the adoption of these greener products to meet ESG standards and enhance brand reputation.

Restraint: Higher production costs limiting wider adoption

Despite the advantages of waterborne polyurethane dispersions, the market faces persistent challenges associated with higher production costs relative to conventional solvent-based polyurethane systems. Waterborne polyurethane dispersions require specialized raw materials, including polyols, isocyanates, and stabilizers, as well as advanced polymerization technologies and stringent quality control processes. These factors increase the cost of manufacturing, which often translates into higher prices for end users (Source: U.S. Department of Commerce). The cost differential is particularly pronounced in emerging markets, where manufacturers are price-sensitive and may prefer traditional solvent-based systems due to lower initial capital and material expenses. While polyurethane dispersions offer environmental benefits and compliance with low-VOC regulations, smaller manufacturers and price-sensitive consumers sometimes hesitate to adopt these solutions due to the incremental costs associated with them.

Opportunity: Expanding the bio-based & circular PUDs market through sustainable innovation

The market for polyurethane dispersions is evolving with significant opportunities in bio-based and green alternatives. The growing demand for sustainable materials, supported by government initiatives and subsidies, is driving innovation in environmentally friendly dispersions made from renewable feedstocks, such as vegetable oils and sugar derivatives. For instance, the EU's Green Deal promotes low-carbon materials, while the U.S. Department of Energy backs industrial biotechnology to enhance renewable material use. This shift is encouraging manufacturers to invest in green polyurethane dispersions, creating new revenue streams and improving brand sustainability. Additionally, rising consumer awareness and corporate ESG commitments are driving demand for eco-friendly applications such as architectural coatings, wood finishes, and textile treatments.

Challenge: Sustaining performance while complying with environmental norms

While waterborne polyurethane dispersions offer environmental advantages, many formulations still lag behind solvent-based systems in terms of chemical resistance, UV stability, and mechanical durability, especially in demanding applications like industrial protective coatings, heavy machinery, or chemical containment. To close this gap, polyurethane dispersions manufacturers must continue investing in R&D, especially in advanced crosslinking chemistries, hybrid polymer systems, and functional additives. This pursuit of high-performance waterborne solutions is technically challenging: developing stable, high-solid dispersions that cure robust films often requires complex polymer architectures and tightly controlled reaction conditions. Commercial scaling of these advanced formulations entails significant capex risk. Moreover, customers in performance-critical sectors may require extensive testing and validation before switching from established solvent-based systems, slowing adoption and payback times. The need to balance performance, cost, and environmental credentials remains a formidable challenge for the polyurethane dispersions industry.

polyurethane-dispersions-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A leading synthetic leather manufacturer in China integrated Covestro’s Impranil waterborne PUDs into its coating and finishing lines for footwear, upholstery, and automotive interiors. | Reduced solvent emissions by 80–90%, improved coating uniformity, and increased line efficiency by 15–18%. |

|

A major automotive OEM coatings supplier in Europe incorporated BASF’s waterborne polyurethane dispersions into clearcoats and basecoats to replace traditional solventborne systems. | Enabled significant VOC reduction (up to 70%), improved scratch resistance by 15–20%, and delivered superior UV durability. |

|

A textile and sportswear coatings manufacturer in East Asia implemented Wanhua’s WanNature PUDs for waterproof–breathable performance fabrics. | Improved wash-fastness by 30–40%, enhanced stretch recovery, and increased print adhesion. Lower-temperature film formation reduced drying energy consumption by 10–12% and enabled compliance with global restricted substance lists (RSLs) for apparel exports. |

|

A U.S.-based wood coatings producer adopted Lubrizol’s Sancure and Permax PUDs for parquet flooring and premium furniture finishes. These dispersions were selected for their balance of hardness, chemical resistance, and clarity. | Achieved 20–25% higher abrasion and chemical resistance, reduced yellowing, and improved blocking performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The polyurethane dispersions (PUD) ecosystem includes raw material suppliers (Huntsman International LLC, Vencorex, BorsodChem, ISOCHEM, Kemipex), manufacturers (Covestro AG, BASF, Dow, Wanhua, Lubrizol), distributors (Azelis, BTC Europe, Univar Solutions LLC, Palmer Holland), and end users (Adidas, Nike, Huafeng Co., Ltd.). Key inputs, such as polyols, isocyanates, chain extenders, and specialty additives, are supplied by established raw material producers. PUD manufacturers convert these materials into waterborne polyurethane systems through controlled dispersion and polymerization processes that meet stringent global environmental and safety regulations, particularly those focused on reducing VOCs and promoting sustainability. Distributors provide formulation support, storage stability, and regional delivery, all while complying with chemical handling and safety requirements. End users span synthetic leather, footwear, textiles, automotive coatings, adhesives, and industrial coatings, where PUDs serve as essential components enabling high durability, flexibility, low emissions, and compliance with restricted substance lists (RSLs). This interconnected ecosystem supports the production and adoption of environmentally friendly, high-performance polyurethane technologies across multiple downstream industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polyurethane Dispersions Market, By Type

Driven by the global shift toward sustainable manufacturing and stricter VOC regulations, solvent-free polyurethane dispersions are expected to be the fastest-growing type in the polyurethane dispersions market. Solvent-free PUDs eliminate the use of co-solvents and NMP/NEP, making them a preferred choice for formulators seeking highly compliant, environmentally friendly solutions. These dispersions offer superior film properties, including improved durability, chemical resistance, and flexibility, making them ideal for high-performance applications such as synthetic leather, automotive coatings, wood finishes, and adhesives. As end-use sectors demand greener materials with minimal emissions, solvent-free PUDs deliver strong performance while supporting carbon reduction goals and promoting safer workplace practices.

Polyurethane Dispersions Market, By Chemistry

With their rising use in multifunctional and performance-driven formulations, the hybrid segment is expected to be the fastest-growing in the market during the forecast period. Hybrid PUDs, which combine polyurethane with acrylic, silicone, fluoropolymer, or other complementary chemistries, offer a unique balance of flexibility, hardness, chemical resistance, and weatherability that surpasses the capabilities of single-polymer systems. Their ability to deliver tailored properties makes them highly suitable for next-generation coatings, adhesives, leather finishes, and textile treatments that demand both durability and environmental compliance. Growth in this segment is further propelled by the expansion of architectural and industrial coatings, automotive interiors, packaging, and high-performance textile applications, where manufacturers seek waterborne solutions that provide superior film quality with low VOC emissions.

Polyurethane Dispersions Market, By Functionality

With their expanding use in high-performance industrial, automotive, and flooring applications, the two-component (2K) polyurethane dispersion systems segment is projected to be the fastest-growing functionality in the polyurethane dispersions market during the forecast period. 2K PUDs are essential for producing coatings that require exceptional durability, chemical resistance, abrasion strength, and long-term film stability performance levels that cannot be achieved consistently with 1K waterborne systems. Their strong demand is further driven by the growth of industrial wood coatings, protective metal coatings, concrete sealers, and high-end automotive refinishing, where end users prioritize higher hardness, faster cure response, and superior resistance to fuels, solvents, and mechanical stress. This segment continues to gain momentum due to the increasing industrialization in emerging economies and the shift toward high-performance, low-VOC coating technologies that comply with global environmental regulations.

Polyurethane Dispersions Market, By Application

With the rising demand for environmentally friendly and high-performance surface protection technologies, the paints & coatings segment is projected to be the fastest-growing application in the polyurethane dispersions market during the forecast period. PUD-based coatings are vital for manufacturing wood coatings, industrial metal coatings, automotive OEM/refinish coatings, concrete sealers, and protective architectural finishes in areas where low-VOC, durable, and cost-efficient solutions are increasingly essential. Their strong demand is further bolstered by regulatory pressure from REACH, EPA, and global VOC directives, which are accelerating the shift from solvent-borne to water-borne systems across industrial and consumer markets. This segment continues to gain momentum due to rapid construction activity, growth in automotive production, and rising adoption of eco-friendly materials in both developed and emerging economies.

REGION

Asia Pacific to be the fastest-growing region in the global polyurethane dispersions market during the forecast period

Asia Pacific is expected to witness the fastest growth in the polyurethane dispersions market due to rapid industrial expansion, strong manufacturing output, and accelerated adoption of environmentally friendly coating and adhesive technologies. The region’s booming automotive production, large-scale construction activity, and growing textile and synthetic leather industries are major drivers pushing demand for high-performance waterborne PU systems. Countries such as China, India, South Korea, and Japan continue to scale up downstream manufacturing capacities in sectors like automotive OEM coatings, footwear, furniture, electronics, and packaging industries that increasingly prefer low-VOC, odorless, and high-durability PUD formulations. Stringent environmental regulations on solvent-borne coatings, combined with national mandates for reduced emissions and cleaner production, are further accelerating the shift to waterborne and solvent-free polyurethane technologies.

polyurethane-dispersions-market: COMPANY EVALUATION MATRIX

In the polyurethane dispersions market, Covestro AG (Star) holds a leading position, supported by its extensive portfolio of high-performance waterborne and solvent-free PUD technologies used in coatings, adhesives, synthetic leather, and textile finishing. Covestro’s strong global manufacturing footprint, advanced R&D capabilities, and deep partnerships across automotive, furniture, and footwear OEMs enable it to serve large-volume industrial customers through innovative, low-VOC, and high-durability polyurethane solutions. Alberdingk Boley GmbH (Emerging Leader) is rapidly gaining market recognition, driven by its specialization in self-crosslinking, bio-based, and hybrid polyurethane dispersions tailored for wood coatings, industrial finishes, and specialty applications. The company is expanding its product portfolio with niche, application-specific PUDs that offer superior hardness, chemical resistance, and sustainability benefits.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Covestro AG (Germany)

- BASF (Germany)

- Dow (United States)

- Wanhua (China)

- Lubrizol (United States)

- Mitsui Chemicals, Inc. (Japan)

- Alberdingk Boley GmbH (Germany)

- Perstorp (Sweden)

- Stahl Holdings B.V. (Netherlands)

- UBE Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.79 Billion |

| Market Forecast in 2030 (value) | USD 4.34 Billion |

| Growth Rate | CAGR of 7.7 % from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: polyurethane-dispersions-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Polyurethane dispersions Manufacturer |

|

|

| Synthetic Leather & Footwear Manufacturer |

|

|

| Industrial & Architectural Coatings Producer |

|

|

RECENT DEVELOPMENTS

- October 2025 : BASF started up a new production line in Dilovasi, Türkiye, to increase dispersion capacity for architectural coatings and the construction industries. The line produces low-VOC, low-CO2 (Mass-Balance enabled) dispersions.

- August 2025 : Wanhua completed a 50,000 ton/year water-based resin project at Ningbo Daxie Development Zone, including 33,000 t/year waterborne polyurethane dispersions (PUD) and 15,000 ton/year epoxy resin.

- October 2024 : Stahl inaugurated a new polyurethane dispersion (PUD) manufacturing facility in Singapore, designed to serve the Asia Pacific region. The plant focuses on high-performance water-based polyurethane coating systems, supporting local demand in automotive, synthetic leather, and flexible packaging markets.

- August 2023 : Mitsui Chemicals announced a major capacity expansion for its TAKELAC polyurethane dispersions (PUDs) at the Shimizu Factory of Mitsui Chemicals MC, Ltd., a wholly owned subsidiary.

Table of Contents

Methodology

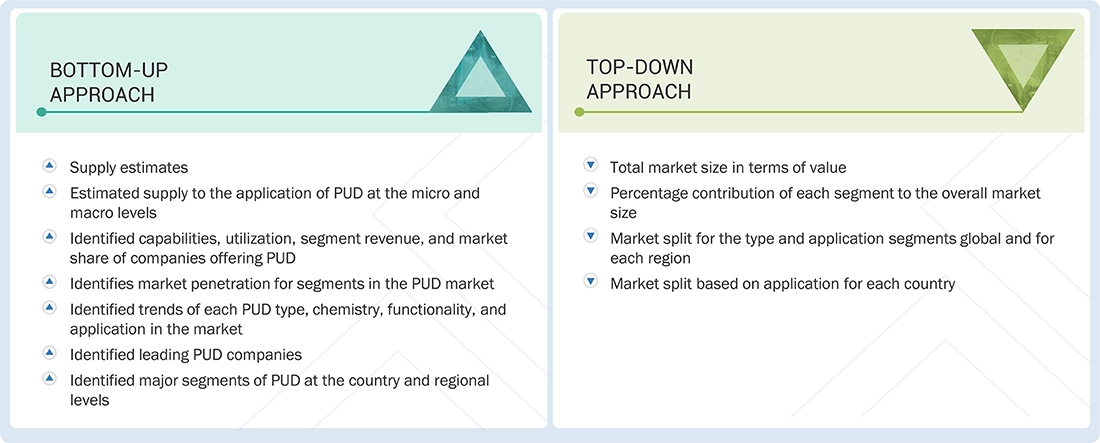

The study involved four major activities to estimate the current size of the global polyurethane dispersions market. Exhaustive secondary research was conducted to gather information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with industry experts across the PUD value chain through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the polyurethane dispersions market. Following this, market breakdown and data triangulation procedures were employed to determine the size of various market segments and sub-segments.

Secondary Research

The market for companies offering polyurethane dispersions is determined by secondary data obtained from paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and evaluating companies based on their performance and quality. Various secondary sources, including Business Standard, Bloomberg, the World Bank, and Factiva, were consulted for identifying and collecting information for this study on the polyurethane dispersions market. Secondary sources also included annual reports, press releases, and investor presentations from vendors, as well as forums, certified publications, and whitepapers. The secondary research was utilized to gather critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from both market- and technology-oriented perspectives.

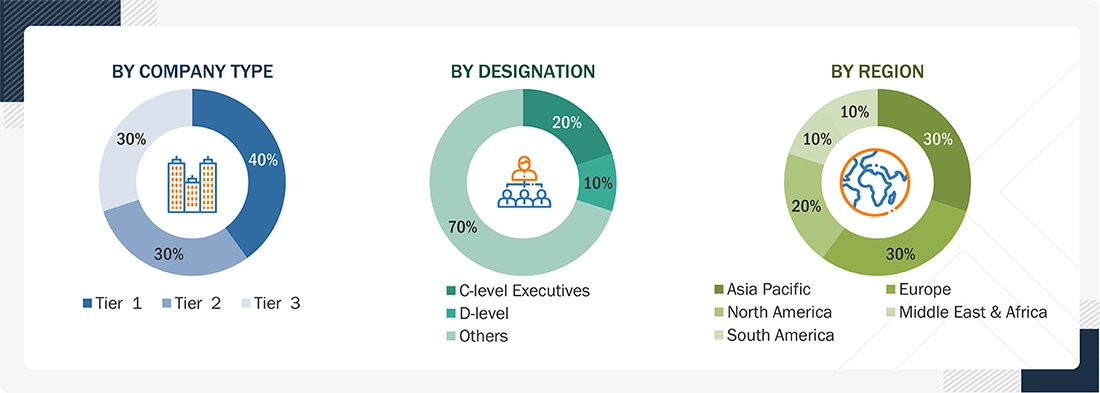

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the polyurethane dispersions market. After completing the market engineering process (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers derived. Primary research was also conducted to identify the segmentation types, industry trends, and competitive landscape of polyurethane dispersions offered by various market players, as well as key market dynamics, including drivers, restraints, opportunities, challenges, and industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Other designations include sales, marketing, and product managers. Companies are classified into tiers based on their revenue—Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global polyurethane dispersions market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Polyurethane Dispersions Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using market size estimation processes, the market was segmented into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Polyurethane dispersions (PUDs) are advanced water-borne polymer systems designed to deliver high performance across a wide range of industrial and commercial applications. PUDs possess many desirable properties, including high film formability, physical performance properties, as well as excellent chemical resistance and environmental compatibility. There are several different types of PUD's available including anionic PUD's, cationic PUD's, nonionic PUD's, self-crosslinking PUD's and hybrid PUD's, each of which was developed for a specific purpose as to meet exacting performance requirements for use in a wide variety of applications including coatings, adhesives, leather finishing, textile, paper, automotive and industrial applications. The low VOC content, versatility, and wide range of adhesion properties make PUDs highly popular among manufacturers seeking a sustainable alternative to solvent-based polymers.

Key Stakeholders

- PUD manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global PUDs market, based on material type, temperature range, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as acquisitions, expansions, partnerships, and agreements in the polyurethane dispersions market

- To provide the impact of AI/Gen AI on the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the polyurethane dispersions market report:

Product Analysis

- A product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the polyurethane dispersions market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Polyurethane Dispersions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Polyurethane Dispersions Market

Fareed

Dec, 2015

Interested in technical information on PUD.

Daniel

Oct, 2019

Polyurethane Dispresion market report .

kafeel

Aug, 2016

Looking for waterbased PU dispersion market.

Mohammed

Apr, 2019

Forecast of PUD based products in MEQuery not Clear region.